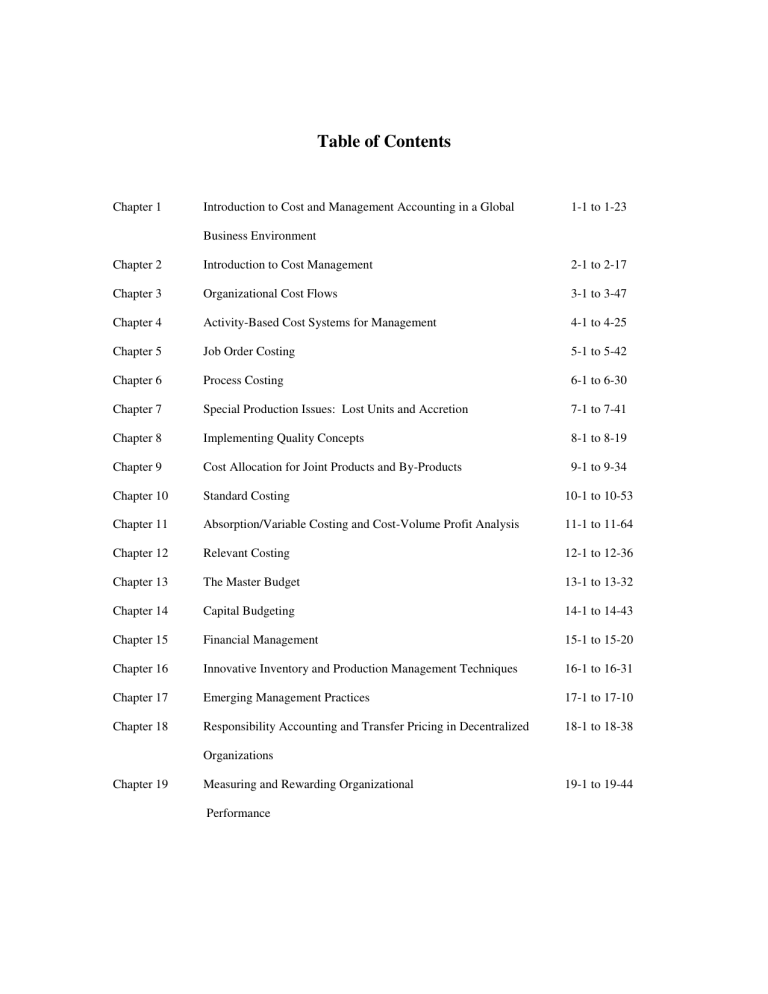

Table of Contents Chapter 1 Introduction to Cost and Management Accounting in a Global 1-1 to 1-23 Business Environment Chapter 2 Introduction to Cost Management 2-1 to 2-17 Chapter 3 Organizational Cost Flows 3-1 to 3-47 Chapter 4 Activity-Based Cost Systems for Management 4-1 to 4-25 Chapter 5 Job Order Costing 5-1 to 5-42 Chapter 6 Process Costing 6-1 to 6-30 Chapter 7 Special Production Issues: Lost Units and Accretion 7-1 to 7-41 Chapter 8 Implementing Quality Concepts 8-1 to 8-19 Chapter 9 Cost Allocation for Joint Products and By-Products 9-1 to 9-34 Chapter 10 Standard Costing 10-1 to 10-53 Chapter 11 Absorption/Variable Costing and Cost-Volume Profit Analysis 11-1 to 11-64 Chapter 12 Relevant Costing 12-1 to 12-36 Chapter 13 The Master Budget 13-1 to 13-32 Chapter 14 Capital Budgeting 14-1 to 14-43 Chapter 15 Financial Management 15-1 to 15-20 Chapter 16 Innovative Inventory and Production Management Techniques 16-1 to 16-31 Chapter 17 Emerging Management Practices 17-1 to 17-10 Chapter 18 Responsibility Accounting and Transfer Pricing in Decentralized 18-1 to 18-38 Organizations Chapter 19 Measuring and Rewarding Organizational Performance 19-1 to 19-44 CHAPTER 1 INTRODUCTION TO COST AND MANAGEMENT ACCOUNTING IN A GLOBAL BUSINESS ENVIRONMENT MULTIPLE CHOICE 1. In comparing financial and management accounting, which of the following more accurately describes management accounting information? a. b. c. d. historical, precise, useful required, estimated, internal budgeted, informative, adaptable comparable, verifiable, monetary ANSWER: 2. EASY Management and financial accounting are used for which of the following purposes? a. b. c. d. Management accounting internal external internal external ANSWER: 3. c a Financial accounting external internal internal external EASY One major difference between financial and management accounting is that a. b. c. d. financial accounting reports are prepared primarily for users external to the company. management accounting is not under the jurisdiction of the Securities and Exchange Commission. government regulations do not apply to management accounting. all of the above are true. ANSWER: d EASY 1–1 1–2 4. Chapter 1 Introduction to Cost and Management Accounting In A Global Business Environment Which of the following statements about management or financial accounting is false? a. b. c. d. Financial accounting must follow GAAP. Management accounting is not subject to regulatory reporting standards. Both management and financial accounting are subject to mandatory recordkeeping requirements. Management accounting should be flexible. ANSWER: 5. is more concerned with the future than is financial accounting. is less concerned with segments of a company than is financial accounting. is more constrained by rules and regulations than is financial accounting. all of the above are true. ANSWER: a EASY Modern management accounting can be characterized by its a. b. c. d. flexibility. standardization. complexity. precision. ANSWER: 7. EASY Management accounting a. b. c. d. 6. c a EASY To meet decision-making needs, the process of gathering and analyzing information about a company and its competitive environment is known as a. b. c. d. business process reengineering. process elimination. business intelligence. planning. ANSWER: c MEDIUM Chapter 1 8. Introduction to Cost and Management Accounting In A Global Business Environment In a global economy, a. b. c. d. the trade of goods and services is focused on trade between or among countries on the same continent. the international movement of labor is prohibited except for multilingual persons. the international flows of capital and information are common. all of the above happen in a global economy. ANSWER: 9. EASY Racketeer Influenced and Corrupt Organizations Act Foreign Illegal Activities Act Foreign Corrupt Practices Act Federal Bribery and Corrupt Practices Act ANSWER: c EASY Which of the following is not a valid method for determining product cost? a. b. c. d. arbitrary assignment direct measurement systematic allocation cost-benefit measurement ANSWER: 11. c Which of the following U.S. legislation relates to bribes being offered to foreign officials? a. b. c. d. 10. 1–3 d MEDIUM Broadly speaking, cost accounting can be defined as a(n) a. b. c. d. external reporting system that is based on activity-based costs. system used for providing the government and creditors with information about a company’s internal operations. internal reporting system that provides product costing and other information used by managers in performing their functions. internal reporting system needed by manufacturers to be in compliance with Cost Accounting Standards Board pronouncements. ANSWER: c EASY 1–4 12. Chapter 1 Introduction to Cost and Management Accounting In A Global Business Environment Cost accounting is directed toward the needs of a. b. c. d. regulatory agencies. external users. internal users. stockholders. ANSWER: 13. b. c. d. are legal standards set by the Institute of Management Accountants for use in all manufacturing and professional businesses. are set by the Cost Accounting Standards Board and are legally binding on all manufacturers, but not service organizations. do not exist except for those legal pronouncements for companies bidding or pricing cost-related contracts with the government. are developed by the Cost Accounting Standards Board, issued by the Institute of Management Accountants, and are legally binding on CMAs. ANSWER: c MEDIUM Cost accounting is necessitated by a. b. c. d. the high degree of conversion found in certain businesses. regulatory requirements for manufacturing companies. management’s need to be aware of all production activities. management’s need for information to be used for planning and controlling activities. ANSWER: 15. EASY Cost accounting standards a. 14. c a MEDIUM The process of ___________ causes the need for cost accounting. a. b. c. d. conversion sales controlling allocating ANSWER: a EASY Chapter 1 16. Introduction to Cost and Management Accounting In A Global Business Environment Financial accounting a. b. c. d. is primarily concerned with internal reporting. is more concerned with verifiable, historical information than is cost accounting. focuses on the parts of the organization rather than the whole. is specifically directed at management decision-making needs. ANSWER: 17. EASY preparing budgets. determining product cost. providing managers with information necessary for control purposes. determining performance standards. ANSWER: b EASY Which of the following topics is of more concern to management accounting than to cost accounting? a. b. c. d. generally accepted accounting principles inventory valuation cost of goods sold valuation impact of economic conditions on company operations ANSWER: 19. b Financial accounting and cost accounting are both highly concerned with a. b. c. d. 18. 1–5 d MEDIUM Cost and management accounting a. b. c. d. require an entirely separate group of accounts than financial accounting uses. focus solely on determining how much it costs to manufacture a product or provide a service. provide product/service cost information as well as information for internal decision making. are required for business recordkeeping as are financial and tax accounting. ANSWER: c EASY 1–6 20. Chapter 1 Introduction to Cost and Management Accounting In A Global Business Environment The Institute of Management Accountants issues a. b. c. d. Statements on Accounting Research for Managers. Statements on Management Accounting. Statements on Managerial and Cost Accounting. Cost Accounting Standards. ANSWER: 21. is a legally enforceable contract with all management accountants. should be viewed as a goal for professional behavior. is a legally enforceable contract with all CPAs. provides ways to measure departures from ethical behavior. ANSWER: EASY Internal Revenue Service. American Institute of CPAs. Institute of Management Accountants. Institute of Certified Management Accountants. ANSWER: c EASY The ethical standards established for management accountants are in the areas of a. b. c. d. competence, licensing, reporting, and education. budgeting, cost allocation, product costing, and insider trading. competence, confidentiality, integrity, and objectivity. disclosure, communication, decision making, and planning. ANSWER: 24. b The organization whose primary function is to provide a means to share information among cost and management accountants in the United States is the a. b. c. d. 23. EASY The Institute of Management Accountants’ Code of Ethics a. b. c. d. 22. b c MEDIUM Which of the following statements is true? a. b. c. d. Management accounting is a subset of cost accounting. Cost accounting is a subset of both management and financial accounting. Management accounting is a subset of both cost and financial accounting. Financial accounting is a subset of cost accounting. ANSWER: b MEDIUM Chapter 1 25. Introduction to Cost and Management Accounting In A Global Business Environment Which of the following statements is false? a. b. c. d. A primary purpose of cost accounting is to determine valuations needed for external financial statements. A primary purpose of management accounting is to provide information to managers for use in planning, controlling, and decision making. The act of converting production inputs into finished products or services necessitates cost accounting. Two primary hallmarks of cost and management accounting are standardization of procedures and use of generally accepted accounting principles. ANSWER: 26. MEDIUM management style. strategy. mission statement. operational mission. ANSWER: b EASY Strategy integrates which of the following? a. b. c. d. Planning yes yes yes no ANSWER: 28. d A long-term plan that fulfills the goals and objectives of an organization is known as a(n) a. b. c. d. 27. 1–7 c Controlling yes no yes no Decision making no no yes no EASY Which of the following is/are not considered by management in determining strategies for the organization? a. b. c. d. core competencies environmental constraints organizational structure accounting basis ANSWER: d EASY 1–8 29. Chapter 1 Introduction to Cost and Management Accounting In A Global Business Environment Which of the following is not a generic mission for organizational segments? a. b. c. d. build harvest hold save ANSWER: 30. save mission. harvest mission. build mission. hold mission. ANSWER: c EASY Protecting current market share and competitive position is the major concern of the a. b. c. d. save mission. harvest mission. build mission. hold mission. ANSWER: 32. MEDIUM Increasing market share, even if short-term earnings and cash flow suffer, is the major concern of the a. b. c. d. 31. d d EASY Maximizing short-term earnings and cash flow, even at the expense of current market share, is the primary concern of the a. b. c. d. save mission. harvest mission. build mission. hold mission. ANSWER: b EASY Chapter 1 33. Introduction to Cost and Management Accounting In A Global Business Environment The organizational units that require the highest level of strategic planning are those with a ____________ mission. a. b. c. d. hold harvest product life cycle build ANSWER: 34. EASY product life cycle. target costing. employee empowerment. intellectual capital. ANSWER: a EASY To effectively use employee empowerment, an organization’s structure would likely reflect a. b. c. d. strategic resource management. centralized management. decentralized management. contract management. ANSWER: 36. d Segment mission is directly related to a. b. c. d. 35. 1–9 c MEDIUM An organizational structure in which all decision making is held by top managers is known as ____________ management. a. b. c. d. centralized decentralized strategic resource activity-based ANSWER: a EASY 1–10 Chapter 1 37. Introduction to Cost and Management Accounting In A Global Business Environment An organizational structure in which decision making is spread throughout different levels of management is known as __________ management. a. b. c. d. centralized decentralized strategic resource activity-based ANSWER: 38. internal functions crucial to the success and survival of a company. attributes that keep a firm from competing. different for every organization. considered influences on corporate strategies. ANSWER: b EASY Which of the following are potential constraints on organizational strategies being considered by management? a. b. c. d. Core competencies yes no yes yes ANSWER: 40. EASY Core competencies are not a. b. c. d. 39. b d Technology availability yes yes no yes Monetary capital resources no yes yes yes EASY The intangible assets of skill, knowledge, and information are also known as a. b. c. d. intellectual capital. business intelligence. kaizen knowledge. management style. ANSWER: a EASY Chapter 1 41. Introduction to Cost and Management Accounting In A Global Business Environment 1–11 The norms of a company as they impact internal and external, as well as formal and informal, transactions reflect a. b. c. d. operational plans. organizational culture. organizational strategy. strategic resource management. ANSWER: 42. environmental constraints. operational constraints. organizational constraints. budgeting constraints. ANSWER: a EASY The manner in which managers react and interact with stakeholders in the organization is a. b. c. d. strategic resource management. the organizational value chain. management style. responsibility accounting. ANSWER: 44. EASY Limitations on strategy options based on political barriers, legal, fiscal, and regulatory are a. b. c. d. 43. b c EASY The key link between managing resources and managing change in an organization is a. b. c. d. responsibility accounting. information. strategies. conversion activities. ANSWER: b EASY 1–12 Chapter 1 45. Introduction to Cost and Management Accounting In A Global Business Environment Which of the following defines the details that are necessary to maintain and accomplish the strategies of an organization? a. b. c. d. Responsibility accounting yes yes no no ANSWER: 46. MEDIUM decentralization. centralization. strategic resource management. value chain. ANSWER: c MEDIUM Strategic resource management does not concerns itself with a. b. c. d. the deployment of resources to support strategies. how resources are to be deployed and redeployed over time. how resources are used or recovered from changing processes. how resource disposition will decrease customer and shareholder value. ANSWER: 48. Value chain yes yes no yes Organizational planning for disposition of resources to create value for customers and shareholders is known as a. b. c. d. 47. c Operational plans yes no yes no d MEDIUM The set of processes that convert inputs into services and products that consumers use is called a. b. c. d. a core competency. an operational plan. the value chain. the product life cycle. ANSWER: c EASY Chapter 1 49. Introduction to Cost and Management Accounting In A Global Business Environment 1–13 The world has essentially become smaller because of a. b. c. d. improved technology. trade agreements. better communications systems. all of the above. ANSWER: 50. Introduction of the Internet Introduction of the first consumer charge card Introduction of wireless money transfers Deregulation of the communications industry ANSWER: c MEDIUM Which of the following would most commonly reflect the highest e-commerce cost to a large, global business? a. b. c. d. Web site development Internal network shutdowns from e-mail complaints Losses from sales of pirated goods Development of appropriate passwords for users ANSWER: 52. EASY Which of the following was the earliest event of importance to the beginning of e-commerce? a. b. c. d. 51. d a MEDIUM Which of the following would most commonly be viewed as the greatest negative for ecommerce customers? a. b. c. d. Possibility for purchasing counterfeit goods Privacy issues Legal issues of redress Site “friendliness” issues ANSWER: b EASY 1–14 Chapter 1 53. Introduction to Cost and Management Accounting In A Global Business Environment At the start of Web site development, a U.S. company would probably be least concerned with which of the following? a. b. c. d. Site maintenance Multiple languages Data encryption Site search function ANSWER: 54. North American Foreign Trade Agreement New Age Free Trade Amendment North American Free Trade Agreement North Atlantic Federated Trade Agreement ANSWER: c EASY Which of the following statements is true? a. b. c. d. Prior to economic integration, consumer choices were often made on the basis of production location. The General Agreement on Tariffs and Trade was established to reduce tariffs among businesses in Europe and North America. The majority of trade agreements currently in place emphasize the need for consumers to purchase quality goods. International trade agreements, while increasing availability of goods to consumers, have decreased the need for international laws governing transactions. ANSWER: 56. EASY NAFTA refers to which of the following? a. b. c. d. 55. b a MEDIUM A U.S. manufacturer of which of the following goods would be likely to face the most cultural risks in operating globally? a. b. c. d. Furniture Automobiles Clothing Food ANSWER: d MEDIUM Chapter 1 57. Introduction to Cost and Management Accounting In A Global Business Environment 1–15 A U.S. manufacturer of which of the following goods would be likely to face the fewest cultural risks in operating globally? a. b. c. d. Toys Food Clothing Furniture ANSWER: 58. Asset expropriation Inflation Workplace diversity All of the above ANSWER: a EASY Most American laws are a. b. c. d. ethical foundations for living. codified societal rules that have changed over time. concerned with regulating public service companies. designed to restrict foreign business competition. ANSWER: 60. MEDIUM Which of the following would be considered a political risk in doing business globally? a. b. c. d. 59. d b MEDIUM The Foreign Corrupt Practices Act is directed at a. b. c. d. U.S. businesses operating overseas. foreign businesses operating in the U.S. all businesses dealing with U.S. consumers. U.S. businesses operating in developed nations. ANSWER: a MEDIUM 1–16 Chapter 1 61. Introduction to Cost and Management Accounting In A Global Business Environment The behavioral norms in a company’s code of ethics should a. b. c. d. be specific to the countries in which the company operates. vary depending on an employee’s job level and global location. engender consistent actions in all geographical segments. require employees to act in accordance with local customs and traditions when in non-domestic situations. ANSWER: 62. b. c. d. Determination of whether there are local business practices that will impact interactions with other parts of the world. Determination of whether some business practices need to be adapted to fit local laws in a specific locale. Determination of whether there is compliance with all legal requirements on a local level. Determination of whether the “tone at the top” is appropriate in all organizational segments. ANSWER: d MEDIUM A company may choose to avoid competition by selecting a. b. c. d. Differentiation strategy no no yes yes ANSWER: 64. MEDIUM Texas Instruments has adopted a three-level approach to ethical integrity on a global level. Which of the following is not part of that approach? a. 63. c c Business intelligence analysis no yes no yes Cost leadership no no yes yes MEDIUM A company establishing a position of cost leadership would a. b. c. d. emphasize the value of its product’s distinguishing features. stress the cost efficiencies in its production processes. match all competitors’ price changes. all of the above are possible tactics. ANSWER: b MEDIUM Chapter 1 65. Introduction to Cost and Management Accounting In A Global Business Environment 1–17 A company engaging in a confrontation strategy recognizes that a. b. c. d. such a strategy is less profitable than attempting to avoid competition. its products and services will always be priced higher than those of its competitors. competitors will be exploiting temporary opportunities for advantage and, thus, the company must retain the advantage of low price. the need for competitor analysis is much greater than the need for business intelligence. ANSWER: 66. competitor analysis competitive intelligence business intelligence confrontation analysis ANSWER: b MEDIUM The business intelligence system should provide management with a. b. c. d. organizational strengths and weaknesses. external markets, technologies, and competitors. future trends and an environmental scan. all of the above. ANSWER: 68. MEDIUM In gathering information about the environment in which the organization operates, which level of intelligence is most likely to provide an early warning of opportunities and threats? a. b. c. d. 67. a d MEDIUM A business intelligence system provides information for management to use in a. b. c. d. Decision-making yes no no yes ANSWER: a EASY Strategic planning yes yes yes no Tactical planning yes yes no no 1–18 Chapter 1 69. Introduction to Cost and Management Accounting In A Global Business Environment The first step in the planning process is for managers to analyze the threats and opportunities of the customers, competition, and environment in relationship to the entity’s a. b. c. d. strategic objectives. financial goals. strengths and weaknesses. equity stakeholders. ANSWER: 70. strategic plans. tactical plans. wealth maximization strategies. organizational cash flows. ANSWER: b MEDIUM To provide appropriate management incentives, accounting measurements should be tied to the a. b. c. d. generation of annual profits. organization’s mission. ability to rapidly develop new products. business intelligence system. ANSWER: 72. MEDIUM Organizational budgets typically reflect a. b. c. d. 71. c b EASY Which of the following statements is true? a. b. c. d. All segments of an organization will have the same mission. An organization’s products will not affect the determination of segment mission. Product life cycle is affected by segment mission. Segment mission is affected by product life cycle. ANSWER: d MEDIUM Chapter 1 73. Introduction to Cost and Management Accounting In A Global Business Environment 1–19 Which of the following types of performance measurements are most appropriate for each of the following segment misssions? a. b. c. d. Build Long-term Long-term Short-term Short-term ANSWER: 74. strategic resource management value chain analysis cost-benefit analysis activity-based costing ANSWER: d MEDIUM Strategic resource management is directly concerned with a. b. c. d. strategy development. resource deployment. resource acquisition. product life cycle management. ANSWER: 76. MEDIUM Which of the following is generally viewed as improving organizational cost data? a. b. c. d. 75. b Harvest Long-term Short-term Long-term Short-term b MEDIUM Strategic resource management issues a. b. c. d. are primarily measurable by financial accounting data. have few costs and benefits can that be ascertained. often relate to nonmonetary benefits. create current monetary costs and nonmonetary benefits. ANSWER: c MEDIUM 1–20 Chapter 1 77. Introduction to Cost and Management Accounting In A Global Business Environment The value chain a. b. c. d. reflects the production of goods within an organizational context. is concerned with upstream suppliers, but not downstream customers. results when all non-value-added activities are eliminated from a production process. is the foundation of strategic resource management. ANSWER: 78. d MEDIUM The agents of change in a business are the a. b. c. d. employees. members of the organizational value chain. managers. organizational stakeholders. ANSWER: c MEDIUM SHORT ANSWER/PROBLEMS 1. What four areas are covered by the Standards of Ethical Conduct for Certified Management Accountants? How are these areas defined? ANSWER: The four areas covered by the Standards of Ethical Conduct for Certified Management Accountants are: competence, confidentiality, integrity, and objectivity. Competence means having the capacity to function in a particular manner. Confidentiality means having the ability to maintain or keep information undisclosed. Integrity is defined as adherence to a code of moral values. Objectivity is defined as expressing or using facts without distortion by personal feelings or prejudices. MEDIUM 2. On what needs do (1) management accounting and (2) financial accounting focus? ANSWER: Management accounting focuses on the needs of users inside an organization. Managers need information related to planning, controlling, decision making, and performance evaluation. Their needs are satisfied through the providing of information designed for their particular uses. Financial accounting focuses on the needs of users outside the organization, such as stockholders, creditors, and regulatory agencies. These users require information that is in conformity with generally accepted accounting principles and, thus, is standardized in the form of general purpose financial statements. MEDIUM Chapter 1 3. Introduction to Cost and Management Accounting In A Global Business Environment 1–21 List and discuss the three missions for organization segments. ANSWER: The three missions are build, hold, and harvest. The build mission is concerned with increasing market share, regardless of whether short-term earnings and cash flow suffer. A segment that operates under this mission will be a major user of organizational cash. Segments that have low market shares in “high growth industries” will typically be in a build mode. The hold mission is concerned with maintaining current market share and market position. In most instances, cash inflows will equal cash outflows. The harvest mission is concerned with increasing short-term earnings and cash flow, even at the expense of current market share. A business segment that follows a harvest mission will be supplying cash to the organization. MEDIUM 4. What is strategic resource management and with what issues is it concerned? ANSWER: Strategic resource management involves the organizational planning for the deployment of resources to create value for customers and shareholders. Key variables in SRM success are the management of information and of change in responding to threats and opportunities. SRM is concerned with the following issues: (1) how to deploy resources to support organizational strategies, (2) how resources are used in or recovered from changing processes, (3) how customer and shareholder value will serve as guides in the effective use of those resources, and (4) how to deploy and redeploy resources over time. MEDIUM 5. List and discuss three organizational constraints with which management must deal when making strategic decisions for the firm. ANSWER: Although there are more than three constraints, the following provide brief examples of possible constraints faced by management: (1) capital, (2) structure, and (3) core competencies. Capital or the lack of capital is a major constraint for most organizations. Organizations must decide where and how the spend the money that they currently have access to and then decide if they can or want to borrow additional funds. Structure is a short-term (for many firms) constraint that can be overcome by additions to the equipment base and/or employee training. Thirdly, core competencies are the internal functions that management has decided are important to the overall success and survival of the organization. These competencies represent the potential competitive advantages of the firm. MEDIUM 1–22 Chapter 1 6. Introduction to Cost and Management Accounting In A Global Business Environment You are going to start a new e-commerce business. Discuss at least three positive factors and three negative factors of such a business from your (the merchant’s) point of view. ANSWERS will all differ, but should be based on information in Exhibit 1-5. MEDIUM 7. You are going to start a new e-commerce business. Discuss at least three positive factors and three negative factors of such a business from your customer’s point of view. ANSWERS will all differ, but should be based on information in Exhibit 1-5. MEDIUM 8. Every business, whether domestic or global, must operate under conditions of risk. Discuss four types of operating risks involved in business and how these risks might change when a business expands to global operations. ANSWERS will all differ, but should be based on information in Exhibit 1-6. MEDIUM 9. Every business, whether domestic or global, must operate under conditions of risk. Discuss three types of financial risks involved in business and how these risks might change when a business expands to global operations. ANSWERS will all differ, but should be based on information in Exhibit 1-6. MEDIUM 10. Every business, whether domestic or global, must operate under conditions of risk. Discuss three types of information risks involved in business and how these risks might change when a business expands to global operations. ANSWERS will all differ, but should be based on information in Exhibit 1-6. MEDIUM Chapter 1 11. Introduction to Cost and Management Accounting In A Global Business Environment 1–23 Most people would agree that a “moral free space” must exist relative to some business decisions. Discuss the concept of “moral free space.” ANSWER: Because all business practices cannot be categorized as either ethical or unethical and because business practices may change over time, there must be a “moral free space” that allows managers and employees to make decisions within the bounds of reason. Decisions should be guided by an understanding of basic values and principles of integrity—preferably shared within and supported by the organization. MEDIUM 12. Define value chain and provide a graphic of the interacting flows of information within the value chain. ANSWER: The value chain is the set of processes that convert inputs into products and services for a firm’s customers. It includes both internal and external processes. It encompasses both upstream and downstream entities. A depiction of the value chain and its information flows is shown in Exhibit 1-12. MEDIUM CHAPTER 2 INTRODUCTION TO COST MANAGEMENT SYSTEMS MULTIPLE CHOICE 1. A management information system should do which of the following? a. b. c. d. Collect data yes yes no yes ANSWER: 2. EASY external demands for information. external and internal demands for information. internal demands for information. the Accounting Department’s demands for information. ANSWER: c EASY Who of the following are external users of data gathered by a management information system? a. b. c. d. Creditors yes no no yes ANSWER: 4. Analyze data for management yes no yes yes A management information system should emphasize satisfying a. b. c. d. 3. b Organize data for managers no yes no yes d Regulatory Bodies no no yes yes Suppliers yes no yes yes EASY Which of the following is not a primary component of a control system? a. b. c. d. operator communications network effector assessor ANSWER: a EASY 2–1 2–2 5. Chapter 2 Which of the following would be considered a detector? a. b. c. d. computer program source document variance report all of the above ANSWER: 6. d EASY Feedback is reflected in which component of a management control system? a. b. c. d. sensor assessor effector detector ANSWER: c EASY Reactions to information provided by the management control system are a. b. c. d. formulated in the organization’s strategic plan. judgmental, and are based on interpretations and circumstances. assessed by the communications network of the MCS. determined as those activities that will be most efficient and effective given the organization’s available technology. ANSWER: 9. EASY A management control system may be referred to as a black box. A management control system should serve as a guide to organizations. A management control system should help implement strategies. A management control system is separate from a cost management system. ANSWER: 8. b Which of the following statements is false concerning a management control system? a. b. c. d. 7. Introduction to Cost Management Systems b EASY A cost management system should a. b. c. d. identify and evaluate new activities. determine whether the organization is effective and efficient. identify the cost of consumed resources within the organization. all of the above. ANSWER: d EASY Chapter 2 10. Introduction to Cost Management Systems A cost management system should provide information to a. b. c. d. all functional areas of the organization. only the accounting area of the organization. only the production area of the organization. organizational managers, but not to staff personnel. ANSWER: 11. use cost drivers to develop product costs improve understanding of activities develop organizational strategies measure performance ANSWER: c EASY A cost management system will provide the means to develop a. b. c. d. the most accurate product or service costs. a reasonably accurate product or service cost given cost-benefit analysis. a product or service cost that does not include any non-value-added overhead. a costing system that traces all costs directly to individual products or services. ANSWER: 13. EASY Which of the following is not a primary goal of a cost management system? a. b. c. d. 12. a b EASY The costs generated by the cost management system are used to a. b. c. d. assess product/service profitability. establish prices for products with significant competition. determine underlying reasons for variations from standards. all of the above. ANSWER: a EASY 2–3 2–4 Chapter 2 14. Information about the life-cycle performance of a product or service should be provided in the a. b. c. d. Financial accounting system yes yes no no ANSWER: 15. EASY Financial accounting system no yes no yes ANSWER: c Cost accounting system no yes yes yes Cost management system yes no yes no EASY A cost management system would be an integral part of implementing which of the following? a. b. c. d. Strategic resource management no no yes yes ANSWER: 17. Cost management system yes no yes no Cost control is an important function of the a. b. c. d. 16. c Introduction to Cost Management Systems d Core competency assessment yes no no yes Centralized management yes no yes no EASY Which of the following organizational characteristics critically affect the design of a cost management system? a. b. c. d. Culture yes yes no no ANSWER: a Critical success factors yes no yes yes EASY Mission yes yes no yes Form yes no yes no Chapter 2 18. Introduction to Cost Management Systems A cost management system a. b. c. d. is finalized when the information currently being produced is the same as the information currently desired. can be generically designed to fit the information needs of the majority of domestic (but not global) organizations. must be continuously improved to adapt to changes in an organization’s internal and external environment. that has been appropriately designed from gap analysis, does not need to be changed unless there is a change in organizational management or culture. ANSWER: 19. c MEDIUM In a highly regulated, monopolistic industry, such as the electrical utility or TV cable, a cost management system is a. b. c. d. of limited need because costs are typically passed along to customers via the rate structure. essential because of the need to provide the highest degree of cost efficiency possible for customers. critical to the needs of empowered employees making decisions at various levels of the organizational hierarchy. of no use because there is no attempt by management to control costs. ANSWER: 20. 2–5 a EASY Which of the following statements is true? a. b. c. d. A good cost management system is a key consideration in determining an organization’s mission. The organization’s mission is a critical success factor in assessing how to react to competition. Knowledge of an organization’s critical success factors help to clarify organizational mission and develop a cost management system. An organization must establish a position of cost leadership to compete in a global business environment. ANSWER: c EASY 2–6 21. Chapter 2 Which of the following indicates the mission being pursued by a subunit that is a. b. c. d. using cash? save build harvest build ANSWER: 22. c. d. MEDIUM is only possible if a company has formed strategic alliances with its suppliers. generally increases long-run product costs because of the need to develop new production processes. results in the ability of a firm to pursue a cost leadership competitive strategy. may result in design flaws, a need for engineering change orders, and customer “bad will.” ANSWER: d EASY An increase in the use of technology has caused a. b. c. d. fewer costs to be susceptible to short-run control. companies to be more flexible in responding to changing short-term conditions. managers to be less concerned about capacity utilization because of the increased ability to produce in large quantities. a decline in the amount of fixed costs in an organization. ANSWER: 24. d generating cash? harvest save build harvest Reducing the time-to-market for a new product a. b. 23. Introduction to Cost Management Systems a MEDIUM Engaging in product design for manufacturability reduces a. b. c. d. Training costs yes no yes no ANSWER: c Preproduction design time yes yes no no EASY Assembly time yes yes yes no Chapter 2 25. Introduction to Cost Management Systems Substantial reductions in product cost can be obtained by a. b. c. d. decreasing capacity utilization. using focused factory arrangements. using tried and true manufacturing techniques. using product life cycle accounting. ANSWER: 26. b. c. d. EASY the information being received by competitors’ managers to the information being received by in-house managers. the information needed to what is available. current cost information to projected cost information. budget figures to actual spending. ANSWER: b EASY Which of the following limits an organization’s ability to minimize the “gaps” found when a gap analysis has been performed? a. b. c. d. Limited resources yes yes no no ANSWER: 28. b In conjunction with a cost management system, gap analysis refers to comparing a. 27. 2–7 b Number of managers yes no yes no Technology capabilities yes yes no yes EASY Which of the following is considered a “feeder” system to the cost management system? a. b. c. d. Payroll yes yes no yes ANSWER: Budgeting no yes no yes b EASY Inventory valuation yes yes no no 2–8 29. Chapter 2 Which of the following is a primary element of a cost management system? a. b. c. d. Information yes no yes yes ANSWER: 30. Motivation yes yes no yes Evaluation yes no yes no EASY Cost behavior analysis yes no yes yes ANSWER: d VA/NVA activity identification yes yes no yes Assignment of joint costs to joint products yes yes no no EASY ___________ refers to avoiding competition in making a product distinct from that of competitors by adding value or features for which consumers are willing to pay more. a. b. c. d. Kaizen Differentiation Confrontation Cost leadership ANSWER: 32. d Reporting yes yes no yes As part of its control function, a cost management system is useful for a. b. c. d. 31. Introduction to Cost Management Systems b EASY Distinguishing a product by adding additional features or value is part of which of the following competitive strategies? a. b. c. d. Differentiation yes yes yes no ANSWER: a Cost leadership no yes no yes EASY Confrontation yes yes no yes Chapter 2 33. Introduction to Cost Management Systems A cost leadership strategy emphasizes a. b. c. d. product features. low prices. just-in-time production capabilities. short-run opportunities for cost minimization. ANSWER: 34. EASY differentiation cost leadership confrontation price fixing ANSWER: c EASY A commonly recognized critical success factor for most organizations is a. b. c. d. Quality yes yes no no ANSWER: 36. b Which of the following competitive strategies is least profitable? a. b. c. d. 35. 2–9 b Decentralization yes no yes no Short cycle time yes yes no yes Responsiveness to change no yes yes no EASY In a decentralized organization, a. b. c. d. all functions are delegated to subunit managers who are closest to the information. subunits under the control of a single manager are normally grouped by organizational structure. it would be difficult to group geographically related subunits pursuing different missions under the same manager. functions such as financing and product/service pricing are typically retained by top management. ANSWER: c EASY 2–10 37. Chapter 2 Organizational form directly affects which of the following? a. b. c. d. Decision-making authority no yes no yes ANSWER: 38. Taxation yes yes no no Mission yes no yes no EASY about the same importance as less importance than more importance than a level of importance that depends on organizational size as compared to ANSWER: c EASY The performance measurement system should encourage each manager to act in a manner that a. b. c. d. makes the manager’s units profits as high as possible. most positively supports the organization’s mission and competitive strategies. increases his/her performance reward in the form of profit sharing. reduces the need for informational elements in support of the manager’s planning function. ANSWER: 40. b Cost of capital yes yes yes yes As an organization moves to decentralize its operations, an effective reporting system will have ______________ when the organization was centralized. a. b. c. d. 39. Introduction to Cost Management Systems b EASY Performance reports are useful only to the extent that performance is measured against a. b. c. d. a meaningful benchmark. the performance of all other units or managers. the budget as adopted for the period. competitors’ achievements. ANSWER: a EASY Chapter 2 41. Introduction to Cost Management Systems The accounting function in an organization is expected to support managers in which of the following functions? a. b. c. d. Planning yes no no yes ANSWER: 42. Evaluating performance no no yes yes EASY kaizen costing. reverse engineering. computer simulation. all of the above. ANSWER: c EASY The reward system for subunit managers of mature businesses should emphasize a. b. c. d. long-term competitive prospects. near-term profit and cash flow. success in product design and development. exceeding last year’s subunit profit. ANSWER: 44. c Controlling yes yes no yes Relating resource consumption and cost to alternative product and process designs can be achieved through a. b. c. d. 43. 2–11 b EASY Profit sharing is a method of employee compensation that a. b. c. d. allocates an equal amount of profit reward to each manager in the organization. allows organizational profits to be divided among employees in a non-taxable status. is contingent based on the level of subunit profit generated. is used in many foreign companies but is virtually nonexistent in most U.S. organizations. ANSWER: c EASY 2–12 45. Chapter 2 Most managers evaluate decision alternatives based on how a. b. c. d. much the decision will increase or decrease organizational profits. the outcomes may affect selected performance measurement and reward criteria. much the outcome will reduce the organization’s cost of capital. easily the decision impacts can be quantified in the organization’s cost management system. ANSWER: 46. MEDIUM motivational informational reporting all of the above ANSWER: a EASY Focus on cost control and assessing core competencies are part of which cost management element? a. b. c. d. motivational informational reporting all of the above ANSWER: 48. b Performance measurements and a reward system are part of which cost management element? a. b. c. d. 47. Introduction to Cost Management Systems b EASY Which of the following should be able to provide the financial information needed for budget preparation? a. b. c. d. Cost management system no no yes yes ANSWER: d EASY Financial accounting system yes yes no yes Cost accounting system yes no yes yes Chapter 2 49. Introduction to Cost Management Systems In the future competitive environment, companies will emphasize a. b. c. d. achievement of financial results. development of strategic alliances. development of annual plans. conformity to project expectations. ANSWER: 50. b. c. d. EASY causing companies to recognize that it may be more advantageous to confront, rather than compete with, the competition. making products in the maturity stage of their life cycle the basis on which firms expect growth to be generated. so companies spend less and less on product design and development because products will not last as long as previously. meaning that tools such as benchmarking and target costing become less important in adapting to the competitive environment. ANSWER: a MEDIUM A responsibility accounting system provides information to top management about the a. b. c. d. organizational responsibilities of each subunit manager. performance of each organizational subunit and its manager. ability of each subunit manager to ensure a satisfactory cost to revenue relationship. all of the above. ANSWER: 52. b The life cycles of many products are becoming shorter a. 51. 2–13 b EASY Which of the following should be considered in a cost management system design? a. b. c. d. Cost principles yes no no yes ANSWER: d Personnel training principles yes yes no no EASY Investment management principles yes yes no yes 2–14 Chapter 2 Introduction to Cost Management Systems SHORT ANSWER/PROBLEMS 1. Discuss the four primary components of a control system. ANSWER: The four components include the following: a detector which is a measuring device that identifies what is happening in the controlled process; an assessor that helps determine the significance of what is happening; an effector that changes the behavior if indicated by the assessor; and a communications network that transmits information between the detector and assessor and between the assessor and the effector. MEDIUM 2. Define a cost management system and indicate how it should help managers. ANSWER: A cost management system is a set of formal methods developed for planning and controlling an organization’s cost activities relative to the goals and objectives of the organization. A cost management system should determine how effective and efficient the organization’s activities are and identify the cost of resources consumed in performing these activities. The system should also identify and evaluate any new activities that may improve future performance of the organization while being aware of the changing environment in which the business operates. MEDIUM 3. Discuss from where an organization receives information and what happens to information within an organization. ANSWER: An organization receives information from its external operating environment that includes the following: competition, suppliers, creditors, and the government. This information is then circulated throughout the organization in both a vertical and horizontal direction. The information gathered by the organization is used for planning, decision making, evaluating performance, and controlling within the organization. MEDIUM Chapter 2 4. Introduction to Cost Management Systems 2–15 Discuss the characteristics of an organization for which a true cost management system would be appropriate. ANSWER: The organization for which a true CMS would be appropriate would have specified strategic goals to which its operating position is linked. Its technology, human behavior, and information systems would be integrated as would its managerial and operating systems. The organization would engage in intergroup coordination and coordinated management through employee empowerment. A focus would be on cost elimination rather than cost allocation—thus implying an activity-based management approach. Performance evaluation would rely on both financial and nonfinancial measurements. Finally, the company would utilize changing technologies and embrace customer values and customer satisfaction as part of organizational culture. This organization would be confronting high-quality worldwide competition. MEDIUM 5. What are the six primary goals of a cost management system? Illustrate how a CMS achieves each of these goals. ANSWER: The six goals of a cost management system are (1) to develop fairly accurate product costs by using cost drivers, (2) to assess product and/or service life-cycle performance, (3) to improve understanding of activities and processes, (4) to control costs, (5) to measure performance, and (6) to pursue organizational strategies. The illustrations given by the students should support details provided from pages 45–48 in the text. MEDIUM 6. List and discuss the four stages in the design of a cost management system. ANSWER: The four stages in designing a cost management system are (1) analyze, (2) determine, (3) perform, and (4) assess. In the first stage, organizational structure, culture, and form must be analyzed, as well as the mission and critical success factors of the organization. The second stage involves determining what outputs are desired while considering motivational, informational, and reporting elements of the organization. The third stage involves performing gap analysis between desired output and current output. The fourth stage is to assess the improvements generated by reducing the gap. MEDIUM 2–16 7. Chapter 2 Introduction to Cost Management Systems Define confrontation strategy and indicate why many companies may believe it is the only way to face competitors. ANSWER: Confrontation strategy means that a company, while attempting to differentiate its products or becoming a low-cost producer, meets the competition headon—knowing that any competitive advantage will last only a short time. Confrontation may become the way of the future because of decreased product life cycles (companies are better at reverse engineering and continuous improvement than in the past). MEDIUM 8. Name five items that would be considered critical success factors by most world-class companies. Why is each of these factors so important to organizational longevity? ANSWER: The five items most commonly named are timeliness (time-to-market), quality, customer service, efficiency/cost control, and responsiveness to change. Each student will have different ideas as to why these items are important, but the answer should address the global business environment and thus, the increase in competition, reduction in product life cycles, costs to obtain versus retain customers, litigation issues, and so forth. MEDIUM 9. What are five ways that an organization could reduce product costs? Provide an example of how each method would cause cost reduction. ANSWER: The answer could include any of the following: (1) developing new production processes, (2) capture learning curve and experience data, (3) increase capacity, (4) use a focused factory arrangement, (5) design products for manufacturability, (6) design products for logistical support, (7) design products for reliability, (8) design products for maintainability, and (9) use advanced technology in manufacturing products. Examples will differ by student. MEDIUM Chapter 2 10. Introduction to Cost Management Systems 2–17 Discuss the three elements of a cost management system. ANSWER: Motivational elements include performance measurements and the reward structure of the organization. Support of the organizational mission and competitive strategy are also considered motivational elements. Informational elements include support of the budgeting process as well as support of cost reduction initiatives. Core competencies assessment and make-or-outsource decision analyses are part of informational elements. Emphasis is placed on product life cycle, and distinctions must be made between value-added and non-value-added activities in the informational elements of a cost management system. Lastly, reporting elements include the preparation of financial statements and provision of details for responsibility accounting systems. MEDIUM CHAPTER 3 ORGANIZATIONAL COST FLOWS MULTIPLE CHOICE 1. The term “relevant range” as used in cost accounting means the range over which a. b. c. d. costs may fluctuate. cost relationships are valid. production may vary. relevant costs are incurred. ANSWER: 2. Total cost reaction to increase in activity remains constant remains constant increases increases ANSWER: d Cost per unit reaction to increase in activity remains constant increases increases remains constant EASY When cost relationships are linear, total variable prime costs will vary in proportion to changes in a. b. c. d. direct labor hours. total material cost. total overhead cost. production volume. ANSWER: 4. EASY Which of the following defines variable cost behavior? a. b. c. d. 3. b d EASY Which of the following would not generally be considered a fixed overhead cost? a. b. c. d. Straight-line depreciation no yes yes no ANSWER: c Factory insurance no no yes yes Units-of-production depreciation no yes no no EASY 3–1 3–2 5. Chapter 3 An example of a fixed cost is a. b. c. d. total indirect material cost. total hourly wages. cost of electricity. straight-line depreciation. ANSWER: 6. EASY expired cost. fixed cost. variable cost. mixed cost. ANSWER: b EASY A(n) ________ cost increases or decreases in intervals as activity changes. a. b. c. d. historical cost fixed cost step cost budgeted cost ANSWER: 8. d A cost that remains constant in total but varies on a per-unit basis with changes in activity is called a(n) a. b. c. d. 7. Organizational Cost Flows c EASY When the number of units manufactured increases, the most significant change in unit cost will be reflected as a(n) a. b. c. d. increase in the fixed element. decrease in the variable element. increase in the mixed element. decrease in the fixed element. ANSWER: d EASY Chapter 3 9. Organizational Cost Flows Which of the following always has a direct cause-effect relationship to a cost? a. b. c. d. Predictor yes yes no no ANSWER: 10. MEDIUM causes fixed costs to rise because of production changes. has a direct cause-effect relationship to a cost. can predict the cost behavior of a variable, but not a fixed, cost. is an overhead cost that causes distribution costs to change in distinct increments with changes in production volume. ANSWER: b EASY Product costs are deducted from revenue a. b. c. d. as expenditures are made. when production is completed. as goods are sold. to minimize taxable income. ANSWER: 12. c Cost driver yes no yes no A cost driver a. b. c. d. 11. 3–3 c EASY A selling cost is a(n) a. b. c. d. product cost yes yes no no ANSWER: c period cost yes no yes yes EASY inventoriable cost no no no yes 3–4 13. Chapter 3 Which of the following is not a product cost component? a. b. c. d. rent on a factory building indirect production labor wages janitorial supplies used in a factory commission on the sale of a product ANSWER: 14. EASY are generally expensed in the same period in which they are incurred. are always variable costs. remain unchanged over a given period of time. are associated with the periodic inventory method. ANSWER: a EASY Period costs include a. b. c. d. distribution costs yes no no yes ANSWER: 16. d Period costs a. b. c. d. 15. Organizational Cost Flows a outside processing costs no yes no yes sales commissions yes yes no yes EASY The three primary inventory accounts in a manufacturing company are a. b. c. d. Merchandise Inventory, Supplies Inventory, and Finished Goods Inventory. Merchandise Inventory, Work in Process Inventory, and Finished Goods Inventory. Supplies Inventory, Work in Process Inventory, and Finished Goods Inventory. Raw Material Inventory, Work in Process Inventory, and Finished Goods Inventory. ANSWER: d EASY Chapter 3 17. Organizational Cost Flows Cost of Goods Sold is an a. b. c. d. unexpired product cost. expired product cost. unexpired period cost. expired period cost. ANSWER: 18. period costs. prime costs. overhead costs. conversion costs. ANSWER: EASY direct labor. direct material. factory depreciation. supervisors’ salaries. ANSWER: b EASY Conversion of inputs to outputs is recorded in the a. b. c. d. Work in Process Inventory account. Finished Goods Inventory account. Raw Material Inventory account. both a and b. ANSWER: 21. c Conversion cost does not include a. b. c. d. 20. EASY The indirect costs of converting raw material into finished goods are called a. b. c. d. 19. b a EASY The distinction between direct and indirect costs depends on whether a cost a. b. c. d. is controllable or non-controllable. is variable or fixed. can be conveniently and physically traced to a cost object under consideration. will increase with changes in levels of activity. ANSWER: c MEDIUM 3–5 3–6 22. Chapter 3 GSWS is a construction company that builds houses on special request. What is the proper classification of the carpenters’ wages? a. b. c. d. Product yes yes no no ANSWER: 23. Direct no no yes yes ANSWER: Direct no yes no yes EASY Fixed no yes yes no d EASY Which of the following costs would be considered overhead in the production of chocolate chip cookies? a. b. c. d. flour chocolate chips sugar oven electricity ANSWER: 25. b Period yes no no yes GSWS is a construction company that builds houses on special request. What is the proper classification of the cost of the cement building slab used? a. b. c. d. 24. Organizational Cost Flows d EASY All costs related to the manufacturing function in a company are a. b. c. d. prime costs. direct costs. product costs. conversion costs. ANSWER: c EASY Chapter 3 26. Organizational Cost Flows Prime cost consists of a. b. c. d. direct material no yes yes no ANSWER: 27. prime cost no yes yes yes ANSWER: overhead no no yes yes EASY d product cost yes no yes yes direct cost yes yes no yes fixed cost yes no yes no EASY GSWS is a construction company that builds houses on special request. What is the proper classification of indirect material used? a. b. c. d. Prime no no yes yes ANSWER: 29. b direct labor yes yes no yes Plastic used to manufacture dolls is a a. b. c. d. 28. 3–7 Conversion no yes yes no b Variable no yes yes no EASY The term “prime cost” refers to a. b. c. d. all manufacturing costs incurred to produce units of output. all manufacturing costs other than direct labor and raw material costs. raw material purchased and direct labor costs. the raw material used and direct labor costs. ANSWER: d EASY 3–8 30. Chapter 3 In a perpetual inventory system, the sale of items for cash consists of two entries. One entry is a debit to Cash and a credit to Sales. The other entry is a debit to a. b. c. d. Work in Process Inventory and a credit to Finished Goods Inventory. Finished Goods Inventory and a credit to Cost of Goods Sold. Cost of Goods Sold and a credit to Finished Goods Inventory. Finished Goods Inventory and a credit to Work in Process Inventory. ANSWER: 31. b. c. d. EASY beginning Work in Process Inventory plus purchases of raw material minus ending Work in Process Inventory. beginning Work in Process Inventory plus direct labor plus direct material used plus overhead incurred minus ending Work in Process Inventory. direct material used plus direct labor plus overhead incurred. direct material used plus direct labor plus overhead incurred plus beginning Work in Process Inventory. ANSWER: b EASY The final figure in the Schedule of Cost of Goods Manufactured represents the a. b. c. d. cost of goods sold for the period. total cost of manufacturing for the period. total cost of goods started and completed this period. total cost of goods completed for the period. ANSWER: 33. c The formula to compute cost of goods manufactured is a. 32. Organizational Cost Flows d EASY The formula for cost of goods sold for a manufacturer is a. b. c. d. beginning Finished Goods Inventory plus Cost of Goods Manufactured minus ending Finished Goods Inventory. beginning Work in Process Inventory plus Cost of Goods Manufactured minus ending Work in Process Inventory. direct material plus direct labor plus applied overhead. direct material plus direct labor plus overhead incurred plus beginning Work in Process Inventory. ANSWER: a EASY Chapter 3 34. Organizational Cost Flows Which of the following replaces the retailing component “Purchases” in computing Cost of Goods Sold for a manufacturing company? a. b. c. d. direct material used cost of goods manufactured total prime cost cost of goods available for sale ANSWER: 35. b EASY Which of the following would need to be allocated to a cost object? a. b. c. d. direct material direct labor direct production costs indirect production costs ANSWER: 36. 3–9 d EASY Sonja Svenson earns $8 per hour and is paid time-and-a-half for work in excess of 40 hours per week. During a given week, she works 45 hours. How much of her week’s wages should be charged to overhead? a. b. c. d. $0 $20 $40 $60 ANSWER: b EASY Use the following information for questions 37–40. The following information has been taken from the cost records of T Co. for the past year: Raw material used in production Total manufacturing costs charged to production during the year (includes direct material, direct labor, and overhead equal to 60% of direct labor cost) Cost of goods available for sale Selling and Administrative expenses Inventories Raw Material Work in Process Finished Goods Beginning $75 80 90 Ending $ 85 30 110 $326 686 826 25 3–10 37. Chapter 3 The cost of raw material purchased during the year was a. b. c. d. $316. $336. $360. $411. ANSWER: 38. $135. $216. $225. $360. ANSWER: c EASY Cost of Goods Manufactured was a. b. c. d. $636. $716. $736. $766. ANSWER: 40. MEDIUM Direct labor cost charged to production during the year was a. b. c. d. 39. b c MEDIUM Cost of Goods Sold was a. b. c. d. $691. $716. $736. $801. ANSWER: b MEDIUM Organizational Cost Flows Chapter 3 Organizational Cost Flows 3–11 Use the following information for questions 41–44. BCW Co. manufactures wood file cabinets. The following information is available for June 2001: Raw Material Inventory Work in Process Inventory Finished Goods Inventory 41. $58,500 $46,500 $43,500 $43,100 ANSWER: c MEDIUM Direct labor is paid $9.60 per hour and overhead for the month was $9,600. What are prime costs and conversion costs, respectively if there were 1,500 direct labor hours and $21,000 of raw material was purchased? a. b. c. d. $29,100 and $33,900 $33,900 and $24,000 $33,900 and $29,100 $24,000 and $33,900 ANSWER: 43. Ending $ 7,500 11,700 16,300 Direct labor is $9.60 per hour and overhead for the month was $9,600. Compute total manufacturing costs for June, if there were 1,500 direct labor hours and $21,000 of raw material was purchased. a. b. c. d. 42. Beginning $ 6,000 17,300 21,000 b MEDIUM Direct labor is paid $9.60 per hour and overhead for the month was $9,600. Cost of Goods Manufactured, if there were 1,500 direct labor hours and $21,000 of raw material was purchased is a. b. c. d. $49,100. $45,000. $51,000. $49,500. ANSWER: a MEDIUM 3–12 44. Chapter 3 Direct labor is paid $9.60 per hour and overhead for the month was $9,600. Cost of Goods Sold, if there were 1,500 direct labor hours and $21,000 of raw material was purchased is a. b. c. d. $64,500. $59,800. $38,800. $53,800. ANSWER: 45. MEDIUM $26,400. $34,100. $37,300. $29,600. ANSWER: a EASY If raw material used was $80,000 and Raw Material Inventory at the beginning and end of the period, respectively, was $17,000 and $21,000, what was raw material purchases? a. b. c. d. $76,000 $118,000 $84,000 $101,000 ANSWER: 47. d The beginning balance of Raw Material Inventory was $4,500; raw material purchases of $29,600 were made during the month. At month end, $7,700 of raw material was on hand. Raw material used during the month was a. b. c. d. 46. Organizational Cost Flows c EASY What is the beginning balance of Finished Goods Inventory if Cost of Goods Sold is $107,000; the ending balance of Finished Goods Inventory is $20,000; and Cost of Goods Manufactured is $50,000 less than Cost of Goods Sold? a. b. c. d. $70,000 $77,000 $157,000 $127,000 ANSWER: a EASY Chapter 3 Organizational Cost Flows 3–13 Use the following information pertaining to Arp Co.’s manufacturing operations for questions 48–50. Inventories: Raw material Work in process Finished goods March 1 $18,000 9,000 27,000 Additional information for March: Raw material purchased Direct labor payroll Direct labor rate per hour Overhead rate per direct labor hour 48. For March, prime cost incurred was a. b. c. d. $75,000. $69,000. $45,000. $39,000. ANSWER: 49. EASY For March, conversion cost incurred was a. b. c. d. $30,000. $40,000. $70,000. $72,000. ANSWER: 50. a c EASY For March, Cost of Goods Manufactured was a. b. c. d. $118,000. $115,000. $112,000. $109,000. ANSWER: a EASY March 31 $15,000 6,000 36,000 $42,000 30,000 7.50 10.00 3–14 51. Chapter 3 Since overhead costs are indirect costs, a. b. c. d. they require some process of allocation. they can be easily traced to production. a predetermined overhead rate is not advantageous. they cannot be allocated. ANSWER: 52. direct yes yes no no ANSWER: EASY indirect yes no no yes d EASY An actual cost system differs from a normal cost system in that an actual cost system a. b. c. d. assigns overhead as it occurs during the manufacturing cycle. assigns overhead at the end of the manufacturing process. does not assign overhead at all. does not use an Overhead Control account. ANSWER: 54. a Cost allocation is the assignment of ______ costs to one or more products using a reasonable basis. a. b. c. d. 53. Organizational Cost Flows b EASY In a normal cost system, which of the following is used? a. b. c. d. Actual direct materials yes yes yes no ANSWER: c EASY Actual direct labor no yes yes yes Actual overhead yes yes no no Chapter 3 55. Organizational Cost Flows Predetermined overhead rates are computed based on a. b. c. d. estimated overhead costs yes yes no no ANSWER: 56. EASY because of seasonal variability of overhead costs. to help budget overhead costs. to minimize the overhead cost assigned to products. to maximize the overhead cost assigned to products. ANSWER: a EASY Which of the following is not a reason to use predetermined overhead rates? a. b. c. d. to overcome the problems of assigning overhead to diverse types of products to compensate for fluctuations in monthly overhead costs to provide a means for assigning overhead during the period rather than at the end of the period to smooth out the amount of overhead cost assigned to products when monthly production activity differs ANSWER: 58. a estimated level of activity yes no yes no One reason annual overhead application rates are used is a. b. c. d. 57. 3–15 a MEDIUM When a manufacturing company has a highly automated manufacturing plant producing many different products, which of the following is the more appropriate basis of applying manufacturing overhead costs to work in process? a. b. c. d. direct labor hours direct labor dollars machine hours cost of materials used ANSWER: c EASY 3–16 59. Chapter 3 A mixed cost has which of the following components? a. b. c. d. Variable component yes yes no no ANSWER: 60. fixed costs. total cost. variable costs. mixed costs. ANSWER: b EASY In the formula y = a + bX, a represents a. b. c. d. mixed cost. variable cost. total cost. fixed cost. ANSWER: 62. EASY In the formula y = a + bX, y represents a. b. c. d. 61. b Fixed component no yes no yes d EASY In relationship to changes in activity, variable overhead changes a. b. c. d. in total no no yes yes ANSWER: per unit no yes yes no d EASY Organizational Cost Flows Chapter 3 63. Organizational Cost Flows In relationship to changes in activity, fixed overhead changes a. b. c. d. in total yes no no yes ANSWER: 64. EASY c EASY Weaknesses of the high-low method include all of the following except a. b. c. d. only two observations are used to develop the cost function. the high and low activity levels may not be representative. the method does not detect if the cost behavior is nonlinear. the mathematical calculations are relatively complex. ANSWER: d EASY If there is no “a” value in a linear cost equation, this is an indication that the cost is a. b. c. d. fixed. mixed. variable. either fixed or mixed. ANSWER: 67. c variable cost per unit and total fixed costs increase. fixed cost per unit and total variable cost increase. total cost will increase and fixed cost per unit will decrease. variable cost per unit and total cost increase. ANSWER: 66. per unit yes no yes no If the level of activity increases, a. b. c. d. 65. 3–17 c EASY An outlier is a. b. c. d. something that happens outside the organization that does not affect production. always used in analyzing a mixed cost. something that happens inside the organization that does not affect production. never used in analyzing a mixed cost. ANSWER: d EASY 3–18 68. Chapter 3 Applied overhead consists of which of the following? a. b. c. d. actual activity times predetermined overhead rate estimated activity times predetermined overhead rate actual activity times actual overhead rate estimated activity times actual overhead rate ANSWER: 69. EASY actual overhead. applied overhead. both would receive an equal number of debits. impossible to determine without additional information. ANSWER: a EASY If underapplied overhead is considered to be immaterial, it is closed to which of the following accounts? a. b. c. d. Work in Process yes no yes no ANSWER: 71. a If a company used two overhead accounts (actual overhead and applied overhead), the one that would receive the most debits would be a. b. c. d. 70. Organizational Cost Flows d Finished Goods yes yes no no Cost of Goods Sold yes yes no yes EASY All other things being equal, if actual cost per unit is greater than budgeted cost per unit, variable overhead will be a. b. c. d. overapplied. the same as fixed overhead. underapplied. applied to Finished Goods. ANSWER: c EASY Chapter 3 72. Organizational Cost Flows Overapplied overhead will result if a. b. c. d. the plant is operated at less than expected capacity. overhead costs incurred were greater than estimated overhead costs. overhead costs incurred were less than overhead costs charged to production. overhead costs incurred were greater than overhead charged to production. ANSWER: 73. Overhead is underapplied overapplied overapplied underapplied ANSWER: EASY a Cost of Goods Sold will increase decrease increase decrease EASY If actual overhead is less than applied overhead, which of the following will be true? Upon closing, a. b. c. d. Overhead is underapplied underapplied overapplied overapplied ANSWER: 75. c Actual overhead exceeds applied overhead and the amount is immaterial. Which of the following will be true? Upon closing, a. b. c. d. 74. 3–19 d Cost of Goods Sold is credited debited debited credited EASY An item or event that has a cause-effect relationship with the incurrence of a variable cost is called a a. b. c. d. mixed cost. predictor. direct cost. cost driver. ANSWER: d EASY 3–20 76. Chapter 3 Organizational Cost Flows Caty Weymann owns a tailor shop and has gathered information on utility costs for the past year. She has decided that utilities are a function of the hours worked during the month. The following information is available and representative of her utility costs: Low point High point Hours worked 1,300 1,680 Utility cost incurred $ 903 1,074 If 1,425 hours are worked in a month, total utility cost (rounded to the nearest dollar) using the high-low method should be a. b. c. d. $947. $954. $959. $976. ANSWER: 77. c MEDIUM Nevada Company uses a predetermined overhead application rate of $.30 per direct labor hour. During the year it incurred $345,000 dollars of actual overhead, but it planned to incur $360,000 of overhead. The company applied $363,000 of overhead during the year. How many direct labor hours did the company plan to incur? a. b. c. d. 1,150,000 1,190,000 1,200,000 1,210,000 ANSWER: c EASY Chapter 3 78. Organizational Cost Flows 3–21 Smith Machinery had the following experience regarding power costs: Month Jan. Feb. Mar. Apr. Machine hours 300 600 400 200 Power cost $680 720 695 640 Assume that management expects 500 machine hours in May. Using the high-low method, calculate May’s power cost using machine hours as the basis for prediction. a. b. c. d. $700 $705 $710 $1,320 ANSWER: 79. a EASY Ashley Co. has developed the following flexible budget formula for monthly overhead: For output of less than 200,000 units: For output of 200,000 units or more: $36,600 + $.80(units) $43,000 + $.80(units) How much overhead should Ashley expect if the firm plans to produce 200,000 units? a. b. c. d. $52,600 $59,000 $196,600 $203,000 ANSWER: 80. d EASY Sams Co. wants to develop a single predetermined overhead rate. The company’s expected annual fixed overhead is $340,000 and its variable overhead cost per machine hour is $2. The company’s relevant range is from 200,000 to 600,000 machine hours. Sams expects to operate at 425,000 machine hours for the coming year. The plant’s theoretical capacity is 850,000. The predetermined overhead rate per machine hour should be a. b. c. d. $2.40. $2.57. $2.80. $2.85. ANSWER: c EASY 3–22 Chapter 3 Organizational Cost Flows The following information relates to Ciulla Co. and should be used for questions 81–82. Month Jan. Feb. Mar. Apr. May 81. Cost $750 775 550 650 570 Using the high-low method, what is the variable cost element? a. b. c. d. $1.02 $.98 $1.31 $1.19 ANSWER: 82. Usage 600 650 420 500 450 b EASY Using the high-low method, what is the fixed cost element (to the nearest whole dollar)? a. b. c. d. $225 $138 $411 $364 ANSWER: b EASY Use the following information for questions 83–86. The records of XYZ Co. revealed the following data for 2001: Work in Process Finished Goods Cost of Goods Sold Direct Labor Direct Material $ 73,150 115,000 133,650 111,600 84,200 Chapter 3 83. Organizational Cost Flows Assume, for this question only, actual overhead is $98,700 and applied overhead is $93,250. Manufacturing Overhead is a. b. c. d. overapplied by $12,900. underapplied by $18,350. overapplied by $5,450. underapplied by $5,450. ANSWER: 84. b. c. d. EASY Debit Work in Process $8,456; Finished Goods $13,294; Cost of Goods Sold $15,450 and credit Overhead $37,200 Debit Overhead $37,200 and credit Work in Process $8,456; Finished Goods $13,294; Cost of Goods Sold $15,450 Debit Work in Process $37,200 and credit Overhead $37,200 Debit Cost of Goods Sold $37,200 and credit Overhead $37,200 ANSWER: a MEDIUM Assume that XYZ has underapplied overhead of $10,000 for 2001 and that this amount is immaterial. What is the balance in Cost of Goods Sold after the underapplied overhead is closed? a. b. c. d. $133,650 $123,650 $143,650 $137,803 ANSWER: 86. d Assume that XYZ has underapplied overhead of $37,200 for 2001 and that this amount is material. What journal entry is needed to close the Overhead account? (Round decimals to nearest whole percent.) a. 85. 3–23 c EASY Assume that XYZ has overapplied overhead of $25,000 for 2001 and that this amount is material. What is the balance in Cost of Goods Sold after the overapplied overhead is closed? a. b. c. d. $123,267 $144,033 $158,650 $108,650 ANSWER: a MEDIUM 3–24 87. Chapter 3 Organizational Cost Flows Smart Company is relocating its facilities. The company estimates that it will take three trucks to move office contents. If the per truck rental charge is $1,000 plus 25 cents per mile, what is the expected cost to move 800 miles? a. b. c. d. $1,000 $1,200 $2,400 $3,600 ANSWER: d EASY Use the following information for questions 88 and 89. Danny’s Crushing Service provided the following information: Monthly handling cost $19,000 $23,700 $30,000 88. Using the high-low method, how much of Danny’s handling cost is made up of fixed costs? a. b. c. d. $9,000 $8,000 $7,250 $11,000 ANSWER: 89. Miles traveled 20,000 28,000 40,000 b EASY Using the high-low method, what would Danny expect handling costs to be in a month in which 32,000 miles are traveled? a. b. c. d. $25,600 $25,800 $26,050 $17,600 ANSWER: a EASY Chapter 3 90. Organizational Cost Flows 3–25 (Appendix) The following information pertains to data that have been gathered in the process of estimating a simple least squares regression: Mean value of the dependent variable Mean value of the independent variable Coefficient of the independent variable Number of observations 30 10 3 12 What is the “a” value for the least squares regression model? a. b. c. d. 20 6 0 The intercept term cannot be computed from the information given. ANSWER: 91. MEDIUM (Appendix) In the equation y = $4,000 + $3X; y is the cost of workers’ compensation insurance and X is direct labor hours. According to this equation, a 100-hour change in total direct labor hours will change the cost of workers compensation insurance by a. b. c. d. $4,000. $300. $4,300. none of the above amounts. ANSWER: 92. c b MEDIUM (Appendix) In the equation y = $4,000 + $3X; y is the cost of workers’ compensation insurance and X is direct labor hours. Assume that the model is based on a least squares regression estimate. If the mean value of direct labor hours was 2,000 in the observations that were used to estimate the model’s parameters, what was the mean level of the cost of workers’ compensation insurance? a. b. c. d. $4,000 $2,000 $8,000 none of the above ANSWER: d MEDIUM 3–26 93. Chapter 3 Organizational Cost Flows In a high-low model, which months’ observations would be used to compute the model’s parameters? a. b. c. d. 2 and 5 1 and 6 2 and 6 4 and 5 Outboard Motor Co. is exploring different prediction models that can be used to forecast indirect labor costs. One independent variable under consideration is machine hours. Following are matching observations on indirect labor costs and machine hours for the past six months: Month 1 2 3 4 5 6 ANSWER: Machine hours 300 400 240 370 200 225 a EASY Indirect labor costs $20,000 $24,000 $17,000 $22,000 $13,000 $14,000 Chapter 3 Organizational Cost Flows 3–27 SHORT ANSWER/PROBLEMS 1. What is the difference between a product cost and a period cost? Give three examples of each. What is the difference between a direct cost and indirect cost? Give two examples of each. ANSWER: A product cost is one that is associated with making or acquiring inventory. A period cost is any cost other than those associated with making or acquiring products and is not considered inventory. Students will have a variety of examples, but direct material, direct labor, and overhead are product costs. Selling and administrative expenses are considered period costs. A direct cost is one that is physically and conveniently traceable to a cost object. Direct material and direct labor are direct costs. An indirect cost is one that cannot be conveniently traced to a cost object. Any type of overhead cost is considered indirect. MEDIUM 2. Define relevant range and explain its significance. ANSWER: The relevant range is that range of activity over which a variable cost remains constant on a per-unit basis and a fixed cost remains constant in total. Managers can review the various ranges of activity and the related effects on variable cost (per-unit) and fixed cost (in total) to determine how a change in the range will affect costs and, thus, the firm’s profitability. MEDIUM 3. Define a variable cost and a fixed cost. What causes changes in these costs? Give two examples of each. ANSWER: A variable cost is one that remains constant on a per-unit basis but varies in total with changes in activity. Examples of variable costs include direct material, direct labor, and (possibly) utilities. A fixed cost is one that remains constant in total but varies on a per-unit basis with changes in activity. Examples of fixed costs include straight-line depreciation, insurance, and the supervisor’s salary. MEDIUM 3–28 4. Chapter 3 Organizational Cost Flows Given the following information, prepare the necessary journal entries, assuming that the Raw Material Inventory account contains both direct and indirect material. a. b. c. d. e. f. Purchased raw material on account $28,500. Put material into production: $15,000 of direct material and $3,000 of indirect material. Accrued payroll of $90,000, of which 70 percent was direct and the remainder was indirect. Incurred and paid other overhead items of $36,000. Transferred items costing $86,500 to finished goods. Sold goods costing $71,300 on account for $124,700. ANSWER: a. b. c. d. e. f. MEDIUM RM Inventory A/P WIP Inventory Manufacturing OH RM Inventory WIP Inventory Manufacturing OH Salaries/Wages Payable Manufacturing OH Cash FG Inventory WIP Inventory A/R Sales CGS FG Inventory 28,500 28,500 15,000 3,000 18,000 63,000 27,000 90,000 36,000 36,000 86,500 86,500 124,700 124,700 71,300 71,300 Chapter 3 5. Organizational Cost Flows 3–29 Prepare a Schedule of Cost of Goods Manufactured (in good form) for the Bulls Company from the following information for June 2001: Inventories Raw Material Work in Process Finished Goods Beginning $ 6,700 17,700 29,730 Ending $ 8,900 22,650 19,990 Additional information: purchases of raw material were $46,700; 19,700 direct labor hours were worked at $11.30 per hour; overhead costs were $33,300. ANSWER: Bulls Company Schedule of Cost of Goods Manufactured For the Month Ended June 30, 2001 Work in Process (June 1) Raw Mat. (June 1) Purchases Raw Mat. Available Raw Mat. (June 30) Raw Mat. Used Direct Labor (19,700 × $11.30) Manufacturing Overhead Total Manufacturing Costs Total Goods in Process Work in Process (June 30) Cost of Goods Manufactured MEDIUM $ 17,700 $ 6,700 46,700 53,400 (8,900 ) $ 44,500 222,610 33,300 300,410 $318,110 (22,650 ) $295,460 3–30 6. Chapter 3 Organizational Cost Flows In June 2001, the Bulls Company has Cost of Goods Manufactured of $296,000; beginning Finished Goods Inventory of $29,730; and ending Finished Goods Inventory of $19,990. Prepare an income statement in good form. (Ignore taxes.) The following additional information is available: Selling Expenses Administrative Expenses Sales $ 40,500 19,700 475,600 ANSWER: Bulls Company Income Statement For the Month Ended June 30, 2001 Sales Cost of Goods Sold: Finished Goods (June 1) Cost of Goods Mf’d Total Goods Available Finished Goods (June 30) Cost of Goods Sold Gross Margin Operating Expenses: Selling Administrative Total Operating Expenses Income from operations MEDIUM $475,600 $ 29,730 296,000 $325,730 (19,990 ) (305,740 ) $169,860 $40,500 19,700 (60,200 ) $109,660 Chapter 3 7. Organizational Cost Flows 3–31 The following information is for the Forte Company for November. Inventories Raw Material Work in Process Finished Goods Beginning $17,400 31,150 19,200 Direct Labor (21,000 DLH @ $13) Raw Material Purchases $120,000 Indirect Labor 11,200 Factory Supplies Used 350 Other Expenses: Depr.—Factory Equipment 17,300 Ending $13,200 28,975 25,500 Insurance—Office Office Supplies Expense Insurance—Factory Depr. Office Equipment Repair/Maintenance—Factory 2,570 900 1,770 3,500 7,400 Calculate total manufacturing costs, cost of goods manufactured, and cost of goods sold. ANSWER: Manufacturing Costs: Raw Material (Nov. 1) Purchases Raw Material Available Raw Material (Nov. 30) Raw Material Used Direct Labor (21,000 × $13) Overhead: Depr.—Factory Equipment Repairs/Maintenance—Factory Indirect Labor Insurance—Factory Factory Supplies Used Total Overhead Total Manufacturing Costs MEDIUM $ 17,400 120,000 $137,400 (13,200 ) $124,200 273,000 $17,300 7,400 11,200 1,770 350 38,020 $435,220 Cost of Goods Manufactured: Total Manufacturing Costs Work in Process (Nov. 1) Work in Process (Nov. 30) Cost of Goods Manufactured $435,220 31,150 (28,975 ) $437,395 Cost of Goods Sold: Finished Goods (Nov. 1) Cost of Goods Manufactured Total Goods Available Finished Goods (Nov. 30) Cost of Goods Sold $ 19,200 437,395 $456,595 (25,500 ) $431,095 3–32 8. Chapter 3 Organizational Cost Flows From the following information for the Harris Company, compute prime costs and conversion costs. Inventories Raw Material Work in Process Finished Goods Beginning $ 9,900 44,500 36,580 Ending $ 7,600 37,800 61,300 Raw material purchased during the period cost $40,800; overhead incurred and paid or accrued for the period was $21,750; and 23,600 direct labor hours were incurred at a rate of $13.75 per hour. ANSWER: Prime Costs: Raw Material (Beginning) Purchases Raw Material Available Raw Material (Ending) Raw Material Used Direct Labor Prime Costs $ 9,900 40,800 $50,700 (7,600 ) (23,600 × $13.75 ) Conversion Costs: Direct Labor (Above) Overhead Conversion Costs $ 43,100 324,500 $367,600 $324,500 21,750 $346,250 MEDIUM 9. What are three reasons that overhead must be allocated to products? ANSWER: Overhead must be allocated because it is necessary to (1) determine fill cost, (2) it can motivate managers, and (3) it allows managers to compare alternative courses of action. MEDIUM Chapter 3 10. Organizational Cost Flows 3–33 Why should predetermined overhead rates be used? ANSWER: Predetermined overhead rates should be used for three reasons: (1) to assign overhead to Work in Process during the production cycle instead of at the end of the period; (2) to compensate for fluctuations in actual overhead costs that have no bearing on activity levels; and (3) to overcome problems of fluctuations in activity levels that have no impact on actual fixed overhead costs. MEDIUM 11. Discuss underapplied and overapplied overhead and its disposition at the end of the period. ANSWER: During the course of the production cycle, actual overhead costs are incurred. When overhead is applied to Work in Process, it is commonly applied using a predetermined rate. Overhead application at a predetermined rate may cause overhead to be under- or overapplied. If actual overhead is greater than applied overhead, then underapplied overhead results and a debit balance exists in the overhead account. If applied overhead is greater than actual overhead, then overapplied overhead results and a credit balance exists in the overhead account. If the amount of under- or overapplied overhead is immaterial, it is closed directly to Cost of Goods Sold. If the amount is material, it must be allocated among Work in Process, Finished Goods, and Cost of Goods Sold. MEDIUM 12. Discuss the high-low method. ANSWER: The high-low method is a technique for analyzing mixed costs. The highlow method analyzes changes at two levels of activity (the high end and the low end) within the relevant range. The changes in cost and activity are calculated for these two levels of activity. Dividing the change in cost by the change in activity determines the variable cost element portion of the mixed cost. Once this is determined, the fixed portion is computed by subtracting the variable element times either the high or low level of activity from respectively, total cost at either the high or low level of activity. MEDIUM 3–34 13. Chapter 3 Organizational Cost Flows The Warren Co. has the following data for 2001: Direct Labor Direct Material Actual Overhead Applied Overhead Raw Material Work in Process Finished Goods Cost of Goods Sold $220,000 137,800 320,000 395,000 51,394 101,926 111,192 250,182 What is the amount of under- or overapplied overhead? Prepare the necessary journal entry to dispose of under- or overapplied overhead. ANSWER: Applied Overhead Actual Overhead $395,000 320,000 $ 75,000 overapplied WIP $101,926/$463,300=.22 × $75,000 = $16,500 FG $111,192/$463,300=.24 × $75,000 = $18,000 CGS $250,182/$463,300=.54 × $75,000 = $40,500 Manufacturing Overhead Work in Process Finished Goods Cost of Goods Sold MEDIUM $75,000 $16,500 18,000 40,500 Chapter 3 14. Organizational Cost Flows 3–35 The Ames Corp. has the following data relating to its power usage for the first six months of the current year. Month Jan. Feb. Mar. Apr. May June Usage 500 550 475 425 450 725 (Kw)Cost $450 455 395 310 380 484 Assume usage is within the relevant range of activity. Using the high-low method, compute the cost formula. Ames Corp. estimates its power usage for July at 660 watts; compute the total power cost for July. ANSWER: High Low Usage 725 425 300 Cost $484 310 $174 $174/300 = $.58 × 425 = $246.50 Total variable cost $310 (TC) – $246.50 (TVC) = $63.50 Fixed cost At 660 kw, the total cost would be $.58 × 660 = $382.80 (VC) + $63.50 (FC) = $446.30 MEDIUM 3–36 15. Chapter 3 Organizational Cost Flows The Volkers Co. applies overhead at the rate of 70 percent of direct labor. Volkers Co. incurred $450,000 of direct labor during 2001. Volkers incurred actual overhead of $367,000. (a) Compute the amount of under- or overapplied overhead for Volkers Co. for 2001. (b) Prepare the necessary journal entry to dispose of the under- or overapplied overhead (assuming that the amount is immaterial). ANSWER: a. $450,000 × 70% = $315,000 applied overhead 367,000 actual overhead $ 52,000 underapplied overhead b. Cost of Goods Sold Manufacturing Overhead EASY $52,000 $52,000 Chapter 3 16. Organizational Cost Flows 3–37 Temporary Training, Inc., provides a personalized training program that is popular with many companies. The number of programs offered over the last five months, and the costs of offering these programs are as follows: June July Aug. Sept. Oct. a. b. Programs Offered 55 45 60 50 75 Costs Incurred $15,400 14,050 18,000 14,700 19,000 Using the high-low method, compute the variable cost per program and the total fixed cost per month. (Appendix) Using the least squares regression method, compute the variable cost per program and the total fixed cost per month. ANSWER: a. Variable cost per program: Change in costs Change in activity $19,000 – $14,050 = $165 per program 75 – 45 Fixed cost: At high activity = $19,000 – (75 × $165) = $6,625 per month At low activity = $14,050 – (45 × $165) = $6,625 per month b. x 55 45 60 50 75 285 y $15,400 14,050 18,000 14,700 19,000 $81,150 xy $ 847,000 632,250 1,080,000 735,000 1,425,000 $4,719,250 x2 3,025 2,025 3,600 2,500 5,625 16,775 x bar = 57 y bar = 16,230 b = 4,719,250 – 5(57)($16,230) divided by 16,775 – 5(57)(57) b = 176.79 a = 16,230 – (176.79)(57) a = 6,152.97 MEDIUM 3–38 17. Chapter 3 Organizational Cost Flows (Appendix) The facility manager asked for information to help in forecasting handling costs. The following printout was generated using the least squares regression method. Fixed cost Variable cost per unit Activity variable a. b. $2550 1.85 units of production volume Using the information from the printout, develop a cost function that can be used to estimate handling costs at different volume levels. Estimate handling costs if expected production for next month is 20,000 units. ANSWER: a. Total handling costs = $2,550 + $1.85 (unit production) b. Total handling costs = $2,550 + ($1.85 × 20,000) = $39,550 MEDIUM Chapter 3 18. Organizational Cost Flows 3–39 The Jason Co. has the following information available regarding costs and revenues for two recent months. Selling price is $20. Sales revenue Cost of goods sold Gross profit Less other expenses: Advertising Utilities Salaries and commissions Supplies (bags, cleaning supplies etc.) Depreciation Administrative costs Total Net income April $60,000 –36,000 $24,000 May $100,000 – 60,000 $ 40,000 $ $ 600 4,200 3,200 320 2,300 1,900 –12,520 $11,480 600 5,600 4,000 400 2,300 1,900 –14,800 $25,200 Required: a. Identify each of the company’s expenses (including cost of goods sold) as being either variable, fixed, or mixed. b. By use of the high-low method, separate each mixed expense into variable and fixed elements. State the cost formula for each mixed expense. c. What is the total cost equation? d. Estimate total cost if sales = $75,000. 3–40 Chapter 3 Organizational Cost Flows ANSWER: a. Cost Cogs Advertising Utilities Salaries, Etc. Supplies Depreciation Administration b. Utilities $1,400 $40,000 April 36,000/60,000=60% 600 4,200/60,000= 7% 3,200/60,000=5.3% 320/60,000 .53% 2,300 1,900 May 60,000/100,000=60% 600 5,600/100,000=5.6% 4,000/100,000=4% 400/100,000=.4% 2,300 1,900 = 3.5% Sales FC = $4,200 – (3.5% × 60,000) = $2,100 Salaries $800/$40,000 = 2% Sales FC = $3,200 – (2% × 60,000) = $2,000 Supplies $80/$40,000 = .2% sales FC = $320 – (.2% × $60,000) = $200 c. Total FC = $600 + $2,300 + $1,900 + $2,100 + $2,000 + $200 = $9,100 Total VC = 60% + 3.5% + 2% + .2% = 65.7% sales TC = $9,100 + 65.7% sales d. TC = $9100 + (65.7% × $75,000) = $58,375 MEDIUM Behavior V F M M M F F Chapter 3 19. Organizational Cost Flows 3–41 The following miscellaneous data has been collected for a manufacturing company for the year ended 12/31/01. Inventories: Raw material Work in process Finished goods Beginning $50,000 40,000 60,000 Costs recorded during the year: Purchases of raw material Direct labor Cost of goods sold $195,000 150,000 595,000 Ending $55,000 45,000 50,000 Required: Prepare a cost of goods manufactured statement showing how all unknown amounts were determined. ANSWER: BEGIN WIP + DM (1) + DC + OH – END WIP = COGM (2) $ 40,000 190,000 150,000 ? (45000 ) $585,000 (1) BEG RM + PURCHASE – END RM = DM $ 50,000 195,000 (55,000 ) $190,000 (2) BEGIN FG + COGM – END FG = COGS $ 60,000 ? (50,000 ) $595,000 MEDIUM = $250,000 = $585,000 3–42 20. Chapter 3 Organizational Cost Flows (Appendix) A company owns two automobiles that are used by employees on company business, usually for short trips. Mileage and expenses, excluding depreciation, by quarters were as follows during a typical year (quarters instead of months are used to simplify the arithmetic): Quarter First Second Third Fourth Mileage 3,000 3,500 2,000 3,500 12,000 Expenses $ 550 560 450 600 $2,160 Required: Determine the variable cost per mile (nearest tenth of a cent) and the fixed costs per quarter, using the method of lease squares. ANSWER: ST 1 2ND 3RD 4TH X 3,000 3,500 2,000 3,500 12,000 Y $550 560 450 600 $2,160 XY $1,650,000 1,960,000 900,000 2,100,000 $6,610,000 _ X = 12,000/4 = 3,000/miles per quarter _ Y = $2,160/4 = $540 b = $6,610,000 – 4 (3,000) ($540) = $130,000 = $.087/mile $37,500,000 – 4 (3,000) (3,000) $1,500,000 a = $540 – ($.087) (3,000) = $279 TC = $279 + .087/mile MEDIUM X2 9,000,000 12,250,000 4,000,000 12,250,000 37,500,000 Chapter 3 21. Organizational Cost Flows 3–43 In cost accounting we have three inventory accounts with which to work. Describe in terms of the “cost accounting cycle” how these accounts relate to each other and how the product costs flow through the accounts. In your answer name the inventory accounts and the product costs. ANSWER: Material purchased from outside goes to RM inventory. When work is being done, costs are accumulated in WIP inventory. When goods are finished but not yet sold, costs are transferred to FG inventory. There are three product costs: Direct material—as material is needed in the production process, it is requisitioned from RM inventory and transferred to WIP inventory. Direct labor—cost of converting RM to FG. It is determined from an analysis of time cards and tickets. OH—at the beginning of the period Estimated OH to get a predetermined Estimated Activity rate used to apply OH to production. OH app = Rate × actual activity MEDIUM 3–44 22. Chapter 3 Organizational Cost Flows The following information was taken from the records of the Ucandu Corporation for the month of January 2001. (There were no inventories of work in process or finished goods on January 1.) Sales during month Manufacturing costs for month: Direct material Direct labor Overhead costs applied Overhead costs under-applied Inventories, January 31: Work in process Finished goods Units 8,000 Cost $ ? 32,000 20,000 15,000 800 1,000 2,000 ? ? Indirect manufacturing costs are applied on a direct labor cost basis. The under-applied balance is due to seasonal variations and will be carried forward. The following cost estimates have been submitted for the work in process inventory of January 31: material, $3,000; direct labor, $2,000. Required: a. Determine the number of units that were completed and transferred to finished goods during the month. b. Complete the estimate of the cost of work in process on January 31. c. Prepare a manufacturing statement for the month. d. Determine the cost of each unit completed during the month. e. Determine the total amount debited to the Overhead Control accounts during the month. Chapter 3 Organizational Cost Flows 3–45 ANSWER: a. 8,000 SOLD + 2,000 ENDING FG = 10,000 UNITS b. DM DC OH $3,000 2,000 1,500 $6,500 $15,000 × $2,000 $20,000 c. DM DL OH – END WIP = COGM d. COGM/COMPLETE UNITS = e. OH APPLIED + OH UNDERAPPLIED ACTUAL OH MEDIUM $32,000 20,000 15,000 (6,500 ) $60,500 $ 60,500 = $6.05/UNIT 10,000 UNITS $15,000 800 $15,800 3–46 23. Chapter 3 Organizational Cost Flows The Jones Co. had the following account balances: Raw Material Bal. 1/1 Debits Bal. 12/31 30,000 420,000 Manufacturing Overhead Credits ? Debits Bal. 12/31 70,000 320,000 110,000 400,000 Credits ? Factory Wages Payable 810,000 Debits 179,000 Bal.1/1 Credits Bal. 12/31 10,000 175,000 6,000 ? Finished Goods Bal. 1/1 Credits 60,000 Work in Process Bal. 1/1 Direct material Direct labor Overhead 385,000 40,000 Cost of Goods Sold Credits Debits ? ? Debits ? Bal. 12/31 130,000 Required: a. What was the cost of raw material put into production during the year? b. How much of the material from question 1 consisted of indirect material? c. How much of the factory labor cost for the year consisted of indirect labor? d. What was the cost of goods manufactured for the year? e. What was the cost of goods sold for the year (before considering under- or overapplied overhead)? f. If overhead is applied to production on the basis of direct material, what rate was in effect during the year? g. Was manufacturing overhead under- or overapplied? By how much? h. Compute the ending balance in the Work in Process Inventory account. Assume that this balance consists entirely of goods started during the year. If $32,000 of this balance is direct material cost, how much of it is direct labor cost? Manufacturing overhead cost? Chapter 3 Organizational Cost Flows 3–47 ANSWER: a. $30,000 + $420,000 – $60,000 = $390,000 b. $390,000 – $320,000 DM = $70,000 c. $175,000 – $110,000 DL = $65,000 d. $810,000 e. $40,000 + $810,000 – $130,000 = $720,000 f. $400,000/$320,000 = 125% DM Cost g. OH Actual OH Applied OH Overapplied h. Beginning WIP + DM + DC + OH – Ending WIP = COGM MEDIUM $385,000 400,000 $ 15,000 $ 70,000 320,000 110,000 400,000 (90000 ) $810,000 DM DL (To Balance) FOH (1) End WIP $32000 18,000 40,000 $90,000 (1) $32,000 × 125% = $40,000 CHAPTER 4 ACTIVITY-BASED COST SYSTEMS FOR MANAGEMENT MULTIPLE CHOICE 1. An objective of activity-based management is to a. b. c. d. eliminate the majority of centralized activities in an organization. reduce or eliminate non-value-added activities incurred to make a product or provide a service. institute responsibility accounting systems in decentralized organizations. all of the above ANSWER: 2. Activity analysis yes no no yes ANSWER: a Cost driver analysis yes yes no no EASY Which of the following falls under the Activity-Based Management umbrella? a. b. c. d. Continuous improvement no yes yes no ANSWER: 4. EASY Which of the following is/are part of activity-based management? a. b. c. d. 3. b c Business process reengineering no no yes yes Activity-based costing yes no yes no EASY The sum of the non-value-added time and the value-added time equals a. b. c. d. inspection time. production time. the product life cycle. cycle time. ANSWER: d EASY 4–1 4–2 5. Chapter 4 Which of the following add customer value? a. b. c. d. setup time storage time idle time processing time ANSWER: 6. EASY idle time. storage time. non-value-added time. value-added time. ANSWER: c EASY When a firm redesigns a product to reduce the number of component parts, the firm is a. b. c. d. increasing consumer value. increasing the value added to the product. decreasing product variety. decreasing non-value-added costs. ANSWER: 8. d Lead time minus production time is equal to a. b. c. d. 7. Activity-Based Cost Systems for Management d MEDIUM Non-value-added activities that are necessary to businesses, but not costs that customers are willing to pay for are known as a. b. c. d. business-value-added activities. long-term variable activities. short-term variable activities. superior business activities. ANSWER: a MEDIUM Chapter 4 9. Activity-Based Cost Systems for Management Which of the following would not be considered a value-added activity in the preparation of a tax return? a. b. c. d. printing a copy of the return for the client printing a copy of the return for the IRS installing tax software checking for accuracy ANSWER: 10. Idle time yes no yes no ANSWER: EASY b Inspection time yes no no yes Transfer time no no yes yes EASY A process map a. b. c. d. should indicate only value-added activities. is also known as a detailed flowchart. should indicate only those steps/processes that are obvious in the production of goods/services. is also known as a value chart. ANSWER: 12. c Which of the following is considered a value-added activity? a. b. c. d. 11. 4–3 b EASY A value chart should include which of the following? a. b. c. d. Service time yes no yes yes ANSWER: d Inspection time no no yes yes EASY Transfer time yes yes no yes 4–4 13. Chapter 4 The actual time it takes to perform a specific task is called a. b. c. d. inspection time. service time. transfer time. quality time. ANSWER: 14. EASY bottlenecks. effectiveness. efficiency. quality. ANSWER: c EASY Which of the following is typically regarded as a cost driver in traditional accounting practices? a. b. c. d. number of purchase orders processed number of customers served number of transactions processed number of direct labor hours worked ANSWER: 16. b Manufacturing cycle efficiency is a measure of a. b. c. d. 15. Activity-Based Cost Systems for Management d EASY When a company is labor-intensive, the cost driver that is probably least significant would be a. b. c. d. direct labor hours. direct labor dollars. machine hours. cost of materials used. ANSWER: c EASY Chapter 4 17. Activity-Based Cost Systems for Management An activity driver is used for which of the following reasons? a. b. c. d. To measure demands yes yes no no ANSWER: 18. EASY any activity that can be used to predict cost changes. the attempt to control expenditures at a reasonable level. the person who gathers and transfers cost data to the management accountant. any activity that causes costs to be incurred. ANSWER: d MEDIUM Cost allocation bases in activity-based costing should be a. b. c. d. cost drivers. value-added activities. activity centers. processes. ANSWER: 20. a To measure resources consumed yes no yes no The term cost driver refers to a. b. c. d. 19. 4–5 a EASY Costs that are common to many different activities within an organization are known as ____________ costs. a. b. c. d. product- or process-level organizational-level batch-level unit-level ANSWER: b EASY 4–6 21. Chapter 4 In activity-based costing, cost reduction efforts are directed at specific a. b. c. d. cost categories. cost pools. processes. cost drivers. ANSWER: 22. EASY A batch cost no yes yes no ANSWER: c A value-added cost no yes no yes A production cost yes no yes yes EASY Which of the following have an impact on long-term variable costs? a. b. c. d. Product variety no no yes yes ANSWER: 24. d Setup time is a. b. c. d. 23. Activity-Based Cost Systems for Management d Product complexity no yes no yes Process complexity no yes yes yes MEDIUM In allocating variable costs to products, a. b. c. d. a volume-based cost driver should be used. direct labor hours should always be used as the allocation base. a company should use the same allocation base that it uses for fixed costs. a company should never use more than one cost driver. ANSWER: a EASY Chapter 4 25. Activity-Based Cost Systems for Management In which of the following areas does attribute-based costing (ABCII) employ detailed cost-benefit analyses relating to information on customer needs? a. b. c. d. Reliability no yes yes no ANSWER: 26. The choices are too numerous. The potential for errors is great. Only a small percentage of available choices is normally selected. All of the above are drawbacks. ANSWER: d MEDIUM Simultaneous engineering helps companies accomplish which of the following? a. b. c. d. Reduces product complexity no yes yes no ANSWER: 28. MEDIUM Which of the following is not a drawback of mass customization? a. b. c. d. 27. c Durability no no yes yes b Reduces process complexity no yes no yes EASY For traditional costing purposes, R&D costs are a. b. c. d. capitalized and allocated over the product life cycle. expensed as incurred. capitalized and amortized over three years. charged to the future accounting periods that receive the benefit of the R&D expenditures. ANSWER: b EASY 4–7 4–8 29. Chapter 4 An accounting system that focuses on transactions is a. b. c. d. an activity-based accounting system. a product life cycle costing system. a traditional accounting system. all of the above. ANSWER: 30. EASY activities. processes. departments. costs. ANSWER: d EASY Today, traditional accounting methods are a. b. c. d. still appropriate for financial reporting. still appropriate for providing useful cost information to internal managers. still appropriate for both internal and external financial reporting. outdated for all purposes. ANSWER: 32. c Traditionally, managers have focused cost reduction efforts on a. b. c. d. 31. Activity-Based Cost Systems for Management a EASY Product costing systems in use over the last 40 years a. b. c. d. concentrated on using multiple cost pools and cost drivers. were often technologically incapable of handling activity-based costing information. have generally been responsive to changes in the manufacturing environment. have been appropriate for managerial decision purposes as long as they met the requirements of generally accepted accounting principles. ANSWER: b MEDIUM Chapter 4 33. Activity-Based Cost Systems for Management Traditional overhead allocations result in which of the following situations? a. b. c. d. Overhead costs are assigned as period costs to manufacturing operations. High-volume products are assigned too much overhead, and low-volume products are assigned too little overhead. Low-volume products are assigned too much, and high-volume products are assigned too little overhead. The resulting allocations cannot be used for financial reports. ANSWER: 34. EASY over-costs the product under-costs the product has no effect the product cost cost per unit is unaffected by product volume ANSWER: a EASY Relative to traditional product costing, activity-based costing differs in the way costs are a. b. c. d. processed. allocated. benchmarked. incurred. ANSWER: 36. b Traditionally, overhead has been assigned based on direct labor hours or machine hours. What effect does this have on the cost of a high-volume item? a. b. c. d. 35. 4–9 b EASY Under activity-based costing, benchmarks for product cost should contain an allowance for a. b. c. d. idle time. idle time and scrap materials. spoilage. none of the above. ANSWER: d MEDIUM 4–10 37. Chapter 4 In activity-based costing, final cost allocations assign costs to a. b. c. d. departments. processes. products. activities. ANSWER: 38. d EASY In allocating fixed costs to products in activity-based costing, a. b. c. d. direct labor hours should always be used as the allocation base. a company should use the same allocation base that it uses for variable costs. a cost driver that is not volume-related should be used. machine hours should always be used. ANSWER: c MEDIUM Of the following, which is the best reason for using activity-based costing? a. b. c. d. to keep better track of overhead costs to more accurately assign overhead costs to cost pools so that these costs are better controlled to better assign overhead costs to products to assign indirect service overhead costs to direct overhead cost pools ANSWER: 41. EASY departments. processes. products. activities. ANSWER: 40. c In activity-based costing, preliminary cost allocations assign costs to a. b. c. d. 39. Activity-Based Cost Systems for Management c EASY ABC should be used in which of the following situations? a. b. c. d. single-product firms with multiple steps multiple-product firms with only a single process multiple-product firms with multiple processing steps in all manufacturing firms ANSWER: c EASY Chapter 4 42. Activity-Based Cost Systems for Management The overhead of American manufacturing firms has risen in recent years due to a. b. c. d. an increase in direct labor. an increase in product variety. the implementation of activity-based costing. the cost of product life cycle planning. ANSWER: 43. c MEDIUM Global competition has forced American industry to a. b. c. d. seek increased governmental regulation. improve product quality and customer service. narrow product lines. decrease its social responsibility. ANSWER: b EASY The costs of non-quality work do not include a. b. c. d. the cost of handling complaints. the cost of scrap. warranty costs. original design costs. ANSWER: 46. MEDIUM trace technology costs to products. promote excellence standards. identify only value-added activities. analyze performance problems. ANSWER: 45. b Activity-based costing and activity-based management are effective in helping managers do all of the following except a. b. c. d. 44. 4–11 d EASY In the “new era” of manufacturing, good performance indicators are a. b. c. d. production-based. sales-based. cost-based. consumer-based. ANSWER: d EASY 4–12 47. Chapter 4 Traditional standard costs are inappropriate measures for performance evaluation in the “new era” of manufacturing because they a. b. c. d. build in allowances for non-value-adding activities. are based on historical information. don’t reflect current costs. are ideal goals. ANSWER: 48. MEDIUM the product life cycle. lead time. production time. value-added time. ANSWER: b EASY For one product that a firm produces, the manufacturing cycle efficiency is 20 percent. If the total production time is 12 hours, what is the total manufacturing time? a. b. c. d. 15.0 hours 60.0 hours 12.0 hours 2.4 hours ANSWER: 50. a The amount of time between the development and the production of a product is a. b. c. d. 49. Activity-Based Cost Systems for Management b EASY Activity analysis allows managers to a. b. c. d. classify activities so that processes can be eliminated. devise ways to minimize or eliminate non-value-added activities. evaluate process performance to gain competitive advantages. all of the above. ANSWER: b EASY Chapter 4 51. Activity-Based Cost Systems for Management Which of the following statements about business-value-added activities (BVAs) is true? a. b. c. d. BVAs reflect the same processes in all organizations. A process map will not reflect BVAs because such activities are not essential to process performance. BVAs are actually value-added activities of an organization that relate to administrative processes. It is impossible to eliminate all BVAs in an organization. ANSWER: 52. MEDIUM all steps in a process and the time it takes for them to be completed. the value-added steps in a process and the time it takes for them to be completed. the time and cost of all value-added steps in a process. the time and costs of all value-added and non-value-added steps in a process. ANSWER: a MEDIUM In the pharmaceutical or food industries, quality control inspections would most likely be viewed as a. b. c. d. non-value-added activities. business-value-added activities. value-added-activities. process-efficiency activities. ANSWER: 54. d A value chart indicates a. b. c. d. 53. 4–13 c DIFFICULT A just-in-time manufacturing process should have substantially less of which of the following than a traditional manufacturing process? a. b. c. d. Idle time yes yes yes no ANSWER: c Transfer time yes no yes yes DIFFICULT Value-added time yes no no yes Cycle time yes yes yes no 4–14 55. Chapter 4 Manufacturing cycle efficiency should be increased by employing which of the following techniques? a. b. c. d. JIT Inventory yes yes no yes ANSWER: 56. Batch Manufacturing yes no no yes MEDIUM all cost drivers identified should be used for cost accumulation. the cost of measuring a driver does not exceed the benefits of using it. only costs occurring at the unit-level should be assigned to products or services. organizational/facility costs are non-value-added and should never be assigned to products or services. ANSWER: b MEDIUM When cost driver analysis is used, organizational profit or loss can be determined by subtracting a. b. c. d. organizational costs from total margin provided by products. organizational costs from total product revenue. total product costs from total product revenue. total unit, batch, product/process, and organizational level costs incurred for a period from total product revenue. ANSWER: 58. b Flexible Manufacturing Systems yes yes no no A key concept underlying cost driver analysis is that a. b. c. d. 57. Activity-Based Cost Systems for Management a MEDIUM An activity center is an organizational unit a. b. c. d. that makes a single product or performs a single service. in which only value-added activities are performed. that incurs only unit, batch, or product/process level costs. for which management wants separate activity information. ANSWER: d EASY Chapter 4 59. Activity-Based Cost Systems for Management The following items are used in tracing costs in an ABC system. In which order are they used? (1) (2) (3) (4) cost object cost driver activity driver cost pool a. b. c. d. 1, 2, 3, 4 2, 3, 4, 1 2, 4, 3, 1 4, 3, 1, 2 ANSWER: 60. DIFFICULT variable. fixed. unit-based. short-term. ANSWER: a EASY Tessia Company makes ten different styles of inexpensive feather masks. Which of the following is this company most likely to have? a. b. c. d. Product complexity Process complexity Product variety Process customization ANSWER: 62. c The “Rule of One” underlies the premise that all costs are a. b. c. d. 61. 4–15 c EASY Attribute-based costing (ABC II) employs which of the following in its cost-benefit analyses? a. b. c. d. Past costs Long-term variable costs Reengineered costs Planned costs ANSWER: d MEDIUM 4–16 63. Chapter 4 Mass customization can be achieved through the use of a. b. c. d. activity-based costing. just-in-time inventory. flexible manufacturing systems. all of the above. ANSWER: 64. Product variety yes yes no yes ANSWER: EASY d Product complexity no yes yes no Process errors no yes no yes Pareto principle yes no no yes DIFFICULT The Pareto principle is important to consider when an organization is a. b. c. d. assessing whether to employ activity-based costing versus attribute-based costing. evaluating the number of activities that are value-added versus those that are nonvalue-added. deciding whether to offer a product in one color versus in ten colors. determining whether simultaneous engineering activities will be impacted by the “Rule of One.” ANSWER: 66. c Mass customization is closely associated with a. b. c. d. 65. Activity-Based Cost Systems for Management c MEDIUM Simultaneous engineering can be used to a. b. c. d. reduce both product and process complexity. integrate activity-based costing with value chain analysis. reduce the time-to-market of new products through elimination of batch-level activities. reduce manufacturing cycle efficiency by reducing process waste. ANSWER: a EASY Chapter 4 67. Activity-Based Cost Systems for Management If only one or two overhead cost pools are used, a. b. c. d. it will be easy to determine which products or services are creating the most costs. overhead created by a specific product will be assigned to all products. the reduction in cost accumulation and allocation time will raise company profits. allocations should be made using only unit-based cost drivers. ANSWER: 68. EASY automated one or more production processes. introduced new products to its customers. had its industry deregulated. all of the above. ANSWER: d EASY Engaging in which of the following will result in radical changes being made to an organization’s processes? a. b. c. d. Continuous improvement Benchmarking Reengineering Mass customization ANSWER: 70. b A cost accumulation system should most likely be reevaluated when a company has a. b. c. d. 69. 4–17 c MEDIUM Use of activity-based costing and activity-based management requires a. b. c. d. the creation of an environment for change in an organization. elimination of all non-value-added activities in an organization. that company processes be automated and the use of direct labor be minimal. each process be fully mapped and all activities be identified as value-added or non-value-added. ANSWER: a EASY 4–18 71. Chapter 4 Which of the following is most likely to make the implementation of ABC/ABM slow and difficult? a. b. c. d. The inability of all employees to understand the computations involved in ABC. A lack of involvement by or support from upper management. The need for dual costing systems. An inability to eliminate all business-value-added activities. ANSWER: 72. b MEDIUM Activity-based costing and generally accepted accounting principles differ in that ABC a. b. c. d. does not define product costs in the same manner as GAAP. cannot be used to compute an income statement, but GAAP can. is concerned only with costs generated from automated processes, but GAAP is concerned with costs generated from both manual and automated processes. information is useful only to managers, while GAAP information is useful to all organizational stakeholders. ANSWER: 73. Activity-Based Cost Systems for Management a EASY If activity-based costing is implemented in an organization without any other changes being effected, total overhead costs will a. b. c. d. be reduced because of the elimination of non-value-added activities. be reduced because organizational costs will not be assigned to products or services. be increased because of the need for additional people to gather information on cost drivers and cost pools. remain constant and simply be spread over products differently. ANSWER: d DIFFICULT Chapter 4 74. Activity-Based Cost Systems for Management Kan Co. produces two products (A and B). Direct material and labor costs for Product A total $35 (which reflects 4 direct labor hours); direct material and labor costs for Product B total $22 (which reflects 1.5 direct labor hours). Three overhead functions are needed for each product. Product A uses 2 hours of Function 1 at $10 per hour, 1 hour of Function 2 at $7 per hour, and 6 hours of Function 3 at $18 per hour. Product B uses 1, 8, and 1 hours of Functions 1, 2, and 3, respectively. Kan produces 800 units of A and 8,000 units of B each period. If total overhead is assigned to A and B on the basis of units produced, Product A will have an overhead cost per unit of a. b. c. d. $ 88.64. $123.64. $135.00. none of the above. ANSWER: 75. MEDIUM $84.00. $88.64. $110.64. none of the above. ANSWER: b MEDIUM Use the information from #74. If total overhead is assigned to A and B on the basis of direct labor hours, Product A will have an overhead cost per unit of a. b. c. d. $51.32. $205.28. $461.88. none of the above. ANSWER: 77. a Use the information from #74. If total overhead is assigned to A and B on the basis of units produced, Product B will have an overhead cost per unit of a. b. c. d. 76. 4–19 b MEDIUM Use the information from #74. If total overhead is assigned to A and B on the basis of direct labor hours, Product B will have an overhead cost per unit of a. b. c. d. $51.32. $76.98. $510.32. none of the above. ANSWER: b MEDIUM 4–20 78. Chapter 4 Use the information from #74. If total overhead is assigned to A and B on the basis of overhead activity hours used, the total product cost per unit assigned to Product A will be a. b. c. d. $86.32. $95.00. $115.50. none of the above. ANSWER: 79. c MEDIUM Use the information from #74. If total overhead is assigned to A and B on the basis of overhead activity hours used, the total product cost per unit assigned to Product B will be a. b. c. d. $115.50. $73.32. $34.60. none of the above. ANSWER: 80. Activity-Based Cost Systems for Management a MEDIUM JJ Corp. produces 50,000 units of Product Q and 6,000 units of Product Z during a period. In that period, four set-ups were required for color changes. All units of Product Q are black, which is the color in the process at the beginning of the period. A set-up was made for 1,000 blue units of Product Z; a set-up was made for 4,500 red units of Product Z; a set-up was made for 500 green units of Product Z. A set-up was then made to return the process to its standard black coloration and the units of Product Q were run. Each setup costs $500. If set-up cost is assigned on a volume basis for the department, what is the approximate per-unit set-up cost for Product Z? a. b. c. d. $.010. $.036. $.040. none of the above. ANSWER: b MEDIUM Chapter 4 81. Activity-Based Cost Systems for Management JJ Corp. produces 50,000 units of Product Q and 6,000 units of Product Z during a period. In that period, four set-ups were required for color changes. All units of Product Q are black, which is the color in the process at the beginning of the period. A set-up was made for 1,000 blue units of Product Z; a set-up was made for 4,500 red units of Product Z; a set-up was made for 500 green units of Product Z. A set-up was then made to return the process to its standard black coloration and the units of Product Q were run. Each setup costs $500. If set-up cost is assigned on a volume for the department, what is the approximate per-unit set-up cost for the red units of Product Z? a. b. c. d. $.036. $.111. $.250. none of the above. ANSWER: 82. b MEDIUM Use the information from #80. Assume that JJ Corp. has decided to allocate overhead costs using levels of cost drivers. What would be the approximate per-unit set-up cost for the blue units of Product Z? a. b. c. d. $.04. $.25. $.50. none of the above. ANSWER: 83. 4–21 c MEDIUM Use the information from #80. Assume that JJ Corp. has decided to allocate overhead costs using levels of cost drivers. What would be the approximate per-unit set-up cost for the green units of Product Z? a. b. c. d. $1.00. $0.25. $0.04. none of the above. ANSWER: a MEDIUM 4–22 Chapter 4 Activity-Based Cost Systems for Management SHORT ANSWER/PROBLEMS 1. Why are external performance measures preferred to internal performance measures in American businesses today? ANSWER: External performance measures are appropriate because businesses are now oriented to external goals. For example, many firms are very concerned with providing high-quality products and outstanding customer service. If these are appropriate goals, consumer-based (external) measures must be employed to determine if the goals are being achieved. MEDIUM 2. In activity-based costing, how are cost drivers selected? ANSWER: Cost drivers are selected based on their underlying relationship to organizational costs. Ideally, a causal relationship exists between the cost driver and a cost pool. Once identified, cost drivers are used to allocate organizational costs to activities and products and are the focus of cost control efforts. MEDIUM 3. Discuss the characteristics of a company for which ABC would be useful. ANSWER: Companies having the following characteristics find ABC useful: (1) hardto-make products that show large profits and easy-to-make products that show losses; (2) profit margins that are difficult to explain; (3) considerable automation that makes it difficult to assign overhead to products that use machine hours or direct labor as bases; (4) substantial overhead costs that are not in proportion to the number of products; and (5) a wide variety of services or products. MEDIUM 4. ABC has been criticized for a variety of reasons. Discuss these criticisms. ANSWER: One criticism is that ABC does not promote total quality management and continuous improvement. Another criticism of ABC is that ABC does not adhere to generally accepted accounting principles. An ABC system might allocate nonproduct costs (research and development) to products, while not allocating some traditional product costs (factory depreciation on machines) to products. A third criticism of ABC relates to the cost of implementation. An ABC system takes considerable time to implement, and therefore, it is very costly. MEDIUM Chapter 4 5. Activity-Based Cost Systems for Management 4–23 How has the increase in product variety affected the costs of American business? ANSWER: The increase in product variety has increased the overhead costs of American firms. These costs include significant setup costs to switch from the production of one product to another, costs of additional technology, inventory carrying costs, purchasing costs, and scheduling costs. MEDIUM 6. Discuss the four different levels of costs that are now being identified. How should these types of costs be treated under ABC? ANSWER: The four different levels are unit-level costs, batch-level costs, product- or process-level costs, and organizational or facility costs. Unit-level costs include direct material, direct labor, and some traceable machine costs. These are incurred once for each item produced and are considered part of total product cost. Batch-level costs include machine setup, material handling, and purchasing or ordering costs. These are incurred once for each batch of items produced and are allocated over the total number of units in the batch. These are also considered part of total product cost. Product- or process-level costs include engineering changes, design, and development costs. These are allocated to the total number of units produced in the product line and are considered part of total product cost. Organizational or facility costs include building depreciation, administrative salaries, and organizational advertising. These costs are not product-related and should be deducted from net product revenue. MEDIUM 4–24 7. Chapter 4 Activity-Based Cost Systems for Management Box Co. manufactures hand-made pine storage boxes for a variety of clients. As production manager, you have developed the following value chart: Operation Receiving materials Storing materials Handling materials Cutting/measuring materials Assembling materials Building boxes Attaching hinges Inspection a. b. c. Average Number of Days 1 2 3 6 4 7 2 1 Determine the value-added activities and their total time. Determine the non-value-added activities and their total time. Calculate the manufacturing cycle efficiency. ANSWER: a. Value-added activities Cutting/measuring materials Assembling materials Building boxes Attaching hinges Total production time (days) Time 6 4 7 2 19 b. Non-value-added activities Receiving Storing Handling Inspection Total nonproduction time (days) Time 1 2 3 1 7 c. Total lead time = 19 + 7 = 26 days MCE = 19/26 = 73.1% EASY Chapter 4 8. Activity-Based Cost Systems for Management 4–25 TriCo would like to institute an activity-based costing system to price products. The company’s Purchasing Department incurs costs of $550,000 per year and has six employees. Purchasing has determined the three major activities that occur during the year. Activity Issuing purchase orders Reviewing receiving reports Making phone calls Allocation Measure # of purchase orders # of receiving reports # of phone calls # of People 1 Total Cost $150,000 2 $175,000 3 $225,000 During the year 50,000 phone calls were made in the department; 15,000 purchase orders were issued; and 10,000 shipments were received. Product A required 200 phone calls, 150 receiving reports, and 50 purchase orders. Product B required 350 phone calls, 400 receiving reports, and 100 purchase orders. a. b. Determine the amount of purchasing department cost that should be assigned to each of these products. Determine purchasing department cost per unit if 1,500 units of Product A and 3,000 units of Product B were manufactured during the year. ANSWER: a. $150,000/15,000 = $10 per purchase order $175,000/10,000 = $17.50 per receiving report $225,000/50,000 = $4.50 per phone call 50 purchase orders ×$10 100 purchase orders × $10 150 receiving reports × $17.50 400 receiving reports × $17.50 200 phone calls × $4.50 350 phone calls × $4.50 Total cost b. Product A $ 500 $1,000 2,625 7,000 900 $4,025 Product A= $4,025/1,500 = $2.68 per unit Product B= $9,575/3,000 = $3.19 per unit MEDIUM Product B 1,575 $9,575 CHAPTER 5 JOB ORDER COSTING MULTIPLE CHOICE 1. Which of the following costing methods of valuation are acceptable in a job order costing system? a. b. c. d. Actual Material Cost yes yes no yes ANSWER: 2. Actual Labor Cost no yes yes yes Predetermined Overhead Cost yes no yes yes EASY Which of the following costing systems allows management to quickly recognize materials, labs, and overhead variances and take measures to correct them? a. b. c. d. Actual Cost System yes yes no no ANSWER: 3. d Standard Material Cost yes no yes yes d Normal Cost System yes no yes no EASY In a normal cost system, debits to Work in Process Inventory would not be made for a. b. c. d. actual overhead. applied overhead. actual direct material. actual direct labor. ANSWER: a EASY 5–1 5–2 4. Chapter 5 Which of the following are drawbacks to applying actual overhead to production? a. b. c. d. A delay occurs in assigning costs to jobs or products. Fluctuations in quantities produced during a period could cause varying per-unit charges for fixed overhead. Seasonality of overhead costs may cause distortions in job or product costs. All of the above. ANSWER: 5. b. c. d. EASY Job Order Costing homogeneous products and large quantities homogeneous products and small quantities heterogeneous products and large quantities heterogeneous products and small quantities ANSWER: d Process Costing heterogeneous products and small quantities heterogeneous products and large quantities homogeneous products and small quantities homogeneous products and large quantities EASY A credit to Work in Process Inventory represents a. b. c. d. work still in process. raw material put into production. the application of overhead to production. the transfer of completed items to Finished Goods Inventory. ANSWER: 7. d Job order costing and process costing have which of the following characteristics? a. 6. Job Order Costing d EASY Additional accounts that comprise the balance of a single general account is a a. b. c. d. worksheet. journal. subsidiary ledger. book of original entry. ANSWER: c EASY Chapter 5 8. Job Order Costing In a job order costing system, the dollar amount of the entry that debits Finished Goods Inventory and credits Work in Process Inventory is the sum of the costs charged to all jobs a. b. c. d. started in process during the period. in process during the period. completed and sold during the period. completed during the period. ANSWER: 9. EASY cost of goods manufactured in the year. ending Work in Process Inventory. total manufacturing costs to account for. cost of goods available for sale. ANSWER: c EASY Which of the following would be least likely to be supported by subsidiary accounts or ledgers in a company that employs a job order costing system? a. b. c. d. Work in Process Inventory Raw Material Inventory Accounts Payable Supplies Inventory ANSWER: 11. d Total manufacturing costs for the year plus beginning Work in Process Inventory cost equals a. b. c. d. 10. 5–3 d EASY A journal entry includes a debit to Work in Process Inventory and a credit to Raw Material Inventory. The explanation for this would be that a. b. c. d. indirect material was placed into production. raw material was purchased on account. direct material was placed into production. direct labor was utilized for production. ANSWER: c EASY 5–4 12. Chapter 5 The source document that records the amount of raw material that has been requested by production is the a. b. c. d. job order cost sheet. bill of lading. interoffice memo. material requisition. ANSWER: 13. EASY job number. quantity required. unit cost. purchase order number. ANSWER: d EASY Which of the following statements about job order cost sheets is true? a. b. c. d. All job order cost sheets serve as the general ledger control account for Work in Process Inventory. Job order cost sheets can serve as subsidiary ledger information for both Work in Process Inventory and Finished Goods Inventory. If material requisition forms are used, job order cost sheets do not need to be maintained. Job order cost sheets show costs for direct material and direct labor, but not for manufacturing overhead since it is an applied amount. ANSWER: 15. d A material requisition form should show all of the following information except a. b. c. d. 14. Job Order Costing b EASY Clyde Jenkins is an auditor for the General Accounting Office. Clyde is investigating invoices sent by Proper Paper Products charging the Army $30 per roll for toilet paper. Proper Paper uses a job order costing system. Where should Clyde look to find total production costs related to the toilet paper? a. b. c. d. material requisition form bill of materials sales invoice job order cost sheet ANSWER: d EASY Chapter 5 16. Job Order Costing The primary accounting document in a job order costing system is a(n) a. b. c. d. bill of materials. job order cost sheet. employee time sheet. materials requisition. ANSWER: 17. EASY Finished Goods Inventory. Raw Material Inventory. Work in Process Inventory. Supplies Inventory. ANSWER: c EASY The __________ provides management with an historical summation of total costs for a given product. a. b. c. d. job order cost sheet employee time sheet material requisition form bill of lading ANSWER: 19. b The cost sheets for incomplete jobs at the end of the period comprise the subsidiary ledger for a. b. c. d. 18. 5–5 a EASY Which of the following journal entries records the accrual of the cost of indirect labor used in production? a. b. c. d. debit Work in Process Inventory, credit Wages Payable debit Work in Process Inventory, credit Manufacturing Overhead debit Manufacturing Overhead, credit Work in Process Inventory debit Manufacturing Overhead, credit Wages Payable ANSWER: d EASY 5–6 20. Chapter 5 In job order costing, payroll taxes paid by the employer for factory employees are commonly accounted for as a. b. c. d. direct labor cost. manufacturing overhead cost. indirect labor cost. administrative cost. ANSWER: 21. EASY the insurance company sent the company a refund of its policy premium. overhead for insurance was applied to production. insurance for production equipment expired. insurance was paid on production equipment. ANSWER: c EASY The journal entry to apply overhead to production includes a credit to Manufacturing Overhead control and a debit to a. b. c. d. Finished Goods Inventory. Work in Process Inventory. Cost of Goods Sold. Raw Material Inventory. ANSWER: 23. b The logical explanation for an entry that includes a debit to Manufacturing Overhead control and a credit to Prepaid Insurance is a. b. c. d. 22. Job Order Costing b EASY Production overhead does not include the costs of a. b. c. d. factory depreciation and supplies. factory employees’ cafeteria departments. production line workers. the maintenance department for the factory. ANSWER: c EASY Chapter 5 24. Job Order Costing In a job order costing system, the use of indirect material would usually be reflected in the general ledger as an increase in a. b. c. d. stores control. work in process control. manufacturing overhead applied. manufacturing overhead control. ANSWER: 25. EASY rates are applied within a range of 35 to 60 percent of direct labor. is performed at the beginning of the period. rates fluctuate during the period with changes in production quantities. rates are calculated by dividing budgeted overhead by a budgeted quantity of some cost driver. ANSWER: d EASY A credit to the Manufacturing Overhead control account represents the a. b. c. d. actual cost of overhead incurred. actual cost of overhead paid this period. amount of overhead applied to production. amount of indirect material and labor used during the period. ANSWER: 27. d Manufacturing overhead application a. b. c. d. 26. 5–7 c EASY The journal entry to record the incurrence and payment of overhead costs for factory insurance requires a debit to a. b. c. d. Cash and a credit to Manufacturing Overhead. Manufacturing Overhead and a credit to Accounts Payable. Manufacturing Overhead and a credit to Cash. Work in Process Inventory and a credit to Cash. ANSWER: c EASY 5–8 28. Chapter 5 The source document that records the amount of time an employee worked on a job and his/her pay rate is the a. b. c. d. job order cost sheet. employee time sheet. interoffice memo. labor requisition form. ANSWER: 29. EASY at the end of a period. as jobs are completed. at the end of a period or as jobs are completed, whichever is earlier. at the end of a period or as jobs are completed, whichever is later. ANSWER: c EASY In a job order costing system, the subsidiary ledger for Finished Goods Inventory is comprised of a. b. c. d. all job order cost sheets. job order cost sheets for all uncompleted jobs. job order cost sheets for all completed jobs not yet sold. job order cost sheets for all ordered, uncompleted, and completed jobs. ANSWER: 31. b Overhead is applied to jobs in a job order costing system a. b. c. d. 30. Job Order Costing c EASY Underapplied overhead resulting from unanticipated and immaterial price increases for overhead items should be written off by a. b. c. d. decreasing Cost of Goods Sold. increasing Cost of Goods Sold. decreasing Cost of Goods Sold, Work in Process Inventory, and Finished Goods Inventory. increasing Cost of Goods Sold, Work in Process Inventory, and Finished Goods Inventory. ANSWER: b EASY Chapter 5 32. Job Order Costing Overapplied overhead would result if a. b. c. d. the plant were operated at less than normal capacity. overhead costs incurred were less than costs charged to production. overhead costs incurred were unreasonably small in relation to units produced. overhead costs incurred were greater than costs charged to production. ANSWER: 33. EASY transfer of completed items to Finished Goods Inventory. costs of items sold. selling price of items sold. the cost of goods manufactured. ANSWER: b EASY In a perpetual inventory system, a transaction that requires two journal entries (or one compound entry) is needed when a. b. c. d. raw materials are purchased on account. goods are sold for either cash or on account. goods are finished and transferred out of Work in Process Inventory. overhead is applied to Work in Process Inventory. ANSWER: 35. b Debits to Cost of Goods Sold typically represent the a. b. c. d. 34. 5–9 b EASY Which of the following organizations would be most likely to use a job order costing system? a. b. c. d. the loan department of a bank the check clearing department of a bank a manufacturer of processed cheese food a manufacturer of video cassette tapes ANSWER: a MEDIUM 5–10 36. Chapter 5 Which of the following organizations would most likely not use a job order costing system? a. b. c. d. Avondale Shipbuilders Pickle and Weymann, Attorneys-at-Law Atlantic City Saltwater Taffy Century City Construction Company ANSWER: 37. EASY standards cannot be used. an average cost per unit within a job cannot be computed. costs are accumulated by departments and averaged among all jobs. overhead is typically assigned to jobs on the basis of some cost driver. ANSWER: d EASY When job order costing is used, the primary focal point of cost accumulation is the a. b. c. d. department. supervisor. item. job. ANSWER: 39. c In a job order costing system, a. b. c. d. 38. Job Order Costing d EASY What is the best cost accumulation procedure to use when many batches, each differing as to product specifications, are produced? a. b. c. d. job order process actual standard ANSWER: a EASY Chapter 5 40. Job Order Costing Which of the following could not be used in job order costing? a. b. c. d. standards an average cost per unit for all jobs normal costing overhead allocation based on the job’s direct labor hours ANSWER: 41. b EASY Product costing is not concerned with cost a. b. c. d. assignment. origination. identification. measurement. ANSWER: 42. 5–11 b EASY Which of the following statements is false? a. b. c. d. While the use of standard costing is acceptable for job order costing systems, actual cost records should still be maintained. It is normally more time-consuming for a company to use standard costs in a job order costing system. Standards can be used in a job order costing system, if the company usually produces items that are similar in nature. Standard costs may be used for material, labor, or both material and labor in a job order costing environment. ANSWER: b EASY 5–12 43. Chapter 5 Job Order Costing C Co. uses a job order costing system. During April 2001, the following costs appeared in the Work in Process Inventory account: Beginning balance Direct material used Direct labor incurred Applied overhead Cost of goods manufactured $ 24,000 70,000 60,000 48,000 185,000 C Co. applies overhead on the basis of direct labor cost. There was only one job left in WIP Inventory at the end of April which contained $5,600 of overhead. What amount of direct material was included in this job? a. b. c. d. $4,400 $4,480 $6,920 $8,000 ANSWER: 44. a MEDIUM Q Co. is a print shop that produces jobs to customer specifications. During January 2001, Job #1253 was worked on and the following information is available: Direct material used Direct labor hours worked Machine time used Direct labor rate per hour Overhead application rate per hour of machine time What was the total cost of Job #1253 for January? a. b. c. d. $3,025 $2,812 $2,770 $2,713 ANSWER: d EASY $2,500 15 6 $7 $18 Chapter 5 Job Order Costing 5–13 Use the following information for questions 45–47. Ark Co. uses a job order costing system. At the beginning of January, the company had 2 jobs in process with the following costs: Job #456 Job #461 Direct Material $3,400 1,100 Direct Labor $510 289 Overhead $255 ? Ark pays its workers $8.50 per hour and applies overhead on a direct labor hour basis. 45. What is the overhead application rate per direct labor hour? a. b. c. d. $0.50 $2.00 $4.25 $30.00 ANSWER: 46. EASY How much overhead was included in the cost of Job #461 at the beginning of January? a. b. c. d. $144.50 $153.00 $2,200.00 $2,456.50 ANSWER: 47. c a EASY During January, Ark employees worked on Job #479. At the end of the month, $714 of overhead had been applied to this job. Total Work in Process Inventory at the end of the month was $6,800 and all other jobs had a total cost of $3,981. What amount of direct material is included in Job #479? a. b. c. d. $677 $1,391 $2,142 $4,658 ANSWER: a MEDIUM 5–14 48. Chapter 5 Job Order Costing Black Corp. manufactures products on a job order basis. The job cost sheet for Job #329 shows the following for March: Direct material Direct labor (100 hours @ $7.25) Machine hours incurred Predetermined overhead rate per machine hour $5,000 $725 40 $26 At the end of March, what total cost appears on the job cost sheet for Job #329? a. b. c. d. $5,725 $5,765 $6,765 $8,325 ANSWER: 49. c EASY Products at Green Manufacturing are sent through two production departments: Fabricating and Finishing. Overhead is applied to products in the Fabricating Dept. based on 150 percent of direct labor cost and $18 per machine hour in Finishing. The following information is available about Job #639: Direct material Direct labor cost Direct labor hours Machine hours Overhead applied Fabricating $1,590 ? 22 5 429 What is the total cost of Job #639? a. b. c. d. $2,647 $3,005 $3,093 $3,203 ANSWER: d MEDIUM Finishing $580 48 6 15 ? Chapter 5 50. Job Order Costing 5–15 Carolina Co. applies overhead to jobs at the rate of 40 percent of direct labor cost. Direct material of $1,250 and direct labor of $1,400 were expended on Job #44 during June. At May 31, the balance of Job #44 was $2,800. The June 30th balance is a. b. c. d. $3,210. $4,760. $5,450. $6,010. ANSWER: d EASY Use the following information for questions 51–56. Adams Co. uses a job order costing system and the following information is available from its records. The company has 3 jobs in process: #5, #8, and #12. Raw material used Direct labor per hour Overhead applied based on direct labor cost $120,000 $8.50 120% Direct material was requisitioned as follows for each job respectively: 30 percent, 25 percent, and 25 percent; the balance of the requisitions was considered indirect. Direct labor hours per job are 2,500; 3,100; and 4,200; respectively. Indirect labor is $33,000. Other actual overhead costs totaled $36,000. 51. What is the prime cost of Job #5? a. b. c. d. $42,250 $57,250 $73,250 $82,750 ANSWER: 52. b MEDIUM What is the total amount of overhead applied to Job #8? a. b. c. d. $18,250 $26,350 $30,000 $31,620 ANSWER: d MEDIUM 5–16 53. Chapter 5 What is the total amount of actual overhead? a. b. c. d. $36,000 $69,000 $93,000 $99,960 ANSWER: 54. MEDIUM $69,000 $99,960 $132,960 $144,000 ANSWER: b MEDIUM If Job #12 is completed and transferred, what is the balance in Work in Process Inventory at the end of the period if overhead is applied at the end of the period? a. b. c. d. $96,700 $99,020 $170,720 $139,540 ANSWER: 56. c How much overhead is applied to Work in Process? a. b. c. d. 55. Job Order Costing c DIFFICULT Assume the balance in Work in Process Inventory was $18,500 on June 1 and $25,297 on June 30. The balance on June 30 represents one job that contains direct material of $11,250. How many direct labor hours have been worked on this job (rounded to the nearest hour)? a. b. c. d. 751 1,324 1,653 2,976 ANSWER: a MEDIUM Chapter 5 Job Order Costing 5–17 Use the following information for questions 57–60. The following information pertains to XYZ Co. for September 2001. Direct Material $3,200 ? 5,670 Job #123 Job #125 Job #201 Direct Labor $4,500 5,000 ? Overhead ? ? $5,550 XYZ Co. applies overhead for Job #123 at 140 percent of direct labor cost and at 150 percent of direct labor cost for Jobs #125 and #201. The total cost of Jobs #123 and #125 is identical. 57. What amount of overhead is applied to Job #123? a. b. c. d. $4,800 $5,550 $6,300 $7,500 ANSWER: 58. EASY What amount of overhead is applied to Job #125? a. b. c. d. $8,325 $7,500 $7,000 $5,000 ANSWER: 59. c b EASY What is the amount of direct material for to Job #125? a. b. c. d. $1,950 $1,500 $3,700 $7,500 ANSWER: b MEDIUM 5–18 60. Chapter 5 Job Order Costing Assume that Jobs #123 and #201 are incomplete at the end of September. What is the balance in Work in Process Inventory at that time? a. b. c. d. $18,920 $22,620 $28,920 $30,120 ANSWER: c MEDIUM Use the following information for questions 61–63. Baker Co. has two departments (Processing and Packaging) and uses a job order costing system. Baker applies overhead in Processing based on machine hours and on direct labor cost in Packaging. The following information is available for July: Machine hours Direct labor cost Applied overhead 61. Packaging 1,000 $23,000 $51,750 What is the overhead application rate per machine hour for Processing? a. b. c. d. $22.00 $1.24 $17.80 $0.81 ANSWER: 62. Processing 2,500 $44,500 $55,000 a EASY What is the overhead application rate for Packaging? a. b. c. d. $23.00 $51.75 $2.25 $0.44 ANSWER: c EASY Chapter 5 63. Job Order Costing 5–19 Which of the following conclusions would be reasonable to draw from the Baker Co.’s overhead application system? a. b. c. d. The Processing Department has many unskilled workers. The Processing Department is highly automated. The Packaging Department is more cost-efficient than the Processing Department. The Packaging Department would be a good candidate for downsizing. ANSWER: b EASY Use the following information for questions 64 and 65. Zew Co. has a job order costing system and an overhead application rate of 120 percent of direct labor cost. Job #33 is charged with direct material of $12,000 and overhead of $7,200. Job #34 has direct material of $2,000 and direct labor of $9,000. 64. What amount of direct labor cost has been charged to Job #33? a. b. c. d. $6,000 $8,640 $7,200 $14,400 ANSWER: 65. a EASY What is the total cost of Job #34? a. b. c. d. $30,200 $21,800 $11,000 $10,800 ANSWER: b EASY 5–20 Chapter 5 Job Order Costing Use the following information for questions 66 and 67. Kool Co. uses a job order costing system. Assume that Job #101 is the only one in process. The following information is available: Budgeted direct labor hours Budgeted overhead Direct labor cost 66. 9,000 $110,500 $0.20 $5.00 $5.38 $38.89 ANSWER: c EASY What is the total cost of Job #101 assuming that overhead is applied at the rate of 135 percent of direct labor cost (rounded to the nearest whole dollar)? a. b. c. d. $192,650 $268,250 $275,000 $329,675 ANSWER: 68. Budgeted machine hours Direct material What is the overhead application rate if Kool uses a predetermined overhead application rate based on direct labor hours (rounded to the nearest whole dollar)? a. b. c. d. 67. 65,000 $350,000 $70,000 c EASY At the end of the last fiscal year, Baehr Company had the following account balances: Overapplied overhead Cost of Goods Sold Work in Process Inventory Finished Goods Inventory $ 6,000 $980,000 $ 38,000 $ 82,000 If the most common treatment of assigning overapplied overhead was used, the final balance in Cost of Goods Sold would have been a. b. c. d. $985,340. $974,660. $974,000. $986,000. ANSWER: c EASY Chapter 5 69. Job Order Costing 5–21 Carley Products has no Work in Process or Finished Goods inventories at the close of business on December 31, 2000. The balances of Carley’s accounts as of December 31, 2001, are as follows: Cost of goods sold Selling & administrative expenses Sales Manufacturing overhead control Manufacturing overhead applied $2,040,000 900,000 3,600,000 700,000 648,000 Carley Products’ pretax income for 2001 is a. b. c. d. $608,000. $660,000. $712,000. undeterminable from the information given. ANSWER: 70. eliminate the data entry function for the accounting system. automate the data collection and data entry functions. use accounting software to change the focal point of the job order system. create an Intranet to share information between competitors. ANSWER: b EASY As data input functions are automated, Intranet data becomes more a. b. c. d. complicated to access. manufacturing, but not accounting, oriented. real-time accessible. expensive to install, but easier to use. ANSWER: 72. MEDIUM The trend in job order costing is to a. b. c. d. 71. a c EASY Software manufacturing modules are a. b. c. d. available from major middle-market vendors. available only for companies using process costing systems. not commonly available for middle-market production firms. not commonly available for integration with traditional accounting systems. ANSWER: a MEDIUM 5–22 73. Chapter 5 The use of standard material or labor costs in job order costing a. b. c. d. is similar to the use of predetermined overhead rates in a normal costing system. will keep actual costs of jobs from fluctuating due to changes in component costs. is appropriate for any company making a units to customer specification. all of the above. ANSWER: 74. EASY effectiveness complexity homogeneity efficiency ANSWER: d EASY A company producing which of the following would be most likely to use a price standard for material? a. b. c. d. furniture NFL-logo jackets picture frames none of the above ANSWER: 76. a After the completion of production, standard and actual costs are compared to determine the ______ of the production process. a. b. c. d. 75. Job Order Costing b MEDIUM A company producing which of the following would be most likely to use a time standard for labor? a. b. c. d. mattresses picture frames floral arrangements stained-glass windows ANSWER: a MEDIUM Chapter 5 77. Job Order Costing A service organization would be most likely to use a predetermined overhead rate based on a. b. c. d. machine hours. standard material cost. direct labor. number of complaints. ANSWER: 78. EASY estimate costs of future jobs. establish realistic job selling prices. evaluate job performance. all of the above. ANSWER: d EASY As product variety increases, a. b. c. d. job order costing becomes less useful. production lot sizes decrease. standard costs in job order costing systems cannot be used. all of the above. ANSWER: 80. c By knowing specific job costs, managers are better able to a. b. c. d. 79. 5–23 b MEDIUM A job order costing system is likely to provide better (1) (2) (3) inventory valuations for financial statements. control over inventory. information about ability to accept additional production work. a. b. c. d. (1) yes no no yes ANSWER: (2) no yes no yes (3) no yes no yes d DIFFICULT 5–24 81. Chapter 5 In a production environment that manufactures goods to customer specifications, a job order costing system a. b. c. d. can be used only if standard costs are used for materials and labor. will provide reasonable product cost information only when all jobs utilize approximately the same quantities of material and labor. may be maintained using either actual or predetermined overhead rates. emphasizes that large customers create the most costs even though they also provide the most revenues. ANSWER: 82. c DIFFICULT Kauai Mfg. Co. produces beach chairs. Chair frames are all the same size, but can be made from plastic, wood, or aluminum. Regardless of frame choice, the same sailcloth is used for the seat on all chairs. Kauai has set a standard for sailcloth of $9.90 per square yard and each chair requires 1 square yard of material. Kauai produced 500 plastic chairs, 100 wooden chairs, and 250 aluminum chairs during June. The total cost for 1,000 square yards of sailcloth during the month was $10,000. At the end of the month, 50 square yards of sailcloth remained in inventory. The unfavorable material price variance for sailcloth purchases for the month was a. b. c. d. $100. $495. $1,090. $1,585. ANSWER: 83. Job Order Costing a MEDIUM Use the information from #13. Assuming that there was no sailcloth in inventory at the beginning of June, the unfavorable material quantity variance for the month was a. b. c. d. $495. $500. $990. $1,000. ANSWER: c MEDIUM Chapter 5 84. Job Order Costing 5–25 Use the information from #13. Kauai Mfg. Co. could set a standard cost for which of the following? a. b. c. d. Frame cost yes no yes no ANSWER: Predetermined OH rate yes no no yes d Labor rate yes no no yes DIFFICULT SHORT ANSWER/PROBLEMS 1. Compare and contrast job order and process costing systems. ANSWER: Job order costing is characterized by the production of small quantities of heterogeneous distinct or unique items. Items are produced according to customer specifications and, at a minimum, direct material and direct labor costs can be traced to specific jobs. Process costing is characterized by the production of large quantities of homogeneous (alike or similar in nature) items. Specific items cannot be identified with specific costs during the production process. MEDIUM 2. Discuss actual costing, normal costing, and standard costing. ANSWER: Actual costing, normal costing, or standard costing may be used in either a job order costing or process costing system. Actual costing assigns the actual cost of all direct material, direct labor, and overhead to the units produced. Normal costing uses actual direct material and direct labor cost and a predetermined overhead application rate to cost products. Standard costing establishes “norms” for direct material and direct labor quantities and/or costs and uses a predetermined (standard) overhead rate for the application of overhead to determine product cost. MEDIUM 5–26 3. Chapter 5 Job Order Costing What is a “job” as defined in a job order costing system? ANSWER: A job is a single unit or a group of like items that is produced to customer specifications. A job is separately identifiable from other jobs. Each job is treated as a cost object, and costs (typically actual direct material, actual direct labor, and overhead applied using a predetermined rate) are attached to each job as it flows through the production process. MEDIUM 4. What information should be contained in a subsidiary ledger for Work in Process Inventory in a job order costing system? ANSWER: The Work in Process Inventory subsidiary ledger should contain information on all incomplete jobs. This information will include the amount of direct material and direct labor costs in production, as well as the amount of overhead applied to each job. The subsidiary ledger for Work in Process Inventory is composed of all job cost sheets for uncompleted jobs and substantiates the balance in the general ledger Work in Process Inventory control account. MEDIUM 5. Discuss the basic forms used in a job order costing system. ANSWER: The forms used in a job order costing system include (1) a job order cost sheet which records all the financial and significant production data (actual or standard, and possibly budgeted) relating to a particular job; (2) a material requisition form which records the costs and quantities of material that has been requisitioned for a particular job; and (3) an employee time sheet which records the jobs worked on by an employee and the amount of time spent on each job. MEDIUM Chapter 5 6. Job Order Costing 5–27 Prepare the necessary journal entries from the following information for TriCo, which uses a perpetual inventory system. a. b. c. d. e. f. g. Purchased raw material on account, $56,700. Requisitioned raw material for production as follows: direct material—80 percent of purchases; indirect material—15 percent of purchases. Direct labor wages of $33,100 are accrued as are indirect labor wages of $12,500. Overhead incurred and paid for is $66,900. Overhead is applied to production based on 110 percent of direct labor cost. Goods costing $97,600 were completed during the period. Goods costing $51,320 were sold on account for $77,600. ANSWER: a. b. c. d. e. f. g. Raw Material Inventory A/P WIP Inventory MOH Raw Material Inventory WIP Inventory MOH Wages Payable MOH Cash WIP Inventory MOH FG Inventory WIP Inventory CGS FG Inventory A/R Sales MEDIUM 56,700 56,700 45,360 8,505 53,865 33,100 12,500 45,600 66,900 66,900 36,410 36,410 97,600 97,600 51,320 51,320 77,600 77,600 5–28 Chapter 5 Job Order Costing Use the following information for questions 7–10. Glass Co. uses a job order costing system and develops its predetermined overhead rate based on machine hours. The company has two jobs in process at the end of the cycle, Jobs #17 and #19. Budgeted overhead Budgeted machine hours Raw material Labor cost 7. $100,300 85,000 $ 63,000 $ 50,000 What is the overhead application rate? ANSWER: $100,300 85,000= $1.18 per MH EASY 8. What amount of overhead is charged to Jobs #17 and #19? Machine hours are split between Jobs #17 and #19—65 percent and 35 percent, respectively. Actual machine hours equal budgeted machine hours. ANSWER: OH Applied = MH Cost × POHR #17 85,000 × 65%= 55,250 × $1.18 = $65,195 #19 85,000 × 35%= 29,750 × $1.18 = $35,105 EASY 9. Fifty-four percent of raw material belongs to Job #17 and 38 percent belongs to Job #19, and the balance is considered indirect material. What amount of raw material used was allocated to overhead as indirect material? ANSWER: 54% + 38% = 92%; this means that 8% is indirect or $5,040 (.08 × $63,000). EASY 10. Labor cost was split 25 percent and 70 percent, respectively, between Jobs #17 and #19 for direct labor. The remainder was indirect labor cost. What are the total costs of Jobs #17 and #19? ANSWER: DM DL MOH MEDIUM Job #17 $ 34,020 12,500 65,195 $111,715 Job #19 $23,940 35,000 35,105 $94,045 Chapter 5 11. Job Order Costing 5–29 Can standard costing be used in job order costing? If so, what conditions must exist? If not, explain why. ANSWER: Yes. Firms that use job order costing can also base their costs on standards. Each job must be fairly similar to each other job. Standards may be used for the prices of material and labor if the jobs use basically the same kind of material and labor. If jobs are homogeneous enough, standards can also be used for materials and labor quantities. Some companies may choose to only use price standards, others only quantity standards, and others may use both price and quantity standards. MEDIUM 5–30 12. Chapter 5 Job Order Costing ABC Company manufactures custom-built conveyor systems for factory and commercial operations. Lisa French is the cost accountant for ABC and she is in the process of educating a new employee, Julie English, about the job order costing system that ABC uses. (The system is based on normal costs; overhead is applied based on direct labor cost and rounded to the next whole dollar.) Lisa gathers the following job order cost records for May: Job No. 667 669 670 671 672 Direct Materials $ 5,901 18,312 406 51,405 9,615 Direct Labor $1,730 1,810 500 9,500 550 Applied OH $ 1,990 2,082 575 10,925 633 Total Cost $ 9,621 22,204 1,481 71,830 10,798 To explain the missing job number, Lisa informed Julie that Job #668 had been completed in April. She also told her that Job #667 was the only job in process at the beginning of May. At that time, the job had been assigned $4,300 for direct material and $900 for direct labor. At the end of May, Job #671 had not been completed; all others had. Lisa asked Julie several questions to determine whether she understood the job order system. Required: Help Julie answer the following questions: a. What is the predetermined overhead rate used by ABC Company? b. What was the total cost of beginning Work in Process inventory? c. What was total prime cost incurred for the month of May? d. What was cost of goods manufactured for May? Chapter 5 Job Order Costing 5–31 ANSWER: a. Use any job started in May: Rate = MOH DL COST b. DM DL FOH c. Prime Cost =DM + DL JOB $670 $575 $500 = 115%/DL Cost $4,300 900 1,035 ($900 × 115%) $6,235 DM = $85,639 – 4,300 = $81,339 DL = 14,090 – 900 = 13,190 $94,529 d. EASY COGM = $9,621 + 22,204 + 1,481 + 10,798 = $44,104 5–32 13. Chapter 5 Job Order Costing James Co. uses a job order costing system and has the following information for the first week of June 2002: 1. Direct labor and direct materials used: Job No. 498 506 507 508 509 511 512 Total Direct Material $1,500 960 415 345 652 308 835 $5,015 Direct Labor Hours 116 16 18 42 24 10 30 256 2. The direct labor wage rate is $4 per hour. 3. The overhead rate is $5 per direct labor hour. 4. Actual overhead costs for the week, $1,480. 5. Jobs completed: Nos. 498, 506, and 509. 6. The factory had no work in process at the beginning of the week. Required: a. Prepare a summary that will show the total cost assigned to each job. b. Compute the amount of overhead over- or underapplied during the week. c. Calculate the cost of the work in process at the end of the week. Chapter 5 Job Order Costing 5–33 ANSWER: a. Job No. 498 506 507 508 509 511 512 b. Actual MOH Applied MOH Underapplied $1,480 1,280 $ 200 c. JOB 507 508 511 512 Ending WIP $ 577 723 398 1,105 $2,803 EASY DM $1,500 960 415 345 652 308 835 $5,015 DL $ 464 64 72 168 96 40 120 $1,024 OH $ 580 80 90 210 120 50 150 $1,280 Total $2,544 1,104 577 723 868 398 1,105 $7,319 5–34 14. Chapter 5 Job Order Costing The Watson Tool Corporation, which commenced operations on August 1, employs a job order costing system. Overhead is charged at a normal rate of $2.50 per direct labor hour. The actual operations for the month of August are summarized as follows: a. Purchases of raw material, 25,000 pieces @ $1.20/piece. b. Material and labor costs charged to production: Job No. 101 102 103 104 105 c. Units 10,000 8,800 16,000 8,000 20,000 Material $4,000 3,600 7,000 3,200 8,000 Direct labor cost $6,000 5,400 9,000 4,800 3,600 Direct labor hours 3,000 2,700 4,500 2,400 1,800 Actual overhead costs incurred: Variable Fixed $18,500 15,000 d. Completed jobs: 101, 102, 103, and 104 e. Sales—$105,000. All units produced on Jobs 101, 102, and 103 were sold. Required: Compute the following balances on August 31: a. Material inventory b. Work in process inventory c. Finished goods inventory d. Cost of goods sold e. Under- or overapplied overhead Chapter 5 Job Order Costing ANSWER: a. $30,000 – ($4,000 + $3,600 + $7,000 + $3,200 + $8,000) = $4,200 b. Job #105 $8,000 + $3,600 + ($1,800 × 2.50) = $16,100 c. Job #104 $3,200 + $4,800 + ($2,400 × 2.50) = $14,000 d. Job # 101 $4,000 + $6,000 + ($3,000 × 2.50) = $17,500 102 $3,600 + $5,400 + ($2,700 × 2.50) = 15,750 103 $7,000 + $9,000 + ($4,500 × 2.50) 27,250 $60,500 e. Applied 14,400 × $2.50 = $36,000 Actual 33,500 Overapplied $ 2,500 MEDIUM 5–35 5–36 15. Chapter 5 Job Order Costing You are asked to bring the following incomplete accounts of Ticker Printing Inc. up to date through January 31, 2001. Consider the data that appear in the T-accounts as well as additional information given in items (a) through (i). Ticker’s job order costing system has two direct cost categories (direct material and direct manufacturing labor) and one indirect cost pool (manufacturing overhead, which is allocated using direct manufacturing labor costs). Materials Inventory Control 12/31/2000 Balance 15,000 Work in Process Inventory Control Wages Payable Control 1/31/2001 Balance 3,000 Manufacturing Department Overhead Control January 2001 Charges 57,000 Manufacturing Overhead Control Finished Goods Inventory Control 12/31/2000 Balance 20,000 Cost of Goods Sold Additional Information: a. Manufacturing department overhead is allocated using a budgeted rate set every December. Management forecasts next year’s overhead and next year’s direct manufacturing labor costs. The budget for 2001 is $400,000 of direct manufacturing labor and $600,000 of manufacturing overhead. b. The only job unfinished on January 31, 2001 is No. 419, on which direct manufacturing labor costs are $2,000 (125 direct manufacturing labor hours) and direct material costs are $8,000. c. Total material placed into production during January is $90,000. d. Cost of goods completed during January is $180,000. e. Material inventory as of January 31, 2001 is $20,000. f. Finished goods inventory as of January 31, 2001 is $15,000. g. All plant workers earn the same wage rate. Direct manufacturing labor hours for January totals 2,500. Other labor and supervision totals $10,000. h. The gross plant payroll on January paydays totals $52,000. Ignore withholdings. All personnel are paid on a weekly basis. i. All “actual” manufacturing department overhead incurred during January has already been posted. Chapter 5 Job Order Costing 5–37 Required: a. Material purchased during January b. Cost of Goods Sold during January c. Direct Manufacturing Labor Costs incurred during January d. Manufacturing Overhead Allocated during January e. Balance, Wages Payable Control, December 31, 2000 f. Balance, Work in Process Inventory Control, January 31, 2001 g. Balance, Work in Process Inventory Control, December 31, 2000 h. Balance, Finished Goods Inventory Control, January 31, 2001 i. Manufacturing Overhead underapplied or overapplied for January ANSWER a. $15,000 + Purchases – $20,000 = $90,000. Purchases = $95,000 b. $20,000 + $180,000 – $15,000 = $185,000 c. DL = $2,000 = $16/HR × 2,500 HRS = $40,000 125 d. $600,000 = 150% DL cost × $40,000 = $60,000 $400,000 e. BEGIN + $50,000 – $52,000 = $3,000 f. $2,000 + ($2,000 × 150%) + $8,000 = $13,000 g. BEGIN + $90,000 + $40,000 + $60,000 – $180,000 = $13,000 h. $20,000 + $180,000 – $185,000 = END = $15,000 i. APPLIED $60,000 ACTUAL 57,000 $ 3,000 overapplied DIFFICULT BEGIN = $5,000 BEGIN = $3,000 5–38 16. Chapter 5 Job Order Costing The Smith Company manufactures special purpose machines to order. On 1/1/2001 there were two jobs in process, 405 and 406. The following costs were applied to them in 2000: Job No. Direct material Direct labor Overhead Total 405 $ 5,000 4,000 4,400 $13,400 406 $ 8,000 3,000 3,300 $14,300 During January of 2001, the following transactions took place: * * Raw material costing $40,000 was purchased on account. Jobs #407, 408, and 409 were started and the following costs were applied to them: Direct materials Direct labor * * * * * * * 407 $3,000 5,000 JOB 408 $10,000 6,000 409 $ 7,000 4,000 Job $405 and Job #406 were completed after incurring additional direct labor costs of $2,000 and $4,000, respectively Wages paid to production employees during January totaled $25,000. Depreciation for the month of January totaled $10,000. Utilities bills in the amount of $10,000 were paid for December 2000 operations. Utilities bills totaling $12,000 were received for January operations. Supplies costing $2,000 were used. Miscellaneous overhead expenses totaled $24,000 for January. Actual overhead is applied to individual jobs at the end of each month using a rate based on actual direct labor costs. Required: a. Determine the January 2001 overhead rate. b. Determine the cost of each job. c. Prepare a statement of cost of goods manufactured. Chapter 5 Job Order Costing 5–39 ANSWER: a. MOH $4,000 + $10,000 + $12,000 + $2,000 + $24,000 = $52,000 = $2.4762/dl cost $21,000 dl cost b. DM DC MOH BB c. Beg WIP + DM + DL + MOH – End WIP MEDIUM JOB #405 — $ 2,000 4,952 13,400 $20,352 JOB #406 — $ 4,000 9,905 14,300 $28,205 $27,700 20,000 21,000 52,000 72,143 $48,557 JOB #407 $ 3,000 5,000 12,381 — $20,381 JOB #408 $10,000 6,000 14,857 — $30,857 JOB #409 $ 1,000 4,000 9,905 — $20,905 = $ 20,000 = 21,000 = 52,000 = 27,700 $120,700 5–40 17. Chapter 5 Job Order Costing Fred Company employs a job order costing system. Only three jobs—Job #105, Job #106, and Job #107—were worked on during November and December. Job #105 was completed December 10; the other two jobs were still in production on December 31, the end of the company’s operating year. Job cost sheets on the three jobs follow: Job Cost Sheet Job #105 Job #106 Job #107 November costs incurred: Direct material Direct labor Manufacturing overhead $16,500 13,000 20,800 $ 9,300 7,000 11,200 December cost incurred: Direct materials Direct labor Manufacturing overhead — 4,000 ? 8,200 6,000 ? — — — $ 21,300 10,000 ? The following additional information is available: a. Manufacturing overhead is assigned to jobs on the basis of direct labor cost. b. Balances in the inventory accounts at November 30 were as follows: Raw Material Work in Process Finished Goods $40,000 ? 85,000 Chapter 5 Job Order Costing 5–41 Required: a. Prepare T-accounts for Raw Material, Work in Process Inventory, Finished Goods Inventory, and Manufacturing Overhead Control. Enter the November 30 inventory balances given previously; in the case of Work in Process Inventory, compute the November 30 balance and enter it into the Work in Process Inventory T-account. b. Prepare journal entries for December as follows: 1. Prepare an entry to record the issue of materials into production and post the entry to appropriate T-accounts. (In the case of direct material, it is not necessary to make a separate entry for each job.) Indirect materials used during December totaled $4,000. 2. Prepare an entry to record the incurrence of labor cost and post the entry to appropriate T-accounts. (In the case of direct labor, it is not necessary to make a separate entry for each job.) Indirect labor cost totaled $8,000 for December. 3. Prepare an entry to record the incurrence of $19,000 in various actual manufacturing overhead costs for December (credit Accounts Payable). c. What apparent predetermined overhead rate does the company use to assign overhead cost to jobs? Using this rate, prepare a journal entry to record the application of overhead cost to jobs for December (it is not necessary to make a separate entry for each job). Post this entry to appropriate T-accounts. d. As stated earlier, Job #105 was completed during December. Prepare a journal entry to show the transfer of this job off of the production line and into the finished good warehouse. Post the entry to appropriate T-accounts. e. Determine the balance at December 31 in the Work in Process inventory account. How much of this balance consists of the cost of Job #106? Job #107? 5–42 Chapter 5 Job Order Costing ANSWER: a. RM Inventory BB 40,000 31,500 b. c. 1. WIP Inventory BB 77,800 29,500 60,700 20,000 32,000 98,600 WIP INV MOH RM INV 2. WIP INV MOH CONTROL PAYROLL 3. MOH CONTROL A/P e. 29,500 4,000 33,500 20,000 8,000 28,000 19,000 19,000 160%/DL COST × $20,000 = $32,000 WIP INV 32,000 MOH CONTROL d. FG Inventory BB 85,000 60,700 FG INV 60,700 WIP INV 106 = $51,300 WIP INV BB DM DC FOH MEDIUM 32,000 60,700 98,600 < 107 = $47,300 JOB #105 $50,300 0 4,000 6,400 $60,700 JOB #106 $27,500 8,200 6,000 9,600 $51,300 JOB #107 — $21,300 10,000 16,000 $47,300 MOH Control 4,000 8,000 32,000 19,000 CHAPTER 6 PROCESS COSTING MULTIPLE CHOICE 1. Which cost accumulation procedure is most applicable in continuous mass-production manufacturing environments? a. b. c. d. standard actual process job order ANSWER: 2. engage in road and bridge construction. produce sailboats made to customer specifications. produce bricks for sale to the public. construct houses according to customer plans. ANSWER: c EASY A producer of ________ would not use a process costing system. a. b. c. d. gasoline potato chips blank videotapes stained glass windows ANSWER: 4. EASY Process costing is used in companies that a. b. c. d. 3. c d EASY A process costing system is used by a company that a. b. c. d. produces heterogeneous products. produces items by special request of customers. produces homogeneous products. accumulates costs by job. ANSWER: c EASY 6–1 6–2 5. Chapter 6 Which is the best cost accumulation procedure to use for continuous mass production of like units? a. b. c. d. actual standard job order process ANSWER: 6. d. EASY units completed by a production department in the period. number of units worked on during the period by a production department. number of whole units that could have been completed if all work of the period had been used to produce whole units. identifiable units existing at the end of the period in a production department. ANSWER: c MEDIUM In a process costing system using the weighted average method, cost per equivalent unit for a given cost component is found by dividing which of the following by EUP? a. b. c. d. only current period cost current period cost plus the cost of beginning inventory current period cost less the cost of beginning inventory current period cost plus the cost of ending inventory ANSWER: 8. d Equivalent units of production are equal to the a. b. c. 7. Process Costing b EASY The weighted average method is thought by some accountants to be inferior to the FIFO method because it a. b. c. d. is more difficult to apply. only considers the last units worked on. ignores work performed in subsequent periods. commingles costs of two periods. ANSWER: d MEDIUM Chapter 6 9. Process Costing The first step in determining the cost per EUP per cost component under the weighted average method is to a. b. c. d. add the beginning Work in Process Inventory cost to the current period’s production cost. divide the current period’s production cost by the equivalent units. subtract the beginning Work in Process Inventory cost from the current period’s production cost. divide the current period’s production cost into the EUP. ANSWER: 10. MEDIUM started and completed during the period. residing in beginning Work in Process Inventory. residing in ending Work in Process Inventory. uncompleted in Work in Process Inventory. ANSWER: b MEDIUM EUP calculations for standard process costing are the same as a. b. c. d. the EUP calculations for weighted average process costing. the EUP calculations for FIFO process costing. LIFO inventory costing for merchandise. the EUP calculations for LIFO process costing. ANSWER: 12. a The difference between EUP calculated using FIFO and EUP calculated using weighted average is the equivalent units a. b. c. d. 11. 6–3 b MEDIUM In a FIFO process costing system, which of the following are assumed to be completed first in the current period? a. b. c. d. units started this period units started last period units transferred out units still in process ANSWER: b EASY 6–4 13. Chapter 6 To compute equivalent units of production using the FIFO method of process costing, work for the current period must be stated in units a. b. c. d. completed during the period and units in ending inventory. completed from beginning inventory, units started and completed during the period, and units partially completed in ending inventory. started during the period and units transferred out during the period. processed during the period and units completed during the period. ANSWER: 14. MEDIUM the goods produced are homogeneous. there is no beginning Work in Process Inventory. there is no ending Work in Process Inventory. beginning and ending Work in Process Inventories are each 50 percent complete. ANSWER: b EASY The primary difference between the FIFO and weighted average methods of process costing is a. b. c. d. in the treatment of beginning Work in Process Inventory. in the treatment of current period production costs. in the treatment of spoiled units. none of the above. ANSWER: 16. b The FIFO method of process costing will produce the same cost of goods transferred out amount as the weighted average method when a. b. c. d. 15. Process Costing a EASY Material is added at the beginning of a process in a process costing system. The beginning Work in Process Inventory for the process was 30 percent complete as to conversion costs. Using the FIFO method of costing, the number of equivalent units of material for the process during this period is equal to the a. b. c. d. beginning inventory this period for the process. units started this period in the process. units started this period in the process plus the beginning Work in Process Inventory. units started and completed this period plus the units in ending Work in Process Inventory. ANSWER: d MEDIUM Chapter 6 17. Process Costing In a cost of production report using process costing, transferred-in costs are similar to the a. b. c. d. cost of material added at the beginning of production. conversion cost added during the period. cost transferred out to the next department. cost included in beginning inventory. ANSWER: 18. EASY debit Work in Process Inventory #2, credit Finished Goods Inventory. debit Finished Goods Inventory, credit Work in Process Inventory #1. debit Finished Goods Inventory, credit Work in Process Inventory #2. debit Cost of Goods Sold, credit Work in Process Inventory #2. ANSWER: c EASY Transferred-in cost represents the cost from a. b. c. d. the last department only. the last production cycle. all prior departments. the current period only. ANSWER: 20. a In a process costing system, the journal entry to record the transfer of goods from Department #2 to Finished Goods Inventory is a a. b. c. d. 19. 6–5 c EASY Which of the following is(are) the same between the weighted average and FIFO methods of calculating EUPs? a. b. c. d. Units to account for no yes yes yes ANSWER: d EUP calculations yes yes no no EASY Total cost to account for no yes no yes 6–6 Chapter 6 21. Process costing techniques should be used in assigning costs to products a. b. c. d. if a product is manufactured on the basis of each order received. when production is only partially completed during the accounting period. if a product is composed of mass-produced homogeneous units. whenever standard-costing techniques should not be used. ANSWER: 22. EASY strict FIFO. modified FIFO. weighted average costing. normal costing. ANSWER: b MEDIUM A process costing system a. b. c. d. cannot use standard costs. restates Work in Process Inventory in terms of completed units. accumulates costs by job rather than by department. assigns direct labor and manufacturing overhead costs separately to units of production. ANSWER: 24. c Averaging the total cost of completed beginning inventory and units started and completed over all units transferred out is known as a. b. c. d. 23. Process Costing b EASY A process costing system does which of the following? a. b. c. d. Calculates EUPs no no yes yes ANSWER: c EASY Assigns costs to inventories no yes yes no Chapter 6 25. Process Costing A process costing system a. b. c. d. Calculates average cost per whole unit yes no yes no ANSWER: 26. EASY job order and standard costing systems. job order and process costing systems. process and standard costing systems. job order and normal costing systems. ANSWER: b EASY When standard costs are used in process costing, a. b. c. d. variances can be measured during the production period. total costs rather than current production and current costs are used. process costing calculations are made simpler. the weighted average method of calculating EUPs makes computing transferredout costs easier. ANSWER: 28. d Determines total units to account for yes no no yes A hybrid costing system combines characteristics of a. b. c. d. 27. 6–7 d MEDIUM Short Company transferred 5,500 units to Finished Goods Inventory during June. On June 1, the company had 300 units on hand (40 percent complete as to both material and conversion costs). On June 30, the company had 800 units (10 percent complete as to material and 20 percent complete as to conversion costs). The number of units started and completed during June was a. b. c. d. 5,200. 5,380. 5,500. 6,300. ANSWER: a EASY 6–8 29. Chapter 6 Brown Co. started 9,000 units in October. The company transferred out 7,000 finished units and ended the period with 3,500 units that were 40 percent complete as to both material and conversion costs. Beginning Work in Process Inventory units were a. b. c. d. 500. 600. 1,500. 2,000. ANSWER: 30. c EASY X Co. had beginning Work in Process Inventory of 5,000 units that were 40 percent complete as to conversion costs. X started and completed 42,000 units this period and had ending Work in Process Inventory of 12,000 units. How many units were started this period? a. b. c. d. 54,000 59,000 42,000 47,000 ANSWER: 31. Process Costing a MEDIUM Winn Co. uses a weighted average process costing system. Material is added at the start of production. Winn Co. started 13,000 units into production and had 4,500 units in process at the start of the period that were 60 percent complete as to conversion costs. If Winn transferred out 11,750 units, how many units were in ending Work in Process Inventory? a. b. c. d. 1,250 3,500 5,750 3,000 ANSWER: c EASY Chapter 6 32. Process Costing Murphy Co. uses a weighted average process costing system and started 30,000 units this month. Murphy had 12,000 units that were 20 percent complete as to conversion costs in beginning Work in Process Inventory and 3,000 units that were 40 percent complete as to conversion costs in ending Work in Process Inventory. What are equivalent units for conversion costs? a. b. c. d. 37,800 42,000 40,200 40,800 ANSWER: 33. c EASY Kim Co. makes small metal containers. The company began December with 250 containers in process that were 30 percent complete as to material and 40 percent complete as to conversion costs. During the month, 5,000 containers were started. At month end, 1,700 containers were still in process (45 percent complete as to material and 80 percent complete as to conversion costs). Using the weighted average method, what are the equivalent units for conversion costs? a. b. c. d. 4,610 4,910 3,450 4,560 ANSWER: 34. 6–9 b MEDIUM Zammillo Co. uses a FIFO process costing system. The company had 5,000 units that were 60 percent complete as to conversion costs at the beginning of the month. The company started 22,000 units this period and had 7,000 units in ending Work in Process Inventory that were 35 percent complete as to conversion costs. What are equivalent units for material, if material is added at the beginning of the process? a. b. c. d. 18,000 22,000 25,000 27,000 ANSWER: b EASY 6–10 35. Chapter 6 Process Costing Lisa Co. makes fabric-covered hatboxes. The company began August with 500 boxes in process that were 100 percent complete as to cardboard, 80 percent complete as to cloth, and 60 percent complete as to conversion costs. During the month, 3,300 boxes were started. On August 31, 350 boxes were in process (100 percent complete as to cardboard, 70 percent complete as to cloth, and 55 percent complete as to conversion costs). Using the FIFO method, what are equivalent units for cloth? a. b. c. d. 3,450 3,295 3,395 3,595 ANSWER: b MEDIUM Use the following information for questions 36–38. Forte Co. has the following information for May: Beginning Work in Process Inventory (70% complete as to conversion) Started Ending Work in Process Inventory (10% complete as to conversion) 6,000 units 24,000 units 8,500 units Beginning WIP Inventory Costs: Material $23,400 Conversion 50,607 Current Period Costs: Material Conversion $31,500 76,956 All material is added at the start of the process and all finished products are transferred out. 36. How many units were transferred out in May? a. b. c. d. 15,500 18,000 21,500 24,000 ANSWER: c EASY Chapter 6 37. Process Costing Assume that weighted average process costing is used. What is the cost per equivalent unit for material? a. b. c. d. $1.83 $1.05 $0.55 $1.31 ANSWER: 38. 6–11 a MEDIUM Assume that FIFO process costing is used. What is the cost per equivalent unit for conversion? a. b. c. d. $7.03 $3.44 $4.24 $5.71 ANSWER: c MEDIUM 6–12 Chapter 6 Process Costing Use the following information for questions 39–46. The December 25th Co. makes wreaths in two departments: Forming and Decorating. Forming began the month with 500 wreaths in process that were 100 percent complete as to material and 40 percent complete as to conversion. During the month, 6,500 wreaths were started. At month end, Forming had 2,100 wreaths that were still in process that were 100 percent complete as to material and 50 percent complete as to conversion. Assume Forming uses the weighted average method of process costing. Costs in the Forming Department are as follows: Beginning Work in Process Costs: Material $1,000 Conversion 1,500 Current Costs: Material $3,200 Conversion 5,045 The Decorating Department had 600 wreaths in process at the beginning of the month that were 80 percent complete as to material and 90 percent complete as to conversion. The department had 300 units in ending Work in Process that were 50 percent complete as to material and 75 percent complete as to conversion. Decorating uses the FIFO method of process costing, and costs associated with Decorating are: Beginning WIP Inventory: Transferred In $1,170 Material 4,320 Conversion 6,210 Current Period: Transferred In ? Material $67,745 Conversion 95,820 39. How many units were transferred to Decorating during the month? a. b. c. d. 7,000 600 4,900 5,950 ANSWER: c EASY Chapter 6 40. Process Costing What was the cost transferred out of Forming during the month? a. b. c. d. $6,419 $5,341 $8,330 $8,245 ANSWER: 41. MEDIUM 7,700 8,000 8,600 7,400 ANSWER: b DIFFICULT Disregard your answer to question 39. Assume 8,000 units were transferred to Decorating. Compute the number of equivalent units in Decorating for material. a. b. c. d. 8,000 8,450 8,330 7,970 ANSWER: 43. c Disregard your answer to question 39. Assume 8,000 units were transferred to Decorating. Compute the number of equivalent units as to costs in Decorating for the transferred-in cost component. a. b. c. d. 42. 6–13 d MEDIUM Disregard your answer to question 39. Assume 8,000 units were transferred to Decorating. Compute the number of equivalent units in Decorating for conversion. a. b. c. d. 7,985 8,465 8,360 7,925 ANSWER: a MEDIUM 6–14 44. Chapter 6 Disregard your answer to question 40. Assume that 8,000 units were transferred to Decorating at a total cost of $16,000. What is the material cost per equivalent unit in Decorating? a. b. c. d. $8.80 $8.65 $8.50 $9.04 ANSWER: 45. c MEDIUM Disregard your answer to question 40. Assume that 8,000 units were transferred to Decorating at a total cost of $16,000. What is the conversion cost per equivalent unit in Decorating? a. b. c. d. $12.00 $12.78 $11.32 $11.46 ANSWER: 46. Process Costing a MEDIUM Assume the material cost per EUP is $8.00 and the conversion cost per EUP is $15 in Decorating. What is the cost of completing the units in beginning inventory? a. b. c. d. $11,940 $960 $1,380 $1,860 ANSWER: d MEDIUM Chapter 6 Process Costing 6–15 Use the following information for questions 47–51. BCW Co. adds material at the start to its production process and has the following information available for November: Beginning Work in Process Inventory (40% complete as to conversion) Started this period Ending Work in Process Inventory (25% complete as to conversion) Transferred out 47. 29,500 39,000 36,500 34,500 ANSWER: a MEDIUM Calculate equivalent units of production for material using FIFO. a. b. c. d. 36,800 32,000 39,000 37,125 ANSWER: 49. 2,500 units ? Compute the number of units started and completed in November. a. b. c. d. 48. 7,000 units 32,000 units b EASY Calculate equivalent units of production for conversion using FIFO. a. b. c. d. 34,325 30,125 37,125 39,000 ANSWER: a MEDIUM 6–16 50. Chapter 6 Calculate equivalent units of production for material using weighted average. a. b. c. d. 34,325 32,000 37,125 39,000 ANSWER: 51. Process Costing d EASY Calculate equivalent units of production for conversion using weighted average. a. b. c. d. 39,925 37,125 34,325 38,375 ANSWER: b MEDIUM Use the following information for questions 52–63. Storey Co. adds material at the start of production. February information for the company follows: Beginning Work in Process Inventory (45% complete as to conversion) Started this period Ending Work in Process Inventory (80% complete as to conversion) Beginning Work in Process Inventory Costs: Material $24,500 Conversion 68,905 Current Period Costs: Material Conversion 52. $ 75,600 130,053 How many units must be accounted for? a. b. c. d. 128,200 138,200 130,000 118,200 ANSWER: c EASY 10,000 units 120,000 units 8,200 units Chapter 6 53. Process Costing What is the total cost to account for? a. b. c. d. $205,653 $299,058 $ 93,405 $274,558 ANSWER: 54. b EASY What are the equivalent units for material using the weighted average method? a. b. c. d. 120,000 128,360 130,000 123,860 ANSWER: c EASY What are the equivalent units for material using the FIFO method? a. b. c. d. 130,000 125,500 111,800 120,000 ANSWER: 57. EASY 120,000 111,800 121,800 130,000 ANSWER: 56. b How many units were started and completed in the period? a. b. c. d. 55. 6–17 d EASY What are the equivalent units for conversion using the weighted average method? a. b. c. d. 128,360 123,440 130,000 120,000 ANSWER: a MEDIUM 6–18 58. Chapter 6 What are the equivalent units for conversion using the FIFO method? a. b. c. d. 128,360 123,860 118,360 122,860 ANSWER: 59. c MEDIUM What is the conversion cost per equivalent unit using the weighted average method? a. b. c. d. $1.61 $1.55 $1.05 $1.01 ANSWER: b MEDIUM What is the cost of units completed using the weighted average? a. b. c. d. $266,742 $282,576 $278,400 $237,510 ANSWER: 62. MEDIUM $.58 $.62 $.77 $.82 ANSWER: 61. b What is the material cost per equivalent unit using the weighted average method? a. b. c. d. 60. Process Costing b DIFFICULT What is the conversion cost per equivalent unit using the FIFO method? a. b. c. d. $1.05 $.95 $1.61 $1.55 ANSWER: a MEDIUM Chapter 6 63. Process Costing 6–19 What is the cost of all units transferred out using the FIFO method? a. b. c. d. $204,624 $191,289 $287,004 $298,029 ANSWER: c DIFFICULT Use the following information relating to I M Cute Co. for questions 64–73. Beginning inventory (30% complete as to Material B and 60% complete for conversion) Started this cycle Ending inventory (50% complete as to Material B and 80% complete for conversion) 700 units 2,000 units 500 units Beginning inventory costs: Material A $14,270 Material B 5,950 Conversion 5,640 Current Period costs: Material A Material B Conversion $40,000 70,000 98,100 Material A is added at the start of production, while Material B is added uniformly throughout the process. 64. Assuming a weighted average method of process costing, compute EUP units for Materials A and B. a. b. c. d. 2,700 and 2,280, respectively 2,700 and 2,450, respectively 2,000 and 2,240, respectively 2,240 and 2,700, respectively ANSWER: b EASY 6–20 65. Chapter 6 Assuming a FIFO method of process costing, compute EUP units for Materials A and B. a. b. c. d. 2,700 and 2,280, respectively 2,700 and 2,450, respectively 2,000 and 2,240, respectively 2,450 and 2,880, respectively ANSWER: 66. MEDIUM 2,600 2,180 2,000 2,700 ANSWER: a MEDIUM Assuming a FIFO method of process costing, compute EUP for conversion. a. b. c. d. 2,240 2,180 2,280 2,700 ANSWER: 68. c Assuming a weighted average method of process costing, compute EUP for conversion. a. b. c. d. 67. Process Costing b MEDIUM Assuming a weighted average method of process costing, compute the average cost per unit for Material A. a. b. c. d. $20.10 $20.00 $31.25 $31.00 ANSWER: a MEDIUM Chapter 6 69. Process Costing Assuming a FIFO method of process costing, compute the average cost per EUP for Material A. a. b. c. d. $31.25 $20.10 $20.00 $31.00 ANSWER: 70. MEDIUM $20.10 $31.25 $20.00 $31.00 ANSWER: b MEDIUM Assuming a weighted average method of process costing, compute the average cost per EUP for Material B. a. b. c. d. $20.00 $31.25 $20.10 $31.00 ANSWER: 72. c Assuming a FIFO method of process costing, compute the average cost per EUP for Material B. a. b. c. d. 71. 6–21 d MEDIUM Assuming a FIFO method of process costing, compute the average cost per EUP for conversion. a. b. c. d. $45.50 $45.00 $43.03 $47.59 ANSWER: b MEDIUM 6–22 73. Chapter 6 Process Costing Assuming a weighted average method of process costing, compute the average cost per EUP for conversion. a. b. c. d. $39.90 $45.00 $43.03 $47.59 ANSWER: a DIFFICULT THE FOLLOWING MULTIPLE CHOICE RELATES TO MATERIAL COVERED IN THE APPENDIX OF THE CHAPTER. 74. Which of the following is subtracted from weighted average EUP to derive FIFO EUP? a. b. c. d. beginning WIP EUP completed in current period beginning WIP EUP produced in prior period ending WIP EUP not completed ending WIP EUP completed ANSWER: b EASY SHORT ANSWER/PROBLEMS 1. Discuss the assignment of costs to transferred-out inventories in both process costing methods. ANSWER: The assignment of costs in a process costing system first involves determining total production costs. These costs are then assigned to units completed and transferred out during the period and to the units in Work in Process Inventory at the end of the period. To assign costs, the cost per equivalent unit must be established using either the FIFO or weighted average method. The cost per EUP is then multiplied by the number of equivalent units in the component being costed. Transferred-out costs using the weighted average method are computed as the number of units transferred times the total price per equivalent unit. When using FIFO, transferred-out units are computed as follows: the costs in beginning WIP are added to the current period costs to complete the units which sums to the total cost of beginning WIP; the units started and completed are priced at current period costs; the total of the costs of beginning inventory and units started and completed are then transferred out. MEDIUM Chapter 6 2. Process Costing 6–23 Discuss process costing in a multidepartment atmosphere. ANSWER: When a business has more than one department in its production process, products are transferred from Department A to Department B and so on. As the products are transferred from department to department so, too, must the costs be transferred. When products are transferred, the units and costs are treated as input material in the next department. The new department may add additional material or may simply add conversion costs and finish the products. The total cost of the products is a cumulative total from all departments within the process. MEDIUM 3. Discuss standard costing as used in conjunction with process costing. ANSWER: When standard costing is used in conjunction with process costing, the costing procedure is simplified. Standard costing eliminates the calculation in each new period of a new production cost because the standards are established as on going norms for (at least) a one-year period of time. Standard costing in a process costing system is essentially a FIFO system that permits variances to be recognized during the period. MEDIUM 4. What are two alternative calculations that can be used to either check an equivalent units answer or to obtain the answer initially? ANSWER: One alternative method of calculating equivalent units for weighted average is to determine units transferred out and add to that the equivalent units of ending work in process. Another alternative method of calculating equivalent units for FIFO is to determine equivalent units of production under weighted average and subtract the beginning work in process equivalent units that were completed in the last period. Both of these methods may be used to “check” original answers. MEDIUM 6–24 Chapter 6 Process Costing Use the following information for questions 5–7. VanBuren Co. has the following information available for November: Beginning Work in Process Inventory (25% complete as to conversion) Started Ending Work in Process Inventory (30% complete as to conversion) 10,000 units 120,000 units 30,000 units Beginning Work in Process Inventory Costs: Material $2,100 Conversion 2,030 Current Period Costs: Material Conversion $ 33,000 109,695 All material is added at the start of production and all products completed are transferred out. Chapter 6 5. Process Costing 6–25 Prepare an equivalent units schedule using the (a) FIFO and (b) weighted average method. ANSWER: VanBuren Company Schedule of Equivalent Units for Fifo and Weighted Average November 30, 20XX Beg. WIP Started To Acct. For FIFO 10,000 120,000 130,000 Beg. WIP S&C End. WIP Acct. For 10,000 90,000 30,000 130,000 (a) BWIP S&C EWIP EUP FIFO Mat. 0 90,000 30,000 120,000 CC 7,500 90,000 9,000 106,500 Beg. WIP Started To Acct. For Weighted Average 10,000 120,000 130,000 TO EI Acct. for 100,000 30,000 130,000 (b) Weighted Average Mat. CC TO EI EUP 100,000 30,000 130,000 100,000 9,000 109,000 MEDIUM 6. Prepare a schedule showing the computation for cost per equivalent unit assuming the (a) FIFO and (b) weighted average method. ANSWER: VanBuren Company Schedule of Average Cost Per Unit FIFO and Weighted Average November 30, 20XX (a) FIFO Mat. CC $ 33,000 $ 109,695 120,000 106,500 $ .275 $ 1.03 $1.305 MEDIUM (b) Weighted Average Mat. CC $ 35,100 $111,725 130,000 109,000 $ .27 $ 1.025 $1.295 6–26 7. Chapter 6 Process Costing Prepare a schedule showing the assignment of costs assuming the (a) FIFO and (b) weighted average method. ANSWER: VanBuren Company Schedule of Assigned Costs FIFO and Weighted Average November 30, 20XX (a) FIFO Beginning Work in Process To complete (7,500 × $1.03) = Started and Completed 90,000 × $1.305 = Total costs transferred out Ending Work in Process 30,000 × $ .275 = 9,000 × $1.03 = $ 4,130 7,725 $11,855 117,450 $129,305 Total costs accounted for 8,250 9,270 $ 17,520 $146,825 (b) Weighted Average Completed 100,000 × $1.295 = $129,500 Ending Work in Process 30,000 × $ .27 = 9,000 × $1.025 = Total costs accounted for DIFFICULT $ $ 8,100 9,225 $ 17,325 $146,825 Chapter 6 8. Process Costing 6–27 The Valentine’s Day Company has two processing departments, Cooking and Packaging. Ingredients are placed into production at the beginning of the process in Cooking, where they are formed into various shapes. When finished, they are transferred into Packaging, where the candy is placed into heart and tuxedo boxes and covered with foil. All material added in Packaging is considered as one material for convenience. Since the boxes contain a variety of candies, they are considered partially complete until filled with the appropriate assortment. The following information relates to the two departments for February 2001: Cooking Department: Beginning WIP (30% complete as to conversion) Units started this period Ending WIP (60% complete as to conversion) Packaging Department: Beginning WIP (90% complete as to material, 80% complete as to conversion) Units started during period Ending WIP (80% complete as to material and 80% complete as to conversion) a. b. 4,500 units 15,000 units 2,400 units 1,000 units ? 500 units Determine equivalent units of production for both departments using the weighted average method. Determine equivalent units of production for both departments using the FIFO method. 6–28 Chapter 6 ANSWER: a. Cooking Department Mat. 17,100 2,400 19,500 CC 17,100 1,440 18,540 Packaging Department T. In Trans. Out 17,600 EWIP 500 TOTAL EUP 18,100 Mat. 17,600 400 18,000 Trans. Out EWIP TOTAL EUP b. CC 17,600 400 18,000 Cooking Department Mat. 0 12,600 2,400 15,000 CC 3,150 12,600 1,440 17,190 Packaging Department T. In BWIP 0 S&C 16,600 EWIP 500 TOTAL EUP 17,100 Mat. 100 16,600 400 17,100 BWIP S&C EWIP TOTAL EUP DIFFICULT CC 200 16,600 400 17,200 Process Costing Chapter 6 9. Process Costing 6–29 The following costs were accumulated by Department 2 of H Company during July: Beginning Inventory Current Period Cost Cost Transferred from Dept. 1 $ 17,050 184,000 $ 201,050 Material CC 5,450 104,000 $ 109,450 $ $ 34,000 $ 34,000 Total $ 22,500 322,000 $ 344,500 Production for July in Department 2 (in units): WIP—July 1 Complete period transferred WIP—July 31 2,000 60% complete 20,000 5,000 40% complete Materials are not added in Department 2 until the very end of processing Department 2. Required: Compute the cost of units completed and the value of ending WIP for: a. Average inventory assumption b. FIFO inventory assumption 6–30 Chapter 6 Process Costing ANSWER: a. Average inventory assumption Complete Eq—End WIP EP—WA Dept 1 20,000 5,000 25,000 MAT 20,000 0 20,000 CC 20,000 2,000 22,000 Unit Cost $201,050 = $8.042 $34,000 = $1.70 25,000 20,000 $109,450 = $4.975 22,000 End WIP Dept 1 = 5,000 × $8.042 CC = 2,000 units × $4.975 = $40,210 = 9,950 $50,160 = $14.717 COGM = $344,500 – $50,160 = $294,340 b. FIFO inventory assumption Complete Eq-End WIP – Eq-Begin EP-WA Unit Cost End WIP Dept 1 20,000 5,000 (2,000 ) 23,000 $184,000 = $8.00 23,000 MAT 20,000 0 0 20,000 $34,000 = $1.70 20,000 Dept 1 = 5,000 units × $8.00 CC = 2,000 units × $5.00 COGM = $344,500 – $50,000 = $294,500 MEDIUM CC 20,000 2,000 (1,200 ) 20,800 $104,000 = $5.00 20,800 = $40,000 = 10,000 $50,000 = $14.70 CHAPTER 7 SPECIAL PRODUCTION ISSUES: LOST UNITS AND ACCRETION MULTIPLE CHOICE 1. Shrinkage should be treated as a. b. c. d. defective units. spoiled units. miscellaneous expense. a reduction of overhead. ANSWER: 2. not be sold through normal channels of distribution. be sold through normal channels of distribution. not be reprocessed to a sufficient quality level. also be called a spoiled unit. ANSWER: b EASY A unit that is rejected at a quality control inspection point, but that can be reworked and sold, is referred to as a a. b. c. d. spoiled unit. scrap unit. abnormal unit. defective unit. ANSWER: 4. EASY Economically reworked units may a. b. c. d. 3. b d EASY Spoiled units are a. b. c. d. units that cannot be economically reworked to bring them up to standard. units that can be economically reworked to bring them up to standard. the same as defective units. considered abnormal losses. ANSWER: a EASY 7–1 7–2 5. Chapter 7 The cost of abnormal losses (net of disposal costs) should be written off as a. b. c. d. Product cost yes yes no no ANSWER: 6. Abnormal loss yes yes no no ANSWER: EASY d Normal loss yes no no yes EASY If abnormal spoilage occurs in a job order costing system, has a material dollar value, and is related to a specific job, the recovery value of the spoiled goods should be a. b. c. d. debited to a scrap inventory account the specific job in process a loss account factory overhead ANSWER: 8. c Period cost no yes yes no Which of the following would fall within the range of tolerance for a production cycle? a. b. c. d. 7. Special Production Issues: Lost Units and Accretion a credited to the specific job in process overhead the specific job in process sales MEDIUM If normal spoilage is detected at an inspection point within the process (rather than at the end), the cost of that spoilage should be a. b. c. d. included with the cost of the units sold during the period. included with the cost of the units completed in that department during the period. allocated to ending work in process units and units transferred out based on their relative values. allocated to the good units that have passed the inspection point. ANSWER: d MEDIUM Chapter 7 9. Special Production Issues: Lost Units and Accretion A continuous loss a. b. c. d. occurs unevenly throughout a process. never occurs during the production process. always occurs at the same place in a production process. occurs evenly throughout the production process. ANSWER: 10. c EASY The method of neglect handles spoilage that is a. b. c. d. discrete and abnormal. discrete and normal. continuous and abnormal. continuous and normal. ANSWER: d MEDIUM Normal spoilage is defined as unacceptable production that a. b. c. d. arises because of a special job or process. occurs in on-going operations. is caused specifically by human error. is in excess of that which is expected. ANSWER: 13. EASY adding the correct ingredients to make a bottle of ketchup putting the appropriate components together for a stereo adding the wrong components when assembling a stereo putting the appropriate pieces for a bike in the box ANSWER: 12. d Which of the following would be considered a discrete loss in a production process? a. b. c. d. 11. 7–3 b EASY When the cost of good units are increased and lost units are not included in an equivalent unit schedule, these units are considered a. b. c. d. normal and discrete. normal and continuous. abnormal and discrete. abnormal and continuous. ANSWER: b EASY 7–4 14. Chapter 7 The net cost of normal spoilage in a job order costing system in which spoilage is common to all jobs should be a. b. c. d. assigned directly to the jobs that caused the spoilage. charged to manufacturing overhead during the period of the spoilage. charged to a loss account during the period of the spoilage. allocated only to jobs that are completed during the period. ANSWER: 15. MEDIUM written off as a period cost. never shown in EUP schedules. treated as a product cost. both b and c. ANSWER: c EASY Normal spoilage units resulting from a continuous process a. b. c. d. are extended to the EUP schedule. result in a higher unit cost for the good units produced. result in a loss being incurred. cause estimated overhead to increase. ANSWER: 17. b Normal spoilage is a. b. c. d. 16. Special Production Issues: Lost Units and Accretion b EASY When normal spoilage is discovered at a discrete inspection point and the degree of completion of ending work in process has not reached the level of completion of the inspection point, normal spoilage is handled by a. b. c. d. prorating the spoilage cost between units transferred out and units in ending work in process. extending the spoiled units to the EUP schedule. assigning the normal spoilage costs to the units transferred out and those in beginning inventory. both b and c. ANSWER: d MEDIUM Chapter 7 18. Special Production Issues: Lost Units and Accretion In a job order costing system, the net cost of normal spoilage is equal to a. b. c. d. estimated disposal value plus the cost of spoiled work. the cost of spoiled work minus estimated spoilage cost. the units of spoiled work times the predetermined overhead rate. the cost of spoiled work minus the estimated disposal value. ANSWER: 19. Beginning Inventory no yes no yes ANSWER: MEDIUM b Ending Inventory yes yes no no Units Started & Completed yes yes yes no MEDIUM The cost of normal discrete losses is a. b. c. d. absorbed by all units past the inspection point on an equivalent unit basis. absorbed by all units in ending inventory. considered a period cost. written off as a loss on an equivalent unit basis. ANSWER: 21. d Taylor Co. has a production process in which the inspection point is at 65 percent of conversion. The beginning inventory for July was 35 percent complete and ending inventory was 80 percent complete. Normal spoilage costs would be assigned to which of the following groups of units, using FIFO costing? a. b. c. d. 20. 7–5 a EASY When spoilage is discovered at a discrete point in the production process, a. b. c. d. equivalent units for the spoilage are shown in the EUP schedule. its cost, if normal, should be assigned to the units transferred out. its cost, if abnormal, should be assigned to the good units produced. both a and c. ANSWER: a EASY 7–6 22. Chapter 7 When the cost of lost units must be assigned, and those same units must be included in an equivalent unit schedule, these units are considered a. b. c. d. normal and discrete. normal and continuous. abnormal and discrete. abnormal and continuous. ANSWER: 23. MEDIUM spoilage that is forecasted or planned. spoilage that is in excess of planned. accounted for as a product cost. debited to Cost of Goods Sold. ANSWER: b EASY Which of the following accounts is credited when abnormal spoilage is written off in an actual cost system? a. b. c. d. Miscellaneous Revenue Loss from Spoilage Finished Goods Work in Process ANSWER: 25. d Abnormal spoilage is a. b. c. d. 24. Special Production Issues: Lost Units and Accretion d EASY Which of the following types of spoilage cost is considered a product cost? a. b. c. d. Abnormal spoilage yes yes no no ANSWER: c EASY Normal spoilage yes no yes no Chapter 7 26. Special Production Issues: Lost Units and Accretion Abnormal spoilage can be a. b. c. d. continuous yes no yes no ANSWER: 27. good units yes no yes no ANSWER: EASY d lost units yes no no yes EASY The cost of abnormal continuous losses is a. b. c. d. considered a product cost. absorbed by all units in ending inventory and transferred out on an equivalent unit basis. written off as a loss on an equivalent unit basis. absorbed by all units past the inspection point. ANSWER: 29. c discrete no no yes yes The cost of abnormal discrete units must be assigned to a. b. c. d. 28. 7–7 c EASY Which of the following statements is false? The cost of rework on defective units, if a. b. c. d. abnormal, should be assigned to a loss account. normal and if actual costs are used, should be assigned to material, labor and overhead costs of the good production. normal and if standard costs are used, should be considered when developing the overhead application rate. abnormal, should be prorated among WIP, FG, and CGS. ANSWER: d MEDIUM 7–8 30. Chapter 7 A process that generates continuous defective units a. b. c. d. never requires a quality control point. requires a quality control point at the end of the process. requires quality control points every time new materials are added to the production process. requires quality control points at the beginning of the production process. ANSWER: 31. MEDIUM accretion. reworked units. complex procedure. undetected spoilage. ANSWER: a EASY When material added in a successor department increases the number of units, the a. b. c. d. extra units are treated like spoilage. unit cost of the transferred-in units is decreased. costs associated with the extra units are maintained separately for financial reporting purposes. unit cost of the transferred-in units is increased. ANSWER: 33. b The addition of material in a successor department that causes an increase in volume is called a. b. c. d. 32. Special Production Issues: Lost Units and Accretion b EASY Which of the following is not a question that needs to be answered in regard to quality control? a. b. c. d. What happens to the spoiled units? What is the actual cost of spoilage? How can spoilage be controlled? Why does spoilage happen? ANSWER: a MEDIUM Chapter 7 34. Special Production Issues: Lost Units and Accretion In regard to spoilage, management should be most concerned with which of the following? a. b. c. d. accounting for spoilage controlling spoilage planning for spoilage inspecting spoilage ANSWER: b EASY Use the following information for questions 35–46. The following information is available for K Co. for June: Started this month Beginning WIP (40% complete) Normal spoilage (discrete) Abnormal spoilage Ending WIP (70% complete) Transferred out Beginning Work in Process Costs: Material Conversion Current Costs: Material Conversion 80,000 units 7,500 units 1,100 units 900 units 13,000 units 72,500 units $10,400 13,800 $120,000 350,000 All materials are added at the start of production and the inspection point is at the end of the process. 35. What are equivalent units of production for material using FIFO? a. b. c. d. 80,000 79,100 78,900 87,500 ANSWER: a MEDIUM 7–9 7–10 36. Chapter 7 What are equivalent units of production for conversion costs using FIFO? a. b. c. d. 79,700 79,500 81,100 80,600 ANSWER: 37. b EASY What are equivalent units of production for conversion costs using weighted average? a. b. c. d. 83,600 82,700 82,500 81,600 ANSWER: a EASY What is cost per equivalent unit for material using FIFO? a. b. c. d. $1.63 $1.37 $1.50 $1.56 ANSWER: 40. MEDIUM 86,600 87,500 86,400 85,500 ANSWER: 39. d What are equivalent units of production for material using weighted average? a. b. c. d. 38. Special Production Issues: Lost Units and Accretion c EASY What is cost per equivalent unit for conversion costs using FIFO? a. b. c. d. $4.00 $4.19 $4.34 $4.38 ANSWER: c EASY Chapter 7 41. Special Production Issues: Lost Units and Accretion What is cost per equivalent unit for material using weighted average? a. b. c. d. $1.49 $1.63 $1.56 $1.44 ANSWER: 42. $4.19 $4.41 $4.55 $4.35 ANSWER: EASY $75,920 $58,994 $56,420 $53,144 ANSWER: b MEDIUM What is the cost assigned to abnormal spoilage using FIFO? a. b. c. d. $1,350 $3,906 $5,256 $6,424 ANSWER: 45. d What is the cost assigned to ending inventory using FIFO? a. b. c. d. 44. EASY What is cost per equivalent unit for conversion costs using weighted average? a. b. c. d. 43. a c MEDIUM What is the cost assigned to normal spoilage and how is it classified using weighted average? a. b. c. d. $6,193 allocated between WIP and Transferred Out $6,424 assigned to units Transferred Out $6,193 assigned to loss account $6,424 assigned to units Transferred Out ANSWER: b MEDIUM 7–11 7–12 46. Chapter 7 Special Production Issues: Lost Units and Accretion What is the total cost assigned to goods transferred out using weighted average? a. b. c. d. $435,080 $429,824 $428,656 $423,400 ANSWER: b DIFFICULT Use the following for questions 47–57. The following information is available for OP Co. for the current year: Beginning Work in Process (75% complete) Started Ending Work in Process (60% complete) Abnormal spoilage Normal spoilage (continuous) Transferred out 14,500 units 75,000 units 16,000 2,500 5,000 66,000 units units units units Costs of Beginning Work in Process: Material $25,100 Conversion 50,000 Current Costs: Material $120,000 Conversion 300,000 All materials are added at the start of production. 47. Using weighted average, what are equivalent units for material? a. b. c. d. 82,000 89,500 84,500 70,000 ANSWER: 48. c EASY Using weighted average, what are equivalent units for conversion costs? a. b. c. d. 80,600 78,100 83,100 75,600 ANSWER: b EASY Chapter 7 49. Special Production Issues: Lost Units and Accretion What is the cost per equivalent unit for material using weighted average? a. b. c. d. $1.72 $1.62 $1.77 $2.07 ANSWER: 50. $4.62 $4.21 $4.48 $4.34 ANSWER: MEDIUM $31,000 $15,500 $30,850 none of the above ANSWER: d EASY Assume that the cost per EUP for material and conversion are $1.75 and $4.55, respectively. What is the cost assigned to ending Work in Process? a. b. c. d. $100,800 $87,430 $103,180 $71,680 ANSWER: 53. c What is the cost assigned to normal spoilage using weighted average? a. b. c. d. 52. MEDIUM What is the cost per equivalent unit for conversion costs using weighted average? a. b. c. d. 51. a d EASY Using FIFO, what are equivalent units for material? a. b. c. d. 75,000 72,500 84,500 70,000 ANSWER: d EASY 7–13 7–14 54. Chapter 7 Using FIFO, what are equivalent units for conversion costs? a. b. c. d. 72,225 67,225 69,725 78,100 ANSWER: 55. EASY $1.42 $1.66 $1.71 $1.60 ANSWER: c EASY Using FIFO, what is the cost per equivalent unit for conversion costs? a. b. c. d. $4.46 $4.15 $4.30 $3.84 ANSWER: 57. b Using FIFO, what is the cost per equivalent unit for material? a. b. c. d. 56. Special Production Issues: Lost Units and Accretion a EASY Assume that the FIFO EUP cost for material and conversion are $1.50 and $4.75, respectively. Using FIFO what is the total cost assigned to the units transferred out? a. b. c. d. $414,194 $339,094 $445,444 $396,975 ANSWER: a DIFFICULT Chapter 7 Special Production Issues: Lost Units and Accretion 7–15 Use the following information for questions 58–65. T Co. has the following information for July: Units started Beginning Work in Process: (35% complete) Normal spoilage (discrete) Abnormal spoilage Ending Work in Process: (70% complete) Transferred out Beginning Work in Process Costs: Material $15,000 Conversion 10,000 100,000 20,000 3,500 5,000 14,500 97,000 units units units units units units All materials are added at the start of the production process. T Co. inspects goods at 75 percent completion as to conversion. 58. What are equivalent units of production for material, assuming FIFO? a. b. c. d. 100,000 96,500 95,000 120,000 ANSWER: 59. MEDIUM What are equivalent units of production for conversion costs, assuming FIFO? a. b. c. d. 108,900 103,900 108,650 106,525 ANSWER: 60. a d MEDIUM Assume that the costs per EUP for material and conversion are $1.00 and $1.50, respectively. What is the amount of the period cost for July using FIFO? a. b. c. d. $0 $9,375 $10,625 $12,500 ANSWER: c MEDIUM 7–16 61. Chapter 7 Assume that the costs per EUP for material and conversion are $1.00 and $1.50, respectively. Using FIFO, what is the total cost assigned to the transferred-out units (rounded to the nearest dollar)? a. b. c. d. $245,750 $244,438 $237,000 $224,938 ANSWER: 62. DIFFICULT 107,000 116,500 120,000 115,000 ANSWER: c EASY What are equivalent units of production for conversion costs assuming weighted average is used? a. b. c. d. 113,525 114,400 114,775 115,650 ANSWER: 64. b What are equivalent units of production for material assuming weighted average is used? a. b. c. d. 63. Special Production Issues: Lost Units and Accretion a EASY Assume that the costs per EUP for material and conversion are $1.00 and $1.50, respectively. What is the cost assigned to normal spoilage, using weighted average, and where is it assigned? a. b. c. d. Value $7,437.50 $7,437.50 $8,750.00 $8,750.00 ANSWER: b Assigned To Units transferred out and EI Units transferred out Units transferred out and EI Units transferred out EASY Chapter 7 65. Special Production Issues: Lost Units and Accretion Assume that the costs per EUP for material and conversion are $1.00 and $1.50, respectively. Assuming that weighted average is used, what is the cost assigned to ending inventory? a. b. c. d. $29,725.00 $37,162.50 $38,475.00 $36,250.00 ANSWER: 66. EASY its minimum tolerance for defects. its maximum tolerance for defects. a decision to seek world-class status as a manufacturer. its automated quality limits. ANSWER: b EASY World-class companies a. b. c. d. believe that “Six-Sigma” is the best AQL to have. have performed well if their defect percentage is greater than their AQL. continuously attempt to raise their AQL. all of the above. ANSWER: 68. a A company’s AQL represents a. b. c. d. 67. 7–17 c MEDIUM Six Sigma translates into a rate of 3.4 defects per a. b. c. d. million items processed. billion items processed. thousand items processed. hundred items processed. ANSWER: a EASY 7–18 69. Chapter 7 The concept of Six Sigma is directly related to a. b. c. d. Variation elimination no no yes yes ANSWER: 70. d JIT Inventory no yes yes no MEDIUM Performing services with zero errors is viewed as a(an) a. b. c. d. reasonable goal for all service organizations. impossible goal for any service organization. laudable goal for most service organizations. goal equivalent to achieving Six-Sigma performance. ANSWER: 71. Special Production Issues: Lost Units and Accretion c MEDIUM Which of the following would be the most likely cause of an increase in the number of units in a department? a. b. c. d. Bulk packaging Expansion of material Heat processing All of the above ANSWER: b MEDIUM SHORT ANSWER/PROBLEMS 1. How is the cost of reworking defective items accounted for? ANSWER: Reworked units are also known as defective units. These units can be reprocessed and sold or sold as is as irregulars. Rework cost is classified as either a product or period cost. If rework is considered normal and actual costing is used, the cost is added to current Work in Process and is assigned to all units produced. If rework is abnormal, the cost is allocated to a loss account for the period. MEDIUM Chapter 7 2. Special Production Issues: Lost Units and Accretion 7–19 Discuss the accounting treatment of spoilage in a job order costing system. ANSWER: If the spoilage is common to all jobs, is normal, and can be estimated, the net cost is applied to production using a predetermined overhead rate that was set by including the spoilage estimate in estimated overhead. If spoilage pertains to a particular job and is normal, the disposal value of the spoiled goods should be removed from that particular job. If the spoilage is abnormal, the net cost should be charged to a loss account and credited to the particular Work in Process job that created the spoilage. MEDIUM 3. Discuss why units are lost during production. ANSWER: In most production processes, losses are anticipated to a certain degree. Losses may be classified as normal and abnormal depending on management’s expectations. A normal loss is one that is expected, while an abnormal loss is one that exceeds the normal loss. The losses may result in spoiled or defective units. Spoiled units cannot be economically reworked; defective units can be. Losses can occur on a continuous or a discrete basis. Quality control points are established at the end of and/or within the process to inspect goods and remove from further processing those units that are either spoiled or defective. MEDIUM 4. Discuss how spoilage is treated in EUP computations. ANSWER: If spoilage is normal and continuous, the calculations for EUP do not include this spoilage (method of neglect), and the good units simply absorb the cost of such spoilage. If spoilage is normal and discrete, the equivalent units are used in the EUP calculations, and the spoilage cost is assigned to all units that passed through the inspection point during the current period. If the spoilage is abnormal and either discrete or continuous, the equivalent units are used in EUP calculations and costed at the cost per EUP; the total cost is then assigned to a loss account. MEDIUM 7–20 Chapter 7 Special Production Issues: Lost Units and Accretion Use this data for questions 5 and 6. The following information is available for Paas Co. for January 2001. All materials are added at the start of production. Beginning Work in Process: (80% complete) Started Normal spoilage (continuous) Abnormal spoilage Ending Work in Process: (55% complete) Transferred out Beginning Work in Process Costs: Material $ 14,000 Conversion 45,000 Current Costs: Material 50,000 Conversion 175,000 Total Costs $ 284,000 8,000 35,000 6,000 2,500 15,000 19,500 units units units units units units Chapter 7 5. Special Production Issues: Lost Units and Accretion 7–21 Prepare a cost of production report for January using FIFO. ANSWER: BI 8,000 + Started 35,000 = Accountable for 43,000 Paas Co. Cost Report January 31, 2001 BWIP S&C EWIP Norm Abnorm. Acctd. for 8,000 11,500 15,000 6,000 2,500 43,000 Material 0 11,500 15,000 0 2,500 29,000 Material: $50,000/29,000 = $1.72 Conversion Costs: $175,000/23,850 = $7.34 Cost Assignment: Ending Work in Process 15,000 × $1.72 = $ 25,800 8,250 × $7.34 = 60,555 Abnormal Spoilage 2,500 × $9.06 = Cost Transferred Out $284,000 – 86,355 – 22,650 = Total costs accounted for MEDIUM $ 86,355 22,650 174,995 $ 284,000 CC 1,600 11,500 8,250 0 2,500 23,850 7–22 6. Chapter 7 Special Production Issues: Lost Units and Accretion Prepare the cost of production report assuming weighted average. ANSWER: BI 8,000 + Started 35,000 = Accountable for 43,000 Paas Company Cost Report January 31, 2001 TO EWIP Norm Abnorm. Acctd. for 19,500 15,000 6,000 2,500 43,000 Material 19,500 15,000 0 2,500 37,000 Material: $64,000/37,000 = $1.73 Conversion Costs: $220,000/30,250 = $ 7.27 Cost Assignment: Ending Work in Process 15,000 × $1.73 = 8,250 × $7.27 = Abnormal Spoilage 2,500 × $9.00 = $25,950 59,978 Transferred Out $284,000 – 85,928 – 22,500 = Total costs accounted for MEDIUM $ 85,928 22,500 175,572 $ 284,000 CC 19,500 8,250 0 2,500 30,250 Chapter 7 7. Special Production Issues: Lost Units and Accretion 7–23 MJ Company manufactures picture frames of all sizes and shapes and uses a job order costing system. There is always some spoilage in each production run. The following costs relate to the current run: Estimated overhead (exclusive of spoilage) Spoilage (estimated) Sales value of spoiled frames Labor hours $160,000 $ 25,000 $ 11,500 100,000 The actual cost of a spoiled picture frame is $7.00. During the year 170 frames are considered spoiled. Each spoiled frame can be sold for $4. The spoilage is considered a part of all jobs. a. b. c. Labor hours are used to determine the predetermined overhead rate. What is the predetermined overhead rate per direct labor hour? Prepare the journal entry needed to record the spoilage. Prepare the journal entry if the spoilage relates only to Job #12 rather than being a part of all production runs. ANSWER: a. $160,000 + $25,000 – $11,500 = $173,500 $173,500/100,000 = $1.735 per DLH b. Disposal Value of Spoiled Work Manufacturing Overhead Work in Process Inventory 680 510 Disposal Value of Spoiled Work Work in Process Inventory—Job #12 680 c. MEDIUM 1,190 680 7–24 8. Chapter 7 Special Production Issues: Lost Units and Accretion I Eat Yogurt Company produces yogurt in two departments—Mixing and Finishing. In Mixing, all ingredients except fruit are added at the start of production. In Finishing, fruit is added and then the mixture is placed into containers. Adding the fruit to the basic yogurt mixture increases the volume transferred in by the number of gallons of fruit added. Any spoilage that occurs is in the Finishing Department. Spoilage is detected just before the yogurt is placed into containers or at the 98 percent completion point. All spoilage is abnormal. Finishing Department BWIP (100% fruit, 0% container, 30% CC) Gallons transferred in Gallons of fruit added EWIP (100% fruit, 0% container, 60% CC) Gallons transferred out Abnormal spoilage BWIP Costs: Transferred In Fruit CC Current Costs: Transferred In Fruit Containers CC Total Costs $ 5,000 gallons 5,500 1,200 1,700 gallons 9,000 1,000 9,700 10,500 15,000 12,400 54,000 11,000 98,000 $ 210,600 Prepare a cost of production report for September 2001. The company uses weighted average. Chapter 7 Special Production Issues: Lost Units and Accretion ANSWER: 7–25 I Eat Yogurt Co. Cost Report September 30, 2001 BWIP Trans. In Fruit Acctble. For 5,000 5,500 1,200 11,700 TO EWIP AS TI 9,000 1,700 1,000 11,700 Fruit 9,000 1,700 1,000 11,700 Container 9,000 0 0 9,000 CC 9,000 1,020 980 11,000 TI $ 9,700 12,400 $22,100 11,700 $1.89 Fruit $10,500 54,000 $64,500 11,700 $5.51 Container $ 0 11,000 $11,000 9,000 $1.22 CC $ 15,000 98,000 $113,000 11,000 $10.27 Costs: BWIP Current EUP Per unit Cost Assignment: EWIP 1,700 × $1.89 = $ 3,213 1,700 × $5.51 = 9,367 1,020 × $10.27 = 10,475 Spoilage 1,000 × $1.89 = $ 1,890 1,000 × $5.51 = 5,510 980 × $10.27 = 10,065 Transferred Out $210,600 – 23,055 – 17,465 = Total accounted for MEDIUM $ 23,055 17,465 170,080 $ 210,600 7–26 9. Chapter 7 Special Production Issues: Lost Units and Accretion In Dept 1 material is added at the beginning, in Dept 2 material is added at the end. Normal losses in Department 1 should not exceed 5 percent of the units started; losses are found at an inspection point located 70 percent of the way through the production process. The normal loss in Department 2 is 3 percent of the units transferred in; losses are determined at an inspection point at the end of the production process. The following production and cost data are available for January 2001. PRODUCTION RECORDS (IN UNITS) Beginning inventory Started or transferred in Ending inventory Spoiled units Transferred out Dept. 1 6,000 150,000 18,000 9,000 ? Dept. 2 3,000 ? 15,000 6,000 111,000 COST RECORD Beginning inventory Preceding department Material Conversion Current period: Preceding department Material Conversion n/a $3,000 2,334 $6,690 0 504 n/a $36,000 208,962 $230,910* 740 52,920 *This is not the amount derived from your calculations. Use this amount so that you do not carry forward any possible cost errors from Department 1. The beginning and ending inventory units in Department 1 are, respectively, 10 percent and 60 percent complete as to conversion. In Department 2, the beginning and ending units are, respectively, 40 percent and 80 percent complete as to conversion. Assume spoilage in Department 1 is continuous and discrete in Department 2. Use FIFO in Department 1 and weighted average in Department 2. Chapter 7 Special Production Issues: Lost Units and Accretion 7–27 ANSWER: Complete + Equiv End + Abn Loss – Equiv Beg EP Department 1 Mat CC 129,000 129,000 18,000 10,800 1,500 1,050 148,500 140,850 (6,000 ) (600 ) 142,500 140,250 Unit Cost + Norm Loss EP Unit Cost TI TI 111,000 15,000 2,130 3,870 132,000 Department 2 . Mat CC 111,000 111,000 0 12,000 2,130 2,130 3,870 3,870 117,000 129,000 $6,690 + 230,910 = $1.80 132,000 Mat $36,000 = $0.25 142,500 Mat $740 = $0.01 117,000 CC $208,962 = $1.49 140,250 CC $504 + 52,920 = $0.41 129,000 End WIP 18,000 × $0.25 = $ 4 500 10,800 × $1.49 = 16,092 $20,592 End WIP 15,000 × $1.80 = $27,000 12,000 × $0.41 = 4,920 $31,920 ABN Loss 1,500 × $0.25 = 1,050 × $1.49 = ABN Loss 2,130 × $2.22 = $ 375 1,565 $1,940 COGM (Department 1) $ 250,296 – 20,592 – 1,940 = $ 227,764 DIFFICULT $4,729 COGM (Department 2) $291,764 – $31,920 – $4,729 = $255,115 7–28 10. Chapter 7 Special Production Issues: Lost Units and Accretion All material is added at the beginning of the process. Costs Beginning inventory Current period Total costs Material $ 30,000 885,120 $915,120 Conversion $ 3,600 335,088 $338,688 UNITS Beginning inventory (30% complete—conversion) Started Completed Ending inventory (70% complete—conversion) Normal spoilage Total $ 33,600 1,220,208 $1,253,808 6,000 180,000 152,000 20,000 4,800 units units units units units Required: Find ending WIP inventory, abnormal loss, and COGM. Assume that, for conversion costs, abnormal shrinkage is 60 percent. Chapter 7 Special Production Issues: Lost Units and Accretion 7–29 ANSWER: Units Complete + Equivalents Ending WIP + Abnormal Loss = Equivalent Production—WA = Equivalent Begin WIP = Equivalent Production—FIFO Mat 152,000 20,000 9,200 181,200 (6,000 ) 175,200 Unit Costs: WA Mat $915,120 = $5.05 181,200 FIFO Mat CC CC $338,688 = $1.97 171,520 Ending WIP Material 20,000 × $5.05 CC 14,000 × $1.97 Abnormal Spoilage Material 9,200 × $5.05 CC 5,520 × $1.97 $101,000 27,580 $128,580 $ 46,460 10,874 $ 57,334 Cost of Good Transferred $1,253,808 – 128,580 – 57,334 = $1,067,894 MEDIUM CC 152,000 14,000 5,520 (9,200 × .6) 171,520 (1,800 ) 169,720 $885,120 = $5.05 175,200 $335,088 = $1.97 169,720 7–30 11. Chapter 7 Special Production Issues: Lost Units and Accretion Department 1 uses FIFO costing and Department 2 uses weighted average. Units are introduced into the process in Department 1 (this is the only material added in Department 1). Spoilage occurs continuously through the department and normal spoilage should not exceed 10 percent of the units started. Department 2 adds material (packaging) at the 75 percent completion point; this material does not cause an increase in the number of units being processed. A quality control inspection takes place when the goods are 80 percent complete. Spoilage should not exceed 5 percent of the units transferred in from Department 1. The following production cost data are applicable for operations for May 2001: Department 1 Production Data Beginning inventory (65% complete) Units started Units completed Units in ending inventory (40% complete) Department 1 Cost Data Beginning inventory: Material Conversion Current period: Material Conversion Total costs to account for Department 2 Production Data Beginning inventory (90% complete) Units transferred in Units completed Units in ending inventory (20% complete) Department 2 Cost Data Beginning inventory: Transferred in Material Conversion Current period: Transferred in Material` Conversion Total costs to account for 1,000 25,000 22,000 2,800 $1,550 2,300 $3,850 $38,080 78,645 116,725 $120,575 8,000 22,000 24,000 4,500 $40,800 24,000 4,320 $113,700* 53,775 11,079 $ 69,120 178,554 $247,674 *This may not be the same amount determined for Department 1; ignore any difference and use this figure. Chapter 7 Special Production Issues: Lost Units and Accretion 7–31 Required: a. Compute the equivalent units of production in each department. b. Determine the cost per equivalent unit in each department and compute the cost transferred out, the cost in ending inventory, and the cost of spoilage (if necessary). ANSWER: a. 1 Mat CC Complete + End WIP 22,000 2,800 24,800 22,000 1,120 (2,800 × 4) 23,120 – Beg WIP (1,000 ) (650 ) (1,000 × .65) 23,800 22,470 Mat = $38,080 23,800 = $1.60 CC = $78,645 22,470 = $3.50 End WIP = 2,800 × $1.60 = = 1,120 × $3.50 $ 4,480 3.920 $ 8,400 COGM = $120,575 – 8,400 = $112,175 b. 2 Complete + End WIP + Normal + Abnormal TI Mat CC 24,000 4,500 1,100 400 30,000 24,000 0 1,100 400 25,500 24,000 900 880 320 26,100 End WIP 4,500 × $5.15 900 × $0.59 $23,175 531 $23,706 COGM = $247,674 – 23,706 – 3,469 = $220,499 MEDIUM Mat = $ 77,775 25,500 = $3.05 CC = $ 15,399 26,100 = $0.59 TI = $154,500 30,000 = $5.15 Abn Loss 400 × $3.05 320 × $0.59 400 × $5.15 $1,220 189 2,060 $3,469 7–32 12. Chapter 7 Special Production Issues: Lost Units and Accretion Consider the following data for a cooking department for the month of January: Physical Units Work in process, beginning inventory* Started during current period To account for Good units completed and transferred out during current period: From beginning work in process Started and completed Good units completed Spoiled units Work in process, ending inventory~ Accounted for 11,000 74,000 85,000 11,000 50,000 61,000 8,000 16,000 85,000 *Direct material, 100% complete; conversion costs, 25% complete ~Direct material, 100% complete; conversion costs, 75% complete Inspection occurs when production is 100 percent completed. Normal spoilage is 11 percent of good units completed and transferred out during the current period. The following cost data are available: Work in process, beginning inventory: Direct material Conversion costs Costs added during current period: Direct material Conversion costs Costs to account for $220,000 30,000 $ 250,000 1,480,000 942,000 $2,672,000 Required: Prepare a detailed cost of production report. Use the FIFO method. Distinguish between normal and abnormal spoilage. Chapter 7 Special Production Issues: Lost Units and Accretion 7–33 ANSWER: Normal Sp = 11% × 61,000 = 6,710 units FIFO Abnormal Sp = 8,000 – 6,710 = 1,290 units Mat Complete + End + Ab Sp – Ave – Beg FIFO 61,000 16,000 1,290 78,290 (11,000 ) 67,290 CC 61,000 12,000 1,290 74,290 (2,750 ) 71,540 Mat = $1,480,000 67,290 = $22.00 CC = $942,000 71,540 = 13.17 $35.17 WIP Material 16,000 × $22.00 CC 12,000 × $13.17 Loss = 1,290 × $35.17 $352,000 158,040 $510,040 45,369 COGM = $2,672,000 – 510,040 – 45,369 = $2,116,591 MEDIUM 7–34 13. Chapter 7 Special Production Issues: Lost Units and Accretion In the Lamination Department, varnish is added when the goods are 60 percent complete as to overhead. The units that are spoiled during processing are found upon inspection at the end of production. Spoilage is considered discrete. Production Data for March 2001 Beginning inventory (80% complete as to labor, 70% complete as to overhead) Transferred in during month Ending inventory (40% complete as to labor, 20% complete as to overhead) Normal spoilage (found during final quality inspection) 1,000 units 7,450 units 1,500 units 100 units Abnormal spoilage—found at 30% completion of direct labor and 15% of conversion; the sanding machine was misaligned and scarred the chairs 200 units All other units were transferred to finished goods Cost Data for March 2001 Beginning work in process inventory: Prior department costs Varnish Direct labor Overhead Current period costs: Prior department costs Varnish Direct labor Overhead Total costs to account for $7,510 950 2,194 5,522 $ 16,176 $68,540 7,015 23,000 56,782 155,337 $171,513 Required: Determine the proper disposition of the March costs for the Laminating Department using the weighted average method. Chapter 7 Special Production Issues: Lost Units and Accretion 7–35 ANSWER: TI 6,650 1,500 100 200 8,450 Complete + end + normal + abnormal Unit Cost $76,050 = $9 8,450 End WIP DL MOH TI Abnormal Loss DL MOH TI MAT 6,650 0 100 0 6,750 $7,965 = $1.18 6,750 600 × $3.40 300 × $8.80 1,500 × $9.00 = $ 2,040 = 2,640 = 13,500 $18,180 60 × $3.40 30 × $8.80 200 × $9.00 = $ 204 = 264 = 1,800 $ 2,268 COGM = $171,513 – 18,180 – 2,268 = $151,065 MEDIUM DL 6,650 600 100 60 7,410 $25,194 = $3.40 7,410 MOH 6,650 300 100 30 7,080 $62,304 = $8.80 7,080 7–36 14. Chapter 7 Special Production Issues: Lost Units and Accretion Tons of Shad employs a weighted average process costing system for its products. One product passes through three departments (Molding, Assembly, and Finishing) during production. The following activity took place in the Finishing Department during March 2001: Units in beginning inventory Units transferred in from Assembly Units spoiled Good units transferred out 4,200 42,000 2,100 33,600 The costs per equivalent unit of production for each cost failure area as follows: Cost of prior departments Raw material Conversion Total cost per EUP $5.00 1.00 3.00 $9.00 Raw material is added at the beginning of the Finishing process without changing the number of units being processed. Work in process inventory was 40 percent complete as to conversion on March 31. All spoilage was discovered at final inspection. Of the total units spoiled, 1,680 were within normal limits. Required: a. Calculate the equivalent units of production b. Determine the cost of units transferred out of Finishing c. Determine the cost of ending Work in Process Inventory d. The portion of the total transferred in cost associated with beginning Work in Process Inventory amounted to $18,900. What is the current period cost that was transferred in from Assembly to Finishing? e. Determine the cost associated with abnormal spoilage for the month. Chapter 7 Special Production Issues: Lost Units and Accretion 7–37 ANSWER: a. TI 33,600 10,500 1,680 420 46,200 Complete + Equiv WIP + Normal Sp + Abnor Sp b. 33,600 × $9 1,680 × $9 $302,400 15,120 $317,520 c. 10,500 × $5 10,500 × $1 4,200 × $3 $52,500 10,500 12,600 $75,600 Mat 33,600 10,500 1,680 420 46,200 TC = 46,200 × $5 46,200 × $1 39,900 × $3 COGM = $396,900 – 75,600 – 3,780 = $317,520 d. $5 = $18,900 + X 46,200 X = $231,000 – 18,900 = $212,100 e. ABN = 420 × $9 = $3,780 420 × $9 = $3,780 MEDIUM CC 33,600 4,200 1,680 420 39,900 $231,000 46,200 119,700 $396,900 7–38 15. Chapter 7 Special Production Issues: Lost Units and Accretion Department 2 adds new material to the units received from Department 1 at the end of process. A normal loss occurs early in processing. Production and cost data for Department 2 for the month of September are as follows: Production record (in units): In process, September 1— 75% complete for processing cost Received from Department 1 Completed and transferred to finished goods Lost in processing (normal) In process, September 30— 2/3 complete for process cost Cost Record: Work in process inventory, September 1: Preceding department cost Processing cost Cost from preceding department in September Material cost for September Processing cost for September 4,000 20,000 16,000 2,000 6,000 $ 620 2,000 $2,620 1,800 4,800 10,200 Required: Determine the following for Department 2 under (a) weighted average the method of costing and (b) the FIFO method of costing: (1) unit costs for each cost component, (2) cost of production transferred to finished goods, (3) cost of work in process inventory of September 30. Chapter 7 Special Production Issues: Lost Units and Accretion 7–39 ANSWER: Equivalent production Units complete + Equiv. ending WIP = Equiv. prod. average – Equiv. begin. WIP = Equiv. prod. FIFO Unit Cost Average TI = $620 + 1,800 22,000 TI 16,000 6,000 22,000 (4,000 ) 18,000 Material 16,000 0 16,000 0 16,000 Conv. cost 16,000 4,000 20,000 (3,000 ) 17,000 = $0.11 Unit Cost FIFO TI = $1,800 18,000 = $0.10 Mat = $4,800 16,000 = $0.30 Mat = $4,800 16,000 = $0.30 CC = $2,000 + 10,200 20,000 = $0.61 CC = $10,200 17,000 = $0.60 End. WIP—WA PD 6,000 × $0.11 = CC 4,000 × $0.61 = $ 660.00 2,440.00 $3,100.00 End. WIP—FIFO 6,000 × $0.10 = $ 600.00 4,000 × $0.60 = 2,400.00 $3,000.00 Cost of Goods Complete WA $19,420 – 3,100 = MEDIUM $16,320.00 FIFO $19,420 – 3,000 = $16,420.00 7–40 16. Chapter 7 Special Production Issues: Lost Units and Accretion The formula for a chemical compound requires one pound of Chemical X and one pound of Chemical Y. In the simplest sense, one pound of Chemical X is processed in Department A and transferred to Department B for further processing where one pound of Chemical Y is added when the process is 50 percent complete. When the processing is complete in Department B, the finished compound is transferred to finished goods. The process is continuous, operating 24 hours a day. Normal spoilage occurs in Department A. Five percent of material is lost in the first few seconds of processing. No spoilage occurs in Department B. The following data are available for the month of October 2001: Units in process, October 1 Stage of completion of beginning inventory Units started or transferred in Units transferred out Units in process, October 31 Stage of completion of ending inventory Units of Chemical Y added in Department B Dept. A 8,000 3/4 50,000 46,500 ? 1/3 Dept. B 10,000 3/10 ? ? ? 1/5 44,500 Required: a. Prepare a schedule showing finished equivalents for Chemical X and for conversion cost for Department A using the FIFO method. b. Determine for Department B the number of units of good product completed during October and the number of units in process on October 31. c. Prepare a schedule for Department B showing finished equivalents for preceding department cost, cost of Chemical Y, and conversion cost using the FIFO method. Chapter 7 Special Production Issues: Lost Units and Accretion 7–41 ANSWER: a. c. Mat 46,500 9,000 (8,000 ) 47,500 b. CC 46,500 3,000 (6,000 ) 43,500 PD 44,500 12,000 (10,000 ) 46,500 Mat 44,500 0 0 44,500 CC 44,500 2,400 (3,000 ) 43,900 Since the material in the second department goes in at the 50 percent point and the ending WIP inventory is only at the 20 percent point, units complete is the same as the equivalents of material 44,500, given that units started plus units in beginning WIP are equal to units complete plus ending WIP 10,000 + 46,500 – 44,500 = 12,000 units in ending WIP. MEDIUM CHAPTER 8 IMPLEMENTING QUALITY CONCEPTS MULTIPLE CHOICE 1. An all-inclusive definition of quality views it as the ability of products/services to a. b. c. d. only meet internal design specifications. meet the customer’s stated or implied needs. be produced using all value-added production activities. be produced with no rework costs. ANSWER: 2. EASY Which of the following is false as it relates to quality? a. b. c. d. Quality is the total of all characteristics of a product or service that impacts on its ability to meet the needs of a specific person. Quality must always be viewed from the user’s perspective. Quality is never concerned with what the user thinks, feels, or deems important. The definition of quality has evolved through time and is more currently comprehensive than in the past. ANSWER: 3. b c EASY Productivity is measured by the a. b. c. d. total quantity of output generated from a limited amount of input during a time period. quantity of good output generated from a specific amount of input during a time period. quantity of good output generated from the quantity of good input used during a time period. total quantity of input used to generate total quantity of output for a time period. ANSWER: b MEDIUM 8–1 8–2 4. Chapter 8 Which of the following can be used to indicate factors that slow down or cause unnecessary work in a process? a. b. c. d. activity analysis total quality management cost of quality all of the above ANSWER: 5. EASY value-neutral activities value-added activities non-value-added activities none of the above ANSWER: c EASY Which of the following would typically be viewed as non-value-added activities? a. b. c. d. Moving material yes no no yes ANSWER: 7. a Which of the following are undesirable from a consumer perspective but are frequently needed? a. b. c. d. 6. Implementing Quality Concepts d Inspecting raw material yes no yes yes Attaching product components yes no no no Storing finished goods no yes yes yes EASY __________ places the primary responsibility for quality on the maker or producer. a. b. c. d. Pareto analysis Quality control Benchmarking Activity analysis ANSWER: b EASY Chapter 8 8. Implementing Quality Concepts All attempts to reduce variability and defects in products reflect the implementation of a. b. c. d. activity analysis. statistical process control. quality control. control charts. ANSWER: 9. d MEDIUM A control chart graphs a. b. c. d. actual process results relative to a range of acceptable variation. expected process results relative to upper and lower control limits. actual process results relative to value-added and non-value-added activities. the cost of process malfunctions relative to the cost of reducing process variations. ANSWER: a EASY The addition or removal of product or service characteristics to satisfy additional needs, especially price, reflect the ________ of a product or service. a. b. c. d. value grade quality durability ANSWER: 12. EASY total quality control. statistical process control. total quality management. all of the above. ANSWER: 11. c Control charts are appropriate devices in a. b. c. d. 10. 8–3 b MEDIUM Value reflects the ability of a product to a. b. c. d. provide the best quality at any price. have all possible product and service characteristics. meet the majority of a customer’s needs at the lowest possible price. have the longest technical or service life and the best warranty. ANSWER: c MEDIUM 8–4 13. Chapter 8 Comparing the way a “best-in-class” company performs a specific activity (such as distribution) is called a. b. c. d. process benchmarking. results benchmarking. total quality management benchmarking. SPC benchmarking. ANSWER: 14. d EASY Benchmarking against direct competitors creates the risk of a. b. c. d. creating products or services with identical specifications. becoming stagnant relative to process improvements. being taken over by the competitors to prevent a loss of ideas. all of the above. ANSWER: b MEDIUM Reverse engineering is used in a. b. c. d. statistical process control. process benchmarking. results benchmarking. price fixing. ANSWER: 17. EASY identify its strengths and weaknesses. imitate those ideas that are readily transferable. improve on methods in use by others. all of the above. ANSWER: 16. a Benchmarking allows a company to a. b. c. d. 15. Implementing Quality Concepts c MEDIUM Benchmarking against noncompetitors is extremely important in a. b. c. d. process benchmarking. results benchmarking. reverse engineering. all of the above. ANSWER: a MEDIUM Chapter 8 18. Implementing Quality Concepts Benchmarking a. b. c. d. identifies “best-in-class” companies yes no yes no ANSWER: 19. EASY Compares BIC’s products and processes with own yes yes no yes ANSWER: d Copies BIC’s products and processes directly yes no no no Improves on BIC’s products and processes yes no yes yes EASY Which of the following is not a step in benchmarking procedures? a. b. c. d. analyze the “positive gap” engage in continuous improvement analyze the “negative gap” identify “best-in-class” companies ANSWER: 21. c analyzes the “negative gap” no yes yes no Benchmarking does which of the following activities relative to a “best-in-class” (BIC) company? a. b. c. d. 20. 8–5 a MEDIUM Which of the following is not a critical element in a total quality management system? a. b. c. d. employee involvement activity-based costing continuous improvement problem prevention emphasis ANSWER: b MEDIUM 8–6 22. Chapter 8 A total quality system should be designed to promote a reorientation of thinking from an emphasis on a. b. c. d. internal quality improvements to an emphasis on external benchmarking. the planning process to an emphasis on the performance evaluation process. inspection to an emphasis on prevention. process benchmarking to an emphasis on results benchmarking. ANSWER: 23. MEDIUM what the company’s customers want who the company’s customers are how the company’s processes are designed what the components of the company’s product are ANSWER: b EASY Total quality management is inseparable from the concept of a. b. c. d. ISO certification. centralized organizational structure. continuous improvement. the product life cycle. ANSWER: 25. c Which of the following is the first element of knowledge needed by a company wanting to pursue total quality management? a. b. c. d. 24. Implementing Quality Concepts c EASY A company will not achieve world-class status unless a quality focus a. b. c. d. allows that company to achieve one or more major quality awards. becomes an integral part of the organization’s culture. emphasizes the elimination of all quality costs for compliance and noncompliance. has been mandated by management for workers to pursue. ANSWER: b EASY Chapter 8 26. Implementing Quality Concepts Which of the following statements is true? a. b. c. d. The more customers a company has, the better off the company is. A company should spare no expense to provide customer satisfaction. Most customers stop doing business with a company because of poor product or service quality. Cost-benefit analysis can help identify customers that cost more than they are worth to the company. ANSWER: 27. EASY external failure, internal failure, prevention, and carrying. external failure, internal failure, prevention, and appraisal. external failure, internal failure, training, and appraisal. warranty, product liability, training, and appraisal. ANSWER: b EASY The number of product defects discovered by consumers is what kind of performance indicator? a. b. c. d. Qualitative yes no no yes ANSWER: 29. d The four categories of product quality costs are a. b. c. d. 28. 8–7 b Quantitative no yes yes no EASY Money spent on employee training is a a. b. c. d. prevention cost. appraisal cost. empowerment cost. Pareto cost. ANSWER: a EASY Financial no no yes no Nonfinancial yes yes no yes 8–8 30. Chapter 8 Production quality is affected by a. b. c. d. worker productivity. the amount of failure costs incurred. worker skill level. just-in-time suppliers. ANSWER: 31. EASY appraisal costs no no yes yes ANSWER: d failure costs no yes no yes EASY Product quality includes all of the following except a. b. c. d. appeal. performance. durability. price. ANSWER: 33. c Mistakes not eliminated by prevention costs may cause a. b. c. d. 32. Implementing Quality Concepts d EASY Recalls are fairly common events for automobile manufacturers. The costs of recalling and repairing a car create a. b. c. d. internal failure costs yes yes no yes ANSWER: a EASY external failure costs yes yes yes no prevention costs no yes no yes Chapter 8 34. Implementing Quality Concepts An appraisal cost is created by a. b. c. d. installing automated technology. reworking products. verifying procedures. rescheduling and setup. ANSWER: 35. EASY prevention costs yes no yes yes ANSWER: c appraisal costs no yes yes yes internal failure costs no yes no yes EASY Management can decide where to concentrate its quality prevention dollars using a. b. c. d. statistical process control charts. just-in-time inventory systems. a feedback loop. Pareto analysis. ANSWER: 37. c Compliance costs include a. b. c. d. 36. 8–9 d EASY Historically, the cost of quality has been a. b. c. d. included in account balances for items such as Work in Process Inventory and marketing expenses. detailed in various “cost of quality” account balances on the Income Statement. immaterial because no accounts were developed to detail these amounts. generally spent in the prevention rather than the appraisal category. ANSWER: a EASY 8–10 38. Chapter 8 A significant cost of quality that is not recorded in the accounting records is the a. b. c. d. failure cost for a customer complaint center. cost of reworking products to bring them up to specification. opportunity costs of forgone future sales. appraisal cost for product equipment. ANSWER: 39. EASY last year’s quality costs. current period budgeted quality costs. total quality costs for the period. both a and b. ANSWER: d EASY Which of the following is not one of the three objectives of a quality program? a. b. c. d. Product quality should be consistent to always meet the purchaser’s need(s). A quality program should give management confidence that the quality is and will be at a constant level. A quality program should give customers confidence that the intended quality will be achieved in products. Product quality should always vary because customers change their wants and needs over time. ANSWER: 41. c A cost of quality report compares current period quality costs in specified categories to a. b. c. d. 40. Implementing Quality Concepts d MEDIUM The most visible embodiment of total quality management in the United States is a. b. c. d. being awarded the Deming Prize. achieving ISO 9000 certification. meeting industry standards. receiving the Baldrige Award. ANSWER: d EASY Chapter 8 42. Implementing Quality Concepts Which of the following are categories judged for the Baldrige Award? a. b. c. d. Customer focus yes yes yes no Leadership yes yes no no MEDIUM international guidelines for quality standards. provisions regarding benchmarking activities in the European Union. guidelines for appropriate expenditures on the various categories of quality costs. all of the above. ANSWER: a EASY (Appendix) The ISO 9000 standards a. b. c. d. indicate which companies’ products are better than those of competitors. allow management to decide how to meet the standards for quality assurance. include specific directives about product design, material procurement, and environmental responsibilities. compose a program of quality assurance under which companies are registered by the International Organizational for Standardization. ANSWER: 45. a Use of SPC and Pareto analysis no yes no no (Appendix) The ISO 9000 series refers to a. b. c. d. 44. Business results yes yes yes no Benchmarking no yes yes no ANSWER: 43. 8–11 b EASY (Appendix) A quality audit involves a review of a. b. c. d. manufacturing processes yes no no yes ANSWER: d cost of quality standards yes yes no no EASY quality documentation yes yes no yes 8–12 46. Chapter 8 (Appendix) Registration under ISO 9000 is a. b. c. d. required for all companies doing business internationally. required for all European companies doing business in Europe. not required for U.S. companies unless they use European suppliers. required for all companies producing regulated products to be sold in the European Union. ANSWER: d EASY Use the following information for questions 47–51. Total defective units Number of units reworked Number of customer units returned Profit for a good unit Profit for a defective unit Cost to rework a defective unit Cost of a returned unit Total prevention cost Total appraisal cost 47. 1,000 750 150 $40 $25 $10 $15 $10,000 $5,000 The profit lost by selling defective units not reworked is a. b. c. d. $25,000. $15,000. $18,750. $3,750. ANSWER: 48. Implementing Quality Concepts d MEDIUM The total rework cost is a. b. c. d. $7,500. $15,000. $2,500. $3,750. ANSWER: a MEDIUM Chapter 8 49. Implementing Quality Concepts The cost of processing customer returns is a. b. c. d. $9,000. $2,500. $22,500. $2,250. ANSWER: 50. MEDIUM $15,000. $13,500. $11,250. $8,250. ANSWER: b MEDIUM The total quality cost is a. b. c. d. $15,000. $15,750. $28,500. $11,250. ANSWER: 52. d The total failure cost is a. b. c. d. 51. 8–13 c MEDIUM The profit lost by selling defective units at Logan Company totals $1,440. The total rework cost for 700 units is $28,000. The difference between the profit earned on a good unit and a defective unit is $12. How many total defective units did Logan Company produce? a. b. c. d. 120 740 736 820 ANSWER: d MEDIUM 8–14 53. Chapter 8 Implementing Quality Concepts Coffin Company’s cost of compliance is $58,000. Appraisal cost is $21,000 and failure cost is $32,000. The company’s total quality cost is a. b. c. d. $53,000. $79,000. $90,000. $111,000. ANSWER: c MEDIUM SHORT ANSWER/PROBLEMS 1. Discuss the four kinds of quality costs. ANSWER: Prevention costs are incurred to prevent product or service defects and decrease the number of nonconforming units produced. These costs include items such as quality training programs, quality reporting, quality audits, and quality circles. Raw material vendors are selected with the understanding that all delivered materials meet acceptable quality limits. Appraisal costs arise from determining whether products are in agreement with their specifications. These costs include inspection of raw material, supervising appraisal activities, and product acceptance or sampling finished batches to see if they meet specifications. Failure costs make up the other two types of quality costs. Internal failure costs result when the products don’t meet specifications and must be reworked or discarded. These costs include scrap, rework, retesting, and design changes. High-quality prevention should eliminate internal failure costs. External failure costs occur when buyers note defects after delivery. These costs can be very high and include lost sales from poor performance of the product, returns due to poor quality, warranties, and product liability. MEDIUM Chapter 8 2. Implementing Quality Concepts 8–15 What is the relationship between the incurrence of the various types of quality costs and the quantity of output that meets specification? ANSWER: As the number of conforming units increases, both types of failure costs decrease rapidly. To decrease failure costs, more prevention costs must be incurred. Identifying defective products before they leave the factory can decrease the external failure costs immensely. Although, such identification may increase internal failure costs. A greater emphasis on prevention will decrease appraisal costs and also failure costs. Thus, over time, overall quality costs will decrease. MEDIUM 3. What is continuous improvement? How does it relate to total quality management? ANSWER: Continuous improvement is behavior that encourages employees, either production or service, to perform their tasks better as time passes. Thus, because product or service quality levels improve, continuous improvement is directly related to TQM. Employees are also encouraged to “group think” and brainstorm in quality circles to recognize and correct problems in the business environment. MEDIUM 4. Discuss the concept of total quality management. ANSWER: TQM is a company-wide quality system that emphasizes employee involvement in improving product or service quality throughout the firm. It uses a continuous improvement process that is always striving to update upon the existing system. It uses techniques that encourage employees to make suggestions about how the product or production process can be improved. TQM necessitates an internal managerial system of decision making, controlling, and planning. TQM involves continuous improvement that exceeds customer/client expectations. MEDIUM 5. How do control charts mesh with the concept of total quality control (TQC)? ANSWER: Control charts are graphical, statistical presentations that identify occurrences of products or services as to whether they fall within some measure of performance. Upper and lower limits of acceptability are displayed on the chart. TQC expects all products to meet specifications. Thus, no measures of units or services performed should exceed these limits. MEDIUM 8–16 6. Chapter 8 Implementing Quality Concepts Compare and contrast four characteristics of product quality and of service quality. ANSWER: Exhibit 8-2 provides eight characteristics of product quality and Exhibit 8-3 provides five characteristics of service quality. Depending on the characteristics chosen, student answers will differ. There should, however, be some discussion of a primary difference in that a product tends to last for some time, while a service is typically for a moment in time. Given this difference, it is important that product quality characteristics address longer-term issues (such as durability and serviceability) than a service quality might. MEDIUM 7. Discuss the relationship between benchmarking and total quality management (TQM). ANSWER: TQM is a system of the organization that emphasizes continuous improvement processes that meet or exceed customer quality expectations. It emphasizes quality principles throughout the firm. Benchmarking is the process of investigating, comparing, and evaluating a company’s processes, products, and/or services against those of companies believed to be the “best in class.” Benchmarking stresses quality improvement by finding out how other firms are doing what you do better and attempting to pattern your own processes after what these firms are doing and striving to improve those processes. Benchmarking has been implemented by many firms that have adopted JIT and that have insisted their suppliers do the same. These firms gain insight on how to follow JIT by communicating with other firms. MEDIUM 8. Compare and contrast results benchmarking and process benchmarking. ANSWER: Results benchmarking is associated with quality but is concerned with whether the final product meets product/service specifications. Process benchmarking focuses on practices of competitors or non-competitors that are considered “best-in-class” and tries to adopt features with which the questioning company has problems MEDIUM Chapter 8 9. Implementing Quality Concepts 8–17 Discuss increased competition and improved problem solving skills as they relate to benchmarking. ANSWER: Increased competition and improved problem solving skills are two benefits of benchmarking. Benchmarking helps companies become more competitive in their markets by examining what competitors do in relation to organization practices. Once these differences are determined, the organization will be in a better position to make changes that will help make the organization more competitive. Benchmarking also increases problem-solving skills among employees in the organization by providing a framework in which to operate more effectively. An increase in problem solving ability should promote teamwork with the organization, which is critical to not only benchmarking, but to total quality control. Use the following information to answer questions 10–14. Total defective units Number of units reworked Number of customer units returned Profit for a good unit Profit for a defective unit Cost to rework a defective unit Cost of a returned unit Total prevention cost Total appraisal cost 10. 1,500 800 200 $50 $30 $12 $20 $17,500 $9,500 Compute the profit lost by selling defective units not reworked. ANSWER: Z = (D – Y) (P1 – P2 ) = (1,500 – 800)($50 – $30) = $14,000 MEDIUM 11. Compute the total rework cost. ANSWER: R = (Y) (r) = (800) ($12) = $9,600 MEDIUM 12. Compute the cost of processing customer returns. ANSWER: W = (Dr) (w) = (200) ($20) = $4,000 MEDIUM 8–18 13. Chapter 8 Implementing Quality Concepts What is the total failure cost? ANSWER: F = Z + R + W = $14,000 + $9,600 + $4,000 = $27,600 MEDIUM 14. Determine the total quality cost. ANSWER: T = K + A + F = $17,500 + $9,500 + $27,600 = $54,600 MEDIUM Use the following information for questions 15 and 16. Widget Company, which began operations on Jan. 2, 2001, has just finished its first year of business. Widget makes decorative outdoor furniture. The firm manufactured 2,500 pieces of furniture during the year: 2,400 were sold at garden centers for $456,000; 100 pieces were defective and could only be sold as scrap metal (25 pounds each and can be sold for $2.50 per pound). No defective units could be reworked. During the year the following costs were incurred: Total appraisal cost Total prevention cost Total production cost Total selling and administrative cost 15. $9,000 25,700 250,000 70,000 Compute the total profits lost by Widget from selling scrap units during its first year of operations. ANSWER: Price for good units: $456,000 2,400 = $190 Price for defective units: $6,250* 100 = $ 62.50 *25 pounds × 100 pieces × $2.50/pound. Profits lost: 100 × ($190.00 – $62.50) = $12,750 MEDIUM Chapter 8 16. Implementing Quality Concepts Compute the total quality cost incurred by Widget. ANSWER: Prevention cost Appraisal cost Total failure cost MEDIUM $25,700 9,000 12,750 $47,450 8–19 CHAPTER 9 COST ALLOCATION FOR JOINT PRODUCTS AND BY-PRODUCTS MULTIPLE CHOICE 1. If a company obtains two salable products from the refining of one ore, the refining process should be accounted for as a(n) a. b. c. d. mixed cost process. joint process. extractive process. reduction process. ANSWER: 2. c. d. obtain a cost per unit for financial statement purposes. provide accurate management information on production costs of each type of product. compute variances from expected costs for each joint product. allow the use of high-low analysis by the company. ANSWER: a EASY Joint costs are allocated to which of the following products? a. b. c. d. By-products yes yes no no ANSWER: 4. EASY Joint costs are allocated to joint products to a. b. 3. b c Scrap yes no no yes EASY Joint cost allocation is useful for a. b. c. d. decision making. product costing. control. evaluating managers’ performance. ANSWER: b EASY 9–1 9–2 5. Chapter 9 Joint costs are useful for a. b. c. d. setting the selling price of a product. determining whether to continue producing an item. evaluating management by means of a responsibility reporting system. determining inventory cost for accounting purposes. ANSWER: 6. a EASY Each of the following is a method to allocate joint costs except a. b. c. d. relative sales value. relative net realizable value. relative weight, volume, or linear measure. average unit cost. ANSWER: d EASY Joint costs are most frequently allocated based upon relative a. b. c. d. profitability. conversion costs. prime costs. sales value. ANSWER: 9. EASY direct material, direct labor, and overhead direct material and direct labor only direct labor and overhead only overhead and direct material only ANSWER: 8. d Which of the following components of production are allocable as joint costs when a single manufacturing process produces several salable products? a. b. c. d. 7. Cost Allocation for Joint Products and By-Products d EASY When allocating joint process cost based on tons of output, all products will a. b. c. d. be salable at split-off. have the same joint cost per ton. have a sales value greater than their costs. have no disposal costs at the split-off point. ANSWER: b EASY Chapter 9 10. Cost Allocation for Joint Products and By-Products If two or more products share a common process before they are separated, the joint costs should be assigned in a manner that a. b. c. d. assigns a proportionate amount of the total cost to each product on a quantitative basis. maximizes total earnings. minimizes variations in unit production costs. does not introduce an element of estimation into the process of accumulating costs for each product. ANSWER: 11. d. EASY finished unit of product that has no sales value. residual of the production process that has limited sales value. residual of the production process that can be reworked for sale as an irregular unit of product. residual of the production process that has no sales value. ANSWER: b EASY Waste created by a production process is a. b. c. d. accounted for in the same manner as defective units. accounted for as an abnormal loss. material that can be sold as an irregular product. discarded rather than sold. ANSWER: 13. a Scrap is defined as a a. b. c. 12. 9–3 d EASY While preparing a salad, you remove the core of a head of lettuce. This core would be classified as a. b. c. d. defective. shrinkage. waste. scrap. ANSWER: c EASY 9–4 14. Chapter 9 Which of the following is/are synonyms for joint products? a. b. c. d. Main products no yes yes no ANSWER: 15. EASY 2 × 4 studs sawdust wood chips tree bark ANSWER: a EASY Company Q produces three products from a joint process. The products can be sold at split-off or processed further. In deciding whether to sell at split-off or process further, management should a. b. c. d. allocate the joint cost to the products based on relative sales value prior to making the decision. allocate the joint cost to the products based on a physical quantity measure prior to making the decision. subtract the joint cost from the total sales value of the products before determining relative sales value and making the decision. ignore the joint cost in making the decision. ANSWER: 17. b Co-products no yes no yes In a lumber mill, which of the following would most likely be considered a primary product? a. b. c. d. 16. Cost Allocation for Joint Products and By-Products d EASY By-products are a. b. c. d. allocated a portion of joint production cost. not sufficient alone, in terms of sales value, for management to justify undertaking the joint process. also known as scrap. the primary reason management undertook the production process. ANSWER: b EASY Chapter 9 18. Cost Allocation for Joint Products and By-Products Which of the following statements is true regarding by-products or scrap? a. b. c. d. Process costing is the only method that should result in by-products or scrap. Job order costing systems will never have by-products or scrap. Job order costing systems may have instances where by-products or scrap result from the production process. Process costing will never have by-products or scrap from the production process. ANSWER: 19. By-products no yes yes no ANSWER: MEDIUM b Waste no no yes yes EASY Under an acceptable method of costing by-products, inventory costs of the by-product are based on the portion of the joint production cost allocated to the by-product a. b. c. d. but any subsequent processing cost is debited to the cost of the main product. but any subsequent processing cost is debited to revenue of the main product. plus any subsequent processing cost. minus any subsequent processing cost. ANSWER: 21. c Which of the following has sales value? a. b. c. d. 20. 9–5 c EASY Which of the following is a false statement about scrap and by-products? a. b. c. d. Both by-products and scrap are salable. A by-product has a higher sales value than does scrap. By-products and scrap are the primary reason that management undertakes the joint process. Both scrap and by-products are incidental outputs to the joint process. ANSWER: c EASY 9–6 Chapter 9 22. The split-off point is the point at which a. b. c. d. output is first identifiable as individual products. joint costs are allocated to joint products. some products may first be sold. all of the above. ANSWER: 23. c. d. EASY its marketability will be enhanced. the incremental cost of further processing will be less than the incremental revenue of further processing. the joint cost assigned to it is not already greater than its prospective selling price. both a and b. ANSWER: d EASY Which of the following would not be considered a sunk cost? a. b. c. d. direct material cost direct labor cost joint cost building cost ANSWER: 25. d A product may be processed beyond the split-off point if management believes that a. b. 24. Cost Allocation for Joint Products and By-Products d EASY The definition of a sunk cost is a. b. c. d. a cost that cannot be recovered regardless of what happens. a cost that relates to money poured into the ground. considered the original cost of an item. also known as an opportunity cost. ANSWER: a EASY Chapter 9 26. Cost Allocation for Joint Products and By-Products The net realizable value approach mandates that the NRV of the by-products/scrap be treated as a. b. c. d. an increase in joint costs. a sunk cost. a reduction of joint costs. a cost that can be ignored totally. ANSWER: 27. insignificant yes no no yes ANSWER: b significant yes yes no no EASY Approximated net realizable value at split-off for joint products is computed as a. b. c. d. selling price at split-off minus further processing and disposal costs. final selling price minus further processing and disposal costs. selling price at split-off minus allocated joint processing costs. final selling price minus a normal profit margin. ANSWER: 29. EASY The net realizable value approach is normally used when the NRV is expected to be a. b. c. d. 28. c b EASY Which of the following is a commonly used joint cost allocation method? a. b. c. d. high-low method regression analysis approximated sales value at split-off method weighted average quantity technique ANSWER: c EASY 9–7 9–8 30. Chapter 9 Incremental separate costs are defined as all costs incurred between ___________ and the point of sale. a. b. c. d. inception split-off point transfer to finished goods inventory point of addition of disposal costs ANSWER: 31. EASY sunk costs. incremental separate costs. joint cost. committed costs. ANSWER: b EASY Incremental revenues and costs need to be considered when using which allocation method? a. b. c. d. Physical measures yes yes no no ANSWER: 33. b All costs that are incurred between the split-off point and the point of sale are known as a. b. c. d. 32. Cost Allocation for Joint Products and By-Products c Sales value at split-off yes no no yes MEDIUM The method of pricing by-products/scrap where no value is assigned to these items until they are sold is known as the a. b. c. d. net realizable value at split-off point method. sales value at split-off method. realized value approach. approximated net realizable value at split-off method. ANSWER: c MEDIUM Chapter 9 34. Cost Allocation for Joint Products and By-Products Relative sales value at split-off is used to allocate a. b. c. d. costs beyond split-off yes yes no no ANSWER: 35. EASY For purposes of allocating joint costs to joint products using the relative sales value at split-off method, the costs beyond split-off a. b. c. d. are allocated in the same manner as the joint costs. are deducted from the relative sales value at split-off. are deducted from the sales value at the point of sale. do not affect the allocation of the joint costs. ANSWER: 36. c joint costs yes no yes no d EASY Not-for-profit organizations are required by the _______ to allocate joint costs. a. b. c. d. AICPA FASB CASB GASB ANSWER: a DIFFICULT 9–9 9–10 Chapter 9 Cost Allocation for Joint Products and By-Products Use the following information for questions 37–45. P.O.P. Co. produces two products from a joint process: X and Z. Joint processing costs for this production cycle are $8,000. X Z Sales price per yard at split-off $6.00 9.00 Yards 1,500 2,200 Disposal cost per yard at split-off $3.50 5.00 Further processing per yard $1.00 3.00 Final sale price per yard $ 7.50 11.25 If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer. 37. Using a physical measure, what amount of joint processing cost is allocated to X (round to the nearest dollar)? a. b. c. d. $4,000 $4,757 $5,500 $3,243 ANSWER: 38. EASY Using a physical measure, what amount of joint processing cost is allocated to Z (round to the nearest dollar)? a. b. c. d. $4,000 $3,243 $5,500 $4,757 ANSWER: 39. d d EASY Using sales value at split-off, what amount of joint processing cost is allocated to X (round to the nearest dollar)? a. b. c. d. $5,500 $2,500 $4,000 $3,243 ANSWER: b MEDIUM Chapter 9 40. Cost Allocation for Joint Products and By-Products Using sales value at split-off, what amount of joint processing cost is allocated to Z (round to the nearest dollar)? a. b. c. d. $5,500 $4,000 $2,500 $4,757 ANSWER: 41. MEDIUM $4,000 $5,610 $2,390 $5,500 ANSWER: c MEDIUM Using net realizable value at split-off, what amount of joint processing cost is allocated to Z (round to the nearest dollar)? a. b. c. d. $5,500 $4,000 $2,390 $5,610 ANSWER: 43. a Using net realizable value at split-off, what amount of joint processing cost is allocated to X (round to the nearest dollar)? a. b. c. d. 42. 9–11 d MEDIUM Using approximated net realizable value at split-off, what amount of joint processing cost is allocated to X (round to the nearest dollar)? a. b. c. d. $3,090 $5,204 $4,000 $2,390 ANSWER: a MEDIUM 9–12 44. Chapter 9 Using approximated net realizable value at split-off, what amount of joint processing cost is allocated to Z (round to the nearest dollar)? a. b. c. d. $2,796 $4,910 $4,000 $2,390 ANSWER: 45. Cost Allocation for Joint Products and By-Products b MEDIUM Which products would be processed further? a. b. c. d. only X only Z both X and Z neither X or Z ANSWER: a MEDIUM Use the following information for questions 46–51. Tiny Co. produces three products: Bo, Mo, and Lo from the same process. Joint costs for this production run are $2,100. Bo Mo Lo Pounds 800 1,100 1,500 Sales price per lb. at split-off $6.50 8.25 8.00 Disposal cost per lb. at split-off $ 3.00 4.20 4.00 Further processing per pound $2.00 3.00 3.50 Final sales price per pound $ 7.50 10.00 10.50 If the products are processed further, Tiny Co. will incur the following disposal costs upon sale: Bo, $3.00; Mo, $2.00; and Lo, $1.00. 46. Using a physical measurement method, what amount of joint processing cost is allocated to Bo (round to the nearest dollar)? a. b. c. d. $700 $679 $927 $494 ANSWER: d EASY Chapter 9 47. Cost Allocation for Joint Products and By-Products Using a physical measurement method, what amount of joint processing cost is allocated to Mo (round to the nearest dollar)? a. b. c. d. $494 $679 $927 $700 ANSWER: 48. EASY $700 $416 $725 $959 ANSWER: c MEDIUM Using sales value at split-off, what amount of joint processing cost is allocated to Lo (round to the nearest dollar)? a. b. c. d. $959 $725 $700 $416 ANSWER: 50. b Using sales value at split-off, what amount of joint processing cost is allocated to Mo (round to the nearest dollar)? a. b. c. d. 49. 9–13 a MEDIUM Using net realizable value at split-off, what amount of joint processing cost is allocated to Bo (round to the nearest dollar)? a. b. c. d. $706 $951 $700 $444 ANSWER: d MEDIUM 9–14 51. Chapter 9 Cost Allocation for Joint Products and By-Products Using net realizable value at split-off, what amount of joint processing cost is allocated to Lo (round to the nearest dollar)? a. b. c. d. $706 $951 $444 $700 ANSWER: b MEDIUM Use the following information for questions 52 and 53. DED Co. is placing an ad in the local paper to advertise its products. The ad will run for one week at a total cost of $5,500. DED has four categories of products as follows: Hardware Hand Tools Lawn Furniture Light Fixtures 52. Expected sales value $35,000 15,000 64,500 25,500 What amount of advertising cost should be allocated to hardware, assuming DED allocates based on percent of floor space occupied? a. b. c. d. $1,375 $1,100 $2,475 $ 825 ANSWER: 53. % of floor space occupied 20% 15 45 20 b EASY Assume that DED decides to allocate based on expected sales value. What amount of advertising cost should be allocated to light fixtures (round to the nearest dollar)? a. b. c. d. $1,375 $589 $1,002 $2,534 ANSWER: c MEDIUM Chapter 9 Cost Allocation for Joint Products and By-Products 9–15 Use the following information for questions 54–59. Rax produces four products from the same process: Cep, Dap, Eek, and Gok. Joint product costs are $9,000. (Round all answers to the nearest dollar.) Barrels 750 1,000 1,400 2,000 Cep Dap Eek Gok Sales price per barrel at split-off $10.00 8.00 11.00 15.00 Disposal cost per barrel at split-off $6.50 4.00 7.00 9.50 Further processing costs $2.00 2.50 4.00 4.50 Final sales price per barrel $13.50 10.00 15.50 19.50 If Rax sells the products after further processing, the following disposal costs will be incurred: Cep, $2.50; Dap, $1.00; Eek, $3.50; Gok, $6.00. 54. Using a physical measurement method, what amount of joint processing cost is allocated to Dap? a. b. c. d. $1,748 $2,447 $1,311 $3,495 ANSWER: 55. MEDIUM Using a physical measurement method, what amount of joint processing cost is allocated to Eek? a. b. c. d. $3,495 $2,447 $1,748 $1,311 ANSWER: 56. a b MEDIUM Using sales value at split-off, what amount of joint processing cost is allocated to Dap? a. b. c. d. $4,433 $2,276 $1,108 $1,182 ANSWER: d MEDIUM 9–16 57. Chapter 9 Using sales value at split-off, what amount of joint processing cost is allocated to Gok? a. b. c. d. $4,433 $1,182 $1,108 $2,276 ANSWER: 58. a MEDIUM Using net realizable value at split-off, what amount of joint processing cost is allocated to Cep? a. b. c. d. $1,550 $1,017 $4,263 $2,170 ANSWER: 59. Cost Allocation for Joint Products and By-Products b MEDIUM Using net realizable value at split-off, what amount of joint processing cost is allocated to Eek? a. b. c. d. $1,017 $1,550 $2,170 $4,263 ANSWER: c MEDIUM Chapter 9 Cost Allocation for Joint Products and By-Products 9–17 Use the following information for questions 60–63. Sun Co. produces three products from the same process that has joint processing costs of $4,100. Products RR, SS, and TT are produced in the following gallons per month, respectively: 250, 400, and 750. Sun also incurred advertising costs of $60,000; the ad was used to run sales for all three products. They occupy floor space in the following ratio: 5:4:9. (Round all answers to the nearest dollar.) 60. Using gallons as the physical measurement, what amount of joint processing cost is allocated to SS? a. b. c. d. $2,196 $1,171 $1,367 $732 ANSWER: 61. EASY Using gallons as the physical measurement, what amount of joint processing cost is allocated to TT? a. b. c. d. $2,196 $732 $1,367 $1,171 ANSWER: 62. b a EASY Assume that Sun chooses to allocate its advertising cost among the three products. What amount of advertising cost is allocated to RR using the floor space ratio? a. b. c. d. $20,000 $17,806 $1,139 $16,667 ANSWER: d EASY 9–18 63. Chapter 9 Assume that Sun chooses to allocate its advertising cost among the three products. What amount of advertising cost is allocated to SS using the floor space ratio? a. b. c. d. $911 $14,244 $13,333 $20,000 ANSWER: 64. c EASY Love Co. manufactures products A and B from a joint process. Sales value at split-off was $700,000 for 10,000 units of A, and $300,000 for 15,000 units of B. Using the sales value at split-off approach, joint costs properly allocated to A were $140,000. Total joint costs were a. b. c. d. $98,000. $200,000. $233,333. $350,000. ANSWER: 65. Cost Allocation for Joint Products and By-Products b EASY Lite Co. manufactures products X and Y from a joint process that also yields a byproduct, Z. Revenue from sales of Z is treated as a reduction of joint costs. Additional information is as follows: Units produced Joint costs Sales value at split-off X 20,000 ? Products Y 20,000 ? Z 10,000 ? Total 50,000 $262,000 $300,000 $150,000 $10,000 $460,000 Joint costs were allocated using the sales value at split-off approach. The joint costs allocated to product X were a. b. c. d. $75,000. $100,800. $150,000. $168,000. ANSWER: d EASY Chapter 9 Cost Allocation for Joint Products and By-Products 9–19 SHORT ANSWER/PROBLEMS 1. Briefly discuss the four decisions that management must make concerning joint processes. ANSWER: The four decisions that managers must make regarding joint processes are as follows. They must try to determine what joint costs, selling costs, and separate processing costs are expected to occur when certain products are manufactured. Next, management must decide on the best use of resources that are available. Managers must next classify, as joint products and/or by-products/scrap, the output of production. The last decision that must be made is whether some or all of the products will be processed further or sold at split-off. This decision is made based on the incremental costs that would be incurred to process further and the incremental revenue if processed further. Joint production costs are irrelevant to this decision. MEDIUM 2. Briefly discuss the six steps in the allocation process. ANSWER: The six steps are as follows: 1. Choose the basis on which to allocate joint cost. 2. List all values that comprise the basis. 3. Add up all the values in the list (#2). 4. Determine the percentage of the total each item in #2 is. 5. Multiply the percentage by the cost being allocated. 6. For valuation purposes, divide the prorated cost by equivalent units of production. MEDIUM 3. Discuss briefly the three monetary measurement techniques of joint cost allocation. ANSWER: The sales value at split-off method assigns costs based only on the weighted proportions of the total sales values of the joint products without consideration of disposal costs at the split-off point. To use this method, all products must be salable at the split-off point. The net realizable value method assigns costs based on the product’s proportional net realizable value at the split-off point. Net realizable value is equal to product sales revenue at split-off minus any costs necessary to prepare and dispose of the product. Approximated net realizable value at split-off method requires that a simulated net realizable value at split-off be calculated. This is equal to final sales price minus incremental separate costs. Incremental separate costs refer to all costs that are incurred between split-off and the point of sale. MEDIUM 9–20 4. Chapter 9 Cost Allocation for Joint Products and By-Products Briefly discuss the restrictions and requirements on service organizations and notforprofits that relate to joint cost allocation. ANSWER: Service and not-for-profit organizations incur costs that may be considered joint in nature, such as advertising and printing of multipurpose documents. Service organizations are not required to allocate these costs to the items worked on, delivered, or advertised but may choose to do so for a better matching of revenues and expenses. Notfor-profits are required by the AICPA to allocate these costs among the activities of fundraising, accomplishing an organizational program, or conducting an administrative function. MEDIUM 5. Briefly discuss the net realizable value at split-off point method of allocating joint costs. ANSWER: The net realizable value at split-off method assigns joint costs based on each product’s proportional NRV at the split-off point. NRV is equal to sales price minus costs that are necessary to prepare and dispose of the product. To use this method, all products must be salable at the split-off point. MEDIUM 6. Why is the net realizable value of scrap used to lower estimated overhead costs in setting a predetermined overhead rate in a job order costing situation in which scrap is expected on most jobs? ANSWER: The net realizable value of scrap is used in this way because the amount received from the sale of scrap is considered to be a reduction of the total cost incurred in the production process. This process is similar to the treatment of sales values of assets purchased and then sold in a “basket” of goods. The estimated cost of scrap is used in setting overhead rates; therefore, when the scrap is sold the amount received should be a reduction of total overhead. MEDIUM Chapter 9 Cost Allocation for Joint Products and By-Products 9–21 Use the following information for questions 7 and 8. BL Company produces only two products and incurs joint processing costs that total $3,750. Products Aba and Ibi are produced in the following quantities during each month: 4,500 and 6,000 gallons, respectively. BL also runs one ad each month that advertises both products at a cost of $1,500. The selling price per gallon for the two products are $20 and $17.50, respectively. 7. What amount of joint processing costs is allocated to each product based on gallons produced? ANSWER: A = 4,500/10,500 × $3,750 = $1,607 I = 6,000/10,500 × $3,750 = $2,143 EASY 8. What amount of advertising cost is allocated to each product based on sales value? ANSWER: A = 4,500 × $20.00 = $ 90,000/$195,000 × $1,500 = $692 I = 6,000 × $17.50 = 105,000/$195,000 × $1,500 = $808 $195,000 MEDIUM 9–22 Chapter 9 Cost Allocation for Joint Products and By-Products Use the following information for questions 9 and 10. GAB Company produces three products from the same process and incurs joint processing costs of $3,000. Mat Nat Qat Gallons 2,300 1,100 500 Sales price per gallon at split-off $ 4.50 6.00 10.00 Disposal cost per gallon at split-off $1.25 3.00 8.00 Further processing costs $1.00 2.00 2.00 Final sales price per gallon $ 7.00 10.00 15.00 Disposal costs for the products if they are processed further are: Mat, $3.00; Nat, $5.50; Qat, $1.00. 9. What amount of joint processing cost is allocated to the three products using sales value at split-off? ANSWER: M = 2,300 × $ 4.50 = $10,350/$21,950 × $3,000 = $1,415 N = 1,100 × $ 6.00 = $ 6,600 $21,950 × $3,000 = $902 Q = 500 × $10.00 = $ 5,000/$21,950 × $3,000 = $683 $21,950 MEDIUM 10. What amount of joint processing cost is allocated to the three products using net realizable value at split-off? ANSWER: Sales price minus disposal cost* $4.50 – $1.25 = $3.25 $6.00 – $3.00 = 3.00 $10.00 – $8.00 = 2.00 M = 2,300 × $ 3.25* = $ 7,475 /$11,775 × $3,000 = $1,904 N = 1,100 × $ 3.00* = $ 3,300 /$11,775 × $3,000 = $ 841 Q = 500 × $ 2.00* = $ 1,000 /$11,775 × $3,000 = $ 255 $11,775 MEDIUM Chapter 9 11. Cost Allocation for Joint Products and By-Products 9–23 A company produces two main products jointly, A and B, and C, which is a by-product of B. A and B are produced form the same raw material. C is manufactured from the residue of the process creating B. Costs before separation are apportioned between the two main products by the net realizable value method. The net revenue realized from the sale of C is deducted from the cost of B. Data for April were as follows: Costs before separation Costs after separation: A B C $ 200,000 50,000 32,000 4,000 Production for April, in pounds: A B C Sales for April: A B C 800,000 200,000 20,000 640,000 pounds @ $.4375 180,000 pounds @ .65 20,000 pounds @ .30 Required: Determine the gross profit for April. 9–24 Chapter 9 Cost Allocation for Joint Products and By-Products ANSWER: NRV C REVENUE 20,000 × .30 = $6,000 COST (4,000 ) NRV $2,000 NRV: A (800,000 × $.4375) = $350,000 – $50,000 = $300,000 B (200,000 × $.65) = $130,000 – ($32,000 – $2,000) = 100,000 $400,000 ALLOCATION: A ($300,000/$400,000 × $200,000 = $150,000 B ($100,000/$400,000 × $200,000 = 50,000 UNIT COST: A ($150,000 + $50,000)/800,000 = $ .25 B ($50,000 + $30,000)/200,000 = $ .40 GROSS PROFIT: A ($ .4375 – $.25) × 640,000 = B ($ .65 – $.40) × 180,000 = DIFFICULT $120,000 45,000 $165,000 Chapter 9 12. Cost Allocation for Joint Products and By-Products 9–25 The total joint cost of producing 2,000 pounds of Product A; 1,000 pounds of Product B; and 1,000 pounds of Product C is $7,500. Selling price per pound of the three products are $15 for Product A; $10 for Product B; and $5 for Product C. Joint cost is allocated using the sales value method. Required: a. Compute the unit cost of Product A if all three products are main products. b. Compute the unit cost of Product A if Products A and B are main products and Product C is a by-product for which the cost reduction method is used. 9–26 Chapter 9 Cost Allocation for Joint Products and By-Products ANSWER: a. SALES VALUE UNIT COST A 2,000 × $15 = $30,000/$45,000 × $7,500 = $5,000/2,000 = $2.50 b. B 1,000 x $10 $10,000/$45,000 x $7,500 = $1,667/1,000 = $1.67 C 1,000 x $5 $ 5,000/$45,000 x $7,500 = $ 833/1,000 = $ .83 $45,000 $7,500 TO ALLOCATE: $7,500 – $5,000 = $2,500 SALES VALUE UNIT COST A 2,000 × $15 = $30,000/$40,000 × $2,500 = $1,875/2,000 = $.9375 B 1,000 × $10 = $10,000/$40,000 × $2,500 = $ 625/1,000 = $.625 $40,000 $2,500 EASY Chapter 9 13. Cost Allocation for Joint Products and By-Products 9–27 A Manufacturing Company makes three products: A and B are considered main products and C a by-product. Production and sales for the year were: 220,000 lbs. of Product A, salable at $6.00 180,000 lbs. of Product B, salable at $3.00 50,000 lbs. of Product C, salable at $.90 Production costs for the year: Joint costs Costs after separation: Product A Product B Product C $276,600 320,000 190,000 6,900 Required: Using the by-product revenue as a cost reduction and net realizable value method of assigning joint costs, compute unit costs (a) if C is a by-product of the process and (b) if C is a by-product of B. 9–28 Chapter 9 Cost Allocation for Joint Products and By-Products ANSWER: a. JOINT COST – NRV C TO ALLOCATE $276,600 (38,100) (50,000 – $.90) – $6,900 $238,500 SALES VALUE – COST AFTER SEPARATION = NRV 220,000 × $6 = $1,320,000 – $320,000 = $1,000,000 180,000 × $3 = $ 540,000 – $190,000 = 350,000 $1,350,000 ALLOCATION $1,000,000/$1,350,000 × $238,500 = $176,667 $ 350,000/$1,350,000 × $238,500 = 61,833 $238,500 UNIT COST: A ($176,667 + $320,000)/220,000 = $2.26 B ($61,833 + $190,000)/180,000 = $1.40 b. NRV A $1,000,000 = $1,000,000/$1,388,100 × $276,600 = $199,265 B $350,000 + $38100 = 388,100/$1,388,100 × $276,600 = $ 77,335 $1,388,100 UNIT COST A ($199,265 + $320,000)/220,000 = $2.36 B ($77,335 + $151,900)/180,000 = $1.27 MEDIUM Chapter 9 14. Cost Allocation for Joint Products and By-Products 9–29 Smith Co. processes raw material in Department 1 from which come two main products, A and B, and a by-product, C. A is further processed in Department 2, B in Department 3, and C in Department 4. The value of the by-product reduces the cost of the main products, and sales value is used to allocate joint costs. Cost Incurred: Production: A B C Selling Price: A B C Dept 1 $90,000 Dept 2 $10,000 Dept 3 $8,000 10,000 lbs. 20,000 lbs. 10,000 lbs. $10/lb. $5/lb. $2/lb. Required: a. Compute unit costs for A and B. b. Ending inventory consists of 5,000 lbs. of B and 1,000 lbs. of C. What is the value of the inventory? c. Recompute a and b allocating cost based on net realizable value. Dept 4 $10,000 9–30 Chapter 9 Cost Allocation for Joint Products and By-Products ANSWER: a. JOINT COST – SALES VALUE $90,000 (20,000 ) (10,000 × $2) $70,000 SALES VALUE A 10,000 × $10 = $100,000/$200,000 × $70,000 = $35,000 B 20,000 × $ 5 = 100,000/$200,000 × $70,000 = $35,000 $200,000 UNIT COST A ($35,000 + $10,000)/10,000 = $4.50 B ($35,000 + $8,000)/20,000 = $2.15 b. ENDING INVENTORY B 5,000 × $2.15 = $10,750 C 1,000 × $2.00 = 2,000 $12,750 c. NRV A $100,000 – $10,000 = $ 90,000/$182,000 × $70,000 = $34,615 B $100,000 – $8,000 = 92,000/$182,000 × $70,000 = 35,385 $182,000 $70,000 UNIT COST A ($34,615 + $10,000)/10,000 = $4.46 B ($35,385 + $8,000)/20,000 = $2.17 ENDING INVENTORY B 5,000 × $2.17 = $10,850 C 1,000 × $2.00 = 2,000 $12,850 MEDIUM Chapter 9 15. Cost Allocation for Joint Products and By-Products 9–31 Three identifiable product lines, Products A, B, and C, are obtained in fixed quantities from a basic processing operation. The cost of the basic operation is $320,000 for a yield of 5,000 tons of Product A; 2,000 tons of Product B; and 1,000 tons of Product C. The basic processing cost is allocated to the product lines in proportion to the relative weight produced. Beltway Products Company does both the basic processing work and the further refinement of the three product lines. After the basic operation, the products can be sold at the following prices per metric ton: Product A—$60 Product B—$53 Product C—$35 Costs to refine each of the three product lines follow: A Variable cost per metric ton Total fixed cost $8 $20,000 Product Lines B C $7 $4 $16,000 $6,000 The fixed cost of the refining operation will not be incurred if the product line is not refined. The refined products can be sold at the following prices per metric ton: Product A—$75 Product B—$65 Product C—$40 Required: a. Determine the total unit cost of each product line in a refined state. b. Which of the three product lines, if any, should be refined and which should be sold after the basic processing operation? Show computations. 9–32 Chapter 9 Cost Allocation for Joint Products and By-Products ANSWER: a. WT A 5,000 B 2,000 C 1,000 8,000 ALLOCATION 5,000/8,000 × $320,000 = $200,000 2,000/8,000 × $320,000 = 80,000 1,000/8,000 × $320,000 = 40,000 $320,000 UNIT COST A ($200,000 + $20,000)/5,000 + $8 = $52 B ($80,000 + $16,000)/2,000 + $7 = $55 C ($40000 + $6,000)/1,000 + $4 = $50 b. CHANGE IN REVENUE – CHANGE IN COST = CHANGE IN PROFIT A $75–$60 = $15 – ($20,000/5,000) + $8 = + $3 B $65–$53 = $12 – ($16,000/2,000) + $7 = – $3 C $40–$35 = $5 – ($6,000/1,000) + $4 = – $5 Therefore, process only Product A. MEDIUM Chapter 9 16. Cost Allocation for Joint Products and By-Products 9–33 The Stone Company produced three joint products at a joint cost of $100,000. These products were processed further and sold as follows: Product A B C Sales $245,000 330,000 175,000 Additional Processing Costs $200,000 300,000 100,000 The company has had an opportunity to sell at split-off directly to other processors. If that alternative had been selected, sales would have been: A, $56,000; B, $28,000; and C, $56,000. The company expects to operate at the same level of production and sales in the forthcoming year. Required: Consider all the available information and assume that all costs incurred after split-off are variable. a. Could the company increase net income by altering its processing decisions? If so, what would be the expected overall net income? b. Which products should be processed further and which should be sold at split-off? 9–34 Chapter 9 Cost Allocation for Joint Products and By-Products ANSWER: a. Currently NI is Sales Additional Processing Costs – JC $750,000 (600,000 ) $150,000 (100,000 ) $ 50,000 NI can be increased by $11,000 if A is not processed. b. EASY Sales – Cost NI/(LOSS) A $189,000 (200,000 ) $(11,000 ) B $302,000 (300,000 ) $ 2,000 C $119,000 (100,000 ) $ 19,000 CHAPTER 10 STANDARD COSTING MULTIPLE CHOICE 1. A primary purpose of using a standard cost system is a. b. c. d. to make things easier for managers in the production facility. to provide a distinct measure of cost control. to minimize the cost per unit of production. b and c are correct. ANSWER: 2. direct material only. direct labor only. direct material and direct labor only. direct material, direct labor, and overhead. ANSWER: d EASY Which of the following statements regarding standard cost systems is true? a. b. c. d. Favorable variances are not necessarily good variances. Managers will investigate all variances from standard. The production supervisor is generally responsible for material price variances. Standard costs cannot be used for planning purposes since costs normally change in the future. ANSWER: 4. EASY The standard cost card contains quantities and costs for a. b. c. d. 3. b a EASY In a standard cost system, Work in Process Inventory is ordinarily debited with a. b. c. d. actual costs of material and labor and a predetermined overhead cost for overhead. standard costs based on the level of input activity (such as direct labor hours worked). standard costs based on production output. actual costs of material, labor, and overhead. ANSWER: c EASY 10–1 10–2 5. Chapter 10 A standard cost system may be used in a. b. c. d. job order costing, but not process costing. process costing, but not job order costing. either job order costing or process costing. neither job order costing nor process costing. ANSWER: 6. EASY product costing. planning. controlling. all of the above. ANSWER: d EASY A purpose of standard costing is to a. b. c. d. replace budgets and budgeting. simplify costing procedures. eliminate the need for actual costing for external reporting purposes. eliminate the need to account for year-end underapplied or overapplied manufacturing overhead. ANSWER: 8. c Standard costs may be used for a. b. c. d. 7. Standard Costing b EASY Standard costs a. b. c. d. are estimates of costs attainable only under the most ideal conditions. are difficult to use with a process costing system. can, if properly used, help motivate employees. require that significant unfavorable variances be investigated, but do not require that significant favorable variances be investigated. ANSWER: c EASY Chapter 10 9. Standard Costing A bill of material does not include a. b. c. d. quantity of component inputs. price of component inputs. quality of component inputs. type of product output. ANSWER: 10. c. d. EASY tracks the cost and quantity of material through an operation. tracks the network of control points from receipt of a customer’s order through the delivery of the finished product. specifies tasks to make a unit and the times allowed for each task. charts the shortest path by which to arrange machines for completing products. ANSWER: c MEDIUM A total variance is best defined as the difference between total a. b. c. d. actual cost and total cost applied for the standard output of the period. standard cost and total cost applied to production. actual cost and total standard cost of the actual input of the period. actual cost and total cost applied for the actual output of the period. ANSWER: 12. b An operations flow document a. b. 11. 10–3 d EASY The term standard hours allowed measures a. b. c. d. budgeted output at actual hours. budgeted output at standard hours. actual output at standard hours. actual output at actual hours. ANSWER: c EASY 10–4 13. Chapter 10 A large labor efficiency variance is prorated to which of the following at year-end? a. b. c. d. Cost of Goods Sold no no yes yes ANSWER: 14. d. FG Inventory no yes no yes EASY magnitude of the variance trend of the variances over time likelihood that an investigation will reduce or eliminate future occurrences of the variance whether the variance is favorable or unfavorable ANSWER: d EASY At the end of a period, a significant material quantity variance should be a. b. c. d. closed to Cost of Goods Sold. allocated among Raw Material, Work in Process, Finished Goods, and Cost of Goods Sold. allocated among Work in Process, Finished Goods, and Cost of Goods Sold. carried forward as a balance sheet account to the next period. ANSWER: 16. d WIP Inventory no yes no yes Which of the following factors should not be considered when deciding whether to investigate a variance? a. b. c. 15. Standard Costing c EASY When computing variances from standard costs, the difference between actual and standard price multiplied by actual quantity used yields a a. b. c. d. combined price-quantity variance. price variance. quantity variance. mix variance. ANSWER: b EASY Chapter 10 17. Standard Costing A company wishing to isolate variances at the point closest to the point of responsibility will determine its material price variance when a. b. c. d. material is purchased. material is issued to production. material is used in production. production is completed. ANSWER: 18. b. c. d. EASY the difference between the actual cost of material purchased and the standard cost of material purchased. the difference between the actual cost of material purchased and the standard cost of material used. primarily the responsibility of the production manager. both a and c. ANSWER: a EASY The sum of the material price variance (calculated at point of purchase) and material quantity variance equals a. b. c. d. the total cost variance. the material mix variance. the material yield variance. no meaningful number. ANSWER: 20. a The material price variance (computed at point of purchase) is a. 19. 10–5 d EASY A company would most likely have an unfavorable labor rate variance and a favorable labor efficiency variance if a. b. c. d. the mix of workers used in the production process was more experienced than the normal mix. the mix of workers used in the production process was less experienced than the normal mix. workers from another part of the plant were used due to an extra heavy production schedule. the purchasing agent acquired very high quality material that resulted in less spoilage. ANSWER: a EASY 10–6 21. Chapter 10 If actual direct labor hours (DLHs) are less than standard direct labor hours allowed and overhead is applied on a DLH basis, a(n) a. b. c. d. favorable variable overhead spending variance exists. favorable variable overhead efficiency variance exists. favorable volume variance exists. unfavorable volume variance exists. ANSWER: 22. EASY labor rate variance actual hours of labor used reason for the labor variances efficiency of the labor force ANSWER: c EASY (Appendix) The total labor variance can be subdivided into all of the following except a. b. c. d. rate variance. yield variance. learning curve variance. mix variance. ANSWER: 24. b If all sub-variances are calculated for labor, which of the following cannot be determined? a. b. c. d. 23. Standard Costing c EASY The standard predominantly used in Western cultures for motivational purposes is a(n) _____________________ standard. a. b. c. d. expected annual ideal practical theoretical ANSWER: c EASY Chapter 10 25. Standard Costing Which of the following standards can commonly be reached or slightly exceeded by workers in a motivated work environment? a. b. c. d. Ideal no no yes no ANSWER: 26. b Ideal yes no no no ANSWER: Expected annual no yes no no EASY Practical no no yes no a Expected annual no yes yes no EASY Which of the following capacity levels has traditionally been used to compute the fixed overhead application rate? a. b. c. d. expected annual normal theoretical prior year ANSWER: 28. Practical no yes yes yes Management would generally expect unfavorable variances if standards were based on which of the following capacity measures? a. b. c. d. 27. 10–7 a EASY A company has a favorable variable overhead spending variance, an unfavorable variable overhead efficiency variance, and underapplied variable overhead at the end of a period. The journal entry to record these variances and close the variable overhead control account will show which of the following? a. b. c. d. VOH spending variance debit credit debit credit ANSWER: b VOH efficiency variance credit debit credit debit MEDIUM VMOH credit credit debit debit 10–8 29. Chapter 10 Ronald Corp. incurred 2,300 direct labor hours to produce 600 units of product. Each unit should take 4 direct labor hours. Ronald applies variable overhead to production on a direct labor hour basis. The variable overhead efficiency variance a. b. c. d. will be unfavorable. will be favorable. will depend upon the capacity measure selected to assign overhead to production. is impossible to determine without additional information. ANSWER: 30. b. c. d. MEDIUM using more or fewer actual hours than the standard hours allowed for the production achieved. paying a higher/lower average actual overhead price per unit of the activity base than the standard price allowed per unit of the activity base. larger/smaller waste and shrinkage associated with the resources involved than expected. both b and c are causes. ANSWER: d MEDIUM Which of the following are considered controllable variances? a. b. c. d. VOH spending yes no no yes ANSWER: 32. b A variable overhead spending variance is caused by a. 31. Standard Costing d Total overhead budget yes no yes yes Volume yes yes no no MEDIUM A company may set predetermined overhead rates based on normal, expected annual, or theoretical capacity. At the end of a period, the fixed overhead spending variance would a. b. c. d. be the same regardless of the capacity level selected. be the largest if theoretical capacity had been selected. be the smallest if theoretical capacity had been selected. not occur if actual capacity were the same as the capacity level selected. ANSWER: a EASY Chapter 10 33. Standard Costing The variance least significant for purposes of controlling costs is the a. b. c. d. material quantity variance. variable overhead efficiency variance. fixed overhead spending variance. fixed overhead volume variance. ANSWER: 34. c. d. EASY best controlled on a unit-by-unit basis of products produced. mostly incurred to provide the capacity to produce and are best controlled on a total basis at the time they are originally negotiated. constant on a per-unit basis at all different activity levels within the relevant range. best controlled as to spending during the production process. ANSWER: b MEDIUM The variance most useful in evaluating plant utilization is the a. b. c. d. variable overhead spending variance. fixed overhead spending variance. variable overhead efficiency variance. fixed overhead volume variance. ANSWER: 36. d Fixed overhead costs are a. b. 35. 10–9 d EASY A favorable fixed overhead volume variance occurs if a. b. c. d. there is a favorable labor efficiency variance. there is a favorable labor rate variance. production is less than planned. production is greater than planned. ANSWER: d EASY 10–10 37. Chapter 10 The fixed overhead application rate is a function of a predetermined activity level. If standard hours allowed for good output equal the predetermined activity level for a given period, the volume variance will be a. b. c. d. zero. favorable. unfavorable. either favorable or unfavorable, depending on the budgeted overhead. ANSWER: 38. EASY fixed overhead volume variance. fixed overhead spending variance. noncontrollable variance. controllable variance. ANSWER: b EASY Total actual overhead minus total budgeted overhead at the actual input production level equals the a. b. c. d. variable overhead spending variance. total overhead efficiency variance. total overhead spending variance. total overhead volume variance. ANSWER: 40. a Actual fixed overhead minus budgeted fixed overhead equals the a. b. c. d. 39. Standard Costing c EASY A favorable fixed overhead spending variance indicates that a. b. c. d. budgeted fixed overhead is less than actual fixed overhead. budgeted fixed overhead is greater than applied fixed overhead. applied fixed overhead is greater than budgeted fixed overhead. actual fixed overhead is less than budgeted fixed overhead. ANSWER: d EASY Chapter 10 41. Standard Costing An unfavorable fixed overhead volume variance is most often caused by a. b. c. d. actual fixed overhead incurred exceeding budgeted fixed overhead. an over-application of fixed overhead to production. an increase in the level of the finished inventory. normal capacity exceeding actual production levels. ANSWER: 42. EASY unfavorable capacity variance. favorable material and labor usage variance. favorable volume variance. unfavorable manufacturing overhead variance. ANSWER: c EASY In analyzing manufacturing overhead variances, the volume variance is the difference between the a. b. c. d. amount shown in the flexible budget and the amount shown in debit side of the overhead control account. predetermined overhead application rate and the flexible budget application rate times actual hours worked. budget allowance based on standard hours allowed for actual production for the period and the amount budgeted to be applied during the period. actual amount spent for overhead items during the period and the overhead amount applied to production during the period. ANSWER: 44. d In a standard cost system, when production is greater than the estimated unit or denominator level of activity, there will be a(n) a. b. c. d. 43. 10–11 c MEDIUM Variance analysis for overhead normally focuses on a. b. c. d. efficiency variances for machinery and indirect production costs. volume variances for fixed overhead costs. the controllable variance as a lump-sum amount. the difference between budgeted and applied variable overhead. ANSWER: a MEDIUM 10–12 45. Chapter 10 The efficiency variance computed on a three-variance approach is a. b. c. d. equal to the variable overhead efficiency variance computed on the four-variance approach. equal to the variable overhead spending variance plus the variable overhead efficiency variance computed on the four-variance approach. computed as the difference between applied variable overhead and actual variable overhead. computed as actual variable overhead minus the flexible budget for variable overhead based on actual hours worked. ANSWER: 46. EASY is less expensive to operate and maintain. does not result in underapplied or overapplied overhead. is more effective in assigning overhead costs to products. is easier to develop. ANSWER: c MEDIUM Under the two-variance approach, the volume variance is computed by subtracting _________ based on standard input allowed for the production achieved from budgeted overhead. a. b. c. d. applied overhead actual overhead budgeted fixed overhead plus actual variable overhead budgeted variable overhead ANSWER: 48. a The use of separate variable and fixed overhead rates is better than a combined rate because such a system a. b. c. d. 47. Standard Costing a EASY The overhead variance calculated as total budgeted overhead at the actual input production level minus total budgeted overhead at the standard hours allowed for actual output is the a. b. c. d. efficiency variance. spending variance. volume variance. budget variance. ANSWER: a EASY Chapter 10 49. Standard Costing Analyzing overhead variances will not help in a. b. c. d. controlling costs. evaluating performance. determining why variances occurred. planning costs for future production cycles. ANSWER: 50. c EASY In a just-in-time inventory system, a. b. c. d. practical standards become ideal standards. ideal standards become expected standards. variances will not occur because of the zero-defects basis of JIT. standard costing cannot be used. ANSWER: 51. 10–13 b MEDIUM A company using very tight (high) standards in a standard cost system should expect that a. b. c. d. no incentive bonus will be paid. most variances will be unfavorable. employees will be strongly motivated to attain the standards. costs will be controlled better than if lower standards were used. ANSWER: b EASY 10–14 Chapter 10 Standard Costing Use the following information for questions 52–55. (Round all answers to the nearest dollar.) The following July information is for Kingston Company: 52. Standards: Material Labor 3.0 feet per unit @ $4.20 per foot 2.5 hours per unit @ $7.50 per hour Actual: Production Material Labor 2,750 units produced during the month 8,700 feet used; 9,000 feet purchased @ $4.50 per foot 7,000 direct labor hours @ $7.90 per hour What is the material price variance (calculated at point of purchase)? a. b. c. d. $2,700 U $2,700 F $2,610 F $2,610 U ANSWER: 53. EASY What is the material quantity variance? a. b. c. d. $3,105 F $1,050 F $3,105 U $1,890 U ANSWER: 54. a d MEDIUM What is the labor rate variance? a. b. c. d. $3,480 U $3,480 F $2,800 U $2,800 F ANSWER: c EASY Chapter 10 55. Standard Costing 10–15 What is the labor efficiency variance? a. b. c. d. $1,875 U $938 U $1,875 U $1,125 U ANSWER: b MEDIUM Use the following information for questions 56–60. Timothy Company has the following information available for October when 3,500 units were produced (round answers to the nearest dollar). Standards: Material Labor 3.5 pounds per unit @ $4.50 per pound 5.0 hours per unit @ $10.25 per hour Actual: Material purchased 12,300 pounds @ $4.25 Material used 11,750 pounds 17,300 direct labor hours @ $10.20 per hour 56. What is the labor rate variance? a. b. c. d. $875 F $865 F $865 U $875 U ANSWER: 57. b EASY What is the labor efficiency variance? a. b. c. d. $2,050 F $2,050 U $2,040 U $2,040 F ANSWER: a EASY 10–16 58. Chapter 10 What is the material price variance (based on quantity purchased)? a. b. c. d. $3,075 U $2,938 U $2,938 F $3,075 F ANSWER: 59. d EASY What is the material quantity variance? a. b. c. d. $2,250 F $2,250 U $225 F $2,475 U ANSWER: 60. Standard Costing a EASY Assume that the company computes the material price variance on the basis of material issued to production. What is the total material variance? a. b. c. d. $2,850 U $5,188 U $5,188 F $2,850 F ANSWER: c MEDIUM Chapter 10 Standard Costing 10–17 Use the following information for questions 61–64. The following March information is available for Batt Manufacturing Company when it produced 2,100 units: 61. Standard: Material Labor 2 pounds per unit @ $5.80 per pound 3 direct labor hours per unit @ $10.00 per hour Actual: Material Labor 4,250 pounds purchased and used @ $5.65 per pound 6,300 direct labor hours at $9.75 per hour What is the material price variance? a. b. c. d. $637.50 U $637.50 F $630.00 U $630.00 F ANSWER: 62. EASY What is the material quantity variance? a. b. c. d. $275 F $290 F $290 U $275 U ANSWER: 63. b c EASY What is the labor rate variance? a. b. c. d. $1,575 U $1,575 F $1,594 U $0 ANSWER: b EASY 10–18 64. Chapter 10 Standard Costing What is the labor efficiency variance? a. b. c. d. $731.25 F $731.25 U $750.00 F none of the above ANSWER: d EASY Use the following information for questions 65–74. Redd Co. uses a standard cost system for its production process and applies overhead based on direct labor hours. The following information is available for August when Redd made 4,500 units: 65. Standard: DLH per unit Variable overhead per DLH Fixed overhead per DLH Budgeted variable overhead Budgeted fixed overhead 2.50 $1.75 $3.10 $21,875 $38,750 Actual: Direct labor hours Variable overhead Fixed overhead 10,000 $26,250 $38,000 Using the one-variance approach, what is the total overhead variance? a. b. c. d. $6,062.50 U $3,625.00 U $9,687.50 U $6,562.50 U ANSWER: 66. c EASY Using the two-variance approach, what is the controllable variance? a. b. c. d. $5,812.50 U $5,812.50 F $4,375.00 U $4,375.00 F ANSWER: a EASY Chapter 10 67. Standard Costing Using the two-variance approach, what is the noncontrollable variance? a. b. c. d. $3,125.00 F $3,875.00 U $3,875.00 F $6,062.50 U ANSWER: 68. c MEDIUM Using the three-variance approach, what is the efficiency variance? a. b. c. d. $9,937.50 F $2,187.50 F $2,187.50 U $2,937.50 F ANSWER: b MEDIUM Using the three-variance approach, what is the volume variance? a. b. c. d. $3,125.00 F $3,875.00 F $3,875.00 U $6,062.50 U ANSWER: 71. EASY $4,375 U $3,625 F $8,000 U $15,750 U ANSWER: 70. b Using the three-variance approach, what is the spending variance? a. b. c. d. 69. 10–19 c MEDIUM Using the four-variance approach, what is the variable overhead spending variance? a. b. c. d. $4,375.00 U $4,375.00 F $8,750.00 U $6,562.50 U ANSWER: c MEDIUM 10–20 72. Chapter 10 Using the four-variance approach, what is the variable overhead efficiency variance? a. b. c. d. $2,187.50 U $9,937.50 F $2,187.50 F $2,937.50 F ANSWER: 73. c MEDIUM Using the four-variance approach, what is the fixed overhead spending variance? a. b. c. d. $7,000 U $3,125 F $750 U $750 F ANSWER: 74. Standard Costing d EASY Using the four-variance approach, what is the volume variance? a. b. c. d. $3,125 F $3,875 F $6,063 U $3,875 U ANSWER: d MEDIUM Chapter 10 Standard Costing 10–21 Use the following information for questions 75–84. Spots Inc. uses a standard cost system for its production process. Spots applies overhead based on direct labor hours. The following information is available for July: Standard: Direct labor hours per unit Variable overhead per hour Fixed overhead per hour (based on 11,990 DLHs) Actual: Units produced Direct labor hours Variable overhead Fixed overhead 75. 4,400 8,800 $29,950 $42,300 $7,950 U $25 F $7,975 U $10,590 U ANSWER: a MEDIUM Using the four-variance approach, what is the variable overhead efficiency variance? a. b. c. d. $9,570 F $9,570 U $2,200 F $2,200 U ANSWER: 77. $3.00 Using the four-variance approach, what is the variable overhead spending variance? a. b. c. d. 76. 2.20 $2.50 c MEDIUM Using the four-variance approach, what is the fixed overhead spending variance? a. b. c. d. $15,900 U $6,330 U $6,930 U $935 F ANSWER: b MEDIUM 10–22 78. Chapter 10 Using the four-variance approach, what is the volume variance? a. b. c. d. $6,930 U $13,260 U $0 $2,640 F ANSWER: 79. $23,850 U $23,850 F $14,280 F $14,280 U ANSWER: MEDIUM $11,770 F $2,200 F $7,975 U $5,775 U ANSWER: b MEDIUM Using the three-variance approach, what is the volume variance? a. b. c. d. $13,260 U $2,640 F $6,930 U $0 ANSWER: 82. d Using the three-variance approach, what is the efficiency variance? a. b. c. d. 81. MEDIUM Using the three-variance approach, what is the spending variance? a. b. c. d. 80. a c MEDIUM Using the two-variance approach, what is the controllable variance? a. b. c. d. $21,650 U $16,480 U $5,775 U $12,080 U ANSWER: d MEDIUM Standard Costing Chapter 10 83. Standard Costing Using the two-variance approach, what is the noncontrollable variance? a. b. c. d. $26,040 F $0 $6,930 U $13,260 U ANSWER: 84. MEDIUM $19,010 U $6,305 U $12,705 U $4,730 U ANSWER: a MEDIUM Actual fixed overhead is $33,300 (12,000 machine hours) and fixed overhead was estimated at $34,000 when the predetermined rate of $3.00 per machine hour was set. If 11,500 standard hours were allowed for actual production, applied fixed overhead is a. b. c. d. $33,300. $34,000. $34,500. not determinable without knowing the actual number of units produced. ANSWER: 86. c Using the one-variance approach, what is the total variance? a. b. c. d. 85. 10–23 c EASY One unit requires 2 direct labor hours to produce. Standard variable overhead per unit is $1.25 and standard fixed overhead per unit is $1.75. If 330 units were produced this month, what total amount of overhead is applied to the units produced? a. b. c. d. $990 $1,980 $660 cannot be determined without knowing the actual hours worked ANSWER: a EASY 10–24 87. Chapter 10 Standard Costing Union Company uses a standard cost accounting system. The following overhead costs and production data are available for August: Standard fixed OH rate per DLH Standard variable OH rate per DLH Budgeted monthly DLHs Actual DLHs worked Standard DLHs allowed for actual production Overall OH variance—favorable $1 $4 40,000 39,500 39,000 $2,000 The total applied manufacturing overhead for August should be a. b. c. d. $195,000. $197,000. $197,500. $199,500. ANSWER: 88. a EASY Universal Company uses a standard cost system and prepared the following budget at normal capacity for January: Direct labor hours Variable OH Fixed OH Total OH per DLH Actual data for January were as follows: Direct labor hours worked Total OH Standard DLHs allowed for capacity attained 24,000 $48,000 $108,000 $6.50 22,000 $147,000 21,000 Using the two-way analysis of overhead variances, what is the controllable variance for January? a. b. c. d. $3,000 F $5,000 F $9,000 F $10,500 U ANSWER: a MEDIUM Chapter 10 89. Standard Costing 10–25 The following information is available from the Tyro Company: Actual OH Fixed OH expenses, actual Fixed OH expenses, budgeted Actual hours Standard hours Variable OH rate per DLH $15,000 $7,200 $7,000 3,500 3,800 $2.50 Assuming that Tyro uses a three-way analysis of overhead variances, what is the overhead spending variance? a. b. c. d. $750 F $750 U $950 F $1,500 U ANSWER: 90. a MEDIUM Martin Company uses a two-way analysis of overhead variances. Selected data for the April production activity are as follows: Actual variable OH incurred Variable OH rate per MH Standard MHs allowed Actual MHs $196,000 $6 33,000 32,000 Assuming that budgeted fixed overhead costs are equal to actual fixed costs, the controllable variance for April is a. b. c. d. $2,000 F. $4,000 U. $4,000 F. $6,000 F. ANSWER: a MEDIUM 10–26 91. Chapter 10 Standard Costing Air Inc. uses a standard cost system. Overhead cost information for October is as follows: Total actual overhead incurred $12,600 Fixed overhead budgeted $3,300 Total standard overhead rate per MH $4 Variable overhead rate per MH $3 Standard MHs allowed for actual production 3,500 What is the total overhead variance? a. b. c. d. $1,200 F $1,200 U $1,400 F $1,400 U ANSWER: c EASY Use the following information for questions 92–95. Standard Company has developed standard overhead costs based on a capacity of 180,000 machine hours as follows: Standard costs per unit: Variable portion 2 hours @ $3 = $ 6 Fixed portion 2 hours @ $5 = 10 $16 During April, 85,000 units were scheduled for production, but only 80,000 units were actually produced. The following data relate to April: Actual machine hours used were 165,000. Actual overhead incurred totaled $1,378,000 ($518,000 variable plus $860,000 fixed). All inventories are carried at standard cost. 92. The variable overhead spending variance for April was a. b. c. d. $15,000 U. $23,000 U. $38,000 F. $38,000 U. ANSWER: b MEDIUM Chapter 10 93. Standard Costing The variable overhead efficiency variance for April was a. b. c. d. $15,000 U. $23,000 U. $38,000 F. $38,000 U. ANSWER: 94. a MEDIUM The fixed overhead spending variance for April was a. b. c. d. $40,000 U. $40,000 F. $60,000 F. $60,000 U. ANSWER: 95. 10–27 b MEDIUM The fixed overhead volume variance for April was a. b. c. d. $60,000 U. $60,000 F. $100,000 F. $100,000 U. ANSWER: d MEDIUM 10–28 Chapter 10 Standard Costing THE FOLLOWING MULTIPLE CHOICE RELATE TO MATERIAL COVERED IN THE APPENDIX OF THE CHAPTER. Use the following information for questions 96–101. (Round all answers to the nearest dollar and percents to the nearest whole percent.) Xtra Klean manufactures a cleaning solvent. The company employs both skilled and unskilled workers. Skilled workers class C are paid $12 per hour, while unskilled workers class D are paid $7 per hour. To produce one 55-gallon drum of solvent requires 4 hours of skilled labor and 2 hours of unskilled labor. The solvent requires 2 different materials: A and B. The standard and actual material information is given below: Standard: Material A: 30.25 gallons @ $1.25 per gallon Material B: 24.75 gallons @ $2.00 per gallon Actual: Material A: 10,716 gallons purchased and used @ $1.50 per gallon Material B: 17,484 gallons purchased and used @ $1.90 per gallon Skilled labor hours: 1,950 @ $11.90 per hour Unskilled labor hours: 1,300 @ $7.15 per hour During the current month Xtra Klean manufactured 500 55-gallon drums. (Round all answers to the nearest whole dollar.) 96. What is the total material price variance? a. b. c. d. $877 F $877 U $931 U $931 F ANSWER: 97. c MEDIUM What is the total material mix variance? a. b. c. d. $3,596 F $3,596 U $4,864 F $4,864 U ANSWER: b DIFFICULT Chapter 10 98. Standard Costing What is the total material yield variance? a. b. c. d. $1,111 U $1,111 F $2,670 U $2,670 F ANSWER: 99. a MEDIUM What is the labor mix variance? a. b. c. d. $1,083 U $2,588 U $1,083 F $2,588 F ANSWER: c DIFFICULT What is the labor yield variance? a. b. c. d. $2,583 U $2,583 F $1,138 F $1,138 U ANSWER: 102. DIFFICULT $0 $1,083 U $2,583 U $1,083 F ANSWER: 101. a What is the labor rate variance? a. b. c. d. 100. 10–29 a DIFFICULT The sum of the material mix and material yield variances equals a. b. c. d. the material purchase price variance. the material quantity variance. the total material variance. none of the above. ANSWER: b EASY 10–30 103. Chapter 10 Standard Costing The sum of the labor mix and labor yield variances equals a. b. c. d. the labor efficiency variance. the total labor variance. the labor rate variance. nothing because these two variances cannot be added since they use different costs. ANSWER: a EASY SHORT ANSWER/PROBLEMS 1. List and discuss briefly the three standards of attainability. ANSWER: Expected standards reflect what is actually expected to occur in the future period. This standard takes into consideration waste and inefficiencies and makes allowances for them. Practical standards can be reached or exceeded most of the time with reasonable effort. This standard allows for normal, unavoidable time problems or delays. Ideal standards provide for no inefficiencies of any type. This standard does not allow for normal operating delays or human limitations. MEDIUM 2. Discuss briefly the type of information contained on (a) a bill of materials and (b) an operations flow document. ANSWER: (a) A bill of materials contains the identification of components, a description of components, and the quantity of each material required for a product. (b) An operations flow document contains an identification number, descriptions of the tasks to be performed, the departments doing the work, and standard number of hours and/or minutes to perform each task. MEDIUM Chapter 10 3. Standard Costing 10–31 Define the following terms: standard cost system, total variance, material price variance, and labor efficiency variance. ANSWER: A standard cost system records both standard costs and actual costs in the accounting records. This process allows for better cost control because actual costs can be easily compared to standard costs. A total variance is the difference between actual input cost for material or labor and the standard cost for material or labor for the output produced. The material price variance is the difference between the actual price paid for material and the standard price of the material times the actual quantity used or purchased. The labor efficiency variance compares the number of hours actually worked with the standard hours allowed for the production achieved and values this difference at the standard labor rate. MEDIUM 4. Discuss how establishing standards benefits the following management functions: performance evaluation and decision making. ANSWER: Performance evaluation is enhanced by the use of standard costs because it allows management to pinpoint deviations from standard costs and points out variances. The variances are analyzed and individual responsibility can be assessed for the variances, depending on the nature of the causes. The availability of standard cost information facilitates many decisions. These costs can be used in budgeting, cost estimates for jobs, and determining contributions made by various product lines; and, thus, can be used to decide whether to add new lines or drop old lines. MEDIUM 5. Discuss why standards may need to be changed after they have been in effect for some period of time. ANSWER: Standards may need to be changed from time to time because of changing economic conditions, availability of materials, quality of materials, and labor rates or skill levels. Standards should be reviewed periodically to assure management that current standards are being established and used. MEDIUM 10–32 6. Chapter 10 Standard Costing Discuss how variable and fixed overhead application rates are calculated. ANSWER: The variable overhead application rate is calculated by dividing total budgeted variable overhead by its related level of activity. Any level of activity within the relevant range may be selected since VOH cost per unit is constant throughout the relevant range. The fixed overhead application rate is calculated by dividing total budgeted fixed overhead by the specific capacity level expected for the period. MEDIUM 7. Discuss how variances are disposed of at the end of a production cycle. ANSWER: After variances are calculated and recorded, journal entries must be prepared at the end of the period to properly dispose of those variances. Unfavorable variances have debit balances and favorable variances have credit balances. Disposition of these variances depends on their combined level of materiality. If the variances are immaterial, they are closed to CGS. If they are significant in amount, the material price variance is prorated among the RM, WIP, FG, and CGS accounts. All other variances are prorated among WIP, FG, and CGS. MEDIUM 8. Why are fixed overhead variances considered noncontrollable? ANSWER: Management has limited ability to control fixed overhead costs in the short run because these costs are incurred to provide the capacity to produce. Fixed costs can be controllable to a limited extent at the point of commitment; therefore, the FOH spending variance can be considered, in part, controllable. On the other hand, the volume variance arises solely because management has selected a specific level of activity on which to calculate the FOH application rate. If actual activity differs at all from this selected base, a volume variance will occur. Production levels are controllable to a very limited extent in the production area. Production is more often related to ability to sell and demand; thus, these levels are not controllable by the production manager. MEDIUM Chapter 10 9. Standard Costing 10–33 Provide the correct term for each of the following definitions: a. b. c. d. e. f. g. h. a cost that fluctuates with large changes in level of activity a range of activity over which costs behave as predicted the capacity level at which a firm believes it will operate at during the coming production cycle the difference between actual variable overhead and budgeted variable overhead based on inputs the difference between total actual overhead and total applied overhead the difference between total budgeted overhead based on inputs and applied overhead the difference between total actual overhead and total budgeted overhead based on output the difference between actual fixed overhead and budgeted fixed overhead ANSWERS: a. step fixed cost b. relevant range c. expected annual capacity d. variable overhead spending variance MEDIUM e. f. g. h. total overhead variance volume variance efficiency variance fixed overhead spending variance 10–34 Chapter 10 Standard Costing Use the following information for questions 10 and 11. ABC Company has the following information available for the current year: Standard: Material Labor Actual: Material Labor 10. 3.5 feet per unit @ $2.60 per foot 5 direct labor hours @ $8.50 per unit 95,625 feet used (100,000 feet purchased @ $2.50 per foot) 122,400 direct labor hours incurred per unit @ $8.35 per hour 25,500 units were produced Compute the material purchase price and quantity variances. ANSWER: Material price variance: 100,000 × $2.50 = $250,000 100,000 × $2.60 = 260,000 $ 10,000 F Material quantity variance: 95,625 × $2.60 = $248,625 89,250 × $2.60 = 232,050 $ 16,575 U MEDIUM 11. Compute the labor rate and efficiency variances. ANSWER: Labor rate variance: 122,400 × $8.35 = $1,022,040 122,400 × $8.50 = 1,040,400 $ 18,360 F Labor efficiency variance: 122,400 × $8.50 = $1,040,400 127,500 × $8.50 = 1,083,750 $ 43,350 F Chapter 10 Standard Costing 10–35 Use the following information for questions 12–14. OP Co. applies overhead based on direct labor hours and has the following available for November: Standard: Direct labor hours per unit Variable overhead per DLH Fixed overhead per DLH (based on 8,900 DLHs) Actual: Units produced Direct labor hours Variable overhead Fixed overhead 5 $.75 $1.90 1,800 8,900 $6,400 $17,500 MEDIUM 12. Compute all the appropriate variances using the two-variance approach. ANSWER: Actual ($6,400 + $17,500) Budget Variance: BFOH (8,900 × $1.90) VOH (1,800 × 5 × $.75) Volume Variance: Applied OH: (1,800 × 5 × $2.65) MEDIUM $23,900 $240 U $16,910 6,750 $23,660 $190 F $23,850 10–36 13. Chapter 10 Standard Costing Compute all the appropriate variances using the three-variance approach. ANSWER: Actual Spending Variance: Flexible Budget Based on Actual Input BFOH $16,910 VOH (8,900 × $.75) Efficiency Variance: Flexible Budget Based on Standard DLHs BFOH $16,910 VOH (1,800 × 5 × $.75) Volume Variance: Applied OH: (1,800 × 5 × $2.65) $23,900 $315 U 6,675 $23,585 $75 F 6,750 $23,660 $190 F $23,850 MEDIUM 14. Compute all the appropriate variances using the four-variance approach. ANSWER: Actual VOH Variable Spending Variance: Flex. Bud. Based on Actual Input Hours (8,900 × $.75) Variable Efficiency Variance: Applied VOH (1,800 × 5 × $.75) Actual FOH FOH Spending Variance: BUDGETED FOH $16,910 FOH Volume Variance: Applied FOH (1,800 × 5 × $1.90) MEDIUM $6,400 $275 F $6,675 $75 F $6,750 $17,500 $590 U $190 F $17,100 Chapter 10 15. Standard Costing 10–37 The Hawaii Co. has made the following information available for its production facility for June 2001. Fixed overhead was estimated at 19,000 machine hours for the production cycle. Actual machine hours for the period were 18,900, which generated 3,900 units. Material purchased (80,000 pieces) Material quantity variance Machine hours used (18,900 hours) VOH spending variance Actual fixed overhead Actual labor cost Actual labor hours $314,000 $6,400 U $50 U $60,000 $40,120 5,900 Hawaii’s standard costs are as follows: Direct material Direct labor Variable overhead (applied on a machine hour basis) Fixed overhead (applied on a machine hour basis) Determine the following items: a. material purchase price variance b. standard quantity allowed for material c. total standard cost of material allowed d. actual quantity of material used e. labor rate variance f. standard hours allowed for labor g. total standard cost of labor allowed h. labor efficiency variance i. actual variable overhead incurred j. standard machine hours allowed k. variable overhead efficiency variance l. budgeted fixed overhead m. applied fixed overhead n. fixed overhead spending variance o. volume variance p. total overhead variance 20 pieces @ $4 per piece 1.5 hours @ $6 per hour 4.8 hours @ $2.50 per hour 4.8 hours @ $3 per hour 10–38 Chapter 10 ANSWER: a. actual material cost actual pieces at standard cost (80,000 × $4) material purchase price variance Standard Costing $314,000 320,000 $ 6,000 F b. 3,900 units × 20 pieces per unit = 78,000 standard quantity allowed c. total standard cost of material (78,000 × $4) $312,000 d. standard cost of actual material used $312,000 + $6,400 U quantity variance $318,400 $4 = 79,600 actual pieces used $318,400 e. actual labor cost 5,900 actual DLHs × $6 labor rate variance $40,120 35,400 $ 4,720 U f. 3,900 units × 1.5 standard hours per unit g. 5,850 SHA × $6 $35,100 h. actual hours × standard rate (from e) standard cost of labor allowed (from g) labor efficiency variance $35,400 35,100 $ 300 U i. actual machine hours × standard VOH rate (18,900 × $2.50) VOH spending variance actual VOH $47,250 50 U $47,300 j. 3,900 units × 4.8 standard hours per unit = 18,720 MH allowed k. standard hours allowed (from j) × standard VOH rate (18,720 × $2.50) actual machine hours × standard rate (from i) (18,900 × $2.50) variable overhead efficiency variance 5,850 SHA $46,800 47,250 $ 450 U l. 19,000 machine hours × $3 $57,000 m. 3,900 units × 4.8 hours per unit × $3.00 $56,160 n. actual fixed overhead budgeted fixed overhead (from l) fixed overhead spending variance $60,000 57,000 $ 3,000 U o. budgeted fixed overhead (from l) applied fixed overhead (from m) volume variance $57,000 56,160 $ 840 U p. total actual overhead [$60,000 + $47,300 (from i)] total applied overhead (18,720 SHA × $5.50) Total overhead variance DIFFICULT $107,300 $ 102,960 4,340 U Chapter 10 Standard Costing THE FOLLOWING PROBLEMS RELATE TO MATERIAL COVERED IN THE APPENDIX OF THE CHAPTER. Use the following information for questions 16 and 17. The following information is available for Raxco for the current year: Standard: Material X: 3.0 pounds per unit @ $4.20 per pound Material Y: 4.5 pounds per unit @ $3.30 per pound Class S labor: 3 hours per unit @ $10.50 per hour Class US labor: 7 hours per unit @ $8.00 per hour Actual: Material X: 3.6 pounds per unit @ $4.00 per pound (purchased and used) Material Y: 4.4 pounds per unit @ $3.25 per pound (purchased and used) Class S labor: 3.8 hours per unit @ $10.60 per hour Class US labor: 5.7 hours per unit @ $7.80 per hour Raxco produced a total of 45,750 units. 10–39 10–40 16. Chapter 10 Standard Costing Compute the material price, mix, and yield variances (round to the nearest dollar). ANSWER: Standard: X Y 3.0/7.5 = 40% 4.5/7.5 = 60% Actual: X 3.6 × 45,750 × $4.00 = Y 4.4 × 45,750 × $3.25 = $ 658,800 654,225 $1,313,025 $43,005 F price Actual × Standard Prices: X 3.6 × 45,750 × $4.20 = Y 4.4 × 45,750 × $3.30 = $ 691,740 664,290 $1,356,030 $16,470 U mix Standard Qty. × Actual Mix × Standard Prices: X 40% × 366,000* × $4.20 = $ 614,880 Y 60% × 366,000 × $3.30 = 724,680 $1,339,560 $83,722 U yield Standard x Standard: X 40% × 343,125** × $4.20 = $ 576,450 Y 60% × 343,125 × $3.30 = 679,388 $1,255,838 *(45,750 × 8 = 366,000) **(45,750 × 7.5 = 343,125) DIFFICULT Chapter 10 17. Standard Costing 10–41 Compute the labor rate, mix, and yield variances (round to the nearest dollar). ANSWER: Standard: S 3/10 = 30% US 7/10 = 70% Actual × Actual Prices: S 3.8 × 45,750 × $10.60 = US 5.7 × 45,750 × $7.80 = Actual: S 3.8/9.5 = 40% US 5.7/9.5 = 60% $1,842,810 2,034,045 $3,876,855 $34,770 F rate Actual × Standard Prices: S 3.8 × 45,750 × $10.50 = US 5.7 × 45,750 × $ 8.00 = $1,825,425 2,086,200 $3,911,625 $108,656 U mix Standard Qty. × Actual Mix × Standard Prices: S 30% × 434,625* × $10.50 = $1,369,069 US 70% × 434,625 × $ 8.00 = 2,433,900 $3,802,969 $200,156 F yield Standard × Standard: S 30% × 457,500** × $10.50 = $1,441,125 US 70% × 457,500 × $ 8.00 = 2,562,000 $4,003,125 *(45,750 × 9.5 = 434,625) **(45,750 × 10 = 457,500) DIFFICULT 10–42 18. Chapter 10 Standard Costing (Appendix) Saksena Corp. produces a product using the following standard proportions and costs of material: Material A Material B Material C Standard shrinkage (33 1/3%) Net weight and cost Pounds 50 40 60 150 50 100 Cost Per Pound $5.00 6.00 3.00 4.4667 6.70 A recent production run yielding 100 output pounds required an input of: Material A Material B Material C Amount 40 50 65 Required: Material price, mix, and yield variances. Cost Per Pound $5.15 6.00 2.80 Amount $250.00 240.00 180.00 $670.00 ______ $670.00 Chapter 10 Standard Costing 10–43 ANSWER: MATERIAL PRICE VARIANCE MATERIAL A MATERIAL B MATERIAL C ($5.15 – 5.00) × 40 = $ 6 U ($6.00 – 6.00) × 50 = 0 ($2.80 – 3.00) × 65 = 13 F $ 7F ACT Q ACT MIX STD P ACT Q STD MIX STD P MIX VARIANCE A B C 40 × $5 = $200 50 × $6 = $300 65 × $3 = $195 $695 YIELD VARIANCE 51 2/3 × $5 = $258.33 41 1/3 × $6 = $248.00 62 × $3 = $186.00 $692.33 $2.67 UNF MEDIUM STD Q STD MIX STD P 50 × $5 = $250 40 × $6 = $240 60 × $3 = $180 $670 $22.33 UNF 10–44 19. Chapter 10 Standard Costing Sample Company began business early in January, 2001, using a standard costing for its single product. With standard capacity set at 10,000 standard productive hours per month, the following standard cost sheet was set up for one unit of product: Direct material—5 pieces @ $2.00 Direct labor (variable)—1 sph @ $3.00 Manufacturing overhead: Fixed—1 sph @ $3.00 Variable—1 sph @ $2.00 $10.00 3.00 $3.00 2.00 5.00 Fixed costs are incurred evenly throughout the year. The following unfavorable variances from standard costs were recorded during the first month of operations: Material price Material usage Labor rate Labor efficiency Overhead volume Overhead budget (2 variance analysis) $ 0 4,000 800 300 6,000 1,000 Required: Determine the following: (a) fixed overhead budgeted for a year; (b) the number of units completed during January assuming no work in process at January 31; (c) debits made to the Work in Process account for direct material, direct labor, and manufactuirng overhead; (d) number of pieces of material issued during January; (e) total of direct labor payroll recorded for January; (f) total of manufacturing overhead recorded in January. ANSWER: a. $3 × 10,000 × 12 = $360,000 b. $6,000/$3 = 2,000 under 10,000 – 2,000 = 8,000 units c. DM = 8,000 × $10 = $80,000, DL = 8,000 × $3 = $24000, MOH = 8,000 × $5 = $40,000 d. STD Q = 40,000 (X – 40,000) × $2 = $4,000 unf, X = 42,000 pieces issued e. $24,000 + $800 + $300 = $25,100 f. $40,000 + $6,000 + $1,000 = $47,000 MEDIUM Chapter 10 20. Standard Costing 10–45 A firm producing one product has a budgeted overhead of $100,000, of which $20,000 is variable. The budgeted direct labor is 10,000 hours. Required: Fill in the blanks. a. b. Production Flexible Budget Applied Volume Variance 120% ____________ ____________ ____________ 100% ____________ ____________ ____________ 80% ____________ ____________ ____________ 60% ____________ ____________ ____________ What is the budget variance at the 80 percent level if the actual overhead incurred is $87,000? ANSWER: TOTAL COST EQUATION = $80,000 FIX + 20,000 ($2) variable 10,000 per unit a. A = $80,000 + (12,000 × $2) = $104,000 B = $80,000 + (10,000 × $2) = $100,000 C = $80,000 + ( 8,000 × $2) = $ 96,000 D = $80,000 + ( 6,000 × $2) = $ 92,000 APPLICATION RATE = $100,000 10,000 UNITS = $10/unit b. BUDGET VARIANCE = ACTUAL FOH – BUDGETED FOH $9,000 FAV = $87,000 – $96,000 MEDIUM 10–46 21. Chapter 10 Standard Costing Berry Co. manufactures a product effective in controlling beetles. The company uses a standard cost system and a flexible budget. Standard cost of a gallon is as follows: Direct material: 2 quarts of A 4 quarts of B Total direct material $14 16 $30 Direct labor: 2 hours Manufacturing overhead Total 16 12 $58 The flexible budget system provides for $50,000 of fixed overhead at normal capacity of 10,000 direct labor hours. Variable overhead is projected at $1 per direct labor hour. Actual results for the period indicated the following: Production: Direct material: A B Direct labor: Overhead: 5,000 gallons 12,000 quarts purchased at a cost of $7.20/quart; 10,500 quarts used 20,000 quarts purchased at a cost of $3.90/quart; 19,800 quarts used 9,800 hours worked at a cost of $79,380 Fixed $48,100 Variable 21,000 Total overhead $69,100 Required: 1. What is the application rate per direct labor hour, the total overhead cost equation, the standard quantity for each material, and the standard hours? 2. Compute the following variances: a. Total material price variance b. Total material quantity variance c. Labor rate variance d. Labor efficiency variance e. MOH volume variance f. MOH efficiency variance g. MOH spending variance, both fixed and variable Chapter 10 Standard Costing 10–47 ANSWER: 1. App rate = $6/DLH TOHC = $50,000 + $1/DLH Std O (A) 5,000 × 2 = 10,000 (B) 5,000 × 4 = 20,000 Std Hrs. 5,000 × 2 = 10,000 2. a. 1. ($7.20 – $7.00) × 12,000 = $2,400 U 2. ($3.90 – $4.00) × 20,000 = 2,000 F $ 400 U b. 1. (10,500 – 10,000) × $7.00 = $3,500 U 2. (19,800 – 20,000) × $4.00 = 800 F $2,700 U c. $79,380 – (9,800 × $8) = $980 U d. (9,800 – 10,000) × $8 = $1600 F e. (10,000 – 10,000) × $5 = 0 f. (9,800 – 10,000) × $1 = $200 F g. Fix Spd Var Spd MEDIUM $48,100 – $50,000 = $1,900 F $21,000 – (9,800 × $1) = $11,200 U 10–48 22. Chapter 10 Standard Costing (Appendix) Mac is concerned about the large unfavorable labor quantity variance that arose in his department last month. He has had a small favorable variance for several months, and he thinks his crew worked just as effectively last month as in previous months. This makes him believe that something must be wrong with the calculations, but he admits he doesn’t understand them. The variance was reported as follows: Standard labor cost of output (120,000 pounds @ $0.0645) Actual labor hours at standard wage rate Labor quantity variance $7,740 (8,585 ) $ (845 ) The product is made in batches that start with 1,200 pounds of material. The standard calls for the following labor quantities for each batch: Labor Class Class A Class B Class C Total Standard Wage Rate $4.50 4.00 3.00 Standard Labor Hours 3 6 9 18 Standard Labor Cost $13.50 24.00 27.00 $64.50 The material is of uneven quality, and the product yield from a batch varies with the quality of the material used. The standard output is 1,000 pounds, resulting in a standard labor cost of $0.0645 a pound. Mac’s workforce is a crew of 12 workers. The standard crew consists of two Class A workers, four Class B workers, and six Class C workers. Lower-rated employees cannot do the work of the higher-rated employees, but the reverse is possible with some slight loss in efficiency and a resulting increase in labor hours. The standard work day is nine hours. Last month had 23 working days, for a total of 207 standard working hours. Last month, 165,000 pounds of material were used to produce 120,000 pounds of product. The actual amounts of labor used were as follows: Labor Class Class A Class B Class C Total Labor Hours 390 980 970 2,340 Labor Rate $4.50 4.00 3.00 Labor Cost $1,755 3,920 2,910 $8,585 Mac’s workforce last month, assigned to him by the personnel department, consisted of two Class A workers, five Class B workers, and five Class C workers. Required: Find the labor mix and yield variances. Chapter 10 Standard Costing 10–49 ANSWER: STD Q A 120,000 × 3 = 360 1,000 B 120 × 6 = 720 C 120 × 9 = 1,080 ACT HRS ACT MIX STD P ACT HRS STD MIX STD P MIX VARIANCE A B C 390 × $4.50 = $1,755 980 × $4.00 = $3,920 970 × $3.00 = $2,910 $8,585 YIELD VARIANCE 390 × $4.50 = $1,755 780 × $4.00 = $3,120 1,170 × $3.00 = $3,510 $8,385 $200 UNF MEDIUM STD HRS STD MIX STD P $645 UNF 360 × $4.50 = $1,620 720 × $4.00 = $2,880 1,080 × $3.00 = $3,240 $7,740 10–50 23. Chapter 10 Standard Costing (Appendix) Smith Corp. operates a factory. One of its departments has three kinds of employees on its direct labor payroll, classified as pay grades A, B, and C. The employees work in 10-person crews in the following proportions: Pay Grade A B C Total No. of Workers in Standard Crew 6 3 1 10 Standard Hourly Wage Rate $4 6 8 Standard Cost per Crew Hour $24 18 8 $50 The work crews can’t work short-handed. To keep a unit operating when one of the regular crew members is absent, the head of the department first tries to reassign one of the department’s other workers from indirect labor operations. If no one in the department is able to step in, plant management will pull maintenance department workers off their regular work, if possible, and assign them temporarily to the department. These maintenance workers are all classified as Grade D employees, with a standard wage rate of $10 an hour. The following data relate to the operations of the department during the month of May: 1. Actual work time, 1,000 crew hours. 2. Actual direct labor hours: Grade A, 5,400 hours. Grade B, 3,200 hours. Grade C, 1,300 hours. Grade D, 100 hours. 3. Standard crew hours for actual output, 980. Required: Compute labor rate, mix, and yield variances. Chapter 10 Standard Costing 10–51 ANSWER: ACT HRS ACT MIX STD RATE ACT HRS STD MIX STD RATE MIX VARIANCE A B C D 5,400 × $4 = $21,600 3,200 × $6 = 19,200 1,300 × $8 = 10,400 100 × $10 = 1,000 $52,200 STD HRS STD MIX STD RATE YIELD VARIANCE 6,000 × $4 = $24,000 3,000 × $6 = 18,000 1,000 × $8 = 8,000 $50,000 MIX VARIANCE = $2,200 UNF YIELD VARIANCE = $1,000 UNF RATE VARIANCE = $ 800 UNF ($53,000 – $52,200) MEDIUM 5,880 × $4 = $23,520 2,940 × $6 = 17,640 980 × $8 = 7,840 $49,000 10–52 24. Chapter 10 Standard Costing (Appendix) The Fred Company manufactures a certain product by mixing three kinds of materials in large batches. The blendmaster has the responsibility for maintaining the quality of the product, and this often requires altering the proportions of the various ingredients. Standard costs are used to provide material control information. The standard material inputs per batch are: Material A Material B Material C Total batch Quantity (pounds) 420 70 10 500 Price (per pound) $0.06 0.12 0.25 Standard Cost of Material $25.20 8.40 2.50 $36.10 The finished product is packed in 50-pound boxes; the standard material cost of each box is, therefore, $3.61. During January, the following materials were put in process: Material A Material B Material C Total 181,000 lbs. 33,000 6,000 220,000 lbs. Inventories in process totaled 5,000 pounds at the beginning of the month and 8,000 pounds at the end of the month. It is assumed that these inventories consisted of materials in their standard proportions. Finished output during January amounted to 4,100 boxes. Required: Compute the total material quantity variance for the month and break it down into mix and yield components. Chapter 10 Standard Costing 10–53 ANSWER: MATERIAL QUANTITY VARIANCE A B C (181,000 – 172,200) × $0.06 = (33,000 – 28,700) × $0.12 = (6,000 – 4,100) × $0.25 = ACT Q ACT Mix STD P A B C $ 528 UNF 516 UNF 475 UNF $1,519 ACT Q STD MIX STD P 181,000 × $0.06 = $10,860 33,000 × $0.12 = 3,960 6,000 × $0.25 = 1,500 $16,320 184,800 × $0.06 = $11,076 30,800 × $0.12 = 3,696 4,400 × $0.25 = 1,100 $15,872 MIX VARIANCE = $ 436 UNF YIELD VARIANCE = $1,083 UNF Total $1,519 UNF MEDIUM STD Q STD MIX STD P 172,200 × $0.06 = $10,332 28,700 × $0.12 = 3,444 4,100 × $0.25 = 1,025 $14,801 CHAPTER 11 ABSORPTION/VARIABLE COSTING AND COST-VOLUME-PROFIT ANALYSIS MULTIPLE CHOICE 1. Consider the following three product costing alternatives: process costing, job order costing, and standard costing. Which of these can be used in conjunction with absorption costing? a. b. c. d. job order costing standard costing process costing all of them ANSWER: 2. absorption costing. variable costing. direct costing. standard costing. ANSWER: a EASY Another name for absorption costing is a. b. c. d. full costing. direct costing. job order costing. fixed costing. ANSWER: 4. EASY In a recent period, Marvel Co. incurred $20,000 of fixed manufacturing overhead and deducted $30,000 of fixed manufacturing overhead. Marvel Co. must be using a. b. c. d. 3. d a EASY If a firm produces more units than it sells, absorption costing, relative to variable costing, will result in a. b. c. d. higher income and assets. higher income but lower assets. lower income but higher assets. lower income and assets. ANSWER: a MEDIUM 11–1 11–2 5. Chapter 11 Under absorption costing, fixed manufacturing overhead could be found in all of the following except the a. b. c. d. work-in-process account. finished goods inventory account. Cost of Goods Sold. period costs. ANSWER: 6. EASY only on the balance sheet. only on the income statement. on both the balance sheet and income statement. on neither the balance sheet nor income statement. ANSWER: c EASY Under absorption costing, if sales remain constant from period 1 to period 2, the company will report a larger income in period 2 when a. b. c. d. period 2 production exceeds period 1 production. period 1 production exceeds period 2 production. variable production costs are larger in period 2 than period 1. fixed production costs are larger in period 2 than period 1. ANSWER: 8. d If a firm uses absorption costing, fixed manufacturing overhead will be included a. b. c. d. 7. Absorption/Variable Costing and Cost-Volume-Profit Analysis a MEDIUM The FASB requires which of the following to be used in preparation of external financial statements? a. b. c. d. variable costing standard costing activity-based costing absorption costing ANSWER: d EASY Chapter 11 9. Absorption/Variable Costing and Cost-Volume-Profit Analysis An ending inventory valuation on an absorption costing balance sheet would a. b. c. d. sometimes be less than the ending inventory valuation under variable costing. always be less than the ending inventory valuation under variable costing. always be the same as the ending inventory valuation under variable costing. always be greater than or equal to the ending inventory valuation under variable costing. ANSWER: 10. EASY treatment of fixed manufacturing overhead. treatment of variable production costs. acceptability for external reporting. arrangement of the income statement. ANSWER: b EASY Which of the following is not associated with absorption costing? a. b. c. d. functional format gross margin period costs contribution margin ANSWER: 12. d Absorption costing differs from variable costing in all of the following except a. b. c. d. 11. 11–3 d EASY Unabsorbed fixed overhead costs in an absorption costing system are a. b. c. d. fixed manufacturing costs not allocated to units produced. variable overhead costs not allocated to units produced. excess variable overhead costs. costs that cannot be controlled. ANSWER: a EASY 11–4 13. Chapter 11 Profit under absorption costing may differ from profit determined under variable costing. How is this difference calculated? a. b. c. d. Change in the quantity of all units in inventory times the relevant fixed costs per unit. Change in the quantity of all units produced times the relevant fixed costs per unit. Change in the quantity of all units in inventory times the relevant variable cost per unit. Change in the quantity of all units produced times the relevant variable cost per unit. ANSWER: 14. a EASY What factor, related to manufacturing costs, causes the difference in net earnings computed using absorption costing and net earnings computed using variable costing? a. b. c. d. Absorption costing considers all costs in the determination of net earnings, whereas variable costing considers fixed costs to be period costs. Absorption costing allocates fixed overhead costs between cost of goods sold and inventories, and variable costing considers all fixed costs to be period costs. Absorption costing “inventories” all direct costs, but variable costing considers direct costs to be period costs. Absorption costing “inventories” all fixed costs for the period in ending finished goods inventory, but variable costing expenses all fixed costs. ANSWER: 15. Absorption/Variable Costing and Cost-Volume-Profit Analysis b EASY The costing system that classifies costs by functional group only is a. b. c. d. standard costing. job order costing. variable costing. absorption costing. ANSWER: d EASY Chapter 11 16. Absorption/Variable Costing and Cost-Volume-Profit Analysis A functional classification of costs would classify “depreciation on office equipment” as a a. b. c. d. product cost. general and administrative expense. selling expense. variable cost. ANSWER: 17. EASY process costing. job order costing. variable costing. absorption costing. ANSWER: c EASY Under variable costing, which of the following are costs that can be inventoried? a. b. c. d. variable selling and administrative expense variable manufacturing overhead fixed manufacturing overhead fixed selling and administrative expense ANSWER: 19. b The costing system that classifies costs by both functional group and behavior is a. b. c. d. 18. 11–5 b EASY Consider the following three product costing alternatives: process costing, job order costing, and standard costing. Which of these can be used in conjunction with variable costing? a. b. c. d. job order costing standard costing process costing all of them ANSWER: d EASY 11–6 20. Chapter 11 Another name for variable costing is a. b. c. d. full costing. direct costing. standard costing. adjustable costing. ANSWER: 21. EASY only on the balance sheet. only on the income statement. on both the balance sheet and income statement. on neither the balance sheet nor income statement. ANSWER: b EASY Under variable costing, a. b. c. d. all product costs are variable. all period costs are variable. all product costs are fixed. product costs are both fixed and variable. ANSWER: 23. b If a firm uses variable costing, fixed manufacturing overhead will be included a. b. c. d. 22. Absorption/Variable Costing and Cost-Volume-Profit Analysis a EASY How will a favorable volume variance affect net income under each of the following methods? a. b. c. d. Absorption reduce reduce increase increase ANSWER: c Variable no effect increase no effect reduce EASY Chapter 11 24. Absorption/Variable Costing and Cost-Volume-Profit Analysis Variable costing considers which of the following to be product costs? a. b. c. d. Fixed Mfg. Costs yes yes no no ANSWER: 25. Variable Mfg. Costs yes yes yes yes Variable Selling & Adm. no yes yes no EASY costs are classified by their behavior. costs are always lower. it is required for external reporting. it justifies higher product prices. ANSWER: a EASY The difference between the reported income under absorption and variable costing is attributable to the difference in the a. b. c. d. income statement formats. treatment of fixed manufacturing overhead. treatment of variable manufacturing overhead. treatment of variable selling, general, and administrative expenses. ANSWER: 27. d Fixed Selling & Adm. no no no no The variable costing format is often more useful to managers than the absorption costing format because a. b. c. d. 26. 11–7 b EASY Which of the following costs will vary directly with the level of production? a. b. c. d. total manufacturing costs total period costs variable period costs variable product costs ANSWER: d EASY 11–8 28. Chapter 11 On the variable costing income statement, the difference between the “contribution margin” and “income before income taxes” is equal to a. b. c. d. the total variable costs. the Cost of Goods Sold. total fixed costs. the gross margin. ANSWER: 29. EASY deducted in the period that they are incurred. inventoried until the related products are sold. treated like period costs. inventoried until the related products have been completed. ANSWER: b EASY In the application of “variable costing” as a cost-allocation process in manufacturing, a. b. c. d. variable direct costs are treated as period costs. nonvariable indirect manufacturing costs are treated as product costs. variable indirect manufacturing costs are treated as product costs. nonvariable direct costs are treated as product costs. ANSWER: 31. c For financial reporting to the IRS and other external users, manufacturing overhead costs are a. b. c. d. 30. Absorption/Variable Costing and Cost-Volume-Profit Analysis c EASY A basic tenet of variable costing is that period costs should be currently expensed. What is the rationale behind this procedure? a. b. c. d. Period costs are uncontrollable and should not be charged to a specific product. Period costs are generally immaterial in amount and the cost of assigning the amounts to specific products would outweigh the benefits. Allocation of period costs is arbitrary at best and could lead to erroneous decision by management. Because period costs will occur whether production occurs, it is improper to allocate these costs to production and defer a current cost of doing business. ANSWER: d MEDIUM Chapter 11 32. Absorption/Variable Costing and Cost-Volume-Profit Analysis Which of the following is a term more descriptive of the type of cost accounting often called “direct costing”? a. b. c. d. out-of-pocket costing variable costing relevant costing prime costing ANSWER: 33. EASY only direct costs only variable production costs all variable costs all variable and fixed manufacturing costs ANSWER: b EASY Which of the following must be known about a production process in order to institute a variable costing system? a. b. c. d. the variable and fixed components of all costs related to production the controllable and non-controllable components of all costs related to production standard production rates and times for all elements of production contribution margin and break-even point for all goods in production ANSWER: 35. b What costs are treated as product costs under variable (direct) costing? a. b. c. d. 34. 11–9 a EASY Why is variable costing not in accordance with generally accepted accounting principles? a. b. c. d. Fixed manufacturing costs are treated as period costs under variable costing. Variable costing procedures are not well known in industry. Net earnings are always overstated when using variable costing procedures. Variable costing ignores the concept of lower of cost or market when valuing inventory. ANSWER: a EASY 11–10 36. Chapter 11 Which of the following is an argument against the use of direct (variable) costing? a. b. c. d. Absorption costing overstates the balance sheet value of inventories. Variable factory overhead is a period cost. Fixed manufacturing overhead is difficult to allocate properly. Fixed manufacturing overhead is necessary for the production of a product. ANSWER: 37. b. c. d. EASY The cost of a unit of product changes because of changes in the number of units manufactured. Profits fluctuate with sales. An idle facility variation is calculated. None of the above. ANSWER: b EASY An income statement is prepared as an internal report. Under which of the following methods would the term contribution margin appear? a. b. c. d. Absorption costing no no yes yes ANSWER: 39. d Which of the following statements is true for a firm that uses variable costing? a. 38. Absorption/Variable Costing and Cost-Volume-Profit Analysis b Variable costing no yes no yes EASY In an income statement prepared as an internal report using the variable costing method, fixed manufacturing overhead would a. b. c. d. not be used. be used in the computation of operating income but not in the computation of the contribution margin. be used in the computation of the contribution margin. be treated the same as variable manufacturing overhead. ANSWER: b EASY Chapter 11 40. Absorption/Variable Costing and Cost-Volume-Profit Analysis Variable costing has an advantage over absorption costing for which of the following purposes? a. b. c. d. analysis of profitability of products, territories, and other segments of a business determining the CVP relationship among the major factors of selling price, sales mix, and sales volume minimizing the effects of inventory changes on net income all of the above ANSWER: 41. EASY selling expenses general and administrative expense product contribution margin total contribution margin ANSWER: d EASY A firm presently has total sales of $100,000. If its sales rise, its a. b. c. d. net income based on variable costing will go up more than its net income based on absorption costing. net income based on absorption costing will go up more than its net income based on variable costing. fixed costs will also rise. per unit variable costs will rise. ANSWER: 43. d In the variable costing income statement, which line separates the variable and fixed costs? a. b. c. d. 42. 11–11 a MEDIUM CVP analysis requires costs to be categorized as a. b. c. d. either fixed or variable. fixed, mixed, or variable. product or period. standard or actual. ANSWER: a EASY 11–12 44. Chapter 11 With respect to fixed costs, CVP analysis assumes total fixed costs a. b. c. d. per unit remain constant as volume changes. remain constant from one period to the next. vary directly with volume. remain constant across changes in volume. ANSWER: 45. EASY fixed costs decrease. variable costs remain constant. costs decrease. costs remain constant. ANSWER: c EASY According to CVP analysis, a company could never incur a loss that exceeded its total a. b. c. d. variable costs. fixed costs. costs. contribution margin. ANSWER: 47. d CVP analysis relies on the assumptions that costs are either strictly fixed or strictly variable. Consistent with these assumptions, as volume decreases total a. b. c. d. 46. Absorption/Variable Costing and Cost-Volume-Profit Analysis c EASY CVP analysis is based on concepts from a. b. c. d. standard costing. variable costing. job order costing. process costing. ANSWER: b EASY Chapter 11 48. Absorption/Variable Costing and Cost-Volume-Profit Analysis Cost-volume-profit analysis is a technique available to management to understand better the interrelationships of several factors that affect a firm’s profit. As with many such techniques, the accountant oversimplifies the real world by making assumptions. Which of the following is not a major assumption underlying CVP analysis? a. b. c. d. All costs incurred by a firm can be separated into their fixed and variable components. The product selling price per unit is constant at all volume levels. Operating efficiency and employee productivity are constant at all volume levels. For multi-product situations, the sales mix can vary at all volume levels. ANSWER: 49. EASY contribution margin per unit. fixed cost per unit. total costs per unit. all of the above. ANSWER: a EASY Which of the following factors is involved in studying cost-volume-profit relationships? a. b. c. d. product mix variable costs fixed costs all of the above ANSWER: 51. d In CVP analysis, linear functions are assumed for a. b. c. d. 50. 11–13 d EASY Cost-volume-profit relationships that are curvilinear may be analyzed linearly by considering only a. b. c. d. fixed and mixed costs. relevant fixed costs. relevant variable costs. a relevant range of volume. ANSWER: d EASY 11–14 52. Chapter 11 After the level of volume exceeds the break-even point a. b. c. d. the contribution margin ratio increases. the total contribution margin exceeds the total fixed costs. total fixed costs per unit will remain constant. the total contribution margin will turn from negative to positive. ANSWER: 53. Decrease in fixed cost yes yes yes no ANSWER: EASY b Increase in direct labor cost yes no no yes Increase in selling price yes yes no no EASY At the break-even point, fixed costs are always a. b. c. d. less than the contribution margin. equal to the contribution margin. more than the contribution margin. more than the variable cost. ANSWER: 55. b Which of the following will decrease the break-even point? a. b. c. d. 54. Absorption/Variable Costing and Cost-Volume-Profit Analysis b EASY The method of cost accounting that lends itself to break-even analysis is a. b. c. d. variable. standard. absolute. absorption. ANSWER: a EASY Chapter 11 56. Absorption/Variable Costing and Cost-Volume-Profit Analysis Given the following notation, what is the break-even sales level in units? SP = selling price per unit, FC = total fixed cost, VC = variable cost per unit a. b. c. d. SP/(FC/VC) FC/(VC/SP) VC/(SP – FC) FC/(SP – VC) ANSWER: 57. net income fixed costs contribution margin variable costs ANSWER: d MEDIUM If a firm’s net income does not change as its volume changes, the firm(‘s) a. b. c. d. must be in the service industry. must have no fixed costs. sales price must equal $0. sales price must equal its variable costs. ANSWER: 59. EASY Consider the equation X = Sales – [(CM/Sales) × (Sales)]. What is X? a. b. c. d. 58. d d MEDIUM Break-even analysis assumes over the relevant range that a. b. c. d. total variable costs are linear. fixed costs per unit are constant. total variable costs are nonlinear. total revenue is nonlinear. ANSWER: a EASY 11–15 11–16 60. Chapter 11 To compute the break-even point in units, which of the following formulas is used? a. b. c. d. FC/CM per unit FC/CM ratio CM/CM ratio (FC+VC)/CM ratio ANSWER: 61. EASY FC/CM per unit VC/CM FC/CM ratio VC/CM ratio ANSWER: c EASY The contribution margin ratio always increases when the a. b. c. d. variable costs as a percentage of net sales increase. variable costs as a percentage of net sales decrease. break-even point increases. break-even point decreases. ANSWER: 63. a A firm’s break-even point in dollars can be found in one calculation using which of the following formulas? a. b. c. d. 62. Absorption/Variable Costing and Cost-Volume-Profit Analysis b EASY In a multiple-product firm, the product that has the highest contribution margin per unit will a. b. c. d. generate more profit for each $1 of sales than the other products. have the highest contribution margin ratio. generate the most profit for each unit sold. have the lowest variable costs per unit. ANSWER: c EASY Chapter 11 64. Absorption/Variable Costing and Cost-Volume-Profit Analysis _____________ focuses only on factors that change from one course of action to another. a. b. c. d. Incremental analysis Margin of safety Operating leverage A break-even chart ANSWER: 65. EASY was presently operating at a volume that is below the break-even point. present fixed costs were less than its contribution margin. variable costs exceeded its fixed costs. degree of operating leverage is greater than 100. ANSWER: a EASY The margin of safety is a key concept of CVP analysis. The margin of safety is the a. b. c. d. contribution margin rate. difference between budgeted contribution margin and actual contribution margin. difference between budgeted contribution margin and break-even contribution margin. difference between budgeted sales and break-even sales. ANSWER: 67. a The margin of safety would be negative if a company(‘s) a. b. c. d. 66. 11–17 d EASY Management is considering replacing an existing sales commission compensation plan with a fixed salary plan. If the change is adopted, the company’s a. b. c. d. break-even point must increase. margin of safety must decrease. operating leverage must increase. profit must increase. ANSWER: c MEDIUM 11–18 68. Chapter 11 As projected net income increases the a. b. c. d. degree of operating leverage declines. margin of safety stays constant. break-even point goes down. contribution margin ratio goes up. ANSWER: 69. Absorption/Variable Costing and Cost-Volume-Profit Analysis a MEDIUM A managerial preference for a very low degree of operating leverage might indicate that a. b. c. d. an increase in sales volume is expected. a decrease in sales volume is expected. the firm is very unprofitable. the firm has very high fixed costs. ANSWER: b MEDIUM Use the following information for questions 70–73. Young Corporation has the following standard costs associated with the manufacture and sale of one of its products: Direct material Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses Fixed SG&A expense $3.00 per unit 2.50 per unit 1.80 per unit 4.00 per unit (based on an estimate of 50,000 units per year) .25 per unit $75,000 per year During 2001, its first year of operations, Young manufactured 51,000 units and sold 48,000. The selling price per unit was $25. All costs were equal to standard. 70. Under absorption costing, the standard production cost per unit for 2001 was a. b. c. d. $11.30. $7.30. $11.55. $13.05. ANSWER: a EASY Chapter 11 71. Absorption/Variable Costing and Cost-Volume-Profit Analysis Under variable costing, the standard production cost per unit for 2001 was a. b. c. d. $11.30. $7.30. $7.55. $11.55. ANSWER: 72. EASY Based on variable costing, the income before income taxes for the year was a. b. c. d. $570,600. $560,000. $562,600. $547,500. ANSWER: 73. b c MEDIUM The volume variance under absorption costing is a. b. c. d. $8,000 F. $4,000 F. $4,000 U. $8,000 U. ANSWER: b MEDIUM 11–19 11–20 Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis Use the following information for questions 74–76. The following information is available for X Co. for its first year of operations: Sales in units Production in units Manufacturing costs: Direct labor Direct material Variable overhead Fixed overhead Net income (absorption method) Sales price per unit 74. $30,000 ($7,500) $67,500 can’t be determined from the information given ANSWER: b MEDIUM What was the total amount of SG&A expense incurred by X Co.? a. b. c. d. $30,000 $62,500 $6,000 can’t be determined from the information given ANSWER: 76. $3 per unit 5 per unit 1 per unit $100,000 $30,000 $40 What would X Co. have reported as its income before income taxes if it had used variable costing? a. b. c. d. 75. 5,000 8,000 b MEDIUM Based on variable costing, what would X Co. show as the value of its ending inventory? a. b. c. d. $120,000 $64,500 $27,000 $24,000 ANSWER: c EASY Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis 11–21 Use the following information for questions 77–79. The following information has been extracted from P Co.’s financial records for its first year of operations: Units produced Units sold Variable costs per unit: Direct material Direct labor Manufacturing overhead SG&A Fixed costs: Manufacturing overhead SG&A 77. $70,000 30,000 $21,000 higher than it would be under variable costing. $70,000 higher than it would be under variable costing. $30,000 higher than it would be under variable costing. higher than it would be under variable costing, but the exact difference cannot be determined from the information given. ANSWER: a MEDIUM Based on absorption costing, the Cost of Goods Manufactured for P Co.’s first year would be a. b. c. d. $200,000. $270,000. $300,000. $210,000. ANSWER: 79. $8 9 3 4 Based on absorption costing, P Co.’s income in its first year of operations will be a. b. c. d. 78. 10,000 7,000 b MEDIUM Based on absorption costing, what amount of period costs will P Co. deduct? a. b. c. d. $70,000 $79,000 $30,000 $58,000 ANSWER: d MEDIUM 11–22 80. Chapter 11 For its most recent fiscal year, a firm reported that its contribution margin was equal to 40 percent of sales and that its net income amounted to 10 percent of sales. If its fixed costs for the year were $60,000, how much were sales? a. b. c. d. $150,000 $200,000 $600,000 can’t be determined from the information given ANSWER: 81. b MEDIUM At its present level of operations, a small manufacturing firm has total variable costs equal to 75 percent of sales and total fixed costs equal to 15 percent of sales. Based on variable costing, if sales change by $1.00, income will change by a. b. c. d. $0.25. $0.10. $0.75. can’t be determined from the information given. ANSWER: 82. Absorption/Variable Costing and Cost-Volume-Profit Analysis a EASY You obtain the following information regarding fixed production costs from a manufacturing firm for fiscal year 2001: Fixed costs in the beginning inventory Fixed costs incurred this period $ 16,000 100,000 Which of the following statements is not true: a. b. c. d. The maximum amount of fixed production costs that this firm could deduct using absorption costs in 2001 is $116,000. The maximum difference between this firm’s 2001 income based on absorption costing and its income based on variable costing is $16,000. Using variable costing, this firm will deduct no more than $16,000 for fixed production costs. If this firm produced substantially more units than it sold in 2001, variable costing will probably yield a lower income than absorption costing. ANSWER: c MEDIUM Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis 11–23 Use the following information for questions 83–86. Simple Corp. produces a single product. The following cost structure applied to its first year of operations, 2001: Variable costs: SG&A $2 per unit Production $4 per unit Fixed costs (total cost incurred for the year): SG&A $14,000 Production $20,000 83. Assume for this question only that during 2001 Simple Corp. manufactured 5,000 units and sold 3,800. There was no beginning or ending work-in-process inventory. How much larger or smaller would Simple Corp.’s income be if it uses absorption rather than variable costing? a. b. c. d. The absorption costing income would be $6,000 larger. The absorption costing income would be $6,000 smaller. The absorption costing income would be $4,800 larger. The absorption costing income would be $4,000 smaller. ANSWER: 84. MEDIUM Assume for this question only that Simple Corp. manufactured and sold 5,000 units in 2001. At this level of activity it had an income of $30,000 using variable costing. What was the sales price per unit? a. b. c. d. $16.00 $18.80 $12.80 $14.80 ANSWER: 85. c b MEDIUM Assume for this question only that Simple Corp. produced 5,000 units and sold 4,500 units in 2001. If Simple uses absorption costing, it would deduct period costs of a. b. c. d. $24,000. $34,000. $27,000. $23,000. ANSWER: d MEDIUM 11–24 86. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis Assume for this question only that Simple Corp. manufactured 5,000 units and sold 4,000 in 2001. If Simple employs a costing system based on variable costs, the company would end 2001 with a finished goods inventory of a. b. c. d. $4,000. $8,000. $6,000. $5,000. ANSWER: a MEDIUM Use the following information for questions 87–89. The following information was extracted from the first year absorption-based accounting records of Confused Co. Total fixed costs incurred Total variable costs incurred Total period costs incurred Total variable period costs incurred Units produced Units sold Unit sales price 87. What is Cost of Goods Sold for Confused Co.’s first year? a. b. c. d. $80,000 $90,000 $48,000 can’t be determined from the information given ANSWER: 88. $100,000 50,000 70,000 30,000 20,000 12,000 $12 c DIFFICULT If Confused Co. had used variable costing in its first year of operations, how much income (loss) before income taxes would it have reported? a. b. c. d. ($6,000) $54,000 $26,000 $2,000 ANSWER: d DIFFICULT Chapter 11 89. Absorption/Variable Costing and Cost-Volume-Profit Analysis Based on variable costing, if Confused had sold 12,001 units instead of 12,000, its income before income taxes would have been a. b. c. d. $9.50 higher. $11.00 higher. $8.50 higher. $8.33 higher. ANSWER: 90. 11–25 c MEDIUM Z Corp. incurred the following costs in 2001 (its first year of operations) based on production of 10,000 units: Direct material Direct labor Variable product costs Fixed product costs (in total) $5 per unit $3 per unit $2 per unit $100,000 When Z Corp. prepared its 2001 financial statements, its Cost of Goods Sold was listed at $100,000. Based on this information, which of the following statements must be true: a. b. c. d. Z Corp. sold all 10,000 units that it produced. Z Corp. sold 5,000 units. Z Corp. had a very profitable year. From the information given, one cannot tell whether Z Corp.’s financial statements were prepared based on variable or absorption costing. ANSWER: b MEDIUM 11–26 Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis Use the following information for questions 91–93. Three new companies (X, Y, and Z) began operations on January 1, 2001. Consider the following operating costs that were incurred by these companies during the complete calendar year 2001: Production in units Sales price per unit Fixed production costs Variable production costs Variable SG&A Fixed SG&A 91. Company Z 10,000 $10 $30,000 $10,000 $30,000 $10,000 Company X Company Y Company Z All of the companies will report the same income. ANSWER: d MEDIUM Based on sales of 7,000 units, which company will report the greater income before income taxes for 2001 under variable costing? a. b. c. d. Company X Company Y Company Z All of the companies will report the same income. ANSWER: 93. Company Y 10,000 $10 $20,000 $20,000 $20,000 $20,000 Based on sales of 7,000 units, which company will report the greater income before income taxes for 2001 under absorption costing? a. b. c. d. 92. Company X 10,000 $10 $10,000 $30,000 $10,000 $30,000 a MEDIUM Based on sales of 10,000 units, which company will report the greater income before income taxes for 2001 under variable costing? a. b. c. d. Company X Company Y Company Z All of the companies will report the same income before income taxes. ANSWER: d MEDIUM Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis 11–27 Use the following information for questions 94–96. JV Co. produces a single product that sells for $7.00 per unit. Standard capacity is 100,000 units per year; 100,000 units were produced and 80,000 units were sold during the year. Manufacturing costs and selling and administrative expenses are presented below. There were no variances from the standard variable costs. Any under- or overapplied overhead is written off directly at year-end as an adjustment to cost of goods sold. Direct material Direct labor Manufacturing overhead Selling & Admin. Fixed costs $0 0 150,000 80,000 Variable costs $1.50 per unit produced 1.00 per unit produced 0.50 per unit produced 0.50 per unit sold JV had no inventory at the beginning of the year. 94. In presenting inventory on the balance sheet at December 31, the unit cost under absorption costing is a. b. c. d. $2.50. $3.00. $3.50. $4.50. ANSWER: 95. MEDIUM What is the net income under variable costing? a. b. c. d. $50,000 $80,000 $90,000 $120,000 ANSWER: 96. d a MEDIUM What is the net income under absorption costing? a. b. c. d. $50,000 $80,000 $90,000 $120,000 ANSWER: b MEDIUM 11–28 97. Chapter 11 A firm has fixed costs of $200,000 and variable costs per unit of $6. It plans on selling 40,000 units in the coming year. To realize a profit of $20,000, the firm must have a sales price per unit of at least a. b. c. d. $11.00. $11.50. $10.00. $10.50. ANSWER: 98. Absorption/Variable Costing and Cost-Volume-Profit Analysis b MEDIUM A firm has fixed costs of $200,000 and variable costs per unit of $6. It plans on selling 40,000 units in the coming year. If the firm pays income taxes on its income at a rate of 40 percent, what sales price must the firm use to obtain an after-tax profit of $24,000 on the 40,000 units? a. b. c. d. $11.60 $11.36 $12.00 $12.50 ANSWER: c DIFFICULT Use the following information for questions 99–102. Below is an income statement for Bender Co. for 2001: Sales Variable costs Contribution margin Fixed costs Profit before taxes 99. $400,000 (125,000 ) $275,000 (200,000 ) $ 75,000 What is Bender’s degree of operating leverage? a. b. c. d. 3.67 5.33 1.45 2.67 ANSWER: a MEDIUM Chapter 11 100. Absorption/Variable Costing and Cost-Volume-Profit Analysis Based on the cost and revenue structure on the income statement, what was Bender’s break-even point for 2001 in dollars? a. b. c. d. $200,000 $325,000 $300,000 $290,909 ANSWER: 101. d MEDIUM What was Bender’s margin of safety for 2001? a. b. c. d. $200,000 $75,000 $100,000 $109,091 ANSWER: 102. 11–29 d EASY Assuming that the fixed costs are expected to remain at $200,000 for 2002 and the sales price per unit and variable costs per unit are also expected to remain constant, how much profit before taxes will be produced if the company anticipates 2002 sales rising to 130 percent of the 2001 level? a. b. c. d. $97,500 $195,000 $157,500 A prediction cannot be made from the information given. ANSWER: c MEDIUM 11–30 Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis Use the following information for questions 103 and 104. Timberline produces and sells a single product. Information on its costs for 2001 follow: Variable costs: SG&A Production Fixed costs: SG&A Production 103. $15.00 $11.40 $9.60 $10.00 ANSWER: a MEDIUM In 2002, Timberline estimates that it will produce and sell 4,000 units. The variable costs per unit and the total fixed costs are expected to be the same as in 2001. However, it anticipates a sales price of $16 per unit. What is Timberline’s projected margin of safety in 2002? a. b. c. d. $7,000 $20,800 $18,400 $13,000 ANSWER: 105. $12,000 per year $15,000 per year Assume Timberline produced and sold 5,000 units in 2001. At this level of activity, it produced a profit of $18,000. What was Timberline’s sales price per unit? a. b. c. d. 104. $2 per unit $4 per unit b MEDIUM Story Manufacturing incurs annual fixed costs of $250,000 in producing and selling “Tales.” Estimated unit sales for 2001 are 125,000. An after-tax income of $75,000 is desired by management. The company projects its income tax rate at 40 percent. What is the maximum amount that Story can expend for variable costs per unit and still meet its profit objective if the sales price per unit is estimated at $6? a. b. c. d. $3.37 $3.59 $3.00 $3.70 ANSWER: c MEDIUM Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis 11–31 Use the following information for questions 106 and 107. The following information relates to financial projections of Big Co. for 2001: Projected sales Projected variable costs Projected fixed costs Projected unit sales price 106. How many units would Big Co. need to sell in 2001 to earn a profit before taxes of $10,000? a. b. c. d. 25,714 10,000 8,571 12,000 ANSWER: 107. d MEDIUM If Big Co. achieves its projections in 2001, what will be its degree of operating leverage? a. b. c. d. 6.00 1.20 1.68 2.40 ANSWER: 108. 60,000 units $2.00 per unit $50,000 per year $7.00 b MEDIUM Signal Co. manufactures a single product. For 2001, the company had sales of $90,000, variable costs of $50,000, and fixed costs of $30,000. Signal expects its cost structure and sales price per unit to remain the same in 2002, however total sales are expected to jump by 20 percent. If the 2002 projections are realized, net income in 2002 should exceed net income in 2001 by a. b. c. d. 100 percent. 80 percent. 20 percent. 50 percent. ANSWER: b MEDIUM 11–32 Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis Use the following information for questions 109–111. Diversified Corp. manufactures and sells two products: X and Y. The operating results of the company for 2001 follow: Sales in units Sales price per unit Variable costs per unit Product X 2,000 $10 7 Product Y 3,000 $5 3 In addition, the company incurred total fixed costs in the amount of $9,000. 109. How many total units would the company have needed to sell to breakeven in 2001? a. b. c. d. 3,750 750 3,600 1,800 ANSWER: 110. MEDIUM If the company would have sold a total of 6,000 units in 2001, consistent with CVP assumptions how many of those units would you expect to be Product Y? a. b. c. d. 3,000 4,000 3,600 3,500 ANSWER: 111. a c MEDIUM How many units would the company have needed to sell in 2001 to produce a profit of $12,000? a. b. c. d. 8,750 20,000 10,000 8,400 ANSWER: a MEDIUM Chapter 11 112. Absorption/Variable Costing and Cost-Volume-Profit Analysis 11–33 Below is an income statement for Jewell Co. for 2002: Sales Variable costs Contribution margin Fixed costs Profit before taxes $ 300,000 (150,000 ) $ 150,000 (100,000 ) $ 50,000 What was the company’s margin of safety in 2002? a. b. c. d. $50,000 $100,000 $150,000 $25,000 ANSWER: 113. b MEDIUM Below is an income statement for Jewell Co. for 2002: Sales Variable costs Contribution margin Fixed costs Profit before taxes $300,000 (150,000 ) $150,000 (100,000 ) $ 50,000 If the unit sales price for Jewell’s sole product was $10, how many units would it have needed to sell in 2002 to produce a profit of $40,000? a. b. c. d. 27,500 29,000 28,000 can’t be determined from the information given ANSWER: 114. c MEDIUM A firm estimates that it will sell 100,000 units of its sole product in the coming period. It projects the sales price at $40 per unit, the CM ratio at 60 percent, and profit at $500,000. What is the firm budgeting for fixed costs in the coming period? a. b. c. d. $1,600,000 $2,400,000 $1,100,000 $1,900,000 ANSWER: d MEDIUM 11–34 115. Chapter 11 Hat Co. manufactures a western-style hat that sells for $10 per unit. This is its sole product and it has projected the break-even point at 50,000 units in the coming period. If fixed costs are projected at $100,000, what is the projected contribution margin ratio? a. b. c. d. 80 percent 20 percent 40 percent 60 percent ANSWER: 116. Absorption/Variable Costing and Cost-Volume-Profit Analysis b MEDIUM Brando Co. manufactures little boxes of “bad attitudes.” Each box sells for $15. The firm’s projected costs for 2002 are listed below: Variable costs per unit: Production SG&A Fixed costs: Production SG&A Estimated volume $5 1 $40,000 60,000 20,000 units What is Brando’s projected margin of safety for 2002? a. b. c. d. $133,333 $150,000 $80,000 $100,000 ANSWER: a MEDIUM Chapter 11 117. Absorption/Variable Costing and Cost-Volume-Profit Analysis 11–35 Brando Co. manufactures little boxes of “bad attitudes.” Each box sells for $15. The firm’s projected costs for 2002 are listed below: Variable costs per unit: Production SG&A Fixed costs: Production SG&A Estimated volume $5 1 $40,000 60,000 20,000 units What is Brando’s projected degree of operating leverage for 2002? a. b. c. d. 2.25 1.80 3.75 1.67 ANSWER: a MEDIUM Use the following information for questions 118–120. Below are income statements that apply to three companies: A, B, and C: Company A $100 (10 ) $90 (30 ) $ 60 Sales Variable costs Contribution margin Fixed costs Profit before taxes 118. Company B $100 (20 ) $80 (20 ) $ 60 Company C $100 (30 ) $70 (10 ) $ 60 Within the relevant range, if sales go up by $1 for each firm, which firm will experience the greatest increase in profit? a. b. c. d. Company A Company B Company C can’t be determined from the information given ANSWER: a EASY 11–36 119. Chapter 11 Within the relevant range, if sales go up by one unit for each firm, which firm will experience the greatest increase in net income? a. b. c. d. Company A Company B Company C can’t be determined from the information given ANSWER: 120. EASY Company A Company B Company C They all have the same margin of safety. ANSWER: c MEDIUM Alan is interested in entering the catfish farming business. He estimates if he enters this business, his fixed costs would be $50,000 per year and his variable costs would equal 30 percent of sales. If each catfish sells for $2, how many catfish would Alan need to sell to generate a profit that is equal to 10 percent of sales? a. b. c. d. 40,000 41,667 35,000 No level of sales can generate a 10 percent net return on sales. ANSWER: 122. d At sales of $100, which firm has the highest margin of safety? a. b. c. d. 121. Absorption/Variable Costing and Cost-Volume-Profit Analysis b DIFFICULT The following information pertains to Nova Co.’s cost-volume-profit relationships: Break-even point in units sold Variable costs per unit Total fixed costs 1,000 $500 $150,000 How much will be contributed to profit before taxes by the 1,001st unit sold? a. b. c. d. $650 $500 $150 $0 ANSWER: c MEDIUM Chapter 11 123. Absorption/Variable Costing and Cost-Volume-Profit Analysis 11–37 Information concerning Label Corporation’s Product A follows: Sales Variable costs Fixed costs $300,000 240,000 40,000 Assuming that Label increased sales of Product A by 20 percent, what should the profit from Product A be? a. b. c. d. $20,000 $24,000 $32,000 $80,000 ANSWER: 124. c MEDIUM Lindsay Company reported the following results from sales of 5,000 units of Product A for June: Sales Variable costs Fixed costs Operating income $200,000 (120,000 ) (60,000 ) $ 20,000 Assume that Lindsay increases the selling price of Product A by 10 percent in July. How many units of Product A would have to be sold in July to generate an operating income of $20,000? a. b. c. d. 4,000 4,300 4,500 5,000 ANSWER: a MEDIUM 11–38 Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis THE FOLLOWING MULTIPLE CHOICE RELATE TO MATERIAL COVERED IN THE APPENDIX OF THE CHAPTER. 125. On a break-even chart, the break-even point is located at the point where the total a. b. c. d. revenue line crosses the total fixed cost line. revenue line crosses the total contribution margin line. fixed cost line intersects the total variable cost line. revenue line crosses the total cost line. ANSWER: 126. rate at which profit changes as volume changes. rate at which the contribution margin changes as volume changes. ratio of increase of total fixed costs. total costs per unit. ANSWER: b MEDIUM In a CVP graph, the area between the total cost line and the total revenue line represents total a. b. c. d. contribution margin. variable costs. fixed costs. profit. ANSWER: 128. EASY In a CVP graph, the slope of the total revenue line indicates the a. b. c. d. 127. d d EASY In a CVP graph, the area between the total cost line and the total fixed cost line yields the a. b. c. d. fixed costs per unit. total variable costs. profit. contribution margin. ANSWER: b EASY Chapter 11 129. Absorption/Variable Costing and Cost-Volume-Profit Analysis If SAB Company’s fixed costs were to increase, the effect on a profit-volume graph would be that the a. b. c. d. contribution margin line would shift upward parallel to the present line. contribution margin line would shift downward parallel to the present line. slope of the contribution margin line would be more pronounced (steeper). slope of the contribution margin line would be less pronounced (flatter). ANSWER: 130. b MEDIUM If SAB Company’s variable costs per unit were to increase but its unit selling price stays constant, the effect on a profit-volume graph would be that the a. b. c. d. contribution margin line would shift upward parallel to the present line. contribution margin line would shift downward parallel to the present line. slope of the contribution margin line would be pronounced (steeper). slope of the contribution margin line would be less pronounced (flatter). ANSWER: 131. 11–39 d EASY The most useful information derived from a cost-volume-profit chart is the a. b. c. d. amount of sales revenue needed to cover enterprise variable costs. amount of sales revenue needed to cover enterprise fixed costs. relationship among revenues, variable costs, and fixed costs at various levels of activity. volume or output level at which the enterprise breaks even. ANSWER: c EASY SHORT ANSWER/PROBLEMS 1. Why do managers frequently prefer variable costing to absorption costing for internal use? ANSWER: Managers may prefer variable costing because it classifies costs both by their function and their behavior. When costs are classified by behavior, managers can more accurately predict how total costs will change when volume changes. With more accurate information, managers can make better production and pricing decisions. MEDIUM 11–40 2. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis Why is variable costing not used extensively in external reporting? ANSWER: Variable costing is not used extensively outside of the firm because absorption costing is required by GAAP and the IRS. MEDIUM 3. How can a company produce both variable and absorption costing information from a single accounting system? ANSWER: Firms only have one accounting information system. This system will be based on either variable or absorption costing. If the system needs to provide information in both the variable and absorption formats, the system’s accounting information can be converted from one format to the other. The conversion requires an adjustment to the product inventory accounts and the amount of product costs charged against the period’s income. The conversion is typically easier if standard costing is employed. MEDIUM 4. What are the major differences between variable and absorption costing? ANSWER: The major difference between variable costing and absorption costing is in the way each defines product cost. While absorption costing includes fixed manufacturing overhead as a product cost, variable costing treats it as a cost of the period. A secondary difference between the two methods is the format of the income statement. Absorption costing utilizes the traditional income statement format that categorizes costs by their function only. Variable costing uses an income statement format that categorizes costs by both their function and behavior. MEDIUM 5. Why is absorption costing not used for CVP analysis? ANSWER: Absorption costing is not used in break-even analysis because it presents a classification of costs by function rather than by behavior. Without a behavioral classification of costs, it is impossible to predict how total costs change as volume changes. MEDIUM Chapter 11 6. Absorption/Variable Costing and Cost-Volume-Profit Analysis 11–41 How do changes in volume affect the break-even point? ANSWER: Within the relevant range, the break-even point does not change. This is due to the linearity assumptions that apply to total revenues, fixed costs, and variable costs. MEDIUM 7. What major assumption do multiproduct firms need to make in using CVP analysis that single-product firms need not make? ANSWER: The assumption that must be imposed is a constant sales mix. A multiproduct firm assumes that (within the relevant range) the sales mix is constant. This permits CVP analysis to be performed using a unit of the constant sales mix. MEDIUM 8. What important information is conveyed by the margin of safety calculation in CVP analysis? ANSWER: The break-even point in CVP analysis is critical because it divides profitable levels of operation from unprofitable levels of operation. The margin of safety gives managers an idea of the extent to which sales can fall before operations will become unprofitable. MEDIUM 11–42 Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis Use the following information for questions 9–11. Limpin Co. manufactures and sells walking canes. The following income statement applies to 2001, its first year of operations: Sales (800 units @ $15) Cost of Goods Sold Gross Margin Selling, general, and administrative expenses Operating income $12,000 (8,000 ) $ 4,000 (3,000 ) $ 1,000 Other information: 1. The company produced 1,000 units during the year. 2. Variable SG&A expenses are $1 per cane. 3. Variable production costs are $7 per cane. 4. There was no ending work-in-process inventory. 9. How much fixed manufacturing overhead did the Limpin Co. incur in 2001? ANSWER: The Cost of Goods Sold is based on sales of 800 units and is recorded at $8,000. This $8,000 is comprised of $5,600 of variable product costs ($7 × 800). Therefore, $2,400 of the Cost of Goods Sold is fixed. Given that the firm sold 80 percent of its output (800/1,000), $2,400 must be 80 percent of the total fixed manufacturing overhead incurred. This sets the total fixed manufacturing overhead costs incurred at $3,000. MEDIUM 10. What were the total variable costs incurred in 2001? ANSWER: The total variable product costs would be $5,600/.80 = $7,000. The total variable SG&A would be $1 × 800 =$800. Total variable costs incurred are $7,000 + $800 = $7,800. MEDIUM 11. If the Limpin Co. adopted variable costing, the ending finished goods inventory for 2001 would be carried at what value? ANSWER: EASY The answer is 200 units × $7 = $1,400. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis 11–43 Use the following information for questions 12–14. The Crown Co. manufactures toasters. The company hired a cost accountant in its first year of operations, 2001, to explain to management how its costs behaved. After studying various documents and industry data, the cost accountant announced that the total SG&A expenses that the firm can expect to incur in any period is captured by the equation: Y = $50,000 + $10X, where Y is the total SG&A expense incurred and X is the number of units sold. Also, the accountant announced that the total product costs incurred in any period could be captured by the formula Y = $100,000 + $6X, where Y is the total manufacturing cost incurred and X is the number of units produced. In 2001, the firm produced 10,000 units and sold 9,000 of them at $35 each. 12. According to the accountant’s equations, what would be the total of all costs incurred by the firm in 2001? ANSWER: Total production costs are based on the number of units produced and would be: (10,000 × $6) + $100,000 = $160,000. Total period costs would be based on the number of units sold and would be: (9,000 × $10) + $50,000 = $140,000. The total of all costs would be $160,000 + $140,000 = $300,000. MEDIUM 13. If the firm’s costs conformed exactly to the accountant’s equations, how much income before income taxes would be reported for 2001 if the firm uses absorption costing? ANSWER: Sales ($35 × 9,000) Cost of Goods Sold: Beg. fin. goods inventory Cost of Goods Manufactured Goods available Ending inventory Cost of Goods Sold Gross margin Less period costs Income before income taxes MEDIUM $315,000 $ 0 160,000 $160,000 (16,000 ) (144,000 ) $171,000 (140,000 ) $ 31,000 11–44 14. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis If the firm’s costs conformed exactly to the accountant’s equations, how much income before income taxes would be reported for 2001 if the firm uses variable costing? ANSWER: Sales Less variable costs: Product costs ($6 × 9,000) Period costs ($10 × 9,000) Contribution margin Less fixed costs: Product costs Period costs Income before income taxes $315,000 $54,000 90,000 $100,000 50,000 (144,000 ) $171,000 (150,000 ) $ 21,000 MEDIUM 15. Stanley Corp. produces a single product. The following is a cost structure applied to its first year of operations, 2001: Sales price Variable costs: SG&A Production Fixed costs (total cost incurred for the year): SG&A Production $15 per unit $2 per unit $4 per unit $14,000 $20,000 During 2001, Stanley Corp. manufactured 5,000 units and sold 3,800. There was no beginning or ending work-in-process inventory. a. b. c. How much income before income taxes would be reported if Stanley uses absorption costing? How much income before income taxes would be reported if variable costing was used? Show why the two costing methods give different income amounts. Chapter 11 ANSWER: a. b. c. Absorption/Variable Costing and Cost-Volume-Profit Analysis Income under absorption costing is: Sales $15 × 3,800 = COGS 3,800 × ($4 + $20,000/5,000) GM Oper. Exp. VSE $2 × 3,800 = FSE Absorption income before income taxes $57,000 30,400 $26,600 $ 7,600 14,000 Income under variable costing: CMU = SP – VProd.Cost – VSGA = $15 – $4 – $2 = $9 ×Vol. sold 3,800 CM Less: FC – Production SG&A Variable costing income before income taxes Reason for difference in income: Fixed costs expensed under absorp. costing COGS 3,800 × $20,000/5,000 units Fixed SG&A Total Fixed costs expensed under variable costing Fixed SG&A Fixed Production Total FC Difference in FC expensed under two methods This is also the difference in income amounts. MEDIUM 11–45 (21,600 ) $ 5,000 $34,200 (20,000 ) (14,000 ) $ 200 $15,200 14,000 $29,200 $14,000 20,000 $34,000 $ 4,800 11–46 Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis Use the following information for questions 16 and 17. Information relating to the 2001 operations of McNickle Corp. follows: Sales Variable costs Contribution margin Fixed costs Profit before taxes 16. $120,000 (36,000 ) $ 84,000 (70,000 ) $ 14,000 McNickle’s break-even point for 2001 was 1,000 units. Compute McNickle’s sales price per unit. ANSWER: The break-even point is found by dividing the fixed costs by the CM ratio. The CM ratio is: $84,000/$120,000 = 70%. Breakeven would then be: $70,000/.70 = $100,000. Since we also know that the break-even point is defined as 1,000 units, it must follow that the unit sales price is $100,000/1,000 = $100. MEDIUM 17. Compute McNickle’s degree of operating leverage for 2001. ANSWER: The degree of operating leverage is computed as the contribution margin divided by profit before taxes: $84,000/$14,000 = 6. MEDIUM Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis 11–47 Use the following information for questions 18 and 19. Dos Co. manufactures and sells 2 products: A and B. The projected information on these two products for 2002 is: Sales in units Sales price per unit Variable costs per unit Product A 4,000 $12 8 Product B 1,000 $8 4 Total fixed costs for the company are projected at $10,000. 18. Compute Dos Co.’s projected break-even point for 2002 in total units. ANSWER: The company anticipates a sales mix consisting of 4 units of Product A and 1 unit of Product B. The total contribution margin for one unit of sales mix would be $20. This consists of $16 of contribution margin from the 4 units of Product A and $4 of contribution margin from 1 unit of Product B. The overall company breakeven is found by dividing total fixed costs by the contribution margin on one unit of sales mix: $10,000/$20 = 500 units. The 500 units of sales mix contain 500 × 5 units of product for a total of 2,500. Of the 2,500 total units, 2,000 are units of Product A and 500 are units of Product B. MEDIUM 19. How many units would the company need to sell to produce an income before income taxes equal to 15 percent of sales? ANSWER: Again, using a unit of sales mix as the unit of analysis, one unit of sales mix sells for $56. Since the contribution margin is $20 on one unit of sales mix, the CM ratio on one unit of sales mix is $20/$56 = .3571. This implies that variable costs as a percentage of sales are equal to 1 – .3571 = .6429. Income before income taxes equal to 15 percent of sales can be found by solving a formula of the following type: Sales – VC – FC = Income before income taxes In this particular case, we solve the following formula: Sales – (.6429 × Sales) – $10,000 = (.15 × Sales) Solving for Sales, we get $48,286. We can find out how many units of sales mix are required to generate sales of $48,286 by dividing $48,286 by $56 = 863. These 863 units of sales mix each contain 5 units of product, so the correct answer would be 863 × 5 = 4,315 units of product, 3,452 of Product A and 863 of Product B. MEDIUM 11–48 Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis Use the following information for questions 20 and 21. P Corp. predicts it will produce and sell 40,000 units of its sole product in 2001. At that level of volume, it projects a sales price of $30 per unit, a contribution margin ratio of 40 percent, and fixed costs of $5 per unit. 20. What is the company’s projected breakeven for 2001 in dollars and units? ANSWER: Given the CM ratio of 40 percent, and the Sales price per unit of $30, the CM per unit must be $30 × .40 = $12. The total fixed costs would be projected at $5 × 40,000 = $200,000. Breakeven would be: $200,000/$12 = 16,667 units. This would also equate to $500,000 of sales. MEDIUM 21. What would the company’s projected profit be if it produced and sold 30,000 units? ANSWER: Projected profit would be: Sales (30,000 × $30) Variable costs (30,000 × $18) Contribution margin Fixed costs Profit MEDIUM $900,000 (540,000 ) $360,000 (200,000 ) $160,000 Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis 11–49 Questions 22 and 23 are based on the following data pertaining to two types of products manufactured by Korn Corp.: Product Y Product Z Per unit Sales price Variable costs $120 $ 70 $500 $200 Fixed costs total $300,000 annually. The expected mix in units is 60 percent for Product Y and 40 percent for Product Z. 22. How much is Korn’s break-even point sales in units? ANSWER: BEP units = FC/(unit SP – unit VC) or unit CM(UMC) For multiple products, use the weighted CM with weights based on units of sales weights. BEP = FC / [60% ($120 – $70) + 40% ($500 – $200)] = $300,000/ ($30/u + $120/u) = 2,000 units MEDIUM 23. What are Korn’s break-even point sales in dollars? ANSWER: BEP dollars = FC/CMR For multiple products, use weighted CMR with weights based on sales dollars as weights or sales mix. Sales mix is 60 percent and 40 percent in units or in dollars. Weighted average CMR = WACM/WASale WACMR = [60% ($120 – $70) + 40% ($500 – $200)] ÷ (60% × $120) + (40% × $500) WACMR = [$30 + $120] ÷ [$72 + $200] = .551 BEP sales = 2,000 × $272 = $544,000 MEDIUM 11–50 24. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis “This makes no sense at all,” said Bill Sharp, president of Essex Company. “We sold the same number of units this year as we did last year, yet our profits have more than doubled. Who made the goof—the computer or the people who operate it?” The statements to which Mr. Sharp was referring are shown here (absorption costing basis): Sales (20,000 units each year) Less cost of good sold Gross margin Less selling and administrative expenses Income before income taxes 2001 $700,000 460,000 $240,000 200,000 $ 40,000 2002 $700,000 400,000 $300,000 200,000 $100,000 The company was organized on January 1, 2001, so the previous statements show the results of its first two years of operation. In the first year, the company produced and sold 20,000 units; in the second year, the company again sold 20,000 units, but it increased production in order to have a stock of units on hand, as shown here: Production in units Sales in units Variable production cost per unit Fixed overhead costs (total) 2001 20,000 20,000 $8 $300,000 2002 25,000 20,000 $8 $300,000 Fixed overhead costs are applied to units of product on a basis of each year’s production. (The company produces and sells a single product.) Variable selling and administrative expenses are $1 per unit sold. Required: 1. Compute the cost of single unit of product for each year under: a. absorption costing. b. variable costing. 2. What is the value of ending inventory in 2002 under: a. full cost? b. variable cost? Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis ANSWER: 1. 2. a Variable man. Fixed man. 2001 $ 8 15 $23 b. Variable man. a. 5,000 × $23 = $115,000 b. 5,000 × 20 = 100,000 MEDIUM 2001 $8 2002 $ 8 12 $20 2002 $8 2001 $300,000 = $15 20,000 2002 $300,000 = $12 25,000 11–51 11–52 25. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis The following data have been taken from the records of a company: Production in units during 2001 Units sold during 2001 Selling price per unit Standard variable costs per unit: Material and labor Indirect manufacturing costs Selling & administrative expenses Fixed costs budgeted for year: Indirect manufacturing costs Selling & administrative expenses 200,000 190,000 $15.00 $8.00 2.00 1.00 $11.00 $400,000 300,000 $700,000 Required: 1. Determine the income (loss) before income taxes for the year 2001 under (a) absorption costing and (b) variable costing. 2. What is the value of ending inventory under (a) absorption costing and (b) variable costing? 3. Reconcile the difference in the two incomes. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis ANSWER: 1. (a.) Sales – COG S (190,000 × 12) – SLA Income before income taxes $2,850,000 2,280,000 $ 570,000 490,000 $ 80,000 2. (a.) $12 × 10,000 = $120,000 (b.) $10 × 10,000 = $100,000 11–53 (b.) Sales – VC (190,000 × 11) CM – FC Income before income taxes PRODUCT COST ABSORPTION VARIABLE VAR $10 FIX 3. NI = (200,000 – 190,000) × $2 = $20,000 MEDIUM $2,850,000 2,090,000 $ 760,000 700,000 $ 60,000 2 $12 $10 (400,000) (200,000) ___ $10 11–54 26. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis Actual costs for Sonic, Inc. for the past year were as follows: Direct material (2 pounds @ $5) Direct labor (3 hours @ $10) Variable selling and administrative Fixed selling and administrative $10 per unit $30 per unit $2 per unit $80,000 During the year, 10,000 units were produced and 9,000 units were sold. There were no beginning inventories. Thirty thousand direct labor hours were worked during the year. Actual overhead for the year totaled $252,000 of which $140,000 was fixed. Selling price = $100/unit. Budgeted fixed overhead was $150,000 and the expected activity level was 30,000 direct labor hours. Variable overhead was budgeted at 3 direct labor hours per unit and $4 per direct labor hour. The company uses a normal costing system and overhead variances are closed to cost of goods sold. Required: a. Determine the unit cost using variable costing. b. Determine the unit cost using absorption costing. c. Using variable costing, determine the contribution margin, and variable costing income. d. Using absorption costing, determine the gross margin, and absorption costing income. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis 11–55 ANSWER: a. DM DL V-FOH (3 × $4) $10 30 12 $52 b. DM DL V-FOH F-FOH (3 × $5) $10 30 12 15 $67 c. $150,000 = $5 30,000 Sell Price $100 – VAR Cost 54 ($52 + $2) CM $ 46 × 9,000 units = – FC = Income before income taxes (STD) + favorable VAR-FOH SPD VAR Income before income taxes (actual) $414,000 (230,000 ) $184,000 8,000 $192,000 Variable FOH spending variance = $112,000 – (30,000 × $4) = $8,000 F d. SP $100 – COGS 67 GM $ 33 × 9,000 units = – S&A EXP (9,000 × $2) + $80,000 Income before income taxes (STD) + Favorable variance Income before income taxes actual MEDIUM $297,000 (98,000 ) $199,000 8,000 $207,000 11–56 27. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis Sports Innovators has developed a new design to produce hurdles that are used in track and field competition. The company’s hurdle design is innovative in that the hurdle yields when hit by a runner and its height is extraordinarily easy to adjust. Management estimates expected annual capacity to be 90,000 units; overhead is applied using expected annual capacity. The company’s cost accountant predicts the following 2001 activities and related costs: Standard unit variable manufacturing costs Variable unit selling expense Fixed manufacturing overhead Fixed selling and administrative expenses Selling price per unit Units of sales Units of production Units in beginning inventory $12 $5 $480,000 $136,000 $35 80,000 85,000 10,000 Other than any possible under- or overapplied fixed overhead, management expects no variances from the previous manufacturing costs. Under- or overapplied fixed overhead is to be written off to Cost of Goods Sold. Required: 1. Determine the amount of under- or overapplied fixed overhead using (a) variable costing and (b) absorption costing. 2. Prepare projected income statements using (a) variable costing and (b) absorption costing. 3. Reconcile the incomes derived in part 2. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis ANSWER: 1. 2. 3. a. $0 b. (90,000 – 85,000) × $5.33 = $26,650 U a. Sales (80,000 × $35) = – VC (80,000 × $17) = CM – FC Income before income taxes $2,800,000 (1,360,000 ) $1,440,000 (616,000 ) $ 824,000 b. Sales (80,000 × $35) – COGS ($17.33 × 80,000) GM – S&A Income before income (STD) – VOL VAR Income before income taxes $2,800,000 (1,386,400 ) $1,413,600 (536,000 ) $ 877,600 (26,650 ) $ 850,950 5,000 × $5.33 = $26,650. MEDIUM 11–57 11–58 28. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis On December 30, 2001, a bomb blast destroyed the bulk of the accounting records of the Horne Division, a small one-product manufacturing division that uses standard costs and flexible budgets. All variances are written off as additions to (or deductions from) income; none are pro-rated to inventories. In addition, the chief accountant mysteriously disappeared. You have the task of reconstructing the records for the year 2001. The general manager has said that the accountant has been experimenting with both absorption costing and variable costing. The records are a mess, but you have gathered the following data for 2001: a. b. c. d. e. f. g. h. i. j. k. l. m. n. o. Cash on hand, December 31, 2001 Sales Actual fixed indirect manufacturing costs Accounts receivable, December 31, 2001 Standard variable manufacturing costs per unit Variances from standard of all variable manufacturing costs Operating income, absorption-costing basis Accounts payable, December 31, 2001 Gross profit, absorption costing at standard (before deducting variances) Total liabilities Unfavorable budget variance, fixed manufacturing costs Notes receivable from chief accountant Contribution margin, at standard (before deducting variances) Direct-material purchases, at standard prices Actual selling and administrative costs (all fixed) $10 $128,000 21,000 20,000 1 $5,000 U $14,400 18,000 22,400 100,000 1,000 U 4,000 48,000 50,000 6,000 These do not necessarily have to be solved in any particular order. Ignore income taxes. Required: 1. Operating income on a variable-costing basis. 2. Number of units sold. 3. Number of units produced. 4. Number of units used as the denominator to obtain fixed indirect cost application rate per unit on absorption-costing basis. 5. Did inventory (in units) increase or decrease? Explain. 6. By now much in dollars did the inventory level change (a) under absorption costing, (b) under variable costing? 7. Variable manufacturing cost of goods sold, at standard prices. 8. Manufacturing cost of goods sold at standard prices, absorption costing. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis 11–59 ANSWER: 1. CM – FC Operating Income (STD) – unfavorable variances Operating Income (actual) $48,000 (26,000 ) $22,000 (6,000 ) $16,000 Actual fix mfg – unfavorable VAR fix cost @STD 2. Sales – CM = VC $128,000 (48,000 ) $ 80,000/$1 UNIT = 80,000 units sold 3. Sales – GM COGS $128,000 (22,400 ) $105,600/80,000 = $1.32 Difference in OI = (P – S) × fix mfg/unit $(1,600) = (P – 80,000) × $.32 P = 75,000 4. OI – absorption cost = $22,400 – $6,000 = variances – other VAR VOL VAR $16,400 (14,400) $ 2,000 6,000 $ 4,000 OI STD OI ACT UNF UNF FAV $4,000 F = (75,000 – X) × $.32 X = 62,500 units produced 5. Inventory decreased. OI absorption is less than OI variable. 6. Absorption cost 5,000 units × $1.32 = $6,600 Variable cost 5,000 units × $1 = $5,000 7. 80,000 units × $1 = $80,000 8. 80,000 × $1.32 = $105,600 DIFFICULT $21,000 (1,000 ) $20,000 11–60 29. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis Smith Company produces and sells two products: A and B in the ratio of 3A to 5B. Selling prices for A and B are, respectively, $1,200 and $240; respective variable costs are $480 and $160. The company’s fixed costs are $1,800,000 per year. Compute the volume of sales in units of each product needed to: Required: a. breakeven. b. earn $800,000 of income before income taxes. c. earn $800,000 of income after income taxes, assuming a 30 percent tax rate. d. earn 12 percent on sales revenue in before-tax income. e. earn 12 percent on sales revenue in after-tax income, assuming a 30 percent tax rate. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis ANSWER: A SP – VC CM $1,200 (480 ) $ 720 B SP – VC CM $240 (160 ) $ 80 Weighted CM = (3 × $720) + (5 × $80) = $2,560 a. $1,800,000 = 703.125 $2,560 A = 704 × 3 = 2,112 units B = 704 × 5 = 3,520 b. $1,800,000 + $800,000 = 1015.625 $2,560 A = 1,016 × 3 = 3,048 units B = 1,016 × 5 = 5,080 c. $800,000/1 – .3 = $1,142,857 $1,800,000 + $1,142,857 = 1,149.55 $2,560 d. SP = (3 × $1,200) + (5 × $240) = $4,800 X = $1,800,000 + $.12X = $4,354,839 $2,560/$4,800 A = ($4,354,839 × .75)/$1200 = 2,722 units B = ($4,354,839 × .25/$240 = 4,537 e. X = $1,800,000 + $.12X 1 – .3 = $4,973,684 $2,560/$4,800 A = ($4,973,684 × .75)/$1,200 = 3,109 units B = ($4,973,684 × .25/$240 = 5,181 MEDIUM A = 1,150 × 3 = 3,450 units B = 1,150 × 5 = 5,750 11–61 11–62 30. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis The Jones Company makes three products. Data follow: Selling price Variable costs Product A $10 7 Product B $20 12 Product C $40 16 Total annual fixed costs are $840,000. The firm’s experience has been that about 20 percent of dollar sales come from product A, 60 percent from B, and 20 percent from C. Required: a. Compute break-even in sales dollars. b. Determine the number of units to be sold at the break-even point. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis ANSWER: a. SP – VC = CM CMR A $10 (7 ) $ 3 30% B $20 (12 ) $ 8 40% C $40 (16 ) $24 60% CMR = (.2 × 30%) + (.6 × 40%) + (.2 × 60%) = 42% BE = $840,000/.42 = $2,000,000 b. A ($2,000,000 × .20)/$10 = 40,000 units B ($2,000,000 × .60)/$20 = 60,000 units C ($2,000,000 × .20)/$40 = 10,000 units MEDIUM 11–63 11–64 31. Chapter 11 Absorption/Variable Costing and Cost-Volume-Profit Analysis The Fred Company sells two products, A and B, with contribution margin ratios of 40 and 30 percent and selling prices of $5 and $2.50 a unit. Fixed costs amount to $72,000 a month. Monthly sales average 30,000 units of product A and 40,000 units of product B. Required: a. Assuming that three units of product A are sold for every four units of product B, calculate the dollar sales volume necessary to breakeven. b. As part of its cost accounting routine, Fred Company assigns $36,000 in fixed costs to each product each month. Calculate the break-even dollar sales volume for each product. c. Fred Company is considering spending an additional $9,700 a month on advertising, giving more emphasis to product A and less emphasis to product B. If its analysis is correct, sales of product A will increase to 40,000 units a month, but sales of product B will fall to 32,000 units a month. Recalculate the break-even sales volume, in dollars, at this new product mix. Should the proposal to spend the additional $9,700 a month be accepted? ANSWER: a. CM = (3 × $2) + (4 × $.75) = $9 SP = (3 × $5) = (4 × $2.50) = $25 BE = $72,000 = $400,000 $9/$25 b. A = $36,000 = $90,000 .4 c. CM = (5 × $2) + (4 × $.75) = $13 SP = (5 × $5) + (4 × $2.50) = $35 B = $36,000 = $120,000 .3 BE = $72,000 + $9,700 = $219,962 $13/35 OLD NEW CM A = 30,000 × $2 = $60,000 B = 40,000 × $.75 = 30,000 $90,000 – FC (72,000 ) OI $18,000 CM A = 40,000 × $2 = $ 80,000 B = 32,000 × $.75 = 24,000 $104,000 – FC (81,700 ) OI $ 22,300 At current sales levels increase advertising. MEDIUM CHAPTER 12 RELEVANT COSTING MULTIPLE CHOICE 1. Which of the following is not a characteristic of relevant costing information? It is a. b. c. d. associated with the decision under consideration. significant to the decision maker. readily quantifiable. related to a future endeavor. ANSWER: 2. a future cost. avoidable. sunk. a product cost. ANSWER: b EASY Relevant costs are a. b. c. d. all fixed and variable costs. all costs that would be incurred within the relevant range of production. past costs that are expected to be different in the future. anticipated future costs that will differ among various alternatives. ANSWER: 4. EASY A fixed cost is relevant if it is a. b. c. d. 3. c d EASY Which of the following is the least likely to be a relevant item in deciding whether to replace an old machine? a. b. c. d. acquisition cost of the old machine outlay to be made for the new machine annual savings to be enjoyed on the new machine life of the new machine ANSWER: a EASY 12–1 12–2 5. Chapter 12 If a cost is irrelevant to a decision, the cost could not be a. b. c. d. a sunk cost. a future cost. a variable cost. an incremental cost. ANSWER: 6. EASY incremental fixed costs all costs of inventory total variable costs that are the same in the considered alternatives the cost of a fixed asset that could be used in all the considered alternatives ANSWER: a EASY The term incremental cost refers to a. b. c. d. the profit foregone by selecting one choice instead of another. the additional cost of producing or selling another product or service. a cost that continues to be incurred in the absence of activity. a cost common to all choices in question and not clearly or feasibly allocable to any of them. ANSWER: 8. d Which of the following costs would be relevant in short-term decision making? a. b. c. d. 7. Relevant Costing b EASY A cost is sunk if it a. b. c. d. is not an incremental cost. is unavoidable. has already been incurred. is irrelevant to the decision at hand. ANSWER: c EASY Chapter 12 9. Relevant Costing Most___________ are relevant to decisions to acquire capacity, but not to short-run decisions involving the use of that capacity. a. b. c. d. sunk costs incremental costs fixed costs prime costs ANSWER: 10. sunk costs yes yes no yes ANSWER: EASY d historical costs yes no no yes allocated costs no no yes yes EASY In deciding whether an organization will keep an old machine or purchase a new machine, a manager would ignore the a. b. c. d. estimated disposal value of the old machine. acquisition cost of the old machine. operating costs of the new machine. estimated disposal value of the new machine. ANSWER: 12. c Irrelevant costs generally include a. b. c. d. 11. 12–3 b EASY The potential rental value of space used for production activities a. b. c. d. is a variable cost of production. represents an opportunity cost of production. is an unavoidable cost. is a sunk cost of production. ANSWER: b EASY 12–4 13. Chapter 12 The opportunity cost of making a component part in a factory with excess capacity for which there is no alternative use is a. b. c. d. the total manufacturing cost of the component. the total variable cost of the component. the fixed manufacturing cost of the component. zero. ANSWER: 14. Variable costs no yes no yes ANSWER: EASY d Avoidable fixed costs yes no no yes Unavoidable fixed costs yes yes yes no EASY In a make or buy decision, the opportunity cost of capacity could a. b. c. d. be considered to decrease the price of units purchased from suppliers. be considered to decrease the cost of units manufactured by the company. be considered to increase the price of units purchased from suppliers. not be considered since opportunity costs are not part of the accounting records. ANSWER: 16. d Which of the following are relevant in a make or buy decision? a. b. c. d. 15. Relevant Costing a EASY Which of the following are relevant in a make or buy decision? a. b. c. d. Prime costs yes yes yes no ANSWER: b Sunk costs yes no no no EASY Incremental costs yes yes no yes Chapter 12 17. Relevant Costing In a make or buy decision, the reliability of a potential supplier is a. b. c. d. an irrelevant decision factor. relevant information if it can be quantified. an opportunity cost of continued production. a qualitative decision factor. ANSWER: 18. EASY maintaining a long-term relationship with suppliers quality control is critical utilization of idle capacity part is critical to product ANSWER: a EASY When a scarce resource, such as space, exists in an organization, the criterion that should be used to determine production is a. b. c. d. contribution margin per unit. selling price per unit. contribution margin per unit of scarce resource. total variable costs of production. ANSWER: 20. d Which of the following qualitative factors favors the buy choice in a make or buy decision for a part? a. b. c. d. 19. 12–5 c EASY Fixed costs are ignored in allocating scarce resources because a. b. c. d. they are sunk. they are unaffected by the allocation of scarce resources. there are no fixed costs associated with scarce resources. fixed costs only apply to long-run decisions. ANSWER: b EASY 12–6 21. Chapter 12 The minimum selling price that should be acceptable in a special order situation is equal to total a. b. c. d. production cost. variable production cost. variable costs. production cost plus a normal profit margin. ANSWER: 22. EASY direct labor equipment depreciation variable cost of utilities opportunity cost of production ANSWER: b EASY The _______________ prohibits companies from pricing products at different amounts unless these differences reflect differences in the cost to manufacture, sell, or distribute the products. a. b. c. d. Internal Revenue Service Governmental Accounting Office Sherman Antitrust Act Robinson-Patman Act ANSWER: 24. c Which of the following costs is irrelevant in making a decision about a special order price if some of the company facilities are currently idle? a. b. c. d. 23. Relevant Costing d EASY An ad hoc sales discount is a. b. c. d. an allowance for an inferior quality of marketed goods. a discount that an ad hoc committee must decide on. brought about by competitive pressures. none of the above. ANSWER: c MEDIUM Chapter 12 25. Relevant Costing A manager is attempting to determine whether a segment of the business should be eliminated. The focus of attention for this decision should be on a. b. c. d. the net income shown on the segment’s income statement. sales minus total expenses of the segment. sales minus total direct expenses of the segment. sales minus total variable expenses and avoidable fixed expenses of the segment. ANSWER: 26. EASY contribution margin per hour of machine time. gross margin per unit. contribution margin per unit. sales price per unit. ANSWER: c EASY For a particular product in high demand, a company decreases the sales price and increases the sales commission. These changes will not increase a. b. c. d. sales volume. total selling expenses for the product. the product contribution margin. the total variable cost per unit. ANSWER: 28. d Assume a company produces three products: A, B, and C. It can only sell up to 3,000 units of each product. Production capacity is unlimited. The company should produce the product (or products) that has (have) the highest a. b. c. d. 27. 12–7 c EASY An increase in direct fixed costs could reduce all of the following except a. b. c. d. product line contribution margin. product line segment margin. product line operating income. corporate net income. ANSWER: a EASY 12–8 29. Chapter 12 When a company discontinues a segment, total corporate costs may decrease in all of the following categories except a. b. c. d. variable production costs. allocated common costs. direct fixed costs. variable period costs. ANSWER: 30. EASY segment variable costs segment fixed costs costs allocated to the segment period costs ANSWER: c EASY K Co. uses 10,000 units of a part in its production process. The costs to make a part are: direct material, $12; direct labor, $25; variable overhead, $13; and applied fixed overhead, $30. K Co. has received a quote of $55 from a potential supplier for this part. If K Co. buys the part, 70 percent of the applied fixed overhead would continue. K Co. would be better off by a. b. c. d. $50,000 to manufacture the part. $150,000 to buy the part. $40,000 to buy the part. $160,000 to manufacture the part. ANSWER: 32. b In evaluating the profitability of a specific organizational segment, all _______________ would be ignored. a. b. c. d. 31. Relevant Costing c MEDIUM P Co. has only 25,000 hours of machine time each month to manufacture its two products. Product X has a contribution margin of $50, and Product Y has a contribution margin of $64. Product X requires 5 hours of machine time, and Product Y requires 8 hours of machine time. If P wants to dedicate 80 percent of its machine time to the product that will provide the most income, P will have a total contribution margin of a. b. c. d. $250,000. $240,000. $210,000. $200,000. ANSWER: b DIFFICULT Chapter 12 33. Relevant Costing 12–9 Down Co. has 3 divisions: R, S, and T. Division R’s income statement shows the following for the year ended December 31, 2001: Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Net loss $1,000,000 (800,000 ) $ 200,000 $100,000 250,000 (350,000 ) $ (150,000 ) Cost of goods sold is 75 percent variable and 25 percent fixed. Of the fixed costs, 60 percent are avoidable if the division is closed. All of the selling expenses relate to the division and would be eliminated if Division R were eliminated. Of the administrative expenses, 90 percent are applied from corporate costs. If Division R were eliminated, Down Co. income would a. b. c. d. increase by $150,000. decrease by $ 75,000. decrease by $155,000. decrease by $215,000. ANSWER: 34. c MEDIUM Sandow Co. is currently operating at a loss of $15,000. The sales manager has received a special order for 5,000 units of product, which normally sells for $35 per unit. Costs associated with the product are: direct material, $6; direct labor, $10; variable overhead, $3; applied fixed overhead, $4; and variable selling expenses, $2. The special order would allow the use of a slightly lower grade of direct material, thereby lowering the price per unit by $1.50 and selling expenses would be decreased by $1. If Sandow wants this special order to increase the total net income for the firm to $10,000, what sales price must be quoted for each of the 5,000 units? a. b. c. d. $23.50 $24.50 $27.50 $34.00 ANSWER: a MEDIUM 12–10 35. Chapter 12 Relevant Costing Q Co. produces a part that has the following costs per unit: Direct material Direct labor Variable overhead Fixed overhead Total $ 8 3 1 5 $17 Z Corp. can provide the part to Q for $19 per unit. Q Co. has determined that 60 percent of its fixed overhead would continue if it purchased the part. However, if Q no longer produces the part, it can rent that portion of the plant facilities for $60,000 per year. Q Co. currently produces 10,000 parts per year. Which alternative is preferable and by what margin? a. b. c. d. Make—$20,000 Make—$50,000 Buy—$10,000 Buy—$40,000 ANSWER: 36. c MEDIUM Armstrong Co. has 15,000 units in inventory that had a production cost of $3 per unit. These units cannot be sold through normal channels due to a significant technology change. These units could be reworked at a total cost of $23,000 and sold for $28,000. Another alternative is to sell the units to a junk dealer for $8,500. The relevant cost for Armstrong to consider in making its decision is a. b. c. d. $45,000 of original product costs. $23,000 for reworking the units. $68,000 for reworking the units. $28,000 for selling the units to the junk dealer. ANSWER: b EASY Chapter 12 Relevant Costing 12–11 Use the following information for questions 37 and 38. 37. R Corp. sells a product for $18 per unit, and the standard cost card for the product shows the following costs: Direct material Direct labor Overhead (80% fixed) Total $ 1 2 7 $10 R received a special order for 1,000 units of the product. The only additional cost to R would be foreign import taxes of $1 per unit. If R is able to sell all of the current production domestically, what would be the minimum sales price that R would consider for this special order? a. b. c. d. $18.00 $11.00 $5.40 $19.00 ANSWER: 38. d EASY Assume that R has sufficient idle capacity to produce the 1,000 units. If R wants to increase its operating profit by $5,600, what would it charge as a per-unit selling price? a. b. c. d. $18.00 $10.00 $11.00 $16.60 ANSWER: c MEDIUM 12–12 39. Chapter 12 Relevant Costing Handy Combs, Inc. makes and sells brushes and combs. It can sell all of either product it can make. The following data are pertinent to each respective product: Units of output per machine hour Selling price per unit Product cost per unit Direct material Direct labor Variable overhead Brushes 8 $12.00 Combs 20 $4.00 $1.00 2.00 0.50 $1.20 0.10 0.05 Total fixed overhead is $380,000. The company has 40,000 machine hours available for production. What sales mix will maximize profits? a. b. c. d. 320,000 brushes and 0 combs 0 brushes and 800,000 combs 160,000 brushes and 600,000 combs 252,630 brushes and 252,630 combs ANSWER: 40. a EASY Boston Shoe Cobblers has been asked to submit a bid on supplying 1,000 pairs of military dress boots to the Pentagon. The company’s costs per pair of boots are as follows: Direct material Direct labor Variable overhead Variable selling cost (commission) Fixed overhead (allocated) Fixed selling and administrative cost $8 6 3 3 2 1 Assuming that there would be no commission on this potential sale, the lowest price the firm can bid is some price greater than a. b. c. d. $23. $20. $17. $14. ANSWER: c EASY Chapter 12 41. Relevant Costing 12–13 Schoof Company has two sales territories—North and South. Financial information for the two territories for 2001 follows: Sales Direct costs: Variable Fixed Allocated common costs Net income (loss) North $980,000 South $750,000 (343,000 ) (450,000 ) (275,000 ) $ (88,000 ) (225,000 ) (325,000 ) (175,000 ) $ 25,000 Because the company is in a start-up stage, corporate management feels that the North sales territory is creating too much of a cash drain on the company and it should be eliminated. If North is discontinued, one sales manager (whose salary is $40,000 per year) will be relocated to the South territory. By how much would Schoof’s income change if the North territory is eliminated? a. b. c. d. increase by $88,000 increase by $48,000 decrease by $267,000 decrease by $227,000 ANSWER: d MEDIUM 12–14 Chapter 12 Relevant Costing Use the following information for questions 42–45. Big City Motors is trying to decide whether it should keep its existing car washing machine or purchase a new one that has technological advantages (which translate into cost savings) over the existing machine. Information on each machine follows: Original cost Accumulated depreciation Annual cash operating costs Current salvage value of old machine 2,000 Salvage value in 10 years Remaining life 42. 500 10 yrs. 1,000 10 yrs. sunk cost. irrelevant cost. future avoidable cost. opportunity cost. ANSWER: b EASY The $9,000 cost of the original machine represents a(n) a. b. c. d. sunk cost. future relevant cost. historical relevant cost. opportunity cost. ANSWER: 44. New machine $20,000 0 4,000 The $4,000 of annual operating costs that are common to both the old and the new machine are an example of a(n) a. b. c. d. 43. Old machine $9,000 5,000 9,000 a EASY The $20,000 cost of the new machine represents a(n) a. b. c. d. sunk cost. future relevant cost. future irrelevant cost. opportunity cost. ANSWER: b EASY Chapter 12 45. Relevant Costing 12–15 The estimated $500 salvage value of the existing machine in 10 years represents a(n) a. b. c. d. sunk cost. opportunity cost of selling the existing machine now. opportunity cost of keeping the existing machine for 10 years. opportunity cost of keeping the existing machine and buying the new machine. ANSWER: b EASY Use the following information for questions 46 and 47. Robco manufactures and sells FM radios. Information on last year’s operations (sales and production of the 2000 model) follows: Sales price per unit Costs per unit: Direct material Direct labor Overhead (50% variable) Selling costs (40% variable) Production in units Sales in units 46. 7 4 6 10 10,000 9,500 At this time (April 2001), the 2001 model is in production and it renders the 2000 model radio obsolete. If the remaining 500 units of the 2000 model radios are to be sold through regular channels, what is the minimum price the company would accept for the radios? a. b. c. d. $30 $27 $18 $4 ANSWER: 47. $30 d MEDIUM Assume that the remaining 2000 model radios can be sold through normal channels or to a foreign buyer for $6 per unit. If sold through regular channels, the minimum acceptable price will be a. b. c. d. $30. $33. $10. $4. ANSWER: c MEDIUM 12–16 Chapter 12 Relevant Costing Use the following information for questions 48–50. The Chip Division of Supercomp Corp. produces a high-quality computer chip. Unit production costs (based on capacity production of 100,000 units per year) follow: Direct material Direct labor Overhead (20% variable) Other information: Sales price SG&A costs (40% variable) 48. $100 $72 $81 $94 ANSWER: d MEDIUM Assume, for this question only, that the Chip Division is operating at a level of 70,000 chips per year. What is the minimum price that the division would consider on a “special order” of 1,000 chips to be distributed through normal channels? a. b. c. d. $78 $95 $100 $81 ANSWER: 50. 100 15 Assume, for this question only, that the Chip Division is producing and selling at capacity. What is the minimum selling price that the division would consider on a “special order” of 1,000 chips on which no variable period costs would be incurred? a. b. c. d. 49. $50 20 10 a MEDIUM Assume, for this question only, that the Chip Division is presently operating at a level of 80,000 chips per year. Accepting a “special order” on 2,000 chips at $88 will a. b. c. d. increase total corporate profits by $4,000. increase total corporate profits by $20,000. decrease total corporate profits by $14,000. decrease total corporate profits by $24,000. ANSWER: b MEDIUM Chapter 12 Relevant Costing 12–17 Use the following information for questions 51–53. The capital budgeting committee of the Virginia Iron Works is evaluating the possibility of replacing its old pipe-bending machine with a more advanced model. Information on the existing machine and the new model follows: Original cost Market value now Market value in year 5 Annual cash operating costs Remaining life 51. 20,000 10,000 5 yrs. $30,000 of annual savings in operating costs. $20,000 of salvage in 5 years on the new machine. lost sales resulting from the inefficient existing machine. $400,000 cost of the new machine. ANSWER: a EASY The $80,000 market value of the existing machine is a. b. c. d. a sunk cost. an opportunity cost of keeping the old machine. irrelevant to the equipment replacement decision. an historical cost. ANSWER: 53. New machine $400,000 The major opportunity cost associated with the continued use of the existing machine is a. b. c. d. 52. Existing machine $200,000 80,000 0 40,000 5 yrs. b EASY If the company buys the new machine and disposes of the existing machine, corporate profit over the five-year life of the new machine will be ____________________ than the profit that would have been generated had the existing machine been retained for five years. a. b. c. d. $150,000 lower $170,000 lower $230,000 lower $150,000 higher ANSWER: a MEDIUM 12–18 54. Chapter 12 Relevant Costing Golden, Inc. has been manufacturing 5,000 units of Part 10541, which is used in the manufacture of one of its products. At this level of production, the cost per unit of manufacturing Part 10541 is as follows: Direct material Direct labor Variable overhead Fixed overhead applied Total $ 2 8 4 6 $20 Brown Company has offered to sell Golden 5,000 units of Part 10541 for $19 a unit. Golden has determined that it could use the facilities currently used to manufacture Part 10541 to manufacture Part RAC and generate an operating profit of $4,000. Golden has also determined that two-thirds of the fixed overhead applied will continue even if Part 10541 is purchased from Brown. To determine whether to accept Brown’s offer, the net relevant costs to make are a. b. c. d. $70,000. $84,000. $90,000. $95,000. ANSWER: 55. b MEDIUM Relay Corporation manufactures batons. Relay can manufacture 300,000 batons a year at a variable cost of $750,000 and a fixed cost of $450,000. Based on Relay’s predictions, 240,000 batons will be sold at the regular price of $5.00 each. In addition, a special order was placed for 60,000 batons to be sold at a 40 percent discount off the regular price. The unit relevant cost per unit for Relay’s decision is a. b. c. d. $1.50. $2.50. $3.00. $4.00. ANSWER: b MEDIUM Chapter 12 56. Relevant Costing 12–19 Big City Motors is trying to decide whether it should keep its existing car washing machine or purchase a new one that has technological advantages (which translate into cost savings) over the existing machine. Information on each machine follows: Original cost Accumulated depreciation Annual cash operating costs Current salvage value of old machine Salvage value in 10 years Remaining life Old machine $9,000 5,000 9,000 2,000 500 10 yrs. New machine $20,000 0 4,000 1,000 10 yrs. The incremental cost to purchase the new machine is a. b. c. d. $11,000. $20,000. $13,000. $18,000. ANSWER: d EASY THE FOLLOWING MULTIPLE CHOICE RELATE TO MATERIAL COVERED IN THE APPENDIX OF THE CHAPTER. 57. The objective in solving the linear programming problem is to determine the optimal levels of the a. b. c. d. coefficients. dependent variables. independent variables. slack variables. ANSWER: 58. c EASY A linear programming problem can have a. b. c. d. no more than three resource constraints. only one objective function. no more than two dependent variables for each constraint equation. no more than three independent variables. ANSWER: b EASY 12–20 59. Chapter 12 A linear programming model must a. b. c. d. have only one objective function. have as many independent variables as it has constraint equations. have at least two dependent variables for each equation. consider only the constraints that can be expressed as inequalities. ANSWER: 60. the independent variables. the dependent variables in the constraint equations. the coefficients of the objective function. iso-cost lines. ANSWER: EASY defined only by binding constraints on the optimal solution. defined as the solution space that satisfies all constraints. identified by iso-cost and iso-profit lines. identified by all of the above. ANSWER: b EASY A linear programming solution a. b. c. d. always involves more than one constraint. always involves a corner point. is the one with the highest vertex coordinates. is provided by the input-output coefficients. ANSWER: 63. b The feasible region for an LP solution is a. b. c. d. 62. EASY In a linear programming problem, constraints are indicated by a. b. c. d. 61. a b EASY The objective function and the resource constraints have the same a. b. c. d. dependent variables. coefficients. independent variables. all of the above. ANSWER: c EASY Relevant Costing Chapter 12 64. Relevant Costing Which of the following items continuously checks for an improved solution from the one previously computed? a. b. c. d. An algorithm yes yes no no ANSWER: 65. Surplus yes yes no no ANSWER: EASY Slack yes no yes no c EASY ____________________ programming relates to a variety of techniques that are used to allocate limited resources among activities to achieve a specific objective. a. b. c. d. Integer Input-output Mathematical Regression ANSWER: 67. a Simplex method yes no no yes Which of the following variables is associated with the “less than or equal to” constraints? a. b. c. d. 66. 12–21 c EASY The graphical approach to solving a linear programming problem becomes much more complex when there are more than two a. b. c. d. constraints yes no yes no ANSWER: c decision variables no yes yes no EASY 12–22 68. Chapter 12 Relevant Costing The feasible region for a graphical solution to a profit maximization problem includes a. b. c. d. all vertex points. all points on every resource constraint line. the origin. all of the above. ANSWER: c EASY Use the following information for questions 69–71. In the two following constraint equations, X and Y represent two products (in units) produced by the Generic Co. Constraint 1: 3X + 5Y < 4,200 Constraint 2: 5X + 2Y > 3,000 69. What is the maximum number of units of Product X that can be produced? a. b. c. d. 4,200 3,000 600 1,400 ANSWER: 70. MEDIUM What is the feasible range for the production of Y? a. b. c. d. 840 to 1,500 units 0 to 840 units 0 to 631 units 0 to 1500 units ANSWER: 71. d b MEDIUM A solution of X = 500 and Y = 600 would violate a. b. c. d. Constraint 1. Constraint 2. both constraints. neither constraint. ANSWER: a EASY Chapter 12 72. Relevant Costing 12–23 One constraint in an LP problem is: 12X + 7Y > 4,000. If the optimal solution is X = 100 and Y = 500, this resource has a. b. c. d. slack variable of 700. surplus variable of 700. output coefficient of 700. none of the above. ANSWER: 73. b EASY Consider the following linear programming problem and assume that non-negativity constraints apply to the independent variables: Max CM = $14X + $23Y Subject to Constraint 1: 4X + 5Y < 3,200 Constraint 2: 2X + 6Y < 2,400 Which of the following are feasible solutions to the linear programming problem? a. b. c. d. X = 600, Y = 240 X = 800, Y = 640 X = 0, Y = 400 X = 1,200, Y = 0 ANSWER: 74. c MEDIUM Contracting with vendors outside the organization to obtain or acquire goods and/or services is called a. b. c. d. target costing. insourcing. outsourcing. product harvesting. ANSWER: c EASY 12–24 75. Chapter 12 Which of the following activities within an organization would be least likely to be outsourced? a. b. c. d. accounting data processing transportation product design ANSWER: 76. EASY contract vendor. lessee. network organization. centralized insourcer. ANSWER: a EASY Costs forgone when an individual or organization chooses one option over another are a. b. c. d. budgeted costs. sunk costs. historical costs. opportunity costs. ANSWER: 78. d An outside firm selected to provide services to an organization is called a a. b. c. d. 77. Relevant Costing d EASY Which of the following costs would not be accounted for in a company’s recordkeeping system? a. b. c. d. an unexpired cost an expired cost a product cost an opportunity cost ANSWER: d EASY Chapter 12 Relevant Costing 12–25 SHORT ANSWER/PROBLEMS 1. Why is depreciation expense irrelevant to most managerial decisions, even when it is a future cost? ANSWER: Depreciation expense is simply the systematic write-off of a sunk cost (the cost of a long-lived asset). Depreciation expense is therefore always irrelevant unless it pertains to an asset that is not yet acquired. MEDIUM 2. What is an opportunity cost and why is it a relevant cost? ANSWER: An opportunity cost is not a “cost” in the traditional out-of-pocket sense. Opportunity costs are benefits that are sacrificed to pursue one alternative rather than another. Once an alternative is selected, the opportunity costs associated with that alternative will not appear directly in the accounting records of the firm as other costs of that alternative will. These costs are, however, relevant because the company is giving up one set of benefits to accept a second set. Rational decision making assumes that the chosen alternative provides the greater benefit. MEDIUM 3. Define segment margin and explain why it is a relevant measure of a segment’s contribution to overall organizational profitability. ANSWER: Segment margin is the amount of income that remains after deducting all avoidable (both variable and fixed) costs from sales. This measure is the appropriate gauge of a segment’s viability because it is a direct measure of how total organizational profits would change if the segment was discontinued. MEDIUM 4. What is the relationship between scarce resources and an organization’s production capacity? ANSWER: In the long run, capacity is likely to be constrained by two fundamental resources: labor and machinery. However, in the short run, additional constraints can push capacity to levels below labor and machine capacity. Constraints can be induced by raw material shortages, interruptions in distribution channels, labor strikes in the plants of suppliers of important components, or governmental restrictions on markets (gas rationing, Quotas). MEDIUM 12–26 5. Chapter 12 Relevant Costing Under what circumstances is the sum of variable production and selling costs the appropriate minimum price for special orders? ANSWER: Variable costs would serve as the bottom price for a special order only if the special order could be produced on production capacity that would otherwise be idle. Whenever presently employed capacity is partially or wholly surrendered to produce a special order, the special order price would be based on both variable costs and the profit sacrificed on the best alternative use of the capacity. MEDIUM 6. Why are fixed costs generally more relevant in long-run decisions than short-run decisions? ANSWER: In the long run, all costs are relevant. In the short run, many costs that apply to the existing production technology are sunk. In particular, depreciation charges and lease payments on long-term assets are unavoidable. In the long run, these assets are replaced and, thus their associated costs are relevant in the replacement decision. MEDIUM Chapter 12 Relevant Costing 12–27 Use the following information for questions 7–9. Farmer Billy grows corn in a small rural area of Texas. Billy’s costs per bushel of corn (based on an average yield of 130 bushels per acre) follow: Direct material Direct labor Variable overhead Fixed overhead Variable selling costs Fixed selling costs $1.10 0.40 0.30 0.60 0.10 0 Billy defines direct material costs as seed, fertilizer, water, and other chemicals. The variable overhead costs represent maintenance and repair costs of machinery. The fixed overhead costs are completely comprised of depreciation expense on machinery and real estate taxes. 7. Assume that the current date is March 15. On this date, Farmer Billy must make a decision as to whether he is financially better off to plant his farm to corn or leave his land idle (no income is derived from idle land). Corn prices have been severely depressed in recent years and Farmer Billy’s best guess is that corn prices will be around $2.00 per bushel at the time his crop is ready for harvest. Should Billy plant corn or leave his land idle? Explain. ANSWER: Billy should make his decision by comparing the incremental income from planting the corn crop to the incremental expenses that would be incurred to grow, harvest, and market the crop. The incremental revenue is simply the $2.00 per bushel and the incremental costs are all variable costs ($1.10 + $0.40 + $0.30 + $0.10 = $1.90). Based on this comparison, Farmer Billy would be $13 per acre better off to plant than to let his land remain idle. MEDIUM 12–28 8. Chapter 12 Relevant Costing Assume for this question only that Billy decided to plant the corn. It is now harvest time and Billy’s actual costs are the same as those listed previously. A local oil refiner has approached Billy about converting his crop to grain alcohol (used to make gasohol) rather than selling his grain to the local grain elevator. If Billy converts the grain to alcohol, he will incur additional costs of $0.60 per bushel and he will be able to sell his crop to the oil refiner for the equivalent of $2.50 per bushel. Otherwise, Billy can sell his corn crop to the local grain elevator for $1.85 per bushel. If Billy elects to sell the grain to the refinery, he will not incur the variable selling costs. What should Billy do? Support your answer with calculations. ANSWER: Billy’s alternatives are to sell the corn as a grain or as alcohol. This decision can be made by comparing the incremental costs to convert the grain to alcohol to the increase in price he can receive for marketing the crop as alcohol rather than grain. By converting the crop to alcohol, Billy increases his total revenue by $0.75 per bushel ($2.60 – $1.85) and he incurs additional costs of $0.50 ($0.60 for the additional processing, less the $0.10 savings on the variable grain marketing costs). Thus, by converting the grain to alcohol, Billy could increase his net income by $0.25 per bushel. MEDIUM 9. Assume that the current date is March 15. On this date, Farmer Billy must make a decision as to whether he is financially better off to plant his farm to corn, leave his land idle (no income is derived from idle land), or rent his land to another farmer for $50 per acre. Corn prices have been severely depressed in recent years and Farmer Billy’s best guess is that corn prices will be around $2.00 per bushel at the time his crop is ready for harvest. What should Billy do? Show calculations. ANSWER: It has already been determined (answer to #80) that planting corn is preferred to leaving the land idle (by $13 per acre). By renting the land, Farmer Billy is even better off. Under the rental alternative, Farmer Billy is $37 per acre better off than if he plants corn ($50 – $13). By renting the land, Billy avoids all costs except the fixed production costs ($0.60 per bushel or $78 per acre). MEDIUM Chapter 12 10. Relevant Costing 12–29 Lisa and Yvette make and sell the “Kitchen Mystic,” a wall hanging depicting a witch. The Kitchen Mystics are sold at specialty shops for $50 each. The capacity of the plant is 15,000 Mystics per year. Costs to manufacture and sell each wall hanging are as follows: Direct material Direct labor Variable overhead Fixed overhead Variable selling expenses $ 5.00 6.00 8.00 10.00 2.50 Lisa and Yvette have been approached by an English company about purchasing 2,500 Mystics. The company is currently making and selling 15,000 per year. The English company wants to attach its own label, which increases costs by $.50 each. No selling expenses would be incurred on this order. Lisa and Yvette believe that they must make an additional $1 on each wall hanging to accept this offer. a. b. What is the opportunity cost per unit of selling to the English organization? What is the minimum selling price that should be set? ANSWER: a. Opportunity cost = Selling price minus total variable costs $50 – ($5 + $6 + $8 + $2.50) = $28.50 b. Direct material ($5.00 + $.50) Direct labor Variable overhead Fixed overhead Variable selling Opportunity cost [from (a) less fixed overhead included] Extra amount required to accept offer Minimum price MEDIUM $ 5.50 6.00 8.00 10.00 0 18.50 1.00 $49.00 12–30 11. Chapter 12 Relevant Costing Tiny Tim’s Accounting Service provides two types of services: audit and tax. All company personnel can perform either service. In efforts to market its services, Tiny Tim’s relies on radio and billboards for advertising. Information on Tiny Tim’s projected operations for 2001 follows: Revenue per billable hour Variable cost of professional labor Material cost per billable hour Allocated fixed costs per year Projected billable hours for 2001 a. b. Taxes $ 30 20 3 200,000 10,000 What is Tiny Tim’s projected profit or (loss) for 2001? If $1 spent on advertising could increase either audit services billable time by 1 hour or tax services billable time by 1 hour, on which service should the advertising dollar be spent? ANSWER: a. Revenue: 14,000 × $35 10,000 × $30 Variable Costs: Labor: 14,000 × $25 10,000 × $20 Material: 14,000 × $2 10,000 × $3 Contribution margin Fixed costs Profit (loss) b. Audit $ 35 25 2 100,000 14,000 Audit Tax Total $ 300,000 $ 490,000 300,000 $490,000 (350,000 ) (200,000 ) (350,000 ) (200,000 ) (30,000 ) $ 70,000 (200,000 ) $(130,000 ) (28,000 ) (30,000 ) $ 182,000 (300,000 ) $(118,000 ) (28,000 ) $112,000 (100,000 ) $ 12,000 Each billable hour of audit services generates $8 of contribution margin ($35 – $25 – $2), tax services generates $7 of contribution margin ($30 – $20 – $3). The advertising should be spent on the audit services. MEDIUM Chapter 12 12. Relevant Costing 12–31 Timothy Warren operates a woodworking shop that makes tables and chairs. He has 25 employees working 40 hours per week, and he has 750 hours per week available in machine time. Timothy knows that he must make at least four chairs for every table. He has also determined the following additional requirements: Table Chair Labor hours 5 3 Machine hours 2 1 Contribution margin $18 4 Write the object function and constraints for the above problem. ANSWER: Objective function: Max CM--> 18X + 4Y Subject to: 4X – Y > 0 5X + 3Y 1,000 2X + Y 750 X = # of tables Y = # of chairs 13. Define and discuss outsourcing. ANSWER: Outsourcing occurs when an organization “farms out” some of its normal business activities or processes. Several areas that are most frequently outsourced by an organization include payroll, accounting, transportation, and possibly legal. When a company outsources some of its functions, it is able to divert more energy to those areas that produce a firm’s core competencies or have the ability to create revenues for the firm. MEDIUM 12–32 14. Chapter 12 Relevant Costing The management of Smith Industries has been evaluating whether the company should continue manufacturing a component or buy it from an outside supplier. A $100 cost per component was determined as follows: Direct material Direct labor Variable manufacturing overhead Fixed manufacturing overhead $ 15 40 10 35 $100 Smith Industries uses 4,000 components per year. After Jones Corp. submitted a bid of $80 per component, some members of management felt they could reduce costs by buying from outside and discontinuing production of the component. If the component is obtained from Jones Corp., Smith’s unused production facilities could be leased to another company for $50,000 per year. Required: a. Determine the maximum amount per unit Smith could pay an outside supplier. b. Indicate if the company should make or buy the component and the total dollar difference in favor of that alternative. c. Assume the company could eliminate one production supervisor with a salary of $30,000 if the component is purchased from an outside supplier. Indicate if the company should make or buy the component and the total dollar difference in favor of that alternative. ANSWER: a. Cost to make = incremental manufacturing cost and opportunity cost = DM + DL + V – FOH + OP COST $77.50 = $15 + $40 + $10 + ($50,000/4,000 units) b. Make: Save ($80.00 – $77.50) × 4,000 = $10,000 c. Incremental mfg. = $65 + ($30,000/4,000) = $72.50 + opportunity cost $50,000/4,000 = 12.50 To make $85.00 Buy: Save ($85 – $80) × 4,000 units = $20,000 MEDIUM Chapter 12 15. Relevant Costing 12–33 Brown Corp is working at full production capacity producing 10,000 units of a unique product, XYZ. Manufacturing costs per unit for XYZ follow: Direct material Direct manufacturing labor Manufacturing overhead $ 2 3 5 $10 The unit manufacturing overhead cost is based on a variable cost per unit of $2 and fixed costs of $30,000 (at full capacity of 10,000 units). The non-manufacturing costs, all variable, are $4 per unit, and the selling price is $20 per unit. A customer, the Miami Co., has asked Brown to produce 2,000 units of a modification of XYZ to be called ABC. ABC would require the same manufacturing processes as XYZ and the Miami Co. has offered to share equally the non-manufacturing costs with Brown. ABC will sell at $15 per unit. Required: a. What is the opportunity cost to Brown of producing the 2,000 units of ABC (assume that no overtime is worked)? b. The Jones Co. has offered to produce 2,000 units of XYZ for Brown, so Brown can accept the Miami offer. Jones would charge Brown $14 per unit for the XYZ. Should Brown accept the Jones offer? c. Suppose Brown had been working at less than full capacity producing 8,000 units of XYZ at the time the ABC offer was made. What is the minimum price Brown should accept for ABC under these conditions (ignoring the $15 price mentioned previously)? 12–34 Chapter 12 Relevant Costing ANSWER: a. XYZ SP – VC = CM $ 20 (11 ) $ 9 ($2 + $3 + $2 + $4) × 2,000 units = $18,000 ABC SP – VC = CM $15 (9 ) $ 6 ($2 + $3 + $2 + $2) × 2,000 units = 12,000 Opportunity cost $ 6,000 b. Make ($15 – $14) = $1 × 2,000 units = $2,000 without giving up any current production = DO IT. c. The variable cost to make and sell = $11 ($2 + $3 + $2 + $4) would be the minimum. Any price over $11 would increase the contribution margin. MEDIUM Chapter 12 16. Relevant Costing 12–35 The Davis Company normally produces 150,000 units of AB per year. Due to an economic downturn, the company has some idle capacity. AB sells for $15 per unit. The firm’s production, marketing, and administration costs at its normal capacity are: Direct material Direct labor Variable overhead Fixed overhead ($450,000/150,000 units) Variable marketing costs Fixed marketing and administrative costs ($210,000/150,000 units) Total Per Unit $1.00 2.00 1.50 3.00 1.05 1.40 $9.95 Required: a. Compute the firm’s operating income before income taxes if the firm produced and sold 110,000 units in 2001. b. For 2002, the firm expects to sell the same number of units as it sold in 2001. However, in a trade newspaper, the firm noticed an invitation to bid on selling AB to a state government. There are no marketing costs associated with the order if Davis is awarded the contract. The company wishes to prepare a bid for 40,000 units at its full manufacturing cost plus $ 0.25 per unit. How much should it bid? If Davis is successful at getting the contract, what would be its effect on operating income? c. Assume that the company is awarded the contract on January 2, 2002, and in addition it also receives an order from a foreign vendor for 40,000 units at the regular price of $15 per unit. The foreign shipment will require the firm to incur its normal marketing costs. The government contract contains a 10-day escape clause (i.e., the firm can reject the contract within 10 days without any penalty). If the firm accepts the government contract, overtime pay at 1½ times the straight time rate will be paid on the 40,000 units. In addition, fixed overhead will increase by $60,000 and variable overhead will behave in its normal pattern. The company has the capacity to product both orders. Decide the following: 1. Should the firm accept the foreign offer? Show the effect on operating income of accepting the order. 2. Assuming the foreign order is accepted, should the firm accept the government order? Show the effect on operating income of accepting the government order. 12–36 Chapter 12 Relevant Costing ANSWER: a. Sales (110,000 × $15) – VC (110,000 × $5.55) = CM – FC ($450,000 + $210,000) = Operating Income b. Full cost to manufacture = $7.50 + profit .25 Bid $7.75 SP – VC CM c. $1,650,000 (610,500 ) $1,039,500 (660,000 ) $ 379,500 $7.75 (4.50 ) $3.25 × 40,000 units = $130,000 increase in operating income. 1. SP $15.00 – VC (6.55 ) ($1 + $3 + $1.50 + $1.05) CM $ 8.45 × 40,000 = $338,000 – FC (60,000 ) Increase in Operating Income $278,000 2. Both orders can be accepted even if the increased costs of $40,000 for labor and $60,000 for fixed overhead are assigned to the government order. DIFFICULT CHAPTER 13 THE MASTER BUDGET MULTIPLE CHOICE 1. A budget aids in a. b. c. d. communication. motivation. coordination. all of the above. ANSWER: 2. Planning Controlling Organizing Staffing ANSWER: b EASY The preparation of an organization’s budget a. b. c. d. forces management to look ahead and try to see the future of the organization. requires that the entire management team work together to make and carry out the yearly plan. makes performance review possible at all levels of management. all of the above. ANSWER: 4. EASY Measuring the firm’s performance against established objectives is part of which of the following functions? a. b. c. d. 3. d d EASY Which of the following is a basic element of effective budgetary control? a. b. c. d. cost behavior patterns cost-volume-profit analysis standard costing all of the above ANSWER: a EASY 13–1 13–2 5. Chapter 13 When actual performance varies from the budgeted performance, managers will be more likely to revise future budgets if the variances were a. b. c. d. controllable rather than uncontrollable. uncontrollable rather than controllable. favorable rather than unfavorable. small. ANSWER: 6. b EASY A budget is a. b. c. d. a planning tool. a control tool. a means of communicating goals to the firm’s divisions. all of the above. ANSWER: d EASY Ineffective budgets and/or control systems are characterized by the use of a. b. c. d. budgets as a planning tool only and disregarding them for control purposes. budgets for motivation. budgets for coordination. the budget for communication. ANSWER: 9. MEDIUM annual budget. industry price and cost structure. talents possessed by its managers. board of directors. ANSWER: 8. b External factors that cause the achievement of company goals are the a. b. c. d. 7. The Master Budget a EASY Strategic planning is a. b. c. d. planning activities for promoting products for the future. planning for appropriate assignments of resources. setting standards for the use of important but hard-to-find materials. stating and establishing long-term plans. ANSWER: d EASY Chapter 13 10. The Master Budget Key variables that are identified in strategic planning are a. b. c. d. normally controllable if they are internal. seldom if ever controllable. normally controllable if they occur in a domestic market. normally uncontrollable if they are internal. ANSWER: 11. c EASY Which of the following statements is true? a. b. c. d. All organizations have the same set of budgets. All organizations are required to budget. Budgets are a quantitative expression of an organization’s goals and objectives. Budgets should never be used to evaluate performance. ANSWER: c EASY Which of the following is not an “operating” budget? a. b. c. d. sales budget production budget purchases budget capital budget ANSWER: 14. EASY middle top middle and top operational ANSWER: 13. a Tactical planning usually involves which level of management? a. b. c. d. 12. 13–3 d EASY The master budget is a static budget because it a. b. c. d. is geared to only one level of production and sales. never changes from one year to the next. covers a preset period of time. always contains the same operating and financial budgets. ANSWER: a EASY 13–4 15. Chapter 13 The master budget is a a. b. c. d. static budget. flexible budget. qualitative expression of a prior goal. qualitative expression of a future goal. ANSWER: 16. d EASY Which of the following is usually perceived as being the master budget’s greatest advantage to management? a. b. c. d. performance analysis increased communication increased coordination required planning ANSWER: d EASY Chronologically, the first part of the master budget to be prepared would be the a. b. c. d. sales budget. production budget. cash budget. pro forma financial statements. ANSWER: 19. EASY an operating budget. a capital budget. pro forma financial statements. all of the above. ANSWER: 18. a The master budget usually includes a. b. c. d. 17. The Master Budget a EASY An example of a recurring short-term plan is a. b. c. d. a probable product line change. expansion of plant and facilities. a unit sales forecast. a change in marketing strategies. ANSWER: c EASY Chapter 13 20. The Master Budget If the chief accountant of a firm has to prepare an operating budget for the coming year, the first budget to be prepared is the a. b. c. d. sales budget. cash budget. purchases budget. capital budget. ANSWER: 21. EASY capital budget. cash budget. purchases budget. pro forma balance sheet. ANSWER: a EASY Budgeted production for a period is equal to a. b. c. d. the beginning inventory + sales – the ending inventory. the ending inventory + sales – the beginning inventory. the ending inventory + the beginning inventory – sales. sales – the beginning inventory + purchases. ANSWER: 23. a It is least likely that a production budget revision would cause a revision in the a. b. c. d. 22. 13–5 b EASY Chronologically, in what order are the sales, purchases, and production budgets prepared? a. b. c. d. sales, purchases, production sales, production, purchases production, sales, purchases purchases, sales, production ANSWER: b EASY 13–6 24. Chapter 13 The material purchases budget tells a manager all of the following except the a. b. c. d. quantity of material to be purchased each period. quantity of material to be consumed each period. cost of material to be purchased each period. cash payment for material each period. ANSWER: 25. EASY sales material usage revenues general and administrative ANSWER: b EASY The amount of raw material purchased in a period may be different than the amount of material used that period because a. b. c. d. the number of units sold may be different from the number of units produced. finished goods inventory may fluctuate during the period. the raw material inventory may increase/decrease during the period. companies often pay for material in the period after it is purchased. ANSWER: 27. d Of the following budgets, which one is least likely to be determined by the dictates of top management? a. b. c. d. 26. The Master Budget c MEDIUM A purchases budget is a. b. c. d. not affected by the firm’s policy of granting credit to customers. the same thing as a production budget. needed only if a firm does not pay for its merchandise in the same period as it is purchased. affected by a firm’s inventory policy only if the firm purchases on credit. ANSWER: a EASY Chapter 13 28. The Master Budget 13–7 Which of the following equations can be used to budget purchases? (BI = beginning inventory, EI = ending inventory desired, CGS = budgeted cost of goods sold, P = budgeted purchases) a. b. c. d. P = CGS + BI – EI P = CGS + BI P = CGS + EI + BI P = CGS + EI – BI ANSWER: 29. material purchases budget. production budget. pro forma income statement. cash budget. ANSWER: a EASY A company that maintains a raw material inventory, which is based on the following month’s production needs, will purchase less material than it uses in a month where a. b. c. d. sales exceed production. production exceeds sales. planned production exceeds the next month’s planned production. planned production is less than the next month’s planned production. ANSWER: 31. EASY Both the budgeted quantity of material to be purchased and the budgeted quantity of material to be consumed can be found in the a. b. c. d. 30. d c MEDIUM If a company has a policy of maintaining an inventory of finished goods at a specified percentage of the next month’s budgeted sales, budgeted production for January will exceed budgeted sales for January when budgeted a. b. c. d. February sales exceed budgeted January sales. January sales exceed budgeted December sales. January sales exceed budgeted February sales. December sales exceed budgeted January sales. ANSWER: a MEDIUM 13–8 32. Chapter 13 Depreciation on the production equipment would appear in which of the following budgets? a. b. c. d. cash budget production budget selling and administrative expense budget manufacturing overhead budget ANSWER: 33. EASY production sales cash purchases ANSWER: b EASY The budgeted amount of selling and administrative expense for a period can be found in the a. b. c. d. sales budget. cash budget. pro forma income statement. pro forma balance sheet. ANSWER: 35. d The selling, general, and administrative expense budget is based on the _______________ budget. a. b. c. d. 34. The Master Budget c EASY Which of the following represents a proper sequencing in which the budgets below are prepared? a. b. c. d. Direct Material Purchases, Cash, Sales Production, Sales, Income Statement Sales, Balance Sheet, Direct Labor Sales, Production, Manufacturing Overhead ANSWER: d EASY Chapter 13 36. The Master Budget The detailed plan for the acquisition and replacement of major portions of property, plant, and equipment is known as the a. b. c. d. capital budget. purchases budget. commitments budget. treasury budget. ANSWER: 37. EASY labor budget. pro forma income statement. selling, general, and administrative expense budget. cash budget. ANSWER: d EASY The cash budget ignores all a. b. c. d. dividend payments. sales of capital assets. noncash accounting accruals. sales of common stock. ANSWER: 39. a The budgeted payment for labor cost each period would be found in the a. b. c. d. 38. 13–9 c EASY Which of the following items would not be found in the financing section of the cash budget? a. b. c. d. cash payments for debt retirement cash payments for interest dividend payments payment of accounts payable ANSWER: d EASY 13–10 40. Chapter 13 The primary reason that managers impose a minimum cash balance in the cash budget is a. b. c. d. because management needs discretionary cash for unforeseen business opportunities. managers lack discipline to control their spending. that it protects the organization from the uncertainty of the budgeting process. that it makes the financial statements look more appealing to creditors. ANSWER: 41. EASY pro forma financial statements. cash budget. capital budget production budget. ANSWER: a EASY The pro forma income statement is not a component of the a. b. c. d. master budget. financial budgets. operating budgets. capital budget. ANSWER: 43. c Chronologically, the last part of the master budget to be prepared would be the a. b. c. d. 42. The Master Budget c EASY A pro forma financial statement is a. b. c. d. a financial statement for past periods. a projected or budgeted financial statement. presented for the form but contains no dollar amounts. a statement of planned production. ANSWER: b EASY Chapter 13 44. The Master Budget A master budget contains which of the following? a. b. c. d. Sales yes no no yes ANSWER: 45. a Pro forma statements yes yes no yes EASY production budget. sales budget. purchases budget. pro forma income statement. ANSWER: d EASY A budget that includes a 12-month planning period at all times is called a ____________ budget. a. b. c. d. pro forma flexible master continuous ANSWER: 47. Production yes no no no The budgeted cost of products to be sold in a future period would be found in the a. b. c. d. 46. 13–11 d EASY The method of budgeting that adds one month’s budget to the end of the plan when the current month’s budget is dropped from the plan is called ____________ budgeting. a. b. c. d. long-term operations incremental continuous ANSWER: d EASY 13–12 48. Chapter 13 Slack in operating budgets a. b. c. d. results from unintentional managerial acts. makes an organization more efficient and effective. requires managers to work harder to achieve the budget. is greater when managers are allowed to participate in the budgeting process. ANSWER: 49. d EASY Budget slack is a condition in which a. b. c. d. demand is low at various times of the year. excess machine capacity exists in some areas of the plant. there is an intentional overestimate of expenses or an underestimate of revenues. managers grant favored employees extra time off. ANSWER: 50. The Master Budget c EASY E Co. has the following expected pattern of collections on credit sales: 70 percent collected in the month of sale, 15 percent in the month after the month of sale, and 14 percent in the second month after the month of sale. The remaining 1 percent is never collected. At the end of May, E Co. has the following accounts receivable balances: From April sales From May sales $21,000 48,000 E’s expected sales for June are $150,000. What were total sales for April? a. b. c. d. $150,000 $72,414 $70,000 $140,000 ANSWER: d MEDIUM Chapter 13 51. The Master Budget Ball Company has a policy of maintaining an inventory of finished goods equal to 30 percent of the following month’s sales. For the forthcoming month of March, Ball has budgeted the beginning inventory at 30,000 units and the ending inventory at 33,000 units. This suggests that a. b. c. d. February sales are budgeted at 10,000 units less than March sales. March sales are budgeted at 10,000 units less than April sales. February sales are budgeted at 3,000 units less than March sales. March sales are budgeted at 3,000 units less than April sales. ANSWER: 52. 13–13 b MEDIUM Budgeted sales for the first six months of 2001 for Henry Corp. are listed below: UNITS: JANUARY 6,000 FEBRUARY 7,000 MARCH 8,000 APRIL 7,000 MAY 5,000 JUNE 4,000 Henry Corp. has a policy of maintaining an inventory of finished goods equal to 40 percent of the next month’s budgeted sales. If Henry Corp. plans to produce 6,000 units in June, what are budgeted sales for July? a. b. c. d. 3,600 units 1,000 units 9,000 units 8,000 units ANSWER: 53. c DIFFICULT McGill Co. manufactures card tables. The company has a policy of maintaining a finished goods inventory equal to 40 percent of the next month’s planned sales. Each card table requires 3 hours of labor. The budgeted labor rate for the coming year is $13 per hour. Planned sales for the months of April, May, and June are respectively 4,000; 5,000; and 3,000 units. The budgeted direct labor cost for June for McGill Co. is $136,500. What are budgeted sales for July for McGill Co.? a. b. c. d. 3,500 units 4,250 units 4,000 units 3,750 units ANSWER: b DIFFICULT 13–14 54. Chapter 13 The Master Budget Budgeted sales for K Inc. for the first quarter of 2001 are shown below: UNITS: JANUARY 35,000 FEBRUARY 25,000 MARCH 32,000 The company has a policy that requires the ending inventory in each period to be 10 percent of the following period’s sales. Assuming that the company follows this policy, what quantity of production should be scheduled for February? a. b. c. d. 24,300 units 24,700 units 25,000 units 25,700 units ANSWER: 55. d MEDIUM Budgeted sales for the first six months of 2001 for Henry Corp. are listed below: UNITS: JANUARY 6,000 FEBRUARY 7,000 MARCH 8,000 APRIL 7,000 MAY 5,000 JUNE 4,000 Henry Corp. has a policy of maintaining an inventory of finished goods equal to 40 percent of the next month’s budgeted sales. How many units has Henry Corp. budgeted to produce in the first quarter of 2001? a. b. c. d. 21,400 units 20,600 units 19,000 units 23,000 units ANSWER: a DIFFICULT Chapter 13 56. The Master Budget 13–15 Production of Product X has been budgeted at 200,000 units for May. One unit of X requires 2 lbs. of raw material. The projected beginning and ending materials inventory for May are: Beginning inventory: 2,000 lbs. Ending inventory: 10,000 lbs. How many lbs. of material should be purchased during May? a. b. c. d. 192,000 208,000 408,000 416,000 ANSWER: 57. c MEDIUM X Co. manufactures toy airplanes. Information on X Co.’s labor costs follow: Sales commissions Administration Indirect factory labor Direct factory labor $5 per plane $10,000 per month $3 per plane $5 per plane The following information applies to the upcoming month of July for X Co.: Budgeted production Budget sales 1,200 units 1,000 units What amount of budgeted labor cost would appear in the July selling, general, and administrative expense budget? a. b. c. d. $10,000 $16,000 $15,000 $23,000 ANSWER: c MEDIUM 13–16 58. Chapter 13 McGill Co. manufactures card tables. The company has a policy of maintaining a finished goods inventory equal to 40 percent of the next month’s planned sales. Each card table requires 3 hours of labor. The budgeted labor rate for the coming year is $13 per hour. Planned sales for the months of April, May, and June are respectively 4,000; 5,000; and 3,000 units. What is McGill Co.’s budgeted direct labor cost for May? a. b. c. d. $54,600 $163,800 $226,200 $179,400 ANSWER: 59. The Master Budget b DIFFICULT X Co. manufactures toy airplanes. Information on X Co.’s labor costs follow: Sales commissions Administration Indirect factory labor Direct factory labor $5 per plane $10,000 per month $3 per plane $5 per plane The following information applies to the upcoming month of July for X Co.: Budgeted production Budget sales 1,200 units 1,000 units What is X Co.’s budgeted factory labor cost for July? a. b. c. d. $8,000 $15,600 $25,600 $9,600 ANSWER: d MEDIUM Chapter 13 60. The Master Budget 13–17 E Co. has the following expected pattern of collections on credit sales: 70 percent collected in the month of sale, 15 percent in the month after the month of sale, and 14 percent in the second month after the month of sale. The remaining 1 percent is never collected. At the end of May, E Co. has the following accounts receivable balances: From April sales From May sales $21,000 48,000 E’s expected sales for June are $150,000. How much cash will E Co. expect to collect in June? a. b. c. d. $127,400 $129,000 $148,600 $152,520 ANSWER: 61. c DIFFICULT For the month of October, P Corp. predicts total cash collections to be $1 million. Also for October, P Corp. estimates that its beginning cash balance will be $50,000 and that it will borrow cash in the amount of $70,000. If P Corp. estimates an ending cash balance of $30,000 for October, what must its projected cash disbursements be? a. b. c. d. $1,090,000 $1,120,000 $1,070,000 $1,020,000 ANSWER: a MEDIUM 13–18 62. Chapter 13 The Master Budget Volkers Hospital has provided you with the following budget information for April: Cash collections April 1 cash balance Cash disbursements $876,000 23,000 978,600 Volkers has a policy of maintaining a minimum cash balance of $20,000 and borrows only in $1,000 increments. How much will Volkers borrow in April? a. b. c. d. $80,000 $79,600 $99,000 $100,000 ANSWER: d MEDIUM Use the following information for questions 63–65. Beginning cash balance Cash collections Cash disbursements Cash excess (shortage) Borrowing (repayments) Ending cash 63. In CASE A, what are the budgeted cash collections? a. b. c. d. $700 $500 $300 $400 ANSWER: 64. CASE A $ 100 ? 500 ? 300 200 CASH BUDGET CASE B $ 300 400 ? ? 100 200 c MEDIUM In CASE B, what are the budgeted cash disbursements? a. b. c. d. $600 $700 $500 $400 ANSWER: a MEDIUM CASE C $ 700 ? 600 400 ? 100 Chapter 13 65. The Master Budget 13–19 In CASE C, what are the budgeted cash collections? a. b. c. d. $200 $300 $400 $500 ANSWER: b MEDIUM Use the following information for questions 66–69. Beginning cash Cash collections Cash disbursements Cash excess (shortage) Borrowing (repayments) Ending Cash 66. What is the correct value of item A in the cash budget? a. b. c. d. $200 $300 $400 $900 ANSWER: 67. QTR 1 $300 900 B 200 ? 200 CASH BUDGET QTR 2 QTR 3 QTR 4 $200 $ ? $? 700 C ? ? 600 ? (400 ) ? ? 600 (300 ) 0 ? 200 ? b EASY What is the correct value of item B in the cash budget? a. b. c. d. $1,000 $1,200 $800 $700 ANSWER: a MEDIUM YEAR $ A 3,300 3,500 ? ? D 13–20 68. Chapter 13 What is the correct value of item C in the cash budget? a. b. c. d. $1,400 $1,200 $900 $700 ANSWER: 69. a MEDIUM Managers may be more willing to accept a budget if a. b. c. d. it is continuous. it is imposed. it is very hard to attain. they can participate in its development. ANSWER: d EASY (Appendix) A budget manual should include which of the following? a. b. c. d. a list of specific budgetary activities to be performed original, revised, and approved budgets a calendar of scheduled budgetary activities all of the above ANSWER: 72. MEDIUM $200 $300 $400 $1,000 ANSWER: 71. c What is the correct value of item D in the cash budget? a. b. c. d. 70. The Master Budget d EASY Which of the following is not true about an imposed budget? a. b. c. d. It reduces the budgeting process time frame. It uses the knowledge of top management as it relates to resource availability. It enhances coordination. It increases the feeling of teamwork. ANSWER: d EASY Chapter 13 73. The Master Budget A disadvantage of participatory budgets is that a. b. c. d. there is a high degree of acceptance of the goals and objectives by operating management. they are usually more realistic. they lead to better morale and higher motivation. they usually require more time to prepare. ANSWER: 74. 13–21 d EASY The master budget a. b. c. d. reflects the determination of an organization’s cost of capital. serves as a managerial tool for the organization. includes only an organization’s pro forma financial statements. utilizes only information from the financial accounting system. ANSWER: b EASY SHORT ANSWER/PROBLEMS 1. Explain why managers might want to build slack into a budget. ANSWER: Building slack into the budget allows managers to achieve the budgeted level of performance with less effort. Thus, they have a higher probability of achieving the budget and any bonus or compensation that may be tied to that performance standard. MEDIUM 2. What role does the budgeting activity play in managerial compensation and performance evaluation? ANSWER: Once set, the budget is not only a plan for the organization, but it becomes a standard against which actual performance may be compared. Recognizing the budget as a performance standard, organizations may base employee compensation (to some extent) on how well actual performance compares to the budgeted performance. Such a compensatory arrangement frequently involves a bonus plan that permits bonuses to go up as performance relative to the budget goes up. MEDIUM 13–22 3. Chapter 13 The Master Budget Why will there frequently be a difference between the budgeted cost of material in the material purchases budget and the budgeted cash disbursement for material in the cash budget? ANSWER: Because firms do not necessarily pay for material in the same period in which they are purchased, the amounts in these two budgets will frequently differ. The material purchases budget is based on the cost of material purchased in a period while the cash budget only reflects expected actual payments for material in the period. MEDIUM 4. Explain why different types of organizations will have different sets of budgets. ANSWER: We may think of the set of budgets as the plan for producing outputs and acquiring inputs. As different organizations have different inputs and outputs, we would naturally expect them to have different budgets. For example, a retailing firm would find no need for a production budget because it does not manufacture anything. On the other hand, the need for a production budget in a manufacturing organization is obvious. Likewise, governmental organizations will have budgets that are different than private organizations. MEDIUM 5. Why have many managers in recent years moved toward emphasizing employee participation in the budgeting process rather than simply imposing the budget on the employees? ANSWER: Many managers believe that the quality of the budget is enhanced through employee participation. This is attributable in part to the fact that many employees possess technical information that management does not have. Through the budgeting process this technical information is imparted to management. Further, participation in the budgeting process may lead employees to be more attentive to the budget and feel like a more important part of the organizational team. Employees feel more committed to meeting a budget they helped prepare. Preparing a budget gives the preparer management training, which makes him or her better prepared for advancement in the company. MEDIUM Chapter 13 6. The Master Budget 13–23 The I. M. Broke Co. has the following collection pattern for its accounts receivable: 40 percent in the month of sale 50 percent in the month following the sale 8 percent in the second month following the sale 2 percent uncollectible The company has recent credit sales as follows: April: May: June: $200,000 420,000 350,000 How much should the company expect to collect on its receivables in June? ANSWER: JUNE COLLECTIONS From April sales: $200,000 × .08 From May sales: 420,000 × .50 From June sales: 350,000 × .40 Total MEDIUM $ 16,000 210,000 140,000 $366,000 13–24 Chapter 13 The Master Budget Use the following information for questions 7 and 8. 7. Barnes Company manufactures three products (A, B, and C) from three raw materials (X, Y, and Z). The following table indicates the number of pounds of each material that is required to manufacture each type of product: Product A B C Material X 2 2 3 Material Y 3 1 2 Material Z 2 2 2 The company has a policy of maintaining an inventory of finished goods on all three products equal to 25 percent of the next month’s budgeted sales. Listed below is the sales budget for the first quarter of 2001: Month Jan. Feb. Mar. Product A 10,000 9,000 11,000 Product B 11,000 12,000 10,000 Product C 12,000 8,000 10,000 Assuming that the company meets its required inventory policy, prepare a production budget for the first 2 months of 2001 for each of the three products. ANSWER: Required ending inventory Projected sales Total production needs Less the beginning inventory Budgeted production Product A January February 2,250 2,750 10,000 9,000 12,250 11,750 (2,500 ) (2,250 ) 9,750 9,500 Required ending inventory Projected sales Total production needs Less the beginning inventory Budgeted production Product B January February 3,000 2,500 11,000 12,000 14,000 14,500 (2,750 ) (3,000 ) 11,250 11,500 Required ending inventory Projected sales Total production needs Less the beginning inventory Budgeted production Product C January February 2,000 2,500 12,000 8,000 14,000 10,500 (3,000 ) (2,000 ) 11,000 8,500 MEDIUM Chapter 13 8. The Master Budget 13–25 Unit costs of materials X, Y, and Z are respectively $4, $3, and $5. The Barnes Company has a policy of maintaining its raw material inventories at 50 percent of the next month’s production needs. Assuming that this policy is satisfied, prepare a material purchases budget for all three materials in both pounds and dollars for January. ANSWER: Prod. × lbs. Tot. Product A Jan. Feb. 9,750 9,500 ×2 ×2 19,500 19,000 Material X Purchases Product B Jan. Feb. 11,250 11,500 ×2 ×2 22,500 23,000 Required EI (19,000 + 23,000 + 25,500) × .50 = Needed: (19,500 + 22,500 + 33,000) = Total raw material X needed: Less: BI (75,000 × .50) Material X to be purchased in January (pounds): Multiply by cost of Material X per lb.: Budgeted Cost of Material X for January: Prod. × lbs. Tot. Product A Jan. Feb. 9,750 9,500 ×3 ×3 29,250 28,500 Material Y Purchases Product B Jan. Feb. 11,250 11,500 ×1 ×1 11,250 11,500 Required EI (28,500 + 11,500 + 17,000) × .50 = Needed: (29,250 + 11,250 + 22,000) = Total raw material Y needed: Less BI (62,500 × .50) Material Y to be purchased in January (pounds): Multiply by cost of Material Y per lb.: Budgeted Cost of Material Y for January: Product C Jan. Feb. 11,000 8,500 ×3 ×3 33,000 25,500 33,750 75,000 108,750 (37,500 ) 71,250 × $4 $285,000 Product C Jan. Feb. 11,000 8,500 ×2 ×2 22,000 17,000 28,500 62,500 91,000 (31,250 ) 59,750 × $3 $179,250 13–26 Chapter 13 Prod. × lbs. Tot. Product A Jan. Feb. 9,750 9,500 ×2 ×2 19,500 19,000 Material Z Purchases Product B Jan. Feb. 11,250 11,500 ×2 ×2 22,500 23,000 Required EI (19,000 + 23,000 + 17,000) × .50 = Needed: (19,500 + 22,500 + 22,000) = Total raw material Z needed: Less BI (64,000 × .50) Material Z to be purchased in January (pounds): Multiply by cost of Material Z per lb.: Budgeted Cost of Material Z for January: The budgeted cost of all materials to be purchased in Jan. would be $285,000 + $179,250 + $307,500 = DIFFICULT The Master Budget Product C Jan. Feb. 11,000 8,500 ×2 ×2 22,000 17,000 29,500 64,000 93,500 (32,000 ) 61,500 ×5 $307,500 $771,750 Chapter 13 The Master Budget 13–27 Use the following information for questions 9 and 10. 9. Farr Music Inc. sells Baldwin pianos. The following information regarding operating costs has been extracted from budgets of Farr Music for December of this year and the first few months of next year: Payroll Insurance Rent Depreciation Taxes Dec. $12,000 4,000 6,000 2,000 1,200 Jan. $13,000 4,000 6,000 2,000 1,400 Feb. $22,000 4,000 6,000 2,000 2,300 Mar. $16,000 4,000 6,000 2,000 2,000 In addition to the above operating costs, enough pianos are purchased each month to maintain the inventory at 40 percent of the projected next month’s sales. The firm is expected to be in compliance with this policy on December 1. Budgeted sales are: Budgeted sales in units: Dec. 40 Jan. 45 Feb. 60 Mar. 50 Apr. 40 The average cost of a piano is $500. Merchandise is paid for in the month following its purchase. All other expenses are paid in the month in which they are incurred. Prepare a budget of the cash disbursements for Farr Music Inc. for the first three months of next year. First, prepare a purchases budget for December through March for the pianos. ANSWER: Required ending inventory Projected sales Total pianos needed Less the beginning inventory Pianos to be purchased × the cost of the piano Budgeted purchases Dec. 18 40 58 (16 ) 42 × $500 $21,000 Payroll Insurance Rent Taxes Merchandise purchases Total Budgeted cash disbursements Jan. Feb. Mar. $13,000 $22,000 $16,000 4,000 4,000 4,000 6,000 6,000 6,000 1,400 2,300 2,000 21,000 25,500 28,000 $45,400 $59,800 $56,000 MEDIUM Jan. 24 45 69 (18 ) 51 × $500 $25,500 Feb. 20 60 80 (24 ) 56 × $500 $28,000 Mar. 16 50 66 (20 ) 46 × $500 $23,000 13–28 10. Chapter 13 The Master Budget The average cost of a piano is $500. Merchandise is paid for in the month following its purchase. All other expenses are paid in the month in which they are incurred. On average, a piano sells for $1,500. Of each sale, 40 percent of the sales price is collected in the month of sale. The balance is collected in the month following the sale. Prepare a cash budget for the first three months of next year. The beginning cash balance on January 1 is budgeted to be $50,000. ANSWER: Beginning cash Cash collections: Dec. sales Jan. sales Feb. sales Mar. Sales Cash available Less cash disb. Ending cash MEDIUM CASH BUDGET FARR MUSIC INC. Jan. Feb. $50,000 $ 67,600 36,000 27,000 _______ 113,000 (45,400 ) $ 67,600 40,500 36,000 _______ 144,100 (59,800 ) $ 84,300 Mar. $ 84,300 54,000 30,000 168,300 (56,000 ) $112,300 Chapter 13 11. The Master Budget 13–29 Shown below are the totals from 2002 period budgets. Revenue budget Materials usage from production budget Labor cost budget Manufacturing overhead budget General and administrative budget Capital expenditure budget Work in Progress Inventories: Beginning of 2002 End of 2002 Finished Goods Inventory: Beginning of 2002 End of 2002 Tax Rate $100,000 15,000 20,000 20,000 30,000 20,000 10,000 5,000 15,000 10,000 40% Required: Prepare a forecasted Income Statement for 2002. ANSWER: Revenue Less: COGS COGM RM used (production budget) DL (labor budget) Mfg. OH (OH budget) Current Mfg. costs Plus: Beg. WIP Total In-Process Less: End WIP COGM Plus: Beg. FG Goods Avail. for Sale Less: End FG COGS Gross Margin Less: G & A expense budget Income before income taxes Less: taxes @ 40% Net Income MEDIUM $100,000 $ 15,000 20,000 20,000 $ 55,000 10,000 $ 65,000 (5,000 ) $ 60,000 15,000 $ 75,000 (10,000 ) 65,000 $ 35,000 (30,000 ) $ 5,000 (2,000 ) $ 3,000 13–30 12. Chapter 13 The Master Budget The following are forecasts of sales and purchases for a company. April May June Sales $80,000 90,000 85,000 Purchases $30,000 40,000 30,000 All sales are on credit. Records show that 70 percent of the customers pay the month of the sale, 20 percent pay the month after the sale, and the remaining 10 percent pay the second month after the sale. Purchases are all paid the following month at a 2 percent discount. Cash disbursements for operating expenses in June were $5,000. Required: Prepare a schedule of cash receipts and disbursement for June. ANSWER: Schedules of Cash Receipts and Disbursements for June Cash Receipts: From current month sale (June) From 1 month prior sale (May) From 2 month prior sale (April) Total cash receipts Cash Disbursements: May purchases @ 98% (less discount) Operating expenses Total cash disbursements Net increase in cash for June MEDIUM (.7 × 85,000) (.2 × 90,000) (.1 × 80,000) $59,500 18,000 8,000 $85,500 (.98 × 40,000) $39,200 5,000 $44,200 $41,300 Chapter 13 13. The Master Budget 13–31 Flour International is in the building construction business. In 2002, it is expected that 40 percent of a month’s sales will be collected in cash, with the balance being collected the following month. Of the purchases, 50 percent are paid the following month, 30 percent are paid in two months, and the remaining 20 percent are paid during the month of purchase. The sales force receives $2,000 a month base pay plus a 2 percent commission. Labor expenses are expected to be $4,000 a month. Other operating expenses are expected to run about $2,000 a month, including $500 for depreciation. The ending cash balance for 2001 was $4,500. 2001—Actual November December 2002—Budgeted January February March Sales Purchases $80,000 90,000 $70,000 80,000 70,000 90,000 30,000 70,000 60,000 50,000 Required: a. Prepare a cash budget and determine the projected ending cash balances for the first three months of 2002. b. Determine the months that the company would either borrow or invest cash. 13–32 Chapter 13 ANSWER: a. Sales Purchases 2001 Nov. $80,000 70,000 Dec. $90,000 80,000 Cash Receipts: Beginning cash balance From current month sales From prior month sales Total cash receipts Total cash available Cash Disbursements: From Purchases: Current month @ 20% From 1 mo. prior purchases @ 50% From 2 mo. prior purchases @ 30% Total payments on purchases Labor expense Sales salaries Commissions @ 2% of sales Other expenses exclude depr. ($500) Total cash disbursements Ending cash balance b. Borrow—March; invest—January and February DIFFICULT The Master Budget Jan. $70,000 70,000 2002 Feb. $90,000 60,000 Mar. $30,000 50,000 Jan. $ 4,500 $28,000 54,000 $82,000 $86,500 Feb. $ 2,600 $36,000 42,000 $78,000 $80,600 Mar. $ 300 $12,000 54,000 $66,000 $66,300 $14,000 40,000 21,000 $75,000 4,000 2,000 1,400 1,500 $83,900 $ 2,600 $12,000 35,000 24,000 $71,000 4,000 2,000 1,800 1,500 $80,300 $ 300 $10,000 30,000 21,000 $61,000 4,000 2,000 600 1,500 $69,100 $ (2,800 ) CHAPTER 14 CAPITAL BUDGETING MULTIPLE CHOICE 1. Which of the following capital budgeting techniques ignores the time value of money? a. b. c. d. payback period net present value internal rate of return profitability index ANSWER: 2. net present value internal rate of return payback period profitability index ANSWER: c EASY In comparing two projects, the ___________ is often used to evaluate the relative riskiness of the projects. a. b. c. d. payback period net present value internal rate of return discount rate ANSWER: 4. EASY Which of the following capital budgeting techniques may potentially ignore part of a project’s relevant cash flows? a. b. c. d. 3. a a EASY Which of the following capital budgeting techniques does not routinely rely on the assumption that all cash flows occur at the end of the period? a. b. c. d. internal rate of return net present value profitability index payback period ANSWER: d EASY 14–1 14–2 5. Chapter 14 Assume that a project consists of an initial cash outlay of $100,000 followed by equal annual cash inflows of $40,000 for 4 years. In the formula X = $100,000/$40,000, X represents the a. b. c. d. payback period for the project. profitability index of the project. internal rate of return for the project. project’s discount rate. ANSWER: 6. EASY net present value. payback period. internal rate of return. profitability index. ANSWER: b EASY The payback method assumes that all cash inflows are reinvested to yield a return equal to a. b. c. d. the discount rate. the hurdle rate. the internal rate of return. zero. ANSWER: 8. a All other factors equal, a large number is preferred to a smaller number for all capital project evaluation measures except a. b. c. d. 7. Capital Budgeting d EASY The payback method measures a. b. c. d. how quickly investment dollars may be recovered. the cash flow from an investment. the economic life of an investment. the profitability of an investment. ANSWER: a EASY Chapter 14 9. Capital Budgeting If investment A has a payback period of three years and investment B has a payback period of four years, then a. b. c. d. A is more profitable than B. A is less profitable than B. A and B are equally profitable. the relative profitability of A and B cannot be determined from the information given. ANSWER: 10. EASY length of time over which the investment will provide cash inflows. length of time over which the initial investment is recovered. shortest length of time over which an investment may be depreciated. shortest length of time over which the net present value will be positive. ANSWER: b EASY Which of the following capital budgeting techniques has been criticized because it fails to consider investment profitability? a. b. c. d. payback method accounting rate of return net present value method internal rate of return ANSWER: 12. d The payback period is the a. b. c. d. 11. 14–3 a EASY The time value of money is explicitly recognized through the process of a. b. c. d. interpolating. discounting. annuitizing. budgeting. ANSWER: b EASY 14–4 13. Chapter 14 The time value of money is considered in long-range investment decisions by a. b. c. d. assuming equal annual cash flow patterns. investing only in short-term projects. assigning greater value to more immediate cash flows. ignoring depreciation and tax implications of the investment. ANSWER: 14. EASY method of financing the project under consideration timing of cash flows relating to the project impact of the project on income taxes to be paid amounts of cash flows relating to the project ANSWER: a EASY As to a capital investment, net cash inflow is equal to the a. b. c. d. cost savings resulting from the investment. sum of all future revenues from the investment. net increase in cash receipts over cash payments. net increase in cash payments over cash receipts. ANSWER: 16. c When using one of the discounted cash flow methods to evaluate the desirability of a capital budgeting project, which of the following factors is generally not important? a. b. c. d. 15. Capital Budgeting c EASY In a discounted cash flow analysis, which of the following would not be consistent with adjusting a project’s cash flows to account for higher-than-normal risk? a. b. c. d. increasing the expected amount for cash outflows increasing the discounting period for expected cash inflows increasing the discount rate for cash outflows decreasing the amount for expected cash inflows ANSWER: c MEDIUM Chapter 14 17. Capital Budgeting When a project has uneven projected cash inflows over its life, an analyst may be forced to use ___________________ to find the project’s internal rate of return. a. b. c. d. a screening decision a trial-and-error approach a post investment audit a time line ANSWER: 18. EASY prime rate. discount rate. cutoff rate. internal rate of return. ANSWER: b EASY A firm’s discount rate is typically based on a. b. c. d. the interest rates related to the firm’s bonds. a project’s internal rate of return. its cost of capital. the corporate Aa bond yield. ANSWER: 20. b The interest rate used to find the present value of a future cash flow is the a. b. c. d. 19. 14–5 c EASY In capital budgeting, a firm’s cost of capital is frequently used as the a. b. c. d. internal rate of return. accounting rate of return. discount rate. profitability index. ANSWER: c EASY 14–6 21. Chapter 14 The net present value method assumes that all cash inflows can be immediately reinvested at the a. b. c. d. cost of capital. discount rate. internal rate of return. rate on the corporation’s short-term debt. ANSWER: 22. EASY a decrease in the marginal tax rate a decrease in the discount rate a decrease in the rate of depreciation an increase in the life expectancy of the depreciable asset ANSWER: b MEDIUM To reflect greater uncertainty (greater risk) about a future cash inflow, an analyst could a. b. c. d. increase the discount rate for the cash flow. decrease the discounting period for the cash flow. increase the expected value of the future cash flow before it is discounted. extend the acceptable length for the payback period. ANSWER: 24. b Which of the following changes would not decrease the present value of the future depreciation deductions on a specific depreciable asset? a. b. c. d. 23. Capital Budgeting a EASY A change in the discount rate used to evaluate a specific project will affect the project’s a. b. c. d. life. payback period. net present value. total cash flows. ANSWER: c EASY Chapter 14 25. Capital Budgeting For a project such as plant investment, the return that should leave the market price of the firm’s stock unchanged is known as the a. b. c. d. cost of capital. net present value. payback rate. internal rate of return. ANSWER: 26. MEDIUM interest expense is deductible for tax purposes. principal payments on debt are deductible for tax purposes. the cost of capital is a deductible expense for tax purposes. dividend payments to stockholders are deductible for tax purposes. ANSWER: a EASY The basis for measuring the cost of capital derived from bonds and preferred stock, respectively, is the a. b. c. d. pre-tax rate of interest for bonds and stated annual dividend rate less the expected earnings per share for preferred stock. pre-tax rate of interest for bonds and stated annual dividend rate for preferred stock. after-tax rate of interest for bonds and stated annual dividend rate less the expected earnings per share for preferred stock. after-tax rate of interest for bonds and stated annual dividend rate for preferred stock. ANSWER: 28. a The pre-tax cost of capital is higher than the after-tax cost of capital because a. b. c. d. 27. 14–7 d MEDIUM The combined weighted average interest rate that a firm incurs on its long-term debt, preferred stock, and common stock is the a. b. c. d. cost of capital. discount rate. cutoff rate. internal rate of return. ANSWER: a EASY 14–8 29. Chapter 14 The weighted average cost of capital that is used to evaluate a specific project should be based on the a. b. c. d. mix of capital components that was used to finance a project from last year. overall capital structure of the corporation. cost of capital for other corporations with similar investments. mix of capital components for all capital acquired in the most recent fiscal year. ANSWER: 30. EASY callable. participating. cumulative. convertible. ANSWER: d MEDIUM The weighted average cost of capital approach to decision making is not directly affected by the a. b. c. d. value of the common stock. current budget for capital expansion. cost of debt outstanding. proposed mix of debt, equity, and existing funds used to implement the project. ANSWER: 32. b Debt in the capital structure could be treated as if it were common equity in computing the weighted average cost of capital if the debt were a. b. c. d. 31. Capital Budgeting b EASY The ___________________ is the highest rate of return that can be earned from the most attractive, alternative capital project available to the firm. a. b. c. d. accounting rate of return internal rate of return hurdle rate opportunity cost of capital ANSWER: d MEDIUM Chapter 14 33. Capital Budgeting If an analyst desires a conservative net present value estimate, she will assume that all cash inflows occur at a. b. c. d. mid year. the beginning of the year. year end. irregular intervals. ANSWER: 34. EASY It would increase the net present value of the proposal. It would decrease the net present value of the proposal. It would not affect the net present value of the proposal. Potentially it could increase or decrease the net present value of the new lathe. ANSWER: a EASY The net present value method of evaluating proposed investments a. b. c. d. measures a project’s internal rate of return. ignores cash flows beyond the payback period. applies only to mutually exclusive investment proposals. discounts cash flows at a minimum desired rate of return. ANSWER: 36. c The salvage value of an old lathe is zero. If instead, the salvage value of the old lathe was $20,000, what would be the impact on the net present value of the proposal to purchase a new lathe? a. b. c. d. 35. 14–9 d EASY Which of the following statements is true regarding capital budgeting methods? a. b. c. d. The Fisher rate can never exceed a company’s cost of capital. The internal rate of return measure used for capital project evaluation has more conservative assumptions than the net present value method, especially for projects that generate a positive net present value. The net present value method of project evaluation will always provide the same ranking of projects as the profitability index method. The net present value method assumes that all cash inflows can be reinvested at the project’s cost of capital. ANSWER: d EASY 14–10 37. Chapter 14 Capital Budgeting A company is evaluating three possible investments. Information relating to the company and the investments follow: Fisher rate for the three projects Cost of capital 7% 8% Based on this information, we know that a. b. c. d. all three projects are acceptable. none of the projects are acceptable. the capital budgeting evaluation techniques profitability index, net present value, and internal rate of return will provide a consistent ranking of the projects. the net present value method will provide a ranking of the projects that is superior to the ranking obtained using the internal rate of return method. ANSWER: 38. equal zero. equal 1. equal -1. be undefined. ANSWER: b EASY If the profitability index for a project exceeds 1, then the project’s a. b. c. d. net present value is positive. internal rate of return is less than the project’s discount rate. payback period is less than 5 years. accounting rate of return is greater than the project’s internal rate of return. ANSWER: 40. MEDIUM If a project generates a net present value of zero, the profitability index for the project will a. b. c. d. 39. c a EASY If a project’s profitability index is less than 1, the project’s a. b. c. d. discount rate is above its cost of capital. internal rate of return is less than zero. payback period is infinite. net present value is negative. ANSWER: d EASY Chapter 14 41. Capital Budgeting The profitability index is a. b. c. d. the ratio of net cash flows to the original investment. the ratio of the present value of cash flows to the original investment. a capital budgeting evaluation technique that doesn’t use discounted values. a mandatory technique when capital rationing is used. ANSWER: 42. EASY internal rate of return payback period profitability index accounting rate of return ANSWER: c MEDIUM If the total cash inflows associated with a project exceed the total cash outflows associated with the project, the project’s a. b. c. d. net present value is greater than zero. internal rate of return is greater than zero. profitability index is greater than 1. payback period is acceptable. ANSWER: 44. b Which method of evaluating capital projects assumes that cash inflows can be reinvested at the discount rate? a. b. c. d. 43. 14–11 b EASY The net present value and internal rate of return methods of decision making in capital budgeting are superior to the payback method in that they a. b. c. d. are easier to implement. consider the time value of money. require less input. reflect the effects of sensitivity analysis. ANSWER: b EASY 14–12 45. Chapter 14 If an investment has a positive net present value, the a. b. c. d. internal rate of return is higher than the discount rate. discount rate is higher than the hurdle rate of return. internal rate of return is lower than the discount rate of return. hurdle rate of return is higher than the discount rate. ANSWER: 46. EASY cost of capital. discount rate. cutoff rate. internal rate of return. ANSWER: d EASY For a profitable company, an increase in the rate of depreciation on a specific project could a. b. c. d. increase the project’s profitability index. increase the project’s payback period. decrease the project’s net present value. increase the project’s internal rate of return. ANSWER: 48. a The rate of interest that produces a zero net present value when a project’s discounted cash operating advantage is netted against its discounted net investment is the a. b. c. d. 47. Capital Budgeting d MEDIUM Which of the following capital expenditure planning and control techniques has been criticized because it might mistakenly imply that earnings are reinvested at the rate of return earned by the investment? a. b. c. d. payback method accounting rate of return net present value method internal rate of return ANSWER: d EASY Chapter 14 49. Capital Budgeting If the discount rate that is used to evaluate a project is equal to the project’s internal rate of return, the project’s _____________ is zero. a. b. c. d. profitability index internal rate of return present value of the investment net present value ANSWER: 50. EASY decreases. increases. stays the same. can move up or down depending on whether the firm’s cost of capital is high or low. ANSWER: b MEDIUM When a profitable corporation sells an asset at a loss, the after-tax cash flow on the sale will a. b. c. d. exceed the pre-tax cash flow on the sale. be less than the pre-tax cash flow on the sale. be the same as the pre-tax cash flow on the sale. increase the corporation’s overall tax liability. ANSWER: 52. d As the marginal tax rate goes up, the benefit from the depreciation tax shield a. b. c. d. 51. 14–13 a MEDIUM In a typical (conservative assumptions) after-tax discounted cash flow analysis, depreciation expense is assumed to accrue at a. b. c. d. the beginning of the period. the middle of the period. the end of the period. irregular intervals over the life of the investment. ANSWER: c EASY 14–14 53. Chapter 14 The pre-tax and after-tax cash flows would be the same for all of the following items except a. b. c. d. the liquidation of working capital at the end of a project’s life. the initial (outlay) cost of an investment. the sale of an asset at its book value. a cash payment for salaries and wages. ANSWER: 54. EASY tax-deductible cash flows. non-tax-deductible cash flows. accounting accruals. all of the above. ANSWER: d MEDIUM A project’s after-tax net present value is increased by all of the following except a. b. c. d. revenue accruals. cash inflows. depreciation deductions. expense accruals. ANSWER: 56. d The after-tax net present value of a project is affected by a. b. c. d. 55. Capital Budgeting a EASY Multiplying the depreciation deduction by the tax rate yields a measure of the depreciation tax a. b. c. d. shield. benefit. payable. loss. ANSWER: b EASY Chapter 14 57. Capital Budgeting Annual after-tax corporate net income can be converted to annual after-tax cash flow by a. b. c. d. adding back the depreciation amount. deducting the depreciation amount. adding back the quantity (t × depreciation deduction), where t is the corporate tax rate. deducting the quantity [(1– t) × depreciation deduction], where t is the corporate tax rate. ANSWER: 58. EASY net cash flow. income as measured by accounting rules. net cash flow plus depreciation. income as measured by tax rules. ANSWER: d EASY Which of the following best represents a screening decision? a. b. c. d. determining which project has the highest net present value determining if a project’s internal rate of return exceeds the firm’s cost of capital determining which projects are mutually exclusive determining which are the best projects ANSWER: 60. a Income taxes are levied on a. b. c. d. 59. 14–15 b EASY Below are pairs of projects. Which pair best represents independent projects? a. b. c. d. buy computer; buy software package buy computer #1; buy computer #2 buy computer; buy computer security system buy computer; repave parking lot ANSWER: d EASY 14–16 61. Chapter 14 Which of the following are tax deductible under U.S. tax law? a. b. c. d. interest payments to bondholders preferred stock dividends common stock dividends all of the above ANSWER: 62. EASY an appropriate response to uncertainty in cash flow projections. useful in measuring the variance of the Fisher rate. typically conducted in the post investment audit. useful to compare projects requiring vastly different levels of initial investment. ANSWER: a MEDIUM If management judges one project in a mutually inclusive set to be acceptable for investment, a. b. c. d. all the other projects in the set are rejected. only one other project in the set can be accepted. all other projects in the set are also accepted. only one project in the set will be rejected. ANSWER: 64. a Sensitivity analysis is a. b. c. d. 63. Capital Budgeting c EASY All other factors equal, which of the following would affect a project’s internal rate of return, net present value, and payback period? a. b. c. d. an increase in the discount rate a decrease in the life of the project an increase in the initial cost of the project all of the above ANSWER: c EASY Chapter 14 65. Capital Budgeting 14–17 (Present value tables needed to answer this question.) Tiger Inc. bought a piece of machinery with the following data: Useful life Yearly net cash inflow Salvage value Internal rate of return Cost of capital 6 years $45,000 –0– 18% 14% The initial cost of the machinery was a. b. c. d. $157,392. $174,992. $165,812. impossible to determine from the information given. ANSWER: 66. MEDIUM (Appendix) Microsoft Co. is considering the purchase of a $100,000 machine that is expected to result in a decrease of $15,000 per year in cash expenses. This machine, which has no residual value, has an estimated useful life of 10 years and will be depreciated on a straight-line basis. For this machine, the accounting rate of return would be a. b. c. d. 10 percent. 15 percent. 30 percent. 35 percent. ANSWER: 67. a c MEDIUM An investment project is expected to yield $10,000 in annual revenues, has $2,000 in fixed costs per year, and requires an initial investment of $5,000. Given a cost of goods sold of 60 percent of sales, what is the payback period in years? a. b. c. d. 2.50 5.00 2.00 1.25 ANSWER: a MEDIUM 14–18 68. Chapter 14 A project has an initial cost of $100,000 and generates a present value of net cash inflows of $120,000. What is the project’s profitability index? a. b. c. d. .20 1.20 .80 5.00 ANSWER: 69. b MEDIUM (Present value tables needed to answer this question.) C Corp. faces a marginal tax rate of 35 percent. One project that is currently under evaluation has a cash flow in the fourth year of its life that has a present value of $10,000 (after-tax). C Corp. assumes that all cash flows occur at the end of the year and the company uses 11 percent as its discount rate. What is the pre-tax amount of the cash flow in year 4? (Round to the nearest dollar.) a. b. c. d. $15,181 $23,356 $9,868 $43,375 ANSWER: 70. Capital Budgeting b DIFFICULT (Present value tables needed to answer this question.) The Salvage Co. is considering the purchase of a new ocean-going vessel that could potentially reduce labor costs of its operation by a considerable margin. The new ship would cost $500,000 and would be fully depreciated by the straight-line method over 10 years. At the end of 10 years, the ship will have no value and will be sunk in some already polluted harbor. The Salvage Co.’s cost of capital is 12 percent, and its marginal tax rate is 40 percent. What is the present value of the depreciation tax benefit of the new ship? (Round to the nearest dollar.) a. b. c. d. $113,004 $282,510 $169,506 $200,000 ANSWER: a DIFFICULT Chapter 14 71. Capital Budgeting (Present value tables needed to answer this question.) Salvage Co. is considering the purchase of a new ocean-going vessel that could potentially reduce labor costs of its operation by a considerable margin. The new ship would cost $500,000 and would be fully depreciated by the straight-line method over 10 years. At the end of 10 years, the ship will have no value and will be sunk in some already polluted harbor. The Salvage Co.’s cost of capital is 12 percent, and its marginal tax rate is 40 percent. If the ship produces equal annual labor cost savings over its 10-year life, how much do the annual savings in labor costs need to be to generate a net present value of $0 on the project? (Round to the nearest dollar.) a. b. c. d. $68,492 $114,154 $88,492 $147,487 ANSWER: 72. 14–19 c DIFFICULT Pebble Co. recently sold a used machine for $40,000. The machine had a book value of $60,000 at the time of the sale. What is the after-tax cash flow from the sale, assuming the company’s marginal tax rate is 20 percent? a. b. c. d. $40,000 $60,000 $44,000 $32,000 ANSWER: c MEDIUM 14–20 Chapter 14 Capital Budgeting Use the following information for questions 73 and 74. Fordem Co. is considering an investment in a machine that would reduce annual labor costs by $30,000. The machine has an expected life of 10 years with no salvage value. The machine would be depreciated according to the straight-line method over its useful life. The company’s marginal tax rate is 30 percent. 73. (Present value tables needed to answer this question.) Assume that the company will invest in the machine if it generates an internal rate of return of 16 percent. What is the maximum amount the company can pay for the machine and still meet the internal rate of return criterion? a. b. c. d. $180,000 $210,000 $187,500 $144,996 ANSWER: 74. d MEDIUM (Present value tables needed to answer this question.) Assume the company pays $250,000 for the machine. What is the expected internal rate of return on the machine? a. b. c. d. between 8 and 9 percent between 3 and 4 percent between 17 and 18 percent less than 1 percent ANSWER: b MEDIUM Chapter 14 Capital Budgeting 14–21 Use the following information for questions 75 and 76. The net after-tax cash flows associated with two projects under consideration by Novelle Co. follow: Project 1 $(300,000 ) 80,000 Initial investment Cash flows years 1–5 75. (Present value tables needed to answer this question.) What is the Fisher rate for these two projects? a. b. c. d. less than 1 percent between 7 and 8 percent between 4 and 5 percent between 6 and 7 percent ANSWER: 76. b DIFFICULT (Present value tables needed to answer this question.) Assume that the company can potentially accept both projects, one project, or neither project. Which project(s) would the company accept if it estimates its weighted average cost of capital is 9 percent? a. b. c. d. both projects Project 1 Project 2 neither project ANSWER: 77. Project 2 $(100,000 ) 30,000 a MEDIUM (Present value tables needed to answer this question.) A project under consideration by the White Corp. would require a working capital investment of $200,000. The working capital would be liquidated at the end of the project’s 10-year life. If White Corp. has an after-tax cost of capital of 10 percent and a marginal tax rate of 30 percent, what is the present value of the working capital cash flow expected to be received in year 10? a. b. c. d. $36,868 $77,100 $53,970 $23,130 ANSWER: b MEDIUM 14–22 78. Chapter 14 Capital Budgeting (Present value tables needed to answer this question.) B Company is considering two alternative ways to depreciate a proposed investment. The investment has an initial cost of $100,000 and an expected five-year life. The two alternative depreciation schedules follow: Year 1 depreciation Year 2 depreciation Year 3 depreciation Year 4 depreciation Year 5 depreciation Method 1 $20,000 $20,000 $20,000 $20,000 $20,000 Method 2 $40,000 $30,000 $20,000 $10,000 $0 Assuming that the company faces a marginal tax rate of 40 percent and has a cost of capital of 10 percent, what is the difference between the two methods in the present value of the depreciation tax benefit? a. b. c. d. $7,196 $0 $2,878 $6,342 ANSWER: c DIFFICULT Use the following information for questions 79 and 80. Blues Bros. Inc. is considering an investment in a computer that is capable of producing various images that are useful in the production of commercial art. The computer would cost $20,000 and have an expected life of eight years. The computer is expected to generate additional annual net cash receipts (before-tax) of $6,000 per year. The computer will be depreciated according to the straight-line method and the firm’s marginal tax rate is 25 percent. 79. What is the after-tax payback period for the computer project? a. b. c. d. 7.62 years 3.90 years 4.44 years 3.11 years ANSWER: b MEDIUM Chapter 14 80. Capital Budgeting 14–23 (Present value tables needed to answer this question.) What is the after-tax net present value of the proposed project (using a 16 percent discount rate)? a. b. c. d. $2,261 $(454) $6,062 $(4,797) ANSWER: a MEDIUM Use the following information for questions 81–83. Hefty Investment Co. is considering an investment in a labor-saving machine. Information on this machine follows: Cost Salvage value in five years Estimated life Annual depreciation Annual reduction in existing costs 81. (Present value tables needed to answer this question.) What is the internal rate of return on this project (round to the nearest 1/2%)? a. b. c. d. 37.5% 25.0% 10.5% 13.5% ANSWER: 82. $30,000 $0 5 years $6,000 $8,000 c MEDIUM (Present value tables needed to answer this question.) Assume for this question only that Hefty Co. uses a discount rate of 16 percent to evaluate projects of this type. What is the project’s net present value? a. b. c. d. $(6,283) $(3,806) $(23,451) $(22,000) ANSWER: b MEDIUM 14–24 83. Chapter 14 Capital Budgeting What is the payback period on this investment? a. b. c. d. 4 years 2.14 years 3.75 years 5 years ANSWER: c MEDIUM Use the following information for questions 84 and 85. L&M Ironworks is considering a proposal to sell an existing lathe and purchase a new computeroperated lathe. Information on the existing lathe and the computer-operated lathe follow: Cost Accumulated depreciation Salvage value now Salvage value in 4 years Annual depreciation Annual cash operating costs Remaining useful life 84. Computer-operated lathe $300,000 0 60,000 75,000 50,000 4 years What is the payback period for the computer-operated lathe? a. b. c. d. 1.87 years 2.00 years 3.53 years 3.29 years ANSWER: 85. Existing lathe $100,000 60,000 20,000 0 10,000 200,000 4 years a MEDIUM (Present value tables needed to answer this question.) If the company uses 10 percent as its discount rate, what is the net present value of the proposed new lathe purchase? a. b. c. d. $236,465 $256,465 $195,485 $30,422 ANSWER: a MEDIUM Chapter 14 Capital Budgeting 14–25 Use the following information for questions 86 and 87. The Allendale Co. has recently evaluated a proposal to invest in cost-reducing production technology. According to the evaluation, the project would require an initial investment of $17,166 and would provide equal annual cost savings for five years. Based on a 10 percent discount rate, the project generates a net present value of $1,788. The project is not expected to have any salvage value at the end of its five-year life. 86. (Present value tables needed to answer this question.) What are the expected annual cost savings of the project? a. b. c. d. $3,500 $4,000 $4,500 $5,000 ANSWER: 87. d MEDIUM (Present value tables needed to answer this question.) What is the project’s expected internal rate of return? a. b. c. d. 10% 11% 13% 14% ANSWER: d MEDIUM Use the following information for questions 88–90. R Co. is involved in the evaluation of a new computer-integrated manufacturing system. The system has a projected initial cost of $1,000,000. It has an expected life of six years, with no salvage value, and is expected to generate annual cost savings of $250,000. Based on R Co.’s analysis, the project has a net present value of $57,625. 88. (Present value tables needed to answer this question.) What discount rate did the company use to compute the net present value? a. b. c. d. 10% 11% 12% 13% ANSWER: b MEDIUM 14–26 89. Chapter 14 What is the project’s profitability index? a. b. c. d. 1.058 .058 .945 1.000 ANSWER: 90. MEDIUM between 12.5 and 13.0 percent between 11.0 and 11.5 percent between 11.5 and 12.0 percent between 13.0 and 13.5 percent ANSWER: a MEDIUM (Present value tables needed to answer this question.) Ann recently invested in a project that promised an internal rate of return of 15 percent. If the project has an expected annual cash inflow of $12,000 for six years, with no salvage value, how much did Ann pay for the project? a. b. c. d. $35,000 $45,414 $72,000 $31,708 ANSWER: 92. a (Present value tables needed to answer this question.) What is the project’s internal rate of return? a. b. c. d. 91. Capital Budgeting b MEDIUM Louis recently invested in a project that has an expected annual cash inflow of $7,000 for 10 years, and an expected payback period of 3.6 years. How much did Louis invest in the project? a. b. c. d. $19,444 $36,000 $25,200 $40,000 ANSWER: c MEDIUM Chapter 14 93. Capital Budgeting 14–27 The McNally Co. is considering an investment in a project that generates a profitability index of 1.3. The present value of the cash inflows on the project is $44,000. What is the net present value of this project? a. b. c. d. $10,154 $13,200 $57,200 $33,846 ANSWER: a MEDIUM THE FOLLOWING MULTIPLE CHOICE RELATE TO MATERIAL COVERED IN THE APPENDICES OF THE CHAPTER. 94. If r is the discount rate, the formula [1/(1 + r)] refers to the a. b. c. d. future value interest factor associated with r for one period. present value of some future cash flow. present value interest factor associated with r for one period. future value interest factor for an annuity with a duration of r periods. ANSWER: 95. EASY Future value is the a. b. c. d. sum of dollars-in discounted to time zero. sum of dollars-out discounted to time zero. difference of dollars-in and dollars-out. value of dollars-in minus dollars-out for future periods adjusted for any interestcompounding factor. ANSWER: 96. c d MEDIUM All other things being equal, as the time period for receiving an annuity lengthens, a. b. c. d. the related present value factors increase. the related present value factors decrease. the related present value factors remain constant. it is impossible to tell what happens to present value factors from the information given. ANSWER: a EASY 14–28 97. Chapter 14 Which of the following indicates that the first cash flow is at the end of a period? a. b. c. d. Ordinary annuity yes yes no no ANSWER: 98. EASY future value of X in one period. future value interest factor associated with r. present value of X. present value interest factor associated with r. ANSWER: a EASY The capital budgeting technique known as accounting rate of return uses a. b. c. d. salvage value no no yes yes ANSWER: 100. a Annuity due no yes yes no Assume that X represents a sum of money that Bill has available to invest in a project that will yield a return of r. In the formula Y = X(1 + r), Y represents the a. b. c. d. 99. Capital Budgeting d time value of money no yes yes no EASY In computing the accounting rate of return, the __________ level of investment should be used as the denominator. a. b. c. d. average initial residual cumulative ANSWER: a EASY Chapter 14 Capital Budgeting 14–29 Use the following information for questions 101 and 102. Jimmy’s Retail is considering an investment in a delivery truck. Jimmy has found a used truck that he can purchase for $8,000. He estimates the truck would last six years and increase his store’s net cash revenues by $2,000 per year. At the end of six years, the truck would have no salvage value and would be discarded. Jimmy will depreciate the truck using the straight-line method. 101. What is the accounting rate of return on the truck investment (based on average profit and average investment)? a. b. c. d. 25.0% 50.0% 16.7% 8.3% ANSWER: 102. MEDIUM What is the payback period on the investment in the new truck? a. b. c. d. 12 years 6 years 4 years 2 years ANSWER: 103. a c MEDIUM (Present value tables needed to answer this question.) Debb borrows $50,000 from her bank on January 1, 2001. She is to repay the loan in equal annual installments over 30 years. How much is her annual repayment if the bank charges 10 percent interest? a. b. c. d. $1,667 $4,200 $2,865 $5,304 ANSWER: d MEDIUM 14–30 104. Chapter 14 (Present value tables needed to answer this question.) Bill Hawkins has just turned 65. He has $100,000 to invest in a retirement annuity. One investment company has offered to pay Bill $10,000 per year for 15 years (payments to begin in one year) in exchange for an immediate $100,000 payment. If Bill accepts the offer from the investment company, what is his expected return on the $100,000 investment (assume a return that is compounded annually)? a. b. c. d. between 5 and 6 percent between 6 and 7 percent between 7 and 8 percent between 8 and 9 percent ANSWER: 105. a MEDIUM (Present value tables needed to answer this question.) Cramden Armored Car Co. is considering the acquisition of a new armored truck. The truck is expected to cost $300,000. The company’s discount rate is 12 percent. The firm has determined that the truck generates a positive net present value of $17,022. However, the firm is uncertain as to whether its has determined a reasonable estimate of the salvage value of the truck. In computing the net present value, the company assumed that the truck would be salvaged at the end of the fifth year for $60,000. What expected salvage value for the truck would cause the investment to generate a net present value of $0? Ignore taxes. a. b. c. d. $30,000 $0 $55,278 $42,978 ANSWER: 106. Capital Budgeting a MEDIUM (Present value tables needed to answer this question.) Booker Steel Inc. is considering an investment that would require an initial cash outlay of $400,000 and would have no salvage value. The project would generate annual cash inflows of $75,000. The firm’s discount rate is 8 percent. How many years must the annual cash flows be generated for the project to generate a net present value of $0? a. b. c. d. between 5 and 6 years between 6 and 7 years between 7 and 8 years between 8 and 9 years ANSWER: c MEDIUM Chapter 14 107. Capital Budgeting A capital budget is used by management to determine a. b. c. d. in what to invest no no yes yes ANSWER: 108. 14–31 d how much to invest no yes no yes EASY The weighted average cost of capital represents the a. b. c. d. cost of bonds, preferred stock, and common stock divided by the three sources. equivalent units of capital used by the organization. overall cost of capital from all organization financing sources. overall cost of dividends plus interest paid by the organization. ANSWER: c EASY SHORT ANSWER/PROBLEMS 1. In a net present value analysis, how can an analyst explicitly and formally consider the influence of risk on the present value of certain cash flows? ANSWER: An analyst could do at least three different things to explicitly account for risk. The analyst could: (1) adjust the discount rate to reflect the risk of the cash flow, (2) adjust the discounting period of the cash flow, or (3) adjust the expected amount of the cash flow up or down to reflect the risk. MEDIUM 2. What factors influence the present value of the depreciation tax benefit? ANSWER: The depreciation tax benefit is primarily affected by three factors: the depreciation rate or method, the tax rate, and the discount rate. MEDIUM 14–32 3. Chapter 14 Capital Budgeting Why is it important for managers to be able to rank projects? ANSWER: Managers need to be able to rank projects for two primary reasons. First, managers need to be able to select the best project from a set of projects that are directly competing with each other (particularly in the case of mutually exclusive projects). Second, even when projects are not directly competing with each other, managers may have a limited supply of capital that has to be allocated to the most worthy of the projects. MEDIUM 4. If it is assumed that managers act to maximize the value of the firm, what can also be assumed about the existing mix of capital components relative to the set of all viable alternative mixes of capital components? ANSWER: It can be assumed that the existing mix of capital components is the one that minimizes the cost of capital (which, therefore, maximizes the value of the firm). MEDIUM 5. Does a project that generates a positive internal rate of return also have a positive net present value? Explain. ANSWER: No. A positive IRR does not necessarily mean that a project will also have a positive NPV. Only if the IRR is greater than the discount rate that is used in the NPV calculation will the NPV be positive. MEDIUM 6. Why is the profitability index a better basis than net present value to compare projects that require different levels of investment? ANSWER: The profitability index relates the magnitude of the net present value to the magnitude of the initial investment. Thus, the PI gives some indication of relative profitability. The NPV itself provides no direct indication of the level of investment that is required to generate the NPV and therefore provides no indication of relative profitability. MEDIUM Chapter 14 7. Capital Budgeting 14–33 (Appendix) What is the major advantage of the accounting rate of return relative to the other techniques that can be used to evaluate capital projects? ANSWER: The accounting rate of return has two major advantages relative to the other capital budgeting techniques. First, it may be more compatible as an investment criterion with criteria that are used to evaluate managerial and segment performance particularly for investment centers that are evaluated on an ROI or RI basis. Second, the accounting rate of return can be generated from accounting data and is therefore easy to track over the life of the investment. MEDIUM 8. Why is it important for organizations to conduct post investment audits of capital projects? ANSWER: The post investment audit provides management with an opportunity to evaluate the actual performance of the investment relative to expected performance. If possible, management can take corrective action when actual performance is poor relative to the expected performance. Management can also use the post investment audit to evaluate the performance of those who provided the original information about the investment and those who are in charge of the investment. In addition, management may use the information from the post investment audit to improve the evaluation process of future capital projects. MEDIUM 9. How are capital budgeting models affected by potential investments in automated equipment investment decisions? ANSWER: Discount rates for present value calculations often far exceed a firm’s cost of capital. Automated machinery is very costly and may be at a disadvantage in discounted cash flow methods. Qualitative factors associated with automated equipment may not receive any weight or value in current capital budgeting methods. Automated equipment is often interrelated with other investments and should be bundled to reflect this synergism. Finally, there is the opportunity cost of not automating when competitors automate and your firm doesn’t. MEDIUM 14–34 10. Chapter 14 Capital Budgeting (Present value tables needed to answer this question.) Managers of the Jonathan Co. realize that the present value of the depreciation tax benefit is affected by the discount rate, the tax rate, and the depreciation rate. They have recently purchased a machine for $100,000 and they are trying to decide which depreciation method to use. There are only two alternatives available, and they must make an irrevocable selection of one method or the other right now. They have no uncertainty about the company’s discount rate (it is 10 percent), but they are highly uncertain about the direction of future tax rates. The company’s uncertainty stems from the fact that the existing tax rate is 30 percent, but congress is presently debating tax legislation that would dramatically increase the rate. If the legislation is passed it would go into affect in two years (after the Jonathan Co. has claimed two years of depreciation). How high would tax rates need to be in two years for the Jonathan Co. to be indifferent between depreciation Method 2 and depreciation Method 1 below? Year 1 Year 2 Year 3 Year 4 Year 5 Method 1 $30,000 $40,000 $10,000 $10,000 $10,000 Method 2 $10,000 $15,000 $25,000 $25,000 $25,000 Difference $(20,000 ) $(25,000 ) $15,000 $15,000 $15,000 ANSWER: No matter what happens, the tax rate for the next two years is 30 percent. Using the differences in depreciation amounts, one can determine the difference in present values between the two methods at the end of year 2 when the tax rate is expected to change. Present value calculations for years 1 and 2: Year 1 ($20,000) × .30 × .9091 = $ (5,455) Year 2 ($25,000) × .30 × .8265 = $ (6,199) Total present value difference at end $ (11,654) So, after the first two years, Method 1 has generated $11,654 more present value than Method 2. This simply means that at the point of indifference, Method 2 would be required to generate $11,654 more present value than Method 1 in the last three years. For the last three years of the project’s life, the difference in depreciation amounts is $15,000. This $15,000 amount can be used in the following equation to solve for the tax rate that yields a present value of $11,654: $11,654 = $15,000 × tax rate × (.7513 + .6830 + .6209) $11,654 = $30,828 × tax rate Tax rate = $11,654/$30,828 Tax rate = 37.8% Thus, an increase in the tax rate to about 37.8 percent would cause management to be indifferent between the two depreciation methods. DIFFICULT Chapter 14 Capital Budgeting 14–35 Use the following information for question 11. XL Corp. is considering an investment that will require an initial cash outlay of $200,000 to purchase non-depreciable assets. The project promises to return $60,000 per year (after-tax) for eight years with no salvage value. The company’s cost of capital is 11 percent. 11. (Present value tables needed to answer this question.) The company is uncertain about its estimate of the life expectancy of the project. How many years must the project generate the $60,000 per year return for the company to at least be indifferent about its acceptance? (Do not consider the possibility of partial year returns.) ANSWER: Dividing $200,000/$60,000, gives the annuity discount factor (3.3333) for 11 percent associated with the minimal required time for this project to be successful. According to the tables in Appendix A, the project will have a positive net present value if the cash flows last through year 5. MEDIUM Use the following information for questions 12–14. Treble Co. is considering an investment in a new product line. The investment would require an immediate outlay of $100,000 for equipment and an immediate investment of $200,000 in working capital. The investment is expected to generate a net cash inflow of $100,000 in year 1, $150,000 in year 2, and $200,000 in years 3 and 4. The equipment would be scrapped (for no salvage) at the end of the fourth year and the working capital would be liquidated. The equipment would be fully depreciated by the straight-line method over its four-year life. 12. (Present value tables needed to answer this question.) If Treble uses a discount rate of 16 percent, what is the NPV of the proposed product line investment? ANSWER: Cash flow Investment Working cap. Cash inflow Cash inflow Cash inflow Cash inflow Working cap. Net present value MEDIUM Year 0 0 1 2 3 4 4 Amount $(100,000 ) $(200,000 ) 100,000 150,000 200,000 200,000 200,000 Discount factor 1.00 1.00 .8621 .7432 .6407 .5523 .5523 Present value $(100,000 ) (200,000 ) 86,210 111,480 128,140 110,460 110,460 $246,750 14–36 13. Chapter 14 Capital Budgeting What is the payback period for the investment? ANSWER: After the first two years, $250,000 of the original $300,000 investment would be recouped. It would take one-quarter of the third year ($50,000/$200,000) to recoup the last $50,000. Thus, the payback period is 2.25 years. MEDIUM 14. (Present value tables needed to answer this question.) Jane has an opportunity to invest in a project that will yield four annual payments of $12,000 with no salvage. The first payment will be received in exactly one year. On low-risk projects of this type, Jane requires a return of 6 percent. Based on this requirement, the project generates a profitability index of 1.03953. a. b. How much is Jane required to invest in this project? What is the internal rate of return on Jane’s project? ANSWER: a. The present value of the $12,000 annuity is found by multiplying $12,000 by the annuity discount factor associated with 6 percent interest for four years: $12,000 × 3.4651 = $41,581.20. From the information on the profitability index, it is known that the present value of the cash inflows is 1.03953 times the initial investment. Thus, the initial investment is$41,581.20/1.03953 = $40,000. b. By dividing $40,000 by the annual cash inflow of $12,000, it is determined that the discount factor associated with the IRR is 3.3333. This discount factor is associated with an interest rate that lies between 7 and 8 percent. Using interpolation, the IRR is computed to be approximately 7.72 percent. MEDIUM Chapter 14 15. Capital Budgeting 14–37 (Present value tables needed to answer this question.) Wood Productions is considering the purchase of a new movie camera, which will be used for major motion pictures. The new camera will cost $30,000, have an eight-year life, and create cost savings of $5,000 per year. The new camera will require $700 of maintenance each year. Wood Productions uses a discount rate of 9 percent. a. b. Compute the net present value of the new camera. Determine the payback period. ANSWER: a. Cost savings per year Maintenance per year Net cash flows per year $5,000 (700 ) $4,300 Cash Discount factor $30,000 1.0000 4,300 5.5348 Net present value of investment b. Present value $(30,000.00 ) 23,799.64 $ (6,200.36 ) Payback equals $30,000/$4,300 = 6.976 years MEDIUM 14–38 16. Chapter 14 Capital Budgeting (Present value tables needed to answer this question.) XYZ Co. is interested in purchasing a state-of-the-art widget machine for its manufacturing plant. The new machine has been designed to basically eliminate all errors and defects in the widgetmaking production process. The new machine will cost $150,000, and have a salvage value of $70,000 at the end of its seven-year useful life. XYZ has determined that cash inflows for years 1 through 7 will be as follows: $32,000; $57,000; $15,000; $28,000; $16,000; $10,000, and $15,000, respectively. Maintenance will be required in years 3 and 6 at $10,000 and $7,000 respectively. XYZ uses a discount rate of 11 percent and wants projects to have a payback period of no longer than five years. a. Compute the net present value of the new machine. b. Compute the firm’s profitability index. c. Compute the payback period. d. Evaluate this investment proposal for XYZ Co. Chapter 14 Capital Budgeting ANSWER: a. Year Cash flow 1 $150,000 1 32,000 2 57,000 3 5,000 4 28,000 5 16,000 6 3,000 7 15,000 7 70,000 Net present value 14–39 Discount factor 1.0000 .9009 .8116 .7312 .6587 .5935 .5346 .4817 .4817 Present value $(150,000.00 ) 28,828.80 46,261.20 3,656.00 18,443.60 9,496.00 1,603.80 7,225.50 33,719.00 $ (766.10 ) b. Profitability index equals present value of cash flows divided by investment: $149,233.90/$150,000 = .995 c. Payback period is 6.11 years, computed as follows: Year 1 2 3 4 5 6 7 Cash Flow $32,000 57,000 5,000 28,000 16,000 3,000 85,000 Cumulative Cash Flow $ 32,000 89,000 94,000 122,000 138,000 141,000 226,000 $150,000 – $141,000 = $9,000/$85,000 = .11 d. The project is quantitatively unacceptable because it has a negative NPV, a lessthan-one PI, and a payback period of over six years. However, the NPV and PI are extremely close to being acceptable. Because the new machine will provide XYZ zero-defect production, the investment may be desirable if additional qualitative factors are considered such as improved competitive position, customer satisfaction, goodwill generated, improved product quality and reliability, and a desire to be in the forefront of manufacturing capability. XYZ may want to attempt to quantify these benefits and reevaluate the machine’s acceptability as an investment. DIFFICULT 14–40 17. Chapter 14 Capital Budgeting (Present value tables needed to answer this question.) The Ruth Company has been operating a small lunch counter for the convenience of employees. The counter occupies space that is not needed for any other business purpose. The lunch counter has been managed by a part-time employee whose annual salary is $3,000. Yearly operations have consistently shown a loss as follows: Receipts Expenses for food, supplies (in cash) Salary Net Loss $20,000 $19,000 3,000 22,000 $(2,000 ) A company has offered to sell Ruth automatic vending machines for a total cost of $12,000. Sales terms are cash on delivery. The old equipment has zero disposal value. The predicted useful life of the equipment is 10 years, with zero scrap value. The equipment will easily serve the same volume that the lunch counter handled. Z catering company will completely service and supply the machines. Prices and variety of food and drink will be the same as those that prevailed at the lunch counter. The catering company will pay 5 percent of gross receipts to the Ruth Company and will bear all costs of food, repairs, and so forth. The part-time employee will be discharged. Thus, Ruth’s only cost will be the initial outlay for the machines. Consider only the two alternatives mentioned. Required: a. What is the annual income difference between alternatives? b. Compute the payback period. c. Compute: 1. The net present value if relevant cost of capital is 20 percent. 2. Internal rate of return. d. Management is very uncertain about the prospective revenue from the vending equipment. Suppose that the gross receipts amounted to $14,000 instead of $20,000. Repeat the computation in part c.1. What would be the minimum amount of annual gross receipts from the vending equipment that would justify making the investment? Show computations. e. Chapter 14 Capital Budgeting ANSWER: a. Old loss $(2,000) New receipts $20,000 × 5% = $ 1,000 Depr. $12,000/10 yrs. = (1,200 ) New (Loss) $ (200 ) b. Change in annual cash inflow is $3,000 Payback = $12,000/$3,000 = 4 yrs. c. 1. PV of inflow $3,000 × 4.1925 = $12,577.50 PV of outflow $12,000 × 1.0 = (12,000.00 ) NPV $ 577.50 2. IRR is approximately 23% d. Change in inflow = $2,700 PV inflow $2,700 × 4.1925 = $11,319.75 PV outflow $12,000 × 1.0 = (12,000.00) NPV $ (680.25 ) e. $12,000/4.1925 = $2,862.25 Receipts = ($2,862.25 – $2,000)/.05 = $17,245 MEDIUM 14–41 14–42 18. Chapter 14 Capital Budgeting The Sun Corp. is contemplating the acquisition of an automatic car wash. The following information is relevant: The cost of the car wash is $160,000 The anticipated revenue from the car wash is $100,000 per annum. The useful life of the car wash is 10 years. Annual operating costs are expected to be: Salaries $30,000 Utilities 9,600 Water usage 4,400 Supplies 6,000 Repairs/maintenance 10,000 The firm uses straight-line depreciation. The salvage value for the car wash is zero. The company’s cutoff points are as follows: Payback 3 years Accounting rate of return 18% Internal rate of return 18% Ignore income taxes. Required: a. Compute the annual cash inflow. b. Compute the net present value. c. Compute internal rate of return. d. Compute the payback period. e. Compute the profitability index. f. Should the car wash be purchased? Chapter 14 Capital Budgeting 14–43 ANSWER: a. Revenue – cash expenses Annual inflow b. PV inflow $40,000 × 4.4941 = PV outflow $160,000 × 1.0 = NPV = c. IRR factor = $160,000/$40,000 = 4.0 which is approximately 23% d. Payback = $160,000/$40,000 = 4 yrs. e. $179,764/$160,000 = 1.123525 f. Car wash exceeds minimum on SRR and IRR, but not payback. Looks good to me. MEDIUM $100,000 (60,000 ) $ 40,000 $179,764 (160,000 ) $ 19,764 CHAPTER 15 FINANCIAL MANAGEMENT MULTIPLE CHOICE 1. A logical structure of activities designed to analyze and evaluate management of expenditures is a cost a. b. c. d. consciousness system. understanding system. avoidance system. control system. ANSWER: 2. the original budget. actual costs for the prior period. a flexible budget. a static budget. ANSWER: c EASY When the organizational output is difficult to define, management may rely on ___________ for cost control. a. b. c. d. qualitative measures program budgeting surrogate measures of output all of the above ANSWER: 4. EASY For cost control purposes, actual costs should be compared to a. b. c. d. 3. d d EASY Setting organizational goals and objectives and preparing a budget are aspects of control a. b. c. d. during an event. before an event. after an event. before, during, and after an event. ANSWER: b EASY 15–1 15–2 5. Chapter 15 Which of the following does not create a specific price level change? a. b. c. d. change in production technology change in the rate of inflation changes due to supply and demand changes in the number of competing suppliers ANSWER: 6. EASY higher this period and lower in future periods. higher this period and higher in future periods. lower this period and higher in future periods. lower this period and lower in future periods. ANSWER: a EASY Spending levels in prior years are often the basis of a. b. c. d. traditional budgets. zero-base budgets. variance targets. engineered cost analyses. ANSWER: 8. b As the economy becomes more and more depressed, a company’s management decides to slash spending on research and development. What is the likely effect of this action on net income? Net income will be a. b. c. d. 7. Financial Management a EASY Minimizing period-by-period increases in unit variable costs and total fixed costs defines efforts of cost a. b. c. d. control. avoidance. containment. reduction. ANSWER: c EASY Chapter 15 9. Financial Management Cost containment practices by a firm would not be effective for cost increases caused by a. b. c. d. inflation. a reduction in the quantity of an input purchased. normal seasonality. a reduction in the number of suppliers. ANSWER: 10. EASY inflation/deflation changes in quantities purchased technological change changes in supply chain costs ANSWER: b MEDIUM The greatest degree of control for committed fixed costs is exerted a. b. c. d. in the post-investment audit. during the life of the investment. prior to acquisition. by equipment operators. ANSWER: 12. a All of the following are explanations of cost changes. Which of these influences can be substantially affected by cost containment measures? a. b. c. d. 11. 15–3 c EASY Careful analysis of the capital budget is an important control activity for a. b. c. d. variable costs. discretionary costs. committed costs. period costs. ANSWER: c EASY 15–4 13. Chapter 15 An effective control system functions before, during, and after an event. However, little control is possible during the event for most a. b. c. d. variable manufacturing costs. variable period costs. discretionary fixed costs. committed fixed costs. ANSWER: 14. b. c. d. EASY management decides to incur in the current period to enable the company to achieve objectives other than the filling of orders placed by customers. are likely to respond to the amount of attention devoted to them by a specified manager. are governed mainly by past decisions that established the present levels of operating and organizational capacity and that only change slowly in response to small changes in capacity. fluctuate in total in response to small changes in the rate of utilization of capacity. ANSWER: c EASY A committed fixed cost can a. b. c. d. never be eliminated. be eliminated in the short term and in the long term. be eliminated in the long term but not in the short term. be eliminated in the short term but not in the long term. ANSWER: 16. d The term “committed costs” refers to costs that a. 15. Financial Management c EASY Which of the following is an example of a committed fixed cost? a. b. c. d. investment in production facilities advertising preventive maintenance employee training programs ANSWER: a EASY Chapter 15 17. Financial Management A company would be reducing its discretionary costs if it a. b. c. d. fired a production supervisor. closed its research and development department. successfully negotiated a reduction in its factory rent. reduced its direct labor costs by hiring temporary workers. ANSWER: 18. MEDIUM program budgeting. zero-base budgeting. capital budgeting. flexible budgeting. ANSWER: d MEDIUM Most discretionary costs relate to a. b. c. d. plant and equipment acquisitions. long-term investments. basic personnel costs. service activities. ANSWER: 20. b If a discretionary cost can be treated like an engineered cost, cost control may be achieved through the use of a. b. c. d. 19. 15–5 d EASY If a cost can be reduced to zero in the short run without significantly harming the organization, the cost is a a. b. c. d. variable cost. committed cost. discretionary cost. product cost. ANSWER: c EASY 15–6 21. Chapter 15 Discretionary costs are often difficult to control because a. b. c. d. it is difficult to measure the cost. they cannot be changed in the short run. they cannot be changed from period to period. it is difficult to measure the benefits of discretionary activities. ANSWER: 22. MEDIUM managerial training programs managerial labor costs factory utilities factory rent ANSWER: a EASY The level of discretionary costs a. b. c. d. are set by management for one period at a time. cannot be changed in the short run. are determined when capital investment is undertaken. always varies with sales. ANSWER: 24. d Which of the following is likely to be a discretionary cost in most organizations? a. b. c. d. 23. Financial Management a EASY Which of the following is not a factor that directly affects the budget for a discretionary cost? a. b. c. d. the importance of the activity to the achievement of the organization’s goals last period’s budget the expected level of operations managerial negotiations in the budgeting process ANSWER: b EASY Chapter 15 25. Financial Management If an actual discretionary cost is exactly equal to the budgeted level of that cost, which of the following statements is true? a. b. c. d. Funds were appropriately spent. The discretionary activity was efficient. The discretionary activity was effective. None of the above. ANSWER: 26. MEDIUM organizational policies and managerial preferences. the budgeted amount from the prior period. the level of long-term investment. an organization’s internal control. ANSWER: a MEDIUM The term “discretionary costs” refers to a. b. c. d. costs that management decides to incur in the current period to enable the company to achieve objectives other than the filling of orders placed by customers. costs that are likely to respond to the amount of attention devoted to them by a specified manager. costs that are governed mainly by past decisions that established the present levels of operating and organizational capacity and that only change slowly in response to small changes in capacity. amortization of costs that were capitalized in previous periods. ANSWER: 28. d Discretionary activities in an organization are determined based on a. b. c. d. 27. 15–7 a EASY Avoidable costs are usually a. b. c. d. committed. common. discretionary. joint. ANSWER: c EASY 15–8 29. Chapter 15 Which of the following is least likely to be a discretionary cost? a. b. c. d. salaries of salespeople advertising maintenance insurance ANSWER: 30. EASY product or period costs. discretionary or committed. direct or common. sunk or avoidable. ANSWER: b EASY If economic activity slows down, total costs could easily decline in which of the following categories? a. b. c. d. variable costs and committed fixed costs variable costs and discretionary fixed costs variable costs only committed fixed costs only ANSWER: 32. a For cost control purposes, fixed costs are classified as a. b. c. d. 31. Financial Management b EASY Usually, with respect to a variable cost, optimal control is exerted when the cost a. b. c. d. can be controlled prior to incurrence. is compared to its budget amount. increases steadily over time. is closely monitored. ANSWER: d EASY Chapter 15 33. Financial Management Which kind of costs could be eliminated by closing a sales office? a. b. c. d. Direct yes yes yes no ANSWER: 34. c. d. a Committed no yes no yes MEDIUM incurring committed fixed costs is less risky than using discretionary costs. managers are usually responsible for committed fixed costs but not for discretionary fixed costs. incurring discretionary fixed costs rather than committed fixed costs gives a company more flexibility in controlling costs. companies are using more discretionary fixed costs because labor is easier to “remove” than technology. ANSWER: c EASY The distinction between avoidable and unavoidable costs is similar to the distinction between a. b. c. d. variable costs and fixed costs. variable costs and mixed costs. step-variable costs and fixed costs. discretionary costs and committed costs. ANSWER: 36. Discretionary yes no no no A major difference between committed and discretionary fixed costs is that a. b. 35. 15–9 d MEDIUM The maximum allowable expenditure is the a. b. c. d. appropriation. allowance. allocation. committed fixed cost. ANSWER: a EASY 15–10 37. Chapter 15 If a firm is successful in meeting its output goal for a period, the firm has been a. b. c. d. efficient. effective. profitable. exercising cost containment measures. ANSWER: 38. EASY qualitative measures of inputs and outputs. a match of inputs in one period with outputs in subsequent periods. a causal relationship between inputs and outputs. a ratio of planned output to actual output. ANSWER: c EASY A ratio of outputs to inputs is a(n) a. b. c. d. effectiveness measure. efficiency measure. qualitative measure. cost reduction measure. ANSWER: 40. b A reasonable measure of efficiency relies on a. b. c. d. 39. Financial Management b EASY A small manufacturing company recently stated its sales goal for a period was $100,000. At this level of activity, its budgeted expenses were $80,000. Its actual sales were $100,000, but its actual expenses were $85,000. This company operated a. b. c. d. effectively and efficiently. neither effectively nor efficiently. effectively but not efficiently. efficiently but not effectively. ANSWER: c EASY Chapter 15 41. Financial Management Master Corp. has a sales goal of $500,000 for the coming year. Based on this level of activity, Master budgets its total expenses at $450,000. Actual sales are $480,000 and actual costs are $460,000. Master Corp.’s operations were a. b. c. d. both efficient and effective. neither efficient nor effective. efficient but not effective. effective but not efficient. ANSWER: 42. EASY a flexible budget variance. an efficiency measure. required in program budgeting. an effectiveness measure. ANSWER: d EASY A cost that is found to bear an observable and known relationship to a quantifiable activity base is a(n) a. b. c. d. discretionary cost. product cost. period cost. engineered cost. ANSWER: 44. b The difference between actual sales and budgeted sales is a. b. c. d. 43. 15–11 d EASY Control of engineered costs is frequently achieved through the use of a. b. c. d. zero-base budgeting. program budgeting. standards. cash budgeting. ANSWER: c EASY 15–12 45. Chapter 15 A variance represents the difference between a budgeted and an actual cost. Thus, the variance measures a. b. c. d. only controllable cost differences. only uncontrollable cost differences. both uncontrollable and controllable cost differences. the effectiveness of management. ANSWER: 46. c EASY Assume actual output exceeds the level of output in the original budget. You would expect costs in which of the following categories to exceed the original budget? a. b. c. d. total variable costs committed fixed costs discretionary fixed costs all of the above ANSWER: 47. Financial Management a EASY An organization plans to produce and sell 50,000 units. It actually produces and sells 45,000 units. You would expect total costs to be below the planned level due to cost a. b. c. d. consciousness. control. reductions. behavior. ANSWER: d EASY Chapter 15 Financial Management 15–13 The following information is provided for the IHM Co. for June 2001, and is to be used for questions 48–51. Actual 1,800 units 8,900 DLHs @ $10.50 per DLH Variable OH $6,400 Fixed OH $17,500 48. What is the price variance? a. b. c. d. $4,450 F $4,450 U $1,000 F $1,000 U ANSWER: 49. $4,450 F $4,450 U $1,000 F $1,000 U ANSWER: c MEDIUM What is the spending variance? a. b. c. d. $590 U $590 F $190 F $190 U ANSWER: 51. MEDIUM What is the efficiency variance? a. b. c. d. 50. b a MEDIUM What is the volume variance? a. b. c. d. $590 U $590 F $190 F $190 U ANSWER: c MEDIUM Standard 5 DLHs per unit @ $10.00 per DLH VOH rate per DLH $ .75 FOH rate per DLH $1.90 Budgeted FOH $16,910 15–14 Chapter 15 Financial Management THE FOLLOWING MULTIPLE CHOICE RELATE TO MATERIAL COVERED IN THE APPENDIX OF THE CHAPTER. 52. Program budgeting typically begins with a(n) a. b. c. d. zero funding level for all organizational activities. statement of the quantity of input activities required. analysis of potential organizational contributors. definition of the organization’s objectives in terms of output results. ANSWER: 53. program zero-base capital cash ANSWER: a EASY Surrogate measures of output are required in a. b. c. d. zero-base budgeting. program budgeting. capital budgeting. cash budgeting. ANSWER: 55. EASY A charitable organization that has well-defined objectives but tremendous flexibility in meeting those objectives might increase its efficiency substantially by using __________________ budgeting. a. b. c. d. 54. d b EASY Zero-base budgeting requires managers to a. b. c. d. justify expenditures that are increases over the prior period’s budgeted amount. justify all expenditures, not just increases over last year’s amount. maintain a full-year budget intact at all times. maintain a budget with zero increases over the prior period. ANSWER: b EASY Chapter 15 56. Financial Management Zero-base budgeting differs from other budgeting techniques in several ways. Zero-base budgeting a. b. c. d. is less expensive than other methods. is more widely used than any other method. requires more time than other methods. can only be used in governmental settings. ANSWER: 57. 15–15 c EASY Budgeting is frequently difficult in government because a. b. c. d. governmental managers are usually inexperienced. governmental managers are not motivated to be cost conscious. it is difficult to identify the output of governmental units. it is difficult to identify the inputs of governmental units. ANSWER: c EASY SHORT ANSWER/PROBLEMS 1. What factors make discretionary costs difficult to control? ANSWER: Discretionary costs are difficult to control because it is difficult to identify the exact benefits of discretionary activities and the relationship of these activities to the organization’s output and goals. Thus, it is difficult to decide at what level a discretionary activity should be funded or if it should be funded at all based on the lack of a definite causal relationship between the discretionary activity and the firm’s output and goals. MEDIUM 2. (Appendix) What kinds of organizations are more likely to use program budgeting? ANSWER: Program budgeting is more likely to be found in organizations that have difficulty in defining their outputs. Such organizations are frequently not-for-profit or governmental organizations. MEDIUM 15–16 3. Chapter 15 Financial Management What are the differences between committed fixed costs and discretionary fixed costs? ANSWER: Committed fixed costs are those costs that flow from the basic existence of the organization. These are the direct costs of the organization’s long-term investments (such as plant and equipment) and the costs of essential personnel. These costs can only be changed in the long run without significantly affecting the organization. Discretionary fixed costs are all fixed costs that do not fit into the committed category. This includes the costs of auxiliary service activities including activities that could be discontinued in the short run without adversely affecting the long-run viability of the organization. MEDIUM 4. When can a discretionary fixed cost be subjected to control methods that are used for engineered costs? ANSWER: When a discretionary cost is repetitive and can be related to some fundamental activity measure (such as machine hours or units of output), it may be treated like an engineered cost. With a repetitive cost that can be related to an activity base, performance standards can be developed and flexible budget variances can be computed and used as cost control tools. MEDIUM 5. What factors influence the total level of discretionary costs in an organization? ANSWER: Organizations tend to fund discretionary activities at different levels depending on the state of the economy and the original profit level. When management anticipates unfavorable economic conditions or downturns in profitability, discretionary costs may be reduced. Likewise, they may be increased as economic conditions improve. Total discretionary expenditures will also vary as certain activities lose their funding and new discretionary activities are initiated. MEDIUM 6. How does strategic staffing fit in with departmental staffing? ANSWER: Strategic staffing is based on a department’s needs related to its long-range objectives and those of the overall company. The department looks at its needs to see how a combination of temporary and permanent personnel fills the bill. By using temporary personnel, flexible staffing is provided that helps insulate the jobs of permanent personnel. Also, when temporary personnel are used by a department, the overall cost of organizational fringe benefits is reduced, thereby saving funds for other needs. MEDIUM Chapter 15 7. Financial Management 15–17 Discuss the various elements of the cost control process. ANSWER: Cost understanding is one element of a cost control system. An organization needs to understand that costs may change from one period to the next or understand why costs differ from budgeted amounts. Total variable costs will increase/decrease with different levels of activity. Costs can also change due to inflation/deflation creating general price-level changes. Costs also change because of supply/supplier cost adjustments. Lastly, costs may change because of quantity purchased by the organization. Cost containment is another element of the cost control process. Cost containment is defined as the practice of minimizing, to the extent possible, period-to-period increases in per-unit variable and total fixed costs. Cost containment is possible for costs that rise due to competition, seasonal variations, and quantities purchased. A third element of the cost control process is cost avoidance. Cost avoidance is defined as the practice of finding acceptable alternatives to high-cost products and/or not spending money for unnecessary goods/services. A final element of the cost control process is cost reduction. Cost reduction means lowering current costs especially for goods/services that may not be needed currently. Exhibit 15–5 provides a visual to the implementation of a cost control system. MEDIUM 8. PJW has made the following information available for January 2001: Actual 1,500 units produced 2,400 DLH used @ $10.25 per DLH Standards 2 DLH per unit @ $10 Assume that PJW hires part-time employees for production of these units. Compute the price and efficiency variances. ANSWER: MEDIUM 2,400 × $10.25 2,400 × $10.00 Price variance $24,600 24,000 $ 600 U 2,400 × $10.00 (1,500 × 2) × $10.00 Efficiency variance $24,000 30,000 $ 6,000 F 15–18 9. Chapter 15 Financial Management SAF has provided the following information for July 2001: Actual 800 units produced Actual DL cost $6,750 Standards 2 DLH per unit @ $5.00 $1 fixed overhead per DLH Assume that SAF hires full-time employees who are paid a total of $6,500 per month. Compute the spending and volume variances. ANSWER: Actual labor cost Budgeted labor cost Spending variance $6,750 6,500 $ 250 U Budgeted labor cost (800 × 2) × $5 Volume variance $6,500 8,000 $1,500 F MEDIUM 10. GSWS provided the following information for 2001 relative to the times and costs to prepare a simple last will and testament: Standards 2 DLH @ $50 per DLH Actual 500 simple wills were prepared during the year 1,100 DLHs utilized during the year @ $52 per DLH Compute the price and efficiency variances. ANSWER: MEDIUM 1,100 × $52 1,100 × $50 Price variance $57,200 55,000 $ 2,200 U 1,100 × $50 (500 × 2) × $50 Efficiency variance $55,000 50,000 $ 5,000 U Chapter 15 Financial Management 15–19 Use the following information for questions 11–13. Big Corp. manufactures and sells baseball bats. For a recent period, its production and sales objectives were each set at 20,000 units. Also, for this period the firm had estimated costs as follows: Variable production costs Variable selling costs Committed fixed costs Discretionary fixed costs 11. $3 per unit $2 per unit $30,000 per period $40,000 per period For this question only, assume that Big Corp. actually produced and sold 18,000 bats. Big Corp.’s operations for the period would (on an overall basis) be regarded as efficient if total costs were below what amount? ANSWER: First, remember how fixed and variable costs change when volume changes. Fixed costs remain constant in total and variable costs remain constant on a perunit basis. To be regarded as efficient, the company’s costs would need to be at or below the flexible budget for 18,000 units. The flexible budget for all costs would be: [18,000 × ($3 + $2)] + $30,000 + $40,000 = $90,000 + $70,000 = $160,000 MEDIUM 12. For this question only, assume Big Corp. actually produced and sold 19,000 bats. At this level of operation, Big Corp.’s total costs were $170,000. Evaluate Big Corp.’s success in terms of effectiveness and efficiency. ANSWER: Big Corp. was not entirely effective in reaching its goal because its objective was to produce and sell 20,000 bats. It only produced and sold 19,000. Its operations would still be regarded as efficient if it contained costs below the flexible budget for 19,000 units, which would be: [19,000 × ($3 + $2)] + $30,000 + $40,000 = $95,000 + $70,000 = $165,000. Since its actual costs were $170,000, the company was neither effective nor efficient in achieving its operating objectives. MEDIUM 15–20 13. Chapter 15 Financial Management Note that the budget for discretionary fixed costs is $40,000. If actual discretionary fixed costs were $50,000, could cost control have still been effective? Explain. ANSWER: Yes, cost control could have been effective. Company managers may have deliberately and consciously overspent on certain items because of opportunities or challenges that emerged during the period. For example, advertising expenses may have been increased because new competitors entered the baseball bat market, or research and development expenditures may have been boosted because of the discovery of a new metal alloy that could revolutionize the baseball bat market. Another explanation would be that cost control was effective, but costs increased dramatically for uncontrollable reasons (severe inflation). MEDIUM CHAPTER 16 INNOVATIVE INVENTORY AND PRODUCTION MANAGEMENT TECHNIQUES MULTIPLE CHOICE 1. Which of the following is not an ordering cost? a. b. c. d. cost of receiving inventory cost of preparing the order cost of the merchandise ordered cost of storing the inventory ANSWER: 2. an ordering cost. a carrying cost. a purchasing cost. a cost of not carrying goods in stock. ANSWER: a EASY A _____________ system of production control is paced by product demand. a. b. c. d. EOQ ABC push pull ANSWER: 4. EASY The cost of receiving inventory is regarded as a. b. c. d. 3. d d EASY Which of the following statements is false concerning electronic data interchange? a. b. c. d. Electronic data interchange (EDI) is essential in a pull system. One of the benefits realized by EDI organizations is a faster processing of transactions. Electronic data interchange is essential in a push system. Electronic data interchange refers to computer-to-computer exchange of information. ANSWER: c MEDIUM 16–1 16–2 5. Chapter 16 _____________ is a “pull” system of production and inventory control. a. b. c. d. EDI EOQ JIT ABC ANSWER: 6. a EASY Reducing setup time is a major aspect of a. b. c. d. all push inventory systems. the determination of safety stock quantities. a JIT system. an EOQ system. ANSWER: c EASY Reducing inventory to the lowest possible levels is a major focus of a. b. c. d. JIT. push inventory systems. EOQ. ABC. ANSWER: 9. EASY a company’s vendors. employees. inspection of finished goods inventory. a good product warranty. ANSWER: 8. c In a JIT system, the quality of each product begins with a. b. c. d. 7. Innovative Inventory and Production Management Techniques a EASY JIT is a philosophy concerned with a. b. c. d. when to do something. how to do something. where to do something. how much of something should be done. ANSWER: a EASY Chapter 16 10. Innovative Inventory and Production Management Techniques When JIT is implemented, which of the following changes in the accounting system would not be expected? a. b. c. d. fewer cost allocations elimination of standard costs combining labor and overhead into one product cost category combing raw material and materials in work-in-process into one product cost category ANSWER: 11. MEDIUM EOQ systems. push systems in general. JIT. pull systems in general. ANSWER: c EASY Just-in-time (JIT) inventory systems a. b. c. d. result in a greater number of suppliers for each production process. focus on a “push” type of production system. can only be used with automated production processes. result in inventories being either greatly reduced or eliminated. ANSWER: 13. b Striving for flexibility in the number of products that can be produced in a short period of time is characteristic of a. b. c. d. 12. 16–3 d EASY The JIT philosophy does not focus on a. b. c. d. standardizing parts used in products. eliminating waste in the production process. finding the absolute lowest price for purchased parts. improving quality of output. ANSWER: c EASY 16–4 14. Chapter 16 In a JIT manufacturing environment, product costing information is least important for use in a. b. c. d. work in process inventory valuation. pricing decisions. product profitability analysis. make-or-buy decisions. ANSWER: 15. MEDIUM cost of specific-purpose equipment cost of equipment maintenance property taxes on the plant salary of a manufacturing cell worker ANSWER: c EASY With JIT manufacturing, which of the following costs would be considered a direct product cost? a. b. c. d. insurance on the plant repair parts for machinery janitors’ salaries salary of the plant supervisor ANSWER: 17. a With JIT manufacturing, which of the following costs would be considered an indirect product cost? a. b. c. d. 16. Innovative Inventory and Production Management Techniques b MEDIUM Which of the following statements is not true? a. b. c. d. JIT manufacturing strives for zero inventories. JIT manufacturing strives for zero defects. JIT manufacturing uses manufacturing cells. JIT manufacturing utilizes long lead time and few deliveries. ANSWER: d EASY Chapter 16 18. Innovative Inventory and Production Management Techniques The JIT environment has caused a reassessment of product costing techniques. Which of the following statements is true with respect to this reassessment? a. b. c. d. Traditional cost allocations based on direct labor are being questioned and criticized. The federal government, through the SEC, is responsible for the reassessment. The reassessment is caused by the replacement of machine hours with labor hours. None of the above is true. ANSWER: 19. b. c. d. MEDIUM employees are retrained on different equipment, but the plant layout generally remains unchanged. new machinery and equipment must be purchased from franchised JIT dealers. machinery and equipment are moved into small autonomous production lines called islands or cells. new, more efficient machinery and equipment are purchased and installed in the original plant layout. ANSWER: c MEDIUM Which of the following describes the effect on direct labor when management adopts the JIT philosophy? a. b. c. d. Each direct labor person performs a single task, thereby allowing that person to reach his or her theoretical potential. Because each person runs a single machine in a JIT environment, there are more employees classified as direct labor. The environment becomes more labor-intensive. Machine operators are expected to run several different types of machines, help set up for production runs, and identify and repair machinery needing maintenance. ANSWER: 21. a When a firm adopts the just-in-time method of management, a. 20. 16–5 d MEDIUM JIT concepts a. b. c. d. can be effectively implemented in organizations that are only partially automated. are only appropriate for use with CIM systems. involve shifting from a capital-intensive to a labor-intensive process. require full computerization of the JIT manufacturing process. ANSWER: a EASY 16–6 22. Chapter 16 According to JIT philosophy, a. b. c. d. inventories of finished goods always should be available to meet customer demand. push-through manufacturing flows are the most efficient. maintaining inventories wastes resources and frequently covers up poor work or other problems. long production runs and large production lot sizes take advantage of economies of scale. ANSWER: 23. MEDIUM uses a job order costing system. classifies processing costs as raw (or direct) material, direct labor, and overhead. is more complex than in other types of manufacturing environments. follows process costing procedures whereby costs are accumulated by the process (cell) and attached to units processed for the period. ANSWER: d MEDIUM An implication of the demand-pull nature of the JIT production process is that a. b. c. d. finished goods inventories must be available to meet customer demand, although raw material is delivered on an as-needed basis. more storage space for inventories is necessary. finished products are packaged and shipped to customers immediately, thus requiring minimal finished goods inventories. problem areas become less visible as inventories are reduced. ANSWER: 25. c Accounting for product costs in a JIT environment a. b. c. d. 24. Innovative Inventory and Production Management Techniques c MEDIUM In accounting for JIT operations, the Raw Material Inventory account a. b. c. d. is closely monitored to ensure that materials are always on hand in time. can be expected to have a larger balance than with traditional manufacturing methods. is combined with the Work In Process Inventory account. is combined with the Finished Goods Inventory account. ANSWER: c EASY Chapter 16 26. Innovative Inventory and Production Management Techniques A kanban plays an important role in a. b. c. d. JIT. EOQ. ABC. CPM. ANSWER: 27. EASY Focused factory arrangements Economic order quantity Multiprocess handling Activity-based management ANSWER: b MEDIUM The term “cell” is used to describe a. b. c. d. a grouping of one or more automated machines within a company. a storage bin for “C” type inventory in an ABC inventory system. files in a CAD/CAM system. a factory’s area of conversion activity. ANSWER: 29. a ____________________ may involve relocation or plant modernization by a vendor. a. b. c. d. 28. 16–7 a EASY In a production cell, a. b. c. d. an individual worker may be expected to operate several different machines, do setups, and perform preventive maintenance on the equipment. each worker becomes an expert in the operation of a single piece of equipment. machines are arranged so that similar machines are grouped together. clear separation is maintained between those workers who operate the machinery and those workers who set up and maintain the machinery. ANSWER: a MEDIUM 16–8 30. Chapter 16 U-shaped groupings of workers and machines that improve materials handling and flow are known as a. b. c. d. manufacturing cells. efficiency stations. multi-flow modules. productivity islands. ANSWER: 31. EASY More flexibility no no yes yes ANSWER: d Less process involvement no yes yes no EASY The process of _________ occurs when equipment is programmed to stop when a certain situation arises. a. b. c. d. throughput automation backflushing information sharing ANSWER: 33. a For workers in a multiprocess handling situation, which of the following happens? a. b. c. d. 32. Innovative Inventory and Production Management Techniques b EASY The connection of two or more flexible manufacturing systems via a host computer and a networking information system is known as a. b. c. d. computer integrated manufacturing yes yes no no ANSWER: b EASY electronic data interchange yes no no yes Chapter 16 34. Innovative Inventory and Production Management Techniques A key element of Japan’s success in world markets is a. b. c. d. the elimination of waste in all operations. automation of the billing function. inefficient labor forces in competing countries. the verification procedures incorporated into computer programs. ANSWER: 35. Standard costs yes no yes no ANSWER: EASY c Minimal variances from standards no no yes yes EASY Which of the following areas offers an opportunity to eliminate waste? a. b. c. d. raw material and labor space and production time recordkeeping and working capital all of the above ANSWER: 37. a Backflush costing is concerned with which of the following? a. b. c. d. 36. 16–9 d EASY Flexible manufacturing systems are a. b. c. d. designed to provide more flexibility in a firm’s manufacturing process by using computer-aided machinery. the same as computer-aided design systems. commonly used by firms that need to make large quantities of one product. are very complicated and cause increased defect rates in output. ANSWER: a EASY 16–10 38. Chapter 16 Kaizen means a. b. c. d. doing it the Japanese way. continuous improvement. employee empowerment. implementation of a centralized organizational structure. ANSWER: 39. a EASY The peak level of unit sales will occur in which stage of the product life cycle? a. b. c. d. growth maturity decline introduction ANSWER: b EASY For product life cycle costing, R&D costs are a. b. c. d. expensed as incurred. capitalized and allocated over the life cycle. deducted as period costs. charged to specific departments as incurred. ANSWER: 42. EASY target costing. product life cycle costing. activity-based costing. responsibility costing. ANSWER: 41. b The process that determines an allowable product cost while setting market price and allowing for an acceptable profit margin is known as a. b. c. d. 40. Innovative Inventory and Production Management Techniques b EASY An important focus in product life cycle costing is a. b. c. d. the activity base. the target cost. the cost driver. variable costs. ANSWER: b EASY Chapter 16 43. Innovative Inventory and Production Management Techniques Projected sales price minus a reasonable profit equals a. b. c. d. the standard cost. contribution margin. projected Cost of Goods Sold. target cost. ANSWER: 44. EASY 30% 50% 70% 90% ANSWER: d EASY Which of the following fluctuate over the product life cycle? a. b. c. d. sales price per unit the types of costs that are incurred product profitability all of the above ANSWER: 46. d Approximately what percentage of future product costs is determined in the development stage of the product life cycle? a. b. c. d. 45. 16–11 d EASY In which of the following stages of the product life cycle would operating losses not be expected? a. b. c. d. growth development introduction decline ANSWER: a EASY 16–12 47. Chapter 16 During which stage of the product life cycle will a company witness the highest profit? a. b. c. d. development maturity growth decline ANSWER: 48. EASY design specifications manufacturing processes impact on product costs when different inputs resources are used all of the above ANSWER: d EASY Ongoing efforts to reduce costs, increase product quality, and/or improve production process once manufacturing has begun is known as a. b. c. d. cost management. kaizen costing. target costing. life-cycle costing. ANSWER: 50. c Cost tables are databases that provide information on which of the following? a. b. c. d. 49. Innovative Inventory and Production Management Techniques b EASY Kaizen costing is used for which of the following types of products? a. b. c. d. New products yes no no yes ANSWER: b Existing products yes yes no no EASY Chapter 16 51. Innovative Inventory and Production Management Techniques A mandate to reduce costs, increase product quality, and/or improve production processes through continuous improvement is known as a. b. c. d. kaizen costing. activity-based costing. the theory of constraints. mass customization. ANSWER: 52. EASY the cost of special orders. the level of activities that are non-value-added. product variety. period costs. ANSWER: b EASY The projected sales price for a new product (which is still in the development stage of the product life cycle) is $50. The company has estimated the life-cycle cost to be $30 and the first-year cost to be $60. On this type of product, the company requires a $12 per unit profit. What is the target cost of the new product? a. b. c. d. $60 $30 $38 $42 ANSWER: 54. a If life-cycle costs exceed the target cost of a product, managers will strive to reduce a. b. c. d. 53. 16–13 c EASY The theory of constraints can a. b. c. d. identify what limitations exist with raw material suppliers. follows a methodology similar to linear programming. be ignored since it assumes too many estimates in the production cycle. show where bottlenecks exist and sets the limit of output to these bottlenecks. ANSWER: d EASY 16–14 55. Chapter 16 Placing quality inspection points ahead of bottlenecks will reduce a. b. c. d. product flow. the number of defective products. the influence of constraints on production flow. the critical path time. ANSWER: 56. MEDIUM precede bottlenecks. follow bottlenecks. be placed at the end of all production processes. be placed at random points in the manufacturing process. ANSWER: a EASY The flow of goods through a production process cannot be at a faster rate than the slowest bottleneck is the definition for a. b. c. d. mass customization. business process reengineering. the theory of constraints. the Pareto principle. ANSWER: 58. c Quality inspection points should a. b. c. d. 57. Innovative Inventory and Production Management Techniques c EASY Bottlenecks are a. b. c. d. machine constraints in the production line. machine constraints that restrict the production cycle so idle time at other processes occurs. useful for identifying any production spot slowdown. restrictions on raw material sources but not the quantity of output. ANSWER: b EASY Chapter 16 59. Innovative Inventory and Production Management Techniques In analyzing production flow, a bottleneck is a. b. c. d. an intermediate inventory. always off the critical path. a capacity constraint. related to a non-value-adding activity. ANSWER: 60. EASY Period-by-period basis yes yes no no ANSWER: b Life-cycle basis yes no yes no EASY Which approaches to costing should be associated with each of the following life-cycle stages? a. b. c. d. Development Kaizen Target Target Kaizen ANSWER: 62. c Product profit margins are typically judged on a a. b. c. d. 61. 16–15 c Introduction Target Standard Kaizen Standard Maturity Standard Kaizen Standard Target MEDIUM In the introduction stage of a product's life-cycle, which of the following type of costs typically may create losses rather than profits? a. b. c. d. advertising assembly design overhead ANSWER: a MEDIUM 16–16 63. Chapter 16 Most studies have indicated that what percent of a product's total life-cycle costs are determined in the development/design stage? a. b. c. d. 60%–70% 70%–80% 80%–90% 90%–95% ANSWER: 64. EASY kaizen costing target costing standard costing process costing ANSWER: b MEDIUM Which of the following formulas is the best representation of the concept of target costing? a. b. c. d. target cost + profit margin = selling price selling price – target cost = profit margin selling price – profit margin = target cost target cost – standard cost = profit margin ANSWER: 66. c Which of the following costing methods is the most effective in controlling a product's total life-cycle cost? a. b. c. d. 65. Innovative Inventory and Production Management Techniques c EASY Successful product development should include a. b. c. d. kaizen costing. value engineering. kanban implementation. all of the above. ANSWER: b MEDIUM Chapter 16 67. Innovative Inventory and Production Management Techniques Value engineering seeks to obtain increased a. b. c. d. product life-cycle and reduced direct labor inputs. planning team membership and reduced time-to-market. product performance ratio and reduced substitute goods. product functionality and reduced costs. ANSWER: 68. DIFFICULT can be applied to services if they are sufficiently uniform. can be applied to services only if they are automated. can be applied to services that are performed in a manufacturing environment. cannot be applied to services. ANSWER: a MEDIUM Kaizen costing helps to a. b. c. d. reduce product costs of products in the design and development stage. keep the target cost as the primary focus after a product enters production. keep profit margin relatively stable as product price declines over the product life cycle. reduce the cost of engineering change orders during each stage of the product life cycle. ANSWER: 70. d Target costing a. b. c. d. 69. 16–17 c DIFFICULT In which life-cycle stage are product quality improvements and stable selling prices likely to occur? a. b. c. d. introduction growth maturity decline ANSWER: b MEDIUM 16–18 71. Chapter 16 From a cost management view, research and development cost represents a. b. c. d. a life-cycle investment a period expense. an unearned revenue. a risk reserve. ANSWER: 72. Computers yes no yes yes ANSWER: MEDIUM c Furniture yes yes no no Textbooks yes yes no yes Automobiles yes no yes yes MEDIUM Kanban is the Japanese word for a. b. c. d. production. just-in-time. card. target costing. ANSWER: 74. a Life-cycle costing is especially important in which of the following types of companies? a. b. c. d. 73. Innovative Inventory and Production Management Techniques c EASY JIT seeks to a. b. c. d. reduce production cost while increasing quality. radically redesign the production process for effectiveness. modify all non-value-added activities. all of the above. ANSWER: a DIFFICULT Chapter 16 75. Innovative Inventory and Production Management Techniques The JIT philosophy indicates that inventory, as well as which of the following, should be eliminated? a. b. c. d. Suppliers yes yes no no ANSWER: 76. Employees yes no yes no Business-ValueAdded Activities yes no no yes MEDIUM variable overhead allocation methodologies. fixed overhead allocation methodologies. variable and fixed overhead allocation methodologies. the financial accounting requirement to expense research and development as incurred. ANSWER: b MEDIUM Goods will flow through a production process at the rate of the a. b. c. d. slowest part of the process. fastest part of the process. average of all the parts of the process. time standards set using externally calibrated benchmarks. ANSWER: 78. d Storage yes yes no yes Companies have often produced significant amounts of unwanted inventory because of a. b. c. d. 77. 16–19 a MEDIUM A machine constraint creates a. b. c. d. an autonomation. a bottleneck. a push inventory system. the need for third-party logistics. ANSWER: b EASY 16–20 79. Chapter 16 In a production process with a machine constraint, if a quality control point is to be established, it should be set up a. b. c. d. within the machine's processes. directly after the machine has performed its functions. immediately before the machine. at the end of the production process. ANSWER: 80. Innovative Inventory and Production Management Techniques c EASY Managing constraints is a process of a. b. c. d. backflush costing. design for manufacturability. just-in-time redesign. continuous improvement. ANSWER: d MEDIUM THE FOLLOWING MULTIPLE CHOICE RELATE TO MATERIAL COVERED IN THE APPENDIX OF THE CHAPTER. 81. (Appendix) The Whitehead Co. produces quality jewelry items for various retailers. For the coming year, it has estimated it will consume 500 ounces of gold. Its carrying costs for a year are $2 per ounce. No safety stock is maintained. If the EOQ is 100 ounces, what is the cost per order? a. b. c. d. $40 $20 $5 $25 ANSWER: 82. b MEDIUM (Appendix) The Whitehead Co. produces quality jewelry items for various retailers. For the coming year, it has estimated it will consume 500 ounces of gold. Its carrying costs for a year are $2 per ounce. No safety stock is maintained. If the EOQ is 100 ounces, what would be the estimate for Whitehead’s total carrying costs for the coming year? a. b. c. d. $200 $250 $100 $1,000 ANSWER: c MEDIUM Chapter 16 83. Innovative Inventory and Production Management Techniques (Appendix) A firm estimates that its annual carrying cost for material X is $.30 per lb. If the firm requires 50,000 lbs. per year, and ordering costs are $100 per order, what is the EOQ (rounded to the nearest pound)? a. b. c. d. 5,774 lbs. 4,082 lbs. 1,732 lbs. 1,225 lbs. ANSWER: 84. a MEDIUM (Appendix) Z Corp.’s EOQ for Material A is 500 units. This EOQ is based on: Annual demand Ordering costs 5,000 units $12.50 What is the annual carrying cost per unit for Material A? a. b. c. d. $0.50 $2.00 $2.50 $5.00 ANSWER: 85. 16–21 a MEDIUM (Appendix) Z Corp.’s EOQ for Material A is 500 units. This EOQ is based on: Annual demand Ordering costs 5,000 units $12.50 What are Z Corp.’s total annual ordering costs for Material A? a. b. c. d. $6,000 $600 $125 $1,000 ANSWER: c MEDIUM 16–22 86. Chapter 16 (Appendix) Clear View Co. manufactures various glass products including a car window. The setup cost to produce the car window is $1,200. The cost to carry a window in inventory is $3 per year. Annual demand for the car window is 12,000 units. What is the most economical production run (rounded to the nearest unit)? a. b. c. d. 6,000 units 3,000 units 9,295 units 3,098 units ANSWER: 87. d MEDIUM (Appendix) Clear View Co. manufactures various glass products including a car window. The setup cost to produce the car window is $1,200. The cost to carry a window in inventory is $3 per year. Annual demand for the car window is 12,000 units. If the annual demand for the car window was to increase to 15,000 units, a. b. c. d. the number of setups would decrease. the total carrying costs would increase. the economic order quantity would decline. all of the above would occur. ANSWER: 88. Innovative Inventory and Production Management Techniques b EASY (Appendix) A company has estimated its economic order quantity for Part A at 2,400 units for the coming year. If ordering costs are $200 and carrying costs are $.50 per unit per year, what is the estimated total annual usage? a. b. c. d. 6,000 units 28,800 units 7,200 units 2,400 units ANSWER: c MEDIUM Chapter 16 89. Innovative Inventory and Production Management Techniques (Appendix) A company annually consumes 10,000 units of Part C. The carrying cost of this part is $2 per year and the ordering costs are $100. The company uses an order quantity of 500 units. By how much could the company reduce its total costs if it purchased the economic order quantity instead of 500 units? a. b. c. d. $500 $2,000 $2,500 $0 ANSWER: 90. MEDIUM 250 units 1,000 units 500 units 2,000 units ANSWER: a MEDIUM (Appendix) Which of the following tells management “when” to order? a. b. c. d. safety stock level order point the economic order quantity the Pareto inventory analysis ANSWER: 92. a (Appendix) A company annually consumes 10,000 units of Part C. The carrying cost of this part is $2 per year and the ordering costs are $100. The company uses an order quantity of 500 units. If the company operates 200 days per year, and the lead time for ordering Part C is 5 days, what is the order point? a. b. c. d. 91. 16–23 b EASY (Appendix) Which of the following affects the order point? a. b. c. d. daily usage lead time safety stock all of the above ANSWER: d EASY 16–24 93. Chapter 16 (Appendix) A decrease in the lead time would reduce the a. b. c. d. order point. safety stock. economic order quantity. ordering costs. ANSWER: 94. d EASY (Appendix) If no safety stock is carried, the average inventory is equal to the a. b. c. d. order point/2. order point × 2. economic order quantity/2. economic order quantity × 2. ANSWER: c EASY (Appendix) The role of safety stock in an organization is to a. b. c. d. reduce the lead time for an order to be received. reduce the probability of a stockout. reduce the order point. decrease the economic order quantity. ANSWER: 97. EASY cost of a stockout. probability of a stockout. carrying cost of stock. economic order quantity. ANSWER: 96. a (Appendix) The size of the safety stock is directly affected by all of the following, except the a. b. c. d. 95. Innovative Inventory and Production Management Techniques b EASY (Appendix) The optimal size of the safety stock is defined by the point where the a. b. c. d. costs of carrying the safety stock equal stockout costs. setup costs equal stockout costs. ordering costs equal stockout costs. reorder point equals safety stock. ANSWER: a MEDIUM Chapter 16 98. Innovative Inventory and Production Management Techniques (Appendix) If a company carries safety stock and its annual carrying costs per unit are $0.30, what formula yields the total annual carrying costs? a. b. c. d. $0.30 × [(EOQ/2) + Safety stock)] $0.30 × (EOQ + Safety stock) $0.30 × [(EOQ × 2) + Safety stock)] $0.30 × (EOQ – Safety stock) ANSWER: 99. EASY 10,000 gallons 38,000 gallons 48,000 gallons 58,000 gallons ANSWER: d MEDIUM (Appendix) Blanchard Corp. operates its factory 300 days per year. Its annual consumption of Material Y is 1,200,000 gallons. It carries a 10,000 gallon safety stock of Material Y and its lead time is 12 business days. If the EOQ for Material Y is 30,000 gallons, and the carrying cost per gallon per year is $.25, what is the total annual carrying cost for Material Y? a. b. c. d. $3,750 $7,500 $6,250 $10,000 ANSWER: 101. a (Appendix) Blanchard Corp. operates its factory 300 days per year. Its annual consumption of Material Y is 1,200,000 gallons. It carries a 10,000 gallon safety stock of Material Y and its lead time is 12 business days. What is the order point for Material Y? a. b. c. d. 100. 16–25 c MEDIUM (Appendix) Blanchard Corp. consumes 1,200,000 gallons of Material Y per year. Its order quantity is 30,000 gallons. It maintains a safety stock of 10,000 gallons and its annual carrying costs are $0.25 per gallon per year. If the ordering cost is $20 per order, what are the total annual ordering costs? a. b. c. d. $600 $800 $8,300 $1,200 ANSWER: b MEDIUM 16–26 102. Chapter 16 (Appendix) R Corp.’s order quantity for Material T is 5,000 lbs. If the company maintains a safety stock of T at 500 lbs., and its order point is 1,500 lbs., what is the lead time assuming daily usage is 50 lbs.? a. b. c. d. 30 days 100 days 10 days 20 days ANSWER: 103. MEDIUM $1,000 $600 $100 $1,100 ANSWER: b MEDIUM (Appendix) For Raw Material B, a company maintains a safety stock of 5,000 pounds. Its average inventory (taking into account the safety stock) is 8,000 pounds. What is the apparent order quantity? a. b. c. d. 16,000 lbs. 6,000 lbs. 10,000 lbs. 21,000 lbs. ANSWER: 105. d (Appendix) R Corp.’s order quantity for Material T is 5,000 lbs. If the company maintains a safety stock of T at 500 lbs., and its order point is 1,500 lbs., what would be the total annual carrying costs assuming the carrying cost per unit is $0.20? a. b. c. d. 104. Innovative Inventory and Production Management Techniques b MEDIUM (Appendix) In an ABC inventory analysis, the items that are most likely to be controlled with a red-line system are the a. b. c. d. A items. B items. C items. items on a perpetual inventory. ANSWER: c EASY Chapter 16 106. Innovative Inventory and Production Management Techniques (Appendix) Which of the following might be appropriate for items in the “C” category of an ABC inventory analysis? a. b. c. d. a red-line system a two-bin system a periodic inventory system all of the above ANSWER: 107. d MEDIUM (Appendix) All other factors equal, a decrease in the order quantity will a. b. c. d. decrease the annual carrying costs. decrease the annual ordering costs. increase the lead time. reduce the safety stock. ANSWER: a EASY (Appendix) The economic order quantity is not affected by the a. b. c. d. estimate of the annual material consumption. cost of insuring a unit of inventory for a year. cost of purchase-order forms. safety stock level. ANSWER: 110. MEDIUM company’s weighted average cost of capital cost of purchase requisition forms cost of insuring inventory cost of a stockout ANSWER: 109. d (Appendix) The __________________ would not affect the economic order quantity. a. b. c. d. 108. 16–27 d EASY (Appendix) A decrease in the price of a raw material could result in a(n) a. b. c. d. increase in the lead time. increase in the EOQ. decrease in the order point. increase in the setup costs. ANSWER: b MEDIUM 16–28 111. Chapter 16 (Appendix) The number of orders that will be submitted each year for raw material is given by which formula? a. b. c. d. Economic order quantity × order point Total annual material needs/economic order quantity Order point/economic order quantity Total annual material needs/safety stock ANSWER: 112. Innovative Inventory and Production Management Techniques b EASY (Appendix) The economic production run quantity directly affects the a. b. c. d. order point for raw material inventories. safety stock for finished goods inventory. level of finished goods inventory. lead time for producing finished goods inventory. ANSWER: c MEDIUM SHORT ANSWER/PROBLEMS 1. Why may a JIT control system be useful in disclosing a firm’s inefficiencies and problems? ANSWER: The JIT control system is based on a philosophy that inventory is undesirable. Subscribers to the JIT philosophy believe inventory reductions expose organizational problems and inefficiencies. These problems and inefficiencies may not be brought to management’s attention if inventories are not pushed to lower and lower levels. They would remain hidden and undetectable at higher levels of inventory. MEDIUM 2. (Appendix) What is the purpose of the EOQ model? ANSWER: The purpose of the EOQ model is to identify the least cost quantity of a material to be purchased at each order point. The model explicitly considers the carrying and ordering costs and identifies the purchase quantity that minimizes the total of these costs. MEDIUM Chapter 16 3. Innovative Inventory and Production Management Techniques 16–29 Why does a “push” based inventory control system generate larger inventory levels than a “pull” system? ANSWER: Larger levels of inventory exist by design in push production control systems. The inventory buffers permit lower levels of communication between business segments, permit longer production runs, and protect the firm from environmental uncertainties and unforeseen interruptions in production or supplies. MEDIUM 4. What does the term “pull” mean in the context of production control? ANSWER: Pull simply refers to the fact that the pace and level of production are geared to product demand. Each work center sets the pace for the next upstream work center. Customer demand paces the final downstream work center. MEDIUM 5. Why might it be necessary to make adjustments to the accounting system in a firm that adopts JIT? ANSWER: JIT production control systems foster automation and reduced levels of inventory. Consequently, raw material inventories and direct labor costs may be too small to warrant separate cost pools—they can be combined with other cost pools. Additional adjustments may be necessary to accommodate standard costs, which are constantly adjusted to reflect the latest technological changes in production methods. Also, more costs could be traced to specific products and fewer costs would have to be allocated. MEDIUM 6. What is the relationship between warehouse space and the length of production runs? ANSWER: Longer production runs increase the levels of specific inventories. To accommodate long production runs, significant warehouse space needs to be available for storing intermediate and final products. MEDIUM 16–30 7. Chapter 16 Innovative Inventory and Production Management Techniques Why is it important for a company to be (geographically) close to its suppliers to implement a JIT inventory control system? ANSWER: The geographical proximity is important to minimize shipping and handling costs of supplies and materials. Geographical proximity also facilitates frequent communication and joint planning between a supplier and customer. MEDIUM 8. Bell Company estimates that it will consume 400,000 units of Part A in the coming year. The ordering cost for this unit is $3.20. What would be the carrying costs per unit if the EOQ model indicates that it is optimal to place exactly 50 orders for the upcoming year? ANSWER: If projected usage for the year is 400,000 units, the EOQ would be 8,000 units (400,000/50). To determine the carrying costs per unit, the following equation is solved: 8,000 = [(2 400,000 $3.20 / CC] , where CC is the carrying cost per unit. Solving the equation, CC = $0.04 per unit. MEDIUM 9. Bell Company estimates that it will consume 400,000 units of Part A in the coming year. The ordering cost for this unit is $3.20. Bell Company wants to maintain a safety stock of 1,000 units, and its factory operates 200 days per year. What is the order point if the lead time is 2 days? ANSWER: The order point = (daily usage × lead time) + safety stock daily usage = 400,000/200 = 2,000; lead time = 2 days, safety stock = 1,000 Order point = (2,000 × 2) + 1,000 = 5,000 units MEDIUM Chapter 16 10. Innovative Inventory and Production Management Techniques 16–31 How does adopting a JIT system affect the firm’s relationship with suppliers and how must suppliers change their way of doing business? ANSWER: The JIT manufacturer will limit the number of suppliers to a few. Longterm contracts are entered into with suppliers. Suppliers’ raw material must be top quality with no defects. Small quantities of raw material are delivered frequently and little or no raw material is maintained by the buyer. Suppliers must be located close enough to the JIT buyer to deliver small quantities very quickly. The supplier must agree to providing a top-quality product to its JIT customer. MEDIUM 11. Identify and discuss how sales and costs are affected during the five stages of the product life cycle. ANSWER: The five stages of the product life cycle are (1) development, (2) introduction, (3) growth, (4) maturity, and (5) decline. In the development stage, no production costs or sales exist, but R & D costs are extremely high. During the introduction stage low unit sales exist while high advertising costs are evident. The growth stage sees increasing unit sales and decreasing production costs per unit. The maturity stage witnesses peak unit sales and a stabilization of production costs per unit. During the decline stage unit sales decrease while production costs per unit increase. MEDIUM 12. Discuss differences in approach and potential usage between target and kaizen costing. ANSWER: Target costing is considered a procedural approach that is used to determine a maximum allowable cost for a product, while kaizen costing is a mandate to reduce costs, increase product quality, and/or improve production process through continuous improvement. Target costing has a large potential for cost reduction in lifelong product cost because these costs are embedded in the product during design and development. Kaizen costing has limited potential in cost reduction of existing products, but may be useful in target costing in the future. MEDIUM CHAPTER 17 EMERGING MANAGEMENT PRACTICES MULTIPLE CHOICE 1. The focus of BPR is improving a. b. c. d. products. processes. cost reduction. decision making. ANSWER: 2. employee layoffs. outsourcing initiatives. technology acquisition. plant expansion. ANSWER: d EASY BPR stands for a. b. c. d. business product reengineering. business purchase reengineering. business process reengineering. business process reduction. ANSWER: 4. EASY BPR is not associated with a. b. c. d. 3. b c EASY Who is not involved in the successful implementation of BPR? a. b. c. d. investors customers suppliers top management ANSWER: a EASY 17–1 17–2 5. Chapter 17 Which of the following is not a trend promoting the increased use of BPR? a. b. c. d. advancement of technology pursuit of increased quality price competition caused by globalization business expansion ANSWER: 6. d EASY An advantage of downsizing is a. b. c. d. decreased costs in the long run. layoffs. one-time losses. reduced communication. ANSWER: a EASY Outsourcing and marketing worldwide enable firms to a. b. c. d. develop new markets. reduce input costs. manage effects of peaks and valleys in local economies. all of the above. ANSWER: 9. EASY reduction in workforce. restructuring of processes. elimination of noncore businesses. all of the above. ANSWER: 8. d Downsizing results in a(n) a. b. c. d. 7. Emerging Management Practices d EASY Diversity applies to differences in a. b. c. d. race. religion. culture. all of the above. ANSWER: d EASY Chapter 17 10. Emerging Management Practices ERP stands for a. b. c. d. enterprise resource production. enterprise resource purchasing. enterprise resource planning. enterprise resource processing. ANSWER: 11. packaged software. methods of examining processes. ways to downsize. ways to expand geographical operations. ANSWER: EASY improve quality. improve service. reduce overhead. all of the above. ANSWER: d EASY Data mining is used to a. b. c. d. uncover quality problems. study customer retention. identify cost drivers. all of the above. ANSWER: 14. a ERP systems should help a company a. b. c. d. 13. EASY ERP systems are a. b. c. d. 12. c d EASY Data mining a. b. c. d. is packaged software. is a method of examining processes. uses statistical techniques to solve problems. is a way to downsize. ANSWER: c EASY 17–3 17–4 15. Chapter 17 A strategic alliance is a a. b. c. d. packaged software. way for two companies to jointly contribute to the supply chain. way to downsize. method of examining processes. ANSWER: 16. d EASY (A) __________ allows a company to accomplish a technology swap. a. b. d. d. data mining strategic alliance diversity BPR ANSWER: b EASY _____________ is a philosophy of increasing a firm’s performance by involving all workers. a. b. c. d. Open-book management Data mining Diversity Strategic alliance ANSWER: 19. EASY joint ventures. technology swaps. licensing. all of the above. ANSWER: 18. b Strategic alliances take the form of a. b. c. d. 17. Emerging Management Practices a EASY Disclosing detailed financial information to all employees is a characteristic of a. b. c. d. open-book management. data mining. diversity. strategic alliance. ANSWER: a EASY Chapter 17 20. Emerging Management Practices _____________ is a way of teaching accounting concepts to financially unsophisticated employees. a. b. c. d. Data mining Open-book management Game playing BPR ANSWER: 21. EASY mine data. form strategic alliances. win. use ERP. ANSWER: c EASY For game playing to work, motivation must come from a. b. c. d. individual employees. lower management. the board of directors. upper management. ANSWER: 23. c To make game playing successful, the employees must be able to a. b. c. d. 22. 17–5 d EASY _____________ is a characteristic of a company that is best suited for open-book management. a. b. c. d. Large size Decentralized management Centralized management Service-oriented ANSWER: b EASY 17–6 24. Chapter 17 EMS stands for a. b. c. d. environmental manufacturing system. employee management system. emergency medical services. environmental management system. ANSWER: 25. d EASY ____________ is (are) a strategy for dealing with environmental effects. a. b. c. d. End-of-pipe strategies Process improvements Pollution prevention All of the above ANSWER: 26. Emerging Management Practices d EASY EMS has to do with handling a. b. c. d. pollution. manufacturing. scrap. by-products. ANSWER: a EASY SHORT ANSWER/PROBLEMS 1. Define business process reengineering (BPR). ANSWER: Business process reengineering is a tool to achieve large, quick gains in effectiveness or efficiency through redesigning the execution of specific business functions. It is a method of examining processes to identify and then eliminate, reduce, or replace functions and processes that add little customer value to products or services. BPR is designed to bring radical changes to an organization’s operations. BPR is often associated with employee layoffs, outsourcing initiatives, and technology acquisition. MEDIUM Chapter 17 2. Emerging Management Practices 17–7 Why has BPR usage increased? ANSWER: 1. The advancement of technology has made possible electronic remittance of accounts payable and the use of robotic equipment to move and assemble components in a manufacturing facility. Advancements in technology have improved efficiencies throughout the supply chain. 2. The pursuit of increased quality is necessary because global competition allows consumers to purchase products and services from the highest quality providers in the world. BPR is a useful tool for increasing quality because it focuses attention on processes associated with poor quality and indicates ways in which quality can be improved by replacing, changing, or eliminating those processes. 3. BPR usage is increasing because of the increase in price competition caused by globalization. To successfully compete on the basis of price, firms must identify ways to become more efficient and thus reduce costs. MEDIUM 3. What is downsizing and how is it accomplished? ANSWER: Downsizing is any management action that reduces employment upon restructuring operations in response to competitive pressures. Events typical of downsizing are reduction of the workforce, restructuring of jobs and processes, and reduction or elimination of noncore businesses. MEDIUM 4. To what does workforce diversity refer? ANSWER: It refers to the fact that companies often find that their employees have very diverse backgrounds such as religion, race, values, work habits, cultures, political ideologies, and education levels. MEDIUM 17–8 5. Chapter 17 Emerging Management Practices What are enterprise resource planning systems (ERPs)? ANSWER: They are packaged software programs that allow companies to: (1) automate and integrate the majority of their business processes, (2) share common data and practices across the entire enterprise, and (3) produce and assess information in a real-time environment. ERP software includes brand names such as SAP, R/3, PeopleSoft, and Baan. MEDIUM 6. Define a strategic alliance. ANSWER: It is an interorganizational agreement that goes beyond normal customer/supplier arrangements involving two or more firms with complimentary core competencies to jointly contribute to the supply chain. EASY 7. What forms can strategic alliances take? ANSWER: Strategic alliances can take the forms of joint ventures, equity investment, licensing, joint R&D arrangements, technology swaps, and exclusive buyer/seller agreements. EASY 8. What is open-book management? ANSWER: It is a philosophy about increasing a firm’s performance by involving all workers and ensuring that all workers have access to operational and financial information necessary to achieve performance improvements. EASY Chapter 17 9. Emerging Management Practices 17–9 What are the principles of open-book management? ANSWER: 1. Turn the management of a business into a game that employees can win. 2. Open the books and share financial and operating information with employees. 3. Teach the employees to understand the company’s financial statements. 4. Show employees how their work influences financial results. 5. Link nonfinancial measures to financial results. 6. Target priority areas and empower employees to make improvements. 7. Review results together and keep employees accountable. 8. Post results and celebrate successes. 9. Distribute bonus awards based on employee contributions to financial outcomes. 10. Share the ownership of the company with employees (i.e., stock options). MEDIUM 10. How should employees be motivated so open-book management will succeed? ANSWER: The obvious way for upper management to motivate workers is to link their compensation to increases in profits from the effective use of the financial and operating information provided to them. EASY 11. What are the characteristics of firms best-suited to open-book management? ANSWER: Characteristics of best-suited firms are small size, decentralized management, a history of employee empowerment, and the presence of trust between employees and managers. EASY 12. Define an environmental management system (EMS). ANSWER: EMS is a system that accounts for both environmental costs and the impact of environmental issues in every aspect of operations. Accountants are increasingly concerned with measuring business performance with regard to environmental issues and management of environmental cost. In the future, investors are likely to evaluate a company’s environmental track record along with its financial record when making financial decisions. Primary environmental issues are energy consumption and pollution. MEDIUM 17–10 13. Chapter 17 Emerging Management Practices What are the three generic strategies for dealing with environmental effects of operations? ANSWER: 1. End-of-pipe strategies. With this approach, managers produce the waste or pollutant and then find a way to clean it up. 2. Process improvements. This approach involves changes to recycle wastes internally, reduce production of waste, or adopt production processes that generate no waste. 3. Pollution prevention. This approach involves eliminating production of pollutants. MEDIUM 14. What is data mining and how is it used? ANSWER: Data mining uses statistical techniques and is useful in uncovering quality problems, studying customer retention, determining which promotions generate the greatest sales impact, and identifying cost drivers. EASY CHAPTER 18 RESPONSIBILITY ACCOUNTING AND TRANSFER PRICING IN DECENTRALIZED ORGANIZATIONS MULTIPLE CHOICE 1. Which of the following is more characteristic of a decentralized than a centralized business structure? a. b. c. d. The firm’s environment is stable. There is little confidence in lower-level management to make decisions. The firm grows very quickly. The firm is relatively small. ANSWER: 2. more elaborate accounting control systems. potential costs of poor decisions. additional training costs. slow response time to changes in local conditions. ANSWER: d EASY Transfer pricing is primarily incurred in a. b. c. d. foreign corporations exporting their products. decentralized organizations. multinational corporations domiciled in the U.S. closely held corporations. ANSWER: 4. EASY Costs of decentralization include all of the following except a. b. c. d. 3. c b EASY In a decentralized company in which divisions may buy goods from one another, the transfer pricing system should be designed primarily to a. b. c. d. increase the consolidated value of inventory. allow division managers to buy from outsiders. minimize the degree of autonomy of division managers. aid in the appraisal and motivation of managerial performance. ANSWER: d EASY 18–1 18–2 5. Chapter 18 When the majority of authority is maintained by top management personnel, the organization is said to be a. b. c. d. centralized. decentralized. composed of cost centers. engaged in transfer pricing activities. ANSWER: 6. EASY responsibility accounting operations-research accounting control accounting budgetary accounting ANSWER: a EASY In a responsibility accounting system, costs are classified into categories on the basis of a. b. c. d. fixed and variable costs. prime and overhead costs. administrative and nonadministrative costs. controllable and noncontrollable costs. ANSWER: 8. a What term identifies an accounting system in which the operations of the business are broken down into reportable segments, and the control function of a foreperson, sales manager, or supervisor is emphasized? a. b. c. d. 7. Responsibility Accounting and Transfer Pricing in Decentralized Organizations d EASY When used for performance evaluation, periodic internal reports based on a responsibility accounting system should not a. b. c. d. be related to the organization chart. include allocated fixed overhead. include variances between actual and budgeted controllable costs. distinguish between controllable and noncontrollable costs. ANSWER: b EASY Chapter 18 9. Responsibility Accounting and Transfer Pricing in Decentralized Organizations A ___________ is a document that reflects the revenues and/or costs that are under the control of a particular manager. a. b. c. d. quality audit report responsibility report performance evaluation report project report ANSWER: 10. EASY cost revenue responsibility investment ANSWER: c EASY In evaluating the performance of a profit center manager, he/she should be evaluated on a. b. c. d. all revenues and costs that can be traced directly to the unit. all revenues and costs under his/her control. the variable costs and the revenues of the unit. the same costs and revenues on which the unit is evaluated. ANSWER: 12. b The cost object under the control of a manager is called a(n) __________________ center. a. b. c. d. 11. 18–3 b EASY If a division is set up as an autonomous profit center, then goods should not be transferred a. b. c. d. in at a cost-based transfer price. out at a cost-based transfer price. in or out at cost-based transfer price. to other divisions in the same company. ANSWER: b MEDIUM 18–4 13. Chapter 18 Performance evaluation measures in an organization a. b. c. d. affect the motivation of subunit managers to transact with one another. always promote goal congruence. are less motivating to managers than overall organizational goals. must be the same for all managers to eliminate suboptimization. ANSWER: 14. MEDIUM goal congruence. centralization. suboptimization. maximization. ANSWER: c EASY A major benefit of cost-based transfers is that a. b. c. d. it is easy to agree on a definition of cost. costs can be measured accurately. opportunity costs can be included. they provide incentives to control costs. ANSWER: 16. a A management decision may be beneficial for a given profit center, but not for the entire company. From the overall company viewpoint, this decision would lead to a. b. c. d. 15. Responsibility Accounting and Transfer Pricing in Decentralized Organizations c MEDIUM An internal reconciliation account is not required for internal transfers based on a. b. c. d. market value. dual prices. negotiated prices. cost. ANSWER: d MEDIUM Chapter 18 17. Responsibility Accounting and Transfer Pricing in Decentralized Organizations The most valid reason for using something other than a full-cost-based transfer price between units of a company is because a full-cost price a. b. c. d. is typically more costly to implement. does not ensure the control of costs of a supplying unit. is not available unless market-based prices are available. does not reflect the excess capacity of the supplying unit. ANSWER: 18. MEDIUM variable cost. market price. full cost. production cost. ANSWER: b MEDIUM A transfer pricing system is also known as a. b. c. d. investment center accounting. a revenue allocation system. responsibility accounting. a charge-back system. ANSWER: 20. b To avoid waste and maximize efficiency when transferring products among divisions in a competitive economy, a large diversified corporation should base transfer prices on a. b. c. d. 19. 18–5 d EASY The maximum of the transfer price negotiation range is a. b. c. d. determined by the buying division. set by the selling division. influenced only by internal cost factors. negotiated by the buying and selling division. ANSWER: a EASY 18–6 21. Chapter 18 The presence of idle capacity in the selling division may increase a. b. c. d. the incremental costs of production in the selling division. the market price for the good. the price that a buying division is willing to pay on an internal transfer. a negotiated transfer price. ANSWER: 22. MEDIUM system is very complex to be the most fair to the buying and selling units effect on subunit performance measures is not easily determined system should reflect organizational goals transfer price remains constant for a period of at least two years ANSWER: c MEDIUM With two autonomous division managers, the price of goods transferred between the divisions needs to be approved by a. b. c. d. corporate management. both divisional managers. both divisional managers and corporate management. corporate management and the manager of the buying division. ANSWER: 24. a Which of the following is a consistently desirable characteristic in a transfer pricing system? a. b. c. d. 23. Responsibility Accounting and Transfer Pricing in Decentralized Organizations b EASY The minimum potential transfer price is determined by a. b. c. d. incremental costs in the selling division. the lowest outside price for the good. the extent of idle capacity in the buying division. negotiations between the buying and selling division. ANSWER: a EASY Chapter 18 25. Responsibility Accounting and Transfer Pricing in Decentralized Organizations As the internal transfer price is increased, a. b. c. d. overall corporate profits increase. profits in the buying division increase. profits in the selling division increase. profits in the selling division and the overall corporation increase. ANSWER: 26. accounts receivable and CGS. CGS and finished goods. finished goods and accounts receivable. finished goods and intracompany sales. ANSWER: d EASY In an internal transfer, the buying division records the transaction by a. b. c. d. debiting accounts receivable. crediting accounts payable. debiting intracompany CGS. crediting inventory. ANSWER: 28. EASY In an internal transfer, the selling division records the event by crediting a. b. c. d. 27. c b EASY Top management can preserve the autonomy of division managers and encourage an optimal level of internal transactions by a. b. c. d. selecting performance evaluation measures that are consistent with the achievement of overall corporate goals. selecting division managers who are most concerned about their individual performance. prescribing transfer prices between segments. setting up all organizational units as revenue centers. ANSWER: a MEDIUM 18–7 18–8 29. Chapter 18 To evaluate the performance of individual departments, interdepartmental transfers of a product should preferably be made at prices a. b. c. d. equal to the market price of the product. set by the receiving department. equal to fully-allocated costs of the producing department. equal to variable costs to the producing department. ANSWER: 30. EASY responsibility accounting. the use of profit centers. the use of cost centers. a transfer pricing system. ANSWER: d MEDIUM External factors considered in setting transfer prices in multinational firms typically do not include a. b. c. d. the corporate income tax rates in host countries of foreign subsidiaries. foreign monetary exchange risks. environmental policies of the host countries of foreign subsidiaries. actions of competitors of foreign subsidiaries. ANSWER: 32. a Allocating service department costs to revenue-producing departments is an alternative to a. b. c. d. 31. Responsibility Accounting and Transfer Pricing in Decentralized Organizations c MEDIUM Corporate taxes and tariffs are particular transfer-pricing concerns of a. b. c. d. investment centers. multinational corporations. division managers. domestic corporations involved in importing foreign goods. ANSWER: b EASY Chapter 18 33. Responsibility Accounting and Transfer Pricing in Decentralized Organizations When managers attempt to cause actual results to conform to planned results, this is known as a. b. c. d. efficiency. effectiveness. conformity. goal congruence. ANSWER: 34. b EASY Which of the following would not be considered a critical success factor? a. b. c. d. quality cost control customer service all of the above are critical success factors ANSWER: 35. 18–9 d EASY The costs of service departments can be assigned to other divisions through the use of a. b. c. d. cost centers. transfer prices. goal congruence. operational auditing techniques. ANSWER: d MEDIUM 18–10 Chapter 18 Responsibility Accounting and Transfer Pricing in Decentralized Organizations Use the following information for questions 36–40. Office Products Inc. manufactures and sells various high-tech office automation products. Two divisions of Office Products Inc. are the Computer Chip Division and the Computer Division. The Computer Chip Division manufactures one product, a “super chip,” that can be used by both the Computer Division and other external customers. The following information is available on this month’s operations in the Computer Chip Division: Selling price per chip Variable costs per chip Fixed production costs Fixed SG&A costs Monthly capacity External sales Internal sales $50 $20 $60,000 $90,000 10,000 chips 6,000 chips 0 chips Presently the Computer Division purchases no chips from the Computer Chips Division, but instead pays $45 to an external supplier for the 4,000 chips it needs each month. 36. Assume that next month’s costs and levels of operations in the Computer and Computer Chip Divisions are similar to this month. What is the minimum of the transfer price range for a possible transfer of the super chip from one division to the other? a. b. c. d. $50 $45 $20 $35 ANSWER: 37. c MEDIUM Assume that next month’s costs and levels of operations in the Computer and Computer Chip Divisions are similar to this month. What is the maximum of the transfer price range for a possible transfer of the chip from one division to the other? a. b. c. d. $50 $45 $35 $30 ANSWER: b MEDIUM Chapter 18 38. Responsibility Accounting and Transfer Pricing in Decentralized Organizations Two possible transfer prices (for 4,000 units) are under consideration by the two divisions: $35 and $40. Corporate profits would be ___________ if $35 is selected as the transfer price rather than $40. a. b. c. d. $20,000 larger $40,000 larger $20,000 smaller the same ANSWER: 39. d MEDIUM If a transfer between the two divisions is arranged next period at a price (on 4,000 units of super chips) of $40, total profits in the Computer Chip division will a. b. c. d. rise by $20,000 compared to the prior period. drop by $40,000 compared to the prior period. drop by $20,000 compared to the prior period. rise by $80,000 compared to the prior period. ANSWER: 40. 18–11 d MEDIUM Assume, for this question only, that the Computer Chip Division is selling all that it can produce to external buyers for $50 per unit. How would overall corporate profits be affected if it sells 4,000 units to the Computer Division at $45? (Assume that the Computer Division can purchase the super chip from an outside supplier for $45.) a. b. c. d. no effect $20,000 increase $20,000 decrease $90,000 increase ANSWER: c MEDIUM 18–12 Chapter 18 Responsibility Accounting and Transfer Pricing in Decentralized Organizations Use the following information for questions 41–43. The Motor Division of Super Truck Co. uses 5,000 carburetors per month in its production of automotive engines. It presently buys all of the carburetors it needs from two outside suppliers at an average cost of $100. The Carburetor Division of Super Truck Co. manufactures the exact type of carburetor that the Motor Division requires. The Carburetor Division is presently operating at its capacity of 15,000 units per month and sells all of its output to a foreign car manufacturer at $106 per unit. Its cost structure (on 15,000 units) is: Variable production costs Variable selling costs All fixed costs $70 10 10 Assume that the Carburetor Division would not incur any variable selling costs on units that are transferred internally. 41. What is the maximum of the transfer price range for a transfer between the two divisions? a. b. c. d. $106 $100 $90 $70 ANSWER: 42. MEDIUM What is the minimum of the transfer price range for a transfer between the two divisions? a. b. c. d. $96 $90 $70 $106 ANSWER: 43. b a MEDIUM If the two divisions agree to transact with one another, corporate profits will a. b. c. d. drop by $30,000 per month. rise by $20,000 per month. rise by $50,000 per month. rise or fall by an amount that depends on the level of the transfer price. ANSWER: c MEDIUM Chapter 18 Responsibility Accounting and Transfer Pricing in Decentralized Organizations 18–13 Use the following information for questions 44–47. Bigole Corp. produces various products used in the construction industry. The Plumbing Division produces and sells 100,000 copper fittings each month. Relevant information for last month follows: Total sales (all external) Expenses (all on a unit base): Variable manufacturing Fixed manufacturing Variable selling Fixed selling Variable G&A Fixed G&A Total $250,000 $0.50 .25 .30 .40 .15 .50 $2.10 Top-level managers are trying to determine how a transfer price can be set on a transfer of 10,000 of the copper fittings from the Plumbing Division to the Bathroom Products Division. 44. A transfer price based on variable cost will be set at ___________ per unit. a. b. c. d. $0.50 $0.80 $0.95 $0.75 ANSWER: 45. MEDIUM A transfer price based on full production cost would be set at ___________ per unit. a. b. c. d. $0.75 $2.10 $1.45 $1.60 ANSWER: 46. c a MEDIUM A transfer price based on market price would be set at ___________ per unit. a. b. c. d. $2.10 $2.50 $1.60 $2.25 ANSWER: b MEDIUM 18–14 47. Chapter 18 If the Plumbing Division is operated as an autonomous investment center and its capacity is 100,000 fittings per month, the per-unit transfer price is not likely to be below a. b. c. d. $0.75. $1.60. $2.10. $2.50. ANSWER: 48. Responsibility Accounting and Transfer Pricing in Decentralized Organizations d MEDIUM A company has two divisions, A and B, each operated as a profit center. A charges B $35 per unit for each unit transferred to B. Other data follow: A’s variable cost per unit A’s fixed costs A’s annual sales to B A’s annual sales to outsiders $30 $10,000 5,000 units 50,000 units A is planning to raise its transfer price to $50 per unit. Division B can purchase units at $40 each from outsiders, but doing so would idle A’s facilities now committed to producing units for B. Division A cannot increase its sales to outsiders. From the perspective of the company as a whole, from whom should Division B acquire the units, assuming B’s market is unaffected? a. b. c. d. outside vendors Division A, but only at the variable cost per unit Division A, but only until fixed costs are covered, then should purchase from outside vendors Division A, in spite of the increased transfer price ANSWER: 49. d MEDIUM A service department includes which of the following? a. b. c. d. Payroll yes yes no no ANSWER: Production no yes yes no a EASY Chapter 18 50. Responsibility Accounting and Transfer Pricing in Decentralized Organizations Indirect costs should be allocated for all of the following reasons except to a. b. c. d. motivate managers. determine the full cost of a product. motivate general administration. compare alternatives for decision making. ANSWER: 51. MEDIUM purchasing warehousing distributing manufacturing ANSWER: d EASY All of the following objectives are reasons to allocate service department costs to compute full cost except to a. b. c. d. provide information on cost recovery. abide by regulations that may require full costing in some instances. provide information on controllable costs. reflect production’s “fair share” of costs. ANSWER: 53. c A service department provides specific functional tasks for other internal units. Which of the following activities would not be engaged in by a service department? a. b. c. d. 52. 18–15 c MEDIUM All of the following objectives are reasons that service department allocations can motivate managers except to a. b. c. d. instill a consideration of support costs in production managers. encourage production managers to help service departments control costs. encourage the usage of certain services. determine divisional profitability. ANSWER: d MEDIUM 18–16 54. Chapter 18 Which of the following is a reason for allocating service department costs and thereby motivating management? a. b. c. d. provides for cost recovery provides relevant information in determining corporatewide profits generated by alternative actions meets regulations in some pricing instances reflects usage of services on a fair and equitable basis ANSWER: 55. Internal units no yes no yes ANSWER: MEDIUM b External units no no yes yes EASY After service department costs have been allocated, what is the final step in determining full product cost? a. b. c. d. determine direct material cost determine overhead application rates for revenue-producing areas determine direct labor cost determine total service department costs ANSWER: 57. d Service departments provide functional tasks for which of the following? a. b. c. d. 56. Responsibility Accounting and Transfer Pricing in Decentralized Organizations b EASY Which of the following is not an objective for computing full cost? a. b. c. d. to reflect production’s “fair share” of costs to instill a consideration of support costs to reflect usage of services on a fair and equitable basis to provide for cost recovery ANSWER: c MEDIUM Chapter 18 58. Responsibility Accounting and Transfer Pricing in Decentralized Organizations A rational and systematic allocation base for service department costs should reflect the cost accountant’s consideration of all of the following except a. b. c. d. the ability of revenue-producing departments to bear the allocated costs. the benefits received by the revenue-producing department from the service department. a causal relationship between factors in the revenue-producing department and costs incurred in the service department. all of the above are considerations. ANSWER: 59. MEDIUM step method indirect method direct method algebraic method ANSWER: b EASY Which service department cost allocation method assigns costs directly to revenueproducing areas with no other intermediate cost pools or allocations? a. b. c. d. step method indirect method algebraic method direct method ANSWER: 61. d Which of the following is not a method for allocating service department costs? a. b. c. d. 60. 18–17 d EASY The overhead allocation method that allocates service department costs without consideration of services rendered to other service departments is the a. b. c. d. step method. direct method. reciprocal method. none of the above. ANSWER: b EASY 18–18 62. Chapter 18 Which service department cost allocation method assigns indirect costs to cost objects after considering some of the interrelationships of the cost objects? a. b. c. d. step method indirect method algebraic method direct method ANSWER: 63. EASY algebraic method indirect method step method direct method ANSWER: c EASY Which service department cost allocation method assigns indirect costs to cost objects after considering interrelationships of the cost objects? a. b. c. d. Algebraic method no no yes yes ANSWER: 65. a Which service department cost allocation method utilizes a “benefits-provided” ranking? a. b. c. d. 64. Responsibility Accounting and Transfer Pricing in Decentralized Organizations c Step method no yes yes no EASY Which of the following methods of assigning indirect service department costs recognizes on a partial basis the reciprocal relationships among the departments? a. b. c. d. step method direct method indirect method algebraic method ANSWER: a EASY Chapter 18 66. Responsibility Accounting and Transfer Pricing in Decentralized Organizations The most accurate method for allocating service department costs is the a. b. c. d. step method. direct method. algebraic method. none of the above. ANSWER: 67. EASY Benefits received yes yes no no ANSWER: b Fairness yes yes yes no Causal relationships no yes yes no MEDIUM To identify costs that relate to a specific product, an allocation base should be chosen that a. b. c. d. does not have a cause-and-effect relationship. has a cause-and-effect relationship. considers variable costs but not fixed costs. considers direct material and direct labor but not manufacturing overhead. ANSWER: 69. c The criteria that are most often used to decide on allocation bases are? a. b. c. d. 68. 18–19 b EASY The fixed costs of service departments should be allocated to production departments based on a. b. c. d. actual short-run utilization based on predetermined rates. actual short-run units based on actual rates. the service department’s expected costs based on expected long-run use of capacity. the service department’s actual costs based on actual utilization of services. ANSWER: d MEDIUM 18–20 70. Chapter 18 Which service department cost allocation method provides for reciprocal allocation of service costs among the service department as well as to the revenue producing departments? a. b. c. d. algebraic method indirect method step method direct method ANSWER: 71. b. c. d. EASY considers all interrelationships of the departments and reflects these relationships in equations. does not consider interrelationships of the departments nor reflect these relationships in equations. is also referred to as the “benefits-provided” ranking method. is not a service department cost allocation method. ANSWER: a EASY Which service department cost allocation method considers all interrelationships of the departments and reflects these relationships in equations? a. b. c. d. step method indirect method algebraic method direct method ANSWER: 73. a The algebraic method a. 72. Responsibility Accounting and Transfer Pricing in Decentralized Organizations c EASY An automotive company has three divisions. One division manufactures new replacements parts for automobiles, another rebuilds engines, and the third does repair and overhaul work on a line of trucks. All three divisions use the services of a central payroll department. The best method of allocating the cost of the payroll department to the various operating divisions is a. b. c. d. total labor hours incurred in the divisions. value of production in the divisions. direct labor costs incurred in the divisions. machine hours used in the divisions. ANSWER: a MEDIUM Chapter 18 74. Responsibility Accounting and Transfer Pricing in Decentralized Organizations 18–21 The allocation of general overhead control costs to operating departments can be least justified in determining a. b. c. d. income of a product or functional unit. costs for making management’s decisions. costs of products sold. costs for government’s “cost-plus” contracts. ANSWER: b MEDIUM Use the following information for questions 75–84. Gates Co. has three production departments A, B, and C. Gates also has two service departments, Administration and Personnel. Administration costs are allocated based on value of assets employed, and Personnel costs are allocated based on number of employees. Assume that Administration provides more service to the other departments than does the Personnel Department. Dept. Admin. Personnel A B C 75. Employees 25 10 15 5 10 Asset Value $450,000 600,000 300,000 150,000 800,000 Using the direct method, what amount of Administration costs is allocated to A (round to the nearest dollar)? a. b. c. d. $216,000 $150,000 $288,000 $54,000 ANSWER: 76. Direct Costs $900,000 350,000 700,000 200,000 250,000 a MEDIUM Using the direct method, what amount of Personnel costs is allocated to B (round to the nearest dollar)? a. b. c. d. $50,000 $43,750 $26,923 $58,333 ANSWER: d MEDIUM 18–22 77. Chapter 18 Using the direct method, what amount of Administration costs is allocated to C (round to the nearest dollar)? a. b. c. d. $576,000 $54,000 $108,000 $150,000 ANSWER: 78. MEDIUM $72,973 $291,892 $145,946 $389,189 ANSWER: b MEDIUM Using the step method, what amount of Administration costs is allocated to A (round to the nearest dollar)? a. b. c. d. $72,973 $291,892 $145,946 $389,189 ANSWER: 80. a Using the step method, what amount of Administration costs is allocated to Personnel (round to the nearest dollar)? a. b. c. d. 79. Responsibility Accounting and Transfer Pricing in Decentralized Organizations c MEDIUM Using the step method, what amount of Administration costs is allocated to B (round to the nearest dollar)? a. b. c. d. $72,973 $291,892 $145,946 $389,189 ANSWER: a MEDIUM Chapter 18 81. Responsibility Accounting and Transfer Pricing in Decentralized Organizations Using the step method, what amount of Administration costs is allocated to C (round to the nearest dollar)? a. b. c. d. $389,189 $145,946 $291,892 $72,973 ANSWER: 82. MEDIUM $213,964 $106,982 $430,000 $0 ANSWER: c MEDIUM Assume that Administration costs have been allocated and the balance in Personnel is $860,000. What amount is allocated to B (round to the nearest dollar)? a. b. c. d. $213,964 $430,000 $106,982 $143,333 ANSWER: 84. a Assume that Administration costs have been allocated and the balance in Personnel is $860,000. What amount is allocated to A (round to the nearest dollar)? a. b. c. d. 83. 18–23 d MEDIUM Assume that Administration costs have been allocated and the balance in Personnel is $860,000. What amount is allocated to C (round to the nearest dollar)? a. b. c. d. $213,964 $430,000 $286,667 $143,333 ANSWER: c MEDIUM 18–24 Chapter 18 Responsibility Accounting and Transfer Pricing in Decentralized Organizations Use the following information for questions 85–90. Brooks Co. has two service departments: Data Processing and Administration/Personnel. The company also has three divisions: X, Y, and Z. Data Processing costs are allocated based on hours of use and Administration/Personnel costs are allocated based on number of employees. Direct costs $400,000 850,000 450,000 300,000 550,000 Admin/Per. Data Pro. X Y Z Employees 10 5 30 15 25 Hours of use 3,300 1,100 1,800 2,200 4,500 Assume that Data Processing provides more service than Administration/Personnel. 85. Using the direct method, what amount of Data Processing costs is allocated to X (round to the nearest dollar)? a. b. c. d. $180,000 $129,661 $0 $84,706 ANSWER: 86. MEDIUM Using the direct method, what amount of Data Processing costs is allocated to Y (round to the nearest dollar)? a. b. c. d. $158,475 $0 $220,000 $103,529 ANSWER: 87. a c MEDIUM Using the direct method, what amount of Data Processing costs is allocated to Z (round to the nearest dollar)? a. b. c. d. $211,765 $0 $152,542 $450,000 ANSWER: d MEDIUM Chapter 18 88. Responsibility Accounting and Transfer Pricing in Decentralized Organizations Assume that Data Processing costs have been allocated and the balance in Administration is $600,000. Using the step method, what amount is allocated to X? a. b. c. d. $257,143 $112,500 $200,000 $187,500 ANSWER: 89. a MEDIUM Assume that Data Processing costs have been allocated and the balance in Administration is $600,000. Using the step method, what amount is allocated to Y? a. b. c. d. $225,000 $128,571 $187,500 $200,000 ANSWER: 90. 18–25 b MEDIUM Assume that Data Processing costs have been allocated and the balance in Administration is $600,000. Using the step method, what amount is allocated to Z? a. b. c. d. $200,000 $112,500 $214,286 $225,000 ANSWER: c MEDIUM 18–26 Chapter 18 Responsibility Accounting and Transfer Pricing in Decentralized Organizations Use the following information for questions 91 and 92. Blake Company has two service departments: Data Processing and Personnel. Data Processing provides more service than does Personnel. Blake also has two production departments: A and B. Data Processing costs are allocated on the basis of assets used while Personnel costs are allocated based on the number of employees. Direct costs $1,000,000 300,000 500,000 330,000 Data Pro. Pers. A B 91. Assets used $700,000 230,000 125,000 220,000 Using the direct method, what amount of Data Processing costs is allocated to A (round to the nearest dollar)? a. b. c. d. $362,319 $637,681 $253,623 $446,377 ANSWER: 92. Employees 15 8 12 20 a MEDIUM Using the direct method, what amount of Personnel costs is allocated to B (round to the nearest dollar)? a. b. c. d. $123,750 $206,250 $112,500 $187,500 ANSWER: d MEDIUM Chapter 18 Responsibility Accounting and Transfer Pricing in Decentralized Organizations 18–27 Use the following information for questions 93–96. Hartwell Company distributes its service department overhead costs directly to producing departments without allocation to the other service departments. Information for January is presented here. Overhead costs incurred Service provided to: Maintenance Dept. Utilities Dept. Producing Dept. A Producing Dept. B 93. Utilities $9,000 10% 20% 40% 40% 30% 60% The amount of Utilities Department costs distributed to Dept. B for January should be (rounded to the nearest dollar) a. b. c. d. $3,600. $4,500. $5,400. $6,000. ANSWER: 94. Maintenance $18,700 d MEDIUM Assume instead Hartwell Company distributes the service department’s overhead costs based on the step method. Maintenance provides more service than does Utilities. Which of the following is true? a. b. c. d. Allocate maintenance expense to Departments A and B. Allocate maintenance expense to Departments A and B and the Utilities Department. Allocate utilities expense to the Maintenance Department and Departments A and B. None of the above. ANSWER: b MEDIUM 18–28 95. Chapter 18 Using the step method, how much of Hartwell’s Utilities Department cost is allocated between Departments A and B? a. b. c. d. $9,900 $10,800 $12,740 $27,700 ANSWER: 96. Responsibility Accounting and Transfer Pricing in Decentralized Organizations c MEDIUM Assume that Hartwell Company distributes service department overhead costs based on the algebraic method. What would be the formula to determine the total maintenance costs? a. b. c. d. M = $18,700 + .10U M = $9,000 + .20U M = $18,700 + .30U + .40A + .40B M = $27,700 + .40A + .40B ANSWER: a MEDIUM SHORT ANSWER/PROBLEMS 1. Describe the lowest internal transfer price that an autonomous division manager of an investment center would consider accepting for a product that his/her division produces. ANSWER: The lowest price that an investment center manager should ever consider is the one that would leave his/her performance evaluation measures unaffected. Typically, this would be the price that maintains divisional profits at the level that existed prior to acceptance of the internal transfer. This price should be no lower than the total of the selling segment’s incremental costs associated with the services/goods plus the opportunity cost of the facilities used. MEDIUM Chapter 18 2. Responsibility Accounting and Transfer Pricing in Decentralized Organizations 18–29 What are the advantages and disadvantages of market value as a transfer price? ANSWER: Market value has the advantage of being an external measure of value. It is subject to manipulation by neither the internal buying nor selling segment. In addition, it captures the relevant opportunity costs because it is a measure of the price that the internal selling unit could receive for its production from another buyer and a measure of the cost that would be incurred by the internal buying segment to purchase from an alternative seller. The disadvantages of market price include the possibility that there may not be a comparable product in the marketplace. If demand for the product has declined, establishing a transfer price becomes more difficult. Additionally, if the firm has experienced a reduction in expenses related to the product, market price may not be reliable or appropriate as a transfer price. MEDIUM 3. Why is “standard cost” a better measure for a transfer price than “actual cost”? ANSWER: When a transfer is based on actual cost, the producing division has no incentive to be efficient in its production. With a standard costing system, any differences between standard and actual costs will be the responsibility of the producing division. Hence, the producing division has incentive to be efficient. MEDIUM 4. Can the performance evaluation measures (for autonomous subunit managers) create goal congruence problems in transfer pricing situations? Explain. ANSWER: Yes, at times, performance-based incentives can conflict with overall organizational goals. The situation is the worst when upper level managers look at the performance of subunit managers in a comparative fashion. In this case, before transacting with another internal segment, each manager needs to determine how the transaction would affect his/her performance evaluation measure relative to the performance evaluation measure of the other transacting party. MEDIUM 18–30 5. Chapter 18 Responsibility Accounting and Transfer Pricing in Decentralized Organizations Why don’t upper-level managers simply dictate transfer prices to divisional managers, and thereby avoid all the hassles and expense of the negotiations between them (divisional managers)? ANSWER: Once upper-level managers impose their wills on lower-level managers, the autonomy of the lower-level managers is reduced. This situation is significant because managers should only be evaluated on the controllable aspects of operations. If upper management sets transfer prices, various divisional income measures (ROI, RI, etc.) are no longer fair bases on which to evaluate lower-level managers. Thus, intervention reduces both the authority to act and the subsequent responsibility of lower managers. MEDIUM Use the following information for questions 6–9. Electric Division of Engineered Products Co. has developed a wind generator that requires a special “S” ball bearing. The Ball Bearing Division of Engineered Products Co. has the capability to produce such a ball bearing. Unfortunately, the Ball Bearing Division is operating at capacity and will need to reduce production of another existing product, the “T” bearing, by 1,000 units per month to provide the 600 “S” bearings needed each month by the Electric Division. The “T” bearing currently sells for $50 per unit. Variable costs incurred to produce the “T” bearing are $30 per unit; variable costs to produce the new “S” bearing would be $60 per unit. Electric Division has found an external supplier that would furnish the needed “S” bearings at $100 per unit. Assume that both Electric Division and Ball Bearing Division are independent, autonomous investment centers. 6. What is the maximum price per unit that Electric Division would be willing to pay the Ball Bearing Division for the “S” bearing? ANSWER: Electric Division would be willing to pay no more than $100 per unit, the price offered by the external supplier. MEDIUM Chapter 18 7. Responsibility Accounting and Transfer Pricing in Decentralized Organizations 18–31 What is the minimum price that Ball Bearing Division would consider to produce the “S” bearing? ANSWER: The minimum price that Ball Bearing Division would accept is the one that would leave its profits at the same level as if it only produced “T” bearings. To produce the “S” bearing, Ball Bearing Division must give up production and sale of 1,000 “T” bearings. These 1,000 bearings generate $20,000 of contribution margin: [1,000 × ($50 – $30) ]. The sales price would have to be high enough to recoup both the variable costs of the “S” bearings and the contribution margin that is forfeited on the 1,000 units of “T” bearings: $60 + ($20,000/600) = $93.33 MEDIUM 8. How would your answer to question 104 be different if Ball Bearing Division did not need to forfeit any of its existing sales to produce the “S” bearing? ANSWER: “S” bearing. The minimum price would be $60, the incremental costs to produce the MEDIUM 9. What factors besides price would Electric Division want to consider in deciding where it will purchase the bearing? ANSWER: In particular, Electric Division would want to consider the quality of both suppliers. The factors to be considered would include: ability to meet delivery deadlines, quality of the product produced, ability to change as environmental conditions change, willingness to work on future cost reductions/quality improvements, business reputation, stability of the labor force, and possibility of future price increases. MEDIUM 18–32 Chapter 18 Responsibility Accounting and Transfer Pricing in Decentralized Organizations Use the following information for questions 10–14. Wire Division of XS Steel Corporation produces “bales” of steel wire that are used in various commercial applications. The bales sell for an average of $20 each and Wire Division has the capacity to produce 10,000 bales per month. Consumer Products Division of XS Steel uses approximately 2,000 bales of steel wire each month in its production of various appliances. The operating information for Wire Division at its present level of operations (8,000 bales per month) follows: Sales (all external) Variable costs per bale: Production Selling G&A Fixed costs per bale (based on a 10,000 unit capacity): Production Selling G&A $160,000 $5 2 3 $2 3 4 Consumer Products Division currently pays $15 per bale for wire obtained from its external supplier. 10. If 2,000 bales are transferred in one month to Consumer Products Division at $10 per bale, what would be the profit/loss of Wire Products Division? ANSWER: The $10 per unit would equal the Division’s variable costs ($5 + 2 + 3 = $10), so the contribution margin per unit is zero. Thus, only the 8,000 units of external sales would generate a contribution margin of $80,000 (8,000 × $10) to cover fixed costs of $90,000 (10,000 × $9). So the Division would show a $10,000 loss. MEDIUM Chapter 18 11. Responsibility Accounting and Transfer Pricing in Decentralized Organizations 18–33 For the Wire Products Division to operate at break-even level, what would it need to charge for the production and transfer of 2,000 bales to the Consumer Products Division? Assume all variable costs indicated will be incurred by the Wire Division. ANSWER: Total fixed costs to Wire are: Production $2 × 10,000 = Selling $3 × 10,000 = G&A $4 × 10,000 = Total $20,000 30,000 40,000 $90,000 Less: Contrib.Margin on Regular Business [$20 – (5 + 2 + 3)] × 8,000 (80,000 ) Unrecovered Fixed Costs $10,000 which must be covered by CM of inside sales = Trans.Price × Vol. = SP – [(5 + 2 + 3) × 2,000] SP = $15 MEDIUM 12. If Wire Products Division transferred 2,000 wire bales to the Consumer Products Division at 200 percent of full absorption cost, what would be the transfer price? ANSWER: Full absorption cost: Variable Production Cost = Fixed Production Cost = Total full absorption cost Doubled Transfer price $ 5 2 $ 7 × 2 $14 MEDIUM 13. If Consumer Products Division agrees to pay Wire Products Division $16 for 2,000 bales this month, what would be Consumer’s change in total profits? ANSWER: Proposed transfer price per unit Consumer’s current market purchase price per unit Increase in cost per unit of wire to Consumer’s Times units purchased Decrease in profit due to increased costs MEDIUM $ 16 15 $ 1 × 2,000 $ 2,000 18–34 14. Chapter 18 Responsibility Accounting and Transfer Pricing in Decentralized Organizations Assuming, for this question only, that Wire Products Division would not incur any variable G&A costs on internal sales, what is the minimum price that it would consider accepting for sales of bales to Consumer Products Division? ANSWER: Wire Division must cover its out of pocket costs or the relevant variable costs; the fixed costs are irrelevant since they will be incurred regardless of this extra inside business. Thus, the total cost to be covered is $7 (production, $5; selling, $2). MEDIUM Use the following information for questions 15–19. Carpet Division of Building Products Inc. manufactures a single grade of residential grade carpeting. The division has the capacity to produce 500,000 square yards of carpet each year. Its current costs and revenues are shown here: Sales (400,000 square yards) Variable costs per square yard: Production SG&A Fixed costs per square yard (based on 500,000 yard capacity) Production SG&A $2,000,000 $2.00 1.00 $0.50 1.00 The Housing Division currently purchases 40,000 yards of carpeting (of the grade produced by the Carpet Division) each year at a cost of $6.50 per square yard from an outside vendor. 15. If the autonomous Housing and Carpet Divisions enter negotiations on the internal transfer of 40,000 square yards of carpeting, what is the maximum price that will be considered? ANSWER: The maximum price or ceiling is the current purchase price of the buying division or $6.50 per yard. MEDIUM 16. If the autonomous Housing and Carpet Divisions enter negotiations on the internal transfer of 40,000 square yards of carpeting, what is the Carpet Division’s minimum price? ANSWER: The minimum price acceptable to Carpet is its incremental cost of $3 ($2 + $1) per square yard. MEDIUM Chapter 18 17. Responsibility Accounting and Transfer Pricing in Decentralized Organizations 18–35 If the Housing and Carpet Divisions agree on the internal transfer of 40,000 square yards of carpet at a price of $4.50 per square yard, how will the profits of the Housing Division be affected? ANSWER: Current external purchase price Proposed transfer price Reduction in purchase price per yard Times yards acquired Increase in profits $6.50 4.50 $2.00 ×40,000 $80,000 MEDIUM 18. If the Housing and Carpet Divisions agree on the internal transfer of 40,000 square yards of carpet at a price of $4.00 per square yard, how will overall corporate profits be affected? ANSWER: Current outside purchase price per square yard Carpet’s variable cost per square yard Savings per square yard to Housing Division & corporate Times number square yards bought Savings to corporate and increase in profits $6.50 3.00 $3.50 × 40,000 $140,000 MEDIUM 19. Assume, for this question only, that Carpet Division is producing and selling 500,000 square yards of carpet to external buyers at a price of $5 per square yard. What would be the effect on overall corporate profits if Carpet Division reduces external sales of carpet by 40,000 square yards and transfers the 40,000 square yards of carpet to the Housing Division? ANSWER: Since Carpet is operating at full capacity, it would lose the contribution margin on the 40,000 square yards. However, the Housing Division would not have to buy externally. Thus, Lost CM ($2 × 40,000 yd) = Gained CM ($3.50 × 40,000 yd) = Net increase in corporate profits MEDIUM $(80,000 ) 140,000 $ 60,000 18–36 Chapter 18 Responsibility Accounting and Transfer Pricing in Decentralized Organizations Use the following information for questions 20 and 21. XY Corporation is comprised of two divisions: X and Y. X currently produces and sells a gear assembly used by the automotive industry in electric window assemblies. X is currently selling all of the units it can produce (25,000 per year) to external customers for $25 per unit. At this level of activity, X’s per unit costs are: Variable: Production SG&A Fixed: Production SG&A $7 2 6 5 Y Division wants to purchase 5,000 gear assemblies per year from X Division. Y Division currently purchases these units from an outside vendor at $22 each. 20. What is the minimum price per unit that X Division could accept from Y Division for 5,000 units of the gear assembly and be no worse off than currently? ANSWER: X Division is operating and selling outside at full capacity so minimum price is equal to the variable cost to make and sell plus the lost contribution margin from outside sales: VC: Production SGA Contribution margin Selling price MEDIUM $7 2 $ 9 16 $25 Chapter 18 21. Responsibility Accounting and Transfer Pricing in Decentralized Organizations What will be the effect on overall corporate profits if the two divisions agree to an internal transfer of 5,000 units? ANSWER: Corporate profits will decrease by forcing the transfer. CM per units earned by X is from external sales $25 – [$7 + $2] Times units to be sold Decrease in CM to X and XY Corp. Net savings to buy internally rather than externally [$22 – $9] Times units to be purchased Savings by buying internally Net effect on XY Corp. profits MEDIUM $16 × 5,000 $ 80,000 $13 × 5,000 $ 65,000 $(15,000) 18–37 18–38 Chapter 18 Responsibility Accounting and Transfer Pricing in Decentralized Organizations Use the following information for questions 22 and 23. Third Savings and Loan of Dallas has three departments that generate revenue: loans, checking accounts, and savings accounts. Third S & L has two service departments: Administration/Personnel and Maintenance. The service departments provide service in the order of their listing. The following information is available for direct costs. Administration/ Personnel costs are best allocated based on number of employees while Maintenance costs are best allocated based on square footage occupied. Department Admin./Pers. Maintenance Loans Checking Savings 22. Direct costs $530,000 450,000 900,000 600,000 240,500 Employees 10 8 15 6 5 Footage 30,000 16,500 45,000 10,000 42,000 Using the direct method, compute the amount allocated to each department from Administration/Personnel. ANSWER: Loans 15/26 × $530,000 = $305,769 Checking 6/26 × 530,000 = 122,308 Savings 5/26 × 530,000 = 101,923 MEDIUM 23. Using the step method, compute the amount allocated to each department from Maintenance. ANSWER: To allocate Admin./Pers. to Maintenance 8/34 × $530,000 = $124,706(rounded) Then, Maintenance balance is $450,000 + $124,706 = $574,706 Then, allocate Maintenance : Loans 45/97 × $574,706 = $266,616 Checking 10/97 × 574,706 = 59,248 Savings 42/97 × 574,706 = 248,842 MEDIUM CHAPTER 19 MEASURING AND REWARDING ORGANIZATIONAL PERFORMANCE MULTIPLE CHOICE 1. Variance analysis would be appropriate to measure performance in a. b. c. d. profit centers. investment centers. cost centers. all of the above. ANSWER: 2. investment center revenue center profit center cost center ANSWER: a EASY Net cash flow could be used to measure performance in a. b. c. d. cost centers and investment centers. revenue centers and profit centers. revenue centers and investment centers. profit and investment centers. ANSWER: 4. EASY Which of the following responsibility centers may be evaluated on the basis of residual income? a. b. c. d. 3. d d EASY Using a single performance evaluation criterion for an investment center a. b. c. d. is most effective because a manager can concentrate on a single goal. can result in manipulation of the performance measure. allows multinational investment centers' performances to be equitably compared. is only appropriate if the criterion is non-monetary. ANSWER: b EASY 19-1 19-2 5. Chapter 19 A company has set a target rate of return of 16% for its investment center. An investment center manager in this company would a. b. c. d. acquire assets that would increase divisional income by more than 16%. sell all assets that do not generate divisional income of more than 16%. acquire assets that would increase sales by more than 16%. acquire any technologically advanced assets that would cause costs to be reduced by 16% or more. ANSWER: 6. c. d. EASY and the sub-unit should be evaluated on the basis of the same costs and revenues. should only be evaluated on the basis of variable costs and revenues of the subunit. should be evaluated on all costs and revenues that are controllable by the manager should be evaluated on all costs and revenues that can be directly traced to the sub-unit. ANSWER: c EASY The Statement of Cash Flows may be superior to the cash budget as a performance evaluation measure because a. b. c. d. cash flows are shown on the accrual basis on the cash budget. the cash budget does not include capital investments. cash flows are arranged by activity. of all the above reasons. ANSWER: 8. a In evaluating the performance of a profit center manager, the manager a. b. 7. Measuring and Rewarding Organizational Performance c MEDIUM The Statement of Cash Flows indicates the cash inflows and outflows from a. b. c. d. investing, financing, and borrowing activities. operating, investing, and sending activities. merchandising, financing, and investing activities. operating, investing, and financing activities. ANSWER: d EASY Chapter 19 9. Measuring and Rewarding Organizational Performance Division A's investment in a new project will raise the overall organization's return on investment if a. b. c. d. the return on investment on the new project exceeds the target return of the overall organization. the return on investment on the new project exceeds the return on investment of Division A. the return on investment on the new project exceeds the overall organization's return on investment. Division A's return on investment exceeds the return on investment of the overall organization. ANSWER: 10. c EASY If sales and expenses both rise by $100,000 a. b. c. d. residual income will increase. return on investment will increase. return on investment will be unchanged. asset turnover will decrease ANSWER: 11. 19-3 c EASY ABC Corp. is composed of three operating divisions. Overall, the ABC Corp. has a return on investment of 20%. A Division has a return on investment of 25%. If ABC Corp. evaluates its managers on the basis of return on investment, how would the A Division manager and the ABC Corp. president react to a new investment that has an estimated return on investment of 23%? a. b. c. d. A Division manager accept accept reject reject ANSWER: c EASY ABC Corp. president accept reject accept reject 19-4 12. Chapter 19 A company's return on investment is affected by a change in a. b. c. d. Profit Margin Asset Turnover on Sales Yes Yes Yes No No No No Yes ANSWER: 13. EASY only asset turnover. only earnings as a percent of sales. both asset turnover and earnings as a percent of sales. asset turnover and earnings as a percent of sales, correcting for the effects of differing depreciation methods. ANSWER: c EASY Return on investment (ROI) is a term most often used to express income earned on assets invested in a business unit. A company's return on investment would increase if sales a. b. c. d. increased by the same dollar amount as expenses and total assets increased. remained the same and expenses were reduced by the same dollar amount that total assets increased. decreased by the same dollar amount that expenses increased. and expenses increased by the same percentage that total assets increased. ANSWER: 15. a The return on investment (ROI) ratio measures a. b. c. d. 14. Measuring and Rewarding Organizational Performance b MEDIUM A sub-unit of an organization is evaluated on the basis of its ROI. If this sub-unit’s sales and expenses both increase by $30,000, how will the following measures be affected? a. b. c. d. ROI increase indeterminate no change no change ANSWER: c Assert turnover increase increase increase decrease MEDIUM Profit margin increase decrease decrease no change Chapter 19 16. Measuring and Rewarding Organizational Performance Which of the following would be an appropriate alternative to the use of ROI in evaluating the performance of an investment center? a. b. c. d. Residual income yes no yes yes ANSWER: 17. c Cost and revenue variance analysis yes no no yes EASY contribution margin. inventory turnover. assets invested. average assets employed. ANSWER: c EASY Presently, the Alligator Division of Animal Crackers Co. has a profit margin of 30%. If total sales rise by $100,000, both the numerator and the denominator of the profit margin will increase. The net result will be a. b. c. e. an increase in the profit margin ratio to above 30%. a decrease in the profit margin ratio to below 30%. no change in the profit margin ratio. a change in the profit margin ratio that cannot be determined from this information. ANSWER: 19. Net cash flow yes yes no no Return on investment is computed by dividing income by a. b. c. d. 18. 19-5 c MEDIUM Profit margin indicates the portion of sales that a. b. c. d. covers fixed expenses. is not used to cover expenses. equals contribution margin. equals product contribution margin. ANSWER: b EASY 19-6 20. Chapter 19 Profit margin equals a. b. c. d. income divided by sales. incomes divided by average inventory. income divided by average assets. income divided by average stockholder’s equity. ANSWER: 21. b EASY In the Du Pont model, profit margin is a ratio of a. b. c. d. income to sales. income to assets. sales to income. sales to assets. ANSWER: a EASY The Du Pont model measures ROI as it is affected by a. b. c. d. contribution margin and asset turnover. profit margin and asset turnover. asset turnover. profit margin. ANSWER: 24. EASY residual income. return on investment. throughput. profit. ANSWER: 23. a The Du Pont model measures a. b. c. d. 22. Measuring and Rewarding Organizational Performance b EASY Residual income is used as a performance measure in a. b. c. d. profit centers. cost centers. investment centers. revenue centers. ANSWER: c EASY Chapter 19 25. Measuring and Rewarding Organizational Performance If a new project generates a positive residual income, the a. b. c. d. project's return on investment is less than the target rate. project's return on investment is greater than the target rate. project's return on investment is equal to the target rate. relationship between the project's return on investment and the target rate cannot necessarily be determined. ANSWER: 26. EASY project generates a negative return on investment. project's return on investment is zero. project's return on investment is 5% less than the company's target rate. company's target rate is 15% ANSWER: c MEDIUM Residual income is the a. b. c. d. contribution margin of an investment center, less the imputed interest on the invested capital used by the center. contribution margin of an investment center, plus the imputed interest on the invested capital used by the center. income of an investment center, less the imputed interest on the invested capital used by the center. income of an investment center, plus the imputed interest on the invested capital used by the center. ANSWER: 28. b A prospective project under consideration by P Division of C Co. has an estimated residual income of a negative $20,000. If the project requires an investment of $400,000, the a. b. c. d. 27. 19-7 c EASY Residual income is an example of a ____________ performance measurement. a. b. c. d. long-term short-term qualitative profit center ANSWER: b EASY 19-8 29. Chapter 19 If a division generates a positive residual income then the division’s a. b. c. d. asset turnover was very high. profitability was greater than that of other divisions in the company. performance was above expectations. actual return on investment exceeds the division’s target return. ANSWER: 30. EASY income times the asset turnover rate. income times the inventory turnover rate. income minus (asset base times target rate of return). sales minus (asset base times target rate of return). ANSWER: c EASY Residual income is used as a performance measure in which of the following types of centers? a. b. c. d. Revenue yes yes no no ANSWER: 32. d Residual income is determined as a. b. c. d. 31. Measuring and Rewarding Organizational Performance d Investment no yes yes yes Profit yes yes yes no EASY An increase in a corporation's target rate would result in a(n) a. b. c. d. increase in residual income. decrease in return on investment. decrease in residual income. decrease in both residual income and return on investment. ANSWER: c EASY Chapter 19 33. Measuring and Rewarding Organizational Performance All other things being equal, an increase in sales price would increase a. b. c. d. asset turnover. profit margin. residual income. all of the above. ANSWER: 34. decrease and asset turnover will decrease. increase and asset turnover will decrease. decrease and asset turnover will increase. increase and asset turnover will increase. ANSWER: c MEDIUM Asset turnover equals a. b. c. d. income divided by average assets. sales divided by assets. sales divided by average assets. assets divided by sales. ANSWER: 36. EASY If sales and expenses both rise by $100,000, profit margin will a. b. c. d. 35. d c EASY The information below relates to costs, revenues, and assets anticipated for 1999 in B Division of BVD Corp: Sales Variable costs Average assets employed Fixed costs $ 4,000,000 75% of sales $12,000,000 0 How would each of the following measures be affected if sales rise by $5,000 in X Division? a. b. c. d. ROI increase increase increase no change ANSWER: c Asset turnover increase no change increase no change EASY Profit margin increase increase no change increase 19-9 19-10 37. Chapter 19 A division of Lucky Co. reported a return on investment of 20% for a recent period. If the division's asset turnover was 5, its profit margin must have been a. b. c. d. 100% 4% 25% 2% ANSWER: 38. b EASY Which measure is limited by the fact that it uses accounting income? a. b. c. d. ROI RI EVA All of the above ANSWER: 39. Measuring and Rewarding Organizational Performance d EASY Z Division of XYZ Corp. has the following information for 1998: Assets available for use $1,800,000 Target rate of return 10% Residual income $ 270,000 What was Z Division's return on investment for 1998? a. b. c. d. 15% 10% 25% 20% ANSWER: c MEDIUM Chapter 19 Measuring and Rewarding Organizational Performance 19-11 Use the following information for questions 40-43: Apple Division of the American Fruit Co had the following statistics for 1998: Assets available for use $1,000,000 Book Value $1,500,000 Market Value Residual income 100,000 Return on investment 15% 40. What was Apple Division's segment income for 1998? a. b. c. d. $150,000 $100,000 $250,000 $ 50,000 ANSWER: 41. 10% 15% 25% 5% ANSWER: d MEDIUM If the manager of Apple Division is evaluated based on return on investment, how much would she be willing to pay for an investment that promises to increase net segment income by $50,000? a. b. c. d. $ 50,000 $ 333,333 $1,000,000 $ 500,000 ANSWER: 43. MEDIUM What was the target rate of return in the American Fruit Company for 1998? a. b. c. d. 42. a b MEDIUM If expenses increased by $20,000 in Apple Division, a. b. c. d. return on investment would decrease. residual income would increase. the target rate of return would decrease. asset turnover would decrease. ANSWER: a EASY 19-12 Chapter 19 Measuring and Rewarding Organizational Performance Use the following information for questions 44 through 46: T Division of the Alphabet Co. has the following statistics for its 1998 operations: Assets available for use $2,000,000 T Division's return on investment 25% T Division's residual income 200,000 Return on investment (entire Alphabet Co) 20% 44. Compute EVA assuming the cost of capital is 10% and the tax rate is 40%. a. b. c. d. $ 90,000 $ 150,000 $0 $ (60,000) ANSWER 45. MEDIUM What is the target rate of return in the Alphabet Co.? a. b. c. d. 25% 20% 15% 10% ANSWER: 46. d c MEDIUM If Alphabet Co. evaluates its managers on the basis of return on investment, the manager of T Division would invest in a project costing $100,000 only if it increased net segment income by at least a. b. c. d. $10,000. $15,000. $20,000. $25,000. ANSWER: d MEDIUM Chapter 19 Measuring and Rewarding Organizational Performance 19-13 47. A Corp. has a target return of 15%. If a prospective investment has an estimated return on investment of 20%, and a residual income of $10,000, what is the estimated cost of the investment? a. b. c. d. $200,000 $ 66,667 $ 50,000 The answer can't be determined from this information. ANSWER: 48. 15% 12% 25% 27% ANSWER: d MEDIUM In the X Division of S Co., 1998 segment income exceeded 1998 residual income by $15,000. Also for 1998, return on investment exceeded the target rate of return by 10%. What was the level of investment in the X Division for 1998? a. b. c. d. $ 15,000 $100,000 $150,000 An answer can't be determined from this information. ANSWER: 50. MEDIUM The Bullwhip Division of Leather Products Co. is considering an investment in a new project. The project has an estimated cost of $1,000,000. If Leather Products Co. has a target rate of return of 12%, how large does the return on investment on this project need to be to generate $150,000 of residual income? a. b. c. d. 49. a c DIFFICULT BAD Co. has established a target rate of return of 16% for all divisions. In 1998, Division D generated sales of $10,000,000 and expenses of $7,500,000. Total assets at the beginning of the year were $5,000,000 and total assets at the end of the year were $7,000,000. For 1998, what was Division D’s return on investment ? a. b. c. d. 20.83 % 35.71 % 41.67 % 50.00 % ANSWER: c MEDIUM 19-14 51. Chapter 19 BAD Co. has established a target rate of return of 16% for all divisions. In 1998, Division D generated sales of $10,000,000 and expenses of $7,500,000. Total assets at the beginning of the year were $5,000,000 and total assets at the end of the year were $7,000,000. For 1998, what was Division D’s residual income? a. b. c. d. $ 960,000 $1,380,000 $1.540,000 $1,700,000 ANSWER: 52. Measuring and Rewarding Organizational Performance c MEDIUM Bagel Division of Pita Company reported the following results for 1999: Sales Expenses Total assets (1/1/99) Total assets (12/31/99) $8,000,000 6,250,000 5,000,000 5,400,000 What was the profit margin of Bagel Division in 1999? a. b. c. d. 68% 35% 32% 22% ANSWER: 53. d MEDIUM Bagel Division of Pita Company reported the following results for 1999: Sales Expenses Total assets (1/1/99) Total assets (12/31/99) $8,000,000 6,250,000 5,000,000 5,400,000 What was the asset turnover ratio of Bagel Division in 1999? a. b. c. d. 1.538 2.97 0.650 1.20 ANSWER: a MEDIUM Chapter 19 54. Measuring and Rewarding Organizational Performance Pasta Division of We Make Italian, is evaluated based on residual income generated. For 1998, the Division generated a residual income of $2,000,000 and net income of $5,000,000. The target rate of return for all divisions of We Make Italian is 20%. For 1998, what was the return on investment for Pasta Division? a. b. c. d. 40% 13% 20% 33% ANSWER: 55. c. d. MEDIUM are usually the most well-received by managers. often reflect long-term organizational goals better than financial performance measures. can only be developed in the production area of an organization. is limited by the number of critical success factors defined by the organization. ANSWER: b EASY Relative to qualitative performance measures, quantitative performance measures are less a. b. c. d. subject to manipulation. dependent on accounting information. effective in the pursuit of organizational goals. subjective. ANSWER: 57. d Qualitative non-financial performance measures a. b. 56. 19-15 d EASY Improved effectiveness and efficiency of a product is considered a ______ performance measurement? a. b. c. d. non-financial financial quantitative qualitative ANSWER: d EASY 19-16 58. Chapter 19 Non-financial performance measures (NFPMs) are better than financial measures in that NFPMs a. b. c. d. provide a better indication of customer satisfaction. may better predict the direction of future cash flows. directly measure how well an organization does those things that create shareholder value. all of the above ANSWER: 59. b. c. d. EASY qualitative characteristics that point out sub-optimization activities and throughput bottlenecks. both short-term and long-term measures related to critical success factors. long-term supplier satisfaction levels. short-term financial viability. ANSWER: b EASY Which of the following would be considered a non-financial performance measurement? a. b. c. d. increase in market share variances from standards number of customer complaints cost of engineering changes ANSWER: 61. d In selecting non-financial performance measures managers should choose measures that reflect a. 60. Measuring and Rewarding Organizational Performance c EASY Which type of financial measure better predicts the direction of future cash flows? a. b. c. d. Non-financial Measures yes yes no no ANSWER: d EASY Financial Measures yes no no yes Chapter 19 62. Measuring and Rewarding Organizational Performance Which of the following would be classified as a non-financial critical success factor? a. b. c. d. Quality no yes yes yes ANSWER: 63. Manufacturing Effectiveness yes no yes yes EASY profitability costs market sales ANSWER: d EASY Which of the following is necessary for any valid performance measurement? a. b. c. d. It must be part of the financial accounting system in use. It must be quantifiable. Goal congruence must be promoted by its use. It must be financial in nature. ANSWER: 65. c Manufacturing Efficiency no no yes no Which of the following is not one of the four areas of performance measurements mentioned in the text? a. b. c. d. 64. Technical Excellence no no yes yes c EASY Process quality yield is used in the measurement of a. b. c. d. throughput. cash flows. asset turnover. profit margin. ANSWER: a EASY 19-17 19-18 66. Chapter 19 An increase in productive processing time will increase a. b. c. d. throughput. process yield. return on investment. productive capacity. ANSWER: 67. b EASY Productive capacity is a measure used in computing a. b. c. d. residual income. net cash flow. return on investment. throughput. ANSWER: d EASY Process quality yield reflects the proportion of a. b. c. d. good units to bad units. time required to produce a good unit. total units manufactured that are good. total time spent to time available. ANSWER: 70. EASY Processing time/Total time Good units/Total time Good units/Processing time Total units/Total time ANSWER: 69. a Which of the following is the throughput measure? a. b. c. d. 68. Measuring and Rewarding Organizational Performance c EASY When inventory sits idle in a department, this would not affect the department's a. b. c. d. processing time. throughput. process quality yield. dollar days. ANSWER: c EASY Chapter 19 71. Measuring and Rewarding Organizational Performance Process quality yield reflects the proportion of a. b. c. d. time it takes to make a good unit. good units to defective units. total time spent to total time available. total units produced that are good units. ANSWER: 72. EASY total unit sales. throughput. process quality yield. process productivity. ANSWER: d EASY Process productivity is calculated as a. b. c. d. total units divided by non-value-added processing time. total units divided by value-added processing time. value-added processing time divided by total units. value-added processing divided by total time. ANSWER: 74. d Holding total production in units constant, as the proportion of defective units to total units declines, all of the following measures will be affected, except a. b. c. d. 73. 19-19 b EASY Which of the following would not be an appropriate cost driver to measure internal failure? a. b. c. d. design error product failure machine reliability operator error ANSWER: b EASY 19-20 75. Chapter 19 When assessing performance, one way to compensate for differences among divisions of a multinational organization would be for the parent company to a. b. c. d. use different target rates of return to compute residual incomes. modify the return on investment calculation so that foreign currency fluctuations are removed from all financial statement figures. classify all domestic divisions as investment centers and all foreign divisions as profit centers. use financial performance measures for units whose records are kept in the domestic currency and non-financial measures for units whose records are kept in a foreign currency. ANSWER: 76. a MEDIUM If performance measures are perfect proxies for organizational goals, a. b. c. d. sub-optimization will be enhanced. sub-unit managers will strive to achieve organizational goals. sub-units can all be decentralized. residual income will rise. ANSWER: 77. Measuring and Rewarding Organizational Performance b EASY The following information is made available for June, what is the throughput per hour? Good units manufactured Value-added hours of manufacturing time Total units manufactured Total hours of manufacturing time a. b. c. d. 1.3 units (rounded) 2.0 units 1.8 units .8 units ANSWER: a EASY 40,000 20,000 50,000 30,000 Chapter 19 78. Measuring and Rewarding Organizational Performance The following information is made available for June, what is the process quality yield? Good units manufactured Value-added hours of manufacturing time Total units manufactured Total hours of manufacturing time a. b. c. d. 40,000 20,000 50,000 30,000 50% 75% 80% 125% ANSWER: 79. 19-21 c EASY One of the products manufactured by I Can Fly TOO, Company is a plastic disk. The information below relates to the Disk Production Department: Good units produced Units started in production Processing time (budgeted hours) Processing time (total hours) Value-added processing time 200,000 250,000 425 400 300 What is the process quality yield in the Disk Production Department? a. b. c. d. 75% 44% 80% 125% ANSWER: c EASY 19-22 80. Chapter 19 Measuring and Rewarding Organizational Performance One of the products manufactured by I Can Fly TOO, Company is a plastic disk. The information below relates to the Disk Production Department: Good units produced Units started in production Processing time (budgeted hours) Processing time (total hours) Value-added processing time 200,000 250,000 425 400 300 What is the throughput per hour in the Disk Production Department? a. b. c. d. 470 units 500 units 625 units 667 units ANSWER: 81. b MEDIUM One of the products manufactured by I Can Fly TOO, Company is a plastic disk. The information below relates to the Disk Production Department: Good units produced Units started in production Processing time (budgeted hours) Processing time (total hours) Value-added processing time 200,000 250,000 425 400 300 What is the process productivity in the Disk Production Department? a. b. c. d. 588 625 667 833 ANSWER: 82. d MEDIUM Which of the following is not a balanced scorecard category? a. b. c. d. financial measures environmental measures business process measures personnel measures ANSWER: b EASY Chapter 19 83. Measuring and Rewarding Organizational Performance A primary purpose of a balanced scorecard is to give a. b. c. d. managers a way to judge past performance. stockholders a way to judge current performance. managers a way to forecast future performance. stockholders a way to tie strategy to profitability. ANSWER: 84. MEDIUM organizational strategy and values. the cost management system. current organizational profitability. activity-based management concepts. ANSWER: a EASY Customer measures on the balanced scorecard should be a. b. c. d. Internal yes no no yes ANSWER: 86. c In a balanced scorecard, measurements should be directly linked to a. b. c. d. 85. 19-23 External no yes yes yes d Monetary no yes no yes Non-monetary yes no yes yes MEDIUM A balanced scorecard a. b. c. d. records the variances between budgeted and actual revenues and expenses. can be used at multiple organizational levels by redefining the categories and measurements. is most concerned with organizational financial solvency and business processes. all of the above. ANSWER: b MEDIUM 19-24 87. Chapter 19 On a balanced scorecard, which of the following would be most appropriate to measure customer service? a. b. c. d. Rapid time-to-market of new products Corporate financial profits On-time delivery Decrease in reworked products ANSWER: 88. EASY Rapid time-to-market of new products Corporate financial profits Low employee turnover Decrease in reworked products ANSWER: d EASY On a balanced scorecard, which of the following would be most appropriate to measure innovation: a. b. c. d. Rapid time-to-market of new products Corporate financial profits On-time delivery Manufacturing cycle efficiency ANSWER: 90. c On a balanced scorecard, which of the following would be most appropriate to measure production process integrity? a. b. c. d. 89. Measuring and Rewarding Organizational Performance a EASY On a balanced scorecard, which of the following would be most appropriate to measure financial performance? a. b. c. d. Market share Customer retention Percentage of sales from new products Investment in intellectual capital ANSWER: a EASY Chapter 19 91. Measuring and Rewarding Organizational Performance A primary characteristic of a performance management system is a. b. c. d. consistency at all levels in the organization. adaptability to differing situations in the organization. efficiency of application to all individuals in the organization. flexibility to delay rewards although performance objectives have been met. ANSWER: 92. d EASY Managers should be paid a. b. c. d. on a periodic basis. based on results achieved. using ESOPs. on a piece rate basis. ANSWER: b EASY Financial incentives are a. b. c. d. different from monetary rewards the same thing as a salary element provided to all employee groups. available to top management whose performance exceeds targeted objectives ANSWER: 95. MEDIUM organizational goals location of firm competition number of subsidiaries ANSWER: 94. b Which of the following would not normally affect the compensation strategy of a firm? a. b. c. d. 93. 19-25 d EASY Which of the following steps in the performance reward plan model comes before the others listed? a. b. c. d. set performance rewards identify performance measures determine reward identify critical success factors ANSWER: d EASY 19-26 96. Chapter 19 Objectives for a pay plan a. b. c. d. are not needed in a performance-based plan. must be stated for a performance-based plan to work. are essential for a periodic compensation plan to be successful. are unnecessary for a merit pay plan. ANSWER: 97. b. c. d. EASY a contingent amount of pay that is earned by managers whose subunits meet a target rate of return. always for a limited period of time and must be re-earned each period. any pay earned when the company is profitable. a pay increment received when a specific performance level is achieved. ANSWER: d EASY Contingent pay a. b. c. d. is always paid in stock options. is the sole source of pay an employee receives from his/her employer. is received in addition to the basic wage and is dependent upon performance exceeding some performance objective. can only apply to individual performance. ANSWER: 99. b Merit pay is a. 98. Measuring and Rewarding Organizational Performance c EASY Piece rate pay a. b. c. d. is a suitable pay plan for low-IQ workers. involves a salary plus pay for each unit produced or carried out. encourages quality output. does not encourage workers to look at the company's well being. ANSWER: d EASY Chapter 19 100. Measuring and Rewarding Organizational Performance Which of the following pay plans encourages the improvement of the overall company's well-being? a. b. c. d. monthly salary cafeteria plan profit sharing pensions ANSWER: 101. EASY profit sharing pensions piece rate merit pay ANSWER: a EASY Which performance plan best promotes quality of the product or service? a. b. c. d. piece rate health insurance pensions profit sharing ANSWER: 103. c Which performance plan is most tied to company objectives? a. b. c. d. 102. 19-27 d EASY Employee stock ownership in the employees' firm a. b. c. d. will encourage short term earnings growth patterns. will encourage employees to take a longer term perspective regarding their performance in the company. is not suitable for hourly or salaried employees. is common for management in American firms. ANSWER: b MEDIUM 19-28 104. Chapter 19 A pay plan that gives an employee cash or stock equal to the difference between some specified stock price and the quoted market price at some future time period is a. b. c. d. stock appreciation rights . an ESOP. profit sharing. merit pay . ANSWER: 105. EASY contingent pay profit sharing cafeteria plans stock appreciation rights ANSWER: d MEDIUM The traditional compensation package provides a. b. c. d. fixed monthly or weekly salaries. the same salary structure for all groups of employees. no incentive for non-top management to improve performance. no need to include incentive compensation. ANSWER: 107. a Which of the following types of employee compensation are tax-exempt? a. b. c. d. 106. Measuring and Rewarding Organizational Performance c EASY Compensation packages for executives of American firms a. b. c. d. are beginning to emphasize the long-term commitment executives should have in the firm. are considered comparable to packages earned by European and Asian executives. are shifting towards lower percentages of annual incentives. are shifting away from long-term awards. ANSWER: a EASY Chapter 19 108. Measuring and Rewarding Organizational Performance Perks include all of the following except a. b. c. d. free child care. free parking. recreational memberships. hourly wages. ANSWER: 109. profit sharing. an employee stock option plan. contingent pay. monthly salary. ANSWER: EASY company lunch rooms. flexible fringe benefit programs. ESOPs. pensions. ANSWER: b EASY Which performance plan is most motivating? a. b. c. d. health insurance piece rate hourly wages pensions ANSWER: 112. d Cafeteria plans are a. b. c. d. 111. EASY A pay plan that does not encourage the overall company good is a. b. c. d. 110. d d MEDIUM A person who specializes in taking over other firms is called a(n) a. b. c. d. shirker(s). raider(s). expatriate(s). none of the above. ANSWER: b EASY 19-29 19-30 113. Chapter 19 The average compensation for chief executives was lowest in a. b. c. d. the United States. Canada. Japan. France. ANSWER: 114. c MEDIUM The average compensation level for manufacturing employees was shown in the text as being highest in a. b. c. d. Japan. Britain. the United States. Germany. ANSWER: 115. Measuring and Rewarding Organizational Performance d MEDIUM Expatriate employees a. b. c. d. should be paid a base comparable to what he/she was earning domestically. will be paid more than corresponding managers in their home country. will always pay taxes in the country in which they are based. should receive retirement benefits based on local currencies. ANSWER: a MEDIUM Chapter 19 Measuring and Rewarding Organizational Performance 19-31 SHORT ANSWER/PROBLEMS 1. Discuss economic value added. a. b. c. d. e. What is it intended to do? How is it measured? How is the measurement different than that of RI? Why is EVA a better performance measure of RI? What is the major problem with using EVA as a long-term performance measure? ANSWER: a. b. c. d. e. More directly align the interests of common shareholders and managers. EVA = A/Tax profit – (market value of invested capital x cost of capital %). EVA uses after-tax profit, cost of capital and market value of assets invested. RI uses segment income, target rate of return and book value of assets invested. Because it recognizes that there may be a significant difference between book value and market value of assets. The market value of a company is reflected in stock prices which are another measure of performance evaluation. EVA includes the increased investment immediately even though significant income may not occur until sometime in the future. Most investments will show decreased short-term performance (EVA) and may cause a company to refuse projects that are profitable in the long-term (similar to shortcomings of the payback method). MEDIUM 2. What items affect comparability of different divisions within the same company on the basis of EVA, ROI and RI? ANSWER: a. b. c. Each measure is based on accounting income which can be manipulated in the short-term by accounting methods used, which can differ between investment centers. The measurement of the asset base is affected by the choice of what to include, and may include items that relate to decisions made by prior managers. All measures focus primarily on how well the segments do in isolation with results compared to prior years for the same segment, rather than relative company-wide objectives. MEDIUM 19-32 3. Chapter 19 Measuring and Rewarding Organizational Performance Why is it likely that a subordinate manager would be more attentive to certain performance measures than overall corporate objectives to guide his decision making? ANSWER: Managers are evaluated based on how their actual results compare to specific measures of performance. These performance measures are intended to be surrogates for the overall corporate goals as they apply to specific managers. Thus performance measures are selected by the extent to which they are good proxies for corporate goals (that is the extent to which they operationally define, and are consistent with, corporate goals) and are intended to be major focal points for managers. MEDIUM 4. What are some of the major problems associated with accrual-based accounting performance measures? ANSWER: There are two major problems with accrual-based accounting numbers. The first problem is that they can be easily manipulated by managers. For example, the timing of end of period transactions can be accelerated or delayed to affect performance measures. Secondly, accounting measures cannot capture all corporate goals. Accounting measures are particularly inappropriate to measure qualitative changes in the workforce, qualitative changes in products, and achievement of social and non-monetary objectives. Additionally, accounting measures reflect only a short-term perspective of operations rather than a long-range goal orientation. MEDIUM 5. What distinct advantage does a return on investment measure have over a residual income measure? Explain. ANSWER: The advantage of ROI measure over RI is that ROI facilitates a comparison of organizational sub-units of differing sizes. Because ROI is a performance measure that automatically scales for size, large and small sub-units can be compared to each other (subject to all the factors that should be considered when two units in different industries, different geographical areas, etc. are compared). MEDIUM Chapter 19 6. Measuring and Rewarding Organizational Performance 19-33 How can return on investment result in sub-optimization when it is used as a performance measure? ANSWER: Because performance measures are used to reward performance, managers use them as decision criteria when they evaluate alternative courses of action. For example, if ROI is the performance criterion, a division manager will only invest in new projects that will result in an increase in his/her division's ROI. This is sub-optimal if the overall organization would be better off by the division manager's investment in available projects with lower ROIs. MEDIUM 7. Define residual income. Evaluate residual income as a measure of performance. ANSWER: Residual income is the remainder of net profit once a target cost of capital has been taken into consideration. Residual income is determined by deducting from net income a prescribed or imputed interest charge on assets. This method allows an organization to use different rates of interest for various organizational assets. A main advantage of using RI is that it overcomes some limitations of ROI (sub-optimization). MEDIUM 8. What are some common problems encountered in determining ROI? ANSWER: Net income and investment involved can both be calculated several ways. Multiple calculations are often presented to show the different factors that effect ROI, changes in sales, expenses, and capital investments. MEDIUM 19-34 9. Chapter 19 Measuring and Rewarding Organizational Performance Discuss management uses of flexible budgets. ANSWER: Flexible budgets are important to managers in performing a variety of functions. Formulating budgets commits certain activities agreed to during the planning process to specific monetary amounts. The flexible budget provides the means to estimate costs at various levels of activity. The control function is undertaken to assure that actual operations meet planned operations. Through this function, deviations are determined and variances can be ascertained. Managers also use flexible budgets in performance evaluation. Evaluation is more meaningful with valid and accurate data to make the process of evaluation beneficial to all involved. MEDIUM Use the following information for questions 10 and 11: Deep Sea Division is one of the operating units of Global Treasure Hunters Inc.. Some of this division's 1998 operating results follow: Sales Profit margin Target return Residual income 10. $3,000,000 10% 15% $ 60,000 What was the segment income of Deep Sea Division for 1998? ANSWER: Segment income = Profit Margin * Sales = .10 * $3,000,000 = $300,000 EASY 11. What was the return on investment in the Deep Sea Division for 1998? ANSWER: ROI = Segment Income/Assets Segment Income = $3,000,000 * .10 = $300,000 Assets = ($300,000 - $60,000)/.15 = $1,600,000 ROI = $300,000/$1,600,000 = 18.75% MEDIUM Chapter 19 Measuring and Rewarding Organizational Performance 19-35 Use the following information for questions 12 and 13: Northern Division of Utah Chemical Co. produced the following operating results in 1998: Sales Segment income Assets $10,000,000 1,500,000 6,000,000 Northern Division is considering a $1,000,000 investment in a new project. Northern estimates that its return on investment (for all of its operations) would be at 22% with the new investment. 12. How much net segment income is the new project expected to produce? ANSWER: the total of the new segment income = .22($6,000,000+$1,000,000) = .22($7,000,000) = $1,540,000 the portion of the total segment income that is produced by the new project = $1,540,000 - $1,500,000 = $40,000 MEDIUM 13. If the manager of Northern Division is evaluated on return on investment alone, will she invest in the new project? Explain. ANSWER: The manager would not invest in the new project because the new project would lower the Division's ROI from the current 25% ($1,500,000/$6,000,000) to 22%. The new project only generates an ROI of 4% ($40,000/$1,000,000) MEDIUM 19-36 14. Chapter 19 Measuring and Rewarding Organizational Performance The manager of the Dallas Division of Walking Tours of America is preparing the budget for 1999. At this point, she has determined that average total assets for 1999 will equal $4,000,000. She is evaluated on the amount of residual income generated by her division. Assume variable costs in Dallas Division are expected to equal 60% of total sales and fixed costs are expected to equal $400,000 in 1999. a. b. Compute the sales level that would generate a 20% return on investment. Assuming the rate of return is 15%, determine the level of sales that would generate $200,000 of residual income. ANSWER: a. The required net income = 20% x $4,000,000 = $800,000. sales = net income + fixed costs + variable costs sales = $800,000 +| $400,000 + (.60 x sales) sales x 40% = $1,200,000 sales = $3,000,000 b. sales = fixed costs + variable costs + required return + residual income sales = $400,000 + (.60 x sales) + (.15 x sales) + $200,000 sales = $2,400,000 MEDIUM Chapter 19 15. Measuring and Rewarding Organizational Performance 19-37 The following information is given for Blue and Red Divisions of Color Company. Sales Var. cost of goods sold Fixed manufacturing costs Variable selling Fixed admin. (50% allocated) Fixed selling (20% allocated) Assets at cost Accumulated depreciation a. b. Blue $600,000 200,000 50,000 30,000 20,000 50,000 800,000 200,000 Red $300,000 150,000 40,000 5,000 4,000 30,000 600,000 100,000 If Color uses income to evaluate division managers, compute net income that should be used for that purpose given the limited data above. If Color uses ROI to evaluate division managers and uses historical cost as the investment base, compute the ROI for Blue and Red. ANSWER: a. Sales CGS Gross Margin Variable selling Fixed admin Fixed selling Controllable income b. Blue $600,000 (250,000) $350,000 (30,000) (10,000) (40,000) $ 270,000 Blue $270,000 $800,000 = 33.75% MEDIUM Red $ 300,000 ( 190,000) $ 110,000 (5,000) (2,000) (24,000) $ 79,000 Red $79,000 $600,000 = 13.17% 19-38 16. Chapter 19 Measuring and Rewarding Organizational Performance Information for two divisions of M & M Company is given below: Net income Capital investment a. b. Peanut Plain $ 60,000 $100,000 $400,000 $500,000 If M & M charges each division 12% for capital employed, compute residual income for Peanut and Plain. Compute the ROI for each division. ANSWER: a. Net income Interest charge Residual income b. ROI MEDIUM Peanut $60,000 (48,000) $12,000 Plain $100,000 (60,000) $ 40,000 $60,000 $400,000 $100,000 $500,000 = 15% = 20% Chapter 19 17. Measuring and Rewarding Organizational Performance 19-39 Creative Business Solutions (CBS), a division of Doug Jorgenson CPA, buys and installs modular office components. For the most recent year, the division had the following performance targets: Asset turnover Profit margin Target rate of return on investments for RI Cost of capital Income tax rate 2.5 6% 13% 10% 40% Actual information concerning the company’s performance for last year follows: Total assets at beginning of year Total assets at end of year Total invested capital (annual average) Sales Variable operating costs Direct fixed costs Allocated fixed costs $3,600,000 5,300,000 8,000,000 9,000,000 3,650,000 4,770,000 675,000 Required: a. b. c. d. e. f. For CBS, compute the segment margin and the average assets for the year. Based on segment margin and average assets, compute the profit margin, asset turnover and ROI. Evaluate the ROI performance of CBS. Using your answers from part b., compute the residual income of CBS. Compute the EVA of CBS. Why are the EVA and RI levels different? Based on the data given in the problem, discuss why ROI, EVA and RI may be inappropriate measures of performance for CBS. 19-40 Chapter 19 Measuring and Rewarding Organizational Performance 17. (cont’d.) ANSWER: a. Sales Variable costs Direct fixed costs Segment margin $ 9,000,000 (3,650,000) (4,770,000) $ 580,000 Average assets = ($3,600,000 + $5,300,000) / 2 = $4,450,000 b. Profit margin = $580,000 / $9,000,000 = 6.44% Asset turnover = $9,000,000 / $4,450,000 = 2.02 ROI = $580,000 / $4,450,000 = 13% c. The target ROI for the division was 2.5 x 6 = 15%. The division generated an ROI of only 13%. Thus the division did not achieve its target rate of return. The poor performance resulted from the divisions failure to achieve its targeted asset turnover. d. RI = $580,000 – (13% x $4,450,000) = $580,000 - $578,500 = $1500 e. After-tax profits = pretax income – taxes = $580,000 – ($580,000 x 40%) = $348,000 EVA = $348,000 – ($8,000,000 x 10%) = $(452,000) EVA and RI differ for three reasons. First, RI is based on pre-tax rather than after-tax income. Second, RI is based on the book value of investment, whereas EVA is based on the market value of investment. Third, the target rates of return differ between the methods. f. ROI, RI and EVA are measures of short-term performance. These measures may be particularly inappropriate for divisions that have long-term missions (such as high growth). In this case, the relatively large growth and assets of CBS from the beginning of the period to the end of the period may indicate this division is oriented to growth. If so, the ROI, RI and EVA measures will provide an incentive contrary to the growth mission. DIFFICULT Chapter 19 18. Measuring and Rewarding Organizational Performance 19-41 The IHM Company produces small plastic dolls in its Nevada manufacturing plant. The company is currently evaluating ways to improve productivity. The accountant of the firm’s parent organization suggested that management implement a new compensation plan based on throughput performance measure as an incentive to increase productivity. To demonstrate how such a measure might work, the accountant gathered the following data from the firm for June 1998: Total units attempted Good units manufactured Processing time (total hours) Value-added processing time a. b. c. d. e. 6,000,000 4,800,000 800 600 How many defective units were produced in June? Compute manufacturing cycle efficiency for June. Compute the process productivity in June. Compute the process quality yield in June. Compute the hourly throughput for June. ANSWER: a. b. c. d. e. Defective units = 6,000,000 - 4,800,000 = 1,200,000 MCE = 600 800 = 75% Process productivity = 6,000,000 600 = 10,000 units per hour Process quality yield = 4,800,000 6,000,000 = 80% Throughput = 10,000 x .75 x .8 = 6,000 dolls per hour MEDIUM 19. Identify the steps to follow in establishing the performance reward system for a company. ANSWER: The steps are in the following order: 1. set strategic goals 2. identify the critical success factors 3. set the compensation strategy 4. identify performance measures 5. set performance rewards 6. measure/monitor performance 7. determine rewards MEDIUM 19-42 20. Chapter 19 Measuring and Rewarding Organizational Performance Discuss pay-for-performance plans. ANSWER: Employees should be encouraged by compensation plans to perform and be loyal to the organization. Performance measures should be related to a company's operational targets. These performance measures do not have to be evenly weighted. Management can assign higher weights to more important performance measures as they are related to the corporate goals. MEDIUM 21. Discuss the rethinking taking place regarding the time frame used in American business performance systems. ANSWER: Historically, American time frames for performance has been short term, often only one year. Presumably management tries to do what is best for the firm and its owners. Thus, shareholder wealth maximization should be the primary focus of management. Short term profit maximization doesn't necessarily result in long-run shareholder wealth maximization. To encourage this different attitude, employees and management are being asked to take a longer run perspective. This is enhanced with employee stock ownership in their firm. MEDIUM 22. Are individual performance plans suitable for the Japanese worker? Why? ANSWER: The Japanese worker tends to be more group oriented. These workers view themselves a team working together for some common goal. Thus, individual performance plans would not work well in Japan. MEDIUM Chapter 19 23. Measuring and Rewarding Organizational Performance 19-43 What is a golden parachute and why is it used? ANSWER: A golden parachute is a benefit package awarded to managers if their firm is taken over and they are terminated. This normally follows a hostile takeover of their firm. Proponents of parachutes say that they allow managers to devote their limited time to serving the interests of their company's stockholders in an unbiased manner. Others say parachutes lead to entrenched managers and reward managers who may have mismanaged their firm which created the conditions that resulted in the hostile takeover. MEDIUM 24. Deferred compensation techniques are currently used in the American work place. What are they and how do they benefit the employer and the employee? ANSWER: Deferred compensation is pay that was earned on current performance but is paid later to the employee. The compensation may include profit sharing plans, pensions, and stockbased plans like ESOPs. The payment by the employer can be deducted currently for tax purposes but the employee doesn't recognize it as income until it is received. In stock option plans, earnings in the plan are not taxable to the employee until the plan is distributed. Size of the plans are affected by the firm's stock value and encourage employees to take a more positive attitude about the company's future. MEDIUM 25. Comment on differences regarding employee performance that exists between for-profit and not-for-profit organizations. ANSWER: In a for profit entity, stockholders and their representatives, the board of directors, maintain oversight of the company and its officers. These individuals are directly concerned about the effectiveness and efficiency of operations because they are the residual claimants who are paid (in the form of dividends and stock value increases) only after all other involved parties receive their compensation. In NFP organizations, no overriding interest group comparable to stockholders keeps herd on the performance of managers in the entity. Performance rewards are less effective in these operations. Pay and performance rewards in NFPs have often not been regarded as adequate by NFP employees. Attempts are being made in this sector to incorporate some performance factors in its compensation system. MEDIUM 19-44 26. Chapter 19 Measuring and Rewarding Organizational Performance Explain why the average worker in a plant or office may feel dissatisfied with the salary structure in American operations today. ANSWER: Exhibit 22-8 in the text indicates that CEOs in the U.S. average compensation far exceed comparable CEOs in other industrial countries. No other country's CEOs approach U.S. CEO compensation. Even U.S. managers are relatively low ranked compared to other countries. Employees' compensation in U.S. manufacturing plants are one of the lowest in the industrialized world. Thus, American workers feel they are being short-changed or the CEOs are being overpaid. MEDIUM