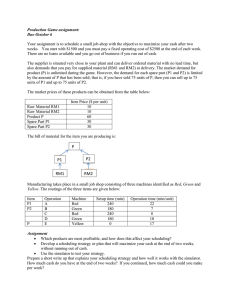

ACT3211 (G3n4):TIME VALUE OF MONEY (II) EXERCISE 1. What is the future value of a 5-year ordinary annuity with annual payments of RM200, evaluated at a 15 percent interest rate? Annuity Due? PMT= RM200 I=15% N=5 M=1 PV=0 FV=? FV= RM1,348.4762 Annuity Due= RM 2. What is the present value of a 10-year ordinary annuity with annual payments of $2000, evaluated at a 10 percent interest rate? FV=0 PMT=2000 N=10 I=10 M=1 PV=? RM12,289.1342 3. To pay for her college education, Sephia is saving RM2,000 at the beginning of each year for the next eight years in a bank account paying 12 percent interest. How much will Sephia have in that account at the end of 8th year? Calculate using annuity due I=12% N=8 PMT=RM2,000 FV=RM27,551.3126 4. Assume that you will receive RM4,000 a year in Years 1 through 5, RM6,000 a year in Years 6 through 8, and RM8,000 in Year 9, with all cash flows to be received at the end of the year. If you require a 15 percent rate of return, what is the present value of these cash flows? CF0 = 0 CF1 to CF5 = RM4,000 CF6 to CF8 = RM6,000 CF9 = RM8,000 I=15% NPV=? RM22,493.7182 5. Assume that you will saving RM1,000 a year in Years 1 through 5, RM2,000 a year in Years 6 through 8, and RM5,000 in Year 9 and 10, with all cash flows to be received at the end of the year. If you require a 10 percent rate of return, what is the future value of these cash flows? CF0 = 0 CF1 to CF5 = RM1,000 CF6 to CF8 = RM2,000 CF9 to CF10 = RM5,000 I = 10% FV=? RM28,342.5246 6. Your bank offers to lend you $180,000 at an 8.5% annual interest rate to start your new business. The terms require you to amortize the loan with 10 equal end-of-year payments. How much interest would you be paying in Year 2? Total principal paid from Year 1 till 4? PV=$180,000 FV=$0 I=8.5% N=10 PMT= $27,433.3869 Interest Year 2 = $14,268.6621 Total Prn paid in 4 years = $55,079.6813 7. Ahmad has purchased a new car for RM80,000. He paid RM30,000 as down payment and he paid the balance by a loan from his hometown bank. The loan is to be paid on a monthly basis for seven years charging 4 percent interest. How much are the monthly payments? Principal paid in 4th month? Total interest paid till Year 2? PV=RM50,000 M=12 I=4/12=0.3333% N=7x12=84 PMT=? RM683.4311 PRN on 4th month? RM521.9656 Total interest paid in 2 years? RM3,512.3834 8. In their meeting with their advisor, Mr. & Mrs. Klopp concluded that they would need RM80,000 per year during their retirement years in order to live comfortably. They will retire 10 years from now and expect a 20 year retirement period. How much should Mr. & Mrs. Klopp deposit now in a bank account paying 9 percent to reach financial happiness during retirement? CF0 = 0 C01 = RM0 F01 = 10 C02 = RM80,000 F02 = 20 I=9% NPV=RM308,479.7073