Uploaded by

Chanel Cruz

Process Costing: WA vs FIFO Methods Explained

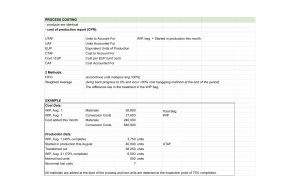

Process Costing Learning Objectives Why are equivalent units of production used in process costing? How are equivalent units of production, unit costs, and inventory values determined using the weighted average (WA) method of process costing? How are equivalent units of production, unit costs, and inventory values determined using the first-in, first-out (FIFO) method of process costing? How are transferred-in costs and units accounted for in a multidepartment production setting? Job Order vs. Process Costing Job Order Small quantities of distinct products or services Assign costs to job and then to units within the job Process Costing Large quantities of homogeneous products or services Using an averaging technique, assign costs directly to units produced during the period Process Costing Averaging technique to assign costs to units produced Unit Cost = Production Costs Production Quantity Production Costs The Numerator—Production Costs Accumulate costs by department Accumulate costs by product Direct material from material requisitions Direct labor from time sheets and wage rates Overhead Actual Predetermined application rates Unit Cost = Production Costs Production Quantity Materials Requisition Form Date ___________________ No. 341 Job No. _________________ Department _______________ Authorized by ___________ Issued by _________________ Received by _____________ Inspected by _______________ Item Part Unit of Quantity Quantity Unit Total No. No. Descrip. Measure Required Issued Cost Cost Employee Time Sheet Employee Name _______________ Employee No. _______________ Department _______________ Type of Work Job No. Employee Signature Start Time For week ending _______ Stop Time Day Total Hours Supervisor’s Signature Units Produced The Denominator—Units Produced Complicated by work in process Units started last period and completed this period Units started this period and not completed Convert partially completed units to equivalent whole units Unit Cost = Production Costs Production Quantity Equivalent Units of Production Approximation of the number of whole units of output that could have been produced from the actual effort expended Includes units Started last period and finished this period Started and finished this period Started this period and not finished Assumes FIFO physical flow through the production department Two Process Costing Methods Weighted Average (WA) Method Combines beginning work in process current period production First-in, First-Out (FIFO) Method Separates beginning work in process current period production Process Costing Methods WA Beginning WIP Started and finished Ending WIP The Difference FIFO Beginning WIP Started and finished Ending WIP 100% 100% % completed % completed 100% % completed Process Costing Direct material Direct labor Added at the beginning, during, and/or at the end of process Added throughout the process Overhead Added throughout the process Based on direct labor Based on other, multiple cost drivers Process Costing Steps 1 2 3 4 5 6 Units to account for Units Units accounted for Determine equivalent units Costs to account for Costs Compute cost per equivalent unit Assign costs to inventories Cost of Production Report Name of Department for the period --Production Data: Units to account for Units accounted for EUP for each cost Cost Data: Costs to account for Cost per EUP Cost Assignment: Transferred Out Ending Work in Process Inventory * Numbers correlate to the process costing steps in the previous slide Step 1—Units to Account For Beginning WIP Started Units to account for 5,000 200,700 205,700 Step 2—Units Accounted For Beginning WIP Started Units to account for Finished and transferred Ending WIP Units accounted for 5,000 200,700 205,700 must 203,000 be 2,700 equal 205,700 Step 3—Compute Equivalent Units Beginning WIP inventory Started and completed Ending WIP inventory Equivalent units WA Method DM Conversion 5,000 5,000 198,000 198,000 2,700 2,160* 205,700 205,160 * ending units * % complete 2,700 * 80% = 2,160 Step 4—Costs to Account For Beginning WIP Current costs To account for DM Conversion Total $ 5,943 $ 16,758 $ 22,701 321,120 660,270 981,390 $327,063 $677,028 $1,004,091 WA Method © 2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part. Step 5—Cost per Equivalent Unit Beginning WIP Current costs To account for DM $ 5,943 321,120 $327,063 Divide by EUP 205,700 Cost per EUP $1.59 WA Method Conversion Total $ 16,758 $ 22,701 660,270 981,390 $677,028 $1,004,091 205,160 + $3.30 = $4.89 Step 6—Assign Costs to Inventories Transferred (203,000 * $4.89) $992,670 Ending WIP Inventory Transferred Direct Materials Out Ending (2,700 * $1.59) $4,293 WIP Conversion Costs (2,700 * 80% * $3.30) 7,128 11,421 Cost accounted for $1,004,091* *must agree with costs to account for WA Method Process Costing—FIFO Emphasizes current period costs and production Steps 1, 2, and 4 are the same Step 3—Compute Equivalent Units DM Beginning WIP/completed Started and completed Ending WIP Inventory Equivalent units FIFO Method 0 198,000 2,700 200,700 Conversion 3,000* 198,000 2,160 203,160 * beginning units * % complete in current period 5,000 * 60% = 3,000 Step 5—Cost per Equivalent Unit Current costs DM $321,120 Divide by EUP 200,700 Cost per EUP $1.60 FIFO Method Conversion Total $660,270 $981,390 203,160 + $3.25 = $4.85 * Recall that Step 4 is the same as used for the WA method Step 6—Assign Costs to Inventories Transferred Beginning WIP Inventory Cost to complete Conversion (3,000 * $3.25) Started and completed (198,000 * $4.85) Total cost transferred Ending inventory Direct Materials (2,700 * $1.60) Conversion Costs (2,7000 * 80% * $3.25) Cost accounted for *must agree with costs to account for $22,701 9,750 Transferred Out $ 32,451 960,300 $992,751 Ending WIP $4,320 7,020 11,340 $1,004,091* FIFO Method Process Costing Comparison WA FIFO EUP DM 205,700 EUP DM 200,700 EUP Conversion 205,160 EUP Conversion 203,160 Cost per unit DM $1.59 Cost per unit DM $1.60 Cost per unit Conv. 3.30 Cost per unit Conv. 3.25 Total $4.89 Total $4.85 Transferred Out $992,670 Transferred Out $992,751 Ending WIP 11,421 Ending WIP 11,340 Total $1,004,091 Total $1,004,091 Process Costing The purpose of the six steps Assign a value to ending work in process Assign a value to items transferred out Prepare this journal entry Finished Goods Work in Process or Transferred-In Cost (successor department) Work in Process (current department) Cost Allocation Cost allocation is the process of assigning common costs to two or more cost objects. Allocation Bases for Service Department Costs Rational and systematic base Benefit received by revenue-producing department Causal relationship Fairness or equity of the allocations Ability of revenue-producing department to bear the allocated cost Methods Direct method Step method Benefits-provided ranking Algebraic method Simultaneous equations Direct Method Assigns costs straight to revenue-producing areas Revenue Service 1 2 A B Step 1 $ Step 2 $ Does not recognize service provided to other service departments C Service Method Partially recognizes relationships among service departments Revenue Service 1 2 A B C Step 1 $ Step 2 $ Does not recognize the two-way exchange of services between service departments Algebraic Method Provides the best allocation information Revenue Service 1 At the same time 2 A B C $ $ Recognizes all interrelationships among departments The End