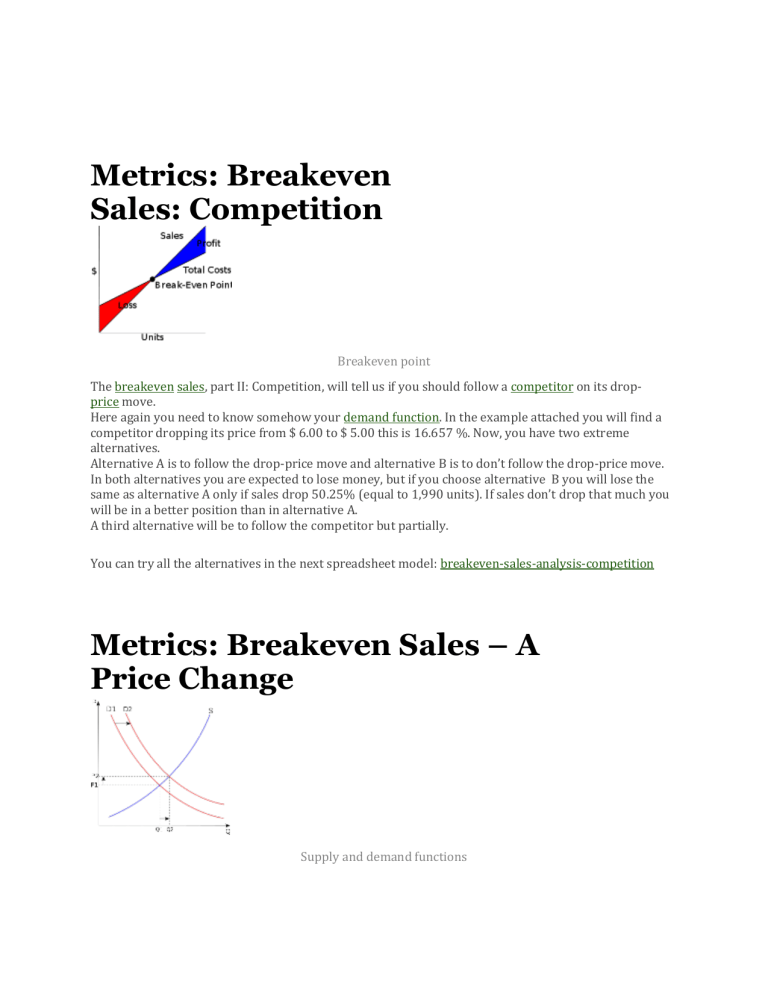

Metrics: Breakeven Sales: Competition Breakeven point The breakeven sales, part II: Competition, will tell us if you should follow a competitor on its dropprice move. Here again you need to know somehow your demand function. In the example attached you will find a competitor dropping its price from $ 6.00 to $ 5.00 this is 16.657 %. Now, you have two extreme alternatives. Alternative A is to follow the drop-price move and alternative B is to don’t follow the drop-price move. In both alternatives you are expected to lose money, but if you choose alternative B you will lose the same as alternative A only if sales drop 50.25% (equal to 1,990 units). If sales don’t drop that much you will be in a better position than in alternative A. A third alternative will be to follow the competitor but partially. You can try all the alternatives in the next spreadsheet model: breakeven-sales-analysis-competition Metrics: Breakeven Sales – A Price Change Supply and demand functions The breakeven sales analysis, part I: a change in price, will find a mathematical answer to the question: how much would the sales volume have to increase to profit from a price reduction? This metric is very useful because so many times we assume that a reduction in price will increase automatically the sales volume and overcompensate the reduction in price. In the example attached we can see how a 10% price reduction will need an increase of 72.21 % in the sales volume to compensate the price reduction. How to apply this concept: If you Know somehow your demand function of a specific product, and if you believe that this 10 %reduction will cause and increase over 72 % of the sales volume, then, is a good reason to cut the price. Another good reason for price reduction is a change in price policy, if you are going from a skim policy to a neutral or from neutral to penetration then a reduction in price make sense, but be aware of the consequences in revenues. Note that the model provided also works in the opposite direction, when trying to increase prices. In this case the question would be: How much would the sales volume have to decrease to profit from an increase price?