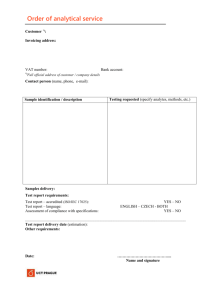

ETRM SOLUTION PROVIDERS - 2018 TIMETRICS RISK ADVANCED ANALYTICS FOR ENERGY RISK MANAGEMENT O rganizations in every industry deal with the complexities—and other areas of risk that aren’t easily challenge of risk quantification, however, those quantifiable,” begins Samantha, President of Timetrics Risk. in the energy trading industry face even Ms. Kumaran founded Timetrics Risk, a minority woman higher risks, owing to the complex— owned business, in 1993. For twenty five years, often bespoke—profiles of non-traditional its’ client base has spanned investment banks, physical assets, which include volumetric Fortune 500 companies, large and small utilities, and climate risks, renewable energy and government owned entities, and deregulated variable supply risks, exploration risks, energy players. which all need to be integrated with highly Timetrics is also a leader in the volatile market risks. This increased risk commodities derivative market, developing should mandate an increased investment a solution called Timetrics Z-Live™ that in high-end, analytical tools, that not only supersedes many platforms, in its advanced Samantha Kumaran provide robust market risk calculations, but mathematical ability to handle large portfolios of also tackle the framework of non-traditional exchange-traded commodity derivatives, with realrisks, for example in integrating volumetric risk, time intraday CME compliance, providing a competitive climate forecasting, and asset-based risks associated with edge in the intraday market risk for Futures Clearing Merchants exploration, drilling, and life cycles of generation. (FCMs’). Timetrics also has successfully pioneered analytic Samantha Kumaran, who has earned a first class honors solutions, in the bespoke risk management of electricity in Applied Mathematics, from Trinity College, University of transmission contracts such as FTR’s and TCC’s, where market Cambridge, UK, is the founder and owner of Timetrics Risk, risk calculations are more unique in time series distribution, a boutique risk analytics solutions company, which provides liquidity and auctions in the secondary markets. advanced analytical solutions to address the challenges Timetrics analytical engines are IT neutral and modular of enterprise risk management in the commodities and based and can interface with existing software platforms. energy trading industry. “We solve problems in unchartered, Moreover, the modular-based solutions offer a greater degree non-traditional markets—which have high mathematical of flexibility and compatibility that can be interfaced with |38| JULY 2018 any bigger system, seamlessly and effortlessly. With innovation in its DNA, Timetrics is continuously developing new solutions to challenge the status-quo in advancing new risk measures that go beyond VaR, and pioneering risk management methodologies in that tackle nontraditional, complex, and hard-to- (on contractual provisions, or whether to drill or not drill), fractionation, and liquidity in the deregulated natural gas markets. The impact was several millions of dollars upside to the client, in improving operations. With a focus on improving client’s returns, and to determine/master risks in non-traditional areas, Timetrics We solve problems in unchartered, nontraditional and derivatives market—which have high mathematical complexities—and other areas of risk that aren’t easily quantifiable quantify energy risk problems. Timetrics’ solutions can be better understood through their offerings to a natural gas and oil exploration client, a Fortune 100 company, who had a complicated physical asset portfolio, of several thousand gas wells, pipelines, and contractual obligations spread over a large region in the southwest U.S. Timetrics pioneered a one-of-a-kind, customized Risk Adjusted Return on Capital (“RaRoC”) solution tailored to the client’s gas exploration business which took into consideration, wellhead decline, quality of gas, real optionality owns the trademark for a risk solution Infrastructure-at-Risk™, which calculates risks based on asset planning and system planning for infrastructure across roads, railways, generation assets and integrated systems. Examples of how Infrastructure-at-Risk™ carves a niche in the market place, is it can assist in governmental and energy planning from a quantified risk perspective, such as consideration of asset life cycle, natural disaster protections, hedging, system planning, flooding, backup generation and impacts to generation and utilities distribution. Deployment of infrastructure planning can be in the billions of dollars. Additionally, the boutique, advanced analytical solution provider has an agile approach to quickly understand the needs of their clients and builds solutions accordingly. At the core, what differentiates Timetrics, is their ability to build customized solutions based on client needs, and its focus to use risk management to improve shareholder value. Timetrics business model has an emphasis on creativity and innovation at the forefront, a focus on research and development, and the provider always has something new in the analytical engine pipeline. Samantha concludes, “Timetrics' vision is to integrate risk management into the thought-process and the spinal cord of the company's organizational planning to help create financial value and better optimize and use risk capital, to allocate risk capital cost to business to improve a client’s revenue. We are becoming quite competitive in the US with our derivatives trading and so we are looking at expanding the usage of our derivatives risk management capabilities and expand in the positioning of the marketplace. We foresee a massive potential to tap into the Middle East oil markets, and developing infrastructure markets.” EC |39| JULY 2018