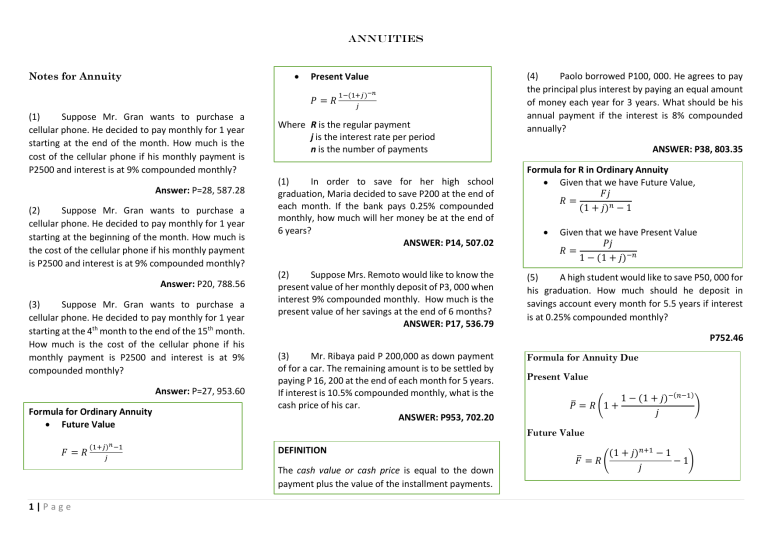

ANNUITIES Notes for Annuity Present Value 𝑃=𝑅 (1) Suppose Mr. Gran wants to purchase a cellular phone. He decided to pay monthly for 1 year starting at the end of the month. How much is the cost of the cellular phone if his monthly payment is P2500 and interest is at 9% compounded monthly? Answer: P=28, 587.28 (2) Suppose Mr. Gran wants to purchase a cellular phone. He decided to pay monthly for 1 year starting at the beginning of the month. How much is the cost of the cellular phone if his monthly payment is P2500 and interest is at 9% compounded monthly? Answer: P20, 788.56 (3) Suppose Mr. Gran wants to purchase a cellular phone. He decided to pay monthly for 1 year starting at the 4th month to the end of the 15th month. How much is the cost of the cellular phone if his monthly payment is P2500 and interest is at 9% compounded monthly? Answer: P=27, 953.60 Formula for Ordinary Annuity Future Value 𝐹=𝑅 (1+𝑗)𝑛 −1 𝑗 1−(1+𝑗)−𝑛 𝑗 Where R is the regular payment j is the interest rate per period n is the number of payments (1) In order to save for her high school graduation, Maria decided to save P200 at the end of each month. If the bank pays 0.25% compounded monthly, how much will her money be at the end of 6 years? ANSWER: P14, 507.02 (2) Suppose Mrs. Remoto would like to know the present value of her monthly deposit of P3, 000 when interest 9% compounded monthly. How much is the present value of her savings at the end of 6 months? ANSWER: P17, 536.79 ANSWER: P38, 803.35 Formula for R in Ordinary Annuity Given that we have Future Value, 𝐹𝑗 𝑅= (1 + 𝑗)𝑛 − 1 Given that we have Present Value 𝑃𝑗 𝑅= 1 − (1 + 𝑗)−𝑛 (5) A high student would like to save P50, 000 for his graduation. How much should he deposit in savings account every month for 5.5 years if interest is at 0.25% compounded monthly? P752.46 (3) Mr. Ribaya paid P 200,000 as down payment of for a car. The remaining amount is to be settled by paying P 16, 200 at the end of each month for 5 years. If interest is 10.5% compounded monthly, what is the cash price of his car. ANSWER: P953, 702.20 Formula for Annuity Due Present Value 𝑃̅ = 𝑅 (1 + 1 − (1 + 𝑗)−(𝑛−1) ) 𝑗 Future Value DEFINITION The cash value or cash price is equal to the down payment plus the value of the installment payments. 1|P age (4) Paolo borrowed P100, 000. He agrees to pay the principal plus interest by paying an equal amount of money each year for 3 years. What should be his annual payment if the interest is 8% compounded annually? 𝐹̅ = 𝑅 ( (1 + 𝑗)𝑛+1 − 1 − 1) 𝑗 ANNUITIES (1) For a house and lot, a man made cash down payment for 2 years ago, and agreed to pay 3, 500 monthly for 10 years starting now. Find the present value of his monthly payments now if money is worth 9% compounded monthly. Answer: 𝑃̅ = 278,368.14 (2) If 3000 is deposited at every beginning of each 6 months for 10 years at 7% compounded semiannually, how much is in the fund (a) at the end of 6 ½ years after the payment; (b) at the end of 10 years? Answer: (a) 𝐹̅ = 50, 030.96(b) 𝐹̅ = 87,808.41 Formula for R in Annuity Due Given that we have Future Value, 𝑅= (1 + 𝑗)𝑛+1 − 1 ( − 1) 𝑗 𝑃̅ 1 − (1 + 𝑗)−(𝑛−1) (1 + ) 𝑗 (3) To discharge a debt amounting to 80, 000 pesos, Mr. S.A. Mal agreed to make equal monthly deposit at the beginning of the month for 5 years. How much should he deposit monthly if the money is worth 4%compounded monthly? Answer: 𝑅 = 1, 468.43 2|P age Answer: 𝑅 = 1, 115.05 Formula for Present Value of Deferred Annuity 𝑃∗ = 𝑅 1 − (1 + 𝑗)−𝑛 𝑗(1 + 𝑗)𝑘 (1) Emma availed of a cash loan that gave her an option to pay P10, 000 monthly for 1 year. The first payment is due after 6 months. How much is the present value of the loan if the interest rate is 12% converted monthly? Answer: P=107, 088.20 𝐹̅ Given that we have Present Value, 𝑅= (4) Mrs. Cha Knock deposits at the beginning of each quarter to accumulate 100, 000 at the end of 15 years. How much is his quarterly at 5% compounded quarterly? Formula for R in Deferred Annuity 𝑅= 𝑃∗ 𝑗(1 + 𝑗)𝑘 1 − (1 + 𝑗)−𝑛 (2) A house costs P 1,300,000 cash. A buyer bought it by paying P 300, 000 down payment and would pay 48 monthly installments, the first of which is due at the end of one year. If the rate of interest is 20.4% compounded monthly, what is the monthly installments? Answer: P 36,887.08 SEATWORK!! Determine the kind of annuity used in each problem then solve. 1. Deku is looking for an apartment near his school. An apartment with a monthly rent of P18, 000 is payable at the beginning of each month. If money is worth 15% compounded monthly. What is the cash equivalent of 3 years rent? 2. Peter started to deposit P 5, 000 quarterly at the end of each term in a fund that pays 1% compounded quarterly. How much will be the fund after 6 years? 3. To create a fund worth 500, 000 at the end of 5 years, 15 members of a cooperative association contributed an equal amount every beginning of the month. How much will each member contribute if money is worth 9%? 4. Mr. and Mrs. Mercado decided to sell their house to deposit the fund in a bank. After computing the interest, they found out that they may withdraw P350,000 yearly for 4 years starting at the end of 7 years when their will be in college. How is the fund deposited if the interest rate is 3% converted annually? 5. The buyer of a lot pays P 50, 000 cash and P10, 000 every month for 10 years. If money is 8% compounded monthly, how much is the cash value of the lot?