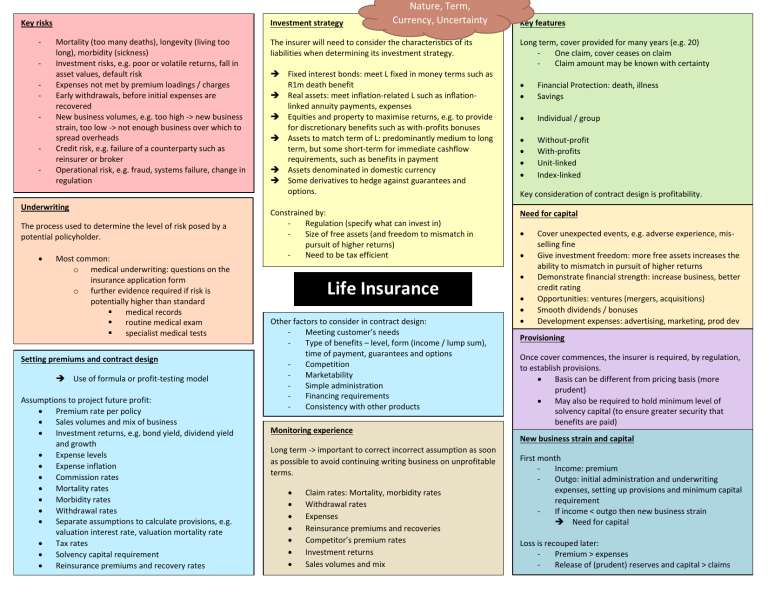

Key risks - - Investment strategy Mortality (too many deaths), longevity (living too long), morbidity (sickness) Investment risks, e.g. poor or volatile returns, fall in asset values, default risk Expenses not met by premium loadings / charges Early withdrawals, before initial expenses are recovered New business volumes, e.g. too high -> new business strain, too low -> not enough business over which to spread overheads Credit risk, e.g. failure of a counterparty such as reinsurer or broker Operational risk, e.g. fraud, systems failure, change in regulation Underwriting The process used to determine the level of risk posed by a potential policyholder. • Most common: o medical underwriting: questions on the insurance application form o further evidence required if risk is potentially higher than standard ▪ medical records ▪ routine medical exam ▪ specialist medical tests Setting premiums and contract design ➔ Use of formula or profit-testing model Assumptions to project future profit: • Premium rate per policy • Sales volumes and mix of business • Investment returns, e.g. bond yield, dividend yield and growth • Expense levels • Expense inflation • Commission rates • Mortality rates • Morbidity rates • Withdrawal rates • Separate assumptions to calculate provisions, e.g. valuation interest rate, valuation mortality rate • Tax rates • Solvency capital requirement • Reinsurance premiums and recovery rates Nature, Term, Currency, Uncertainty The insurer will need to consider the characteristics of its liabilities when determining its investment strategy. ➔ Fixed interest bonds: meet L fixed in money terms such as R1m death benefit ➔ Real assets: meet inflation-related L such as inflationlinked annuity payments, expenses ➔ Equities and property to maximise returns, e.g. to provide for discretionary benefits such as with-profits bonuses ➔ Assets to match term of L: predominantly medium to long term, but some short-term for immediate cashflow requirements, such as benefits in payment ➔ Assets denominated in domestic currency ➔ Some derivatives to hedge against guarantees and options. Constrained by: Regulation (specify what can invest in) Size of free assets (and freedom to mismatch in pursuit of higher returns) Need to be tax efficient Life Insurance Other factors to consider in contract design: Meeting customer’s needs Type of benefits – level, form (income / lump sum), time of payment, guarantees and options Competition Marketability Simple administration Financing requirements Consistency with other products Monitoring experience Long term -> important to correct incorrect assumption as soon as possible to avoid continuing writing business on unprofitable terms. • • • • • • • Claim rates: Mortality, morbidity rates Withdrawal rates Expenses Reinsurance premiums and recoveries Competitor’s premium rates Investment returns Sales volumes and mix Key features Long term, cover provided for many years (e.g. 20) One claim, cover ceases on claim Claim amount may be known with certainty • • Financial Protection: death, illness Savings • Individual / group • • • • Without-profit With-profits Unit-linked Index-linked Key consideration of contract design is profitability. Need for capital • • • • • • Cover unexpected events, e.g. adverse experience, misselling fine Give investment freedom: more free assets increases the ability to mismatch in pursuit of higher returns Demonstrate financial strength: increase business, better credit rating Opportunities: ventures (mergers, acquisitions) Smooth dividends / bonuses Development expenses: advertising, marketing, prod dev Provisioning Once cover commences, the insurer is required, by regulation, to establish provisions. • Basis can be different from pricing basis (more prudent) • May also be required to hold minimum level of solvency capital (to ensure greater security that benefits are paid) New business strain and capital First month Income: premium Outgo: initial administration and underwriting expenses, setting up provisions and minimum capital requirement If income < outgo then new business strain ➔ Need for capital Loss is recouped later: Premium > expenses Release of (prudent) reserves and capital > claims