MONETARYDETERMINATIONPANDEMICUNEMPLOYMENTASSISTANCE CHARLESPOWELL-3824202007284640

advertisement

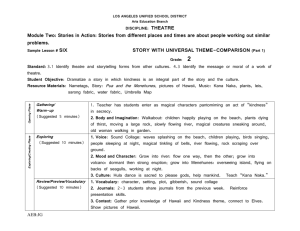

MONETARY DETERMINATION PANDEMIC UNEMPLOYMENT ASSISTANCE Unemployment Insurance Program PO Box 29225 Mail Drop 5895 Phoenix, AZ 85038 - 9225 Claimant ID: 1804728 Claim Effective Date (BYB): 07/26/2020 Charles A Powell 1124 E Polk St Phoenix, AZ 85006-3490 Benefit Year Ending (BYE): 12/26/2020 This determination notifies you that you are monetarily eligible for Pandemic Unemployment Assistance (PUA) benefits pursuant to the Coronavirus, Aid, Relief, and Economic Security (CARES) Act. Provided you meet all program deadlines and eligibility requirements during the week(s) claimed, you are eligible for a weekly benefit amount (WBA) of $117.00. Your WBA is based on your wages paid and/or net income from self-employment earned during calendar year 2019. If you do have sufficient wages, your WBA is based on the following: 1/25 or 4% of your highest quarter earnings from the PUA base period, which is calendar year 2019, up to the maximum weekly benefit amount is $240.00. If you have insufficient or no employment/self-employment income, your WBA is based on the following: 50% of the average weekly benefit amount of regular compensation paid in the State of Arizona, in accordance with Section 2102(d) of the CARES Act, which is $117.00. Our records and/or the records you provided show, that during your base period wages and/or selfemployment net income reported were; Employment Income: No employment histories found. OTHER IMPORTANT INFORMATION WEEKLY FILING INSTRUCTIONS - Online (fastest option) - Each week you will be required to file a weekly certification in order to receive Pandemic Unemployment Assistance Benefits. Log into the Pandemic Unemployment Assistance portal at pua.azdes.gov. Postal Mail - Fill out a paper copy of the weekly claim form found on www.azdes.gov/pua and follow the instructions on the form for returning the document. Fax - 602-362-5389 or toll-free 1-888-417-3638. During a claim week that you are working and you earn more than $30.50 but less than your weekly benefit amount, you may qualify for partial benefits. YOU ARE REQUIRED TO REPORT ALL WORK AND ALL GROSS EARNINGS DURING ANY WEEK THAT YOU ARE FILING FOR BENEFITS REGARDLESS OF WHETHER THE AMOUNT IS ABOVE OR BELOW YOUR PARTIAL BENEFIT CREDIT. PANDEMIC ASSISTANCE PERIOD - The Pandemic Assistance Period (PAP) begins February 2, 2020 (the first week following the beginning date provided by the CARES Act) and ends on December 26, 2020 (the last week provided by the CARES Act) or December 27, 2020 (the last week provided by the CARES Act. PUA claims are effective the week filed. However, they must be backdated to the first week during the PAP in which the individual meets the definition of a covered individual. The total number of weeks in which a covered individual may receive PUA may not exceed 39 weeks and such total must include any week for Equal Opportunity Employer / Program • Auxiliary aids and services are available upon request to individuals with disabilities • To request this document in alternative format or for further information about this policy, contact your local office; TTY/TDD Services:7-1-1 • Disponible en español en línea o en la oficina local. 1 of 3 E55201BC-B99A-4B88-A2FF-5769CE0345C7 3275939 which a covered individual received regular compensation or extended benefits under any state or federal law. Section 2102 of the Act provides that if extended benefits duration is extended after March 27, 2020, the 39-week period shall be extended by the number of weeks that is equal to the number of weeks by which the extended benefits were extended. Thus, if a state enters a “high unemployment period,” as provided in section 202(b)(3)(B) of the Federal-State Extended Unemployment Compensation Act of 1970 (26 U.S.C. 3304 note), up to an additional 7 weeks of benefits for a total of 46 weeks of PUA benefits would be available to eligible individuals. However, note that PUA entitlement must be reduced by the amount of regular compensation and extended benefits the individual received. MAXIMUM AND MINIMUM WEEKLY BENEFIT AMOUNT - In no case will your WBA be higher than $240.00. This is known as the Maximum PUA WBA. If you have insufficient wages from employment or insufficient or no net income from self-employment in the applicable tax year base period, your WBA is equal to 50 percent of the average weekly payment of regular compensation in Arizona, which is $117.00. This is known as the Minimum PUA WBA. OTHER TYPES OF APPLICANTS - Refer to the PUA Handbook found at www.azdes.gov/pua for information on head of household/breadwinner, incapacitated or deceased applicants and family business. FUTURE REDETERMINATION DURING PANDEMIC PERIOD - If you filed your PUA claim based only on your certification of credit weeks and/or wage documentation, you must submit sufficient documentation of employment/self-employment within 21 days of your initial application. If sufficient documentation is not received within 21 calendar days, your PUA WBA will be redetermined. If the redetermined amount is less than the original PUA WBA and you received payments of PUA for any weeks of unemployment prior to the date of the redetermination, a determination will be issued establishing an overpayment. The initial PUA application will be reviewed to determine if you should be subject to a disqualification for fraudulently filing the application. You may submit additional documentation at any time during the Pandemic Assistance Period to substantiate wages earned or paid during the base period. The state must immediately issue a monetary redetermination if the state determines the wages documentation is sufficient to permit a re-computation. The monetary redetermination applies to all weeks of unemployment for which you qualify and file during the Pandemic Assistance Period. The state must recalculate the WBA for any weeks previously paid and provide supplementary payment as appropriate. If the PUA WBA was redetermined because the required wage documentation was not submitted within 21 calendar days, you may have your WBA redetermined upon submittal of the documentation prior to the end of the pandemic assistance period. Any higher weekly amount determined will be applied to all weeks that you filed for which you were eligible for the payment of PUA. Documentation may include but is not limited to: 2019 Tax Returns, Schedule C 2019 W2s or 1099s Business records (bank statements, financial statements) Copies of paycheck stubs showing your 2019 earnings Please submit your documentation by one of these methods: Online (fastest option) - Log into the Arizona PUA portal at pua.azdes.gov. Then from your PUA dashboard, click "Upload a Document" from the left side menu. 2 of 3 E55201BC-B99A-4B88-A2FF-5769CE0345C7 3275939 Postal mail - Make a copy of your documentation and mail the copy to: Unemployment Insurance Program PO Box 29225 Mail Drop 5895 Phoenix, AZ 85038 - 9225 Fax - 602-362-5391 or toll-free 1-888-417-3639. PUA HANDBOOK- Further information about your rights and responsibilities is available in the PUA handbook found at www.azdes.gov/pua. The information provided above is intended as a brief description of the requirements under applicable state and federal laws. This information does not have the force of law or regulation. IMPORTANT NOTICE ABOUT FRAUD The PUA Federal Regulation at 20 CFR §625.14(i) provides that if a person was overpaid because the person (1) knowingly made, or caused another to make a false statement or misrepresentation of a material fact, or (2) knowingly failed, or caused another to fail, to disclose a material fact, pertaining to an initial application for PUA, the person is disqualified from the receipt of any PUA with respect to that major pandemic. If the false statement, misrepresentation, or nondisclosure pertains to a week for which application for payment of PUA is made, the individual shall be disqualified from the receipt of PUA for that week and the first two compensable weeks in the Pandemic Assistance Period immediately following that week, with respect to which the individual is otherwise entitled to a payment of PUA. 3 of 3 E55201BC-B99A-4B88-A2FF-5769CE0345C7 3275939