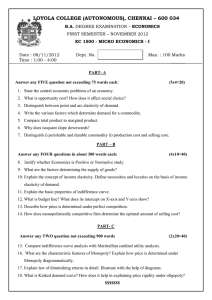

Economics is generally classified as a social science. It uses the scientific method as a basis of its investigation. Economics is the study of how groups of individuals make decisions about the allocation of scarce resources. Economists build models and theories to explain economic interactions. Models and theories are simplifications of reality. Models can be distinguished according to whether they are static or dynamic, equilibrium or disequilibrium. The basic economic problem Summary Nearly all resources are scarce; Human wants are infinite .Scarce resources and infinite wants give rise to the basic economic problem – resources have to be allocated between competing uses. Allocation involves choice and each choice has an opportunity cost. The production possibility frontier (PPF) shows the maximum potential output of an economy. Production at a point inside the PPF indicates an inefficient use of resources-Growth in the economy will shift the PPF outwards. Key definitions Scarce resources - Resources which are limited in supply so that choices have to be made about their use. Basic economic problem – Resources have to be allocated between competing uses because wants are infinite whilst resources are scarce. Choice – Economic choices involve the alternative uses of scarce resources. Economic goods – Goods which are scarce because their use has an opportunity cost. Opportunity cost – the benefits forgone of the next best alternative. Production Possibility Frontier – (A.K.A the production possibility curve or the production possibility boundary or the transformation curve) a curve that shows the maximum potential level of one good given a level of output for all other goods in the economy. The function of an economy Summary An economy is a social organization through which decisions about, how and for whom to produce are made. The factors of production; – land, labour, capital and entrepreneurship – are combined together to create goods and services for consumption. Specialisation and the division of labour give rise to large gains in productivity. The economy is divided into three sectors, primary, secondary and tertiary. Markets exist for buyers and sellers to exchange goods and services using barter or money. The main actors in the economy, consumers, firms and government, have different objectives. Consumes, for instance, wish to maximise their welfare whilst firms might wish to maximise profit. Key definitions Capital productivity – Output per unit of capital employed. Division of labour – specialisation by workers. Factors of production – CELL Capital Entrepreneurship land and labour. These factors make production possible. Fixed capital – economic resources such as factories and hospitals which are used to transform working capital into goods and services. Human capital – the value of the productive potential of an individual or group of workers. It is made up of the skills, talents, education and training of an individual or group and represents the value of future earnings and production. Labour productivity – output per worker. Market – any convenient set of arrangements by which buyers and sellers communicate to exchange goods and services. Non-renewable resources – resources, such as coal or oil, which once exploited be replaced. Non -sustainable resources – resource which is being economically exploited cannot be replaced. Primary Sector – extractive and agricultural industries. Productivity – output per unit of input employed. Profits – the reward to the owners of a business. It is the difference between a firm’s revenues and its costs. Renewable resources – resources such as fish stocks or forests, which can be exploited over and over again because they have the potential to renew themselves. Secondary sector – production of manufactured goods. Specialisation – a system of organisation where economic units such as households or nations are not self-sufficient but concentrate on producing certain goods and services and trading the surplus with others. ~The objective of economic actors There are four main types of economic actors in a market economy – consumers, workers, firms and governments. It is important to understand what are the economic objectives of each of these sets of actors. Consumers – In economics, consumers are assumed to want to maximize their own economic welfare, sometimes referred to utility or satisfaction. They are faced with the problem scarcity. They do not have enough income to be able to purchase all the goods or services that they would like. So they have to allocate their resources to achieve their objective. To do this, they consider the utility to be gained from consuming an extra unit of a product with its opportunity cost. Workers – Workers are assumed in economics to want to maximise their own welfare at work. Evidence suggests that the most important factor in determining welfare is the level of pay. So workers are assumed to want to maximise their earning in a job. Firms – The objectives of firms are often mixed. However, in the UK and the USA, the usual assumption is that firms are in business to maximise their profits. This is because firms are owned by private individuals who want to maximise their return on ownership. This is usually achieved if the firm is making the highest level of profit possible. In Japan and continental Capital – the manufactured stock of tools, machines, factories, offices, roads and other resources which is used in the production of goods and services. There are two types of capital: working capital, stocks of raw materials, semi manufactured goods and finished goods which are waiting to be sold; fixed capital is the stock of factories, offices, plant and machinery. Fixed capital is fixed in the sense that it will not be transformed into a final product. Entrepreneurship – Entrepreneurs are individuals who: organize production: organize all factors to production in the production of goods and services. Factors of Production Land- All natural resources that process of production requires to be complete. Labour – The workforce of an economy, everybody from a house person to a doctor. The value of a worker is called his or her human capital. Capital- these are man made goods that are used to produce other goods. Positive and Normative economics Summary Positive economics deals with statements of “fact which can either be refuted or supported. Normative economics deals with value judgements, often in the context of policy recommendation. Key definitions Ceteris paribus – the assumption that all other variables within the model remain constant whilst one change is being considered. Equilibrium – the point where what is expected or planned is equal to what is realised or actually happens. Law – a theory or model which has been verified by empirical evidence. *Positive economics – is the scientific or objective study of the subject. It is concerned with finding out how economies and markets actually work- Positive statements are statements about economic which can be proven to be true or false. They can be supported or refuted by evidence. For example, “ The UK economy has high unemployment” is a positive statement. *Normative economics – is concerned with value judgements. It deals with the study of and presentation of policy prescriptions about economics. Normative statements are statements which cannot be supported or refuted. The Demand Curve Summary Demand for a good is the quantity of goods or services that will be bought over a period of time at any given price. Demand for a good will rise or fall if there are changes in factors such as incomes, the price of other goods, tastes, and the size of the population. *A change in price is show by a movement along the demand curve. A change in any other variable affecting demand, such as income, is shown by a shift in the demand curve. -The market demand curve can be derived by horizontally summing all the individual demand curves in the market. Key definitions Consumer surplus – the difference between how much buyers are prepared to pay for a good and what they actually pay. Demand curve – the line on a price-quantity diagram which shows the level of effective demand at any given price. Individual demand curve – the demand curve for an individual consumer, firm or other economic unit. Market demand curve – the sum of all individual demand curves. Shift in the demand curve – a movement of the whole demand curve to the right or left of the original caused by a change in any variable affecting demand except price. Notes Demand is the quantity of goods and services that will be bought at any give price over a period of time. If everything else were to remain the same (ceteris paribus) what would happen demanded of a product as its price changed? Prices rises - Demand falls Prices fall - Demand rises there are a another few important factors: 1. Price of substitution goods- If price of potatoes rise the amount of pasta, bread and rice bought will increase. 2. Changes in population- An increase in population will likely cause an increase in the demand for goods. 3. Changes in Fashion; 4. Changes in legislation; 5. Advertising; 6. Weather; 7. Income; For income, it affects it two different ways. If there is a rise in income, there will be a rise in demand for normal goods. However, if income rises there will be a fall in demand for inferior goods. *The difference between the value to buyers and what they actually pay is called the consumer surplus. The supply curve Summary ~A rise in price leads to a rise in quantity supplied, shown by a movement along the supply curve. - A change in supply can be caused by factors such as a change in costs of production, technology and the price of other goods, This results in a shift in the supply curve. The market supply curve in a perfectly competitive market is the sum of each firm’s individual supply curve. Key Definitions Individual supply curve – The supply curve of an individual producer. Market supply curve – the supply curve of all producers within the market. In a perfectly competitive market it can be calculated by summing the supply curves of individual producers. Producer surplus – the difference between the market price which firms receive and the price at which they are prepared to supply. Supply – the quantity of goods that suppliers are willing to sell at any given price over a period of time. Notes =In economics supply is defined as the quantity of goods that sellers are prepared to sell at any given price over a period of time. -Supply is the opposite of Demand as price rises and supply falls and vice versa. A fall In price will lead to a fall in quantity supplied, shown by a movement along the supply curve. Prices rises - Supply rises Prices fall - Supply falls **The supply curve is drawn on the assumption that the general costs of production in the economy remain constant. If other things change, then the supply curve will change. If costs rise, firms will attempt to pass on these increases in the form higher prices. Thus, the supply curve will shift upwards and to the left. Changes in the prices of some goods can affect the supply of a particular good. 1. The goal of sellers – If there is a change in profit levels, there will be a change in supply. 2. Goverment Legislation – Anti- pollution controls which can raise the costs of production is an example how governments can affect supply. 3. Expectation of future events – if firms expect future prices to be much higher, they may restrict supplies and stockpile goods. 4. Weather – in agricultural markets, the weather plays a crucial role in determining supply. 5. Producer cartels – in some markets, producing firms or producing countries band together, usually to restrict supply. Price Determination Summary [- The equilibrium or market clearing price is set where demand equals supply. ~Changes in demand and supply will lead to a new equilibrium prices being set. ~A change in demand will lead to a shift in the demand curve, a movement along the supply curve and a new equilibrium price. * The equlibrium price is not necessarily the price which will lead to the greatest economic efficiency or the greatest equity. Key notes Equilibrium price – the price at which there Is no tendency to change because planned purchases are equal to planned sales. Excess demand – where demand is greater than supply. Excess supply – where supply is greater than demand. Free market forces – forces in free markets which act to reduce prices when there is excess supply and raise prices when there is excess demand. Market clearing price – the price at which there is neither excess demand nor excess supply but where everything offered for sale is purchased Equilibrium *Equilibrium is a term relating to a 'state of rest', a situation where there is no tendency to change. In economics, equilibrium is an important concept. -Equilibrium analysis enables us to look at what factors might bring about change and what the possible consequences of those changes might be. Remember, that models are used in economics to help us to analyze and understand how things in reality might work ~~Market equilibrium occurs where the amount consumers wish to purchase at a particular price is the same as the amount producers are willing to offer for sale at that price. ^It is the point at which there is no incentive for producers or consumers to change their behavior. Graphically, the equilibrium price and output are found where the demand curve intersects (crosses) the supply curve. Interrelationships between markets Summary Some goods are complemens, in joint demand. Other goods are substitues for each other, in competitive demand. Derived demand occurs when one good is demanded because it is needed for the production of other goods or services. Key notes competitive demand – when two or more goods are substitutes for each other. Complement – a good which is purchased with other goods to satisfy a want. Composite demand – when a good is demanded for two or more distinct uses. Derived demand – when the demand for one good is the result of or derived from the demand for another good. goods are demanded only because they are needed for the production of other goods. For example steel in car manufacturing. Joint demand – when two or more complements are bought together. Joint supply- when two or more goods are produced together, so that a change in supply of one good will necessarily change the supply of other goods with which it is in joint supply. Substitute – a good which can be replaced by another to satisfy a want. Price elasticity of demand Summary =Elasticity is a measure of the extent to which quantity responds to a change in a variable which affects it, such as price and income; ~Price elascity of demand measure the proportionate response of quantity demanded to proportionate change in price. -Price elasticity of demand varies from zero, infinitely inelastic, to infintely elastic. The value of price elasticity of demand is mainly determined by the availability of substitutes and by time. Key notes *Elastic demand – where the price elasticity of demand is greater than 1. The responsiveness of demand is proportionally greater than the change in price. Demand is infinetly elastic if price elasticity of demand is ifinity. Inelastic demand – where the price elasticity of demand is less than 1. The responsiveness of demand is proportionally less than the change in price. Demand is infinitely inelastic if price elasticity of demand is zero. CHANGE Price elasticity of demand or own elasticity of demand – the proportionate response of changes in quantity demand to a proportionate change in price, measured by the formula: %CHANGE IN QUANTITY DEMANDED/ %IN PRICE Unitary elasticity – when the change in demand is the same as the change in price, elasticity is 1. Notes The determinants of price elasticity of demand: -The exact value of price elasticity of demand for a good is determined by a wide variety of factors. Economists, however argue that two factors in particular can be singled out _ the availability of substitutes and time. - The availability of substitutes: The better the substitutes for a product, the higher the price elasticity of demand will tend to be. For instance, salt has few good substitutes. - Time The longer period of time, the more price elastic is the demand for a product. Luxuries and necessities It is sometimes argued that necessities have lower price elasticity than luxuries. Necessities by definition have to be bought whatever their price in order to stay alive. So an increase in the price of necessities will barely reduce the quantity demanded. Luxuries on the other hand are by definition goods which are not essential to existence. Elasticities Summary Income elasticity of demand measures the proportionate response of quantity demanded to a proportionate change in income. * Cross elasticity of demand measures the proportionate response of quantity demand of one good to a proportionate change in price of another good. Price elasticity of supply measures the proportionate response of quantity supplied to a proportionate change in price. The value of elasticity of supply is determined by the availability of substitutes and by time factors. The price elasticity of demand for a good will determine by whether a change in the price of a good results in a change in expenditure on the good. Key notes Cross price elasticity of demand – a measure of the responsiveness of quantity demanded of one good to a change in price of another good. It is measured by dividing the percentage change in quantity demanded of one good by the percentage change in price of other good. Income elasticity of demand – a measure of the responsiveness of quantity demanded to a change in income. It is measured by dividing the percentage change in quantity demanded by the percentage in income. Price elasticity of supply – a measure of the responsiveness of quantity supplied to a change in price. It is measured by dividing the percentage change in quantity supplied by the percentage change in price.