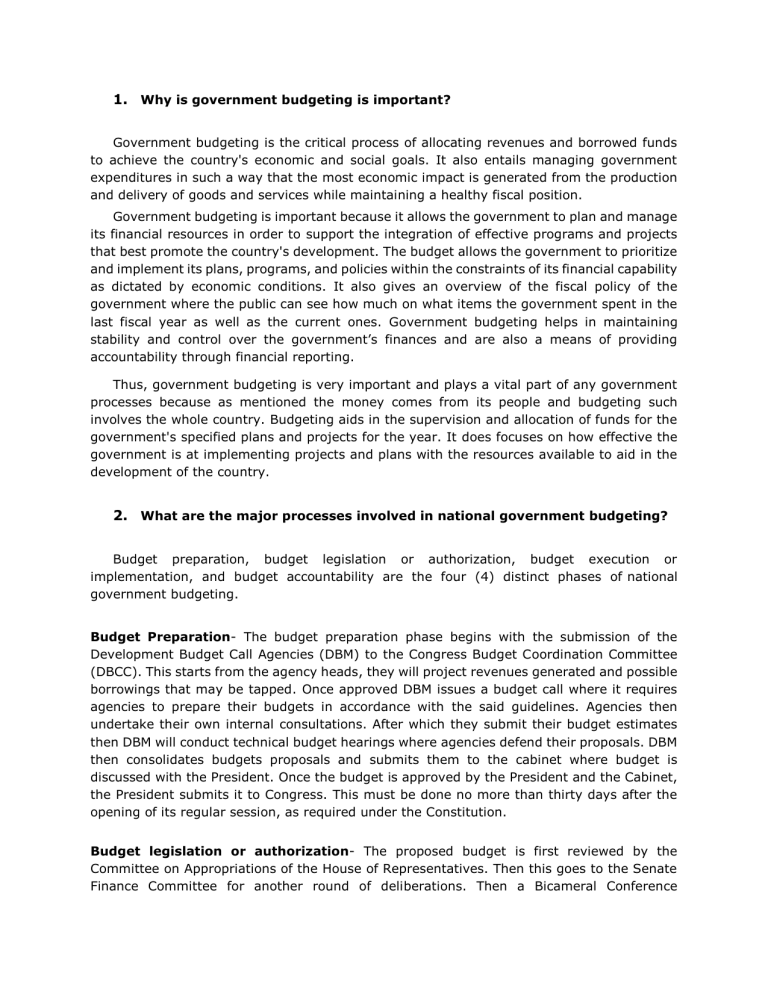

1. Why is government budgeting is important? Government budgeting is the critical process of allocating revenues and borrowed funds to achieve the country's economic and social goals. It also entails managing government expenditures in such a way that the most economic impact is generated from the production and delivery of goods and services while maintaining a healthy fiscal position. Government budgeting is important because it allows the government to plan and manage its financial resources in order to support the integration of effective programs and projects that best promote the country's development. The budget allows the government to prioritize and implement its plans, programs, and policies within the constraints of its financial capability as dictated by economic conditions. It also gives an overview of the fiscal policy of the government where the public can see how much on what items the government spent in the last fiscal year as well as the current ones. Government budgeting helps in maintaining stability and control over the government’s finances and are also a means of providing accountability through financial reporting. Thus, government budgeting is very important and plays a vital part of any government processes because as mentioned the money comes from its people and budgeting such involves the whole country. Budgeting aids in the supervision and allocation of funds for the government's specified plans and projects for the year. It does focuses on how effective the government is at implementing projects and plans with the resources available to aid in the development of the country. 2. What are the major processes involved in national government budgeting? Budget preparation, budget legislation or authorization, budget execution or implementation, and budget accountability are the four (4) distinct phases of national government budgeting. Budget Preparation- The budget preparation phase begins with the submission of the Development Budget Call Agencies (DBM) to the Congress Budget Coordination Committee (DBCC). This starts from the agency heads, they will project revenues generated and possible borrowings that may be tapped. Once approved DBM issues a budget call where it requires agencies to prepare their budgets in accordance with the said guidelines. Agencies then undertake their own internal consultations. After which they submit their budget estimates then DBM will conduct technical budget hearings where agencies defend their proposals. DBM then consolidates budgets proposals and submits them to the cabinet where budget is discussed with the President. Once the budget is approved by the President and the Cabinet, the President submits it to Congress. This must be done no more than thirty days after the opening of its regular session, as required under the Constitution. Budget legislation or authorization- The proposed budget is first reviewed by the Committee on Appropriations of the House of Representatives. Then this goes to the Senate Finance Committee for another round of deliberations. Then a Bicameral Conference Committee is created to resolve differences. And if the committee arrives at a common version, it is then submitted to the President. The president can either approve or disapprove the bill, if signed into law it shall be considered General Appropriations Act. Budget execution or implementation- The expenditure project is implemented during the budget execution stage. Allotments are made, which are deducted from the regular agency budgets. It is also at this stage that agencies may submit requests for SPF allocation. Budget accountability- The budget process concludes with the accountability phase. This is the time for agencies to report on their actual physical and financial performance. While distinct, these processes overlap in their implementation over the course of a fiscal year. Budget preparation for the next fiscal year continues while government agencies carry out the current fiscal year's budget. Simultaneously, the state is engaged in budget accountability as it reviews the previous year's budget. 3. How is the annual national budget prepared? The Development Budget Coordinating Committee (DBCC) determines the overall economic targets, expenditure levels, revenue projections, and the financing plan, which is followed by a series of steps in the preparation of the annual budget. The DBCC is an interagency body comprised of the DBM Secretary as Chairman, the Bangko Sentral Governor, the Secretary of Finance, the Director General of the National Economic and Development Authority, and a representative from the President's Office as members. The following are the major activities involved in the preparation of the annual national budget: a. Determination of overall economic targets, expenditure levels and budget framework by the DBCC; b. Issuance by the DBM of the Budget Call which defines the budget framework; sets economic and fiscal targets; prescribe the priority thrusts and budget levels; and spells out the guidelines and procedures, technical instructions and the timetable for budget preparation; c. Preparation by various government agencies of their detailed budget estimates ranking programs, projects and activities using the capital budgeting approach and submission of the same to DBM; d. Conduct a budget hearings were agencies are called to justify their proposed budgets before DBM technical panels; e. Submission of the proposed expenditure program of department/agencies special for confirmation by department/agency heads. f. Presentation of the proposed budget levels of department/agencies/special purpose funds to the DBCC for approval. g. Review and approval of the proposed budget by the President and the Cabinet; h. Submission by the President of proposed budget to Congress The budget preparation phase is guided by a budget calendar in order to meet the Constitutional requirement of submitting the President's budget within 30 days of the start of each regular session of Congress. 4. How does the budget become a law? As per the Constitution, the President submits his/her presented annual budget in the form of a Budget of Expenditure and Sources of Financing (BESF). In which is supported by details of proposed expenditures in the form of a National Expenditure Program (NEP) and the President's Budget Message, which summarizes the budget policy thrusts and priorities for the year. The proposed budget is first sent to the House of Representatives, which delegated the task of initial budget review to its Appropriations Committee. The Appropriation Committee, along with the other House Subcommittees, hold hearings on department/agency budgets and scrutinize their respective programs/projects. As a result, the amended budget proposal is introduced to the House as the General Appropriations Bill. While the House of Representatives is holding budget hearings, the Senate Finance Committee, through its various subcommittees, begins its own review and scrutiny of the proposed budget and proposes amendments to the House Budget Bill to the Senate body for approval. The House and Senate forms a Bicameral Conference Committee that finalizes the General Appropriations Bill to iron out differences and reach a consensus on the General Appropriations Bill. After both Houses have approved a common budget bill, it is sent to the President for his signature, at which point it becomes the General Appropriations Act. 5. What is the General Appropriation Act (GAA) General Appropriations Act (GAA) is the legislative authorization that contains new spending bills in the form of specific amounts for salaries, wages, and other personnel benefits; maintenance and other operating expenses; and capital outlays authorized to be spent for the application of integrated applications and activities of all departments, bureaus, and offices of the government for the given year. General Appropriations Act (GAA) is one of the most important legislations that Congress annually passes. It defines the annual expenditure program of the national government and all of its instrumentalities. The expenditure program includes all programs and projects that are supposed to be supposed to be funded out of government funds of the year. The process starts with the issuance by the DBCC of the national expenditure ceiling for the succeeding year. Once the DBM receives this, it issues the national budget call that provides general guidelines to be followed by the agencies in preparing their budget proposal. The respective agencies then issue their agency guidelines for their regional offices and directs them to prepare their respective regional budget proposals. The agency regional officers prepare their budget proposals and consult their respective local government counterparts and the regional development council on the on the priority programs and projects to be funded for the succeeding year’s general appropriations. The importance of CBMS and any other information database is in the identification of the region or local-specific programs and projects that shall be funded out of the GAA. The concerned legislator may participate more effectively even at the regional level preparation and consultations if they have a better grasp of the conditions as shown by up to date information such as the CBMS. Sources: https://economictimes.indiatimes.com/budget-faqs/why-is-it-important-for-thegovernment-to-have-a-budget/articleshow/67450000.cms?from=mdr https://www.dbm.gov.ph/wp-content/uploads/2012/03/PGB-B2.pdf https://pllo.gov.ph/images/Documents/Downloads/RepublicActsJointResolutions/18C_RA_JR /RA11465_GAAFY2020.pdf https://www.yourarticlelibrary.com/economics/budgeting/6-important-objectives-ofgovernment-budget/30410