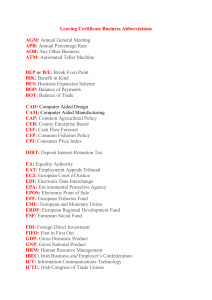

PENSIONS INVESTMENTS LIFE INSURANCE MODERATE GROWTH FUND Information is correct at 31 January 2021 FUND FACTS FUND DESCRIPTION OBJECTIVE To achieve positive returns while managing the fund within its target risk level. INVESTMENT STYLE Active & Indexed Multi Strategy RISK LEVEL 1 2 LOW RISK 3 4 5 MEDIUM RISK 6 7 HIGH RISK This fund is a mix of assets such as bonds, shares and property. It features several risk management strategies and may invest in cash from time to time. This is a medium risk fund, which aims to have a moderate allocation to high risk assets such as shares and property. Irish Life Investment Managers monitors and rebalances the fund regularly and may change the mix over time. Warning: If you invest in this product you may lose some or all of the money you invest. ASSET ALLOCATION SHARES Alternatives 18.0% 62.4% Global Shares (DSC) 39.8% Global Low Volatility Shares 13.1% Option Strategy 6.6% Infrastructure Equities 2.9% ALTERNATIVES 18.0% BOND 11.6% Bond 11.6% Shares 62.4% Property 7.1% Emerging Market Bonds 7.1% High Yield Bonds 3.4% Corporate Bonds 1.1% PROPERTY 7.1% CASH 0.9% Cash 0.9% SHARE REGIONAL DISTRIBUTION TOP TEN SHARE HOLDINGS STOCK NAME Other 4.5% Eurozone 9.7% UK 3.6% US 59.1% Europe ex Eurozone ex UK 5.6% APPLE INC 3.4% MICROSOFT CORP 2.4% AMAZON.COM INC 1.9% ALPHABET INC 1.7% Japan 7.4% Asia Pacific ex Japan 2.0% Emerging Market 8.1% % of FUND TAIWAN SEMICONDUCTOR MANUFACTURING 0.8% ALIBABA GROUP HOLDING LTD 0.7% TENCENT HOLDINGS LTD 0.7% AMERICAN TOWER CORP 0.7% VISA INC 0.6% PROCTER & GAMBLE CO (THE) 0.6% The assets in this fund may be used for the purposes of securities lending in order to earn an additional return for the fund. While securities lending increases the level of risk within the fund it also provides an opportunity to increase the investment return. Part of this fund may borrow to invest in property. Non euro currency exposures may be fully or partly hedged back to euro to reduce foreign currency risk. High Yield Bonds are sub-advised by an external manager. This fund is provided by Irish Life Assurance plc and is managed by Irish Life Investment Managers Limited. Warning: This fund may be affected by changes in currency exchange rates. SHARE SECTOR DISTRIBUTION RISK MANAGEMENT STRATEGIES SECTOR % of FUND Information Technology 19.4% Consumer Discretionary 12.5% Health Care 12.0% Financials 11.4% Industrials 9.4% Communication Services 8.4% Consumer Staples 6.5% Utilities 5.6% Materials 4.4% Other This fund uses a diversified range of risk management strategies. These aim to reduce the impact of the various ups and downs the fund may experience. Currently: - Portfolio Rebalancing - The Dynamic Share to Cash (DSC) model - Global Low Volatility Shares - Option Strategy - Currency Hedging Risk management strategies will be reviewed regularly and may be changed. 10.4% CALENDAR YEAR RETURN Fund 2018 2019 2020 YTD -4.52% 12.20% -0.27% 0.00% PERFORMANCE AS AT 31/01/2021 Fund 1 Month 3 Month 1 Year 3 Year p.a. Since Launch p.a. 0.00% 7.35% 0.00% 1.61% 2.85% CUMULATIVE PERFORMANCE Performance % 12 10 8 6 4 2 0 -2 -4 05/17 10/17 03/18 08/18 01/19 06/19 11/19 04/20 09/20 Fund returns are quoted before taxes and after a standard annual management charge of 0.36%. Annual fund management charges are calculated and deducted based on the offer price of the fund. The unit price and value of the fund are always quoted after an allowance has been made for the fund management charge. There is no Bid/Offer spread. Launch Date (for the series used in the above performance illustration) = 15 May 2017; YTD = year to date; p.a. = per annum Source: Irish Life Investment Managers Warning: Past performance is not a reliable guide to future performance. Warning: The value of your investment may go down as well as up. Irish Life Investment Managers are recognised internationally for their expertise, innovation and track record: -4 STAR AWARD IN THE IRISH LIFE PENSION FUND GRESB 2020 -INVESTMENT MANAGER OF THE YEAR Irish Pensions Awards 2020 -EXCELLENCE IN DC AWARDS Irish Pensions Awards 2020 -PASSIVE MANAGER OF THE YEAR European Pensions Awards 2018 Irish Life Assurance p.l.c. is regulated by the Central Bank of Ireland. Irish Life Investment Managers Limited is regulated by the Central Bank of Ireland. To find out more about our fund range and to view the latest market and fund manager updates please visit: http://www.irishlifecorporatebusiness.ie EY2-NET-0121