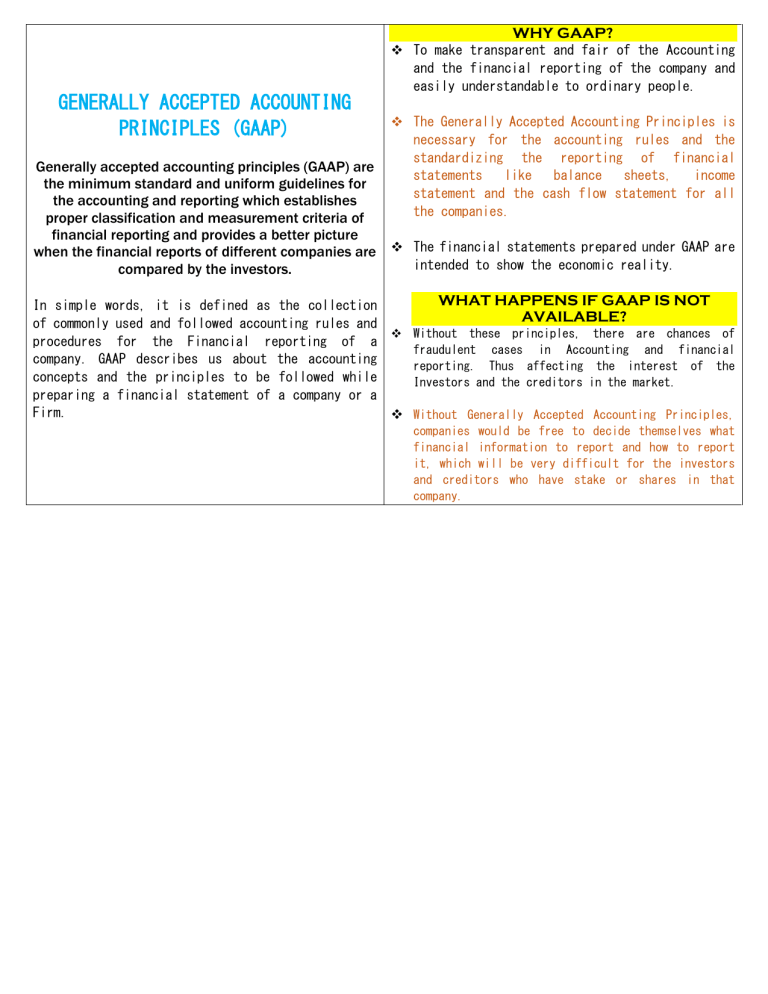

WHY GAAP? GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAP) To make transparent and fair of the Accounting and the financial reporting of the company and easily understandable to ordinary people. The Generally Accepted Accounting Principles is necessary for the accounting rules and the standardizing the reporting of financial statements like balance sheets, income statement and the cash flow statement for all the companies. Generally accepted accounting principles (GAAP) are the minimum standard and uniform guidelines for the accounting and reporting which establishes proper classification and measurement criteria of financial reporting and provides a better picture when the financial reports of different companies are The financial statements prepared under GAAP are intended to show the economic reality. compared by the investors. WHAT HAPPENS IF GAAP IS NOT In simple words, it is defined as the collection AVAILABLE? of commonly used and followed accounting rules and Without these principles, there are chances of procedures for the Financial reporting of a fraudulent cases in Accounting and financial company. GAAP describes us about the accounting reporting. Thus affecting the interest of the concepts and the principles to be followed while Investors and the creditors in the market. preparing a financial statement of a company or a Firm. Without Generally Accepted Accounting Principles, companies would be free to decide themselves what financial information to report and how to report it, which will be very difficult for the investors and creditors who have stake or shares in that company. BASIC PARINCIPLES OF GAAP ADVANTAGES OF GAAP It promotes the interest of the Investors, Shareholders, and Creditors in the market. By following Generally Accepted Accounting Principles, procedures, consistency can be maintained and the overall performance can be determined. Identifying the areas that need improvement and required modifications for the better performance of the company. The financial reports which are made using the GAAP help to maintain investor’s trust and interest in investments of that company; Complying with GAAP gives the guarantee to anyone who wants to invest in that company. With the help of the GAAP report, one can easily understand the financial statements and can also compare easily with another. Generally Accepted Accounting Principle, reports it is easy to find out the profit, loss, expenses, investment, income, and revenues of the company. Generally Accepted Accounting Principles reduce risks and avoids fraud cases by monitoring them properly. 1 – The Business as a single Entity Principle A business is a separate entity in terms of the law. All its activities are treated separately from that of its owners. In terms of accounting, the business is independent, and the owners are different. 2 – The Specific Currency Principle A currency is specified for the reporting of financial statements. In India, we deal with Indian Rupee. Hence it should be treated as INR for the money specific. In the United States, they economically deal with the US dollar, and their financial reporting will be mentioned in USD. Since, we are in the Philippines, we use Philippine Peso (Php). 3 – Time period Specific Principle Financial statements pertain to a specific period i.e., end time and start time. Balance sheets are also reported on a particular date, like monthly, quarterly, half-yearly, and annually. 4 – The Cost Principle In accounting, “Cost” refers to the amount spent 8 – Matching Principle on obtaining the goods or services. Hence for this, the amounts shown in the financial statements also This Matching Principle requires companies to use referred to as the Historical cost amounts. the accrual basis of accounting. The matching principle requires that expenses should be matched 5 – The full disclosure Principle with the revenues. The Full disclosure principle states that a company should disclose all the financial statements fully. It is vital for an investor or the lender to know about the significant account policies. A company generally lists its accounting policies as the first note to its financial statements. 6 – The Recognition Principle 9 – The Principle of materiality This Principle generally states about the adjustment of the very minute errors, that is, while maintaining accounting reports, there could be some small errors like $5 error which is not matching, here this can be used and adjusted accordingly. This revenue recognition principle states that the 10 – The Principle of Conservative companies should reveal the income and expenses of Accounting the company in that period where they have occurred. Conservative Accounting Principle should be adopted by all companies wherein when expenses occur that 7 – The Non-Death Principle of Business are to be recorded immediately, but the income to be recorded when actual cash flow is there. In It is also called as Principe of continuity as for addition to all these, the Principle of Honesty to accounting. There should not be an end as its be maintained. continuing to operate until and unless any winding up of the company. Recognizing Revenues PRUDENCE CONCEPT OF ACCOUNTING Now, what’s the prudence concept principle is that whenever you have a situation where have some prospective income, you should recognize or include that in your books accounts. say you not of Prudence Concept or Conservatism principle is a key accounting principle that makes sure that assets and income are not overstated and provision is made for So, when I am preparing my financial statements, my books of accounts or my balance sheet, or all known expenses and losses whether the amount profit or loss account, I will not recognize the is known for certain or just an estimation i.e prospective income as part of my income for the expenses and liabilities are not understated in the current year’s financial records because I am books of accounting. acting on a conservative basis. Prudence concept is a concept that has been put in place to ensure that the person who is making the The idea behind this principle is not to overstate your income unless and until you have financial statements makes sure that the assets and the possession for that income. income are not overstated to make sure the company is not overvalued. The expenses are not understated to make sure that the company is not rightly valued. As per the prudence concept in accounting, we cannot overstate income. We cannot take into account the prospective income, which may arise. The prudence principle in accounting is many times described using the phrase “Do not anticipate Recognized Expenses profits, but provide for all possible losses.” At the same time, the concept of prudence principle in accounting says that you should never underestimate the expenses, which means if there is an expectation that some expenses are likely to be The Prudence concept makes the comparability of incurred, you should provide it in your books of financial information possible. accounts. DISADVANTAGES In this case, the prudence concept in accounting says that you should never underestimate the expenses, and if there is a likelihood of The prudence concept in accounting doesn’t always necessarily consist of correct facts. expenses, we call it a provision. We should make a provision for expenses in your book of You cannot apply the prudence concept to accounts. cultures that are outside of the IFRS or the GAAP. Advantages The prudence concept or conservatism principle A company may try to create provisions which are not required that may result in the creation of is well known and used worldwide. It gives a some secret reserves. Disadvantages base to the companies on which companies could build or prepare their financial statements The prudence concept in accounting doesn’t according to this principle. always necessarily consist of correct facts. Prudence principle in accounting ensures that the financial statements present the realistic You cannot apply the prudence concept to cultures that are outside of the IFRS or the and fair picture of a company’s revenue and GAAP. liabilities. A company may try to create provisions which are not required that may result in the creation of some secret reserves. It helps in not overestimating as well as not underestimating the financial risk of a company. It helps in the minimization of losses. HISTORICAL COST PRINCIPLE Cost Principle states that an asset should always be recorded at original buying price or cost and not the perceived value and therefore, any changes in the market value of the asset should not affect how they are represented in the balance sheet. Since asset value is recorded as per books, that cost can be rallied back from the invoice or any other means. Hence it can be easily verifiable. Since this is very easy to use, so it is a much cheaper way to record the journal entries. Disadvantages This is also known as the “historical cost Since asset price will be changed over the years, so this method is not the accurate one principle.” Historical Cost Principle is better as it is not showing the fair value of the asset. suited for short term assets since their values don’t get changed much in a short time. For a fixed asset, to correctly record, asset value over the This method also doesn’t show the value of intangible assets example, goodwill, customer years, accountants use depreciation, amortization, value, etc. which could be a very crucial aspect and impairment, etc. of the asset. These intangible assets add a lot of value of the asset over time. Advantages Since assets need to be recorded at cost price If a company wants to sell its asset at that time of selling, there can be some confusion hence, it is very easy to use. You just need to arise, because the market value of that asset, enter the cost of the asset in accounting books. at which company wants to sell, will be quite different than the book value of the asset. Historical Cost Principle Limitations This method is most suitable for short term assets. If an asset is highly liquid or has some market value, then this method is not applicable. That asset should be listed as a market value rather than historical cost. The company’s financial investment accounting should not be based on the cost principle. Instead, its value should be changed each accounting period based on market value. NOTA BENE: Cost Principle in accounting is easy to implement and cheap, but it has few limitations in terms of the fair value of an asset. It ignores any kind of inflation in the value of the asset. As already mentioned, financial investment should not be booked as per Cost Principle; instead, its value should get changed in each accounting period as per market value. ACCOUNTING CONTROLS Accounting controls are the procedures and the methods which are applied by an entity for the assurance, validity and accuracy of the financial statements but these accounting controls are applied for compliance and as a safeguard for the company and not to comply with the laws, rules and the regulations. Accounting Controls are the measures and controls adopted by an organization that leads to increased efficiency and compliance across the organization and ensures that financial statements are accurate when presented to auditors, bankers, investors, and other stakeholders. There are various types of control applied within an organization. Also, there is no straight forward control policy that applies to every organization. The application of controls for each organization is designed and implemented to suit its needs, type of business, aspirations, goals, and other guidelines. As per the Cost Principle in accounting, asset value should not get changed, but GAAP allows the asset value to change based on their fair value. This can be done using asset impairment also. 1 – Detective Controls As the name suggests, these controls are the ACCOUNTING INTERNAL CONTROL controls in place to detect any discrepancy and deviation from the policies in place. It also 1. Segregation of duties – processor and approver serves the purpose of the integrity check. should be two different people. 2 – Preventive Controls 2. An independent user id and passwords should be provided to all the employees. The controls are applied daily within the organization to stop the errors or discrepancies for happening in the first place. We can say these 3. Physical verification of Inventory and Assets should be done. are the rules which everyone within the organization has to abide by in their day to day 4. Bank reconciliation and other Trial balance job. reconciliations should be done. 3 – Corrective Controls 5. Standard Operating Procedure documents should These are the controls that come to rescue when be made regarding process flow. preventive and detective both the controls have failed to avoid an error. In an accounting 6. Surprise check of petty cash and cash book environment posting an adjustment or rectification balances. entry is an example of corrective controls. Once the books are closed after the financial year and auditors find an issue that needs to be addressed. Reopening the financial yearbooks and making the adjustments asked by an auditor is also a part of a corrective control. ADVANTAGES The action log identifies the person responsible CONSERVATISM PRINCIPLE for any error. Accuracy of financial statements and funds Conservatism Principle of Accounting provides application guidance for the accounting, according to which in Efficient use of the resources for the intended case there exists any uncertainty then all the purpose expenses and the liabilities should be recognized Helpful in audit facilitation whereas all the revenues and gains should not be A strong foundation for a more significant recorded, and such revenues and gains should be growth recognized only when there is reasonable certainty of Identification and rectification of any its actual receipt. discrepancy identified Saving of cost and resources. Conservatism Principle is a concept in accounting under GAAP which recognizes and records expenses DISADVANTAGES and liabilities-certain or uncertain, as soon as possible but recognizes revenues and assets when Sometimes irritating and time-consuming for they are assured of being received. It gives clear employees. guidance in documenting cases of uncertainty and The high cost of maintaining controls and estimates. standards. Over dependent for financial statements and audit Duplication of work. Conservatism principle of accounting states that the accountants must choose the most conservative outcome when two outcomes are available to them. The main logic behind this principle of conservatism is that when two reasonable possibilities for recording a transaction are available, one must error on the conservative side. It means one has to record uncertain losses while staying away from recording uncertain gains. So when the conservatism principle of accounting is followed, a lower asset amount is recorded on the balance sheet, lower net income is recorded on the income statement. So, adhering to this principle results in recording lower profits in the statements. The two main aspects of the conservatism principle of accounting are – recognizing revenue only if they are confident and recognizing expenses as soon as they are reasonably possible. The principle of conservatism is the primary basis for lower of cost or market rule, which tells that inventory should be recorded at the lower of either its acquisition cost or the current market value. Following this process leads to lower taxable income and lower tax receipts. The conservatism principle of accounting is only a guideline that an accountant needs to follow to maintain a clear picture of the financial standing of a business entity. GOING CONCERN CONCEPT Going Concern concept is one of the basic principles of accounting that states that the accounting statements are formulated in such a way that the company will not be bankrupt or liquidated for the foreseeable future, which, generally is for a period of 12 months. Going concern concept means the ability of a Business to ‘run profitable’ for an indefinite period of time until the concern is stopped due to bankruptcy and its assets were gone for liquidation. When a business stops trading and deviates from its principal business, then there is a high possibility that the concern would likely stop delivering profits in the near-term future. Thus, a Business cannot bear losses for a longer time and erode shareholders’ wealth. A healthy business shows Revenue growth, Profitability growth with margins improvement and growth in product sales. 1 – Acceptability of the core product A Business runs on the Going Concern basis of the products/services they offer to the consumers. The pulse of a business starting from a fruit-seller to a Multinational company selling IT services would be the same. The owner or the top-management has found new customers and maintain its existing customer’s so as to maintain the Organic and inorganic growth of the company. Retention of old customers and expansion through new customer acquisition would help to make the business profitable and aids toward the volume growth of the product. The product should be reasonably priced and innovative in nature so that it can beat its peers and retains value for the customers. ACCRUAL ACCOUNTING Accrual Accounting is the most accepted accounting principle which states that revenue is recognized when the sale is done (irrespective of the cash or credit sale) and the expense is matched and recognized along with the corresponding revenue (irrespective of whenever it’s paid). Accruals in Accounting are the expenses or revenues The Financials of the Business should speak about the that have been recorded by the firm but not yet sustainability of the business through Top-line and realized. In simple terms, they are the financial Bottom-line growth along with higher Operating and Net transactions already estimated in the current profit margin. An ideal growing concern should have a accounting cycle and payment for which is done in higher number of product sales compared to last year. the future. #2 – Margin, Growth, and Volumes #3 – Cyclical Profitability Revenue Growth and It showcases exactly what is happening in the Another instance where there might not be constant top- business, not what a business will achieve shortly. line and Bottom-line growth along with increased margin For example, if a firm has sold products on credit, is when the demand for the product is ‘Cyclical’ in then it will show the same as sales even if the nature. For example, the rise and fall of volume in steel money is yet to be received by the company. products may affect the Revenue and due to fixed cost, the profitability may get hinder. But the interesting part of the Business is that it is still following the basic fundamentals and due to the nature of the business it is getting a hit. Advantages It is a holistic approach: Unlike cash accounting, accrual accounting is a comprehensive accounting system. You would agree that a business is not about cash only. There are many aspects that should be taken into account. Under the accrual system, we can record all the financial transactions of business (cash and others), and we can also create financial statements like the income statement, balance sheet to get a more holistic view of how a company is doing overall. There are almost no discrepancies/errors: Since the financial transaction is immediately recorded as it occurs, there are virtually no chances of discrepancies or inaccuracies. And since everything is recorded all the time, if one wants to do an audit, the information is readily available. Accuracy level is higher: Unlike cash accounting, accrual accounting follows a double-entry system. That means one account is debited and another account is credited. As a result, we can see how one account is reduced, and another account has increased. It increases the accuracy level of accounting, and later on, during an audit, things get easier. It is recognized by Companies Act: It is recognized by the Companies Act, and that’s why a vast number of companies follow this. Disadvantages Quite complex: Cash accounting is easy to record and easy to maintain. But accrual accounting is complicated to record since every time a financial transaction happens, there should be an entry in the books of accounts. And maintaining the whole accounting system isn’t an easy job as well. Holistic but challenging to maintain: A business has different aspects. And if a business is enormous, in the single day hundreds and thousands of financial transactions need to be recorded under this accounting. Maintaining all of these every day, day after day, isn’t an easy job for an accountant. MATCHING PRINCIPLE RELEVANCE Relevance in accounting means the information we get from the accounting system will help the endusers to take important decisions. End users can be either internal or external stakeholders. Internal stakeholders include managers, employees, and business owners. By external stakeholders, we mean investors, lenders etc. Therefore, relevance in accounting indicates the capacity of influencing the end-users of the financial statement in their decisionmaking process. In short, accounting relevance should contain accurate and orderly information. The relevance of accounting numbers depends on the person using it. And it will hold more meaning if it has been used over some time and more useful if one understands the generally accepted accounting principles based on which the financial report has been prepared. Matching Principle of Accounting provides guidance for the accounting, according to which all the expenses should be recorded in the income statement of the period in which the revenue related to that expense is earned. This means that the expenses which are entered into the debit side of the accounts should have a corresponding credit entry (as required by the double-entry bookkeeping system of accounting) in the same period, irrespective of when the actual transaction is made. ACCRUED EXPENSES Please note that in matching principle of accounting, for expenses, the actual date of payment doesn’t matter; It is important to note when the work was done. In this case study, the work was completed in July. This recording of such accrued expenses (irrespective of actual payment made or not) and matching it with the related revenue is known as the Matching Principle of accounting. DEPRECIATION EXPENSE The reported amounts on his balance sheet for assets such as equipment, vehicles, and buildings are routinely reduced by depreciation. Depreciation expense is required by the basic accounting principle known as the matching principle of accounting. Depreciation is used for assets whose life is not indefinite—equipment wears out, vehicles become too old and costly to maintain, buildings age and some assets (like computers) become obsolete. REVENUE RECOGNITION The principle of revenue recognition is a generally accepted accounting principle (GAAP) that outlines the specific conditions under which the revenue is recognized or is accounted for. Cash may be received at an earlier stage or at a later date after the goods and services have been delivered to the customer and the revenue gets recognized. ACCRUED PRINCIPLE OF REVENUE RECOGNITION SIGNIFICANCE OF MATCHING PRINCIPLE Under accrual accounting, revenues need to be The matching principle in accounting is closely recorded in the same accounting period it has been related to the accrual accounting. Rather it earned, irrespective of the timings of the related requires the accrual system to be followed very cash flows from that transaction. stringently. The term “accrual” in accounting means anything which is accrued for a particular If the seller is doubtful concerning receiving the period until it gets paid on a future date. amount from the customer, he will recognize an allowance for doubtful accounts in the amount by Hence, this principle equates the total credits which the customer will likely default on the with total debits (or total expenses with the total payment. income) as of a particular period. There are temporary account Payable, Accounts Accounts Receivable which get net off as is made. labels created like Wages Payable, Interest Payable, and Interest Receivable, etc., and when the actual transaction METHODS FOR REVENUE RECOGNITION 1) – Completed Contract Method DEFERRED PRINCIPLE OF REVENUE RECOGNITION Deferred revenue refers to the payments received in advance for the services yet not rendered or goods yet not delivered. If a company receives advance payment, it classifies as a liability, as the service is not yet performed, and it needs to be delivered in the future. The deferred revenue classifies as an asset once the company delivers the services or goods to the customer. Under this method, the revenue associated with a transaction is recognized only after the completion of the transaction. This method is generally used when there in case of uncertainty concerning the collection of funds from the client. 2) – Installment Method The seller accounts for the transaction by using the installment method when the customer is allowed to pay for the product/service over several years. 3) – Cost Recovery Method As per the cost recovery method, the revenue recognition is only done after the cost factor of the sale has been paid by the customer in cash. 4) – Percentage of Completion Method The seller can recognize some gain or loss related to the deal in every accounting period in which the deal continues to be in force. This method is usually adopted while handling long-term projects. FULL DISCLOSURE PRINCIPLE Full Disclosure Principle is an accounting policy backed by GAAP (Generally Accepted Accounting Principles) and IFRS7 (International Financial Reporting Standards), which requires the management of an organization to disclose each and every relevant and material financial information whether monetary or non-monetary to creditors, investors and any other stakeholder who depends on the financial reports published by the organization in their decision-making process related to the organization. COMPONENTS 1 – Materiality A material item is something that is significant and impacts the decision-making process of any person. When an organization prepares its financial statements, it should ensure that every little detail which could be relevant to any party is included in the books of accounts. If it cannot be 2 – Accounting Standards Accounting standards in every country are like traffic rules which everyone must abide by. The accounting standards make it compulsory to disclose the standards followed by an organization in the current year and past years. Also, if there is any change in method of accounting policies from last year, it should be disclosed with reason specified for change. This will help the other party to understand the rationale behind the change. 3 – Auditors Auditors are one of the components of the full disclosure principle, which are also supposed to ensure that the company has disclosed every vital information in the books or footnote. In case of any doubt, the auditor to send the confirmation query to any third party. Also, in cases where the auditors are not confident about in house data, they must seek confirmation from higher management and senior leadership to ensure that numbers in the financial reports reflect credibility. included in the financial reports, it must be shown as a footnote after the reports. 4 – Related Party Disclosures 7 – Non-Monetary Transaction If an organization does business with another entity or person who is defined by law as of a related part, then the former has to disclose to auditors and in the books of accounts. Related party disclosure ensures that two entities don’t get involved in money laundering or reducing the cost/selling price of a product. 5 – Contingent Assets & Liabilities Contingent assets and liabilities are those assets and liabilities which expect to materialize shortly and the outcome of which depends on certain conditions. For example – if there is a lawsuit is in process and the company expects to win it soon, it should declare this lawsuit and winning amount as contingent assets in the footnote. However, if the company expects to lose this lawsuit, it should declare this lawsuit and winning the amount as a contingent liability in the footnote. It’s not always that only the monetary transaction impacts the organization and another stakeholder. Sometimes change in the lending bank, appointment, or release of an independent director, change in the shareholding pattern is also material to the stakeholders in the organization. So, the organization should ensure that any of these types of activities are disclosed in the books of accounts. 8 – Motive The rationale behind the full disclosure principle is that the accountants and higher management of any organization do not get involved in malpractice, money laundering, or manipulation of books of accounts. Also, when an outsider has full information about loans, creditors, debtors, directors, significant shareholders, etc., it will be easy to form an informed judgment and opinion 6 – Merger & Acquisitions and Disinvestment about the organization. If the company has sold any of its products or business unit or acquired another business or another organization unit of the same business, it should disclose these transaction details in the books of accounts. Advantages Makes it easier to understand financial statements and form a decision; Makes usage and comparison of financial statements easier. Improves the goodwill and integrity of the organization in the market; Inculcates best practices in the industry and improved public faith in the organization; Essential for audits and applying for loans. Disadvantages Sometimes inside information disclosed outside might be harmful to the company. Competitors might use the data and use it against the company, which will be bad for business. COST BENEFIT PRINCIPLE Cost Benefit Principle is an accounting concept that states that the benefits of an accounting system that help produce financial reports and statements should always outweigh its associated costs. The Cost-Benefit principle focuses on the benefits which the receiver should get from a given activity. It attempts to measure the value one can extract after paying a sum of money. Below are some of the critical pointers to be kept in mind: The controller of the company requiring the benefits should not spend excessive time on fine-tuning the financial statements with the immaterial/irrelevant adjustments. Additionally, information through footnotes should also be avoided since it can give an An individual/firm/society should take action only if excessive benefits from impression of too much window dressing or taking action are at least as much as the perhaps distortion of facts. extra costs The entities which have set the standards require judging the level of information People generally are under the impression they expect firms to report in their as if they are comparing the relevant costs financial statements. This is done so that and benefits. requirements do not cause an excessive amount of work for the business. Critics of this approach often object that people don’t compute costs and associated benefits when making a decision. CONSISTENCY PRINCIPLE Consistency Principle states that all accounting treatments should be followed consistently throughout the current and future period unless required by law to change or the change gives a better presentation in accounts. This principle prevents manipulation in accounts and makes financial statements comparable across historical periods. According to this, all accounting policies or accounting assumptions to be followed consistently so that financial statements can be easily comparable. If an entity changes the accounting policies or assumptions then it should be by the reason that law demands the change or change gives better preparation and presentation in accounts and if there is change due to any other reasons that reason to be stated clearly and also an effect of change and nature of the change to be disclosed in the financial statements so that it attracts the attention of users and users can understand the change in profit due to change in accounting estimate or assumptions. USES AND IMPORTNACE OF CONSISTENCY It is used in all types of industry whether manufacturing, trading, or service This principle is important from both industry. All entities need to follow accounting and auditing point of view as the accounting policies and principles on a following consistency gives accountants consistent basis. As consistency is one of ease in recording business transactions and the fundamental accounting assumptions for auditors, it helps in the comparison of unless the change in accounting policies financial statements with last year. disclosed it is assumed that all accounting policies which followed last year are For shareholders and stakeholders also followed in the current year also. consistency principle is important as it Consistency makes the financial statements gives them the satisfaction that financial comparable and it also gives ease in statements are more accurate and reliable. preparation of accounts. The correctness of decision is highly depending on the accuracy of financial It is important in every industry as it information and proper presentation of makes sure that accounting policies and financial statements. assumptions to be followed on a continuous basis if accounting policies or assumptions change every year then it confuses the accountants also and users of financial statements also get diverted due to heavy fluctuations in profits. Advantages Disadvantages Ease in Audit and Accounts: It helps accountants in recording the accounting transactions and Restrict to Follow the same Accounting deals with the accounts and it helps the Policies and Assumptions: This restricts auditors in comparing the financial statements the management to follow the same principles and provides the basis for reliability on and assumptions over the years and due to financial statements. change in technology situations demand the change in accounting but this principle restricts the same. Ease for Management: When accounting principles and estimates applied consistently, management becomes familiar with the accounting Errors: As Principle of procedures, technologies, treatments, and its Judgment effects and helps in proper decision making. consistency based on a judgment of whether change gives a better presentation in Reduce the Cost of Training: If accounting accounts hence judgmental errors and principles are followed consistently then only problems arise. initial training to be provided to the accounting staff and this reduces the training Changes Permitted: Only when the new method cost. Makes the Financial Statements Comparable: By following the principle of consistency the financial statements make the comparison and it helps the auditors and users of financial statements to make the comparison of financial statements. is considered better and gives a better presentation in accounts. The reason for the change and its effect on profit to be disclosed in the financial statements creates lots of calculations and pressure on accounting staff.