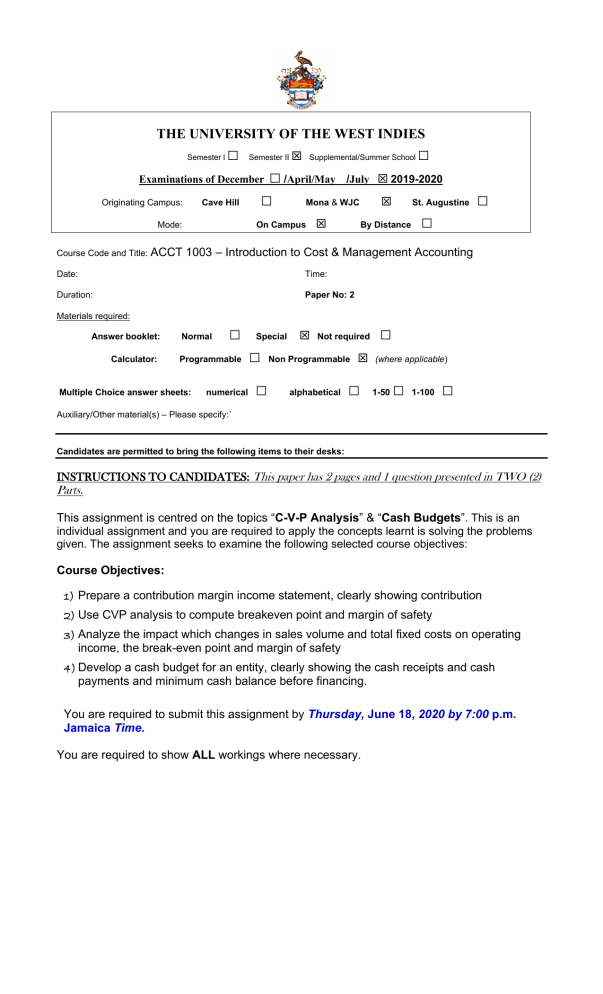

THE UNIVERSITY OF THE WEST INDIES Semester l □ Semester II Supplemental/Summer School □ /April/May /July □ Mona & WJC Examinations of December Originating Campus: Cave Hill Mode: Course Code and Title: ACCT On Campus □ 2019-2020 St. Augustine By Distance □ □ 1003 – Introduction to Cost & Management Accounting Date: Time: Duration: Paper No: 2 Materials required: Answer booklet: Calculator: Normal □ Programmable Multiple Choice answer sheets: numerical Special □ □ Not required Non Programmable alphabetical □ □ (where applicable) 1-50 □ 1-100 □ Auxiliary/Other material(s) – Please specify:` Candidates are permitted to bring the following items to their desks: INSTRUCTIONS TO CANDIDATES: This paper has 2 pages and 1 question presented in TWO (2) Parts. This assignment is centred on the topics “C-V-P Analysis” & “Cash Budgets”. This is an individual assignment and you are required to apply the concepts learnt is solving the problems given. The assignment seeks to examine the following selected course objectives: Course Objectives: 1) Prepare a contribution margin income statement, clearly showing contribution 2) Use CVP analysis to compute breakeven point and margin of safety 3) Analyze the impact which changes in sales volume and total fixed costs on operating income, the break-even point and margin of safety 4) Develop a cash budget for an entity, clearly showing the cash receipts and cash payments and minimum cash balance before financing. You are required to submit this assignment by Thursday, June 18, 2020 by 7:00 p.m. Jamaica Time. You are required to show ALL workings where necessary. PART I (40 marks) L & P Merchandising & More is a family-owned furniture store. You are the management accountant of the concern and have been given the task of preparing the cash budget for the business for the quarter ending December 31, 2020. Your data collection has yielded the following: (i) Extracts from the sales and purchases budgets are as follows: Month 2020 (ii) Cash Sales Sales On Account Purchases On Account August September October November $121,000 $95,500 $132,680 $105,900 $480,000 $600,000 $720,000 $650,000 $390,000 $360,000 $480,000 $400,000 December $216,000 $800,000 $500,000 An analysis of the records shows that trade receivables (accounts receivable) are settled according to the following credit pattern, in accordance with the credit terms 5/30, n90: 60% in the month of sale 30% in the first month following the sale 10% in the second month following the sale (iii) Accounts payable are settled as follows, in accordance with the credit terms 3/30, n60: 80% in the month in which the inventory is purchased 20% in the following month (iv) During November, the management of L & P Merchandising expects to sell an old motor vehicle that cost $650,000 at a gain of $25,000. Accumulated depreciation on this motor vehicle at that time is expected to be $475,000. The employee will be allowed to pay a deposit equal to 40% of the selling price in November and the balance settled in four equal amounts from December 2020 to March of 2021. (v) Computer Equipment, which is estimated to cost $480,000, will be purchased in December. The manager has made arrangements with the seller to make a cash deposit of 50% of the amount upon signing of the agreement in December, with the balance to be settled in four equal monthly instalments, starting in January 2021. (vi) A long-term instrument purchased by L & P Merchandising with a face value of $480,000 will mature on October 20, 2020. In order to meet the financial obligations of the business, management has decided to liquidate the investment upon maturity. On that date quarterly interest computed at a rate of 4½% per annum is also expected to be collected. (vii) Fixed operating expenses which accrue evenly throughout the year, are estimated to be $2,040,000 per annum, [including depreciation on non-current assets of $35,000 per month] and are settled monthly. (viii) Other operating expenses are expected to be $174,000 per quarter and are settled monthly. (ix) The management of L & P Merchandising has negotiated with a tenant to rent office space to her beginning November 1. The rental is $540,000 per annum. The first month’s rent along with one month’s safety deposit is expected to be collected on November 1. Thereafter, monthly rental income becomes due at the beginning of each month. (x) Wages and salaries are expected to be $2,940,000 per annum and will be paid monthly. (xi) At the recently concluded negotiations between management and the union representing the workers it was agreed that L & P Merchandising should make retroactive payments in the amount of $1,520,000 to employees. The payment is being settled in four equal tranches. The third payment becomes due and payable in October of 2020. (xii) The cash balance on December 30, 2020 is expected to be an overdraft of $198,000 Required: (a) The business needs to have a sense of its future cash flows and therefore requires the preparation of the following: ▪ A schedule of budgeted cash collections for trade receivables for each of the months October to December. (5 marks) ▪ A schedule of expected cash disbursements for accounts payable for each of the months October to December. (4 marks) ▪ A cash budget, with a total column, for the quarter ending December 31, 2020, showing the expected cash receipts and payments for each month and the ending cash balance for each of the months, given that no financing activity took place. (25½ marks) (b) Another team member who is preparing the Budgeted Balance Sheet for the business for the same quarter and has asked you to furnish him with the figures for the expected trade receivables and payables to be included in the statement. Is that a reasonable request? If yes, what should these amounts be? (2 marks) (c) Upon receipt of the budget the team manager has now informed you that all companies in the industry in which L & P Merchandising & More operates are required to maintain a minimum cash balance of $125,000 each month. Based on the budget prepared, will the business be meeting this requirement? The business is already heavily indebted, so management does not wish to borrow any additional funds from outside sources. Suggest three (3) internal strategies that the business may employ in order to improve the organization’s monthly cash flow. Each strategy must be fully explained. (3½ marks) PART II Valencia Manufacturing Company manufactures and sells musical gadgets. You have just begun your summer internship at Valencia Manufacturing. To expand sales, the business is considering paying a commission to its sales team. You have been asked to compute 1) the new break-even sales figure, and 2) the operating profit if sales increase by 10% under the new sales commission plan. She is confident that you can handle the task, because you learned CVP analysis in your accounting class. The following data was obtained: Selling price per unit Variable expenses per unit: Fixed expenses: Production/Sales Direct Material Direct Labour Variable Manufacturing Overhead Fixed Manufacturing Overhead Fixed Selling Costs Fixed Administrative Costs $200 $40 $32 $18 $190,000 $115,000 $135,000 6,000 Units After collecting your data, you performed your analysis and submitted a memo to your manager, who was very pleased with the work done. Your report indicated that the new sales commission plan would result in a significant increase in operating income but only a small increase in break-even sales. A few days after, you realized that you made an error in the CVP analysis, as the sales personnel’s $88,000 salaries were inadvertently left out and you therefore did not include this fixed marketing cost in your computations. You are not sure what to do, as you are afraid that Valencia might not offer you permanent employment after the internship. How would your error affect breakeven sales and operating income under the proposed sales commission plan? After considering all factors, should you inform your manager or simply keep quiet? (10 marks)