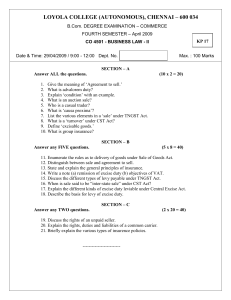

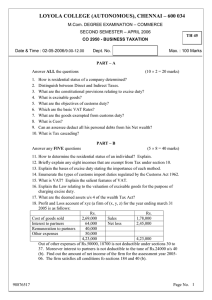

Excise Duty ( 10% of the total tax revenue) 1. Overview of Excise duty ( special consumption tax) - One of the most popular consumption tax applied worldwide Contribute a significant proportion to government budget Rationale o To raise, generate revenue for general purposes: public goods and services o To reflect external (social) costs associated with consumption or production but not accounted for in price (smoking, drinking, driving, polluting) Tax is added to the price because + This price doesn’t reflect external (social) costs ( costs refers to negative externality: the negative consequences from the consumption of some kind of goods) associated with consumption. + this price also refers to production costs, profits for the producers (firms) Tax is the way to quantify this cost => want to add this social cost into the price along with the production cost and profit for the firm. Price of goods with kind of tax will be higher People will reduce the consumption ( law of demand): that is what the gov wants to aim at. o To discourage consumption that is deemed undesirable (consider harmful for health and government) o To achieve social equity (refers to the gap between the rich and the poor) Gap will be close by taking more tax from the rich and less from the poor, but both of the classes can consume same G&S In order to call for more financial contribution in terms of tax from the rich Tax will be imposed on special kind of goods which normally consumed by the rich (luxurious G&S) 2. - Characteristic of excise duty Indirect tax the one who submit the tax to the government is not the one bear the tax) Imposed in addition to another indirect tax (VAT/ import duty) All collected at sale in the first stage of the supply chain # VAT: multi- stage tax (collected at all the stage of the supply chain) Narrow scope (imposed on that some G&S) Higher tax rate 3. Scope based on the purpose of the tax 11 GOODS 1. Cigarettes, cigars and processed products made from tobacco 7. Gasoline of various kind 2. Liquors 8. Air conditioners of capacity of 90,000 BTU or less 3. Beers 9. Playing cards (lux) 4. Under-24-seat passenger vehicles, semi-passenger automobiles ( harmful to the environment) 10. Votive gilt paper (vàng mã), votive objects 5. Airplanes (lux) 11. Motors with cylinder capacity of over 125cm3 6. Yachts (lux) 6SERVICES 1. Dancing halls 2. Massage parlors, karaoke bars 3. Casino, electronic games with prizes 4. Betting tickets business 5. Golf business: sale of club membership card and playing tickets 6. Lottery business 4. Non-taxable transaction a. Goods directly exported by producers or processors or sold or entrusted to other business establishments for export There is no 0% for excise duty, do not need to calculate => exempt transaction => no tax collected Because: both excise and Vat are consumption tax and VN use destination principle: when apply for the goods which are produced in 1 country and consumed in another country Only the country consume the goods need to pay tax - Exception Goods sold to or processed for export processing companies, except for passenger cars having fewer than 24 seats Goods brought abroad for sale at overseas fairs or exhibitions - Notice <24 seat cars If sold domestically => Exciable If exported either directly or indirectly If sold to EPC => Excisable - b. Importation of goods in the following cases: Noncommercial purpose ( not for sales) Humanitarian aid or non-refundable aid goods; Gifts for state agencies, political organizations, social organizations, the army; Belongings of foreign organizations and individuals within diplomatic immunity limits; Personal effects in duty-free luggage limits - - Goods that are not consumed in VN Goods transshipped, transited or transported through Vietnam’s border Goods temporarily imported for re-export, or temporarily exported for re-import during the import or export duty-free period Goods imported for duty-free sale under the prescribed regulations c. Importation of goods from either foreign countries or domestic market into nontariff areas for use in this area, goods sold among non-tariff zone (except for under-24-seat car) - Explanation: NTA (areas within VN) but the activity inside NTA => export NTA sell goods to company domestically => it considered as import for this kind of co. If NTA are traded among each other or trading with other foreign company => export Not for personal consumption d. Aircraft, cruise ships used for passenger transport, cargo transport, and tourism services, and aircraft serving national defense and security purposes e. Specialized passenger vehicles including ambulance, criminal carrying cars, funeral cars, mobile television cars… f. Air conditioners of a capacity of 90,000 BTU or less which are designed by producer for parts of transport vehicles such as cars, train carriages, ships, boats or aircraft 5. Tax payers ( collected at first stage only) - Organizations and individuals that produce and/or import goods and provide services, which are subject to excise duty only producer and importer need to pay tax - Except fot this situation: Business that purchases excisable goods from producers for export but do not export and sell these goods domestically + (producer sell the goods to exporter for export (initial purpose) => indirect export No excise at first + But if the producer fail to export because of the covid 19, sell the goods domestically => no longer export => excisable => exporter need to pay the tax This is the only case when the tax payer is not the producer 6. Tax calculation Excise duty payable = Base price of excisable G&S * Applicable tax rate 7. When to calculate ( tax is calculated at sale => calculated at sale as well) - For goods: transferring the right to own or use the goods to the buyer, whether the payment is collected or not ( as long as the goods are sold/ delivered => need to calculate excise duty) - For services: completion of service provision or issuance of the invoice (when collect money from customers) for service provision buyer, whether the payment is collected or not. - For imported goods: registration of the customs declaration (calculate at importation) 8. Base price ◦ Base price of excise duty is selling price exclusive of excise duty, environmental protection tax (if any) and value added tax, set by the producer BP (excise) [ before excise, EPT, VAT] = Price + surcharge – Trade discount Invoice types: + VAT invoice: without VAT + Special type: with VAT + Sale invoice: with VAT Invoice price is inclusive of excise and EPT already ◦ ◦ VAT = (Price of goods + Excise + EPT) * VAT % 𝑃𝑟𝑖𝑐𝑒 𝑒𝑥𝑐𝑙𝑢𝑠𝑖𝑣𝑒 𝑜𝑓 𝑉𝐴𝑇− 𝐸𝑃𝑇 Excise duty BP = 1+ 𝑒𝑥𝑐𝑖𝑠𝑒 𝑑𝑢𝑡𝑦 𝑟𝑎𝑡𝑒 Goods sold under a deferred payment plan or instalment plan: lump-sum selling prices exclusive of VAT, EPT (if any), and ED, exclusive of deferred payment interest or instalment interest. Imported goods: + Excise duty base price = import tax base price + import tax payable + VAT = (P + import tax + Excise + EPT) * % Example 1: Beer production Excise duty payable: 65% Output VAT: 10%’ Export - VAT = tax rate = 0% => output VAT = 0 - Excise: no 0 for excise => nontaxable (exempt) - Sales domestically Output VAT= 500,000 * 9,000 * 10% = 450m 9,000 BP of excise = 1+65% = 5,454.5455 - Excise duty = 500,000∗65%∗9,000 1+65% = 1.772 Example 2: Importation BP excise = Price + Import duty BP VAT = P + Import (40%)+ Excise (35%) Excise duty payable = 100,000 * 120,000 * (1 +40%) * 35% = 5,880 VAT payable = [100,000 * 120,000 * (1 +40%) * ( 1+35%)] * 10% = 2,268 9. Special case for BP - No revenue => BP = Price of the same goods - No excise duty on watching tickets Example 3 Dancing hall : buyers => no need to calculate tax for beer and liquor Only pay tax for the service only 200+420+130+90 Excise duty payable = *40% (1+40%) 10. Excise duty credit ( input excise duty) a. Use excisable goods as material to produce other excisable goods Excise duty payable of goods sold Excise duty payable = in tax period Excise duty paid for excisable materials used to produce excisable goods sold in tax period Example 4: Excisable materials Buy material (Draft beer) ===== Beer When A buy draft beer from B => A has to pay B the price with excise duty Excisable Excisable Producer (B) Producer (A) Pay excise + VAT. Export + Domestic ( VAT 0% , Excise: Nontaxable) + Domestic sale( VAT: 10%, Excise 65% - Output VAT = 1m * 9,000 *10% 9,000 Excise = 1m (of excisable goods) * 1+65% * 65% - Deductible Input VAT = 8,000 * 10,500 * 10% 10,500 Paid Input excise = 8,000 * 1+65% * 65% ( amount paid) but according to regulation, only deduct for the material used to produce excisable goods sold Only calculate for 1m 10,500 Amount deductible = 8,000 * 1+65% * 65% * 0.5 * 1m End of period - VAT payable = Output VAT – Input VAT - Excise payable= …… b. Traders import excisable goods for sale in domestic market Excise duty paid at importation Excise duty Excise duty collected on goods = - corresponding to excisable goods payable sold in tax period sold in tax period Example 5: Import ================= ================= ============= Sale ( domestic) Pay excise at importation + VAT Collect excise = collect VAT Sales Excise: 400 * *10% 1+10% Output VAT = 400 * 14m *10% 14𝑚 Importation 400 Deductible input excisable = 400m * 500 *10% Deductible input VAT = 500 * 450m * 10%