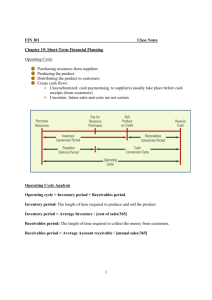

CLASS 1 Managing Working Capital and Cash Flow Corporate Finance and Valuation | Dr. Viktoria Dalko 1 HOW DO YOU MAKE SURE YOUR COMPANY DOESN’T RUN OUT OF CASH? 2 Key Takeaways What is the appropriate amount and mix of current assets for the firm to hold? How should these current assets be financed? 3 What is the appropriate amount and mix of current assets for the firm to hold? 4 Working Capital Basics Apple Inc. Financial Statements, Fiscal Year Ended September 24, 2016 ($ millions) This exhibit shows the balance sheet and income statement for Apple Inc. for the fiscal year ended September 24, 2016. We use this information in illustrating various elements of working capital management. Assets Cash Short-term investments Accounts receivable Inventory Other current assets Total current assets Property, plant, and equipment Less: Accum. depreciation Net plant and equipment Investments Other noncurrent assets Total Assets $20,484 46,671 15,754 2,132 21,828 $106,869 61,245 34,235 27,010 170,430 17,377 $321,686 5 Working Capital Basics Liabilities and equity Accounts payable $37,294 Deferred revenue 8,080 Accrued expenses 22,027 Other current liabilities 11,605 Total current liabilities Balance Sheet as of September 24, 2016 $79,006 Long-term debt 75,427 Other noncurrent liabilities 39,004 Total liabilities $193,437 Preferred stock 0 Common stock 31,251 Retained earnings 96,364 Other stockholder equity Less: Treasury stock 634 0 Total common equity $128,249 Total liabilities and stockholder’s equity $321,686 6 Working Capital Basics Income Statement for the fiscal year ended September 24, 2016 7 Working Capital Basics: Terms and Concepts 8 ➢ Current assets are cash and other assets that the firm expects convert into cash in a year or less ➢ Current liabilities (or short-term liabilities) are obligations that the firm expects to pay off in a year or less ➢ Working capital (also called gross working capital) are the funds invested in a company’s cash account, account receivables, inventory, and other current assets 9 ➢ Net working capital (NWC) refers to the difference between current assets and current liabilities; it is important because it is a measure of liquidity and represents the net short-term investment the firm keeps in the business ➢ Working capital management involves making decisions regarding the use and sources of current assets 10 ➢ Working capital efficiency refers to the length of time between when a working capital asset is acquired and when it is converted into cash ➢ Liquidity is the ability of a company to convert real or financial assets into cash quickly and without loss of value 11 Working Capital Accounts and Trade-Offs 12 ➢ Working capital accounts ➢ Cash includes cash and other highly liquid short-term money market instruments, such as U.S. Treasury securities ➢ Receivables represent the amount owed by customers who have availed themselves of the firm’s trade credit facility ➢ Firms maintain inventory of raw materials, work in process, and finished goods ➢ Payables represent the amount owed to the firm’s vendors and suppliers for materials purchased on credit ➢ Increasing working capital costs money, but should lead to increased sales and better relationships with vendors, suppliers, and employees 13 Strategies of Working Capital Management: Corporate Finance 14 ➢ Financial managers use two types of strategies for current assets: flexible and restrictive ➢ The flexible current asset management strategy has a high percent of current assets to sales, whereas a restrictive policy has a low percent of current assets to sales 15 ➢ Flexible current asset management strategy ➢ Calls for management to invest large amounts in cash, marketable securities, and inventory ➢ Is considered low-risk and low-return ➢ The advantage of this strategy is large working capital balances ➢ The downside of this strategy is the high carrying cost associated with owning a high level of inventory and providing liberal credit terms to customers 16 ➢ The restrictive current asset management strategy is a high-risk high-return alternative to the flexible strategy ➢ The high risk comes in the form of shortage costs, both financial and operating ➢ Operating shortage costs result from lost production and sales ➢ Financial shortage costs arise mainly from illiquidity, shortage of cash, and a lack of marketable securities to sell for cash 17 ➢ The working capital trade-off: management will try to find the level of current assets that minimizes the sum of the carrying costs and shortage costs ➢ The optimal current assets investment strategy will depend on the relative magnitudes of carrying costs and shortage costs; this conflict is often referred to as the working capital trade-off ➢ Financial managers need to balance shortage costs against carrying costs to define an optimal strategy ➢ If carrying costs are larger than shortage costs, then the firm will maximize value by adopting a more restrictive strategy ➢ On the other hand, if shortage costs dominate carrying costs, the firm will need to move towards a more flexible policy 18 What are the decisions that define the size of working capital? 19 Accounts Receivables ➢ Companies frequently make sales to customers on credit by delivering goods in exchange for the promise of a future payment ➢ The promise is an account receivable from the firm’s point of view ➢ Offering credit to customers can help a firm attract customers by differentiating the firm and its products from its competitors 20 Terms of Sale ➢ Whenever a firm sells a product, the seller spells out the terms and conditions of the sale in a document called the terms of sale ➢ The agreement specifies when payment is due and the amount of any discount if early payment is made ➢ The simplest offer is cash on delivery (C O D), with no credit offered ➢ When credit is part of the sale, the terms of sale spell out the credit agreement between the buyer and seller ➢ Trade credit, which is short-term financing, is typically made with a discount for early payment rather than an explicit interest charge 21 Terms of Sale ➢ Trade credit is a loan from the supplier and is usually a very costly form of credit ➢ We can find the effective annual rate (E A R) for trade credit using the following formula: Discount EAR for accounts receivable = EARR = 1 + Discounted price 365 days credit −1 22 Aging Accounts Receivables ➢ A common tool that credit managers use is called an aging schedule ➢ The aging schedule shows the breakdown of the firm’s accounts receivable by their date of sale, how long the account has not been paid ➢ Its purpose is to identify and then track delinquent accounts and to see that they are paid ➢ Aging schedules are also an important tool for analyzing the quality of a firm’s receivables ➢ The aging schedule reveals patterns of delinquency and shows where collections efforts should be concentrated 23 Inventory Management ➢ Inventory management is largely a function of operations management, not financial management ➢ Manufacturing companies generally carry three types of inventory: raw materials, work in process, and finished goods ➢ Investment in inventory is costly ➢ Capital invested in inventory provides no direct return, but running out of raw materials can cause manufacturing to shut down at a greater cost to the firm ➢ A shortage of finished goods can mean lost sales 24 Cash Management and Budgeting ➢ There are three main reasons for holding a cash balance ➢ ➢ ➢ First, it facilitates transactions with suppliers, customers, and employees Second, for precautionary or strategic reasons The third reason for holding cash is simply that most banks require firms to hold compensating balances, minimum cash balances in exchange for services 25 Example: Cash Flow Budget for January through April Assume beginning cash of $80,000. Jan Feb. Mar Apr Beginning cash $ 80,000 $ 64,000 $ 44,400 $ 22,080 Cash receipts 105,000 126,000 151,200 181,440 Cash disbursements 121,000 145,600 173,520 203,624 Net cash flow (16,000) (19,600) (22,320) (22,184) Ending cash Note ending cash for a month becomes the beginning cash for the following month. $ 64,000 $ 44,400 $ 22,080 $ (104) Note that even though growth in sales lead to growth in net income, the company runs out of cash Cash Collections ➢ Collection time, or float, is the time between when a customer makes a payment and when the cash become available to the firm ➢ Collection time can be broken down into three components: ➢ Delivery, or mailing, time: when a customer mails a payment it may take several days before that payment arrives ➢ Processing delay: once the payment is received it must be opened, examined, accounted for, and deposited at the firm’s bank ➢ Finally, there is a delay between the time of the deposit and the time the cash is available for withdrawal 27 What is the best way to finance working capital? 28 Financing Working Capital (1 of 4) ➢ The minimum level of working capital is viewed as permanent working capital ➢ Exhibit below shows the three basic strategies that a firm can follow to finance its working capital and fixed assets ➢ Each of the three panels show: ➢ The total long-term financing needed, consisting of long-term and equity ➢ The seasonal needs for working capital that fluctuates with the level of sales 29 Financing Working Capital (2 of 4) Working Capital Financing Strategies Three alternative strategies for financing working capital and fixed assets are (1) a maturity matching strategy, which matches the maturities of assets and the sources of funding; (2) a long-term funding strategy, which relies on long-term debt to finance both working capital and fixed assets; and (3) a short-term funding strategy, which uses short-term debt to finance all seasonal working capital needs and a portion of permanent working capital and fixed assets. 30 Financing Working Capital (3 of 4) ➢ Strategies for financing working capital ➢ The maturity matching strategy is one of the most basic techniques used by financial managers to reduce risk when financing assets ➢ All seasonal working capital is funded with short-term borrowing and, as the level of sales varies seasonally, short-term borrowing fluctuates between some minimum and maximum level 31 Financing Working Capital (4 of 4) ➢ Strategies for financing working capital ➢ The long-term funding strategy is shown in Panel B ➢ All permanent working capital and fixed assets are funded with long-term financing ➢ This strategy relies on long-term debt to finance both capital assets and working capital ➢ The short-term funding strategy is shown in Panel C ➢ This strategy relies on short-term debt to finance all seasonal working capital, a portion of the permanent working capital and fixed assets 32 Financing Working Capital in Practice ➢ Matching Maturities ➢ Nearly all financial managers try to match the maturities of assets and liabilities when funding the firm ➢ Short-term assets are funded with short-term financing and long-term assets are funded with long-term financing ➢ Permanent Working Capital ➢ Most financial managers like to fund some of their current assets with longterm debt as shown in Panel B ➢ Some large firms with the highest credit standing prefer to fund some of their long-term fixed assets with short-term debt sold in the commercial paper market 33 Sources of Short-Term Financing (1 of 4) ➢ Accounts Payable ➢ ➢ Accounts payable (trade credit), bank loans, and commercial paper are common sources of short-term financing The buyer decides whether to take advantage of the cash discount or wait and pay in full when the account is due 34 Sources of Short-Term Financing (2 of 4) ➢ Short-term Bank Loans ➢ If the firm backs the loan with an asset the loan is defined as secured, otherwise the loan is unsecured ➢ Secured loans should allow the borrower to borrow at a lower interest rate ➢ An informal line of credit is a verbal agreement between the firm and the bank, allowing the firm to borrow up to an agreed-upon upper limit ➢ In exchange for providing the line of credit, a bank may require that the firm hold a compensating balance with them ➢ A formal line of credit is also known as revolving credit ➢ Under this type of agreement, the bank has a legal obligation to lend an amount of money up to a pre-set limit; the firm pays a yearly fee in addition to the interest expense on the amount they borrow 35 Sources of Short-Term Financing (3 of 4) ➢ Commercial Paper ➢ ➢ ➢ Commercial paper is a promissory note issued by large financially secure firms that have high credit ratings Commercial paper is not secured (the issuer is not pledging any assets to the lender in the event of default), but most commercial paper is backed by a credit line from a commercial bank The default rate on commercial paper is very low, resulting in an interest rate that is usually lower than what a bank would charge on a direct loan 36 Sources of Short-Term Financing (4 of 4) ➢ Accounts Receivable Financing ➢ ➢ ➢ A company can secure a bank loan by pledging the firm’s accounts receivable as security Accounts receivable financing is an important source of funds for medium-size and small businesses A second way for a business to finance itself with accounts receivables, called factoring, is to sell the receivables to a factor at a discount; the firm that sells the receivables has no further legal obligation to the factor 37 Any questions? https://mashable.com/article/comedy-wildlife-photography38 awards-2020/ Practice Q1 Trend Foods distributes its products to more than 100 restaurants and delis. The company's collection period is 32 days, and it keeps its inventory for 10 days. What is Trend's operating cycle? 39 Practice Q2 Senter Corp. sells its goods with terms of 2/10 EOM, net 30. What is the implicit cost of the trade credit? Round your final percentage answer to 2 decimal places. Do not round your intermediate calculations. 40 Practice Q3 Which of the following statements about maturity matching strategy is true? A) All seasonal working capital needs are funded with short-term borrowing. B) As the level of sales varies seasonally, short-term borrowing fluctuates with the level of seasonal working capital. C) All fixed assets are funded with long-term financing. D) All of the above 41 Breakout session: Take a screen shot of the questions or keep this ppt open During Breakout Session, share a Microsoft Excel file, or share a google sheet. Type your actual current team members’ name on first worksheet who are participating in this activity with you. Record a single joint answer of the team on the second worksheet and upload it in Dropbox. Be ready to present it in class. 42 Breakout session Q1 Stamp, Inc. has an operating cycle of 81 days and takes 47 days to collect on its receivables. What is its level of inventory if the firm's cost of goods sold is $312,455? Round your final answer to the nearest dollar. 43 Breakout session Q2 Kearns, Inc. sells its goods with terms of 3/15 EOM, net 60. What is the implicit cost of the trade credit? Do not round your intermediate calculations, and round your final answer to the nearest whole percent. 44 Breakout session Q3 What are some strategies that financial managers can follow in managing their working capital accounts? 45 Key Takeaways What is the appropriate amount and mix of current assets for the firm to hold? How should these current assets be financed? 46 Appendix: Operating and Cash Conversion Cycles: Accounting Review 47 ➢ The cash conversion cycle is the length of time from the point at which a company pays for raw materials until the point at which it receives cash from the sale of finished goods made from those materials ➢ Sequence of events in the cash conversion cycle: ➢ The firm uses cash to pay for the cost of raw materials and the costs of conversion ➢ Finished goods are held in finished goods inventory until they are sold ➢ Finished goods are sold on credit to the firm’s customers ➢ Customers repay the credit the firm has extended to them; and the firm receives the cash 48 ➢ A typical cash conversion cycle begins with cash outflows for raw materials and conversion costs and goes through several stages before these resources are turned back into cash. The cash conversion cycle reflects the average time from the point that cash is used to pay for raw materials until cash is collected on the account receivable associated with the product produced with those raw materials. One of the main goals of a financial manager is to optimize the time between the cash outflows and the cash inflows. 49 ➢ Minimal working capital is obtained is the financial managers in managing the cycle: ➢ To delay paying accounts as long as possible without suffering any penalties ➢ To maintain minimal raw material inventories without causing manufacturing delays ➢ To use as little labor as possible to manufacture the product while maintaining quality ➢ To maintain minimal finished good inventories without losing sales ➢ To offer customers the most attractive credit terms possible on trade credit to maximize sales while minimizing the risk of non-payment ➢ To collect cash payments on accounts receivable as fast as possible to close the loop 50 Operating and Cash Conversion Cycles ➢ Time Line for Operating and Cash Conversion Cycles for Apple Inc. in 2016 ➢ The exhibit shows the cash inflows and outflows and other key events in a firm’s operating cycle and cash conversion cycle, along with computed values for Apple. Both of these cycles are used for measuring working capital efficiency. 51 Operating and Cash Conversion Cycles Inventory-on-hand period + Receivable collection period = Operating Cycle – Day’s payable period Additional working capital financing period - called Cash Conversion Cycle 52 DSI ➢ The operating cycle begins when the firm uses its cash to purchase raw materials and ends when the firm collects cash payments on its credit sales ➢ Days sales in inventory (D S I) shows to the daily cost of good sold how long the firm keeps its inventory before selling it, the ratio of the inventory balance to the daily cost of good sold 365 days 365 days DSI = = Inventory turnover COGS / Inventory 53 DSO Days sales outstanding (DSO) estimates how long it takes on average for the firm to collect its outstanding accounts receivable balances; also called the Average Collection Period (A C P) DSO = = 365 days Accounts receivable turnover 365 days Net sales Accounts receivable 54 Operating Cycle = DSI + DSO 55 DPO ➢ The cash conversion cycle does not start until the firm actually pays for its inventory ➢ It represents the length of time between the cash outflow for materials and the cash inflow from sales ➢ Days payables outstanding (DPO) tells how long a firm takes to pay off its suppliers for the cost of inventory DPO = 365 days 365 days = Accounts payable turnover COGS / Accounts payable 56 Cash Conversion Cycle ➢ We can now calculate the cash conversion cycle using one of two methods: Cash Conversion Cycle = DSI + DSO − DPO Cash Conversion Cycle = Operating Cycle − DPO 57 Selected Financial Ratios for Apple Inc. and the Computer Industry in 2016 When we compare working capital ratios for Apple with average ratios for the computer industry, we see that Apple is outperforming its peers on all metrics. Apple holds less inventory, collects on its outstanding balances more quickly than competitors, and is able to defer its cash payments to suppliers longer than competitors. These three facts combined ensure that Apple’s operating and cash conversion cycles are significantly shorter than is the norm in the computer industry. Note that a negative cash conversion cycle of −71.11 days means that Apple collects cash from its customers before it has to pay its suppliers. Thus, Apple’s suppliers are financing all of Apple’s working capital and then some Financial Ratio Apple Computer Industry Days’ sales in inventory (D S I) 5.92 54.25 Days’ sales outstanding (D S O) 26.66 58.10 103.69 72.41 Operating cycle (days) 32.58 112.35 Cash conversion cycle (days) −71.11 39.93 Days’ payables outstanding (D P O) 58