QUANTITATIVE TECHNIQUES

USING STATISTICAL METHODS TO FINE TUNE

PRODUCTIVITY OF CANDY FACTORY & TEST COST

EFFICIENCY USING ALTERNATE FUEL

Table of Contents

Introduction & Motivation

Confidentiality

Data source

Problem statement

Data analysis for fine-tuning productivity of production plants

Source data

Analysis

Graphical representations

Using probability distributions to analyze the efficiency of cost/productivity in different possible

scenarios

Binomial distribution

Poisson distribution

Using hypothesis analysis for an increase cost efficiency with alternate channel

Conclusion

2

Introduction & Motivation

The challenge faced by any production industry is to make use of its available resources in the best possible

way to increase the output and reduce the cost consistently. Especially in companies with multiple plants

of varying output efficiency producing the same product, it is very essential to define the best possible way

to use them in order to get the best efficiency.

Fuel is one major influencer is deciding the cost efficiency of manufacturing. Looking out for cheaper

alternative fuels and getting them implemented in a consistent way will help companies to increase margins

and keep them ahead of the competition.

In this project, we have used statistical methods for analyzing the productivity of plants, for understanding

cost-effectiveness probabilities under different scenarios and a hypothesis analysis to analyze if we can

achieve the cost-effectiveness expected by the company using alternative fuel.

Confidentiality

We thank the organization and its staff who have provided their valuable data for this project. The data

represented here are actuals to the extend permissibly. Some of this data might of competitor interest. We

request for viewer’s discretion in sharing data represented in this report.

Data Source

We have used data from Sweetco Foods Limited. manufacturers of candies and confectionaries have its

debut in Nigeria. With a keen focus on Quality and adoption of international standards, Sweetco Foods

Limited earned an enviable position in the confectionery market in Nigeria. The data presented is their

output data from plants and output results by changing to the alternate.

Problem Statement

Our approach in this project is to give an analysis of the effective usage of current working plants

Testing the output probability of different working cases for cost and production efficiency

Company has decided to take a shift from the conventional use of diesel as the fuel to LPG expecting

a reduction in overall cost by 10% in a short run and 30% reduction in cost in long term

3

Data Analysis for Fine-tuning Productivity of Production Plants

Source Data

Description

Count

Plant 1

Plant 2

Plant 3

Plant 4

Plant 5

11,898.55

280.98

15,493.28

0.00

7,240.36

12,517.29

274.05

15,454.80

0.00

7,061.76

10,398.42

278.61

13,265.85

0.00

7,179.38

15,107.82

223.82

15,844.61

0.00

5,767.56

18,226.42

232.21

19,271.93

0.00

5,983.64

5,24,22,875.50

-0.96

-0.92

19,537.20

0.00

19,537.20

4,98,68,439.51

-0.62

-1.01

23,036.40

0.00

23,036.40

5,15,43,471.54

-1.27

-0.56

32,018.78

0.00

32,018.78

3,32,64,778.10

3.60

-0.19

38,922.62

0.00

38,922.62

3,58,03,926.99

3.44

-1.57

38,272.50

0.00

38,272.50

79,00,638.75

0.61

664.00

83,11,482.90

0.56

664.00

69,04,548.29

0.69

664.00

1,00,31,593.52

0.38

664.00

1,21,02,339.60

0.33

664.00

Correlation Table

1

2

51.37%

2

3

15.79%

21.32%

3

Graphical View

4

4

1.31%

2.20%

-2.32%

4

5

11.93%

10.78%

-0.58%

61.09%

Key Insights

Plant 5 has seen the maximum Production

It's also the most consistent as it has the lowest standard deviation and coefficient of variation

Plant 4 is also the most consistent in terms of output after plant 5

A quick analysis of the performance shows that there is medium correlation between outputs of

plant1 and plant 2 & plant 4 and plant 5

Plant Productivity – Trend Analysis

Key Insights

5

Using Probability Distributions to Analyze the Efficiency of Cost/Productivity in

Different Possible Scenarios

Probability Distribution - Random Variable

Considering the Production in the month of Jan 2020, there were 22 production days out of which

Plant 3 was productive only on 15 days.

Production Data

12,830.40

17,496.00

14,531.40

11,372.40

17,204.40

17,496.00

18,370.80

14,673.15

17,204.40

16,912.80

16,912.80

16,912.80

12,538.80

15,163.20

16,329.60

16,038.00

12,279.60

12,830.40

17,204.40

18,079.20

16,912.80

14,077.80

13,996.80

19,245.60

14,904.00

10,206.00

17,204.40

18,079.20

17,204.40

14,624.55

17,496.00

12,976.20

23,036.40

17,496.00

11,080.80

17,204.40

17,496.00

16,329.60

13,085.55

12,830.40

16,621.20

18,079.20

17,204.40

14,239.80

9,959.76

16,820.93

12,818.58

0.00

0.00

0.00

0.00

0.00

16,599.60

12,412.81

16,378.27

15,492.96

0.00

0.00

9,959.76

16,378.27

11,352.28

9,959.76

22,132.80

17,484.91

17,263.58

13,399.57

Probability of Productive vs Non-Productive

6

11,022.34

16,763.14

13,447.82

9,644.54

18,600.19

18,600.19

18,600.19

13,988.42

18,370.56

18,140.93

17,911.30

17,911.30

11,251.97

18,140.93

2,774.72

0.00

0.00

14,007.55

18,140.93

18,140.93

17,222.40

13,658.32

11,955.60

21,870.00

16,819.65

7,873.20

22,453.20

16,839.90

16,912.80

14,341.05

23,036.40

21,870.00

22,744.80

23,036.40

15,746.40

22,453.20

22,744.80

16,276.95

18,504.45

18,370.80

18,877.05

21,870.00

22,453.20

17,398.80

59,764.90

92,195.66

72,521.45

39,096.14

75,462.19

71,015.29

71,088.19

57,627.17

92,706.96

82,312.74

96,983.57

90,849.46

50,617.97

72,961.73

69,304.88

65,022.82

55,221.88

67,998.91

92,976.38

93,654.24

91,056.38

72,774.29

Plant-3’s management would like to determine the probability of plant not being effectively utilized

in a month over its productive utilization.

Find the Probability of both Plant-3 and Plant-4 being productive on a given day in Jan 2020.

What is the probability that on a randomly chosen day in Jan 2020, all 5 plants were operational

and, on an average, produced more than 60K?

Probability Distribution – Discrete Variable

Fuel Cost Data – 2019

Month

Total

Sum of Total Cost

of LPG

Sum of Total Cost

of Diesel

₹ 10,194.50

₹ 10,364.25

₹ 9,798.77

₹ 8,486.06

₹ 9,793.50

0

0

0

0

0

₹ 8,398.38

₹ 8,549.82

₹ 12,703.99

₹ 12,073.03

₹ 11,648.46

₹ 9,161.00

0

0

0

0

0

0

₹ 11,615.04

0

₹ 1,22,786.81

0

S No

1

2

3

4

5

Range

8000 to 9000

9000 to 10000

10000 to 11000

11000 to 12000

> 12000

Probability

0.25

0.25

0.17

0.17

0.17

What is the probability that total LPG consumption in a month of the year 2019 is at at-most

10000?

This means, in a year at-most 50%, monthly expenditure on LPG is less than equal to 10000.

7

Cost of LPG consumption in 2019 on an average crossed 10K per month for 6 times. What is the

probability that the cost of the LPG consumption will cross 10k for 2 months during the duration of the

first 6 months in 2020? (Poisson)

This means there is a 23% chance that the monthly average consumption of LPG will be more

than 10k in 2 months of Q1/Q2 in 2020.

In the month of Mar 2018, 50% of productive days have run the plant using diesel. On a chosen

sample of 10 days in that month, find the probability of at-least on 3 days plants used LPG (Binomial)

Probabilities

Binomial Value

P(X=0)

0.0009766

P(X=1)

P(X=2)

P(X=3)

0.0097656

0.0439453

0.1171875

0.1718750

So, for the chosen 10 sample days – 83% probability that 3 or more days used LPG over Diesel.

Using Hypothesis Analysis for an Increase Cost Efficiency with Alternate Channel

Hypothesis analysis reflect the following interpretations –

After shifting from diesel to LPG as the fuel for the boiler, we expect a 10% drop in the cost of fuel

per day per unit of unit.

From the diesel population data, the mean cost of fuel per day per unit of output is 11.77 NGN.

After switching to LPG, we expect the mean cost of fuel per day per unit of output to drop by 10%

(in the short run) to 10.593 NGN.

To validate this claim, we perform a hypothesis testing. After 3 months of production with LPG as

the boiler fuel, we consider a sample of 61 data points (removing outliers) for the hypothesis

testing. The status quo scenario is that the mean cost of fuel per day per unit of output is greater

than or equal to 10.593 NGN. We perform the testing at a significance level, α = 0.05.

µ0 = 10.593

8

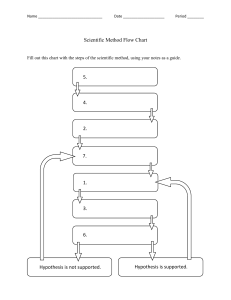

Null hypothesis, H0: u ≥ 10.593

Alternate hypothesis, Ha: u < 10.593

Number of sample data points, n = 61

LPG population data is not available, and population standard deviation is unknown.

Therefore, we need to assume that the population being sampled is normally distributed. We will

have to use t distribution for the hypothesis testing.

Sample mean, x̄= 10.0527

Sample standard deviation, s = 1.8654

Degrees of freedom, df = 60

t = (x̄ - µ0) / (s/√n) = -2.2623

tα, df = t0.05,60 = -1.6706

α = 0.05

p-value = 0.01367 (calculated)

Since t < tα and p < α, the test is significant, and we reject H0. We can hereby state with 95%

confidence that the firm has achieved a 10% decrease in the cost of fuel per day per unit of output.

We can also determine the 95% confidence interval.

α = 0.05

α/2 = 0.025

upper limit = x̄ + (tα/2*[ s/√n]) = 10.5303

lower limit = x̄ - (tα/2*[ s/√n]) = 9.57499

Therefore, the 95% confidence interval for LPG population mean is [9.57499,10.5303]

Conclusion

Based on the above analysis and the LPG population data (from March 2018 till January 2020), we find –

9

This page is left blank

intentionally

10