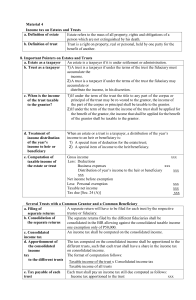

Estate and Trust a. Definition of estate b. Definition of trust Estate refers to the mass of all property, rights and obligations of a person which are not extinguished by his death. Trust is a right on property, real or personal, held by one party for the benefit of another. 8. Important Pointers on Estates and Trusts a. Estate as a taxpayer An estate is a taxpayer if it is under settlement or administration. b. Trust as a taxpayer 1) A trust is a taxpayer if under the terms of the trust the fiduciary must accumulate the income. 2) A trust is a taxpayer if under the terms of the trust the fiduciary may accumulate or distribute the income, in his discretion. c. When is the income 1) If under the term of the trust the title to any part of the corpus or of the trust taxable to principal of the trust the grantor? may be revested to the grantor, the income of the part of the corpus or principal shall be taxable to the grantor. 2) If under the term of the trust the income of the trust shall be applied for the benefit of the grantor, the income that shall be applied for the benefit of the grantor shall be taxable to the grantor. d. Treatment of income When an estate or a trust is a taxpayer, a distribution of the year’s distribution of the income to an heir or beneficiary is: year’s 1) A special item of deduction for the estate/trust; income to heir or 2) A special item of income to the heir/beneficiary. beneficiary e. Computation of Gross income xxx xxx taxable income of Less: Deductions the estate or trust Business expenses xxx Distribution of year’s income to the heir or beneficiary xxxxxx Net income before exemption xxx Less: Personal exemption xxx Taxable net income xxx Tax due [Sec. 24 (A)] xxx Several Trusts with a Common Grantor and a Common Beneficiary a. Filing of separate A separate return will have to be filed for each trust by the respective returns trustee or fiduciary. b. Consolidation of the The separate returns filed by the different fiduciaries shall be separate returns consolidated in the BIR allowing against the consolidated taxable income one exemption only of P50,000. c. Consolidated income An income tax shall be computed on the consolidated income. tax d. Apportionment of the The tax computed on the consolidated income shall be apportioned to consolidated income the different trusts, such that each trust shall have a share in the income tax tax on consolidated income. to the different trusts The format of computation follows: e. Tax payable of each trust Taxable income of the trust x Consolidated income tax Taxable income of all trusts Each trust shall pay an income tax still due computed as follows: Income tax apportioned to the trust xxx Less: Income tax already paid by the fiduciary of the trust xxx Income tax still due xxx Filing of Returns and Payment of Tax (Estate and Trust) a. Who shall file the The following persons acting in any fiduciary capacity shall file the income return? tax return for an estate or trust: 1) Guardians; 5) Receivers; 2) Trustees; 6) Conservators; 3) Executors; 7) All other persons or corporations acting as fiduciary. 4) Administrators; b. Gross income is The return shall be filed if the estate or trust has a gross income of P50,000 P50,000 or more or more during the taxable year. c. In case of two or In case of two or more joint fiduciaries, return filed by one of them shall be more a sufficient compliance with the requirements of the Tax Code. joint fiduciaries 14. Income Tax Returns (Individuals, Estates and Trusts) a. Pure compensation The income tax return shall be filed on or before April 15 of the income earner succeeding year. b. Income from business Quarterly declarations: or practice of First quarter April 15 profession Second quarter August 15 Third quarter November 15 Final adjusted return April 15 of the succeeding year c. Place of filing of return d. Payment of tax 1) Authorized agent banks; 2) Revenue District Officer; 3) Collection agent; 4) Duly authorized city or municipal Treasurer in which the taxpayer has his legal residence or principal place of business. The tax is paid as the return is filed. ESTATE TAX RATES There shall be levied, assessed, collected and paid upon the transfer of the net estate of every decedent, whether resident or non-resident of the Philippines, a tax at the rate of six percent 6% based on the value of such net estate. TAXABILITY OF THE ESTATE IN GENERAL 1. Classification of a Decedent a. Resident Citizen b. Non-Resident Citizen c. Resident Alien d. Non-Resident Alien