Process Costing Assignment: Journal Entries & Cost Reports

advertisement

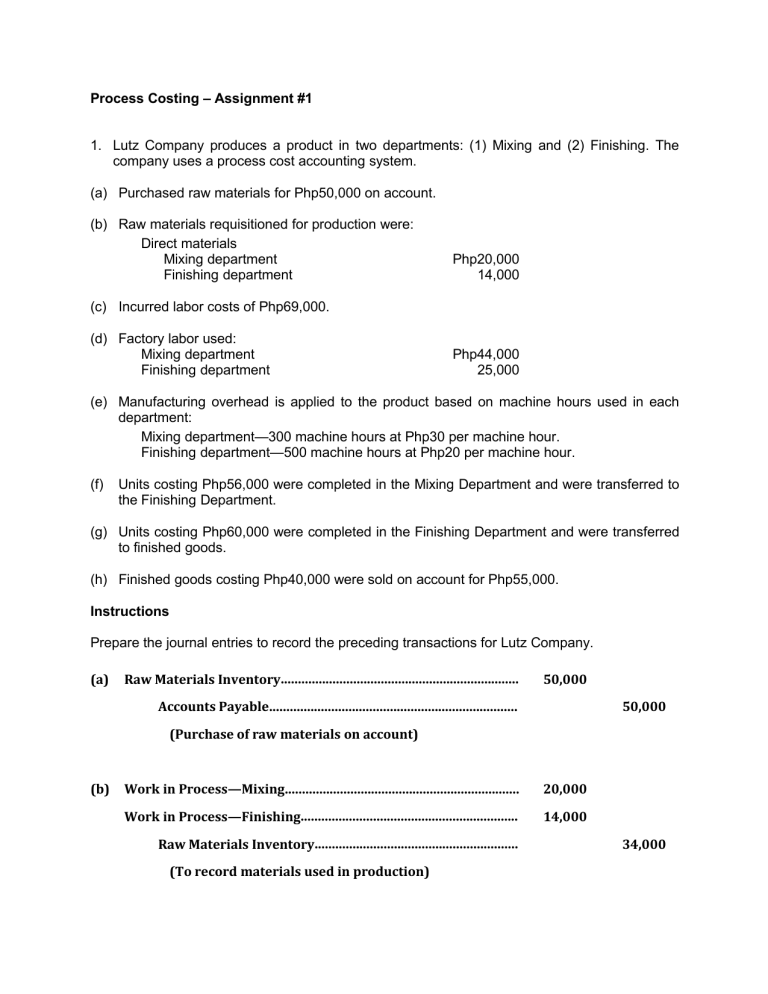

Process Costing – Assignment #1 1. Lutz Company produces a product in two departments: (1) Mixing and (2) Finishing. The company uses a process cost accounting system. (a) Purchased raw materials for Php50,000 on account. (b) Raw materials requisitioned for production were: Direct materials Mixing department Finishing department Php20,000 14,000 (c) Incurred labor costs of Php69,000. (d) Factory labor used: Mixing department Finishing department Php44,000 25,000 (e) Manufacturing overhead is applied to the product based on machine hours used in each department: Mixing department—300 machine hours at Php30 per machine hour. Finishing department—500 machine hours at Php20 per machine hour. (f) Units costing Php56,000 were completed in the Mixing Department and were transferred to the Finishing Department. (g) Units costing Php60,000 were completed in the Finishing Department and were transferred to finished goods. (h) Finished goods costing Php40,000 were sold on account for Php55,000. Instructions Prepare the journal entries to record the preceding transactions for Lutz Company. (a) Raw Materials Inventory..................................................................... 50,000 Accounts Payable........................................................................ 50,000 (Purchase of raw materials on account) (b) Work in Process—Mixing.................................................................... 20,000 Work in Process—Finishing............................................................... 14,000 Raw Materials Inventory........................................................... (To record materials used in production) 34,000 (c) Factory Labor........................................................................................ 69,000 Factory Wages Payable.............................................................. 69,000 (To record payroll liability) (d) Work in Process—Mixing …………………………………………. Work in Process—Finishing............................................................... 44,000 25,000 Factory Labor............................................................................... 69,000 (To assign factory labor to production) (e) Work in Process—Mixing (300 × Php30)........................................ 9,000 Work in Process—Finishing (500 × Php20).................................... 10,000 Manufacturing Overhead.......................................................... 19,000 (To assign overhead to processes) (f) Work in Process—Finishing............................................................... 56,000 Work in Process—Mixing.......................................................... 56,000 (To record transfer of units to the Finishing Department) (g) Finished Goods Inventory................................................................... 60,000 Work in Process—Finishing..................................................... 60,000 (To record transfer of units to finished goods) (h) Accounts Receivable............................................................................ 55,000 Sales Revenue.............................................................................. 55,000 (To record sale of finished goods on account) Cost of Goods Sold.................................................................................. Finished Goods Inventory......................................................... (To record cost of goods sold) 40,000 40,000 2. Mayer Company uses a process cost system. The Molding Department adds materials at the beginning of the process and conversion costs are incurred uniformly throughout the process. Work in process on May 1 was 75% complete and work in process on May 31 was 40% complete. Instructions Complete the Production Cost Report for the Molding Department for the month of May using the above information and the information below. MAYER COMPANY Molding Department Production Cost Report For the Month Ended May 31, 2013 Equivalent Units QUANTITIES Physical Units Materials Conversion Costs Units to be accounted for Work in process, May 1 8,000 Started into production 27,000 Total units 35,000 Units accounted for Transferred out Work in process, May 31 Total units 30,000 30,000 30,000 5,000 5,000 2,000 35,000 35,000 32,000 COSTS Unit costs Materials Conversion Costs Total Php140,000 Php160,000 Php300,000 Equivalent units 35,000 32,000 Unit costs Php 4.00 Php 5.00 Costs in May Php 9.00 Costs to be accounted for Work in process, May 1 Php 60,000 Started into production 240,000 Total costs Php300,000 Cost Reconciliation Schedule Costs accounted for Transferred out ( Php. 30,000 x Php. 9) Php 270,000 Work in process, May 31 Materials Conversion costs ( Php. 5,000 x Php. 4) = Php. 20,000 ( Php. 2,000 x Php. 5) = Php. 10,00 30,000 Total costs 270,000 Php300,000 3. Baker Winery manufactures a fine wine in two departments, Fermenting and Bottling. In the Fermenting Department, grapes are aged in casks for a period of 30 days. In the Bottling Department, the wine is bottled and then sent to the finished goods warehouse. Labor and overhead are incurred uniformly through both processes. Materials are entered at the beginning of both processes. Cost and production data for the Fermenting Department for December 2013 are presented below: Cost data Beginning work in process inventory Materials Conversion costs Total costs Production data Beginning work in process (gallons) Gallons started into production Ending work in process (gallons) $ 37,000 ($30,000 of materials cost) 390,000 121,000 $548,000 5,000 (40%) 65,000 8,000 (25%) Instructions (a) Compute the equivalent units of production. (b) Determine the unit production costs. (c) Determine the costs to be assigned to units transferred out and ending work in process. A. Transferred Out Ending WIP Total: Physical Units 62,000 8,000 70,000 Equivalent Units Materials Conversion cost 62,000 62,000 8,000 2,000 70,000 64,000 ( 65,000 +5,000 - 8,000) B. Unit Production Costs: Materials Conversion Costs Total Unit Cost $6 ( $ 390,000 + 30,000 = 420,000/70,000) 2 ($ 37,000 - 30,000 + 121,000 / 64,000) $8 C. Costs assigned to units transferred out and ending work in process: Total Cost Assigned Transferred out ( 62,000 x $8 ) $ 496,000 Ending work in process Materials (8,000 x 6) $ 48,000 Conversion ( 2,000 x 2) 4,000 52,000 Total $ 548,000