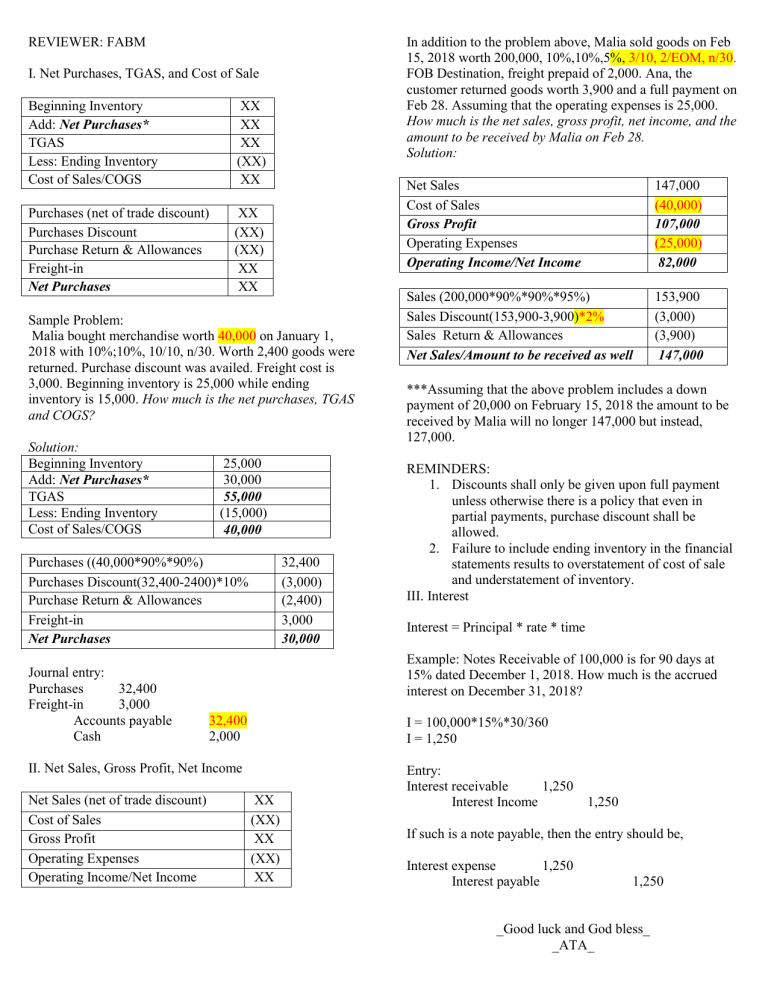

REVIEWER: FABM In addition to the problem above, Malia sold goods on Feb 15, 2018 worth 200,000, 10%,10%,5%, 3/10, 2/EOM, n/30. FOB Destination, freight prepaid of 2,000. Ana, the customer returned goods worth 3,900 and a full payment on Feb 28. Assuming that the operating expenses is 25,000. How much is the net sales, gross profit, net income, and the amount to be received by Malia on Feb 28. Solution: I. Net Purchases, TGAS, and Cost of Sale Beginning Inventory Add: Net Purchases* TGAS Less: Ending Inventory Cost of Sales/COGS XX XX XX (XX) XX Purchases (net of trade discount) Purchases Discount Purchase Return & Allowances Freight-in Net Purchases XX (XX) (XX) XX XX Sample Problem: Malia bought merchandise worth 40,000 on January 1, 2018 with 10%;10%, 10/10, n/30. Worth 2,400 goods were returned. Purchase discount was availed. Freight cost is 3,000. Beginning inventory is 25,000 while ending inventory is 15,000. How much is the net purchases, TGAS and COGS? Solution: Beginning Inventory Add: Net Purchases* TGAS Less: Ending Inventory Cost of Sales/COGS 25,000 30,000 55,000 (15,000) 40,000 Purchases ((40,000*90%*90%) Purchases Discount(32,400-2400)*10% Purchase Return & Allowances Freight-in Net Purchases Journal entry: Purchases 32,400 Freight-in 3,000 Accounts payable Cash 32,400 (3,000) (2,400) 3,000 30,000 147,000 (40,000) 107,000 (25,000) 82,000 Sales (200,000*90%*90%*95%) Sales Discount(153,900-3,900)*2% Sales Return & Allowances Net Sales/Amount to be received as well 153,900 (3,000) (3,900) 147,000 ***Assuming that the above problem includes a down payment of 20,000 on February 15, 2018 the amount to be received by Malia will no longer 147,000 but instead, 127,000. REMINDERS: 1. Discounts shall only be given upon full payment unless otherwise there is a policy that even in partial payments, purchase discount shall be allowed. 2. Failure to include ending inventory in the financial statements results to overstatement of cost of sale and understatement of inventory. III. Interest Interest = Principal * rate * time Example: Notes Receivable of 100,000 is for 90 days at 15% dated December 1, 2018. How much is the accrued interest on December 31, 2018? 32,400 2,000 I = 100,000*15%*30/360 I = 1,250 II. Net Sales, Gross Profit, Net Income Net Sales (net of trade discount) Cost of Sales Gross Profit Operating Expenses Operating Income/Net Income Net Sales Cost of Sales Gross Profit Operating Expenses Operating Income/Net Income XX (XX) XX (XX) XX Entry: Interest receivable 1,250 Interest Income 1,250 If such is a note payable, then the entry should be, Interest expense 1,250 Interest payable 1,250 _Good luck and God bless_ _ATA_