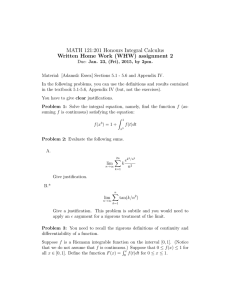

ACCT1101 Worksheet Week 1 Recording 1.1: The Accounting Function 1.1 What are the first word(s) that come to mind? Number crunching Accountants Bookkeeping Reports 1.2 What are the key features of the accounting function? The process of identifying, measuring and communicating economic information It permits the informed judgements and decision making of the users of that information 1.3 Both internal and external users will demand accounting information. Give examples of internal and external users and their information needs Internal users External users Managers / Directors Employees What resources are available How much does it cost Investors Resource Providers Recipients of goods and services Regulatory agencies Public Are the assets being used efficiently Health of the company What type of returns on investment Is the agency credit worthy 1 1.4 Explain the differences between financial and management accounting FINANCIAL ACC. MANAGEMENT ACC. Financial budgets Balance sheet Sales forecasts Income statement Performance reports Purpose/Objectives Statement of changes in Cost of production reports equity Incremental analysis Statement of cash flows reports Shareholders Lenders Managers Potential investors CEOs Main users Creditors General Managers Customers Account Managers Government Sales Managers Interest groups Level of detail Less detailed More detailed Regulation Formals rules by the accounting standards No standards, internal users Frequency of reporting Reports at regular On demand reports – as intervals demanded by the requested by management statutory boards 2 1.5 Reflect on the Cynthia example (textbook or lecture notes) and note the different types of information Cynthia requires to inform her decision. Where will she typically find the information? 1.6 What is the role of ethics in accounting? 1.7 Is there a conflict between profit and ethics? The role of ethics in accounting is to prevent self interest from harming the interests of the various stakeholders in the company. Failure to maintain objectivity and independence Pressure to make decisions contrary to their ethics Failure to exercise proper professional judgement Improper leadership and poor organizational culture Ethics and profits do not always go hand in hand. While maintaining a high standard of ethical behaviour is in the long-term interest of the business, it can affect short term interests. Ethics are not a barrier to financial success but neither are they a prerequisite to it 3 Recording 1.2: Financial statements for decision making Concept Map 4 Recording 1.2: Financial statements for decision making 1.8 Briefly explain why each of the accounting assumptions are followed in accounting reports Accounting Entity: Defines the entity of the entity being reported on. Separation of business and personal expenses Accrual Accounting: Leads to more complete and accurate financial representation Avoids understating profit Going Concern: The values of assets are measured by going concern. Deferred expenses must be recognised Period Assumption: Financial statements must be comparable over reporting periods 1.9 Open HVN’s Statement of Financial Position and identify the three financial statement elements reported in this statement Assets Liabilities Equity 1.10 Express the three elements in a mathematical equation A–L=E 1.11 Is HVN displaying its SFP in account or narrative format? Narrative form. Shows net assets and equity on its own 1.12 Open HVN’s Income Statement and identify the two financial statement elements reported in this statement Income Expense 5 1.13 Did HVN report a profit or a loss for 2019? Profit of 409 million dollars 1.14 Turn to HVN’s SOCE and note the various categories of equity items. See if you can find the profit figure from the Income Statement Retained profits balance 1.15 Turn to HVN’s SCF and Identify the three ‘buckets’ used to classify cash flows. Operating activities Investing activities Financing activities 6 1.16 Sdfsd Bakehouse had the following transactions in the month of June. 1 June 5 June 10 June 15 June Start-up capital was received from Mr Baker ($50 000 for shares) and a bank loan of $110 000 was secured. Took ownership of bakery equipment. $85 000 fully installed. It was paid for in cash. Shop fittings were completed and the final invoice was $15 000, payable on the invoice date It was time to move out of the dining room and into a proper office. Office equipment acquired amounted to $12 500 and it was paid for in cash ` DATE ASSETS Cash at Bank 1-Jun $160,000 5-Jun ($85,000) 10-Jun ($15,000) 15-Jun ($12,500) Equipment Shop Fittings LIABILITIES Office Equipment EQUITY Bank Loan Contributed Capital $110,000 $50,000 $85,000 $15,000 $12,500 7 1.17 Name 5 : Characteristics / advantages / disadvantages Sole proprietorships Partnerships Companies 1.18 Identify factors that need to be considered in selecting an appropriate organisational structure for Lucy’s Dog Grooming Salon How easy to set up business? Establishment costs? Liability issues? Tax? Control? Access to capital? 8