2020/11/16

Introduction

Background

The Butler Lumber Company had been founded in 1981 as a partnership by Mark

Butler and his brother-in-law, Henry Stark.

In 1988 Mr. Butler bought out Stark’s interest for $105,000, to be paid off in 1989.

Late in 1988, Mr. Butler negotiated a loan of $70,000, secured by land and

buildings, with an interest rate of 11%. The loan was repayable in quarterly

installments at the rate of $7,000 per year over the next 10 years.

Although Butler has a rapid growth in its business, it had experienced a

shortage of cash and had to increase its borrowing from the Suburban

National Bank to $247,000 in the spring of 1991.

Butler Lumber

Company

The maximum loan that Suburban National would make was $250,000,

and Butler had been able to stay within this limit only by relying very

heavily on trade credit.

Butler was introduced to the Northrop National Bank, who might

extend the credit up to $465,000. Interest would be set on a floatingrate basis at 2% points above the prime rate (should be 10.5% in 1991).

Your company slogan in here

Introduction

Introduction

Business Model

Product

•

•

•

Limited to the retail distribution of lumber products in the local area

Typical products included plywood, moldings, and sash and door products.

Non-cyclical

Basic Analysis of

Financial Statements

Downstream Sales

•

•

•

Retails only

Careful control of operating expenses. E.g. No sales representatives

About 55% of total sales were made from April through September

Upstream Supply

•

•

•

Get quantity discounts through bulk purchases

A discount of 2% for payments made within 10 days of the invoice date

Accounts were due in 30 days at the invoice price, but suppliers ordinarily did not object

if payments lagged somewhat behind the due date.

Introduction

Introduction

(2) Profitability Analysis - A

(1) Sales Analysis

Profitability of Butler (1990)

Sales grows rapidly!

1988

Net sales

$1,697

Cost of goods sold

Beginning inventory 183

Purchases 1,278

$1,461

Ending inventory 239

Total COGS $1,222

Gross profit

475

b

Operating expense

425

Interest expense

13

Net income before taxes

$37

Provision for income taxes

6

Net Income

$31

1989

$2,013

1990 1991Q1

$2,694 $718a

239

1,524

$1,763

326

$1,437

576

515

20

$41

7

$34

326

2,042

$2,368

418

$1,950

744

658

33

$53

9

$44

418

660

$1,078

556

$522

196

175

10

$11

2

$9

Return on Total Assets

ROA = Net Income / Average Assets

= 44/[(736+933)/2]=5.27%

Return on Equity Capital

ROE = Net Income / Average Equity

= 44/[(304+348)/2]=13.50%

Return on Invested Capital

ROIC = Net Income / Average Invested Capital*

= 44/[(304+57+7+146+348+50+7+233)/2]=7.64%

*Invested Capital= Equity + Liability with Interest**

**Liability with Interest = long-term debt + bank loans

1

2020/11/16

Introduction

(2) Profitability Analysis - B

Introduction

(3) Evaluation of financing strategy -- A

Profitability of Butler (1990)

Leverage of Butler (1990)

Gross Margin

=Gross Profit/Revenue= 744/2694=27.62%

Debt to Total Capital

=Total Debt/[Total Debt+Equity]

=585 /(585+348)=62.7%

Debt-to-Equity

=Total Debt/Equity = 585/348 = 1.68

Net Margin

=Net Income/Revenue = 44/2694 = 1.63%

(after tax)

=[ST Debt+LT Debt-Cash-ST Investment]/Equity

Net-debt-to-equity

EBITDA Margin

= (585-41)/348 = 1.56

=EBITDA/Revenue= (53+33)/2694=3.19%

(Earnings Before Interest,

Tax, Depreciation, & Amortization)

=LT Debt/Equity = 50/348 = 14.37%

Long-term Debt-to-Equity

NOPAT Margin

(Net Operating Profit After Tax)

= (Net Income+after-tax interest expense)/Revenue

=[44+33*(1-17%)]/2694=2.65%

*Tax rate = 17%, calculated from 1988 to 1990

Introduction

(3) Evaluation of financing strategy -- B

Introduction

(3) Evaluation of financing strategy -- C

Coverage Ratio of Butler (1990)

Times Interest Earned,

Earnings Basis

Time Interst Earned,

Cash Flow Basis

=EBIT/Interest Expense= (44+9+33)/33 = 2.60

1988

1989

1990

Debt Ratio

55%

59%

63%

Interest cover ratio

3.85

3.05

2.61

=[CF from Operating Activities+Interest Expense+

Tax]/Interest Expense

= (-70+33+9)/33 = -0.85

• Debt ratio continues to rise

• The pressure of interest payment has increased

Introduction

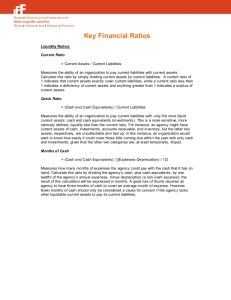

(4) Liquidity Analysis -A

Liquidity of Butler (1990)

Current Ratio

Quick Ratio (Acid Ratio)

= Current Asset / Current Debt = 776/535 = 1.45

=(Current Asset - Inventory) / Current Debt

= (776-418)/535 = 0.67

Cash Ratio

=(Cash+ST Investment)/ Current Debt= 41/535 = 0.08

Operating Cash Flow Ratio

=CF from Operating Activities/ Current Debt = -70/535 = -0.13

Introduction

(4) Liquidity Analysis - B

1988

1989

1990

Current

Ratio

1.80

1.59

1.45

Quick Ratio

0.88

0.72

0.67

Cash Ratio

0.22

0.13

0.08

Cash

Accounts receivable, net

Inventory

Current assets

Property, net

Total assets

1988

$58

171

239

$468

126

$594

1989

$48

222

326

$596

140

$736

1990

$41

317

418

$776

157

$933

Notes payable, bank

Notes payable, Mr. Stark

Notes payable, trade

Accounts payable

Accrued expenses

Long-term debt, current portion

Current liabilities

Long-term debt

Total liabilities

Net worth

Total liabilities and net worth

—

105

—

124

24

7

$260

64

$324

270

$594

$146

—

—

192

30

7

$375

57

$432

304

$736

$233

—

—

256

39

7

$535

50

$585

348

$933

2

2020/11/16

Introduction

Introduction

(5) Asset Turnover - A

(4) Liquidity Analysis - C

Asset Turnover (1990): Evaluation of investing activities

2.00

1.80

1.60

1.40

1.20

Current Ratio

1.00

0.80

0.60

1988

1989

1990

1.80

1.59

1.45

Quick Ratio

0.88

0.72

0.67

Cash Ratio

0.22

0.13

0.08

0.40

0.20

1988

1989

Current Ratio

1990

Quick Ratio

Inventory Turnover

=Cost of goods sold / Average Inventory

= 1950/[(326+418)/2]=5.24

Days Sales of Inventory

=365 / Inventory Turnover = 365/5.24 = 69.63

Receivable Turnover

=Net sales / Average Receivables

= 2694/[(222+317)/2]=10.00

Days Accounts Receivable

=365/ Receivable Turnover

= 365/10.00 = 36.50

Payable Turnover

=Cost of goods sold /Average Payables

= 2042/[(192+256)/2]= 8.71

Days Accounts Payable

=365/ Payable Turnover= 365/8.71 = 41.93

Cash Ratio

• All liquidity indicators show a downward trend

• Quick ratio and cash ratio are very low

Introduction

Introduction

(5) Asset Turnover - B

(5) Asset Turnover - C

Asset Turnover (1990): Evaluation of investing activities

=Net Sales / Average Working Capital

=2694/{[(776-41)-(535-233-7)+(596-48)-(375-146-7)]/2}=7.03

Working Capital Turnover

Total Assets Turnover

=Net Sales / Average Total Assets

=2694/[(736+933)/2] = 3.23

Fixed Assets Turnover

=Net Sales / Average Fixed Assets

= 2694/[(140+157)/2]=18.14

1989

5.11

5.09

1990

5.24

Receivable Turnover

9.92

10.24

10.00

Payable Turnover

9.85

9.09

8.71

Working Capital Turnover

10.81

8.34

7.03

* Due to the lack of 1987 data, this column is calculated by year end data instead of average of the year.

=Net Sales / Average Net Long-term Assets

=2694/[(140+157)]2]=18.144

Net Long-term Assets Turnover

1988*

Inventory Turnover

•

The ability of asset management needs to be improved

•

Increased dependence on suppliers

•

The ability of collection of receivables dropped

* Working capital = (Current assets - Cash - ST investment) – (Current liabilities - Notes payable &

Long-term debt, current position)

* Net long-term assets=Total long-term assets- Interest-free long-term debt

Introduction

Introduction

DuPont Analysis

Comprehensive Analysis

Extended

1988

1989

1990

Net Income/EBT

0.84

0.83

0.83

EBT/EBIT

0.74

0.67

0.62

Assets

EBIT/Sales

0.029

0.03

0.03

Equity

Sales/Asset

2.86

2.74

2.89

Asset/Equity

2.2

2.42

2.68

ROE

0.11

0.11

0.12

DuPont Analysis

ROE =

Net Income

EBT

x

Tax burden

ROE =

EBT

EBIT

Int. burden

Net Income

Sales

ROS

x

x

EBIT

Sales

x

ROS

Sales

Assets

TAT

Sales

Assets

x

TAT

x

Assets

Equity

Leverage

Leverage

Basic

1988

1989

1990

Net Income/Sales

0.018

0.017

0.016

2.89

Sales/Asset

2.86

2.74

Asset/Equity

2.2

2.42

2.68

ROE

0.11

0.11

0.12

ROA

3

2020/11/16

Introduction

Introduction

Cash Flow Analysis

1988

1989

Cash

58

48

41

Accounts receivable, net

171

222

317

Inventory

1990

239

326

418

Current assets

468

596

776

126

140

157

Total assets

594

736

933

—

146

233

105

—

—

Property, net

Notes payable, bank

Notes payable, Mr. Stark

Notes payable, trade

Decrease of cash

Mainly because the cash flow

generated by operating

activities is negative, in which

the capital occupied by

inventory exceeds twice the

net profit

CF from operating and

investing activities

—

—

—

Accounts payable

124

192

256

Accrued expenses

24

30

39

Long-term debt, current portion

7

7

7

260

375

535

64

57

50

324

432

585

270

304

348

Operating Cash Flow

594

736

933

Fixed Asset Investment

Current liabilities

Long-term debt

Total liabilities

Net worth

Total liabilities and net worth

Net Income

Minus: Changes in net

working capital

△Accounts receivable

1989

1990

1991.1

Q

34

44

9

64

114

51

95

25

28

△Inventory

87

92

138

△Accounts payable

68

64

144

△Accrued expenses

Investing Cash Flow

6

-30

9

-70

14

-14

-3

-16

17

-17

Introduction

5

-5

Introduction

Why borrow from Northrop Bank?

Issues Faced

1

Why companies borrow money?

Payables rose sharply in the spring of 1991

2

3

Spend huge amounts of

money to buy the

remaining share of the

company from MR. Stark

As

sales

increase,

additional investment in

working capital is required

Shortage

of funds

Introduction

Why borrow from Northrop Bank?

Increase

Increase

Increase

Increase

Increase

of

of

of

of

of

Source of cash

payable to bank

accounts payable

retained earnings

cash

accrued expenses

Total

Use of cash

Increase of inventory

Increase of accounts receivable

Paid to Mr. Stark

Repayment of long-term debt

Increase of property investment

Total

1990-1988

233

132

78

41

15

475

1990-1988

179

146

105

14

31

475

Introduction

How did Butler deal with the

cash shortage problem before?

4

2020/11/16

Introduction

Introduction

Credit to Suppliers

Cost of Trade Credit

The total of accounts receivable plus inventories

(percentage of sales)

24.2% as of December 31, 1988,

27.3% as of December 31, 1990.

High financing costs

for accounts payable

Purchase

$1,000 raw

materials

Pay within 10 days,

$980

Pay on the 42 th day,

$1,000

=+$ 84,000

The interest of $980 for 32 days is $20,

(3.1% of sales, 26% of the total

increase in accounts receivable and inventories)

with a annualized interest rate of

360/32*20/980=23.0%

*According to Exhibit 2, it took about 42 days for the company to pay in 1990.

days accounts payable (Days A/P)=

Average accounts payable x 365 ÷ cost of sales.

Introduction

Introduction

Q1: Is the credit size of Northrop Bank sufficient?

Will a credit line of Northrop

Bank be sufficient to meet the

company’s needs?

Forecasting: Assuming full use of cash discounts

Income Statement

(thousand of dollars)

Net sales

1988

1989

1990

1991E

1,697

2,013

2,694

3,600

183

239

326

Cost of goods sold

Beginning Inventory

Purchases

Ending Inventory

Total cost of goods sold

1,278

75.31%

239

14.08%

1,524

75.71%

326

16.19%

418

2,042

75.80%

418

15.52%

76%

576

16%

1,222

1,437

1,950

Gross Profit

475

576

744

27.62%

1,022

Operating expense

425

658

24.42%

900

25.04%

515

25.58%

2,578

Plus: Purchase discount

13

20

33

53

Net income before taxes

37

41

53

111

6

7

9

26

31

34

44

85

Net income

25%

42

Interest expense*

Provision for income taxes

*The interest expense consists of outstanding long-term loan and new short-term bank loan

** Butler was taxed at the rate of 15% on its first $50,000 of income, 25% on the next $25,000

of income, and 34% on all additional income above $75,000.

Introduction

2,736

The proportion of

income is the

same as that of

previous years

Introduction

Q1: Is the credit size of Northrop Bank sufficient?

Forecasting: Assuming full use of cash discounts

Balance Sheet

1988

Cash

1989

1990

1991E

58

3.42%

48

2.38%

41

1.52%

Accounts receivable, net

171

10.08%

222

11.03%

317

11.77%

432

12%

Inventory

239

14.08%

326

16.19%

418

15.52%

576

16%

Current Assets

Property, net

468

126

Total Assets

594

Notes payable, bank

-

596

7.42%

140

736

146

776

6.95%

157

-

-

-

-

-

Accounts payable

Accrued expenses

Long-term debt, current portion

Current Liabilities

Long-term debt

Total liabilities

Net worth

Total liabilities and net worth

64

324

270

594

192

57

432

304

736

6%

Are Northrop Bank loans risky?

667

75

The loan required

24

1.41%

30

1.49%

39

exceeds

the Northrop’s

7

7

7

credit

size 375

260

535

124

210

1,272

233

105

Notes payable, trade

1.5%

1,062

5.83%

933

Notes payable, Mr. Stark

54

256

50

585

348

933

1.45%

52

1.45%

7

796

43

839

428

1,272

5

2020/11/16

Q2: RiskIntroduction

of Northrop’s Loan

Q2: RiskIntroduction

of Northrop’s Loan

Butler may face a larger financing gap

Butler’s poor liquidity

Butler's debt burden is getting heavier

1988

1989

1990

1991E

Current Ratio

1.80

1.59

1.45

1.30

Quick Ratio

0.88

0.72

0.67

0.60

Cash Ratio

0.22

0.13

0.08

0.07

•

•

All liquidity indicators show a downward trend

Quick ratio and cash ratio are very low

Introduction

The demand for bank loans formed by the

growth of operating income at different

growth rates (when accounts payable

financing is not used)

Operating income exceeds

$4,000,000, even if Butler does not

enjoy cash discounts (i.e. financing

through accounts payable), it still

needs to increase the bank credit size

Introduction

Credit Terms

Working capital

must be maintained

at a predetermined

level, which limits

the further

expansion of

Butler’s business

Investment in

fixed assets

requires bank

approval

Does Butler have other financing

choices?

???

Introduction

Q1: Is the credit size of Northrop Bank sufficient?

Other financing channels

1. Keep ’borrowing’ from suppliers

Balance Sheet

Cash

1988

1989

1990

1991E

58

48

41

54

Acocunts receivable, net

171

222

317

432

Inventory

239

326

418

576

Current Assets

Property, net

468

126

Total Assets

594

Notes payable, bank

-

596

140

736

146

776

157

933

233

1,062

210

1,272

414

Notes payable, Mr. Stark

105

-

-

-

Notes payable, trade

-

-

-

-

Accounts payable

124

192

256

342

Accrued expenses

24

30

39

52

7

7

7

Long-term debt, current portion

Current Liabilities

Long-term debt

Total liabilities

Net worth

Total liabilities and net worth

260

64

324

270

594

375

57

432

304

736

535

50

585

348

933

2. The company is in a

high-growth stage,

consider introducing

VC/PE

Equals to 9.5%

of revenue

7

815

Introduction

Conclusion

• Butler needs more funds than the current line of credit

granted by Suburban National Bank.

• Butler has to continue to relying very heavily on trade credit,

otherwise the company's development will be restricted.

For Butler, there are several ways:

(1)Strive for larger bank credit lines or other sources of

financing;

(2)Slow down the company's development speed to

reduce capital needs;

(3)Continue to rely heavily on trade credit and bear high

financing costs

43

858

414

1,272

6