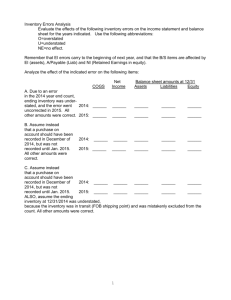

PARTNERSHIP TAXATION: PARTNERSHIP ALLOCATIONS I. RECOURSE ALLOCATIONS A. The Basic Rules of 704(b). A two part test for the validity of the allocations: 1. 2. An allocation must first have an economic effect. This means that the allocation must be consistent with the economic business deal of the parties. 1.704-1(b)(2)(ii)(a). Substantiality Test. a. b. B. There must be a reasonable possibility that the allocation will affect substantially the dollar amts. to be received by the partners from the PS apart from the tax consequences. Insubstantiality results when the economic effect of an allocation is likely to be eliminated by one or more allocations and the overall tax liab. of the partners is reduced. 1.704-1(b)(2)(iii)(a). The 3 tests for economic effect. 1. The primary test. The "Big Three" This is satisfied if the following is provided in the PS agreement: a. The capital accts. are maintained in accordance with the rules of 1.7041(b)(2)(iv). (1) The capital accts. are considered properly maintained only if each partner's capital acct. is (a) Increased by the following: 1.704-1(b)(2)(iv)(a). i) The amt. of money contributed to the PS as well as the FMV of property contributed (net of liab. securing the property that the PS is considered to assume under 752), Allocations to the partner of PS income and gain, including tax-exempt income. ii) (b) Decreased by the following: 1.704-1(b)(2)(iv)(b). i) The amt. of money distrib. to the partner by the PS as well as the FMV of the property distrib. (net of liab. secured by the prop. that the partner is considered to assume under 752). Allocations of PS losses and deductions. Allocations to the partner of PS expenditures that are not properly deductible or chargeable to a capital acct., i.e. gambling losses, bribes, ii) iii) 1 (2) (3) charit. contrib., syndication exp., etc. The FMV reasonably agreed to among the partners in arm's length negotiation will control if they have sufficiently adverse interests. 1.704-1(b)(2)(iv)(k). The FMV of the assets may be booked up on these occasions. (a) (b) (c) (d) b. c. Contributions. Distributions. Profits Interests. According to GAAP. Upon liquidation, liquidating distributions must be made in accordance with the positive capital acct. balances of the partners. 1.7041(b)(2)(ii)(b)(3). If the partner has a deficit balance following a liquidation, the partner must be unconditionally obligated to restore the deficit. Orrisch HELD: The ct. decided that the Orrisches would not have been obligated to contribute cash to the PS with respect to the losses if the PS later dissolves. EXAMPLE: A & B purchased a building for $100,000 agreeing to allocate all recourse deductions to B with a gain chargeback to B. Initial Years 1-10: dep. End Year 10 Sale for $100,000 End Balance 2. A's capital B's capital account account 50,000 $50,000 $(100,000) $50,000 $(50,000) $100,000 $50,000 $50,000 Alternate Economic Effect (i.e. test for LP). The PS agreement must satisfy four tests (the first two are identical to the primary test). a. b. c. The capital accts. must be maintained in accordance with the rules of 1.704-1(b)(2)(iv). Upon liquidation, liquidating distributions must be made in accordance with the positive capital acct. balances of the partners. An allocation must not create/increase a deficit in the partner's capital acct. in excess of any limited deficit make-up provision. (1) (2) If an allocation of loss does create/increase a deficit, the loss must be reallocated in accordance with the other partners' interests. Expected contributions. (a) The partners must also reduce their capital accts. by distributions reasonably expected in a later PS year in 2 (b) (c) which the loss allocation was made. For purposes of an expected distrib., you must "hypothetically" modify the capital accts. ahead of time. This, however, may be netted by upward adjustments for anticipated income and expected contributions. COMPREHENSIVE EXAMPLE Purchase of a building for $100,000. All allocations to B. Plus B issues a promissory note of $10,000 giving B a limited makeup provision of $10,000. Also, the PS expects to make a $30000 distribution to each partner in year 6 by taking out a $60000 recourse loan. All other operating income and expenses offset. Initial Years. 1-3: dep. End Year 3 Distribution Years 4-10: dep. End Year 10 d. A's capital B's capital B's "hypo" account(GP) account(LP) capital account $50,000 $50,000 $20,000 $(30,000) $(30,000) $50,000 $20,000 $(10,000) $(30,000) $(30,000) $(70,000) $(50,000) $(10,000) The agreement must also include a qualified income offset. (QIO). Treatment of unexpected distributions. 3 steps. (1) (2) First, the distribution to the partners. Second, the QIO. (a) (b) (3) An LP who unexpectedly receives a distrib. which causes the capital account to go negative (or in excess of a limited makeup provision) must be allocated items of future income/gain to eliminate any remaining deficit as quickly as possible. The allocation from the other partners must be in accord with the other partners' interest, and comes from ordinary income first. The remaining income or losses from all of the other activities must be allocated according to the other partner's interest in the partnership. 3 EXAMPLE: Unexpected distribution in year 6 of $60,000 from a recourse loan taken out. The PS has $150,000 operating income and expenses. Initial Years 1-5 yrs: End Year 5 Year 6: distribution QIO Remaining loss Year 7-10: dep. End Year 10 3. II. A's capital B's capital account account (GP) (LP) $50,000 $50,000 $(50,000) $50,000 $0 $(60,000) $60,000 $(70,000) $(40,000) $(60,000) $0 Economic Effect Equivalence (if neither of the above tests is met). Allocations are deemed to have economic effect if the PS agreement, as interpreted by reference to the applicable state law, ensures that a liquidation of the PS will produce the same economic results as if the Big 3 were satisfied. 1.704-1(b)(2)(ii)(i). NONRECOURSE ALLOCATIONS This requires a separate test because the NR deductions never have economic effect. A. The safe harbor rule with respect to NR deductions. 1. 2. The PS must maintain capital accounts; liquidate in accordance with the capital accounts; and provide a QIO. For the 1st tax yr. of NR ded'n and thereafter, the NR ded'n must be allocated in a manner reasonably consistent with allocations (having substantial economic effect) of some other significant PS item attributable to property securing the NR liab. of the PS. a. b. 3. 4. B. For example, if the recourse deductions/operating income is allocated on a 80/20 basis with a later switch to 50/50, then The NR allocation includes any amount between these two numbers. A MGC is required for all nonrecourse deductions. All of the other allocations must be valid under 704(b). Important definitions. 1. PS Minimum Gain. This is the amt. of gain the PS would realize if it disposed of each of its properties subject to a NR liability for no consideration other than satisfaction of 4 2. debt, i.e. the excess of NR liab. over the AB of the property. 1.704-2(d)(1). NR Deductions Deductions which relate to the net increase in PS minimum gain. EXAMPLE: Building (5 yr. life) bought for $20 and $80 of NR debt. The building is depreciated to $60, but its FMV is still $100. They share everything equally. Initial Year 1: recourse deds End Year 1 Years 2-5: nonrecourse deds End Year 5 GP LP $10 $(10) $0 $(40) $(40) $10 $(10) $0 $(40) $(40) Basis NR liab. MG $100 $80 $(20) $80 $80 $(80) $0 $80 Increase (Decrease) $0 $0 $0 $80 $80 $80 EXAMPLE: Same as above, except that GP contributes $5 and LP contributes $15. Recourse ded'ns are allocated in that ratio with a later "flip" to 50/50. NR ded'ns are allocated 30% to GP and 70% to LP. Initial Year 1: recourse deds End Year 1 Years 2-5: nonrecourse deds End Year 5 3. 4. GP LP $5 $(5) $0 $(24) $(24) $15 $(15) $0 $(56) $(56) Basis NR liab. MG $100 $80 $(20) $80 $80 $(80) $0 $80 Increase (Decrease) $0 $0 $0 $80 $80 $80 Partner's share of MG. The premise of the regs. is that NR ded'n may reduce a partner's cap'l acct. below 0 to the extent of the partner's share of MG, because they will be recaptured and charged back to the partner to whom they were allocated. Minimum Gain Chargeback. a. For any tax yr. in which there is a net decrease in a partner's share of MG, that partner must be allocated, by a provision called a MG chargeback, income and gain equal to the net decrease in the partner's share of MG. 1.704-2(f)(1). (1) (2) b. A decrease can occur when property subj. to NR debt is disposed. A decrease can also occur when the principal amt. on a NR liab. is reduced, or converted from NR to Recourse. MG Chargeback applies to both GPs and LPs. 5 EXAMPLE: Same as above except the building is disposed after the 3d year. GP LP Basis NR liab. MG Net MG $5 $15 $100 $80 $0 $(5) $(15) $(20) $0 $0 $0 $80 $80 $0 $(12) $(28) $(40) $40 $4 $12 $28 $(40) $(80) $(40) $(40) $0 $0 $0 $0 $0 Initial Year 1: recourse deds End Year 1 Years 2-3: nonrecourse des Year 4: sale End balance c. Exceptions. If a partner contributed capital to the PS to pay its NR debt. (1) (2) That partner's share of MG will decrease, but the capital contribution increases his capital acct. equal to the decrease in MG. Therefore, a partner is not subject to a MGC to the extent that the decrease in the partner's share of the MG is attributable to the partner's own capital contribution that was used to pay off the PS's NR debts. 1.704-2(f)(3). EXAMPLE: Same as above except that GP contributes $30 to pay off $30 of NR debt in year 4. Operating income and operating expenses both equal $20. Initial Year 1: recourse deds End Year 1 Years 2-3: nonrecourse deds End Year 3 Year 4: Contribution MGC Remedial recourse deds End Year 4 GP $5 $(5) $0 $(12) $(12) $30 LP Basis NR liab. MG Net MG $15 $100 $80 $0 $(15) $(20) $0 $0 $80 $80 $0 $(28) $(40) $40 $40 $(28) $40 $80 $40 $(30) $(30) $7 $(27) $(20) $20 $(10) $(9) $(21) $20 $50 $30 6 EXAMPLE: Same as above, but operating expenses and income now equal only $5. Initial Year 1: recourse deds End Year 1 Years 2-3: nonrecourse deds End Year 3 Year 4: contribution MGC Remedial deds End Year 4 Year 5: nonrecourse deds MGC End Year 5 (3) C. GP LP Basis NR liab. MG Net MG $5 $15 $100 $80 $0 $(5) $(15) $(20) $0 $0 $0 $80 $80 $0 $(12) $(28) $(40) $40 $40 $(12) $(28) $40 $80 $40 $30 $(30) $(30) $5 $(25) $(20) $20 $(10) $(7) $(23) $20 $50 $30 $(6) $(14) $(20) $20 $(2) $2 $20 $(15) $(35) $0 $50 $50 If nonrecourse debt is changed into recourse debt. There is no MG chargeback to the extent the P's EROL increases. 1.704-2(f)(2). Distrib. of NR Liab. Proceeds allocable to the increase in minimum gain. Because there are no NR ded'n in this scenario, the PS is unable to allocate MG to a partner to whom the corresponding NR ded'n were allocated. 1. 2. Essentially, the excess MG is assigned automatically to the distribution because the increase in the NR liability cannot produce income. Therefore, the distribution is treated as carrying out part of the MG. EXAMPLE: GP and LP each contribute $10 cash. Building (5 yr. life) bought for $20 and $80 of NR debt. The building is depreciated to $0, but its FMV at the end of 5 years was $180. The partners borrow an additional $100 NR in year 6 and distribute equally. End Year 5 Year 6: distribution End Year 6 III. GP $(40) $(50) $(90) LP Basis NR liab. MG Net MG $(40) $0 $80 $80 $(50) $0 $100 $100 $100 $(90) $0 $180 $180 ALLOCATIONS WITH RESPECT TO CONTRIBUTED PROPERTY 704(c) A. Introduction 1. 2. B. 704(c) operates solely on tax allocations. Technically, it narrows the book/tax disparity. General allocation principles. 7 1. An item of G/L with respect to property contributed by a partner to a PS shall be shared among the partners so as to take acct. of the variation between the AB of the property to the PS and its FMV at the time of contribution. 704(c)(1)(A). a. Precontribution G/L must be allocated back to the contributor. (1) (2) b. 2. The Service will generally accept a valuation determined at arm's length if the partner's interests are sufficiently adverse. 1.704-1(b)(2)(iv)(h). Allocations with respect to built-in G/L are made under 1 of 3 methods. a. b. c. C. If the property's book value is greater than its AB, the difference is "built-in gain," and if the AB exceeds BV, the difference is "built-in loss." 1.704-3(a)(3)(ii). Traditional method. 1.704-3(b). Traditional method with curative allocations. 1.704(3)(c). Remedial method. 1.704-3(d) Sales and exchanges of contributed property: 704(c) allocation methods. 1. Traditional method a. Requirements (1) (2) b. This generally requires a PS to allocate any built-in G/L to the contributing partner. 1.704-3(b)(1). The difference between the BV and its tax basis requires the PS to keep two sets of books. Ceiling Rule Limitations (1) (2) This rule states that the total tax G/L allocated to the partners may not exceed the tax G/L realized by the PS. 1.704-3(b)(1). This rule, however, can result in shifting of tax burden and tax/book disparities could result because the partner may not be able to "book up" any disparity. EXAMPLE: GP contributes $100 cash. LP contributes land with $50 basis and $100 FMV. It is eventually sold for $70. Initial Gain on sale GP LP Tax Book Tax Book $100 $100 $50 $100 $(15) $20 $(15) 8 $100 $85 Final 2. Traditional method with curative allocations. a. This allows the PS to make reasonable "curative allocations" of other PS tax items of income, gain, loss, or deduction to correct the distortions of the ceiling rule. 1.704-3(c)(1). (1) (2) b. 3. $70 $85 A curative allocation is an allocation made solely for tax purposes that differ from the PS allocation of the corresponding book item. As such, a curative allocation has no economic effect. Disadvantage: this only corrects in the year of distortion if the PS has enough recognized tax gain. Remedial method a. b. This allows the PS to restore its books by creating a tax G/L of the appropriate type needed to offset the ceiling rule distortions. These do not affect the capital accounts. 1.704-3(d)(1). If a tax/book disparity results, the PS may make a remedial allocation to the noncontributing partner equal to the full amt. of the disparity and a simultaneous offsetting remedial allocation to the contributing partner. 1.704-3(d)(1). EXAMPLE: Same as above except without the purchase and sale of a security. Initial Gain (loss) on land Remedial Allocation End balance 4. D. GP Tax Book $100 $100 $(15) $(15) $85 $85 Planning aspects The partner's may choose the traditional method if the contrib. partner is in a high tax bracket because it understates the contrib. partner's gain and defers the noncontributing partner's use of a deduction. Depreciation of contributed property 1. LP Tax Book $50 $100 $20 $(15) $15 $85 $85 Traditional method. a. The Steps. 9 (1) (2) (3) b. Allocate the book depreciation according to the PS interest. Then, allocate tax depreciation to the non-contributing partner to the extent of book depreciation. Finally, allocate any leftover depreciation to the contributing partner. 1.704-3(b)(1) and -3(b)(2) Effect of the ceiling rule: The partners tax depr. deductions cannot exceed the PS total tax depreciation deductions. EXAMPLE: GP contributes $100 cash, and LP contributes building (10 yr. property) with $50 basis and $100 FMV. Initial Year 1: dep. End Year 1 2. E. Traditional method with curative allocations. If elected, the PS may make a curative allocation to the noncontributing partner of the depreciation deduction not allowed under the ceiling rule to correct the distortion. 1.704-3(c). Other applications of 704(c). 1. 2. 3. IV. PS Basis GP LP in Bldg Tax Book Tax Book $50 $100 $100 $50 $100 $(5) $(5) $(5) $(5) $45 $95 $95 $50 $95 When a new partner is admitted, the PS may allocate built-in gains dormant in the PS by revaluing PS assets along with corresponding upward adj. in the partner's capital accts. The rules of 704(c) should also come into play. If revaluation is not elected a shift in income may occur, which the regulations may treat as a gift or compensation to the new partner. ALLOCATIONS OF PS LIABILITIES TO BASIS A. Recourse Liabilities. 1. Economic Risk of Loss ("EROL") A PS liability is recourse only to the extent that a partner or any person related to the partner bears the EROL w/ respect to the debt. 1.752-1(a)(1). a. b. In general, the partner bears the EROL to the extent the partner would be ultimately obligated to pay the debt if all PS assets were worthless and all PS liabilities were due and payable. In order to allocate the EROL, the PS must go through a constructive liquidation. 10 2. Constructive Liquidation The PS assets (including cash) are deemed worthless. All PS liabilities become due and payable. The PS disposes of assets in a taxable exchange for no consideration (other than relief of NR liabilities). d. The PS allocates G/L among the partners and liquidates. The regs. require the PS to constructively liquidate all assets. e. EXAMPLE: GP contributes $100 of cash and LP contributes $150 cash. A building was bought for $250 in cash and $750 recourse debt. They share all losses equally. a. b. c. CAPITAL ACCOUNTS Prior to atom bomb Loss after atom bomb. Share of liab. 3. GP $100 $(850) $(750) BASIS Contribution (§721) Alloc. of liab. (§752(a)) LP $150 $(150) $0 GP LP $100 $150 $750 $0 The partner bears the EROL to the extent that she must contribute to the PS at the time of the deemed liquidation. a. In determining the partner's pmt. obligation, all factual circumstances must be taken into acct., including (1) (2) (3) b. c. Contractual obligations outside of the PS agreement. 1.752-2(b) (3)(i). Obligations imposed by the PS agreement, i.e. deficit restoration obligations. 1.752-2(b)(3)(ii), and The value of any property pledged (directly/indirectly) by the partner to secure any PS liability. 1.752-2(h)(3) The value of property pledged is deemed to be the value at the time it was pledged. The regs. assume that the recourse liab. will be paid by the partners to the extent they are personally obligated to do so even if the partner's net worth is less than the amt. of the obligation unless the facts and circumstances indicate a plan to circumvent or avoid the obligation. 1.752-2(b)(6). Broad General Rule with respect to limited partners. Recourse debt is not allocated to a LP unless (1) (2) The LP contributes a promissory note, pledges property as security, or is otherwise obligated to contribute additional amounts, and is not entitled to reimbursement from the PS. 11 d. The constructive liquidation is always based on book values. EXAMPLE: GP contributes $200 to the PS, and LP contributes $300. The PS purchases a building with $500 cash and $500 recourse debt. The partners share losses equally. CAPITAL ACCOUNTS Prior to atom bomb Loss after atom bomb Share of liab. GP $200 $(700) $(500) LP $300 $(300) $0 EXAMPLE: A and B contributed a building to the PS with a AB: 300,000; FMV: 800,000. C contributed property with AB: 150,000 and FMV: 700,000 subject to 300,000 recourse debt. Building 1 Building 2 300,000 800,000 150,000 700,000 TOTAL 450,000 1,500,000 Liab. A B C TOTAL 300,000 150,000 150,000 (150,000) 450,000 300,000 400,000 400,000 400,000 1,500,000 BASIS: C has $50,000 recognized gain and the PS has the option of increasing IB on the land by $50,000 Initial basis (§ 721) Relief of liab. (§752(b)) Increase in liab. (§752(a)) End basis B. A B $150,000 $150,000 $100,000 $100,000 $250,000 $250,000 C $150,000 $(300,000) $100,000 $0 Nonrecourse Liabilities. To the extent no partner bears the EROL, the liab. is classified as nonrecourse. These are generally allocated according to the PS share of profits. 1. The PS share of NR liab. is the sum of: a. b. c. The partner's share of MG (total MG determined by 704(b)). In the case of NR liab. secured by contributed property, the amt. of gain the partner would recognized under 704(c) if the PS disposed the property in full satisfaction of the liability with no other consideration. The partner's share of the remaining ("excess") NR liabilities, determined in accordance with his share of PS profits. (1) Any specification of the partner's interests in the PS agreement will be respected for 752 purposes if it is reasonably consistent with an allocation of any other significant item of PS income or gain which has substantial economic effect. 1.752-3(a)(3). 12 (2) (3) 2. Alternatively, excess NR liabilities may be allocated in accordance with the manner in which it reasonably expected that deductions attributable to those liab. will be allocated. Absent any special allocation, the partners' interest in the PS profits are determined by taking into acct. all facts relating the partners' economic arrangement. Partner's share of MG. a. The rule for allocation of NR liab. directly follows the rule for allocation of the deductions and distributions attributable to those liabilities. (1) (2) b. The liabilities are first allocated in accordance with each partner's share of MG, i.e. who gets the MG chargeback. This rule reflects the fact that one of the principal purposes for including PS liab. in the partners' OB is to support deductions that will be claimed by the partners for items attributable to those liable. When the MG allocation is triggered. (1) (2) (3) The MG allocation rules is triggered by nonrecourse deductions. The MG allocation rule is also triggered where MG results from a distribution of the proceeds of a NR loan. The distributee partner, to whom the MG is allocated under 704(b), is the partner to whom the NR liab. that generates the MG will be allocated. EXAMPLE: GP contributes $10,000 and LP contributes $90,000. The PS buys a building with nonrecourse debt for $1,000,000. The building is depreciable over 10 years. The partnership agreed to share nonrecourse and recourse deductions at 10:90 with a flip at year 10 to 50:50. They also agreed to share the excess nonrecourse liabilities 50:50. BASIS Initial basis (§721) Share of liab. Beginning Year 1 Wash (50/50) MG Liab. Deduction End Year 1 3. GP $10,000 $500,000 $510,000 $(50,000) $10,000 $(10,000) $460,000 LP $90,000 $500,000 $590,000 $(50,000) $90,000 $(90,000) $540,000 Partner's share of 704(c) gain. a. To the extent of minimum 704(c) gain, the NR liab. secured by the contributed property is allocated to the same partner to whom the built-in 13 b. gain is allocated under 704(c). There may also be built-in gain (as a result of NR liabilities in excess of basis) which is neither 704(c) or MG, i.e. when a new partner joins and book value is restated. (1) This "built-in" gain is treated the same as 704(c) gain under the regs. (2) The prior partners are allocated the 704(c)-type gain which would result if there were a sale of the property. EXAMPLE: A and B contributed a building to the PS with a AB: 300,000; FMV: 800,000. C contributed property with AB: 150,000 Initial basis (§721) Relief of liab. (§752(b)) Increase in liab. (§704(c) MG) Excess liab. End basis A B $150,000 $150,000 $50,000 $50,000 $200,000 $200,000 14 C $150,000 $(300,000) $150,000 $50,000 $50,000