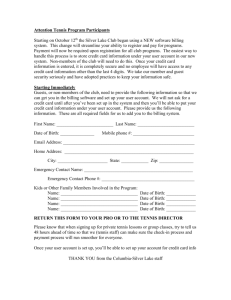

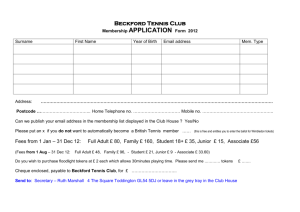

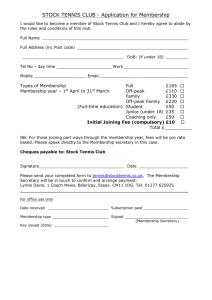

Group Assignment 1 (GA1) for ACCT 742 Winter 2021 Stephen Hudovernik – The Business School, Centennial College Group Number: #1 Group Members (list names): Albin Paul Mayank Gupta Muhammad Hassan Akram Rushil Kummar Krishna Sandra Cheruvathoor Sam Question 1: a) According to the review, Teper and Lubetsky should accept the audit engagement of the Autio Inc corporation as the audit engagement evaluation is positive and also internal control of the company is effective when compared to the overall risk. 1) Autio Corp has an effective and efficient internal financing operations, as the corporation hasn’t had any dispute inregards of payments to suppliers, vendors which ensures the company’s operations are not affected whatsoever ensuring the objective of efficiency and completeness is achieved. Also as stated in the agreement that the company maintains a proper records and clearly documents each and everything which ensures operations are done effectively and efficiently with suppliers, as it will ensure that all documents with different suppliers, updated price lists, financial reports are in order. High ethical standards of the company means that it would be helpful for the investors and the stakeholders of the company as high ethical standards means that the company has a good reputation and credibility in the market. Based on the given information audit should be accepted. Документ1 1 of 8 Group Assignment 1 (GA1) for ACCT 742 Winter 2021 Stephen Hudovernik – The Business School, Centennial College 2) Shareholders are the owners of the company who have a right to say in how the company works and operates. As said, the company has two shareholders, and each of them is intimately knowledgeable of company financial and operating Waffairs. Having only two knowledgeable shareholders has an overall advantage for the Autio. Inc corporation as all the decisions on how the company would run and operate the business needs an approval from the shareholders and having less shareholders means the overall efficiency would be achieved for the company to be successful. Having Knowledgeable shareholders who often speak with the top level management means constant checks for any reporting errors may be found and corrected, which will help the company. Also, it would help the company to take important decisions related to the performance of the company. Probability of having any misrepresentation of financial statements or fraud in the balance sheet would be very minimal when one of the shareholder of the company is also the sole owner of all the company’s bond. Based on the given information audit should be accepted. 3) Company changes suppliers of its inventory on a regular basis, including change in country and currency of payments which means that the company needs to have a stable accounting system that consolidate the financial statements between the two due to the different methods of the reporting currency values. Thus, the company should have some type of system/software to acknowledge the foreign transactions into their own reporting system. Continuously changing exchange rates will not benefit the company as it will lead to miscalculations and also it is not easy for the company to adjust the differences in the accounting standards of the foreign company when they prepare their financial statements. Change in the value of foreign currency will generate gains/ loss for the company which needs to be acknowledged and recorded to the correct books of accounts. If the company is changing their suppliers continuously, this will create a bad reputation/image of the company in the market and it would create trustworthy issues for the company. Suppliers would be hesitant in giving supply to the company knowing the history of the company of changing suppliers frequently. Also, it is important for the company to have a regular trustworthy supplier whom the company can rely that they will meet the proper standard Документ1 2 of 8 Group Assignment 1 (GA1) for ACCT 742 Winter 2021 Stephen Hudovernik – The Business School, Centennial College requirements of the company, if bad quality material is supplied it could damage the reputation of the firm. Therefore, it is always advisable to have a regular supplier whom you can reply to match the standards of the company. Based on the information audit should be accepted. Overall the audit by the Autio. Inc should be accepted by Teper and Lubetsky b) Current Assets = Cash + Accounts Receivable - Reserves + Inventory = $144000 + $126000- $2000 + $246000 = $514000 Current Liabilities = Accounts Payable + Bonds Payable = $245000 + $20000 = $265000 Current Ratio = Current Assets/Current Liabilities Current Ratio= $514000/$265000 = 1.93/1 Industry Standard is 1.8: 1 Quick Assets = Cash + Net Receivables = $144000 + $124000 = $268000 Quick Liabilities = $265000 Quick Ratio = Quick Assets/ Quick Liabilities Quick Ratio = $268000/$265000 = 1.01/1 Industry Standard is 0.9: 1 Документ1 3 of 8 Group Assignment 1 (GA1) for ACCT 742 Winter 2021 Stephen Hudovernik – The Business School, Centennial College According to Current ratio and Quick ratio of Autio Inc Corporation, the corporation is performing above the industry standards which makes company in a very strong position to meet its debt/ equity requirements. Also, price of company’s Assets, Equity Share, Bonds will be above the fair value of the market. 2 Collectability of the 2020 net Accounts Receivable using 2019 as a reasonable basis. Net Accounts Receivable = Gross Accounts Receivable – Allowance for doubtful Accounts = $105000- $5000 = $100000 The total collectible AR for 2020 on the basis of 2019 is $ 100000 Question 2: a) Aged Accounts Receivable Trial Balance for Foot Fault: Customer Acton Tennis Club Acton Tennis Club Bowmanville Athletic Club Bowmanville Athletic Club Bowmanville Athletic Club Caledonia Sports and Fitness Caledonia Sports and Fitness Caledonia Sports and Fitness Dominic's Tennis Spot Документ1 Invoice Number 1010 1022 1006 1013 1014 No of Days Aged Amount 25-Sep-20 36 1000 15-Oct-20 16 5000 25-Aug-20 67 1500 28-Sep-20 33 2000 04-Oct-20 27 3000 30-Jun-20 123 6000 02-Oct-20 29 4000 4000 10-Oct-20 21 3000 3000 27-Jul-20 96 4000 Invoice Date 0-29 Days 30 - 60 Days 61-90 Days Over 90 Days 1000 5000 1500 2000 3000 6000 1002 1015 1018 1003 4000 4 of 8 Group Assignment 1 (GA1) for ACCT 742 Winter 2021 Stephen Hudovernik – The Business School, Centennial College Dominic's Tennis Spot Dominic's Tennis Spot Edwards Gardens Tennis Edwards Gardens Tennis Edwards Gardens Tennis Farnaz’s Racquet Club Farnaz’s Racquet Club Giovanni's Tennis Emporium Harry's Athletics Ing Tennis and Golf Club Customer Jang's Athletic Club Kingston Downtown Tennis Kingston Downtown Tennis Leamington Sports Centre Morningside Tennis Club Newtonbrook Sports Centre Newtonbrook Sports Centre Total Документ1 1005 1011 1016 1019 1026 1008 1023 1012 1020 1017 Invoice Number 27-Aug-20 65 2500 27-Sep-20 34 4000 02-Oct-20 29 4000 4000 13-Oct-20 18 4000 4000 24-Oct-20 7 4000 4000 15-Sep-20 46 2000 15-Oct-20 16 4000 27-Sep-20 34 2000 13-Oct-20 18 8000 8000 05-Oct-20 26 6400 6400 Invoice Date No of Days Aged Amount 2500 4000 2000 4000 2000 0-29 Days 30 - 60 Days 61-90 Days 1007 31-Aug-20 61 8000 8000 1004 25-Aug-20 67 6600 6600 1025 17-Oct-20 14 7500 7500 1021 13-Oct-20 18 15000 15000 1001 31-May-20 153 7000 1009 22-Sep-20 39 7500 1024 15-Oct-20 16 3000 3000 125000 70900 Over 90 Days 7000 7500 18500 18600 17000 5 of 8 Group Assignment 1 (GA1) for ACCT 742 Winter 2021 Stephen Hudovernik – The Business School, Centennial College Provision for Accounts doubtful: Amount Provision (collectability of receivables) % 0-29 Days 70900 0% 0 30 - 60 Days 18500 2% 370 61-90 Days 18600 10% 1860 Over 90 Days 17000 50% 8500 Total 125000 Provisional Amount 10730 Please Note: In order to calculate the number of days aged (31st October 2020 – the invoice date of each invoice). b) It can be seen that the allowance for Doubtful Accounts made is $5000 but instead it should have been $10730 which exceeds the provision made by $5730 (10730 - 5000). Michele had set the materiality level to be $5000 and the difference is exceeds this amount. Therefore, the Provision for Doubtful Accounts must be revised and reviewed as it is materially misstated. Документ1 6 of 8 Group Assignment 1 (GA1) for ACCT 742 Winter 2021 Stephen Hudovernik – The Business School, Centennial College Question 3: VALIDITY OBJECTIVE This objective ensures that the recorded transactions are valid and documented fairly. Existence is the associated assertion here. Matching payment voucher against particular purchase invoice. Matching purchase order against the receipt of goods. AUTHORISATION OBJECTIVE This objective ensures that the transactions are authorized according to the company policy and prevent any unauthorized transactions from entering into the records. Ownership assertion is used here. Inspecting signature of the person who authorize the payment voucher and verification of him being competent for the authorization. Invoices to debtors are to be authorized by the person with their delegation of authority. ACCURACY OBJECTIVE This objective ensures that the transactions dollar amounts are properly calculated. It includes the valuation assertion. Reviewing Bank Reconciliation Statement for accuracy. Tracing payment voucher to purchase invoice to ensure accuracy of payments. Документ1 7 of 8 Group Assignment 1 (GA1) for ACCT 742 Winter 2021 Stephen Hudovernik – The Business School, Centennial College Reference https://www.freshbooks.com/hub/reports/accounts-receivable-aging-report Документ1 8 of 8