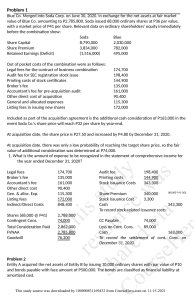

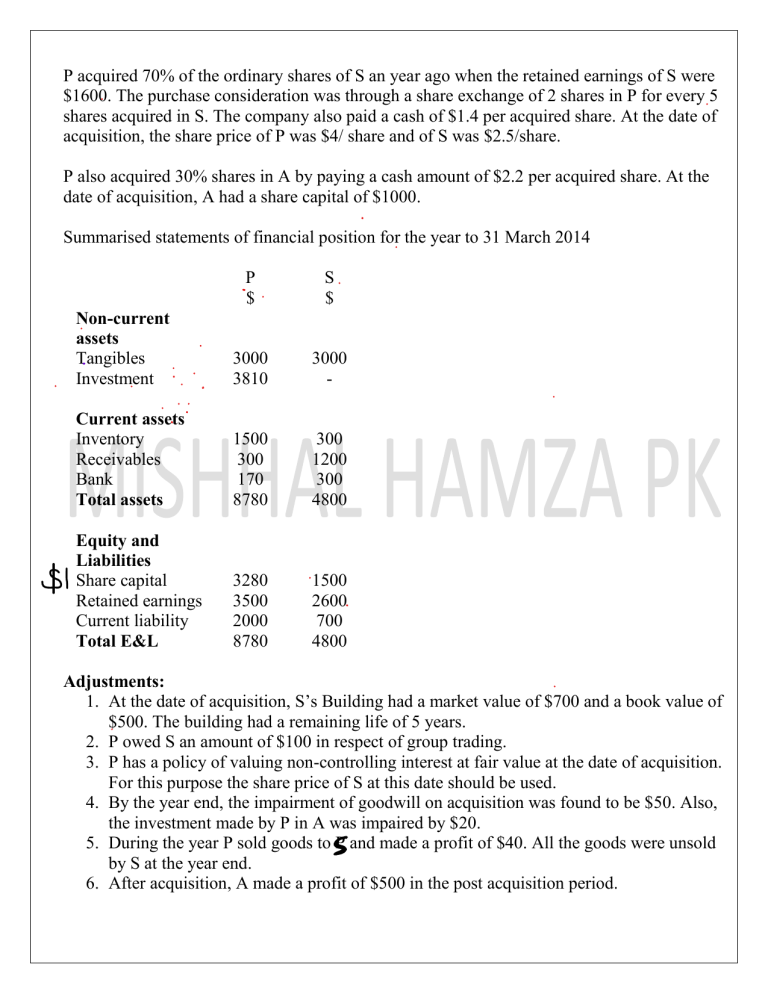

P acquired 70% of the ordinary shares of S an year ago when the retained earnings of S were $1600. The purchase consideration was through a share exchange of 2 shares in P for every 5 shares acquired in S. The company also paid a cash of $1.4 per acquired share. At the date of acquisition, the share price of P was $4/ share and of S was $2.5/share. P also acquired 30% shares in A by paying a cash amount of $2.2 per acquired share. At the date of acquisition, A had a share capital of $1000. Summarised statements of financial position for the year to 31 March 2014 P $ S $ Non-current assets Tangibles Investment 3000 3810 3000 - Current assets Inventory Receivables Bank Total assets 1500 300 170 8780 300 1200 300 4800 Equity and Liabilities Share capital Retained earnings Current liability Total E&L 3280 3500 2000 8780 1500 2600 700 4800 Adjustments: 1. At the date of acquisition, S’s Building had a market value of $700 and a book value of $500. The building had a remaining life of 5 years. 2. P owed S an amount of $100 in respect of group trading. 3. P has a policy of valuing non-controlling interest at fair value at the date of acquisition. For this purpose the share price of S at this date should be used. 4. By the year end, the impairment of goodwill on acquisition was found to be $50. Also, the investment made by P in A was impaired by $20. 5. During the year P sold goods to P and made a profit of $40. All the goods were unsold by S at the year end. 6. After acquisition, A made a profit of $500 in the post acquisition period. Required: Prepare consolidated SOFP for the year ended 31 March 2014.