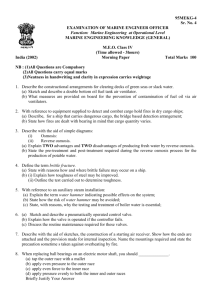

Marine insurance will cover: Physical or structural damage to the vessel due to collision with another submerged or above water vessel. Damage to the attendants or others property on board and bodily injuries Towing, assistance and gas delivery in case the attendant is stranded on the boat Marine insurance will also cover the ship and cargo if any problems are faced when transporting the goods and any liabilities in the event of damage or loss of the goods. Therefore, it is important to ensure adequate marine insurance especially when dealing with commercial transportation of customers’ goods and belongings. The Marine insurance transfers the risk from the owners and other stakeholders to the insurance provider. This means limited liability and protection against any loss or damage. Types of Marine Insurance 1. Freight Insurance This protects a merchant ship’s owning corporation, because they are prone to losing money in freight. For example, if cargo is lost due to an accident, freight insurance will cover the losses. 2. Hull Insurance This covers the vessels hull and torso along with other pieces and articles of the ship’s furniture. It also covers any damage or loss to the ship, boat or vessel in the event of an accident. 3. Liability Insurance This offers compensation for any liability caused due to the ship colliding or crashing, or any form of an induced attack. 4. Marine Cargo Insurance Cargo owners are at risk of mishandling the cargo at any stage. This may result in loss, misplacement, or damage to the goods. Therefore, to protect the interest of the cargo owner, marine cargo insurance will cover the losses against an adequate premium payment.