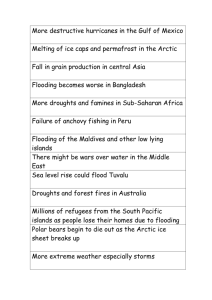

High commodity prices, receding ice and better technology are spurring a hunt for Arctic resources Jun 16th 2012 | from the print edition IN WAINWRIGHT, A tiny village on the Alaskan shore of the Chukchi Sea, scientists from Royal Dutch Shell recently drew a small crowd of Eskimos to the school gymnasium to hear about the company’s summer plans. Between July and October, Shell hopes to drill three exploratory wells in its Burger prospect, 100km offshore of Wainwright. Having found oil and gas there in the 1980s, it is confident it will do so again. Oilmen are usually cagey; the chances of finding commercial oil in a well-charted prospect are around one in 20. But Shell, which in 2005 and 2007 paid $2.2 billion for exploration licences off the shore of Alaska, believes the Burger is a whopper. “This is a big year for the Arctic,” says its regional chief, Robert Blaauw. That could breathe new life into Alaska’s flagging, mostly onshore, oil industry. Merely to maintain pressure in the Trans-Alaska pipeline, now operating at less than a third of its capacity, requires a big new find. It would also affect Wainwright: to move crude from the Burger prospect to the Trans-Alaska pipeline, Shell would build a 650-km feeder pipe that might run close to the village. Hence the mission to woo the locals. Shell’s scientists described their precautions against oil spills, which are far more stringent now than they were before the 2010 Deepwater Horizon leak. Shell has a capping stack—the sort of bespoke metal plug that stopped that giant spill—ready and waiting. It will also have 22 vessels in the Arctic. Yet the scientists talked more about their extensive work on the local wildlife and archaeology, which involves 150 researchers and has cost the firm $60m so far. ConocoPhillips and Statoil, which also plan to drill off Alaska, together have chipped in another $30m or so. A good chunk of this spending is required by the regulators, but the oil firms have gone beyond that, hoping to head off legal challenges from Inuit hunters and greens. Such suits have already played a part in holding up Shell’s plans by several years, at enormous cost. So far Shell has sunk over $4 billion into its Arctic venture without drilling a single well. Opposition from President Barack Obama’s administration—which briefly imposed a moratorium on offshore Arctic exploration—has added to the delay. So has the bureaucracy involved in getting over 35 permits, at least two of which the company has yet to secure. Shell’s research is focused on species that the Eskimos hunt, including bowhead whale. The company will halt its drilling season in the nearby Beaufort Sea for around three weeks to allow the Eskimos there to kill their quota of whales. But Wainwright’s mayor, Enoch Oktollik, was unimpressed. “We have our subsistence culture, but what’s going to happen to our future grandchildren if you have polluted our ocean?” he asked. The oil firm is wise to be patient. According to a 2008 study by the US Geological Survey, the Arctic may hold 90 billion barrels of oil and 1,669 trillion cubic feet of natural gas, respectively 13% and 30% of the world’s estimated undiscovered reserves. Over 84% of this is thought to be offshore, with the continental shelves of the United States, Canada and Greenland likeliest to hold oil and Russia’s and Norway’s the best prospects for gas. Alaska may have 20% of the lot. Oil has long been produced in the Arctic. The first onshore wells were sunk in Canada’s Mackenzie River valley in 1920; since then over 400 Arctic oil and gas fields have been discovered. But, chiefly because of the high cost of operating in the Arctic, their development has been slow. The only big offshore Arctic production site is the Snohvit gas field in the Norwegian Barents Sea, opened by Statoil in 2007. Half the Arctic’s basins are unexplored. But this is now changing, with oil firms increasingly heading north, nudged by high oil prices, better technology, a dearth of easier opportunities and melting ice. When Shell found oil and gas off Alaska in the late 1980s, the oil price was around $15 a barrel. That was too low to make extraction profitable, so it let its licences lapse. The price is now around $100. Progress in horizontal drilling, which allows more oil to be produced from fewer wells, is another boon for the Arctic. Meanwhile the world’s most accessible oil fields, in the Middle East and elsewhere, are being depleted. They are also increasingly controlled by state-backed firms. This has left the big independent oil companies scratching around for alternatives that play to their technological prowess and their ability to secure long-term investment. The Arctic requires plenty of both. Oil companies are reluctant to admit that climate change plays a part in their northward shift. Naturally they do not want to be seen to be profiting from the environmental damage to which their activities have contributed. Sometimes there is no such link: Norway’s southern Barents Sea has had little ice to worry about for a long time. And Shell plausibly argues that Alaska’s melting ice will make its operations more difficult to plan by forcing it to prepare for a wider range of conditions. Yet it will eventually make it much easier to operate off Alaska, with ever longer periods of open water. And elsewhere the retreat of the sea ice is already a factor in new exploration. The boss of Greenland’s Bureau of Minerals and Petroleum, Jorn Skolv Nielsen, describes it as a big reason for the bureau’s decision to open Greenland’s western Disko Bay, where Cairn Energy drilled in 2010-11. The United States, Norway, Russia and Greenland have all opened more of their Arctic offshore to exploration in recent years, leading to several big discoveries. Canada’s Mackenzie river valley is again being explored, as, more modestly, is its less promising Arctic offshore. Statoil, having found two additional Barents Sea gas fields in the past 12 months, expects to produce up to 1m barrels a day of oil equivalent from new Arctic wells by 2020. Norway, which awarded 26 licences for the Barents and Norwegian Sea in January, plans to issue more for the eastern Barents Sea early next year. According to a recent report for Lloyd’s, the London insurance market, the Arctic could attract $100 billion of investment in the next decade, mostly in offshore energy. With the possible exception of the United States, where influential greens oppose drilling in Alaska, all Arctic coastal countries want this development. Norway is looking to the Barents Sea to compensate for declining North Sea production. Russia, as Mr Putin has signalled by announcing plans for a new investment regime for foreign oil firms, is even keener. It needs Arctic production to offset the decline in its main west Siberian oil fields. It also needs foreign capital and expertise to help its state-owned firms pull it off. Shortly after the RosneftExxonMobil tie-up was finalised in April, Rosneft and Italy’s Eni announced an agreement to explore the Kara Sea. Statoil and Total have an agreement with Gazprom to invest up to $40 billion in opening the massive Shtokman gas field in the eastern Barents Sea. Foreign oil firms are aching to get into Russia; hence BP’s 2011 effort to negotiate a deal with Rosneft, which fell through because of objections from its existing Russian partners in TNK-BP, an oil firm. But the enormous cost of operating in such a hostile and remote place has made them dig in for more favourable terms than the Kremlin is wont to provide. Exxon estimates that developing its three blocks of the Kara Sea could require an investment of $500 billion over several decades. Beginning production at Shtokman is expected to cost $15 billion. The finalising of ExxonMobil’s tie-up with Rosneft suggests that the notoriously hard-nosed firm got what it needed from Mr Putin’s promised reform. Whether it will be enough for the Shtokman project is unclear. It was designed to supply America with liquefied natural gas, but this export market has disappeared as the country’s supplies of domestic shale gas have boomed. For Greenland, the prospect of oil revenue is tied to its aspirations to independence. Cold, dark, remote and with little physical or regulatory infrastructure to support an oil industry, it is the Arctic’s wildcat energy frontier. In 2002 and 2004 it held auctions for offshore exploration licences in the island’s south-east that each drew a single bid, from Canada’s Encana. Between 2006 and 2010 it sold licences to firms including ExxonMobil, Chevron and Cairn Energy, which recently found traces of oil in western Disko Bay. This is exciting stuff, but producing offshore Arctic hydrocarbons will generally be a slow business. ExxonMobil and Rosneft will not make a final investment decision on their joint exploration until late 2016 or early 2017. In the best case Shell would hope to begin producing offshore Alaskan oil in 10-15 years. It may be more like 20 years before Greenlandic oil is produced, assuming it is even found. The technical difficulties remain daunting. Exploratory drilling—from floating rigs that can be towed away from icebergs—generally cannot be done through ice, so the drilling season will be short. Producing Arctic hydrocarbons, often through ice, will be complicated. One way of doing it is to build production infrastructure on the seabed, below the ice; another is to encase it in concrete that will withstand sea ice. But both would be vulnerable to a very big iceberg that might scour the seabed to a depth of several metres. Such problems are sufficient to give some oil companies pause. Total, for instance, has invested heavily in offshore Arctic gas, but “drilling for Arctic oil is not being considered by us. Not at all. Our gas assets are enough for the moment,” says Total’s head of development, Michel Hourcard. “There are many technical challenges—there is too much ice, darkness and stormy weather.” Another technical risk is also a political one: the difficulty or— depending whom you talk to—impossibility of cleaning up oil spills in ice. That is why the United States and Greenland both require exploratory drilling to stop in September, a month before the sea freezes for the winter. But when production begins, such pauses will no longer be possible. And a serious accident, such as a blowout under sea ice, could be disastrous. Ice-and-oil sandwiches, anyone? Controlled oil spills in ice in and off Norway suggest that the oil would coat the pitted underside of the sea ice and more ice would form under it, making an ice-and-oil sandwich. As the sea ice moves, this would be spread around the Arctic and gradually dispersed as the ice melts. Shell, one of the most technologically advanced oil firms, admits it has no satisfactory answer but suggests it could track the frozen oil and burn it as it melts. The controlled oil spills have inspired little confidence in such claims. Shell’s return to Alaska was intended as a way to reduce its exposure to political risk. Clearly this has not gone to plan. Even if the courts permit it to drill off Alaska, it is likely to be disrupted by environmental protesters, as Cairn was off Greenland. On May 1st Greenpeace activists boarded an Alaska-bound icebreaker, hired by Shell, in Helsinki harbour. Such conflicts are likely to come up everywhere in the Arctic outside Russia—which presents other sorts of non-technical risk. The Arctic is rich in other minerals, too, some of which have long been mined. The 1897-99 Klondike gold rush, in northern Canada, one degree outside the Arctic Circle, was short-lived. The iron ore in Swedish Lapland sustained Germany during the second world war and helped to rebuild Europe after it. One of the world’s biggest zinc mines is in Arctic Alaska, and the biggest nickel palladium mine is in the Russian Arctic. Mining in the region is poised for growth, for much the same reasons as energy production: high commodity prices, improved technology and keen Arctic governments. This is already obvious in the Canadian Arctic, where ArcelorMittal, a big steelmaker, and a partner paid $590m for a large iron-ore deposit in 2011. But its effects may be most dramatic in Greenland, which has issued over 100 exploration permits to companies looking for metals and gemstones. High operating costs and harsh conditions will limit the rate of extraction, but Greenland will probably be mining lots of iron, uranium, gold, rare earths, diamonds and rubies before it gets an oil industry.