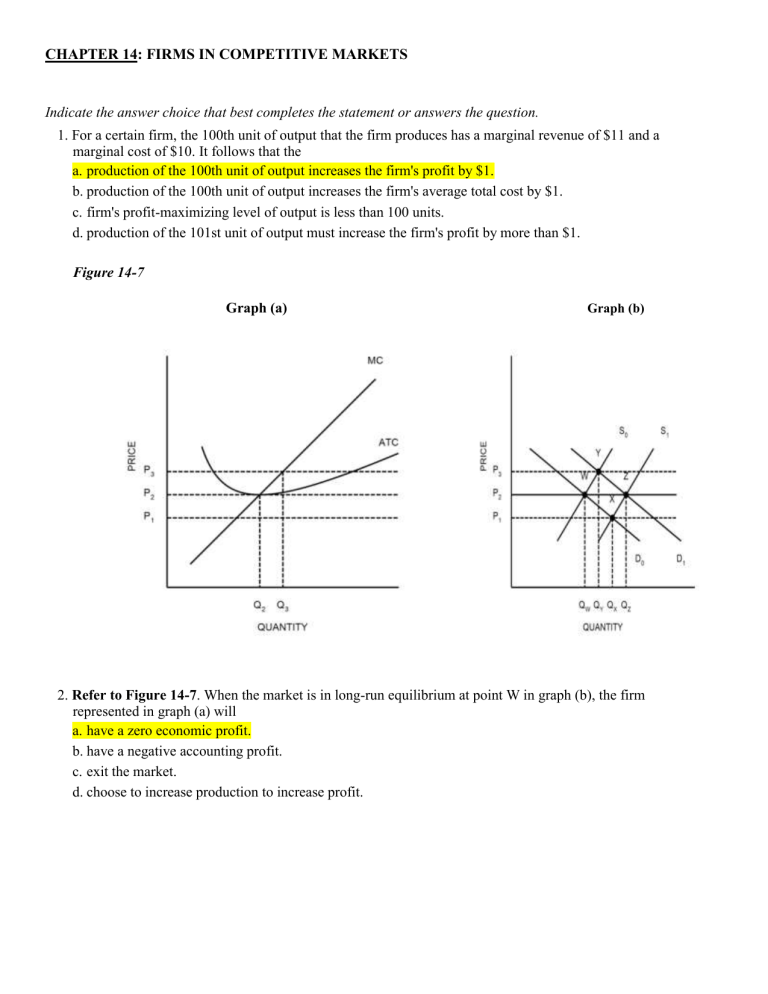

CHAPTER 14: FIRMS IN COMPETITIVE MARKETS Indicate the answer choice that best completes the statement or answers the question. 1. For a certain firm, the 100th unit of output that the firm produces has a marginal revenue of $11 and a marginal cost of $10. It follows that the a. production of the 100th unit of output increases the firm's profit by $1. b. production of the 100th unit of output increases the firm's average total cost by $1. c. firm's profit-maximizing level of output is less than 100 units. d. production of the 101st unit of output must increase the firm's profit by more than $1. Figure 14-7 Graph (a) Graph (b) 2. Refer to Figure 14-7. When the market is in long-run equilibrium at point W in graph (b), the firm represented in graph (a) will a. have a zero economic profit. b. have a negative accounting profit. c. exit the market. d. choose to increase production to increase profit. Figure 14-1 Suppose that a firm in a competitive market has the following cost curves: 3. Refer to Figure 14-1. The firm will earn a positive economic profit in the short run if the market price is a. above $6.5. b. less than $6.5 but more than $3. c. less than $3. d. exactly $6.5. 8. Refer to Figure 14-1. If the market price is exactly $6.5, the firm will earn a. positive economic profits in the short run. b. negative economic profits in the short run but remain in business. c. negative economic profits and shut down. d. zero economic profits in the short run. 9. Refer to Figure 14-1. If the market price is $2.5, the firm will earn a. positive economic profits in the short run. b. negative economic profits in the short run but remain in business. c. negative economic profits and shut down. d. zero economic profits in the short run. 24. Refer to Figure 14-1. The firm will earn a negative economic profit but remain in business in the short run if the market price is a. above $6.5 but less than $9. b. anywhere above $6.5. c. less than $6.5 but more than $3. d. less than $3. Figure 14-2 Suppose a firm operating in a competitive market has the following cost curves: 4. Refer to Figure 14-2. The firm will earn zero economic profit if the market price is a. $0. b. $6. c. $7. d. $10. Figure 14-3 Suppose a firm operating in a competitive market has the following cost curves: 5. Refer to Figure 14-3. When market price is P7, a profit-maximizing firm's short-run profits can be represented by the area a. P7 × Q5. b. P7 × Q3. c. (P7 − P5) × Q3. d. We are unable to determine the firm's profits because the quantity that the firm would produce is not labeled on the graph. 7. Refer to Figure 14-3. In the short run, if the market price is higher than P4 but less than P6, individual firms in a competitive industry will earn a. positive profits. b. zero profits. c. losses but will remain in business. d. losses and will shut down/ Scenario 14-2 The information below applies to a competitive firm that sells its output for $45 per unit. • When the firm produces and sells 100 units of output, its average total cost is $24.5. • When the firm produces and sells 101 units of output, its average total cost is $24.65. 6. Refer to Scenario 14-2. When the firm produces 100 units of output, its profit is a. $4,500.00. b. $2,050.00. c. $2,450.00. d. $7,675.00 10. Refer to Figure 14-1. If the market price is exactly $6.5, the firm will earn a. positive economic profits in the short run. b. negative economic profits in the short run but remain in business. c. negative economic profits and shut down. d. zero economic profits in the short run. 11. Refer to Figure 14-1. If the market price is $2.5, the firm will earn a. positive economic profits in the short run. b. negative economic profits in the short run but remain in business. c. negative economic profits and shut down. d. zero economic profits in the short run. 12. For a firm, marginal revenue minus marginal cost is equal to a. profit. b. average total cost. c. change in profit. d. change in average revenue. 11. Farmer McDonald sells wheat to a broker in Kansas City, Missouri. Because the market for wheat is generally considered to be competitive, Mr. McDonald maximizes his profit by choosing a. to produce the quantity at which average variable cost is minimized. b. to produce the quantity at which average fixed cost is minimized. c. the quantity at which market price is equal to Mr. McDonald's marginal cost of production. d. the quantity at which market price exceeds Mr. McDonald's marginal cost of production by the greatest amount. Table 14-3 The table represents a demand curve faced by a firm in a competitive market. Quantity Demanded (Units) 12 15 18 21 24 Total Revenue (Dollars) 132 165 198 231 264 12. Refer to Table 14-3. For this firm, the marginal revenue of the 15th unit is a. $1. b. $3. c. $11. d. The marginal revenue cannot be determined without knowing the total revenue when 15 units are sold. 13. If a competitive firm is currently producing a level of output at which marginal cost exceeds marginal revenue, then a. a one-unit increase in output will increase the firm's profit. b. a one-unit decrease in output will increase the firm's profit. c. total revenue exceeds total cost. d. total cost exceeds total revenue. 14. Suppose that in a competitive market the equilibrium price is $2.50. What is marginal revenue for the last unit sold by the typical firm in this market? a. Less than $2.50 b. More than $2.50 c. Exactly $2.50 d. The marginal revenue cannot be determined without knowing the actual quantity sold by the typical firm. 15. Tom produces commemorative t-shirts in a competitive market. If Tom decides to decrease his output, this will a. increase his revenue, since the output decrease leads to a higher market price. b. increase his revenue, since Tom's competitors will also decrease their output, so that price rises to offset the drop in Tom's output. c. decrease his revenue, since his output has decreased and the price remains the same. d. decrease his revenue, since the price falls as competitors increase their output to make up for his decrease in output. 16. Profit-maximizing firms enter a competitive market when existing firms in that market have a. total revenues that exceed fixed costs. b. total revenues that exceed total variable costs. c. average total costs that exceed average revenue. d. average total costs that are less than market price. 17. If a competitive firm is selling 900 units of its product at a price of $10 per unit and earning a positive profit, then a. its total cost is more than $9,000. b. its marginal revenue is less than $10. c. its average total cost is less than $10. d. the firm cannot be a competitive firm because competitive firms cannot earn positive profits. 18. When profit-maximizing firms in competitive markets are earning profits, a. market demand must exceed market supply at the market equilibrium price. b. market supply must exceed market demand at the market equilibrium price. c. new firms will enter the market. d. the most inefficient firms will be encouraged to leave the market. 19. Robin owns a horse stable and riding academy and gives riding lessons for children at "pony camp." His business operates in a competitive industry. Robin gives riding lessons to 20 children per month. His monthly total revenue is $4,000. The marginal cost of pony camp is $250 per child. In order to maximize profits, Robin should a. give riding lessons to more than 20 children per month. b. give riding lessons to fewer than 20 children per month. c. continue to give riding lessons to 20 children per month. d. We do not have enough information to answer the question. 20. Raiman's Shoe Repair produces custom-made shoes. When Mr. Raiman produces 12 pairs per week, the marginal cost of the 12th pair is $84, and the marginal revenue of the 12th pair is $70. What would you advise Mr. Raiman to do? a. Shut down the business b. Produce more custom-made shoes c. Decrease the price d. Produce fewer custom-made shoes Table 14-6 Suppose that a firm in a competitive market faces the following revenues and costs: Quantity (Units) 0 1 2 3 4 5 6 7 Total Revenue (Dollars) 0 6 12 18 24 30 36 42 Total Cost (Dollars) 3 5 8 12 17 23 30 38 21. Refer to Table 14-6. The firm will produce a quantity greater than three because at 3 units of output, marginal cost a. is greater than marginal revenue. b. equals marginal revenue. c. is less than marginal revenue. d. is minimized. Scenario 14-1 Assume a certain firm in a competitive market is producing Q = 1,000 units of output. At Q = 1,000, the firm's marginal cost equals $15 and its average total cost equals $11. The firm sells its output for $12 per unit. 22. Refer to Scenario 14-1. To maximize its profit, the firm should a. increase its output. b. continue to produce 1,000 units. c. decrease its output but continue to produce. d. shut down. 23. The intersection of a firm's marginal revenue and marginal cost curves determines the level of output at which a. total revenue is equal to variable cost. b. total revenue is equal to fixed cost. c. total revenue is equal to total cost. d. profit is maximized. Figure 14-1 Suppose that a firm in a competitive market has the following cost curves: 25. Which of the following represents the firm's short-run condition for shutting down? a. Shut down if TR < TC b. Shut down if TR < FC c. Shut down if P < ATC d. Shut down if TR < VC 26. The accountants hired by Forever Fitness have determined total fixed cost to be $75,000, total variable cost to be $130,000, and total revenue to be $125,000. Because of this information, in the short run, Forever Fitness should a. shut down because staying open would be more expensive. b. lower their prices to increase their profits. c. stay open because shutting down would be more expensive. d. stay open because the firm is making an economic profit. Figure 14-4 In the following figure, graph (a) depicts the linear marginal cost (MC) of a firm in a competitive market, and graph (b linear market supply curve for a market with a fixed number of identical firms. Graph (a): Firm Graph (b): Market 27. Refer to Figure 14-4. If there are 300 identical firms in this market, what level of output will be supplied to the market when price is $1.00? a. 300 b. 6,000 c. 30,000 d. 60,000 28. Which of the following statements regarding a competitive firm is correct? a. Because each firm faces a downward sloping demand, if a firm increases its level of output, the firm will have to charge a lower price to sell the additional output. b. If a firm raises its price, the firm may be able to increase its total revenue even though it will sell fewer units. c. By lowering its price below the market price, the firm will benefit from selling more units at the lower price than it could have sold by charging the market price. d. For all firms, average revenue equals the price of the good. Table 14-4 The following table presents cost and revenue information for a firm operating in a competitive industry. Quantity Supplied (Units) 0 1 2 3 4 5 6 7 8 Costs Total Cost (Dollars) 100 150 202 257 317 385 465 562 682 Marginal Cost (Dollars) -- Quantity Demanded (Units) 0 1 2 3 4 5 6 7 8 Revenues Price Total (Dollars per Revenue unit) (Dollars) 120 120 120 120 120 120 120 120 120 29. Refer to Table 14-4. What is the average revenue when 6 units are sold? a. $20 b. $465 c. $120 d. $7 Marginal Revenue (Dollars) --