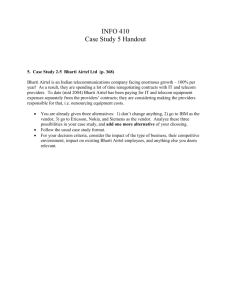

Airtel Magic - Selling a Pre-paid Cellphone Service: Casting the Celebrity Magic Case Objective: Cost wars among competitors Summary: In 2002, the leading Indian telecommunications company, Bharti Cellular Limited (Bharti) signed the famous cricket player Saurav Ganguly and leading movie stars, Madhavan and Kareena Kapoor as endorsers for its brand, Airtel Magic (pre-paid cellular card). Its objective was to create the highest recall for Magic in the pre-paid cellular telephony segment by cashing in on the two biggest passions of India - movies and cricket. Bharti also changed the tagline for Magic from 'You Can Do Magic' to 'Magic Hai To Mumkin Hai' (If there is Magic, it's possible). The move attracted considerable media attention, as it was unusual for a company to spend so lavishly to promote a single brand. In October 2002, Bharti launched a television commercial (TVC), featuring Shah Rukh Khan (leading actor, already endorsing Magic since a couple of years) and Kareena Kapoor. The TVC, developed by one of India's leading advertising agencies, Percept Advertising, was the first of the series of four TVCs for Magic's new campaign. According to Bharti, the TVCs aimed at attracting young adults in SEC B and C categories of the Indian market1. Commenting on the new developments, Hemant Sachdev (Hemant), Director, Marketing and Corporate Communications, Bharti Enterprises, said, "The aim is to be relevant to the masses and make all their dreams, hopes and desires come true instantly, at Rs 3002 per month." However, industry observers felt that these actions were necessiated by the intensifying competition in the pre-paid cellular card segment in India in the early 21st century. Many new players (national as well as international) had entered the segment and the competition had become quite severe. Besides Magic, the major players in the pre-paid card segment in 2002 included Idea (Tata, AT&T and Birla Group), Speed (Essar), Hutch (Hutchison), Wings (RPG), Cellsuvidha (Fascel) and Yes (Usha Martin). In October 2002, Magic led the market, with 30% of the market share. Bharti claimed that its strategies were one of the most ambitious experiments ever in the Indian pre-paid cellular telephony market. However, given the increasing competitive pressure, doubts were being expressed regarding the ability of Bharti's marketing initiatives to help Magic retain its 'Magic' in the future. Background Note Cellular telephony was introduced in India during the early 1990s. At that time, there were only two major private players, Bharti (Airtel) and Essar (Essar) and both these companies offered only post-paid services. Initially, the cellular services market registered limited growth. This was primarily due to the high tariff rates charged by the companies (about Rs 16 per minute for outgoing calls). Indians who were used to paying much lesser amounts (Rs 1.20 for 3 minutes) for landline telephone calls found these to be very expensive. However, as there were only two players, a monopoly regime prevailed. The tariff rates as well as the prices of cellular phone handsets (instrument) available in that period continued to remain high. Hence, cellular phone services during that period were regarded as a luxury and companies mostly targeted the elite segment of the society. Moreover, these services were mostly restricted to the metros. Other factors such as lack of awareness among people, lack of infrastructural facilities, low standard of living, and government regulations were also responsible for the slow growth of cellular phone services in India. Although the cellular services market in India grew during the late 1990s (as the number of players increased and tariffs and handset prices came down significantly) the growth was rather marginal. This was because the cellular service providers offered only post-paid cellular services, which were still perceived to be very costly as compared to landline communications. Following this realization, the major cellular service providers in India, launched pre-paid cellular services in the late 1990s. The main purpose of these services was to target customers from all sections of society (unlike post-paid services, which were targeted only at the premium segment). On account of the benefits they offered, pre-paid cellular card services gained quick popularity during the late 1990s. Between the late 1990s and early 2000s, tariff rates declined 75%. Reportedly, Indian cellular players were offering the lowest cellular tariffs in the world (Rs 1.99 for 60 seconds). By October 2002, of the 8.5 million cellular phone users in the country, 65% belonged to the pre-paid segment. Also, an estimated 80% of the new add-ons were pre-paid card subscribers. Bharti, being one of the early entrants in the industry, launched its own pre-paid cellular service under the Magic brand in January 1999. Magic was first launched in Delhi and later in other circles3 in India (where the company offered cellular services under its flagship brand, Airtel). Through Magic, Bharti targeted the infrequent users of mobile phone. Acquiring Magic connection was very easy - all a customer needed to do was walk into an outlet (selling Magic) with a handset. Here the customer was provided with a pre-activated SIM card4 (which had to be loaded with the calling value) and a recharge card (which was required for loading the calling value into the SIM card). These cards were valid only for specific period (beyond which the services could not be availed), depending on the value of the recharge card loaded. Whenever a customer utilized his Magic card, a specific amount was deducted as per the applicable tariff rates. Customers were required to recharge the card before the expiry of the validity period to avail the services (further). When the card was recharged, customers were provided with a new calling value possessing a new validity period. The company provided a grace period of 30-90 days based on the denomination of recharge card. However, no incoming or outgoing calls were allowed during this period. The attractively designed Magic cards could be activated/recharged by using a 16-digit number. Bharti adopted the international 'scratch system' for Magic cards, that is, customers were required to scratch a marked area on the card to acquire this service recharge or activation number. To establish Magic as a brand and make it more accessible, Bharti focused on its distribution strategies. Apart from company outlets, Magic was made available at departmental stores, gift shops, retailing outlets, telephone booths and even 'Kirana' stores (small grocery shops). Besides the absence of rental hassles and security deposits, Magic offered features such as instant connectivity, pre-activated STD/ISD facility (customers did not have to maintain a minimum balance in the pre-paid card for utilizing the STD/ISD services), voice mail and short messaging service (SMS). To meet the requirements of varying customer groups Magic was made available in various denominations (ranging between Rs 300 to Rs 3,000). Due to its innovative and customer-friendly features, Magic came to be credited by industry observers for bringing about dynamic changes in the Indian cellular services market and expanding the cellular user base. Thus, providing affordable and easily accessible services to all sections of the community and maintaining strong relationship with customers, Magic was able to differentiate itself from other pre-paid cellular services. Magic soon became the market leader and was the most visible pre-paid cellular brand in the country - aided by Bharti's (and Airtel's) strong presence in 16 states of the country (reaching around 400 million customers). By 2002, it became the largest selling pre-paid cellular card in India. However, Bharti was not content with sitting back and savoring the short-term success of Magic. The company realized that the Indian cellular telephony market was undergoing a radical transformation. With the entry of a fourth players in various telecom circles in 2002 (until then only three players were operating in all circles), the future was expected to be rather uncertain. The subscriber base was over 6.4 million by March 2002 as compared to 3.5 million in March 2001. Telecom circles in the states of Rajasthan, Haryana and Kerala posted an estimated growth rate (in subscribers) of 179%, 151% and 151% respectively in 2002. This growth could be primarily attributed to the introduction of pre-paid cards, which accounted for over 55% of an operator's revenue. In early 2002, analysts forecasted that the number of subscribers using pre-paid cellular services in India was estimated to reach over 25 million by the year 2004 (from 4.5 million in 2002). The immense potential the market offered lured almost all major players to shift their focus to the pre-paid segment to design new marketing strategies to expand their user base in this segment. With the intensifying competition in the market, Bharti also felt the need to revamp its own marketing strategies and retain its position as the market leader. All Set to Create Magic In early 2002, Magic decided to revamp its marketing strategies. There were plans to launch the service in newer areas and bring about changes in pricing, positioning and advertising. The company also planned to make new value additions by providing better services. As a first step in this direction, Magic was brought under Bharti's umbrella brand, Airtel, and was renamed Airtel Magic. Company sources said that the move was aimed at banking on the strengths of Airtel as a brand. While the earlier brand strategy aimed at customers interested in using mobile services, the new strategy was aimed at attracting even non-interested customers by appealing to their needs and requirements (offering them a value they did not perceive earlier). In line with this strategy, Magic was positioned as a friendly, mass-market brand. Sources at Bharti revealed that in its repositioning exercise under the Airtel brand, Magic targeted youth and stood for simplicity and attitude that said, 'anything is possible.' Explaining the rationale behind the brand repositioning on the Airtel level, Hemant said, "As we grew to a 15-circle telecom network, we wanted to become generic to mobility in the country." As a part of its revamping exercise, Bharti also changed the logo. The new Magic logo reflected the new brand values of youthfulness, energy, simplicity and friendliness. Bharti then focused on extending its distribution base in all the circles in which it operated and therefore, ensured the availability of Magic cards in the remotest parts of its operating circles. By late 2002, the states of Kerala and A.P. had 2000 and 4,500 stores respectively. In Chennai (Tamil Nadu) and Kolkata (West Bengal) there were over 2,500 and 3,000 outlets respectively. In mid 2002, in an innovative move, Bharti entered into a strategic tie-up with a leading Indian private sector bank, ICICI to offer recharge facility for Magic cards users at the bank's ATMs5 across Andhra Pradesh, Delhi and Kolkata. Commenting on this, Pawan Kapur, Chief Executive, Bharti Mobile (Andhra Pradesh) said, "It is another innovative combination of customer benefit and technological advancement." Bharti also focused on revamping of its pricing strategies from time to time (at regular intervals) in order to stay ahead of competition. The company charged different rates for incoming and outgoing calls depending on the time when the call was made. For instance, customers in Delhi were charged Rs 1.35 (per 30 seconds) and Rs 0.99 (per 30 seconds) for incoming calls in the time slot of 8.00 am and 10.00 p.m. However, these rates were much lower at night (outgoing calls cost only Rs 0.67 for 30 seconds, while incoming calls cost Rs 0.49). In order to increase its penetration in the market, Magic also came up with many special offers during mid and late 2002. In mid 2002, Magic was made available at only Rs 290 (as against Rs 300 previously), which included Rs 90 worth free talk time valid for 7 days (as against Rs 50 previously). One of its special launch offers included providing free talk time worth Rs 290 to new subscribers (Rs 145 worth talk time free at the end of the third month and the balance Rs 145 worth, at the end of sixth month from the date of making the first call from magic card). Free voice mail service was also offered to new subscribers for a period of three months. As a part of its efforts to expand its reach, Bharti offered and introduced many special features for Magic subscribers. These included free caller line identification, and innovative services like balance on screen (balance amount displayed at the end of each call) and balance on demand (balance amount derived by pressing specific numbers on the phone without making or receiving a call). Bharti also introduced doorstep delivery of Magic cards in mid-2002. Although the service was initially available only in Delhi and Gurgaon (for a recharge value of Rs 500 and above), there were plans to extend it to other circles as well. In mid 2002, Bharti launched its regional roaming6 network in Asia for Magic subscribers. Under this offer, subscribers were able to utilize roaming services in over 66 countries across the world, underlying Europe, Australia, the Asia-Pacific region, the Middle East and the US. This service was offered free of charge for calls placed through any Airtel network in India. Regional roaming facility was offered to customers within the country as well in mid 2002. Apart from this, the company also waived airtime charges on incoming calls between Airtel cellular customers (intra-operator calls) in some parts of the country. New celebrity endorsers who projected a fresh and youthful image were chosen. The idea was to reflect Magic's brand values of energy, hope, optimism and achievement. Explaining the rationale behind focus on celebrity endorsements, P H Rao, MD, Bharti Mobinet Ltd., said, "Magic is a youth brand, and all these celebrities depict exuberance and confidence to succeed, which are in synergy with the core values of the product." These campaigns were extensively covered by both the print and television media. Besides the new tagline of 'Magic Hai To Mumkin Hai,' Bharti devised many ad-specific taglines to take the brand closer to masses. Some of them were 'Kabhi bhi Kahin bhi' (Anytime, anywhere) 'Jahan Chaho, Airtel Magic Pao' (Wherever you want, you will find Magic), Airtel Magic gives you the max out of life, 'Kharch aapki mutthi mein' (Costs are under your control) and 'Life banao ab aur bhi aasaan' (Make life easier with Magic). To promote the brand and retain its customers, Bharti conducted many contests for its subscribers through SMS. For instance, the 'Khulja Sim Sim' contest launched in April 2002, offered a treasure hunt kind of an interactive game through SMS, wherein many attractive prizes were given to the winners. Many other such contests were held, either as part of a new scheme's promotional efforts or to coincide with some local Indian festival. In 2002, Bharti entered into many new telecom circles as the fourth player. Due to the strong brand equity of both Airtel and Magic it picked up instant momentum. Magic was reportedly very popular with customers (especially the youth) who appreciated the (ease of operation, affordability and ready availability) the brand offered. The Industry Strikes Back Bharti's aggressive marketing, advertising and promotional efforts led other players to focus on their marketing efforts as well. Companies resorted to price reductions, new service additions, value additions and focused advertising and promotional campaigns. For instance, in Mumbai, BPL Mobile and Hutchison Max Telecom made incoming calls (from across the country) free to counter Bharti's waiver of airtime charges for incoming calls in Mumbai. Apart from this, BPL and Hutchison also announced the launch of new advertising campaigns in Mumbai. Hutchison and BPL also launched their 32K7 SIM cards in order to match Bharti's 32K SIM offer (previously, the players offered only 8-Kilobyte memory SIM cards). BPL and Hutch also waived airtime charges for incoming calls and reduced their roaming service charges. Both Hutch and BPL announced a flat rate of Rs 1.49 (60 seconds) as roaming charges, as against the previous Rs 3 (60 seconds) on all partner networks. In January 2002, Spice allowed national roaming named Spice Quicky on its pre-paid card. In late 2002, in the light of price slashes by Bharti, Hutch and BPL, MTNL also slashed tariff rates of its Dolphin cellular service in Mumbai and Delhi, in order to sustain its market in these circles. Escotel, one of the leading cellular service providers in UP (West) launched roaming services (both incoming and outgoing) for its pre-paid card subscribers in late 2002. It announced plans to extend these services to its other circles as well. In mid 2002, Idea Cellular Ltd. planned to focus on creating brand awareness and launched an aggressive advertising campaign with an ad-spend of Rs 630 million (7% of its net revenues). The company developed new TVCs to highlight the company's tagline 'Liberation through idea.' Apart from its advertising strategies, the company announced plans to offer various value-added services that included games on mobile, SMS in 9 languages and pre-paid roaming facility. However, the company decided against the usage of celebrity endorsements for its pre-paid cellular service, Idea ChitChat. Bharti's competitors launched various promotional campaigns for their brands many of them copying those of Bharti's. While Spice awarded free talk-time to winners of a Soccer World cup related promotional event, the subscribers of Idea ChitChat in Andhra Pradesh could win gold coins, watches and talk-time under a special scheme. However, the most severe competition was witnessed in the area of tariff reduction. In the Karnataka circle, Spice reduced tariff rates on its pre-paid cellular cards, Simple and Uth in mid 2002. According to the new rates, Simple subscribers were required to pay Rs 1.49 (30 seconds) both for incoming and outgoing calls (24 hours a day) and Uth subscribers were required to pay only Rs 0.5 (30 seconds) at night as against Rs 0.75 charged previously. In September 2002, Spice even offered interesting and even useful information like train timings, astrology, news, movie tickets, cricket updates, stock market news through its brand, Genie. With Hutch Essar entering the Karnataka cellular market as the fourth operator in 2002, both Bharti and Spice were devising strategies to retain their respective positions in the market. The case was the same in Andhra Pradesh (AP), where Hutch entered in August 2002. Hutch8 was becoming a formidable competitor for Bharti in many circles. With its aggressive marketing and promotional campaigns and a range of value added services, Hutch had garnered considerable shares in many circles by mid 2002. Value added services offered by Hutch (through its advanced 16K SIM) included regional roaming, dial-in service, voice messaging (in India and even to US or Canada), voice mail, voice response service, unified messaging service and other online menu services (such as SMS, railway information, train timings, movie tickets, stock market news, TV schedules). In Kolkata, Hutchison's Command recorded over 55.03% growth between January and August 2002, while Orange, Essar and Fascel reported growth rates of 46%, 36.67% and 46.29% respectively for the same period. In early August 2002, Hutchison announced a new scheme 'Go Hutch for Rs 74' in Andhra Pradesh, wherein pre-paid customers were offered a talk time of worth Rs 175 on purchase of a pre-paid card of Rs 249, which made Hutch pre-paid card cheaper to other pre-paid cellular services in the state. In response to this, Bharti introduced its new Magic Recharge scheme, under which, subscribers could accumulate free talk time for every fourth recharge card bought. Bharti decided to design different marketing strategies for different circles depending on the strategies, employed by the competitors. While the company was focusing on its pricing strategies, its competitors in various sectors were concentrated on new service offerings and value additions (For instance, in the Chennai circle, the cellular war between RPG Group, Bharti and Hutch was more value and service driven). Since price reduction moves were almost immediately matched by the players, companies had begun focussing on developing value-added offerings and schemes to expand their market and gain customer loyalty. Analysts remarked that the players were coming up with new schemes or value-additions almost every week to get the better of their competitors. Some such schemes launched in mid 2002 included Tamil SMS and Audiotimes (a service which enabled subscribers to send song clippings to other cell phone users) by RPG. Bharti shot back with an offer wherein new Magic subscribers were given an audiocassette containing popular Tamil movie songs. Various value-added services were also offered in late 2002 in Chennai such as Panchangam (SMS-based), which informed customers about good (and bad) timings during the day. Bharti also tied up with a leading Internet portal, indiatimes.com to offer news headlines and stock market news through SMS. By constantly keeping itself abreast with the moves of its competitors and launching various proactive/reactive schemes, Bharti was able to retain its leadership position. Despite continual attacks from Hutch, RPG, Spice, Idea Cellular and BPL, Bharti's cellular services received good high response in all circles during 2002. It was reported that in Mumbai, 60-75% of customers seeking Airtel services were BPL Mobile and Hutch subscribers. In fact, it was becoming difficult for the company to activate cellular connections in Mumbai swiftly on account of the high rush - in some cases, it took almost three days to activate a connection. The Future - Far from Magical While the players in the cellular market in India were focussing heavily on the pre-paid card segment due to its high potential, some analysts expressed doubts about the profitability of this segment in the long run. They said that low profit margins from the pre-paid segment (on account of low tariff and high advertising, promotional and customer service costs) could lead to losses in the long run. As the fierce competition would make price-cuts and heavy investments in advertising and promotions inevitable, this seemed quite possible. However, it was believed such problems might be overcome by building up a vast customer base and making up for margins by increasing sales volumes (A company's cost per subscriber decreased with the increase in the subscriber base, thereby, resulting in increased margins.) However, the biggest challenge came in the form of CellOne, a cellular service launched by the state-owned telecom major, Bharat Sanchar Nigam Ltd. (BSNL) in October 2002. Not only were the rental charges of CellOne much lower than those of any other player, BSNL had plans to (further) reduce tariff. Given the vast reach of BSNL and years of experience in the Indian telecom sector, the new, private players were justified in their fears. Moreover, BSNL did not have to pay any license fee (8-12% of the revenue share paid by all private players) to the government. Being a major stakeholder in the fixed line telephone network (90%), it did have to shell a large share of its revenues as interconnect charges (over 70% of the calls made from cellular network used fixed line network) for routing calls, both landline and STD. With such control (on fixed line network) and established infrastructure, BSNL could pose a severe threat to its competitors on the pricing front. With the Department of Telecommunications announcing plans to grant International Long Distance (ILD) license to BSNL and BSNL planning to acquire a subscriber base of over 4 million (by late 2003 across 1,000 cities), the competition in the cellular market was expected to intensify further. Meanwhile, true to the belief of industry observers that the cellular telecom sector would see product/service innovations, Bharti launched a two-in-one cellular card in October 2002. This product offered both the features of post-paid and pre-paid cards in one card9. It was aimed at customers residing in places where post-paid facilities were not available. The product was available with all Magic vendors and ICICI's ATMs. Commenting on Bharti's leadership position, representatives of BPL and Hutch said that Bharti might seem to have an advantage at present but it was a long-term game and it was too early to respond. As the market awaited the response of other competitors in November 2002, Indian pre-paid cellular services customers expected the future to be anything but dull. Competitive tariff plans, value-added services and to top it all, entertaining advertisement campaigns - customers, perhaps, could not have asked for more! Problem Statement: 1. With increasing competition pressure, was it a good move to spend on celebrities for marketing? Justify. 2. Low profit margins from the pre-paid segment (on account of low tariff and high advertising, promotional and customer service costs) could lead to losses in the long run. Devise a plan to minimize the losses.