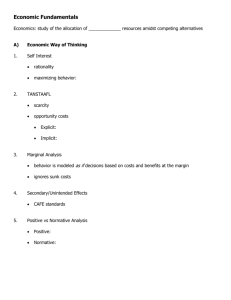

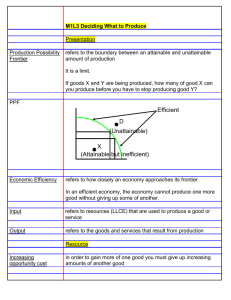

Econ-110 Microeconomics Chapter 2 PPF, Opportunity Cost, Comparative Advantage Contents • 2.1 Tradeoffs • 2.2 Production Possibilities Frontier • 2.3 Market System 2.1 Terms • Scarcity: a situation in which unlimited wants exceed the limited resources available to fulfill those wants. • Trade-off: a situation when if you do one thing, you cannot do another thing. E.g. for vacation, you can go home to visit your parents or you can travel with your friends • Opportunity cost: represents the highest valued alternative given up when a decision is made. E.g. you come to school to earn a degree for a better future, but you give up the money you can earn if you started working right now • Efficiency: is maximizing the total output given a limited amount of input E.g. A GM truck can drive 20 miles per gallon of gas, a Toyota sedan can drive 30 miles per gallon of gas. Given the same input, the Toyota can drive further. 2.1 Trade-offs To demonstrate the concept of scarcity, tradeoffs, opportunity cost, and efficiency, we’ll use a simple example. • Imagine a business creates 2 goods: videos and hats. If the business spends all its time and resources producing hats, it can create 30 hats in 1 day, but it will create zero videos. On the other hand, it could produce 4 videos in 1 day and zero hats. The table below shows the production possibilities of the 2 goods. 2.1 Production Possibilities Frontier By graphing the table, we can create a Production Possibilities Frontier • The production possibilities frontier (PPF) is a curve that shows the maximum attainable combinations of two goods that may be produced with available resources. The PPF is used to illustrate the trade-offs that arise from scarcity. Positive analysis: the PPF tool is a positive tool as it show’s ‘what is’ and not ‘what should be’ • Scarcity: it shows there are limited resources • Tradeoffs: it shows if I make hats, I have to give up videos or vice versa • Opportunity cost (OC): is shown by the specific number of videos given up to make hats. Eg) if I move to A to B, I produce more 1 video, but I lose 1 hat. The number of hats I lose is the OC. • Efficiency: is shown as points on the line. Eg) if I produce anything inside the curve like 2 videos and 10 hats, I am being inefficient because I am not using my resources to the fullest. And I can not produce anything outside the curve because I don’t have enough resources to do so. Practice Calculate the opportunity cost for each of the following: Remember, the opportunity cost is what you’re GIVING UP A to D B to C E to D C to A Practice Calculate the opportunity cost for each of the following: A to D: 15 hats B to C: 4 hats E to D: 1 video C to A: 2 videos Tesla’s Production Possibilities Frontier Tesla can produce its original models, or its new Model 3s. Producing more Model 3s requires reducing the number of original models produced. • Points on the PPF are attainable for Tesla. • Points below the curve are inefficient. • Points above the curve are unattainable with current resources. To produce 20 more Model 3s (e.g. moving from A to B), Tesla must produce 20 fewer original models. • The 20 fewer original models is the opportunity cost of producing 20 more Model 3s. Opportunity cost: The highest-valued alternative that must be given up to engage in an activity. Practice PPF BMW Case • Question 1: Let’s say BMW currently produces 400 Hybrids and 400 SUVs per day (Choice C). What is the opportunity cost of producing 100 more SUVs? • Question 2: Which point is most efficient: B, F, or G? • Question 3: Is F an opportunity cost? Practice PPF BMW Case • Question 1: Let’s say BMW currently produces 400 Hybrids and 400 SUVs per day (Choice C). What is the opportunity cost of producing 100 more SUVs? OC is producing 100 fewer Hybrids. • Question 2: Which point is most efficient: B, F, or G? Point B. Points on the frontier are efficient. Points inside the frontier are inefficient and points outside the frontier are unattainable. • Question 3: Is F an opportunity cost? No, it is not a highest-valued alternative. 2.1 PPF and Marginal Opportunity Costs • In the real world, PPF are usually curved rather than straight lines because of increasing marginal opportunity costs Marginal Cost: cost added by producing one additional unit. • This illustrates the important economic concept that the more resources that are already devoted to any activity, the smaller the payoff from devoting additional resources to that activity is likely to be. Some resources are better suited to one task than another. The first resources to “switch” are the one best suited to switching. The more resources already devoted to an activity, the smaller the payoff to devoting additional resources to that activity. 2.1 PPF and Marginal Opportunity Costs Law of Increasing Opportunity Cost: When all resources are being used, an increase in the production of one good will lead to greater foregone production of another good Constant opportunity cost: straight line • Corn and wheat take about the same resources to produce. So if we produce a certain amount of wheat, we give up a certain amount of corn. As we produce more wheat, we give up the same amount of corn each time. Increasing opportunity cost: curved line • Cactus and pineapples use different resources. So when you produce the first pineapple, you give up only a little bit of cactus. The next one you give up more, and the next one even more. Finally to produce the last pineapple, we give up a lot of cactus 2.1 PPF Shifters A shift in the PPF represents economic growth or decline, which is the ability for an economy to increase or decrease the production of goods and services. There are two ways the PPF can shift • Change in the quantity or quality of resources E.g. if the firm hires more educated workers, then there are more resources available. • Change in technology E.g. if the automobile industry uses more advanced machine manufacturing, then the same number of workers can now create more automobiles and previously unattainable combinations on the PPF curve are now attainable. • *Trade: can also shift a curve, but only in the amount they consume and NOT in the amount they produce. We will talk about that more in the next section with Comparative Advantage Practice • Production Possibility Frontiers (PPF) are usually curved in the real world because marginal opportunity costs Decrease Stay constant Increase • A PPF that shifts down or left would be caused by Less resources like a decreasing population Innovation in technology Explosive economic growth • Suppose you have a limited amount of time to study for two exams, Economics and Accounting. What would the production possibilities curve for the exam grades look like? A straight line, like the PPF for Tesla’s vehicles A bowed-outward curve, like the PPF for tanks and automobiles Practice • Production Possibility Frontiers (PPF) are usually curved in the real world because marginal opportunity costs Decrease Stay constant Increase • A PPF that shifts down or left would be caused by Less resources like a decreasing population Innovation in technology Explosive economic growth • Suppose you have a limited amount of time to study for two exams, Economics and Accounting. What would the production possibilities curve for the exam grades look like? A straight line, like the PPF for Tesla’s vehicles A bowed-outward curve, like the PPF for tanks and automobiles 2.2 Trade Why do countries like USA or China trade with poorer countries? Do wealthier countries benefit from trade? • We can use the ideas of production possibilities frontiers and opportunity costs to understand the basic economic activity of trade because every economy must decide what to produce given limited resources. Producing one good means producing less of another. • Not all economies are created equal. In general, western countries have a lot more capital than others which introduces the concept of advantages. Absolute advantage Comparative advantage 2.2 Trade • Absolute advantage: is the ability of an individual, a firm, or a country to produce more of a good or service than competitors, using the same amount of resources. • Comparative advantage: is the ability of an individual, a firm, or a country to produce a good or service at a lower opportunity cost than competitors. The magic of comparative advantage is that everyone has a comparative advantage at producing something. The result, is quite extraordinary, everyone stands to gain from trade. • E.g. In the PPF graphs below Saudi Arabia and USA produce Oil and Corn 2.2 Comparative Advantage 1. Make a table and identify who has an absolute advantage. SA USA Oil 100 50 Corn 25 100 Saudi Arabia has an absolute advantage over USA producing oil. USA has an absolute advantage over Saudi Arabia producing corn. 2. Add opportunity cost of production to the table. You can remember it with the simple equation: Opportunity Cost of Y = we give up X / we make Y SA USA Oil OC(oil) Corn OC(corn) 100 25/100 25 100/25 50 100/50 100 50/100 *SA OC(oil) = I can make 1 barrel of oil for 0.25 bushels of corn 2.2 Comparative Advantage Oil OC(oil) Corn OC(corn) SA 100 25/100=.25 25 100/25=4 USA 50 100/50=2 100 50/100=.5 *SA OC(oil) = SA can make oil for 0.25 (25/100) corn 3. Now compare who has the smaller opportunity cost to find who has the comparative advantage. Oil: SA gives up 0.25 bushels of corn for 1 barrel of oil. USA gives up 2 bushels of corn for 1 barrel of oil. SA has a comparative advantage in Oil Corn: SA gives up 4 barrel of oil for 1 bushel of corn. USA gives up 0.5 barrels of oil for 1 bushel of corn. USA has a comparative advantage in Corn Result: SA should specialize in Oil and USA should specialize in Corn. 2.2 Comparative Advantage • • • Result: SA should specialize in Oil and USA should specialize in Corn. Why? Together they now have 100 Oil and 100 Corn. Any trade beyond one country’s PPF is considered beneficial. E.g. By specializing, SA has 100 oil, USA has 100 corn. They can trade 1 for 1 and be anywhere on the red line. However, they do not have to trade 1 for 1. 2.2 Practice Problem China India Rice 160 50 Apple 80 50 In a given day, China can produce 160kgs of rice or 80kgs of apples and India can produce 50kgs of rice or 50kg of apples. Which country has the absolute advantage for producing rice and apples? Which country has the comparative advantage for producing rice and apples? Should the countries trade? 2.2 Practice Problem China India Rice 160 50 OC(rice) Apple 80/160=0.5 80 50/50=1 50 OC(apple) 16/8=2 50/50=1 Who has the absolute and comparative advantage? China has an absolute advantage in producing rice and apples. Rice: China has a comparative advantage in Rice. China only gives up 0.5 apples per rice whereas India must give up 1 apple. Apple: India has a comparative advantage in Apples. India only gives up 1 rice per apple whereas China must give up 2 rice. If they specialize in their comparable advantage, China will produce 160 rice and India will produce 50 apples. Without trade India: 20 apples, 30 rice China: 20 apples, 120 rice With Trade: China gives 30 rice to India for 25 apples. India: 25 apples, 30 rice China: 25 apples, 130 rice Both countries are able to consume beyond their PPF by specializing in their comparable advantage and trading! 2.2 Practice Problem 1. Who has an absolute advantage in producing fish? 2. Who has an absolute advantage in producing coconuts? 3. Who has a comparative advantage in producing fish? 4. Who has the comparative advantage in producing coconuts? 5. Should they trade? 2.2 Practice Problem 1. Who has an absolute advantage in producing fish? Country A 2. Who has an absolute advantage in producing coconuts? Country B 3. Who has a comparative advantage in producing fish? Country A 4. Who has the comparative advantage in producing coconuts? Country B 5. Should they trade? Yes. A B Fish 8 12/8 7 14/7 Coconuts 12 8/12 14 7/14 2.3 Trading, Markets, and Real World • We have seen that households, firms, and the government face trade-offs and incur opportunity costs because resources are scarce. We have also seen that trade allows people to specialize according to their comparative advantage. By engaging in trade, people can consume more and raise their standard of living. • Trade in the modern world is very complex and done by millions of people buying and selling in “markets”. Markets: A group of buyers and sellers of a good or service and the institution or arrangement by which they come together to trade. • Two key groups participate in the modern economy: Households consist of individuals who provide the factors of production: labor, capital, natural resources, and other inputs used to make goods and services. Households receive payments for these factors by selling them to firms in factor/resource markets. Firms supply goods and services to product markets; households buy these products from the firms. 2.3 Circular Flow Model • Product market: A market for goods—such as computers—or services—such as medical treatment (anywhere you can buy finished goods sold to consumers) • Factor/Resource market: A market for the factors of production. (anywhere businesses can buy resources to make goods for product market). There are 4 factors of production: Labor: all types of work from part-time laborers to senior executives Capital: physical capital such as machines and tools used to produce other goods Natural resources: such as land, water, oil, metals, or other raw materials Entrepreneur: people who operate businesses – it’s a special factor because they have the ability to bring other factors together to successfully produce goods and services Entrepreneurs can only thrive when there are sufficient property rights Entrepreneurs • An entrepreneur is someone who operates a business, bringing together the factors of production— labor, capital, and natural resources—to produce goods and services. The best entrepreneurs create products that consumers never even knew they wanted. “If I had asked my customers what they wanted, they would have said a faster horse.” - Henry Ford • Entrepreneurs make a vital contribution to economic growth, often with considerable personal risk and sacrifice. They make a vital contribution to economic growth by Responding to consumer demand Introducing new products • Government policies encouraging entrepreneurship are likely to increase economic growth and raise standards of living. In a free market, government does not restrict how firms produce and sell goods, or how they employ factors of production. However governments must provide a sound legal environment (independent court systems) that will allow the market system to succeed, including: Protection of private property: when criminals can take your wages or profits, households and firms have little incentive to work hard. Enforcement of contracts and property rights: if someone can rip-off/copy inventions, households and firms have no incentive to innovate Property rights: the rights individuals or firms have to the exclusive use of their property, including the right to buy or sell it. Circular Flow Diagram • Circular-flow diagram: is a model that illustrate how participants in markets are linked. Firms are supplier of goods and services which Households need. They use income to buy factors/resources of production needed to make goods and services Households are supplier of factors/resources of production which Firms need to operate. They use income from selling factors of production to purchase goods and services from firms This simplified circular flow diagram model assumes there is no gov’t intervention, no financial system, and no foreign trade. We will add these sectors in future classes. • I.e. Households provide factors of production to firms. Firms provide goods and services to households. Firms pay money to households for the factors of production. Households pay money to firms for the goods and services. The Gains from Free Markets • A free market is one with few government restrictions on how a good or service can be produced or sold or on how a factor of production can be employed. Countries that come closest to the free market benchmark have been more successful than those with centrally planned economies in providing their people with rising living standards. This concept is not new: Adam Smith argued for free markets in his 1776 treatise, An Inquiry into the Nature and Causes of the Wealth of Nations. It is not immediately obvious that markets will do better than centrally-planned systems for satisfying human desires. After all, individuals are acting only in their own rational self-interest. But markets with flexible prices allow the collective actions of households and firms to signal the relative worth of goods and services. In this way, the “invisible hand” allows individual responses to collectively end up satisfying the wants of consumers. • E.g. How do you make an iPad? • Although Apple engineers designed the iPad, Apple does not manufacture iPad components, nor does it assemble the final product. Hundreds of firms are involved; many probably don’t even know their products will be used in an iPad. But guided by their own self-interest, they all contribute to the final product—without any desire to enrich Apple or provide enjoyment for iPad purchasers. Practice • The ability of an individual, a firm, or a country to produce a good or service at a lower cost than its competitor is Absolute advantage Comparable advantages Industrial advantage • Trade is beneficial to The country with the absolute advantage Everyone because of comparative advantages Everyone because of absolute advantages Only the wealthier country • According to the circular flow model, which is NOT a factor of production? Labor Entrepreneur Capital Money Practice • The ability of an individual, a firm, or a country to produce a good or service at a lower cost than its competitor is Absolute advantage Comparable advantages Industrial advantage • Trade is beneficial to The country with the absolute advantage Everyone because of comparative advantages Everyone because of absolute advantages Only the wealthier country • According to the circular flow model, which is NOT a factor of production? Labor Entrepreneur Capital Money