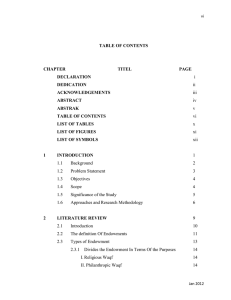

BUS 2237 FOUNDATION OF ISLAMIC ECOMONICS GROUP ASSIGNMENT SECTION 1 WAKAF PREPARED BY: AYU ATIFAH BINTI NABAWI (DBA 112030) NORAMIRAH SHAHIRAH BINTI ADNAN (DIA 121045) FAUZIAH BINTI MOHAMED SALEEM (DIA 112009) SAKIRA BINTI SHAHJAHAN (DIA 121049) PREPARED FOR: MADAM AZIAWATI DATE OF SUBMISSION: 22MAY 2013 TABLE OF CONTENTS INTRODUCTION ..................................................................................................................... 3 HISTORY OF WAQF ............................................................................................................ 3 WAQF FROM DIFFERENT SHCOLARS PERSPECTIVES. ............................................. 4 PURPOSES OF THE ASSIGNMENT .................................................................................. 4 DEFINITION OF WAQF .......................................................................................................... 5 TYPES AND CHARACTERISTICS OF WAQF ..................................................................... 7 TYPES OF WAQF ................................................................................................................. 7 CHARACTERISTICS OF WAQF ........................................................................................ 8 WAQF COMPONENTS ............................................................................................................ 9 i. ENDOWER (WAQIF) REGULATIONS ....................................................................... 9 ii. ENWDOWMENT (MAWQUF) REGULATIONS ...................................................... 10 iii. BENEFICIARIES (MAWQUF „ALAIH) REGULATIONS ....................................... 10 iv. AWQAF LEGAL STATEMENT (AL-SIGHAH) REGULATIONS ........................... 11 IMPORTANCE OF FULFILLING THE REGULATIONS OF COMPONENTS.............. 11 THE INSTITUTIONS THAT HANDLES WAQF IN MALAYSIA ...................................... 12 i. PURPOSES OR JAWHAR........................................................................................... 12 ii. OBJECTIVES OF JAWHAR ....................................................................................... 12 iii. FUNCTION OF JAWHAR........................................................................................... 13 THE USAGES OF THE ENDOWMENT FUND ............................................................... 13 THE DIFFERENCES OF WAQF, ZAKAT, DONATION AND INHERITANCE ............... 14 i. DIFFERENCES BETWEEN WAQF AND ZAKAT ................................................... 14 ii. DIFFERENCES BETWEEN WAQF AND SADAKAH ............................................. 14 iii. DIFFERENCES BETWEEN WAQF AND INHERITANCE ...................................... 15 ISSUES ON WAQF ................................................................................................................. 16 i. SUBSTITUTION (ISTIBDAL) .................................................................................... 16 ii. SYARI‟AH COURT ..................................................................................................... 16 CONCLUSION ........................................................................................................................ 17 REFERENCE ........................................................................................................................... 18 INTRODUCTION There are three mechanisms of economic distributions in Islam and one of them is mechanism of voluntary action (MOV). Aside from hibah (gift) and sadaqah(donation) which are commonly known when it comes to a free-will action of charity, waqf is also classified under the same category. HISTORY OF WAQF Waqf has existed since the time of Prophet Muhammad. It is said that “the first known Waqf is the mosque of Qubaa' in Madinah, a city 400 kilometre north of Makkah, which was built upon the arrival of the Prophet Muhammad, peace and blessings be upon him, in 622 C.E”(Kahf, 2012). A Muslim sailor named IbnuBattutah, who had visited Damascus in the year 726 M witnessed how the institution of waqfcaused great achievements of harmony and development in human‟s society and life. The various methods of how waqf was being done and distributed at that time also were written in his book. A hadith narrated by Muslim, said that, “‟Ibn Umar reported: Umar acquired a land at Khaibar. He came to Allah's Apostle (may peace be upon him) and sought his advice in regard to it. He said: Allah's Messenger, I have acquired land in Khaibar. I have never acquired property more valuable for me than this, so what do you command me to do with it?”Rasulullah SAW. said: “If you like, you arrest the land, you giving the results, not sold, not giving and not endowed." Ibnu Umar said: "Umar giving the results of land to poor people, family, slave, sabilillah, Ibnusabil and guests. And not prohibited for people who managing (nazhir) of wakaf to eat from the results of wakaf or giving eat to somebody else without intending to heaping the properties.” Page 3 of 18 WAQF FROM DIFFERENT SHCOLARS PERSPECTIVES. There are as many as four scholars of Islam that defined waqf differently according to their benefits and understandings on it. Syafi‟i defined waqf as to “keep the benefit of certain wealth and give its benefit to the needy or people who deserved it. It is also an affair that suggested by Islam”. Hanafi said that “waqf can give the kindliness for comrades in this world and will be rewarded by God for the good deeds in the day of resurrection”, Maliki said that “waqf is an affair that suggested by Islam (Sunat)” and Hanbali said “waqf is an affair that suggested by Islam and can make us nearer to God”(Yalawae & Tahir). Through the four scholars, it is acceptable to say that waqf is an absolute amal related to Islam, specifically to gain Allah‟s blessing as He has suggested. Both Syafi‟i and Hanafi claimed waqf to be an act of benefits and kindness to the public or the needy. On the other hand, Maliki concluded that waqf is just an action of recommendation in Islam while Hanbali prolong the same idea as Maliki‟s with an intention of waqf is to getting close to Allah. PURPOSES OF THE ASSIGNMENT The aim throughout this assignment is to elaborate waqf for further understandings. This covers its definition, components, ruling board in Malaysia that handles waqf, differences between waqf, zakat, donation and inheritance as well as an issue relates to waqf and inheritance and solutions taken to solve it. Page 4 of 18 DEFINITION OF WAQF Waqf, derived from the word wakafa in the Arabic language, means to stop, contain, or preserve. In North and West Africa, Waqf (pl. Awqaf) is also called Habs (pl. Ahbas or Hubus). In Islamic terms, waqf refers to a religious endowment, that is, a voluntary dedication of one's wealth or a portion of it either in cash or and its spending for shariah compliant projects.The word Waqf is used in the Islamic Law in the meaning of holding a property and preserving it so that its fruits, revenues or usufruct is used exclusively for the benefit of an objective of righteousness while prohibiting any use or disposition of it outside its specific objective. Waqf is also the transfer of wealth from private ownership to a beneficial social collective ownership.This definition accords continuity or perpetuity to Waqf, i.e., it applies to non-perishable properties whose benefit and usufruct can be extracted without consuming the property itself. Waqf is not obligatory. Instead it is a recommended action because the main purpose of waqf is to get closer to Allah and receive His blessings by spending wealth in the way of Allah. It encourages on voluntary and important for social and economic functions such as education, health, social security and construction of mosques. The four eminent Islamic scholars have given different meaning of waqf or endowment as well. Al-Syafi‟i said that “waqf is to keep the wealth that can give benefit, and keep it remaining in the same form while the original owner cannot consume it”. In another word, waqf is to keep the wealth that is beneficial to the needy and the wealth remains in the same condition as well as the owner is not allowed to consume its benefits. Al-Hanafi said that “waqf is to preserve and upkeep the original wealth that belonged to someone else and give the profit to the need”. In another word, waqf is defined as an action of preserving and up keeping wealth that could give benefit or profit for the needy rather than the owner itself. Page 5 of 18 Al-Maliki said that “ownership of the profit from the origin of wealth which was given for endowment and gives it to whoever the endowment was meant for or the needy”. In another word, waqf is considered as giving the right to consummate the profit of wealth that was given for endowment to whoever the endowment was meant for or the needy. Lastly, Hanbali said that “waqf is keeping the original owner from consuming wealth that he had endowed, wealth which produce benefit should remain in the same form”. In another word, waqf is wealth that was kept from the consummation of the original owner and give its benefit to the poor and needy, and that wealth must remain in the same condition without being consummate by the first owner. All four scholars contain the same idea in their definitions, that is the endowment or the property that has been waqf must remain intact (the same) and it is to be used to help the needy. Since waqf is one of the Islamic economy distribution, few Arabic terms are widely used related to it such asAwqaf, the plural form of waqf,Waqif, that isis referring to the endower or the owner of the property, Mawquf, that is the endowment and Mawquf ‘Alaih is used to refer to the beneficiary of the waqf. In conclusion, waqf can simply be defined as an endowment recommended by Islam that a portion of an individual‟s wealth or themawquf being used to help the needy and the benefits that come from it cannot be consumed by the owner or the waqif itself. Page 6 of 18 TYPES AND CHARACTERISTICS OF WAQF TYPES OF WAQF There are three common types of waqf. They are special endowment, cash endowment and endowment immovable property. Special endowments is that where waqif strengthen the endowment for a particular purpose.During the legal agreement or contract of waqf, the owner has clearly stated the usages he wishes the mawquf to be used as. The owner can declare the purpose of him giving the mawquf, such as land to build a mosque or a house for orphans, and it annotbe used for other reasons. Cash endowments is waqf using cash collected in a trust fund under the corporation endowments, for example PerbadananWakafSelangor, which is being entrusted to administer and manage the endowment shares to finance development projects and investment where the benefits are for the welfare and continued importance of Muslims. Cash endowments are not a direct donation, but instead it is considered as a fund or additional capital to the economy to the usage of society‟s development. Endowments immovable property (property cannot be moved) is provide land for building or community activities that are useful for the growth of Islam and provide for the use of school buildings, hospitals and so on. Page 7 of 18 CHARACTERISTICS OF WAQF 1. Irrevocable The endower or the waqif cannot revoke the endowment if it has already been declared a waqf is created solely for philanthropic purposes and always benefits. 2. Perpetuity This guarantees that it will benefits generation after generation and also prohibits it from being confiscated. 3. Inalienable It is although the benefits of the donation are beneficial to man the property itself is consider to be returned to god. No person can ever become the owner, so the waqf become common assets. It cannot be sold mortgaged, gifted or inherited. Waqf involves converting private ownership to public ownership of a property, fund or asset which disallows the original owner to use the property and anyone to change its ownership. It is understood that, in economic perspective, buying and selling transactions can only be done when the person has full right on the account or a private ownership. Since the endownment is no more a private ownership, it cannot be sold or the ownership to be transferred to another people. Otherwise, it is called as sadakah. The benefits, however, is for everyone and it is not limited. Page 8 of 18 WAQF COMPONENTS Like other forms of amal, waqf consists of components and regulations that have to be followed. There are four components of waqf, mainly the endower (waqif), endowment (mawquf), Benificiaries (mawquf ‘alaih) and Awqaf legal statement (Al-Sighah). i. ENDOWER (WAQIF) REGULATIONS Endower is the founder, or the original owner that wants his property to be waqf. For a person to become a waqif, he or she must be a free person (that is not a slave). A slave cannot be a waqif because he has no full right over his property. Secondly, the person must be baligh that is mature. Since waqf involves transferring a portion of his wealth, he must be mature enough to understand. Children cannot be a waqif because they are not yet baligh and their amal is considered as donation. In fact, those who are not yet baligh do not carry the responsible of their actions entirely. Thirdly, the person mustbe „aqil, which is fully responsible or intelligent. Aqil is derived from the word aql, or intelligent, means in his full sense and mind. Lastly, He is must have the right to spend his properties to welfare and he is not forced by anyone to do so. In another word, he must be the rightful owner of the property or a private ownership who is willing to give away his wealth for the sake of Allah. It is important that there is not forcing involve because waqf is considered as a charity or a form of sadakah that its main purpose is to receive the blessings from Allah. Thus, ikhlas has to be uphold during waqf. Page 9 of 18 ii. ENWDOWMENT (MAWQUF) REGULATIONS Endowment refers to the properties or portion of the wealth that is either in cash or assets or funds that wish to be waqf. The first and foremost regulation of mawquf is that the property must be a real estate or a thing that has real meaning. Waqf on properties with benefits without objects are not accepted. Secondly, the endowment must be a permanent and non-perishable. It has to be an asset or fund that is beneficial for a quire period of time. People commonly relate this to noncurrent assets such as land, buildings or even shares, like how PerbadanaWakaf Selangor has done whereby one can give portion of his income to waqf. Thirdly, the endowment must be fully owned by the owner or private ownership. It is because with the owner having full right on the property that he can make the decisions on it to be waqf. It is also related to the status of the endowment converting from private to public ownership. Lastly, the usage of the properties should be liable in Islam. That is to say that the mawquf should be used for good and beneficial purposes of society according to Syari‟ah or Islamic law. iii. BENEFICIARIES (MAWQUF ‘ALAIH) REGULATIONS Beneficiaries are people who receive the waqf.It can either be individuals or more, such as institutions. It is also designated to Shari‟a compliant deeds or people such as in helping the needy. Page 10 of 18 iv. AWQAF LEGAL STATEMENT (AL-SIGHAH) REGULATIONS They are statements that can be understood words or writings for the purpose of waqf whether it is for the public or private waqf. There are two types of al-sighah, which are Explicit and Implicit declarations. Explicit declaration is a clear declaration that says one meaning, for example “I give this house to the poor people”. It is understood that the individual wishes to waqf the house to the poor people and not mistaken as a donation and any other form of charities. Implicit declaration is a declaration that has another meaning, for example “I give this house as charity to the poor people”. Compared to the example given in explicit declaration, the declaration contains the word „as charity‟ whereby it can be easily misunderstood as simply a donation rather than a waqf. IMPORTANCE OF FULFILLING THE REGULATIONS OF COMPONENTS When one of these regulations is not fulfilled, the person is not considered as a waqif and thus, the waqf is denied. For example, a man who is not sane stated that he wished to donate (waqf) his house for the orphans. Logically, no one would take the man‟s words seriously knowing that he is not at his full mind, so as a drunker. Thus, when one of the regulations is not fulfilled, leading to one of the components being incomplete, the waqf is considered false. Page 11 of 18 THE INSTITUTIONS THAT HANDLES WAQF IN MALAYSIA Malaysia is an Islamic country even though it consists of multi-racial society. Majority of the citizens in Malaysia are Muslims and due to that, it is important the government ensure the needs of the Muslims are preserved, by establishing laws and board of govern to handle it. Realizing the importance of waqf, a board under government called JabatanWakaf Zakat and Haji or JAWHAR. i. PURPOSES OR JAWHAR JAWHAR is developing bumiputera capital resources, such as land and the waqf, under the responsibility of the state Islamic religious authorities. State religion authorities must take responsibility and become compulsory and active in developing by playing the economic role of Muslims and human development. It also plays the role in the establishment of the department of waqf, zakat, hajj to ensure that the administration of waqf, zakat and hajj affairs in the country more structured, systematic and effective. JAWHAR is also intended to improve the effectiveness and efficiency of service delivery to the next level of excellence, glory and distinction. Each region is entrusted its own Islamic council to handle matters regarding Muslims and their needs. For this assignment, it is found out that there is a board in charge of waqf in Selangor called PerbadananWakaf Selangor or PWS. Similar to JAWHAR, PWS is entrusted with responsible to handle waqf and ensuring that the property is not misused. They help the society to understand the importance of waqf and how to do it correctly especially when it comes to fulfilling the requirements of the components. ii. OBJECTIVES OF JAWHAR To improve the value-added Property Management practice endowments and cultivate towards building Ummah economic efficacy and holistic based on Islamic Law. Page 12 of 18 iii. FUNCTION OF JAWHAR 1. To advise the Council with respect to the policies, methods, measures need to be implemented and taken to encourage the development of waqf properties and products 2. Implement and give effect to such a policy, direction or order of the Council in respect of property development and endowment products 3. Develop, adopt and implement policies, methods and measures on the development of waqf properties and products 4. Act as a coordinating agency in the implementation progress of property development and endowment products is rapid 5. Plan, develop, implement and promote the development and implementation of waqf property and products 6. Manage and carry out the operation and maintenance of the waqf, including facilities, infrastructure, and tools in place donated property. 7. Promote, coordinate and carry out research and development in all aspects of property and endowment products. THE USAGES OF THE ENDOWMENT FUND i. Economies activities such as donated land development program, purchase of real estate lots and housing project ii. Social activity such as help orphans, human development programs, treatment funding and recovery. iii. General assistance for example mosque Islamic community and public facilities and maintenance building institutions of religion iv. Education activities such construction of religious schools, universities, MA „had tahfiz and scholarship. Page 13 of 18 THE DIFFERENCES OF WAQF, ZAKAT, DONATION AND INHERITANCE Waqf is a form of amal that is beneficial to Muslims and the society. It is important for people to understand the differences between waqf and other amal or ibadah such as zakat and sadakah. The importance of the endowment to be preserved from inheritance is also important in order to avoid the initial attention of waqf for the sake Allah false. i. DIFFERENCES BETWEEN WAQF AND ZAKAT In Arabic linguistics,zakah, from the infinite of the verb zakaa, is meaning to grow,to purify and to increase. When said about a person,it means to improve to become better.Zakah helps generate a flow of funds and recruit the necessary manpower. The differences between zakah and waqf is,waqf it has unlimited receivers,which means that they did not concern about the rich or poor people,but in zakat they concern about the zakat receivers.Other than that,waqfis recommended in islam but zakat is an obligation action. Referring to the literal meaning zakat itself could differentiate it from waqf entirely, whereby zakah has a certain amount of payment that needs to be made, on certain type and amount of wealth, at certain time to certain people. On the other hand, waqf defined simply as a voluntary dedication of one's wealth or a portion of it either in cash or and its spending for shariah compliant projects. There no restriction of time to it, unlike zakah. ii. DIFFERENCES BETWEEN WAQF AND SADAKAH Literal meaning of donation is called sadakah. Donation refers to a non-obligatory action,whereby it is left to a man‟s faith and charitable nature to give without being asked believing that Allah will compensate him and helping for a greater reward.It is the act of voluntarily spending ones resources with one. A donation is a gift, typically for charitable purposes and or to benefit a cause. For an example,donation is something that we own and give to other person for his or her benefit privately,but in waqaf we give private ownership for public beneficial. Page 14 of 18 iii. DIFFERENCES BETWEEN WAQF AND INHERITANCE Inheritance is when a person is passed away and he or she gave his or her property to their children through declaration (will). A Will is a declaration of a person‟s intentions concerning the disposition and devolution of his property after his death. The person making the Will, the testator, sets down how he wishes his property to be disposed after his death and states the names of the persons (the executors) who are to attend to its distribution. If one of the heirs receive the highest amount more than the third of the inheritance, it means that he have the right to make the decision whether to give the property as waqfor not. The difference between will and Islamic inheritance or Faraid is that, the testator has already decided the ratio of the inheritance, while in Faraid, the inheritance is automatically divided according to the revealed Al-Quran. In Faraid, 2/3 belongs to the sons while 1/3 belongs to the daughters. The huge difference between waqf and inheritance is that, waqf does not allow such ownership to be passed down from one person to another. The beneficiary may asks other person to continue preserving the endowment but to an extent of deciding what to do with the endowment, such as selling it. In heritance, however, refers to a law of passing down the private ownership from one kin to another, giving them full right on what to do with the property, which is even selling it, is legal. Page 15 of 18 ISSUES ON WAQF Waqf has existed since the period time of Prophet Muhammad (Peace be upon him). Back then, legal documents were not a major need in conducting waqf because even verbally is considered as an acceptable Al-Sighah. On top of that, majority people are illiterate and thus, they would prefer to voice out their wish rather than having it written black and white. This has become a great issue in the future, which is now, because their descendants would claim back the property that their ancestors have waqf with an excuse there is no legal contract involved. The scenario had happened in Rembau, Negeri Sembilan as published in BeritaHarian(Harian, 2010). Another issue is when the mawquf is damaged, increase of public interest and government development planning on the endowment especially land. Question rises on what actions should be taken to solve this. In Malaysia, Istibdal is done to overcome the issues aside from Islamic law or Syari‟ah court. i. SUBSTITUTION (ISTIBDAL) Istibdalmeans to substitute a waqf property with another property or with money which is of the same or higher value than it either by substituting, purchasing, selling or any other means in accordance with Syari‟ah. It is to ensure the benefit for the survival of waqf property as well as to solve the problems (Hisham, Jasiran, & Jusoff). ii. SYARI’AH COURT This implies to cases that involve heirs want to claim back the mawquf or the endowment with and without the will of the testator. There are few documents and procedures that have to be taken before the heirs could claim the property. Page 16 of 18 CONCLUSION Due to the significant benefits that could be gained from this charitable donation, the western economics have adapted it in their system and used many names such as endowment, trust fund and foundation. It is realized that prosperity is no longer a private, but it can be shared as a public or in a community. Through waqf, the status of private ownership on an amount of wealth is converted to become public ownership. The convenience or the benefits of the wealth and is accessible by everyone and thus, it is said that prosperity can be shared and not a private ownership anymore. On top of that, waqf generates economy and development of a country. Since the endowment is a form of asset or fund, it is beneficial to the nation for a long period of time. Aside of its main benefit, that is to achieve Allah‟s blessings, it is also a continuous amal that even after the endower dies, the rewards from the endowment for its service and benefits to the community will continue. Due to this greatness that one can achieved, every human is encouraged to waqf as a form of charity to help the society and economy development, the nation‟s growth as well as to achieve the peace in the Hereafter. A hadith narrated by Muslim, said that “The Prophet (Sallallahhualihiwasalam) said:“When the son of Adam dies his actions come to an end except three things, a continuing charity or knowledge which gives benefit or a pious child who prays for him””. Page 17 of 18 REFERENCE (21 May, 2013). Retrieved 9 May, 2013, from General Authority of Islamic Affairs and Endowments: http://www.awqaf.gov.ae/?Lang=EN Aziawaty, A., & Norjaimah, M. J. (2013). Chapter Six: Distribution in Islam. In Foundation of Islamic Economics (pp. 46-48). Berita Harian (20 November, 2010). Anak Tuntut Harta Wakaf Selepas Bapa Meninggal. Rembau, Negeri Sembilan, Malaysia. Hisham, S., Hazel A. J., & Kamaruzaman J. (n.d.). Retrieved 21 May, 2013, from http://www.idosi.org/mejsr/mejsr13(cifwm)13/5.pdf Kahf, M. (4 January, 2012). Kinds and Objectives of Islamic Waqf. Retrieved 17 May, 2013, from On Islam: http://www.onislam.net/english/shariah/contemporary-issues/islamic- themes/452483-kinds-and-objectives-of-the-islamic-waqf.html Yalawae, A., & Tahir, I. M. (n.d.). The Role of Islamic Institution in Achieving Equality and Human Development: Waqf or Endowment. Page 18 of 18