Uploaded by

DE GUZMAN, JB EMANUEL T.

Retained Earnings Appropriation: Accounting Guide

advertisement

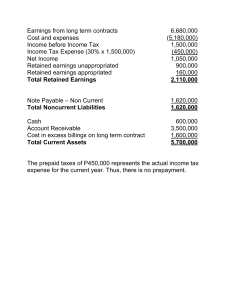

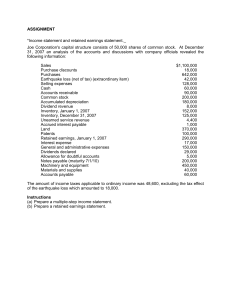

APPROPRIATION OF RETAINED EARNINGS Retained Earnings can be classified into unappropriated retained earnings and appropriated retained earnings. In the absence of evidence to the contrary, the retained earnings can be declared as dividends. In order to limit or restrict the payment of dividends, the entity may transfer a portion of the retained earnings unappropriated to retained earnings appropriated. For example, company ABC has been growing at a rapid rate and needs to move into a larger building to accommodate its workforce. The new building is going to cost them P30,000,000 ABC can then debit their retained earnings of P30,000,000 and credit it to appropriated retained earnings. Once the new building has been completed, ABC can debit appropriated retained earnings and move it back over. *The intent of retained earnings appropriation is to not make these funds available for payment to shareholders The appropriation of retained earnings may be described as follows: a. Legal Appropriation b. Contractual Appropriation c. Voluntary or Discretionary appropriation Legal Appropriation Arises from the fact that the legal capital cannot be returned to the shareholders until the entity is dissolved and liquidated. Thus, if an entity acquires its own shares, it must have sufficient retained earnings balance, otherwise, the acquisition is illegal. Accordingly, a portion of the retained earnings must be appropriated for an amount equal to the cost of the treasury shares. Such appropriation is called “retained earnings appropriated for treasury shares” Contractual Appropriation Arises from the fact that the terms of the bond issue and preference share issue may impose restriction on the payment of dividends. This is to insure the eventual payment of the bonds and redemption of the preference share. The appropriation may be described as “retained earnings appropriated for sinking fund or bond redemption” and “retained earnings appropriated for redemption of preference share”. Voluntary Appropriation Voluntary appropriation is a matter of discretion on the part of management. This may arise from the fact that management wishes to preserve the funds for expansion purposes or covering possible losses or contingencies. The appropriation may be described as follows: a. Retained earnings appropriated for plant expansion b. Retained earnings appropriated for increase in working capital c. Retained earnings appropriated for contingencies Whether legal, contractual or voluntary, the intent of the appropriation is simply to LIMIT THE DECLARATION OF DIVIDEND. #LoveAccounting #TrainYourMindYourBodyWillFollow #AkawntingNambaWan