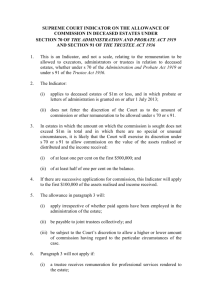

Legal Document Assistants | LDA PRO | Helpful Resources Legal Legal Document Assistants Provides Legal Document Preparation In Sacramento And Surrounding Areas In Northern California. Paralegals, Process Servers Visit here :- https://www.ldaprolegal.com/helpful-resources/ Can A Paralegal Prepare A Living Trust Only Registered Legal Document Assistants or an Attorney can legally accept money from the public to prepare legal documents. A paralegal that is not registered as a Legal Document Assistant, should not prepare any legal documents for the public. Legal Document Assistants are paralegals that have graduated from an American Bar Association Approved Program and Registered in the county as an LDA. A living trust is a legal document, created by an individual, where a designated person, the trustee, is given responsibility for managing that individual’s assets, after death. The living trust lists all the assets, most importantly, real property. The most important concept is to fund the trust. The trust is funded by transferring the property into the trust. For example, if you have a property that is owned by you individually, you will need to create a deed transfer into the name of the living trust. Living Trust should always consist of Living Trust, Will & Testament, Trust Certification, Health Care Directive, Power Of Attorney, and One Property Deed Transfer. If you are trying to decide whether or not you need a Living Trust vs Will, you should get legal advice from an attorney. Most people who own real property will benefit from a Living Trust, in order to avoid probate. If the trust is properly funded into the trust, your loved ones will avoid probate. 8 Reasons Why You Should Consider A Living Trust, by Forbes.com 1. Reduce estate taxes. If you are married, the trust can provide for estate tax savings. In Massachusetts, for example, a properly drafted and administered trust can save a couple approximately $100,000 in estate taxes on the death of the second spouse. 2. Protect minor children. A trust can hold the money for minor children until they are responsible enough to manage the money themselves. Many clients prefer to give the children access to the monies staggered over a period of time i.e. at ages 25, 30 and 35. 3. Save your grown-up kids from themselves. If your child will most likely not ever be able to manage the money himself due to a drug or alcohol issue, or because he is just bad with money, the trustee can hold the money in trust for your child’s lifetime and distribute it as needed. 4. Keep your assets in the family. If your child is getting married and you do not like her fiancé, you should have a trust. In the event they divorce, you do not want half your assets winding up with your exson-in-law. 5. Take the sting out of the fling. If you are concerned that in the event of your untimely death, your grieving spouse will take up with the pool boy, or the cocktail waitress at the country club, putting the assets in trust with a professional trustee will make sure your spouse does not take all the money and give it to his or her latest fling. 6. Avoid probate. If you put your assets in the trust during your lifetime instead of relying on your will to do that when you die, you can avoid probate. It is not difficult to do – you need to transfer ownership from your regular “Mary Smith” bank account to a “Mary Smith, Trustee of The Mary Smith Trust” account – and an experienced financial advisors or lawyer can assist you with this. 7. Ensure your family’s privacy. If you have a will that is probated, it will become a matter of public record along with certain other information such as the value of your assets, and often, an inventory listing your assets. A living trust, on the other hand, is a private document. CONTACT INFO 3550 Watt Ave., Suite 140 Sacramento, California 95821 1100 Melody Lane, Suite 1038, Roseville CA 95678 CALL US: (916) 620-2446 CONTACT@LDAPRO.COM