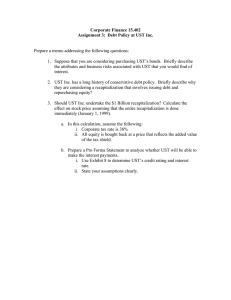

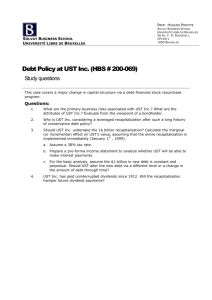

lOMoARcPSD|1008027 UST - Case HB Corporate Finance (Universitat Ramon Llull) StudeerSnel wordt niet gesponsord of ondersteund door een hogeschool of universiteit Gedownload door Andy Chen (andyrosegarden@hotmail.com) lOMoARcPSD|1008027 Running head: Debt Policy at UST Inc Why is UST Inc considering a leveraged recapitalization after such a long history of conservative debt policy? UST Inc. is planning to make changes and expand the operation so that the management is expecting greater returns through recapitalization projects. In December 1998, the board of director approved a $1billion loan over 5 years that would be used in the acceleration of the stock buyout program. Due to the conservative nature of the firm’s dividend policy, the announcement of the $1billion gained the attention of the Wall Street. The recapitalization project was aimed at increasing the company’s overall capitalization. Despite the legal and legislative issues in the tobacco industry, the firm was focused on pushing through the share repurchase program. The smokeless tobacco industry had generated US$ 2 billion from the retail revenue. From the project, the firm expects to enjoy tax shield through increased leverage. The firms have employed various strategies to ensure that the management can enact them before the business is exposed to the risks of investing. One of the most important strategies that the firm has adopted in the capital structure strategy. From the new capitalization structure, the firm will be able to enjoy safer operations and adopt a different approach or channel in the smokeless industry which is faced with constant uncertainty. The business has been able to overcome any challenge and have a greater leverage through the elimination of any possible chance of insolvency. The insolvency threat has been hanging on the firm’s neck for a long time. The new project will be crucial for the reduction of the outstanding shares. Also, the market price of the share will reduce significantly thus increasing the sales volume from all their products. Gedownload door Andy Chen (andyrosegarden@hotmail.com) lOMoARcPSD|1008027 Debt Policy at UST Inc What are the primary business risks associated with UST Inc? What are the attributes of UST Inc? Evaluate these from a viewpoint of a bondholder. From a credit analyst point of view, there are various business risks that the firm will face. The risks may affect the business as a bondholder. If the business environment is harsh, the adverse effects of the risks may cause harm to the operation. First and foremost, UST Inc has so many competitors in the smokeless tobacco industry. The saturation of the tobacco market makes it hard for the business to fully penetrate into the market. As a business, UST Inc will face numerous risks in an effort to beat the competitors in the market. Currently, they have not managed to extinguish the threat posed by its rivals. The continued market erosion and stiff competition have weakened the organization’s ability to gain a competitive advantage. Also, some of the rivals are performing better than UST Inc and thus it has been hard to defeat them in such a competitive market. Some of the firms in the industry have introduced new products which are cheap compared to the already produced in the market. Consequently, the rest of the companies in the markets are forced to work hard so as to launch new products which are of better quality and cheaper. All these competition stands is beyond the firm’s production capacity. The firms are also forced to lower the price of the products so as to avoid customer loss. Low prices mean that the companies will have the lower profit margin and therefore the shareholders will have to be lowly compensated. Competition and market penetration are therefore one of the greatest business risks to UST Inc. Once the Chief Executive Officer resigned, the company was faced by a major blow unable to deal with. The resignation was not anticipated and the firm had to act swiftly to prevent any mismanagement. The act exposed the firm to the risk of low performance due to the absence of a leadership figure. The employees lacked a management grip which would push them to achieve the set objectives. The CFO and the president (Tobacco Unit) would later resign Gedownload door Andy Chen (andyrosegarden@hotmail.com) lOMoARcPSD|1008027 Debt Policy at UST Inc following the steps of the CEO. This was an indication that the organization was unable to deal with the risk of market erosion. The uncertainty in the management was caused by the lawsuit that alluded that the firm was violating the antitrust and anti-competition laws. The research on the health risk of tobacco on cancer has not been concluded but if the results are out they may expose the industry to more risks. There is the probability of a shift in the tobacco preference thus making it hard for the global expansion of UST Inc. The company has also faced more than 5 health-related lawsuits. The litigation in the industry will go on and so it is hard to ascertain the future of UST Inc. UST Inc has an uninterrupted history of dividends. Will the recapitalization hamper future dividend payments? From the leverage plan, the company is hopeful of more returns from the securities. The high returns are as a result of the expected high profits in the near future. The company has announced the tax shield plan which will protect the firm from unnecessary or over-taxation. The shareholders will enjoy the new dividend policy as they anticipate continue the flow of income. The management plan to change the shareholding policy so that they can attract more investors. The increase in the capital available will ensure that the company is not insolvent and that the investors can enjoy the returns from the securities. The capital recapitalization project will allow the business to expand in the global market thus more revenues. UST Inc is making changes in the management team by giving them shares so that they can work hard and ensure that the company is improving on its performance. Also, the changes will ensure that the management can influence the prices of the shares. Although the changes may be viewed as insider trade, the action is highly malleable. When the majority of the securities are held by the employees, they will work hard to ensure that the prices do not fall. Gedownload door Andy Chen (andyrosegarden@hotmail.com) lOMoARcPSD|1008027 Debt Policy at UST Inc Should UST Inc. undertake the $1 billion recapitalizations? Calculate the marginal (or incremental) effect on UST’s value, assuming that the entire recapitalization is implemented immediately (January 1, 1999). a. Assume a 38% tax rate. UST Inc. should undertake the $1billio recapitalization. To calculate the marginal effect on UST’s value, we must first calculate the impact of the tax shield. The shield will waive all the tax liability from the company. The firm will, therefore, be able to survive the financial crisis it is currently in. Bankruptcy is one of the major risks that the company is facing. Bankruptcy is measured by the chances of the occurrence of the scenario and the costs to be incurred. Assume; BP- Bankruptcy probability CB- the cost of bankruptcy Marginal effect = + Tax Shield – Expected Bankruptcy Cost Marginal effect = VU + tD - PV (Financial Distress) Marginal effect = VU + tD - (probability of bankruptcy * cost of bankruptcy) Marginal effect = VU + tD - (probability of bankruptcy Therefore, the marginal effect is: Marginal effect = tD - (probability of bankruptcy * (g * VU)) ; sum of tax shield minus the cost of bankruptcy. The margin effect will therefore be = 0.38($1billion) – (0.0028) (0.30) ($6.5billion) = $0.375 billion 1. The BP was inferred from the AAA credit rating. From the “EBIT interest coverage ratio” spreadsheet the ratio of recapitalization has a 12.9 ratio. Gedownload door Andy Chen (andyrosegarden@hotmail.com) lOMoARcPSD|1008027 Debt Policy at UST Inc 2. g. is the constant fraction of VU and is given as a conservative value of 0.30. It is used to measure the probability that the company will lose a bankruptcy case. 3. VU is the value of the unlevered firm and is calculated by adding the market capitalization and debt (64 billion and 0.1 billion respectively). To prevent any complexity, we assume the firm in unshielded. The EBIT is always higher than the interest charged to the company will be able to pay up the debt interest charge. The recapitalization plan will not prevent the company from paying the dividends in the near future. The long-term impact of the plan is however not known with certainty. The increase in the voting powers by the management will lead to a problem of agency cost since the firm has not been successful in operation investment. In conclusion, the recapitalization plan will increase the firm’s leverage but it may not be able to pay the dividends and interest in the future. The company should always ensure that the EPS is always higher than the DPS so that it can pay the shareholder without struggling. To be able to maintain the dividend payout, the firm will have to incur an 83% payout ratio. An increase of the payout ratio to 90% will reduce the capital available for research and development. Gedownload door Andy Chen (andyrosegarden@hotmail.com)