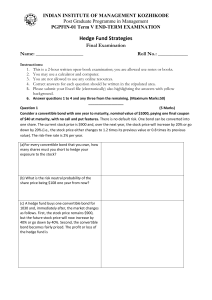

HEDGE FUND STRATEGIES Classified as directional and non-directional Directional: betting one sector of the economy will outperform other sectors Non-directional: attempting to exploit temporary misalignments in relative pricing Non-directional and market neutral: exploit relative mispricing within a market, but is hedge to avoid taking a stance on the direction of the broad market Convergence: mispricing of a futures contracts that must be corrected by contract expiration Relative value: attempting to profit from a change in the spread between mortgages and Treasuries Market neutral position: newly issued 30-year-on-the-run bonds sell at higher yields (lower prices) than 29 ½ year bonds with a nearly identical duration. Pure play: bet on particular mispricing across two or more securities, with extraneous sources of risk such as general exposure hedged away. Statistical Arbitrage: version of market neutral strategy Statistical Arbitrage: uses quantitative techniques and often automated trading systems to seek out many temporary misalignments among securities Backfill: hedge funds report returns to database publishers if they want to. Survivorship: unsuccessful funds are left out of the sample. High water mark: previous value of a portfolio that must be retained before an hedge fund can charge incentive fee. Hedge funds incentive fees: call options on the portfolio with a strike price equal to the current portfolio value times one plus the benchmark return. Pairs trading: statistical arbitrage and data mining Data mining: sorting through huge amounts of historical data to uncover systematic patterns in returns that can be exploited by traders. INVESTMENT POLICIES AND THE FRAMEWORK OF THE CFA INSTITUTE Investment policies: strategies aimed at attaining the established rate of return requirements while meeting expressed risk tolerance and applicable constraints. Contingent immunization: fully-funded pension plan can invest surplus assets in equities provided it reduces the proportion in equities when the value of the fund drops near the accumulated benefit obligation. Keogh Plans: are not taxable until funds are withdrawn as benefits Investment objectives: center on the trade-off between the return the investor wants and how much risk the investor is willing to assume. Investment constraints: boundaries that investors place on their choice of investment assets. Remainderman: receives the principal of a trust when it is dissolved. Principle of duration: useful concept for investments with target dates and means matching one’s assets to one’s objectives. Principle of duration: used only in bond portfolio management. Target-date retirement funds: are funds of funds diversified across stocks and bonds. Target-date retirement funds: change their asset allocation as time passes and are a simple but useful strategy. Investment Policy Statement: can be divided into 4 main elements consisting on scope and purpose, governance, risk management, and return and risk objectives. Scope and purpose: context, investor and structure Governance: assigning the responsibility for determining investment policy, the review process for the IPS, and assigning the responsibility for risk management.