Present Value Model & Ideal Conditions in Accounting

advertisement

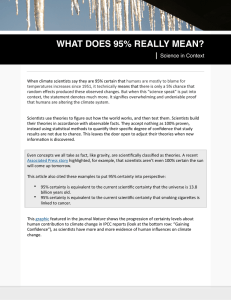

Roughly speaking, by ideal conditions I mean conditions where future firm cash flows and interest rates are known with certainty or, if not known with certainty, where there is a complete and publicly known set of states of nature and associated objective probabilities which enables a completely relevant and reliable ... Accounting Under Ideal Conditions. Financial Accounting Theory: Chapter 2 Cathy Phung Jaspreet Sidhu Neil Ganatra Yashar Davarpanah. Present Value Model Under C ertainty. Overview. The study of Financial Accounting Theory starts with the Present Value Model Accounting Under Ideal Conditions Financial Accounting Theory: Chapter 2 Cathy Phung Jaspreet Sidhu Neil Ganatra YasharDavarpanah Present Value Model Under Certainty Overview • The study of Financial Accounting Theory starts with the Present Value Model • Financial statement Relevance • Dividends, Cash Flow, Profitability • Financial statement Reliability • Financial Position, Results of Operations Present Value Model Under Certainty • Certainty = Complete Relevance and Reliability • IDEAL CONDITIONS = Future cash flows and interest rate in the economy are publicly known with certainty Present Value Model Under Certainty Example • Consider Company A: • One asset firm with no liabilities • Asset will generate end-of-year cash flows of $150 each year for two years • Economy interest rate is 10% Example – Present Value Model Under Certainty • Present Value Opening Balances PVO = 150/(1.10) + 150/(1/1.10)^2 = $260.33 • Balance Sheet Accounts – Time 0 • Capital Assets, at present value = $260.33 • Shareholders’ equity = $260.33 Example – Present Value Model Under Certainty • Income Statement for Year 1 Ended • Net Income = $260.33 x 10% = $26.03 • Accretion of Discount • Opening present value multiplied by the interest rate • Expected Net Income = Realized Net Income Example – Present Value Model Under Certainty Example – Present Value Model Under Certainty • Dividend Irrelevancy • Dividend Policy will not affect firm value under Ideal Conditions • As long as investors can invest dividends they receive at the same rate of return as the firm earns on cash flows not paid in dividends, PV of an investors overall interest in the firm is independent of the timing of dividends. • Dividend Paying Ability Example – Present Value Model Under Certainty • Net Income • Able to determine value from Opening Balance Sheet Accounts • Perfectly Predictable • Plays no role in firm valuation Principal of Arbitrage • At 10%, no one would be willing to pay more than $260.33 for asset at time 0 – would be earning less than 10%. • At 10%, owner would not sell asset for less than $260.33 – would rather hold onto the asset and earn 10%. • Therefore:Only possible equilibrium market price is $260.33 PV of Asset = Market Value Review Questions Question 1 – MDL Doors opening present value is $250, what is the Accretion of Discount for the year given a 10% economy interest rate? • $32 • $25 • $0 • $2.50 Review Questions Question 1 – MDL Doors opening present value is $250, what is the Accretion of Discount for the year given a 10% economy interest rate? • $32 • $25 • $0 • $2.50 Present Value Model Under Uncertainty States of Nature • Definition: Uncertain future events that affect cash flows • Examples: • Weather • Government policies • Strikes by suppliers • Equipment breakdowns States of Nature – Example 1 State 1 : Economy is Bad State 2 : Economy is Good State 1: $100/Year State 2: $200/Year Assumptions – Example 1 • Two year cash flows • Probability of occurrence of each state = 50 % • Set of possible states is publicly known and complete • State realization is publicly observable • State probabilities are objective and publicly known Summary – Ideal Conditions Under Uncertainty • A given, fixed interest rate • A complete and publicly known set of states of nature • State probabilities objective and publicly known • State realization publicly observable Calculate Expected Present Value – Example 1 State 1 : Economy is Bad State 2 : Economy is Good State 1: $100/Year State 2: $200/Year Interest: 10% Assumptions: • Two year cash flows • Probability of occurrence of each state = 50 % Possible Answers • $260.33 • $300.00 • $100.00 • $200.33 Answer PA0 = o.5 ( ( $100 / 1.10) + ( $200 /1.10) ) + 0.5 ( ( $100/1.10 2 ) + ( $200/1.10 2 ) ) = $260.33 Balance Sheet at Time 0 Capital Asset, at Expected $260.33 Present Value Shareholders’ Equity $260.33 • In this Chapter we will ignore the 50/50 gamble • We assume investors are risk-neutral • Firm’s market value will be $260.33 at time 0 Accretion of Discount – Year 1(Bad Economy) • Based on Expected Net Income for Year 1 • Interest x Present value at time 0 • 0.10 x $260.33 = $26.03 • Assume actual cash flows for year 1 = $100 • Expected cash flows = $ 150 (0.5x100+0.5x200) • Therefore Abnormal Earnings Bad State Realization = $50 • Net Income: $26.03 - $50 = (23.97) Expected Present Value of Remaining Cash Flows • PA 1 = 0.5 ( ($100 / 1.10) + ($200/1.10)) = $136.36 Balance Sheet Financial Assets: Cash $100.00 Capital Assets: End of Year Value 136.36 $236.36 Shareholders’ Equity Opening Value $260.33 Net Loss 23.97 $236.36 Notes – Example 1 Completely Relevant and Reliable - Financial statement information is both completely relevant and reliable. Relevance because balance sheet values are based on expected future cash flows and dividend irrelevancy holds. Reliable because ideal conditions ensure that present value calculations faithfully represent the firm’s expected future cash flows. Volatility - Net Income and Balance Sheet values are volatile since end of year period present values depend on which state is realized 2 Way of Calculating Balance Sheet Current Values - Expected Present Values or Market Values Predictability - Net Income is predictable conditional on the state of nature Reserve Recognition Accounting What is Reserve Recognition Accounting (RRA)? • Present value accounting applied to oil and gas reserves Accounting Standards Financial Accounting Standards Board • FASB issued SFAS 69 in 1982 • Publicly traded oil and gas companies are required to disclose supplementary information SFAF Summary • Proved oil and gas reserve quantities • Capitalized costs relating to oil and gas producing activities • Costs incurred in oil and gas property acquisition, exploration, and development activities • Results of operations for oil and gas producing activities • A standardized measure of discounted future net cash flows relating to proved oil and gas reserve quantities Canadian Standards Association • National Instrument (NI) 51-101 requires similar present value disclosures but considerably expanded • Option to apply for exemption and report under U.S. reserve recognition rules Why were these standards issued? • Provides investors with relevant information about future cash flows that historical cost-based financial statements don’t provide A standardized measure of discounted future net cash flows • Future Cash Inflows: requires computations using year-end oil and gas prices • Future production and development costs: estimated expenditures incurred in developing and producing proved oil and gas reserves • Future Income Taxes: Computed by applying appropriate year-ends tax rates • Discount: 10% rate is mandated by SFAS 69 for comparability across firms Husky Energy Inc. - 2008 Future Cash Inflows 29,918 Future Production Costs 11,695 Future Development Costs 4,020 Future income Taxes 3,715 Future Net Cash Flows 10,488 Annual 10% Discount factor 4,129 Future Net Cash Flows $6,359 Husky Energy Inc. - 2008 • Changes in standardized measures of discounted future net cash flows Beginning Balance: Present value at January 1st, 2008 +/- Adjusts for changes in quantities, prices, timings, costs and income taxes = Present Value at December 31st, 2008 Ideal conditions vs. “real world” environment • Two components of changes in estimates: 1) Changes in estimates of cash flow amounts • Under ideal conditions, there are no errors of estimates 2) volatility of earnings depending on the state realized Husky Energy Inc. – Income Statement Method 1 Expected net income 2,098 Abnormal earnings Additional reserves 1,590 Changes in estimate (8,420) Net loss (4,732) Husky Energy Inc. – Income Statement Method 2 Cash Flow from Operations 6,197 Development costs (2,455) Amortization Expense (8,474) Net Loss (4,732) Problem Problem Expected Net Income 22,453 Abnormal earnings NPV of Additional reserves 224,214 Changes in estimates Net changes in price & production costs 710,398 Revision of previous qty estimates 87,934 Net change in income taxes (330,636) Change in estimated in future development Costs (39,238) Total changes in estimates 428,458 Net income from proved oil & gas reserves 675,125 Reliability & Relevance • High relevancy but low reliability Reliability • Proved reserves: “reasonable certainty” of recovery under current economic and operating conditions • Do not operate under ideal conditions Problem: Lack of ideal conditions • Interest rates in the economy are not fixed – SFAS mandates a 10% rate • States of nature are more complex than the “good” and “bad” states • Subjective state probabilities Reliability – Husky Example • Its RRA information is not a reliable performance measure and should not solely be relied upon in evaluating company performance, is not a representation of the value of the company’s reserves, and is not used to internal decision-making Relevance • Information must affect a decision made by decision makers in order for it to be relevant • Highly relevant: present values of future receipts predict future cash flow • Conveys more useful information to investors than historical cost accounting Relevance: RRA vs. Historical Important Note • Complete relevance and reliability is not possible without ideal conditions, there must be a trade off! • More relevant information requires more estimates, reducing reliability Historical Cost Accounting Recap from Chapter 1... • Different systems of accounting valuation include: • Historical cost accounting • Current cost accounting • Value-in-use discounted PV of future cash flows • Fair value (aka exit price) the amount that would be received or paid should the firm dispose of the asset or liability