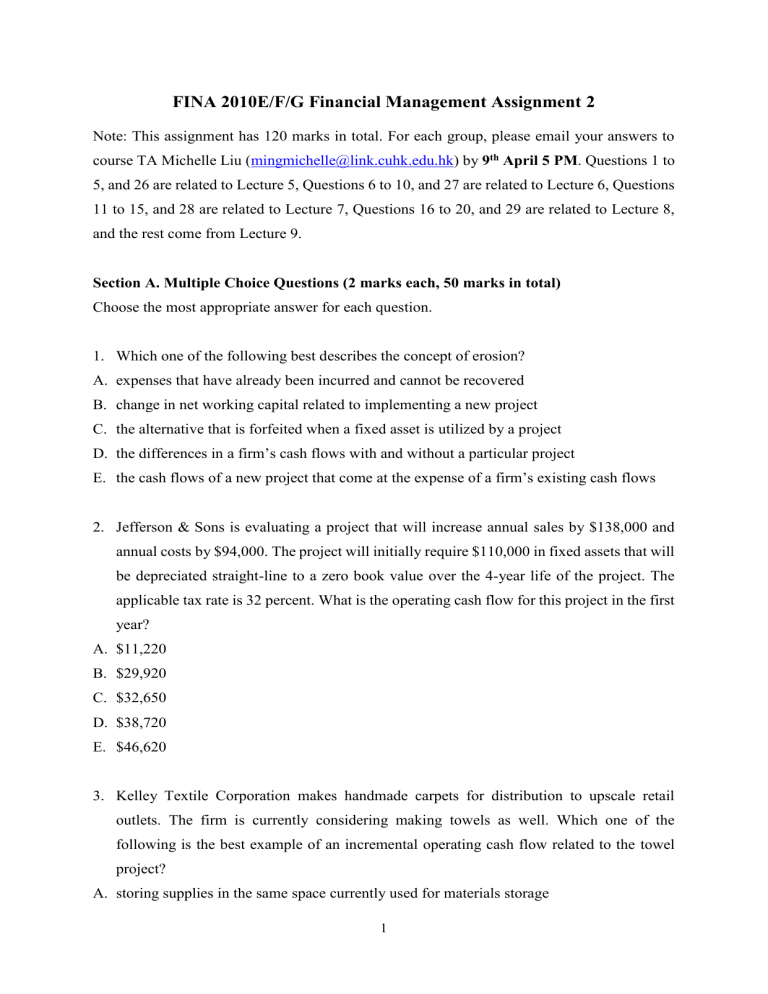

FINA 2010E/F/G Financial Management Assignment 2 Note: This assignment has 120 marks in total. For each group, please email your answers to course TA Michelle Liu (mingmichelle@link.cuhk.edu.hk) by 9th April 5 PM. Questions 1 to 5, and 26 are related to Lecture 5, Questions 6 to 10, and 27 are related to Lecture 6, Questions 11 to 15, and 28 are related to Lecture 7, Questions 16 to 20, and 29 are related to Lecture 8, and the rest come from Lecture 9. Section A. Multiple Choice Questions (2 marks each, 50 marks in total) Choose the most appropriate answer for each question. 1. Which one of the following best describes the concept of erosion? A. expenses that have already been incurred and cannot be recovered B. change in net working capital related to implementing a new project C. the alternative that is forfeited when a fixed asset is utilized by a project D. the differences in a firm’s cash flows with and without a particular project E. the cash flows of a new project that come at the expense of a firm’s existing cash flows 2. Jefferson & Sons is evaluating a project that will increase annual sales by $138,000 and annual costs by $94,000. The project will initially require $110,000 in fixed assets that will be depreciated straight-line to a zero book value over the 4-year life of the project. The applicable tax rate is 32 percent. What is the operating cash flow for this project in the first year? A. $11,220 B. $29,920 C. $32,650 D. $38,720 E. $46,620 3. Kelley Textile Corporation makes handmade carpets for distribution to upscale retail outlets. The firm is currently considering making towels as well. Which one of the following is the best example of an incremental operating cash flow related to the towel project? A. storing supplies in the same space currently used for materials storage 1 B. utilizing the carpet manager to oversee towel production C. hiring additional employees to handle the increased workload should the firm accept the towel project D. researching the market to determine if towel sales might be profitable before deciding to proceed E. planning on lower interest expense by assuming the proceeds of the towel sales will be used to reduce the firm’s currently outstanding debt 4. You own some equipment that you purchased 4 years ago at a cost of $216,000. The equipment is 5-year property for MACRS. You are considering selling the equipment today for $75,500. Which one of the following statements is correct if your tax rate is 35 percent? A. The tax due on the sale is $26,425. B. The book value today is $178,675.20. C. The accumulated depreciation to date is $37,324.80. D. The taxable amount on the sale is $37,324.80. E. The after-tax salvage value is $62,138.68. 5. Champion Mining is considering a project that will require the purchase of $980,000 in new equipment. The equipment will be depreciated straight-line to a zero book value over the 7-year life of the project. The equipment can be scraped at the end of the project for 5 percent of its original cost. Annual sales from this project are estimated at $420,000. Net working capital equal to 20 percent of sales will be required to support the project. All of the net working capital will be recouped. The required return is 16 percent and the tax rate is 35 percent. What is the value of the depreciation tax shield in year 4 of the project? A. $49,000 B. $52,200 C. $68,600 2 D. $71,400 E. $76,500 6. An 8 percent corporate bond that pays interest semi-annually was issued last year. Which of the following most likely apply to this bond today if the current yield to maturity is 7 percent? I. a current yield that less than the coupon rate II. a current yield that larger than the coupon rate III. a market price that less than the face value IV. a market price that larger than the face value A. I and III only B. I and IV only C. II and III only D. II and IV only E. none of the above 7. Sessler Manufacturers has bonds on the market with 13 years to maturity, a yield to maturity of 7.6 percent, and a current price of $901.98. The bonds make semiannual payments and have a face value of $1,000. What is the coupon rate? A. 6.40 percent B. 6.33 percent C. 6.60 percent D. 6.67 percent E. 6.50 percent 8. Winston Co. has a dividend-paying stock with a total return for the year of −6.5 percent. Which one of the following must be true? A. The dividend must be constant. B. The dividend yield must be zero. C. The stock has a negative capital gains yield. D. The required rate of return for this stock increased over the year. E. The firm is experiencing constant growth. 3 9. Upper Crust Bakers just paid an annual dividend of $2.8 a share and is expected to increase that amount by 4 percent per year. If you are planning to buy 1,000 shares of this stock next year, how much should you expect to pay per share if the market rate of return for this type of security is 11.5 percent at the time of your purchase? A. $37.33 B. $38.83 C. $40.38 D. $42.00 E. $43.68 10. Which one of the following rights is never directly granted to all shareholders of a publiclyheld corporation? A. electing the board of directors B. receiving a distribution of company profits C. voting either for or against a proposed merger or acquisition D. determining the amount of the dividend to be paid per share E. having first chance to purchase any new equity shares that may be offered 11. The expected risk premium on a stock is equal to the expected return on the stock minus the: A. expected market rate of return. B. risk-free rate. C. inflation rate. D. standard deviation. E. variance. 12. A stock had returns of 16 percent, 4 percent, 8 percent, 14 percent, −9 percent, and −5 percent over the past six years. What is the geometric average return for this time period? A. 4.26 percent B. 4.67 percent C. 5.13 percent D. 5.39 percent E. 5.60 percent 4 13. One year ago, you purchased 500 shares of Best Wings, Inc. stock at a price of $9.6 a share. The company pays an annual dividend of $0.1 per share. Today, you sold all of your shares for $15.6 a share. What is your total percentage return on this investment? A. 38.46 percent B. 39.10 percent C. 39.72 percent D. 62.50 percent E. 63.54 percent 14. The expected return on a portfolio: I. can never exceed the expected return of the best performing security in the portfolio. II. must be equal to or greater than the expected return of the worst performing security in the portfolio. III. is independent of the allocation of the portfolio amongst individual securities. A. I and II only B. I and III only C. II and III only D. I, II and III E. none of the above 15. The standard deviation of a portfolio: A. is a weighted average of the standard deviations of the individual securities held in the portfolio. B. can never be less than the standard deviation of the most risky security in the portfolio. C. must be equal to or greater than the lowest standard deviation of any single security held in the portfolio. D. is an arithmetic average of the standard deviations of the individual securities which comprise the portfolio. E. can be less than the standard deviation of the least risky security in the portfolio. 16. According to CAPM, the amount of reward an investor receives for bearing the risk of an individual security depends upon the: A. amount of total risk assumed and the market risk premium. B. market risk premium and the amount of systematic risk inherent in the security. 5 C. risk-free rate, the market rate of return, and the standard deviation of the security. D. beta of the security and the market rate of return. E. standard deviation of the security and the risk-free rate of return. 17. Maplewood Cabinets has a beta of 1.09. The risk-free rate of return is 2.75 percent and the market rate of return is 9.8 percent. What is the risk premium on this stock? A. 6.47 percent B. 7.03 percent C. 7.68 percent D. 8.99 percent E. 9.80 percent 18. You are aware that your neighbor trades stocks based on confidential information he overhears at his workplace. This information is not available to the general public. This neighbor continually brags to you about the profits he earns on these trades. Given this, you would tend to argue that the financial markets are at best ________ form efficient. A. weak B. semi-weak C. semi-strong D. strong E. perfect 19. Which one of the following statements is correct concerning a portfolio beta? A. Portfolio betas range between −1.0 and +1.0. B. A portfolio beta is a weighted average of the betas of the individual securities contained in the portfolio. C. A portfolio beta cannot be computed from the betas of the individual securities comprising the portfolio because some risk is eliminated via diversification. D. A portfolio of U.S. Treasury bills will have a beta of +1.0. E. The beta of a market portfolio is equal to zero. 6 20. The market rate of return is 11 percent and the risk-free rate of return is 3 percent. Lexant stock has 3 percent less systematic risk than the market and has an actual return of 12 percent. This stock: A. is underpriced. B. is correctly priced. C. will plot below the security market line. D. will plot on the security market line. E. will plot to the right of the overall market on a security market line graph. 21. Which one of the following is a direct cost of bankruptcy? A. Bypassing a positive NPV project to avoid additional debt B. Interrupting normal business operations C. Maintaining a debt-equity ratio that is lower than the optimal ratio D. Losing a key company employee E. Paying an outside accountant to prepare bankruptcy reports 22. Katlin Markets is debating between a levered and an unlevered capital structure. The allequity capital structure would consist of 60,000 shares of stock. The debt and equity option would consist of 45,000 shares of stock plus $250,000 of debt with an interest rate of 7.25 percent. What is the break-even level of earnings before interest and taxes between these two options? Ignore taxes. A. $50,500 B. $68,200 C. $81,400 D. $66,667 E. $72,500 23. Suppose the applicable tax rate is 20 percent. Which one of the following is correct? A. the optimal capital structure is the one that is totally financed with equity. B. capital structure is irrelevant because investors and companies have differing tax rates. C. WACC is unaffected by a change in the company’s capital structure. D. the value of a taxable company increases as the level of debt increases. E. the cost of equity decreases as the debt-equity ratio increases. 7 24. The Corner Bakery has a debt-equity ratio of 0.53. The required return on assets is 13.5 percent and its cost of equity is 15.8 percent. What is the cost of debt? Ignore taxes. A. 7.56 percent B. 8.40 percent C. 8.78 percent D. 9.16 percent E. 10.68 percent 25. The static theory of capital structure advocates that the optimal capital structure: A. will be the same for all firms in the same industry. B. will remain constant over time unless the firm changes its primary operations. C. will vary over time as taxes and market conditions change. D. places more emphasis on operations than on financing. E. is unaffected by changes in the financial markets. Section B. Long Questions (70 marks in total) Answer the questions in steps. 26. Chapman Machine Shop is considering a 4-year project to improve its production efficiency. Buying a new machine press for $576,000 is estimated to result in $192,000 in annual pre-tax cost savings. The press falls in the MACRS 5-year class, and it will have a salvage value at the end of the project of $84,000. The press also requires an initial investment in spare parts inventory of $24,000, along with an additional $3,600 in inventory each year for the succeeding 3 years of the project. The inventory will return to its original level when the project ends. The shop’s tax rate is 35 percent and its discount rate is 11 percent. What is the net present value of the project? Should the firm buy and install the machine press? (15 marks) 8 27. Storico Co. just paid a dividend of $3.15 per share. The company will increase its dividend by 20 percent next year and then reduce its dividend growth rate by 5 percentage points per year until it reaches the industry average of 5 percent dividend growth, after which the company will keep a constant growth rate forever. If the required return on the company’s stock is 12 percent, what will a share of stock sell for today? (15 marks) 28. Based on the following information, calculate the expected return and standard deviation for the two equities. (15 marks) State of Economy Recession Normal Boom Probability of State of Economy 0.25 0.55 0.20 Rate of Return if State Occurs Equity A Equity B 0.05 –0.17 0.08 0.12 0.13 0.29 29. An equity has a beta of 1.35 and an expected return of 16 percent. A risk-free asset currently earns 4.8 percent. You form a portfolio based on these two assets. a. If a portfolio of the two assets is as risky as the market, what are the portfolio weights? (5 marks) b. If a portfolio of the two assets has an expected return of 8 percent, what is its beta? (5 marks) 30. Change Corporation expects an EBIT of $31,200 every year forever. The company currently has no debt, and its cost of equity is 11 percent. The corporate tax rate is 22 percent. a. What is the current value of the company? (5 marks) b. Suppose the company can borrow at 6 percent. What will the value of the firm be if the company takes on debt equal to 50 percent of its unlevered value? What if it takes on debt equal to 50 percent of its levered value? (10 marks) 9