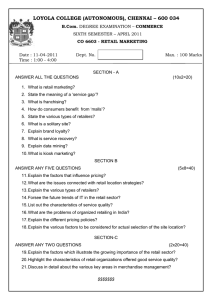

Fashion Marketing & Merchandising - II Home Assignment Member’s Name Kamakshi Gautam Sanchita Vaish Sejal Singh Shobhit Jain Abstract The moderately steady monetary climate, good segment situation and the attitudinal move in the mind of the new Indian buyer offer coordinated retailing both openings and difficulties. This alongside experimentation in retail organizations and section of worldwide players is gradually changing the Indian retail market. Indian retailers need to have a restored way to deal with retail promoting in order to acquire an upper hand and to acquire a section into the hearts and psyches of the shopper. Retailers ought to try different things with retail designs including investigating on the web retailing and tie ups with conventional retail designs like kirana stores. The retail item offering should offer an incentive for cash and retailers need to invest in more amounts of energy to advance private marks and connect and oblige a more extensive client base across India including more modest towns and country territories which likewise present huge freedom. The retail insight anyway should go past this to make encounters which ought to likewise engage constantly the purchaser through different touch focuses to expand their association with the retail brand. There are operational and infrastructural issues like absence of prepared labor and the requirement for greater interest in data innovation and a more grounded inventory network and back end to smooth out activities and plug in shrinkage and wastage so Indian retailers can advantage from the chances presented by the retail market. RETAIL MARKET IN INDIA: CHANGING SCENARIO India used to be an ensured, regulatory market with communist strategies which limited the job of the private area. Today India is among the quickest developing economies in world with numerous areas open to private venture and with developing and promising buyer markets. Other than it additionally has a positive empowering climate with a vigorous financial framework and solid what's more, improving foundation regarding telecom, IT and street and rail organizations (Mittal, 2010). These progressions have made the Indian retail market extremely alluring to financial backers and the area has filled by a wide margin throughout the most recent decade. The retail area adds to more than 20% of the India's total national output (GDP) and around 8% of all out business (PwC, 2012). One may contend that despite the fact that India figured out how to withstand the effect of the worldwide downturn, the current monetary situation in India isn't too splendid with high expansion, easing back development rates and diminished financial backer certainty because of absence of proactive strategy measures. The facts confirm that the two purchasers and retailers are as a rule contrarily influenced as as of now expansion is supply-based, instead of interest driven. Before the slump seen in the economy, shoppers financed their spending through credit or dunking into investment funds, yet presently this may be troublesome and not economical. As an outcome the two edges and deals of retailers are feeling the squeeze (PwC, 2012). Nonetheless, in spite of the current circumstance, India is still among the most alluring retail objections with numerous enormous worldwide retailers holding up to open shop if the public authority shows them the green banner. It is normal that the Indian retail market will surpass 1.3 trillion USD by 2020 from the current market size of 500 billion USD. While the entrance of present-day retailing across classifications is just around 5%, it is expected to develop around multiple times from the current 27 billion USD to 220 billion USD (PwC, 2012). With practically 60% of the Indian populace under 35 years old, India is among the world's most youthful nations. We have a huge burning-through working class with developing expendable pay. The metropolitan communities presently see an expanding number of double profession families who look for out current retailing as an advantageous, efficient choice that suits their way of life. This new section of youthful, upwardly portable experts (or 'elitists' as some may called them) are more danger taking and optimistic than past ages and will spend to have a way of life that satisfies these yearnings. A fragment of them has openness to the best global retail encounters and looks for similar when in India. Other than shopping is no longer saw by them as a task yet as an encounter which means higher assumptions on their part and subsequently more freedoms for retailers to upgrade this shopping experience. To place it in the expressions of Kishore Biyani (2007), "Change and Certainty is prompting ascend in Consumption". He considers it the '3 C Theory' with the 3 Cs representing Change, Confidence and Consumption. Different global investigations like the MasterCard Worldwide Index of Consumer Confidence rank Indian shoppers among the most sure purchasers on the planet (PwC, 2012). This alongside factors like expanding urbanization, changing family structures, simpler admittance to credit and developing shopper mindfulness are main impetuses for development in coordinated retailing in India. Through this paper I take a gander at the critical changes in the retail market and buyer inclinations furthermore, the means that retailers are taking or should take to manage the changing retail situation. The paper depends on writing survey and auxiliary exploration and on my own encounters with the retail area. CHANGING RETAIL SCENARIO: GETTING RIGHT THE RETAIL MIX Throughout the most recent decade, India has seen unhinged advancement in the retail area. During the beginning blast in the retail market enormous ventures were made in shopping centers which were set up in pretty much every niche and corner of urban areas without cautious anticipating catchment region or on the other hand inhabitant blend. A portion of these shopping centers today grieve with low footfalls, absence of inhabitants to top off the shopping center, no anchor store and a general helpless occupant blend. The path forward for retailers is to get the catchment region right, rope in an anchor that guarantee consistent footfalls, get an inhabitant blend that will take into account various requirements of a similar shopper or to necessities of various arrangements of shoppers and to make a retail experience that will 'goodness' the purchaser. Hypermarkets and food courts as anchors: It has been seen that hypermarkets, multiplexes also, food courts can go about as a solid anchor acquiring ordinary footfalls. Hypermarkets have been huge group pullers in many shopping centers. In Orbit shopping center in Malad, Mumbai has a hypermarket - Hypercity and a major food court. Pantaloon Retail Group detected the opportunity and assumed control over the administration of Shoprite (renamed as Food rite) from the South African advertisers of the hypermarket which is spread more than 75,000 sq.ft. Food rite is one of the critical anchors of the Nirmal Lifestyle Mall in Mulund alongside Shoppers Stop, Mc Donald’s and a multiplex. This was done in spite of the way that they previously had a Big Bazaar hypermarket working as one of the vital anchors in a shopping center close by. ‘Formatting the retail scene Current retailers need to painstakingly choose the organization that they would need to embrace. This is a vital choice as the arrangement regularly impacts the footfalls and the sort of buyers who visit the store. Advancements in arrangement can be a critical differentiator for retailers. Nonetheless thinking about the different idea of the Indian market, decision of arrangement can't be founded distinctly on an imaginative thought, or on a fruitful worldwide model; it additionally needs to take into the buyer purchasing conduct and the qualities of the catchment territory. It very well may be contended that the players who will lead over the long haul would be the individuals who can adjust or tweak their store design based on their learnings about the customer and the neighborhood conditions. Section of unfamiliar parts in real money and convey design: The money and convey design obliges clients who can buy in mass to exchange and consequently look for mass limits and offers. Bharati Wal-Mart (a joint endeavor between Bharti Enterprises and Wal-Mart) have opened 18 'Best Price' stores across India, German retailer Metro has opened 6 stores, Carrefour has opened one in Delhi and Tesco has tied up with Tata Trent to set up their stores in India. The money and convey fragment will observer gigantic development the following not many years with players like Bharti Wal-Mart having plans to open around 60 stores the nation over the next 16 months (TNN, 2012). Neglected configurations like 'Classification executioner' offers scope: A region that is still to a great extent neglected in India is that of a class executioner, wherein a retailer offers all conceivable react inside a specific item classification under one rooftop. While there are local players like Nallis in the south working in this classification since numerous years, it is as yet a region not promoted upon by the fresher retailers (Bhatt, 2007). Classification executioners like Home Depot have since a long time ago been peering toward the Indian market. Ikea plans to put Rs.10,600 crore in India and was among the initial worldwide retailers to declare section into India after the public authority's choice in January 2012 to permit 100% unfamiliar direct venture (FDI) in single-brand retail (Agarwal, 2012). Anyway, keeping a huge stock in each class will be a challenge for such stores. Aggarwal et Goyal (2009) have recognized retail sections as per their significance for being bought through coordinated retailing as food and staple; dress, clothes and adornments; catering administrations; wellbeing and magnificence care administrations; drugs, watches; portable, frill and administrations; books, music and endowments and foot products and amusement. They additionally propose the most reasonable arrangements for these portions: Food and grocery Supermarket; Health and excellence care administrations Supermarket; Clothing and Apparels'- Mall; Books; Music and Gifts-Convenience store and Mall; Catering administrations Mall; Entertainment Mall; Watches-Hypermarket; Pharmaceuticals-Hypermarket; Mobile, adornments and Services Hypermarket; Foot products Departmental store. While such examinations can be helpful, there is no ensure that a specific configuration will consistently function admirably for a specific item classification and in this manner exists the need to try. Testing the Trial-and-Error way: Retailers need to try different things with designs and item blend. Pantaloon Retail has been trying different things with arrangements to take into account a more extensive section of buyers on the lookout. The arrangements and new sections presented by them incorporate that of Fashion Station (well known design), Blue Sky (style frill), all (style attire for larger size people), Collection I (home decorations), Depot (books and music) and Ezone (Consumer hardware) (Tripathi, 2008). Tie-up with kirana stores: India was can in any case be known as a country of 'kirana' stores. That kirana stores will be cleared off with the passage of present-day retail is something that has certainly not occurred. Kirana stores will likewise advance to stay aware of the evolving markets. "Kiranawalas know the business, they are associated with their clients and catch on quickly furthermore, the manner in which our entire biological system of the social foundation is set up regarding lodging settlements and streets, it’s absolutely impossible a cutting-edge retailer can even set up a 2500-square feet shop close to the lodging settlement. It’s absolutely impossible a client can reach to purchase staple goods in 20 minutes in light of the fact that the streets are not unreasonably acceptable. So kiranas will really sustain.... the second age of the kiranas is entering the business who are more instructed, who are savvier. – B.S. Nagesh, Vice Chairman, Shoppers Stop (ET Now, 2012) Coordinated retail additionally needs to gain from kirana stores. A portion of the reasons kirana stores still prosper are because of their solid comprehension of client needs and inclinations, confined item blend, keeping up fantastic individual relations, the credit framework and home conveyance. Retailers could tie up with nearby kirana stores to make corner shops that offer the decision and advantages of current retailing alongside the accommodation, commonality and individual dash of the kirana store. They could give backend backing and help kirana stores to modernize, redesign frameworks and help them in securing items at less expensive costs. Entailing is likewise set to fill in India; the previous year has even seen numerous grocers wherein the front end is sites and backend is principally distribution centers. These incorporate entrances like www.araamshop.com and www.kiranawalla.com. A portion of these entries work in tie-up with the kirana shops and when a client puts in a request on the web, the request is discussed to the kirana accomplice shop closest to the client and they convey the request (PwC, 2012). Retail item offering: Ikea, has likewise chosen to change its worldwide store design and item reach and plans to suit the flavors of the Indian shopper. Starbucks which entered India through a joint endeavor with Tata Global Beverages separated from their espresso experience offers a menu which is a mix of neighborhood and western tastes and incorporates things like Elaichi Mawa croissants and baked paneer moves (AP, 2012). To snare on the worth cognizant Indian client, it is vital for the retailer to get the value esteem condition right. Private marks are the place where retailers can get their edges from. As the purchasers are currently acquainted with these new arrangements and have begun to confide in the spots they shop in, retailers ought to put more in sourcing and marking of private names which can be viably focused to the purchasers from the working class looking for more incentive for cash. Expanding entrance in future retail development is anticipated to be coming from the more modest yet quickly developing towns. As indicated by NCAER appraisals of 2008, the portion of 35 towns with a populace multiple million was required to develop from 10.2% then to 14.4% by 2025. Simultaneously, the offer of these towns in the retail pie would increment from 21% in 2008 to 40% in 2025. These top 35 to 40 towns ought to be the objective regions for retailers to drive development in their business. Development in the retail fragment while driven by metros and smaller than normal metros isn't restricted to metropolitan territories; country India is likewise seeing a retail change. Other than India's country populace of 700 million offers an immense chance for retailers. NCAER gauges show that rustic India represents 70% of India's populace, 56% of public pay, 33% of investment funds and 64% of use (Ganesh, 2009). The provincial economy developing at around 8% percent p.a. will be adding $90-100 billion of new utilization in the following three years, more than the base of $240250 billion of every 2010 (Nangia, 2010). Existing country retail players like ITC's E-chaupal, Hariyali Kisan Bazaar of the DCM Shriram Group and Aadhar are now working in country India. Anyway, everything isn't going ideal for these players. For example, Godrej needed to auction 70% stake in Aadhar to the Future gathering as it was not, at this point doable for them to run the procedure all alone. While the general expense of running retail tasks in provincial India may be lesser it is harder to connect with the country buyer. A test in the provincial market will be to manage poor infrastructural offices and adjusting to neighborhood dialects and customs. A retailer may need to utilize flighty intends to contact the customers furthermore, to acquaint them with another method of shopping. It ought to likewise be remembered that numerous buyers in provincial India have had an openness of metropolitan India and the higher pay gatherings in provincial territories can frame a significant fragment that can be focused on. Searching out new clients Kishore Biyani (2007) sorts customers into three classifications: the burning-through class, the serving class and the striving class. While the burning-through class containing the upper and working class make up just 14% of the complete populace, most items in the market are made for them. Then again, the serving class, around 42% of populace which incorporates individuals in occupations like drivers, peons and so forth, is disregarded by most retailers however holds extraordinary potential whenever focused on cautiously. Retailers need to concoct a retail blend and climate that additionally takes into account the serving class. Large Bazaar stores' plan, format and correspondence are planned to such an extent that no buyer feels threatened to enter the store. The serving class may get scared in retail conditions that are excessively coordinated and clean and may likewise have the insight that such stores are excessively costly. Subsequently the store format and feeling plays a significant part in building the store insight in the personalities of the buyers and to empower new buyers to receive another retail design. Patching up the old Communication Mix: India has in excess of 100 million Internet clients, a big part of whom make online buys (PwC, 2012). Retailers need to concoct inventive approaches to contact the Internet sagacious more youthful age particularly in metropolitan zones. The new Indian shopper who is not, at this point wary and is an early adopter could be connected despite the fact that Internet and cell phone showcasing (PwC, 2012). Connecting with a client and expanding unwaveringness and rehash buys are not affected simply by markdown vouchers or a dependability card; it relies upon how the retailer deals with the entire experience. Dealing with the client experience is not, at this point restricted to in-store activities; today it includes overseeing different touch focuses including call focuses, online entryways and interpersonal interaction locales. A few difficulties Key difficulties in looked by Indian retailers incorporate high land costs, different customer needs and an absence of solid back end foundation and store network particularly regarding food and staple retailing. The bigger Indian business bunches are tying up with a portion of the driving global corporate store for back end uphold. For example, Bharati Retail has a tie up with Wal-Mart at their Easy day and Best Cost chain of stores. In general, there is need for greater interest in IT, coordination’s, stock and provider the board, and client maintenance. Another test is the lack of prepared labor in the area. Retailers could tie-up with colleges to prepare individuals in various territories of retail and could offer entry level positions in their stores. For example, B.S. Nagesh of Shoppers Stop dispatched the TRRAIN (Trust for Retailers also, Retail Associates of India) activity in a tie-up with Aptech to prepare their labor force (Sabari Nath, 2011). Another region of worry for some, retailers is retail fakes due to shoplifting, robbery or plain managerial mistakes. As indicated by the Global Retail Theft Gauge (GRTB) 2011 which covers 45 countries, the shrinkage in India remained at 2.38%, the most noteworthy on the planet, against the normal worldwide shrinkage at 1.45%. While a portion of the bigger retailers have CCTV and some type of reconnaissance, there still should be a great deal of venture here (PwC, 2012). It is the ideal opportunity for Indian retailers to assess their retail techniques and step up their moves to confront rivalry from driving worldwide players looking at the Indian market. They need to try, enhance and combine to oblige a requesting and different purchaser base that looks for a shopping experience that goes much past contribution esteem.