COA Circular: Write-off of Dormant Accounts in Gov't Agencies

advertisement

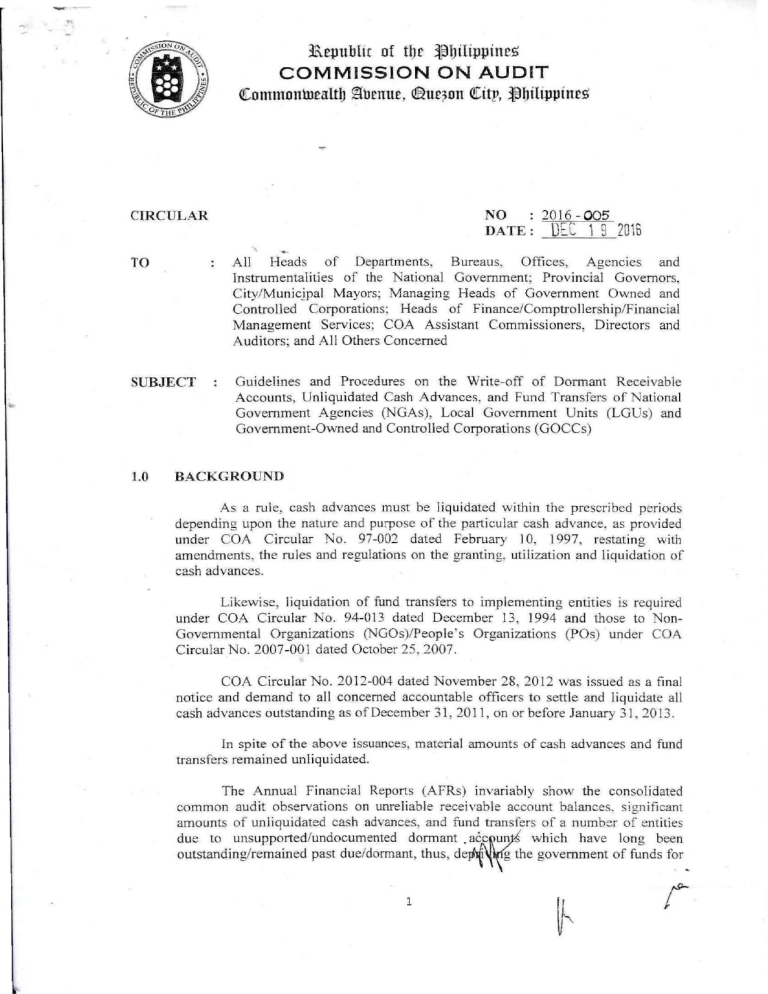

~ - ~epublic of tbt> ~bilippines COMMISSION ON AUDIT ([ommonhlealtb ~benue, ~ue~on ([itp, ~bilippines NO ?016 -005 DATE: DEC 1 9 CIRCULAR 2016 TO All Heads of Departments, Bureaus, Offices, Agencies and Instrumental iti es of the National Government; Provincial Governors, C ity/M uni cjpal Mayors; Managing Heads of Government Owned and Controlled Corporations; Heads of Finance/Comptrollership/Financial Management Services; COA Assistant Commissioners, Directors and Aud itors; and All Others Concerned SUBJECT Guidelines and Proced ures on the Write-off of Dormant Receivable Accounts, Unliquidated Cash Advances, and Fund Transfers of National Government Agenci es (NGAs), Local Government Units (LGUs) and Government-Owned and Controlled Corporati ons (GOCCs) 1.0 BACKGROUND As a rule, cash advances must be liqu idated within the prescribed periods depending upon the nature and purpose of the particular cash advance. as provided under COA Circular No . 97-002 dated February 10, 1997, restating with amendments. the rules and regulations on the granting, utilizati on and liquidation of cash advances. Likewise, liquidation of fund transfers to implementing entities is required under COA Circular No. 94-013 dated December 13, 1994 and those to NonGovernmental Organizations (NGOs)/People's Organizations (POs) under COA Circular No. 2007-001 dated October 25, 2007. COA C ircular No. 201 2-004 dated November 28, 20 12 was issued as a final notice and demand to all concerned accountab le officers to settle and liqu idate all cash advances outstanding as of December 31 , 201 1, on or before January 3 1, 2013. In spite of the above issuances, material amounts of cash advances and fund transfers remained unliquidated. The Annual Financial Reports (AFRs) invariably show the consolidated common audit observations on unrel iable receivable account balances. sign ificant amounts of unliquidated cash advances, and fund transfers of a number of entities due to unsupported/undocumented dormant . ace un which have long been outstanding/remained past due/dormant, thus, de 1 g the government of funds for 1 r- its operations and affecting the fair presentation of accounts m the Financial Statements (FSs). 2.0 PURPOSE This Circular is issued to prescribe the guidelines and procedures in reconciling and cle~ning the books of accounts of NGAs, LGUs, and GOCCs of dormant receivable accounts, unliquidated cash advances, and fund transfers for fair presentation of accounts in the FSs. 3.0 LEGAL BASIS The Commission shall have exclusive authority, subject to the limitations in this Article, to define the scope of its audit and examination, establish the techniques and methods required therefor, and promulgate accounting and auditing rul es and regulations, including those for the prevention and disallowance of irregular, unnecessary, excessive, extravagant, or unconscionable expenditures, or uses of government funds and properties [Section 2 (2), Article IX-D, 1987 Ph ili ppine Constitution]. The Government Accountancy Sector (GAS) of this Commission is mandated to formulate/recomm end policies, rules and regulations on government accounting for consideration of the Public Sector Accounting Standards Board (PSAcSB)/Chairman/Commission Proper (CP). The GAS is al so mandated to provide technical assistance to entities' finance official s, accountants, and auditors on matters pertaining to accounting and financial management (COA Resolut ion No. 2013-021 dated November 20, 2013). 4.0 COVERAGE This Circular covers dormant receivables ansmg from regular trade and business transactions, claims from entities' officers and employees and other dormant receivable accounts; dormant unliquidated cash advances for operating expenses, payroll , special purpose/time-bound activities or undertakings and travel as well as advances granted to Civil Society Organ ization s (CSOs)/NGOs/POs; and dormant unliquidated fund transfers to/from NGAs, LGUs, and GOCCs. Specifically, the following are the accounts used relat~ ·ve to ceivab les, cash advances and fund transfers as defined/described in the revise of accounts: • Accounts Receivable Due from Officers and Employees Other Receivables • Advances for Operating Expenses 2 r • Advances for Payroll Advances to Special Disbursing Officer Advances to Officers and Employees Due from National Government Agencies Due from Government-Owned and Controlled Corporations Due from Local Government Units Due from Non-Government Organizations/People ' s Organizations Du~ froiD Central Office Due from Bureaus Due from Regional Offices Due fi-om Qperating Units Due rrom Other Funds Due to National Government Agencies Due to Government-Owned and Controlled Corporations Due to Local Government Units Due to Central Office Due to Bureaus Due to Regional Offices Due to Operating Units Due to Other Funds This Circular shall not cover the write.:off of loans and advances of Government Financial Institutions which are governed by pertinent provisions of the General Banking Act. Likewise, it shall not cover the following: a. Receivables arising from disallowances and charges; b. Receivables arising from cash shortages; and c. Claims from entities' officers and employees and other parties for transactions which are the subject of a pending case in court or before investigative authorities. 5.0 DEFINITION OF TERMS The following terms when used in this Circular shall be construed to mean as follows: 5.1 Account - refers to Accounts Receivable, Due from Off~cers nd Employees, Oth er Receivables, and other accounts, as enumerated 1 ection 4 of this Circular. 5.2 Condonation of Receivables - amnesty of debt where the creditor is blocked or estopped from attempting to collect the debt later. 3 r 6.0 5.3 Debtor- a person or organization whether public or private that owes money to the government. 5.4 Donnant Receivable Accounts - accounts which balances remained inactive or non-moving in the books of accounts for ten (1 0) years or more and where settlement/co.Uectability could no longer be ascertained. 5.5 Donnant Unliquidated Cash Advances - advances granted to disbursing officers, agency ~officers and employees wh ich remained non-moving for ten (I 0) years or more and where settlement/collectability could no longer be ascertained. 5.6 Donnant Unliquidated Fund Transfers- advances granted by the source entity to implementing entity for the implementation of programs/projects which remained non-moving for ten (10) years or more and where settlement could no longer be ascertained. 5.7 Government Entity - a national government agency, a government-owned and controlled corporation or a local government uni t. 5.8 Impairn1ent - a loss in the future economic benefits due to uncertainty of collectabil ity of the receivables or the amount in respect of which recovery has ceased to be probable. 5.9 Write-off of Donnant Accounts - the process of derecognizing the asset account and the corresponding allowance for impairment from the books of accounts and transferring the same to the Registry of Accounts Written off (RA WO). This does not mean condoning/extinguishing the obl igation of the accountable officer/debtor. GENERAL GUIDELINES 6.1 All government entities shall conduct regular monitoring and analysi s of receivable accounts to ensure that these are collected when these become due and demandable and that cash advances and fund transfers are liquidated within the prescribed period depending upon their nature and purpose; and 6.2 All government entities shall prepare th~ . sc~e ule of all receivables, unliquidated cash advances, and fund transfer~ f December 31 , 20 15 and quarterly thereafter. (see Appendix 55 of Vol. I},\}) M) . r 4 7.0 SPECIFIC GUIDELINES T he Accountant shall: 7.1 Conduct regular and periodic verification, analysis, and validation of the existence of the receivabl es, unliquidated cash advances, and fund transfers, and determine the concerned debtors, accountable officers (Regular and Special Disbursi'ng Dfficers, Collecting Officers, Cash iers) and the source and implementing government entiti es concerned; 7.2 Reconcile the unliquidated fund transfers between the source and implementing government entities, prepare the adjusting entries for the reconciling items noted, and require liquidation of the balances; 7.3 Prepare the necessary adjusting entry/ ies for the following: a. Recognition of the computed/determined impairment in accordance with the Philippine Public Sector Accounting Standards or Philippine Financial Reporting Standards b. Correction of inadvertent errors, or inaccurate calculation or computation c. Reclassification of accounts d. Recovery/settlement of previously written off accounts Adj ustments made pursuant to 7.2 and 7.3 need not be submitted to the COA for approval but are subject to the usual audit. However, the accountant or the auditor may seek assistance from the GAS for proper accounting treatment: and 7.4 8.0 Prepare aging of dormant receivables, unliquidated cash advances. and fund transfers on a quarterly basis (Annexes 1-3) to support the request for write-off, and indicate in the remarks column the existence of the appl icable condi tions, as follows: a. Absence of records or documents to validate/support the cla im and/or unreconciled reciprocal accounts b. Death ofthe accountable officer/empl oyee/debt or c. Unknown whereabouts of the acco untabl e officer/employee/debtor, and that he/she could not be located despite diligent efforts to find him/her d. incapacity to pay or insolvency · e. Exhaustion of all possible remedies by the Management to collect the receivables and to demand liquidation of :~.l~~ces and fund transfers f. No pending case in court involving the su~'~rmant accounts. PROCEDURES IN THE WRITE-OFF OF DORMANT ACCOUNTS 8.1 As a general rul e, pleadings. mode of filing. docketing of cases, and filin g fe~ shell be governed by the 2009 Revised Rules of Procedure of the COA (RRPC), unless specified in this Circular; 5 r 8.2 The Head of the government entity shall file the request for authority to writeoff dormant receivable accounts, unliquidated cash advances, and fund transfers to the COA Audit Team Leader (ATL) and/or Supervising Auditor (SA). No filing fee is required; 8.3 The request shall be supported by the following documents: a. Schedul e of dormant accounts by accountable offi cer/debtor/government entity and by account, certified by the accountant and approved by the Head of the government entity; b. Certified relevant documents validating the existence of the conditions, as applicable, such as: b. I Death Certifi cate issued by Philippine Statistics Authority (formerly N ational Statistics Office) b.2 Proof of Insolvency b.3 Certification from the Department of Trade and Industry that the debtor has no registered business b.4 Certification from the Securiti es and Exchange Commission that the Corporation is no longer active b.S Certificate of no resid ence in the barangay of the muni cipality/city of last known address b.6 Proof of exhaustion of all remedies to co llect the receivables and demand to liquidate the cash advances and fund transfers, such as but not limited to copies of served or returned demand letters b.7 Certification by Legal Officer of the entity of no pending case relative to the account b.8 Certification by the responsible officials of the entity to the effect that there are no records/documents available to validate claim b.9 Other justifications, like in the case of request for write-off due to Joss of documents, the circumstances of the loss shou ld be stated in the letter-request b.l 0 In case of fund transfer, the unliqui dated amount after reconciliation shall be supported by certification by the Chief Accountants and approved by the Heads of the source and implementing entities that the fund was utilized for the purpose, and certifi cation from the recipi ent that the proj ect was partiall y or fully implemented, supported by pictures of the implemented projects. 8.4 The A TL and SA, upon receipt of the request, sha~~assign reference number, · on the req uests for verify and validate the above documents and authority to write off for amounts not exceeding P 0 000.00 per accountable officer/debtor/government entity and by account with in 15 working days from receipt thereof; 6 8.5 In case the basis for denial of the request for write-off by the A TL and SA is failure to comply with the conditions and requirements under paragraph s 7.4 and 8.3, the aggrieved party may refile the request for write-off before the ATL and SA provided that the basis for denial has been satisfactorily complied with/met. The ATL and SA shall decide on the request within 15 workin g days from receipt thereof; 8.6 The aggrieved party oay appeal from the decision of the ATL and SA to the COA Cluster Director (CD)/Regional Director (RD) who has jurisdiction over the government ~ntity under audit within 15 working days from receipt of the decision. The CD/RD shall decide on the appeal within 15 working days from receipt thereof. The decision of the CD/RD on appealed request is final and non-appealable; 8.7 For amounts exceeding P1 00,000.00 per accountable officer/debtor/ government entity and by account, the A TL and SA shall forward the entire records of the requests to the CD/RD , together with their comments and recommendations, within 15 working days from receipt thereof; 8.8 The CD/RD shall review the entire records of the requests and shall decide on amounts involving more than PIOO,OOO.OO but not exceeding Pl ,OOO,OOO.OO per accountable officer/debtor/government entity and by account within 15 working days from receipt thereof; 8.9 ln case the basis for denial of the request for write-off by the CD/RD is fai lure to comply with the conditions and requirements under paragraphs 7.4 and 8.3, the aggrieved party may refile the request for write-off before the CD/RD provided that the basis for denial has been satisfactorily complied with/met; "' 8.1 0 The aggrieved party may appeal from the decision of the CD/RD to the Assistant Commissioner (AC) concerned within 15 working days from receipt of the deci sion. The AC shalL decide on the appeal within 15 working days from receipt thereof. The decision of the AC on appealed request is final and non-appealable; 8.11 For amounts exceeding Pl ,OOO,OOO.OO per accountable officer/debtor/ government entity and by account, the CD/RD shal~fo ar the entire records of the requests together with his/her recommendati e AC of the Sector within 15 working days from receipt thereof; 8.12 The AC of the Sector shall review the entire records of the requests and shall decide on amounts exceeding Pl ,000,000.00 per accountable officer/debtor/ government entity and by account within 15 working days from receipt thereof: r 7 8.13 In case the basis for denial of the request for write-off by the AC of the Sector is failure to complywith the conditions and requirements under paragraphs 7.4 anct 8.3, the aggrieved party may refile the request for write-off before the AC of the Sector provided that the basis for denial has been satisfactoril y compl ied with/met; and 8.14 The aggrieved party may appeal from the decision of the AC of the Sector to the CP within 15 working days from receipt of the decision. F iling fee is required at a rate prescribed in the 2009 RRPC. The decision of the CP is final and non-appealable. - 8.15 The Accountant shall: a. Prepare the JEV within 15 working days upon receipt of the decision granting the authority to write-off, for approval of the Head of the government entity, effect the adjusting entries in the books, and enter the gross amount of the receivables in the RA WO. A sample form of the RA WO is anached as Annex 4 (Appendix 56, Vol. II, GAM); b. Submit the JEV to the COA A TL; c. Maintain a RA WO to record the accounts written-off and keep a copy of the approved request for write-off including the records and documents pertaining thereto: and _ d. At the end of the year, foot entries in the RA WO and make the appropriate disclosures in the Notes to FS. 9.0 MONITORING AND REPORTING 9.1 Quarterly Report on Requests for Write-off (QRRWO) shall be prepared and submitted by the: a. SA/A TL to CD/RD b. CD/RD to AC concerned c. ACto CP Secretariat d. CP Secretariat for CP Decision A·sample form ofQRRWO is attached as Annex 5. 9.2 The CD/RD shall consolidate the QRRWOs submitted by the SA/ATL and the AC of the Sector shall consolidate the QRRWOs submitted by the CD/RD. I 9.3 10.0 • The consolidated QRRWOs of the Sectors shallMkfsubm itted to the CP 1 Secretariat. 0IV . ILLUSTRATIVE ACCOUNTING ENTRIES The illustrative accounting entries to record the adjustment for the writing off of dormant receivable accounts, unliquidated cash advan ces, and fund transfers are shown below: ( . 8 10.1 Writing Off of Receivable Accounts '"" Account Title Credit Accumulated Surplus/(Deficit) Allowance for Impairment- Accounts Receivable Allowance for Impairment- Other Receivables Accounts.Receivable Due from Offic..ers and Employees Other Receivables To recognize writing off of dormant Receivable Accounts XXX XXX XXX XXX XXX XXX 10.2 Writing Off of Unliquidated Cash Advances Account Title Accumulated Surplus/(Deficit) Advances for Operating Expenses Advances for Payroll Advances to Special Disbursing Officer Advances to Officers and Employees To recognize writing off of dormant unliquidated cash advances Debit XXX XXX XXX XXX XXX 10.3 Writing Off of Fund Transfers (Intra/Inter-Agency Receivables!Payables) A. Source Agency 's Books Account Title Debit Accumulated Surplus/(Deficit) Due from National Government A gencies Due from Government-Owned or Controll ed Corporations Due from Local Government Units . __ ; 1 Due· from Non-Government Organi~\\s/People' s Organizations · Due from Central Office Due from Bureaus Due from Regional Offices Due from Operating Units Due from Other Funds To recognize writing off of intra/inter-agency receivables XXX L N ote: Furnish copy of the JEV to the Implementing Agency ( 9 Credit XXX XXX XXX XXX XXX XXX XXX XXX -xxx B. Implementing Agency's Books ...,. Account Title Debit Due to NGAs XXX Due to GOCCs XXX Due to LGUs XXX Due to Central Office XXX XXX Due to Bur~a~s Due to Regional Oifices XXX Due to Operating Units XXX Due to Other Funds XXX Accumulated Surp1us/(Deficit) To recognize writing off of intra/inter-agency payables Credit XXX 10.4 Recovery ofAccounts Written-Off A. Receivable Accounts Account Title Accounts Receivable Due frcm Officers and Em!)loyees Other Receivables Miscellaneous Income To recognize the restoration of recoverable Receivabl e accounts written off Cash- Co llecting Officers Accounts Receivable Due from Office.rs and Employees Other Receivables To recognize collection of recovered dormant Receivable accounts B. Debit Credit XXX XXX XXX XXX XXX XXX XXX XXX Unliquidated Cash Advances Account Title ·Debit Advances for Operating Expenses Advances for Payroll Advances to Special Disbursing Officer Advances to Officers and Employees Accumulated Surplus/(Deficit) To recognize the restoration of recoverable unliquidated cash advances written off XXX 10 r Credit XXX XXX XXX XXX ·. Account Title Cash- Collecting Officers Advances for Operating Expenses Advances for Payroll Advances to Special Disbursing Officer Advances to Officers and Employees To recognize collection of recovered dormant unliquidated -sash advances 11.0 XXX XXX XXX XXX SAVING CLAUSE This Circular shall not be interpreted to neither condone the written off accounts nor to extinguish the obligations. The Management shall continue to exert effort to collect the accounts appearing in the RA WO when circumstances would warrant. Further, this shall not be construed as a ground to exonerate the liability of the officers/employees for infidelity in the custody of documents. 12.0 REPEALING CLAUSE All circulars, memoranda, and other issuances or parts thereof which are inconsistent with the provisions of this Circular are hereby repealed/modified accordingly. 13.0 EFFECTIVITY This Cit:cular shall take effect immediately. ~ ~:·. .J;i:il.:; ·..:;.-:.. CtNll'll!S..SIOt.l ON A.Ut)lT OFFIC~ 0' TH~ C:OlU11SSlCIN $E:CIIt£TA1tlt.T 1 1 11111 Chairperson I Ct\.BEL D. AGITO Commissioner 11