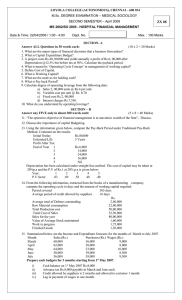

BFB2140 CORPORATE FINANCE I TUTORIAL SET 01- SOLUTIONS INTRODUCTION AND REVIEW Important note to students: It is your responsibility to familiarise yourself with your own personal calculator (HP10bII+ or Casio FX82). Assistance will be provided with HP10bII+ calculator in teaching materials. Do not leave learning how to use your chosen calculator until the last minute. WARM UP Question 1-1 This question is designed for open discussion to important concepts in Finance; there exists no formal solution. Question 1 A) KEY CORPORATE OBJECTIVE: Maximise Shareholders wealth HOW? Maximisation of share price B) THREE KEY DECISIONS: 1) The investment decision (i.e. LHS of the balance sheet) – which assets to invest in that maximises shareholders wealth. 2) The financing decision (i.e. RHS of the balance sheet) – what combination of debt and equity financing is optimal. 3) The dividend decision? i. How much should be distributed? ii. How should this distribution take place? iii. How regular should this distribution be? Question 2 A) Straight line $1000/5=$200 per year depreciation “expense”. Depreciate vacuum cleaner by $200 till 0 book-value remains in year 5. B) 33% diminishing value. Year 1 Year 2 Year 3 Year 4 Year 5 Beg book value Depreciation End book value $1000 $330 $670 $670 $221.10 $448.90 $448.90 $148.14 $300.76 $300.76 $99.25 $201.51 $201.51 $201.51 Nil * If the asset had a scrap value, the depreciation would have remained the same as we always calculate depreciation on initial cost EXCLUDING consideration of scrap or residual value. Question 3 Levered firm = D/E = $1.50/$1.00. This implies that the firm has Assets = $1.50 + $1 = $2.50. Expressed in terms of debt to total assets (D/TA) = $1.50/$2.50 therefore 60% debt and 40% equity. Unlevered firm is 100% equity financed (i.e. zero debt) Question 4 $15,000,000 ÷ $10,000,000 = 1.5 times, or 150% This means that for every dollar of Company XYZ owned by the shareholders, Company XYZ owes $1.50 to creditors. Solutions to Additional text book questions are available on Moodle.