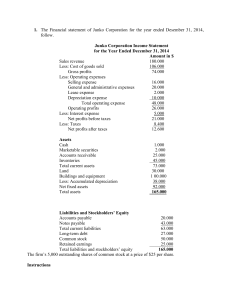

Exercise. Ratio Analysis The Vanguard Group, Inc. has compiled the following financial statements and comparative financial ratios for the year-end review. Balance Sheet Vanguard Group, Inc. December 31, 2012 Assets Current assets Cash Accounts receivable Inventory Total current assets Gross fixed assets Less: Accumulated depreciation Net fixed assets Total assets Liabilities and stockholders’ equity Current liabilities Accounts payable Notes payable Accruals Total current liabilities Long-term debt Total liabilities Stockholders’ equity Common stock Retained earnings Total stockholders’ equity Total liabilities and stockholders’ equity $ 118,750 296,250 303,750 $ 718,750 $625,000 93,750 531,250 $1,250,000 $ 111,250 211,250 108,750 $ 431,250 235,000 $ 666,250 318,750 265,000 $ 583,750 $1,250,000 Income Statement Vanguard Group, Inc. for the Year Ended December 31, 2012 Sales revenue Cost of sales Gross profits $1,680,000 1,362,480 $ 317,520 Less: Operating expenses Selling expense General and administrative expense Depreciation expense Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes (40%) Net profits after taxes $ 125,600 81,600 24,000 $231,200 $ 86,320 15,600 $ 70,720 28,288 $ 42,432 Historical and Industry Average Ratios Vanguard Group, Inc. Ratio Current ratio Quick ratio Inventory turnover Average collection period Total asset turnover Debt ratio Times interest earned Gross profit margin Operating profit margin Net profit margin Return on investment Return on equity 2010 1.6 0.9 6.0 40 days 1.5 60% 2.5 20% 4.7% 2.0% 3.0% 7.5% 2011 1.7 1.0 5.0 50 days 1.5 56% 3.5 19.7% 4.8% 2.3% 3.5% 7.95% 2012 — — — — — — — — — — — — Industry Average 2012 1.6 0.9 8.4 40 days 1.75 50% 4.0 20% 6% 3% 5.25% 10.5% a. Calculate the firm’s 2012 financial ratios. b. Analyze the firm’s performance from both time-series and cross-sectional viewpoints. c. Comment on the firm’s overall financial condition and performance.