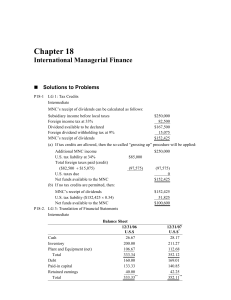

Chapter 18 International Managerial Finance Solutions to Problems P18-1 LG 1: Tax Credits Intermediate MNC’s receipt of dividends can be calculated as follows: Subsidiary income before local taxes Foreign income tax at 33% Dividend available to be declared Foreign dividend withholding tax at 9% MNC’s receipt of dividends $250,000 82,500 $167,500 15,075 $152,425 (a) If tax credits are allowed, then the so-called “grossing up” procedure will be applied: Additional MNC income U.S. tax liability at 34% Total foreign taxes paid (credit) ($82,500 + $15,075) U.S. taxes due Net funds available to the MNC (b) If no tax credits are permitted, then: $250,000 $85,000 (97,575) MNC’s receipt of dividends U.S. tax liability ($152,425 × 0.34) Net funds available to the MNC P18-2. LG 3: Translation of Financial Statements Intermediate Cash Inventory Plant and Equipment (net) Total Debt Paid-in capital Retained earnings Total Balance Sheet 12/31/06 U.S.$ 26.67 200.00 106.67 333.34 160.00 133.33 40.00 333.33** (97,575) 0 $152,425 $152,425 51,825 $100,600 12/31/07 U.S.$* 28.17 211.27 112.68 352.12 169.01 140.85 42.25 352.11** Income Statement 12/31/06 U.S.$ 20,000.00 19,833.33 166.67 Sales Cost of goods sold Operating profits * ** 12/31/07 U.S.$ 21,126.76 20,950.70 176.06 At 6% appreciation, the new exchange rate becomes 1.42 €/U.S.$ Differences in totals result from rounding. P18-3. LG 5: Euromarket Investment and Fund Raising Challenge The effective rates of interest can be obtained by adjusting the nominal rates by the forecast percent revaluation in each case: Effective rates Euromarket Domestic US$ MP ¥ 5.0% 4.5% 8.0% 7.6% 7.2% 6.7% Following the assumption outlined in the problem, the best sources of investment and borrowing are the following: $80 million excess is to be invested in the MP Mexican $60 million to be raised in the US$ Euromarket. P18-4. Ethics Problem Intermediate Yes, because the company may lose out in numerous contract bid opportunities. The management team must explain that it is “ethics first” when doing business, and that the objective is to maximize shareholder wealth subject to ethical constraints. Hopefully, over time, stockholders will get on board with this philosophy—although most will likely be supportive from the outset.