Estate Taxation: Gross Estate Overview & Tax Calculation

advertisement

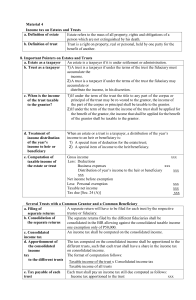

ESTATE TAXATION GENERAL IDEA ESTATE TAX ▪ Tax on the right to transmit property at death ▪ Accrues at the time of death of the decedent ▪ Purpose of Estate Tax a. Raising Revenues Justification : 1) Benefit Received Theory | 2) Ability to Pay Theory b. Reduce Social Inequality Justification : Re-distribution of Wealth Theory OVERVIEW OF GROSS ESTATE Gross Estate Deductions XXX XXX Net Taxable Estate XXX Tax Rate 6% Estate Tax Due XXX Tax Credit XXX Estate Tax Still Due XXX Gross Estate a. Real Properties b. Personal Properties b.1 Tangible Personal Properties b.2 Intangible Personal Properties c. Taxable Transfers C.1 Transfer in Contemplation of Death C.2 Revocable Transfers i. Trust ii. Proceeds of Life Insurance C.3 Transfer under Power of Appointment i. General ii. Limited