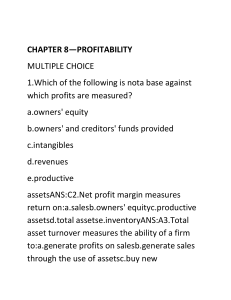

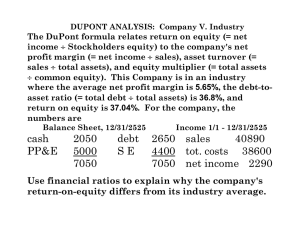

CHAPTER 8—PROFITABILITY MULTIPLE CHOICE 1.Which of the following is nota base against which profits are measured? a.owners' equity b.owners' and creditors' funds provided c.intangibles d.revenues e.productive assetsANS:C2.Net profit margin measures return on:a.salesb.owners' equityc.productive assetsd.total assetse.inventoryANS:A3.Total asset turnover measures the ability of a firm to:a.generate profits on salesb.generate sales through the use of assetsc.buy new assetsd.move inventorye.cover long-term debtANS:B4.The DuPont method return on assets uses two component ratios. What are they?a.inventory turnover gross profit marginb.times interest earned debt ratioc.return on equity dividend payoutd.net profit margin total asset turnovere.return on investment total investment turnoverANS:D5.Return on assets cannotfall under which of the following circumstances?Net Profit MarginTotal Asset Turnovera.decline riseb.rise declinec.rise rised.decline declinee.The ratio could fall under all of the answers.ANS:C Assets:Current assets$1,700$1,120$1,544Plant and equipment (net)8,1107,8305,404Total assets1,004695772$10,814$9,645$7,720Liabilit ies and Stockholders' Equity:Current liabilities$950$880$769Long-term liabilities2,0231,5911,544Capital stock ($10 par)4,6004,6003,000Paid-in capital in excess of par770770389Retained earnings2,4711,8042,018Total liabilities and stockholders' equity$10,814$ 9645$7,720Income StatementFor the Year Ended April 30(in thousands of dollars)201020092008Net sales$38,610$32,175$25,740Cost of sales25,10019,95015,400Gross profit$13,510$12,225$10,340Selling expenses7,7006,5655,148Administrative expenses4,2704,1753,861Total operating expenses$11,970$10,740$9,009Operating income$ 1,540$ 1,485$1,331Interest expense11595100Net income before tax$ 1,425$ 1,390$1,231Income taxes655645541Net income$ 770$ 745$ 690Required:Perform a vertical, common size analysis of the income statement. Comment on significant trends.ANS:201020092008Net sales100.0%100.0%100.0%Cost of sales65.062.059.8Gross profit35.038.040.2Selling expenses19.920.420.0Administrative expenses11.113.015.0Total operating expenses31.033.435.0Operating income4.04.6 5.2Interest expense.3.3.4Net income before tax3.74.34.8Income taxes1.72.02.1Net income2.0%2.3%2.7%Although absolute profits have risen, the profit margin on sales has declined steadily. The principal cause ofthe decline is increased cost of sales. Cost of sales have risen from 59.8% to 65.0%. This increase is offset by declining selling and administrative costs in relation to sales. Taxes as a percent of sales also have declined. 11.On the left is a list of terms related to trend analysis and other types of financial information and services. On the right are descriptions and definitions of these terms.Required:Match each term to its best description by placing the correct number before the term._____a.Vertical, common-size statement1.Full or partial statements expressed in percentages of a given base._____ b.Segment reporting2.Requires full financial statements on a quarterly basis._____ c.Interim reporting3.All statement figures are expressed as a percentage of a base figure from that year's statement._____ d.Trend analysis4.A breakdown by major lines of business, only required in SEC reporting._____ e.Common size5.A breakdown by major lines of business._____ f.Horizontal6.All statement figures are expressed as a percentage of baseyear figures.7.Requires estimation of some expense items.8.A comparison of financial data over time.9.Visual aids to understanding financial data.ANS:a.3b.5c.7d.8e.1f.6Descriptions/definit ions not used are 2, 4, and 9. 12.The Clothes Clutch, a retail clothier, has had average sales of $400,000 for the last five years, 2006–2010. The firm's total assets at the end of 2010 were $400,000.An internal staff cost analyst has prepared the following financial data from the annual reports. You have been hired as a consultant to help analyze the financial position.20102009200820072006Current Ratio2.802.432.362.102.00Acid Test Ratio2.031.931.821.611.47Days' Sales in Receivables6158544235Merchandise Inventory Turnover4.204.104.103.903.70Debt Ratio0.480.500.490.470.47Times Interest Earned4.604.805.905.706.00Sales as a Percent of 1996 Sales1.461.231.121.061.00Net Income as a Percent of 1996 Income1.311.201.101.061.00Gross Profit Margin38.5%38.8%38.9%40.0%39.7%Operating Expenses to Net Sales11.4%11.3%11.5%11.4%11.7%Net Profit Margin7.6%8.6%8.9%9.4%9.3%Return on Total Assets9.4%9.6%9.6%10.0%10.7%Required:a.Ex plain the trend in liquidity. Make specific reference to the effect of receivables and inventory on this trend.b.Briefly describe the trend in the long-term, debt-paying ability of The Clothes Clutch. Explain the cause(s) of this trend.c.The net profit margin has declined substantially. Cite and discuss specific causes of this.d.Has the firm utilized its total assets effectively? Discuss the ability of the firm to generate sales based on total assets. (Use DuPont analysis.)e.Specifically cite and briefly describe two additional types of information that would aid in your analysis.ANS:a.Both the current ratio and acid-test ratio have risen. Initially, this might appear to be a good sign. However, days' sales in receivables have nearly doubled, indicating a worsening problem in the collection of receivables. This problem could cause the rise in the current ratio and acid-test ratio.Merchandiseinventory turnover has increased, although not substantially. This indicates better movement of inventory. Overall, liquidity appears to be good, but not as good as it appears based on the current ratio and acid-test ratio because receivables appear to create a liquidity problem.b.Two measures of long-term, debt-paying ability are given. The debt ratio appears to be relatively stable. However, the times interest earned ratio has declined. This indicates that the firm is not covering its debt as well as it did previously. This decrease could restrict its future borrowing power.c.Gross profit margin has declined slightly, indicating a slight rise in the cost of goods sold. Operating expenses to net sales has remained relatively stable. Other causes of the decline could be other income and expense items, such as interest expense. Problems with interest were already indicated in times interest earned.d.This question calls for the use of DuPont analysis, specifically, asset turnover. Return on=Net Profit Total AssetTotal AssetsMarginTurnover20109.4=7.6 1.2420099. 6=8.6 1.1220089.6=8.9 1.08200710.0=9.4 1.0 6200610.7=9.3 1.15This computation shows that part of the decline in net profit margin between 2006 and 2010 has been offset by increased turnover. Increased turnover indicates more efficient use of assets to generate sales dollars.e.Almost any type of additional data would be of help. Some of the better suggestions are:Common-size analysisIndustry statisticsThe cash flow statementOther specific ratiosSegment dataData for competition13.Listed below are several ratios.a.net profit marginb.total asset turnoverc.return on assetsd.DuPont return on assetse.operating income marginf.operating asset turnoverg.return on operating assetsh.DuPont return on operating assetsi.sales to fixed assetsj.return on investmentk.return on total equityl.return on common equitym.gross profit margin Required:Match the letter that goes with each formula.Net Income Before Nonrecurring Items -_____ 1.Preferred DividendsAverage Common EquityNet Income Before Noncontrolling Interestand Nonrecurring_____ 2.Items + [(Interest Expense) (1 -1 Tax Rate)]Average (Long -Term Liabilities + Equity)Net Income Before Noncontrolling Interest_____ 3.and Nonrecurring ItemsNet SalesNet Income Before Noncontrolling Interest_____ 4.and Nonrecurring ItemsAverage Total Assets_____ 5.Operating IncomeNet Sales_____ 6.Operating IncomeAverage Operating Assets_____ 7.Net SalesAverage net Fixed AssetsNetIncome Before Nonrecurring Items -_____ 8.Dividends on Redeemable preferred StockAverage Total Equity_____ 9.Gross ProfitNet Sales_____ 10.Operating Income Margin Operating Asset Turnover_____ 11.Net SalesAverage Operating Assets_____ 12.Net Profit Margin Total Asset Turnover_____ 13.Net SalesAverage Total Assets ANS:1.l2.j3.a4.c5.e6.g7.i8.k9.m10.h11.f12.d13. ba