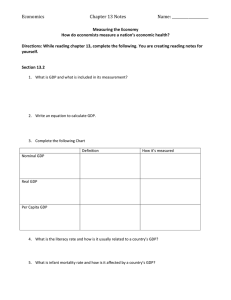

WELCOME Economics Course PGDIP MANAGEMENT & BCOM HONOURS ECONOMETRIX | Leaders in Economic Insight 1 Intro to basic economic concepts Quiz What is economics about? Micro vs Macro 2 Market forces Circular Flow Model Supply and Demand 3 Economic growth (National Accounts) GDP, Consumption, Investment, Government spending, Balance of payments Cycles 4 Economic Monetary policy and fiscal policy 5 The South African economic environment 6 Practical exercises INTRODUCTION TO ECONOMICS “Nobody ever became rich from knowledge of economics, but nobody who is rich got that way without an understanding of how economic forces work……..” Anonymous ECONOMETRIX | Leaders in Economic Insight • Who is the Governor of the Reserve Bank? • Who was the previous Governor of Reserve Bank? • What is the repo rate today? • What is the prime interest rate today? • What is the largest sector in the South African economy? • What is the GDP growth rate of China? • What is the GDP growth rate of India? • What is the GDP growth rate of the USA? • What is the GDP growth rate of South Africa? • What is the largest economy in the world? • What is our unemployment percentage in SA? What does economics deal with? • Economics is a social science and can also be used to describe the way the world actually works • Closely linked to political and social systems – economic policies can affect political choices and vice versa • Study of economics focusses on: What /How / For whom to produce?? “The first lesson of economics is scarcity: there is never enough of anything to satisfy all those who want it. The first lesson of politics is to disregard the first lesson of economics.” Thomas Sowell Economics is about: • Matching what one needs (demand) with what one has (supply) • Provision of goods & services using resources INPUTS Resources: Labour Capital Entrepeneurs Land OUTPUTS NEEDS defined “It is the study of the way in which human-beings employ scarce resources (with alternative uses) to satisfy their many needs”. Ultimately the “study of choices” It is an art and a science! Economics is made up of two main disciplines: micro & macro economics Micro vs MACRO ECONOMICS Micro ⁻ economics at the small level ⁻ Individual, household or company level MACRO ⁻ economics at the big/high level ⁻ or level of government ⁻ looks at economy as a whole Macro economics • The study of the economy as a whole • Macroeconomics answers questions such as the following: Why is average income high in some countries and low in others? Why do prices rise rapidly in some time periods while they are more stable in others? Why do production and employment expand in some years and contract in others? What is the annual health care spend in SA? Micro economics • The study of how individuals, households and firms make decisions and how they interact with one another in markets. • Micro-economics answers questions like: Why is Sandton richer per capita than Gugulethu? Why are transaction numbers in North West falling? What will ticket prices be for the Gautrain? MARKET FORCES CIRCULAR FLOW MODEL SUPPLY VS DEMAND ECONOMETRIX | Leaders in Economic Insight The economy – where do you fit in? • Ever wondered what makes the economy go round? • Who are the participants in an economy and what are their roles? Income Production Aggregate Supply = total supply of goods & services produced within an economy at a given price level in a given time period Supply (AS) Spending Demand (AD) Aggregate Demand = total demand of goods & services in an economy at a given time period. It describes the relationship between price levels & quantity of output that firms are willing to provide Introduction to the Circular Flow Model • Shows how households, government and businesses are connected to each other by the flow of physical things (goods or labour) and of money (what pays for physical things). • Households, owners of production factors such as land, labour and capital make their services available to business sector, in exchange businesses pay households income (money) Money income (salaries, wages) costs Resource Market Land, labor, capital & entrepreneurial activity Resources Expenditure Resources Goods and services Goods and services Government Business Net taxes Net taxes Expenditure Goods and services Goods and services Goods and services Product Market Revenue Households Consumption expenditures No man/business is an island…. War Consumers: high, middle, low, traders, hawkers, inside & outside SA Economic cycles Supply/ Demand Suppliers: Competitors Your Business Inside & outside SA, goods, electricity, labour Inflation OPEC Government, Unions, Trade associations Politics Power Interest rates Economic systems and the market Traditional System Command system Mixed System Keynesian mixed capitalism Social Democracy capitalism Communism Chinese mixed •Type attempted by Chinese and other quasi Marxist countries •State directs all economic activity •Allocates productive assets •Type attempted by European and Scandinavian countries [And India] •Government intervention acceptable • SD: High tax and provision of services • KD: Acceptable to run budget deficits to stimulate demand Free Market Capitalism Capitalism •Type attempted by the USA •Minimal government intervention •Based on tenets of Adam Smith •“The invisible hand” of the market will bring together the producers and the consumers •Governments only role is to ensure property rights and the sovereignty of the country Demand • Quantity demanded = amount of a product people are willing and able to buy at a certain price • The law of demand there is an inverse (opposite) relationship between price and quantity demanded Demand Curve High price, low quantity demanded Price of a cup Quantity of coffee demanded $0 24 $1 20 $2 16 $3 12 $4 8 $5 4 $6 0 Low price, high quantity demanded Demand curve = downward-sloping line relating price to quantity demanded Changes in the quantity demanded is caused by change in price of product (e.g increase in tax on product) Supply • Quantity demanded = amount of a product that sellers are willing and able to sell at a certain price • The law of supply there is an direct (positive) relationship between price and quantity supplied Supply Curve Price of a cup Quantity of coffee supplied $0 0 $1 6 $2 9 $3 12 $4 15 $5 18 $6 21 High price, high quantity supplied Low price, low quantity supplied Determinants of supply • • • Production costs (how much a goods costs to be produced) = cost of inputs (labour, capital, energy and materials). They depend on the technology used in production, and/or technological advances. Firms' expectations about future prices Number of suppliers (competition) Supply and Demand together Market equilibrium Price of a cup of coffee $0 $1 $2 $3 $4 $5 $6 Quantity supplied 0 6 9 12 15 18 21 Price of a cup Quantity of coffee demanded $0 24 $1 20 $2 16 $3 12 $4 8 $5 4 $6 0 At $3 the quantity demanded is equal to the quantity supplied! Equilibrium = situation where there is no tendency for change; when there is no reason for the market price of the product to rise or to fall. This occurs at the price at which the quantity demanded equals quantity supplied. At this price, the amount that consumers wish to buy is exactly the same as the amount that producers wish to sell. There are no unsatisfied buyers: buyers are able to purchase all they want to at that price. There are no unhappy sellers: producers are able to sell all they want to at that price. Shortage demand & excess supply Equilibrium occurs at a price of $3. The equilibrium quantity is 12 cups of coffee. • When price is above equilibrium of $3, quantity supplied is greater than quantity demanded. Firms are unable to sell all they want to at that price. There is an excess supply (surplus/glut) and there is pressure for the price to fall. • If price is below equilibrium, there is excess demand (shortage) and this creates pressure for the price to rise. • Only at the equilibrium price is there no pressure for price to rise or fall. Quantity Supplied Price Quantity Demanded Result What happens to price? 18 $5 4 QS > Q D excess supply price falls 15 $4 8 QS > Q D excess supply price falls 12 $3 12 QS = QD no surplus/no shortage equilibrium 9 $2 16 QD > QS excess demand price rises 6 $1 20 QD > QS excess demand price rises ECONOMIC GROWTH & DRIVERS OF GDP EXPLAINING KEY ECONOMIC CONCEPTS GROSS DOMESTIC PRODUCT CONSUMPTION INVESTMENT GOVERNMENT SPENDING BALANCE OF PAYMENTS ECONOMETRIX | Leaders in Economic Insight Gross domestic product (GDP) Economic Growth • GDP = market value (in Rand etc) of all final goods and services produced domestically in a single year /quarter (SA is a R3.8 trillion economy) • Most important measure of economic performance. • Economic growth = increase in an economy’s capacity to produce goods and services, compared from one period of time to another (= % change in GDP) • Economic growth literally refers to an economy that is getting bigger, not necessarily one that is getting better. • Increasing growth depends on the power of the economy to increase either the quantity and/or quality of production factors (labour/capital) over time or to introduce improved production techniques How is GDP measured/calculated? • In SA, Statistics South Africa (StatsSA) and the SA Reserve Bank is tasked with calculating GDP Consumer • 2 methods: expenditure is the Expenditure approach GDP is calculated by adding all expenditure: main contributor to GDP in SA (64%) GDP = C + I + G + (X - IM) Consumers + Investment (business) + Government + (eXports-IMports) Income approach GDP = Income (wages+rent+profits+income) – Depreciation – Indirect tax The rationale behind income approach is that total expenditures on final goods & services are eventually received by households & firms in form of wage, profit, rent, and interest income. By adding together all income earned by households/firms, one should obtain the same value of GDP as obtained using expenditure approach. Measuring GDP Removing the Price Effect Economic growth can be measured in: • nominal terms, which include inflation (eg if this year inflation is 3% and we have 2% economic growth, nominal GDP will have risen by 5%). • real terms, which are adjusted for inflation (price rises) - price effect is stripped out as it doesn’t show increase in capacity. When we think of the price of a good, we often think of its nominal price. The nominal price of a good is the cost of the good at the current price level. Changes in nominal prices result directly from changes in the price level due to inflation. The real price of a good is the cost of the good at a base year price level. For example if the cost of a ball in 2005 was R10 and the current cost of the ball is R12, we would say the real price of the ball is R10 with base year 2005. What is nominal prices? What is real prices? Measuring GDP Removing the Price Effect - example Real GDP and nominal GDP for an economy producing only shoes and video games over 3 years. We will assume consumption is the only part of this economy’s GDP. We will use year 1 for our base year. Year Price of Shoes Quantity of Shoes Price of Video Games Quantity of Video Games 1 R30 5 R40 5 2 R35 6 R42 10 3 R40 5 R50 8 Year 1: Nominal: (5 shoes x R30/shoe) + (5 video games x R40/game) = R350 Real: Because year 1 is the base year, real GDP = nominal GDP = R350 Year 2: Nominal: (6 shoes x R35/shoe) + (10 video games x R42/game) = R630 Real: (6 shoes x R30/shoe) + (10 video games x R40/game) = R580 Year 3: Nominal: (5 shoes x R40/shoe) + (8 video games x R50/game) = R600 Real: (5 shoes x R30/shoe) + (8 video games x R40/game) = R470 Notice that from year 2 to year 3 there was a slight decrease in the nominal GDP of the economy but a major decrease in the real GDP of the economy. This is very common in economics. It is also very possible for an economy’s nominal GDP to increase while it’s real GDP decreases. Growth in GDP Year GDP at current prices GDP at real prices 1 R350 R350 2 R630 R580 3 R600 R470 Question: What has been the growth in output between Y2 and Y1? Apply the growth formula: % growth = (Y2/Y1) -1 x 100 Current prices 80%; Real prices 65.7% Question: What has been the growth in output between Y3 and Y2? Current prices -4.8%; Real prices -18.9% Consumption Final Consumption Expenditure by Households • Consumption is the value of goods and services bought by people • Consumption is normally the largest GDP component. • Economic performance of a country is usually judged mainly in terms of consumption level and dynamics. • Consumption is divided according to the durability of the purchased objects. o durable goods (cars, television sets) o non-durable goods (food, beverages, cigarettes) o semi-durable goods (clothes, shoes) o services (restaurants, holidays, hairdresser) • Determinants: o Income (current & future expectations) o Savings Investment Gross fixed capital formation • Measure of amount that total physical capital stock increased in a country • Capital formation does not include financial assets such as stocks and securities. • Most volatile component of GDP • 3 ways to calculate/add By economic activity • Agriculture • Mining • Manufacturing • Electricity & water • Construction • Trade & accommodation • Transport & communication • Finance , insurance & real estate • Services By type of organisation • General government • Public corporations (eg Transnet) • Private business By type of asset • Residential buildings • Non-residential buildings • Construction works • IT & telecom equipment • Transport equipment • Machinery • Research & development • Computer software • Mineral exploration & evaluation • Cultivated biological resources Government Spending • Government expenditure = money that a government spends Expenditure occurs on every level of R126.4bn government, from local municipalities to provincial and national government R203.5bn R155.3bn departments • R157.3bn Not all basic needs are always met by the private sector. R64.4bn Some goods/services may not be produced, while others may be not be produced in enough quantity or at R62.2bn affordable rate for all citizens Government expenditure creation and implementation of these goods and services • Examples : military, police, public schools, health care programmes, public transportation infrastructure R199.6bn R206.2bn Where does government obtain its revenue to spend? Central Government Expenditure % of Total 2014/15 2015/16 2016/17 2017/18 Compensation of employees 35.8 35.5 35.2 34.5 Debt-service cost 9.3 9.4 9.7 9.8 Transfers and subsidies 32.7 33.0 32.7 31.9 Payments for capital assets 6.9 7.2 7.2 7.1 Payments for financial assets 0.3 0.3 0.0 0.0 Goods & Services 14.5 13.9 13.8 13.4 Total expenditure 100 100 100 100 Source: National Treasury Imports & Exports An open economy interacts with rest of the world in 2 ways: • buys and sells goods & services • buys and sells real & financial assets Exporting and importing helps grow national economies and expands global market Every country is endowed with certain advantages in resources & skills eg, some countries are rich in natural resources, while other countries have shortages of these resources Exports = sale of goods to a foreign country, Countries want to be net exporters rather than net importers. The more a country exports, the more domestic economic activity is occurring. More exports means more production, jobs and revenue. If a country is a net exporter, its gross domestic product increases, which is the total value of the finished goods & services it produces in a given period of time. Net exports increase the wealth of a country. Imports = purchase of foreign manufactured goods in buyer's domestic market. Countries often need to import goods that are either not readily available domestically or are available cheaper overseas. Often imported products provide a better price or more choices to consumers, which helps increase their standard of living. Importing gives access to important resources and products not otherwise available or at a cheaper cost. However, if a country imports more than it exports, more money is leaving the country than is coming in through export sales. Balance of payments (BoP) BoP = record of a country's: trade in goods & services with rest of world + real & financial assets with rest of world BoP consists of 2 parts: Measured by Current Account (C/A) Measured by Capital & financial account Current account balance = Exports of goods + Service receipts + Income receipts - Imports of goods + Service payments + Income payments + net (unilateral) transfers Services: eg shipping, banking and tourism Income Compensation of employees + Investment income (interest payments & dividends people receive from assets owned outside of their own country) Transfer when one party gives something but receives nothing in return, e.g. foreign aid • • • Capital account measures net (unilateral) transfers of assets between countries ( eg debt forgiveness / migrant transfers of assets they take with them when they move out of a country) Financial account = financial inflows - financial outflows A financial inflow when citizen sells an asset to another country, e.g. a U.S. Treasury bill is sold to Chinese investors A financial outflow when a citizen buys an asset from abroad, e.g. an American obtains a Swiss bank account. Capital and financial account balance = capital account balance + financial inflows - financial outflows BoP must balance Current Account Balance + Capital and Financial Account Balance = 0 The balancing account is called Gold and Cash Reserves ECONOMIC CYCLES TOOLS: MONETARY POLICY FISCAL POLICY ECONOMETRIX | Leaders in Economic Insight Business cycles Economies go through regular pattern of ups & downs in value of GDP = business cycle Business cycle fluctuations in economic output in a country, characterised by 4 phases: • Slump • Recession • Recovery • Boom Recession / slump Slump = overall economic activity starts to decline Recession = business cycle contraction = two quarters of negative growth rate of real GDP Depression: sustained, long-term downturn in economic activity in one or more economies. More severe downturn than economic recession. Very weak consumer spending & business investment; many business failures; rapidly rising unemployment; prices may start falling (deflation) Falling levels of consumer spending & confidence, lower profits for businesses; start to cut back on investment. Spare capacity increases + rising unemployment as businesses cut back, reduce stocks. Liquidations rise. Boom/ recovery Boom = High levels of consumer spending, business confidence, profits & investment. Prices & costs rise faster. Unemployment low as growth in economy creates new jobs Recovery = Things start to get better Consumers begin to increase spending; Businesses feel bit more confident, start to invest again and build stocks; but takes time for unemployment to stop growing Business cycle phases of SA since 1945 Source: SARB How does government stabilise the economy from shocks caused by the business cycle? • Government tries to stabilise the economy • Using macroeconomic policies/tools Fiscal Policy • Taxes • Government Spending Monetary Policy • Control of money supply • Interest rates Monetary Policy • Rests with the central bank (SA Reserve Bank) • Main goal is price stability – • SA has adopted inflation targeting in Feb 2000 = where central bank announces an explicit inflation target and implements policy to achieve this target directly. Fiscal Policy • Government spending – to stimulate the economy government creates jobs by employing people in infrastructure development, public works programmes etc • Taxes – to stimulate spending in the economy government cuts taxes people have more money left over they spend this money, which in turn creates demand and jobs UNPACKING THE SOUTH AFRICAN ECONOMY ECONOMETRIX | Leaders in Economic Insight Impact of global economy on SA SA in context of rest of world • According to the Global Competitiveness Report 2014/15, SA ranks 56th out of 144 economies surveyed globally • Chart below indicates most problematic factors for doing business in SA Most problematic factors for doing business in SA 0.2 Government instability/coups 1 Tax rates 1.2 Poor public health Tax regulations 1.5 Inflation 1.5 Foreign currency regulations 2.1 Access to financing 2.2 Crime and theft 2.5 Insufficient capacity to innovate 3 5.2 Poor work ethic in national labor force 7.4 Policy instability 9.8 Inadequate supply of infrastructure 11 Corruption 14.8 Inefficient government bureaucracy 16.9 Inadequately educated workforce 19.8 Restrictive labor regulations 0 5 10 15 20 25 SA GDP • SA average GDP Growth for 2014 was 1.5% • GDP growth for 2015 projected to be 1.9% BUT…. GDP growth to achieve targets set out in NDP to create jobs by 2020 GDP: annual 6.0 5.6 5.4 5.3 5.0 4.6 4.3 4.2 4.0 3.7 3.2 3.0 3.0 2.9 2.7 2.6 3.2 2.4 2.2 2.2 2.2 1.9 2.0 1.5 1.0 0.5 0.0 -1.0 2016 2015 2014 2013 2012 2011 2010 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 Source: South African Reserve Bank 2009 -1.5 -2.0 1996 Percentage change (year-on-year) Require 5% Contribution to GDP by sector Shares of sectors in GDP: Q4 2014 Community, social and personal services 22.7% Agriculture 2.3% Mining 8.5% Manufacturing 13.4% Electricity 3.3% Finance 20.9% Construction 4.2% Transport 10.1% Source: SARB Trade 14.5% Trade with Africa South Africa in context of Africa SA’s Imports & Exports Main Imports Main Exports Machinery and equipment Gold Chemicals Diamonds Petroleum products Platinum Scientific instruments Food products Some key macroeconomic indicators & interpretation • • • • • • Unemployment – Q4 2014 24.3% GDP growth y/y - 2014 1.5% Trade deficit – 2014 R7.9bn Inflation (CPI) –2014 6.1% Inequality (GINI coefficient) – 0.7 (statssa) Prime vs Repo rate – 9.25% vs. 5.75% 5 key macroeconomic concerns of SA government • • • • • Ensuring economic growth Maintaining price stability Reducing unemployment Balance of payments stability Reducing inequality Structural weaknesses preventing higher economic growth Negative X Intensification of electricity / loadshedding X Public sector wage strike X Further loss of confidence in institutions X Further declines in growth of Eurozone or China Positive Lower oil prices boost disposable income Solid financial health of business sector Knock on effects of monetary easing globally Introduction to inflation “Inflation is when you pay fifteen dollars for the tendollar haircut you used to get for five dollars when you had hair.” Sam Ewing • CPI – measures consumer inflation • PPI – measures producer inflation • Negative effects of inflation – redistributive effect Price Stability • Goal of every government to ensure inflation is contained • Inflation measured in SA by CPI • CPI uses a basket of goods and assigns different weights to different items Source: StatsSA Feb-15 Oct-14 Jun-14 Feb-14 Oct-13 Jun-13 Feb-13 Oct-12 Jun-12 Feb-12 Oct-11 Jun-11 Feb-11 Oct-10 Jun-10 Feb-10 Oct-09 Jun-09 Feb-09 Oct-08 Jun-08 Feb-08 Oct-07 Jun-07 Feb-07 Oct-06 Jun-06 Feb-06 Oct-05 Jun-05 Feb-05 Oct-04 Jun-04 Feb-04 Percentage (%) Inflation : Consumer Price Index (CPI) Headline CPI 13 11 9 7 5 3 1 -1 -3 -5 CPI Weights, 2012 Product Weight in CPI basket Food 14.20% Alcoholic beverages and tobacco 5.43% Clothing and footwear 4.07% Housing and utilities 24.52% Household content, equipment and maintenance 4.79% Health 1.46% Transport 16.43% Source: South African Reserve Bank 2016Q4 2016Q2 2015Q4 2015Q2 2014Q4 2014Q2 2013Q4 2013Q2 2012Q4 2012Q2 2011Q4 2011Q2 2010Q4 2010Q2 2009Q4 2009Q2 2008Q4 2008Q2 2007Q4 2007Q2 2006Q4 2006Q2 2005Q4 10.0 2005Q2 12.0 2004Q4 14.0 11.8 11.5 11.5 11.2 11.0 11.0 10.5 10.5 10.5 10.5 10.7 11.3 12.2 12.5 12.7 13.3 14.2 14.5 15.2 15.5 15.3 14.0 12.0 10.7 10.5 10.3 10.0 9.8 9.2 9.0 9.0 9.0 9.0 9.0 9.0 8.6 8.5 8.5 8.5 8.5 8.5 9.0 9.0 9.3 9.3 9.3 9.3 9.3 9.8 10.0 10.3 10.3 10.5 16.0 2004Q2 2003Q4 % Interest Rates Prime rate: quarterly 20.0 18.0 8.0 6.0 4.0 2.0 0.0 Rand/Dollar Exchange Rates Rand/Dollar exchange rate 16.00 14.00 13.34 12.91 12.30 12.00 10.85 9.65 10.00 8.60 8.25 8.44 7.56 8.00 6.94 6.45 6.36 6.11 8.21 7.32 7.25 6.77 7.05 5.53 6.00 4.30 4.61 4.00 2.00 Source: South African Reserve Bank 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 0.00 1996 Rand per USD 10.52 Weak/Strong Rand argument • Weak Rand – typically benefits exporters, as it makes SA exports cheaper for the rest of the world to buy… however • It also increases inflation via higher prices paid for imported goods and crude oil Factors influencing Rand’s appreciation/depreciation • International conditions – e.g. risk aversion toward emerging markets • Strengthening of the dollar • General investor sentiment Unemployment • Expressed as a percentage of total available workforce • Two classifications of unemployment Narrow/Strict & Expanded/Broad • Four main types of unemployment: Seasonal Frictional Cyclical Structural Unemployment Unemployment Rates for South Africa 26 25.4 25.5 25.6 25.2 25.125.1 25 25.5 25 25 24.8 24.5 25.3 25.4 25.2 25 24.8 24.5 24.5 24.5 24.3 23.9 24.1 24 24.1 23.5 23.2 23 23 22.8 22.5 22 21.5 21.5 Source: StatsSA, QLFS 14Q4 14Q3 14Q2 14Q1 13Q4 13Q3 13Q2 13Q1 12Q4 12Q3 12Q2 12Q1 11Q4 11Q3 11Q2 11Q1 10Q4 10Q3 10Q2 10Q1 09Q4 09Q3 09Q2 09Q1 08Q4 21 08Q3 % 23.8 Employment Shares by sector Agriculture; 4.4 Community Services; 23.0 Mining; 2.8 Manufacturing; 11.5 Utilities; 0.7 Construction; 8.7 Finance; 13.4 Trade; 21.3 Transport; 6.2 Source: StatsSA, QLFS Inequality • Globally, the bottom half of the global population owns less than 1% of total wealth (Credit Suisse:2014) • In SA, the wealthiest 10% of SA’s population owns over two thirds of the country’s assets • SA falls into ‘very high’ income inequality category alongside Brazil, India, Indonesia, Turkey and Russia (Credit Suisse:2014) Inequality in SA Inequality indicators 2006 2009 2011 Gini Coefficient 0.72 0.70 0.69 Share of national consumption of poorest 20% (per capita) 4.4% 4.4% 4.3% Share of national consumption of richest 20% (per capita) 64.1% 61.4% 61.3% Source: Statistics South Africa (2014) Government Policy • How does government plan to reduce inequality and improve growth? • NDP • MTSF • NGP • IPAP • YETI CONCLUSION ECONOMETRIX | Leaders in Economic Insight