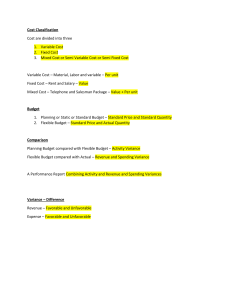

7-1 CHAPTER 7 FLEXIBLE BUDGETS, DIRECT-COST VARIANCES, AND MANAGEMENT CONTROL What is the relationship between management by exception and variance analysis? Management by exception is the practice of concentrating on areas not operating as expected and giving less attention to areas operating as expected. Variance analysis helps managers identify areas not operating as expected. The larger the variance, the more likely an area is not operating as expected. What are two possible sources of information a company might use to compute the 7-2 budgeted amount in variance analysis? Two sources of information about budgeted amounts are (a) past amounts and (b) detailed engineering studies. 7-3 Distinguish between a favorable variance and an unfavorable variance. A favorable variance––denoted F––is a variance that has the effect of increasing operating income relative to the budgeted amount. An unfavorable variance––denoted U––is a variance that has the effect of decreasing operating income relative to the budgeted amount. 7-4 What is the key difference between a static budget and a flexible budget? The key difference is the output level used to set the budget. A static budget is based on the level of output planned at the start of the budget period. A flexible budget is developed using budgeted revenues or cost amounts based on the actual output level in the budget period. The actual level of output is not known until the end of the budget period. Why might managers find a flexible-budget analysis more informative than a static7-5 budget analysis? A flexible-budget analysis enables a manager to distinguish how much of the difference between an actual result and a budgeted amount is due to (a) the difference between actual and budgeted output levels, and (b) the difference between actual and budgeted selling prices, variable costs, and fixed costs. 7-6 Describe the steps in developing a flexible budget. The steps in developing a flexible budget are: Step 1: Identify the actual quantity of output. Step 2: Calculate the flexible budget for revenues based on budgeted selling price and actual quantity of output. Step 3: Calculate the flexible budget for costs based on budgeted variable cost per output unit, actual quantity of output, and budgeted fixed costs. 7-7 List four reasons for using standard costs. 7-1 Four reasons for using standard costs are: (i) cost management, (ii) pricing decisions, (iii) budgetary planning and control, and (iv) simplified inventory costing and financial statement preparation. 7-8 How might a manager gain insight into the causes of a flexible-budget variance for direct materials? A manager should subdivide the flexible-budget variance for direct materials into a price variance (that reflects the difference between actual and budgeted prices of direct materials) and an efficiency variance (that reflects the difference between the actual and budgeted quantities of direct materials used to produce actual output). The individual causes of these variances can then be investigated, recognizing possible interdependencies across these individual causes. 7-9 List three causes of a favorable direct materials price variance. Possible causes of a favorable direct materials price variance are: • purchasing officer negotiated more skillfully than was planned in the budget, • purchasing manager bought in larger lot sizes than budgeted, thus obtaining quantity discounts, • materials prices decreased unexpectedly due to, say, industry oversupply, • budgeted purchase prices were set without careful analysis of the market, and • purchasing manager received unfavorable terms on nonpurchase price factors (such as lower quality materials). 7-10 Describe three reasons for an unfavorable direct manufacturing labor efficiency variance. Some possible reasons for an unfavorable direct manufacturing labor efficiency variance are the hiring and use of underskilled workers; inefficient scheduling of work so that the workforce was not optimally occupied; poor maintenance of machines resulting in a high proportion of nonvalue-added labor; unrealistic time standards. Each of these factors would result in actual direct manufacturing labor-hours being higher than indicated by the standard work rate. 7-11 How does variance analysis help in continuous improvement? Variance analysis, by providing information about actual performance relative to standards, can form the basis of continuous operational improvement. The underlying causes of unfavorable variances are identified and corrective action taken where possible. Favorable variances can also provide information if the organization can identify why a favorable variance occurred. Steps can often be taken to replicate those conditions more often. As the easier changes are made, and perhaps some standards tightened, the harder issues will be revealed for the organization to act on—this is continuous improvement. 7-12 Why might an analyst examining variances in the production area look beyond that business function for explanations of those variances? 7-2 An individual business function, such as production, is interdependent with other business functions. Factors outside of production can explain why variances arise in the production area. For example: • poor design of products or processes can lead to a sizable number of defects, • marketing personnel making promises for delivery times that require a large number of rush orders can create production-scheduling difficulties, and • purchase of poor-quality materials by the purchasing manager can result in defects and waste. 7-13 Comment on the following statement made by a plant manager: “Meetings with my plant accountant are frustrating. All he wants to do is pin the blame on someone for the many variances he reports.” The plant supervisor likely has good grounds for complaint if the plant accountant puts excessive emphasis on using variances to pin blame. The key value of variances is to help understand why actual results differ from budgeted amounts and then to use that knowledge to promote learning and continuous improvement. 7-14 When inputs are substitutable, how can the direct materials efficiency variance be decomposed further to obtain useful information? The direct materials efficiency variance can be decomposed into two parts: a direct materials mix variance that reflects the impact of using a cheaper mix of inputs to produce a given quantity of output, and the direct materials yield variance, which captures the impact of using less input to achieve a given quantity of output. 7-15 “Benchmarking against other companies enables a company to identify the lowest-cost producer. This amount should become the performance measure for next year.” Do you agree? Evidence on the costs of other companies is one input managers can use in setting the performance measure for next year. However, caution should be taken before choosing such an amount as next year's performance measure. It is important to understand why cost differences across companies exist and whether these differences can be eliminated. It is also important to examine when planned changes (in, say, technology) next year make even the current low-cost producer not a demanding enough hurdle. 7-16 Metal Shelf Company’s standard cost for raw materials is $4.00 per pound and it is expected that each metal shelf uses two pounds of material. During October Year 2, 25,000 pounds of materials are purchased from a new supplier for $97,000 and 13,000 shelves are produced using 27,000 pounds of materials. Which statement is a possible explanation concerning the direct materials variances? a. The production department had to use more materials since the quality of the materials was inferior. b. The purchasing manager paid more than expected for materials. c. Production workers were more efficient than anticipated. d. The overall materials variance is positive; no further analysis is necessary. 7-3 SOLUTION Choice "a" is correct. The materials price variance is $3,000 favorable since 25,000 pounds of materials were purchased for $97,000. The materials efficiency variance is $4,000 unfavorable since it took 27,000 pounds of material to produce 13,000 shelves ($4.00 × 1,000 additional pounds). It is possible that the materials which were purchased from a new supplier at a lower price were of a lesser quality and caused more material to be used in the production process. Choice "b" is incorrect. The purchasing manager paid less than expected for materials. The materials price variance is $3,000 favorable since 25,000 pounds of materials were purchased for $97,000. Choice "c" is incorrect. Production workers used more materials than expected. The materials efficiency variance is $4,000 unfavorable since it took 27,000 pounds of material to produce 13,000 shelves ($4.00 × 1,000 additional pounds). Choice "d" is incorrect. The overall material variance is unfavorable. Even if the overall variance were favorable, the components of the variance are analyzed to identify the details on why the variance is favorable and whether there are areas for further improvement. Also, consistent favorable or unfavorable variances may indicate that the standards are not properly set. 7-17 All of the following statements regarding standards are accurate except: a. Standards allow management to budget at a per-unit level. b. Ideal standards account for a minimal amount of normal spoilage. c. Participative standards usually take longer to implement than authoritative standards. d. Currently attainable standards take into account the level of training available to employees. SOLUTION Choice "b" is correct. Ideal standards do not make any provisions for normal spoilage or downtime. They assume perfect efficiency and effectiveness, which is helpful as an initial benchmark but is often unrealistic and unattainable. The other three choices are incorrect as they are factually true. Choice "a" is incorrect. Standards are thought of as per unit budgets. Choice "c" is incorrect. Because they involve managers and their employees, participative standards take longer to implement than authoritative standards which are set solely by management. Choice "d" is incorrect. Currently attainable standards assume an appropriate level of training for the employees who are to be held accountable in achieving those standards. 7-18 Amalgamated Manipulation Manufacturing’s (AMM) standards anticipate that there will be 3 pounds of raw material used for every unit of finished goods produced. AMM began the 7-4 month of May with 5,000 pounds of raw material, purchased 15,000 pounds for $19,500 and ended the month with 4,000 pounds on hand. The company produced 5,000 units of finished goods. The company estimates standard costs at $1.50 per pound. The materials price and efficiency variances for the month of May were: Price Variance Efficiency Variance 1. $3,000 U $1,500 F 2. $3,000 F $ 3. $3,000 F $1,500 U 4. $3,200 F $1,500 U 0 SOLUTION Choice "3" is correct. Actual Quantity Purchased = 15,000 pounds (given) Actual Quantity Used = Beginning Inventory 5,000 + Purchases 15,000 - Ending Inventory 4,000 = 16,000 pounds Standard Quantity Allowed = 5,000 finished units x 3 pounds per unit = 15,000 pounds Actual Price = $19,500 ÷ 15,000 = $1.30 Standard Price = $1.50 (given) Price variance = Actual Quantity Purchased x (Standard Price - Actual Price) = 15,000 × ($1.50 − $1.30) = $3,000 F Efficiency variance = Standard Price x (Standard Quantity Allowed – Actual Quantity Used) = $1.50 × (15,000 − 16,000) = $1,500 U Choice "1" is incorrect. Computation makes an incorrect determination with regard to whether the variance is favorable or unfavorable. Choice "2" is incorrect. Computation inappropriately uses actual quantity purchased in the quantity variance. Choice "4" is incorrect. Computation inappropriately uses the quantity used in the price variance. 7-19 Atlantic Company has a manufacturing facility in Brooklyn that manufactures robotic equipment for the auto industry. For Year 1, Atlantic collected the following information from its main production line: Actual quantity purchased 200 units Actual quantity used 110 units Units standard quantity 100 units Actual price paid $ 8 per unit 7-5 Standard price $ 10 per unit Atlantic isolates price variances at the time of purchase. What is the materials price variance for Year 1? 1. $400 favorable. 2. $400 unfavorable. 3. $220 favorable. 4. $220 unfavorable. SOLUTION Choice "1" is correct. The question asks for the materials price variance for a production line. Materials price variances are isolated at the time of purchase. The actual price was $8 per unit, and the standard price was $10 per unit. The materials price variance has got to be favorable. The variance formula for the materials price variance can be stated as the actual units purchased of 200 units times the difference between the actual and standard price of $2 ($10 − $12), or $400 (favorable). 7-20 Basix Inc. calculates direct manufacturing labor variances and has the following information: Actual hours worked: 200 Standard hours: 250 Actual rate per hour: $12 Standard rate per hour: $10 Given the information above, which of the following is correct regarding direct manufacturing labor variances? a. The price and efficiency variances are favorable. b. The price and efficiency variances are unfavorable. c. The price variance is favorable, while the efficiency variance is unfavorable. d. The price variance is unfavorable, while the efficiency variance is favorable. SOLUTION Choice "d" is correct. The direct labor variance is an expense variance. Therefore, when the actual hours worked are less (greater) than the standard hours worked, this is favorable (unfavorable). Also, when the actual rate per hour is less (greater) than the standard hours worked, this is favorable (unfavorable). This question can be solved without actually calculating the variances. All that is needed is a comparison between the actual and standard hours worked for the efficiency variance and a 7-6 comparison between the actual and standard rate per hour for the price variance. Here, the actual rate per hour is higher than the standard rate, meaning the price variance is unfavorable. The actual hours worked are less than the standard hours worked, meaning the efficiency variance is favorable. Choice "a" is incorrect. The efficiency variance is favorable, but because the actual rate per hour is greater than the standard rate, the price variance is unfavorable. Choice "b" is incorrect. The price variance is unfavorable, but the efficiency variance is favorable because fewer hours were worked than budgeted. Choice "c" is incorrect. The price variance is unfavorable, while the efficiency variance is favorable. 7-21 Flexible budget. Sweeney Enterprises manufactures tires for the Formula I motor racing circuit. For August 2017, it budgeted to manufacture and sell 3,600 tires at a variable cost of $71 per tire and total fixed costs of $55,000. The budgeted selling price was $114 per tire. Actual results in August 2017 were 3,500 tires manufactured and sold at a selling price of $116 per tire. The actual total variable costs were $280,000, and the actual total fixed costs were $51,000. Required: 1. Prepare a performance report (akin to Exhibit 7-2, page 254) that uses a flexible budget and a static budget. 2. Comment on the results in requirement 1. SOLUTION (20–30 min.) Flexible budget. Variance Analysis for Sweeney Enterprises for August 2017 Units (tires) sold Revenues Variable costs Contribution margin Fixed costs Actual Results (1) 3,500g $406,000a 280,000d 126,000 51,000g FlexibleBudget Variances (2) = (1) – (3) 0 $ 7,000 F 31,500 U 24,500 U 4,000 F Flexible Budget (3) 3,500 $399,000b 248,500e 150,500 55,000g Sales-Volume Variances (4) = (3) – (5) 100 U $11,400 U 7,100 F 4,300 U 0 Static Budget (5) 3,600g $410,400c 255,600f 154,800 55,000g Operating income $ 75,000 $20,500 U $ 95,500 $ 4,300 U $ 99,800 $20,500 U $ 4,300 U Total flexible-budget variance Total sales-volume variance $24,800 U Total static-budget variance a $116 × 3,500 = $406,000 $114 × 3,500 = $399,000 c $114 × 3,600 = $410,400 b 7-7 d Given. Unit variable cost = $280,000 ÷ 3,500 = $80 per tire $71 × 3,500 = $248,500 f $71 × 3,600 = $255,600 g Given e 2. The key information items are: Units Unit selling price Unit variable cost Fixed costs Actual 3,500 $ 116 $ 80 $51,000 Budgeted 3,600 $ 114 $ 71 $55,000 The total static-budget variance in operating income is $24,800 U. There is both an unfavorable total flexible-budget variance ($20,500) and an unfavorable sales-volume variance ($4,300). The unfavorable sales-volume variance arises solely because actual units manufactured and sold were 100 less than the budgeted 3,600 units. The unfavorable flexible-budget variance of $20,500 in operating income is due primarily to the $9 increase in unit variable costs. This increase in unit variable costs is only partially offset by the $2 increase in unit selling price and the $4,000 decrease in fixed costs. 7-22 Flexible budget. Bryant Company’s budgeted prices for direct materials, direct manufacturing labor, and direct marketing (distribution) labor per attaché case are $43, $6, and $13, respectively. The president is pleased with the following performance report: Actual Costs Static Budget Variance Direct materials $438,000 $473,000 $35,000 F Direct manufacturing labor 63,600 66,000 2,400 F 143,000 9,500 F Direct marketing (distribution) 133,500 labor Required: Actual output was 10,000 attaché cases. Assume all three direct-cost items shown are variable costs. Is the president’s pleasure justified? Prepare a revised performance report that uses a flexible budget and a static budget. SOLUTION (15 min.) Flexible budget. The existing performance report is a Level 1 analysis, based on a static budget. It makes no adjustment for changes in output levels. The budgeted output level is 11,000 units––direct materials of $473,000 in the static budget ÷ budgeted direct materials cost per attaché case of $43. 7-8 The following is a Level 2 analysis that presents a flexible-budget variance and a salesvolume variance of each direct cost category. Variance Analysis for Bryant Company Output units Direct materials Direct manufacturing labor Direct marketing labor Total direct costs FlexibleSalesActual Budget Flexible Volume Results Variances Budget Variances (1) (2) = (1) – (3) (3) (4) = (3) – (5) 10,000 0 10,000 1,000 U $438,000 $ 8,000 U $430,000 $43,000 F 63,600 3,600 U 60,000 6,000 F 133,500 3,500 U 130,000 13,000 F $635,100 $15,100 U $620,000 $62,000 F Static Budget (5) 11,000 $473,000 66,000 143,000 $682,000 $15,100 U $62,000 F Flexible-budget variance Sales-volume variance $46,900 F Static-budget variance The Level 1 analysis shows total direct costs have a $46,900 favorable variance. However, the Level 2 analysis reveals that this favorable variance is due to the reduction in output of 1,000 units from the budgeted 11,000 units. Once this reduction in output is taken into account (via a flexible budget), the flexible-budget variance shows each direct cost category to have an unfavorable variance indicating less efficient use of each direct cost item than was budgeted, or the use of more costly direct cost items than was budgeted, or both. Each direct cost category has an actual unit variable cost that exceeds its budgeted unit cost: Actual Budgeted Units 10,000 11,000 Direct materials $ 43.80 $ 43.00 Direct manufacturing labor $ 6.36 $ 6.00 Direct marketing labor $ 13.35 $ 13.00 Analysis of price and efficiency variances for each cost category could assist in further the identifying causes of these more aggregated (Level 2) variances. 7-23 Flexible-budget preparation and analysis. Bank Management Printers, Inc., produces luxury checkbooks with three checks and stubs per page. Each checkbook is designed for an individual customer and is ordered through the customer’s bank. The company’s operating budget for September 2017 included these data: Number of checkbooks 15,000 Selling price per book $ 20 Variable cost per book $ 8 7-9 Fixed costs for the month $145,000 The actual results for September 2017 were as follows: Number of checkbooks produced and sold 12,000 Average selling price per book $ 21 Variable cost per book $ 7 Fixed costs for the month $150,000 The executive vice president of the company observed that the operating income for September was much lower than anticipated, despite a higher-than-budgeted selling price and a lower-thanbudgeted variable cost per unit. As the company’s management accountant, you have been asked to provide explanations for the disappointing September results. Bank Management develops its flexible budget on the basis of budgeted per-output-unit revenue and per-output-unit variable costs without detailed analysis of budgeted inputs. Required: 1. Prepare a static-budget-based variance analysis of the September performance. 2. Prepare a flexible-budget-based variance analysis of the September performance. 3. Why might Bank Management find the flexible-budget-based variance analysis more informative than the static-budget-based variance analysis? Explain your answer. SOLUTION (25–30 min.) Flexible-budget preparation and analysis. 1. Variance Analysis for Bank Management Printers for September 2017 Level 1 Analysis Units sold Revenue Variable costs Contribution margin Fixed costs Operating income Actual Results (1) 12,000 $252,000a 84,000d 168,000 150,000 $ 18,000 Static-Budget Variances (2) = (1) – (3) 3,000 U $ 48,000 U 36,000 F 12,000 U 5,000 U $ 17,000 U $17,000 U 7-10 Static Budget (3) 15,000 $300,000c 120,000f 180,000 145,000 $ 35,000 Total static-budget variance 2. Level 2 Analysis Units sold Revenue Variable costs Contribution margin Fixed costs Actual Results (1) 12,000 $252,000a 84,000d 168,000 150,000 Operating income $ 18,000 FlexibleBudget Variances (2) = (1) – (3) 0 $12,000 F 12,000 F 24,000 F 5,000 U $19,000 F Sales Flexible Volume Static Budget Variances Budget (3) (4) = (3) – (5) (5) 12,000 3,000 U 15,000 $240,000b $60,000 U $300,000c e 96,000 24,000 F 120,000f 144,000 36,000 U 180,000 145,000 0 145,000 $ (1,000) $36,000 U $ 35,000 $19,000 F $36,000 U Total flexible-budget Total sales-volume variance variance $17,000 U Total static-budget variance a d b e 12,000 × $21 = $252,000 12,000 × $20 = $240,000 c 15,000 × $20 = $300,000 12,000 × $7 = $ 84,000 12,000 × $8 = $ 96,000 f 15,000 × $8 = $120,000 3. Level 2 analysis breaks down the static-budget variance into a flexible-budget variance and a sales-volume variance. The primary reason for the static-budget variance being unfavorable ($17,000 U) is the reduction in unit volume from the budgeted 15,000 to an actual 12,000. One explanation for this reduction is the increase in selling price from a budgeted $20 to an actual $21. Operating management was able to reduce variable costs by $12,000 relative to the flexible budget. This reduction could be a sign of efficient management. Alternatively, it could be due to using lower quality materials (which in turn adversely affected unit volume). 7-11 7-24 Flexible budget, working backward. The Clarkson Company produces engine parts for car manufacturers. A new accountant intern at Clarkson has accidentally deleted the company’s variance analysis calculations for the year ended December 31, 2017. The following table is what remains of the data. Required: 1. Calculate all the required variances. (If your work is accurate, you will find that the total static-budget variance is $0.) 2. What are the actual and budgeted selling prices? What are the actual and budgeted variable costs per unit? 3. Review the variances you have calculated and discuss possible causes and potential problems. What is the important lesson learned here? SOLUTION (30 min.) Flexible budget, working backward. 1. Variance Analysis for The Clarkson Company for the year ended December 31, 2017 Units sold Revenues Variable costs Contribution margin Fixed costs Operating income Actual Results (1) 130,000 $715,000 515,000 200,000 140,000 $ 60,000 FlexibleBudget Variances (2)=(1)(3) 0 $260,000 F 255,000 U 5,000 F 20,000 U $ 15,000 U Flexible Budget (3) 130,000 $455,000a 260,000b 195,000 120,000 $ 75,000 $15,000 U Total flexible-budget variance Sales-Volume Variances (4)=(3)(5) 10,000 F $35,000 F 20,000 U 15,000 F 0 $15,000 F $15,000 F Total sales volume variance $0 Total static-budget variance 7-12 Static Budget (5) 120,000 $420,000 240,000 180,000 120,000 $ 60,000 a b 130,000 × $3.50 = $455,000; $420,000 120,000 = $3.50 130,000 × $2.00 = $260,000; $240,000 120,000 = $2.00 2. Actual selling price: Budgeted selling price: Actual variable cost per unit: Budgeted variable cost per unit: $715,000 420,000 515,000 240,000 ÷ ÷ ÷ 130,000 120,000 130,000 120,000 = = = = $5.50 $3.50 $3.96 $2.00 3. A zero total static-budget variance may be due to offsetting total flexible-budget and total sales-volume variances. In this case, these two variances exactly offset each other: Total flexible-budget variance Total sales-volume variance $15,000 Unfavorable $15,000 Favorable A closer look at the variance components reveals some major deviations from plan. Actual variable costs increased from $2.00 to $3.96, causing an unfavorable flexible-budget variable cost variance of $255,000. Such an increase could be a result of, for example, a jump in direct material prices. Clarkson was able to pass most of the increase in costs onto their customers—actual selling price increased by 57% [($5.50 – $3.50) $3.50], bringing about an offsetting favorable flexible-budget revenue variance in the amount of $260,000. An increase in the actual number of units sold also contributed to more favorable results. The company should examine why the units sold increased despite an increase in direct material prices. For example, Clarkson’s customers may have stocked up, anticipating future increases in direct material prices. Alternatively, Clarkson’s selling price increases may have been lower than competitors’ price increases. Understanding the reasons why actual results differ from budgeted amounts can help Clarkson better manage its costs and pricing decisions in the future. The important lesson learned here is that a superficial examination of summary level data (Levels 0 and 1) may be insufficient. It is imperative to scrutinize data at a more detailed level (Level 2). Had Clarkson not been able to pass costs on to customers, losses would have been considerable. 7-13 7-25 Flexible-budget and sales volume variances. Cascade, Inc., produces the basic fillings used in many popular frozen desserts and treats—vanilla and chocolate ice creams, puddings, meringues, and fudge. Cascade uses standard costing and carries over no inventory from one month to the next. The ice-cream product group’s results for June 2017 were as follows: Jeff Geller, the business manager for ice-cream products, is pleased that more pounds of ice cream were sold than budgeted and that revenues were up. Unfortunately, variable manufacturing costs went up, too. The bottom line is that contribution margin declined by $52,900, which is just over 2% of the budgeted revenues of $2,592,600. Overall, Geller feels that the business is running fine. Required: 1. Calculate the static-budget variance in units, revenues, variable manufacturing costs, and contribution margin. What percentage is each static-budget variance relative to its static-budget amount? 2. Break down each static-budget variance into a flexible-budget variance and a sales-volume variance. 3. Calculate the selling-price variance. 4. Assume the role of management accountant at Cascade. How would you present the results to Jeff Geller? Should he be more concerned? If so, why? SOLUTION (30-40 min.) Flexible budget and sales volume variances, market-share and market-size variances. 1. and 2. 7-14 Performance Report for Cascade, Inc., June 2017 Units (pounds) Revenues Variable mfg. costs Contribution margin Actual (1) 460,000 $2,626,600 1,651,400 $975,200 Flexible Budget Variances (2) = (1) – (3) $ 41,400 U 41,400 U $ 82,800 U Flexible Budget (3) 460,000 $2,668,000a 1,610,000b $1,058,000 $82,800 U Flexible-budget variance Sales Volume Variances (4) = (3) – (5) 13,000 F $75,400 F 45,500 U $ 29,900 F Static Budget (5) 447,000 $2,592,600 1,564,500 $1,028,100 $ 29,900 F Sales-volume variance $52,900 U Static-budget variance a Budgeted selling price = $2,592,600 ÷ 447,000 lbs = $5.80 per lb. Flexible-budget revenues = $5.80 per lb. × 460,000 lbs. = $2,668,000 b Budgeted variable mfg. cost per unit = $1,564,500 ÷ 447,000 lbs. = $3.50 Flexible-budget variable mfg. costs = $3.50 per lb. × 460,000 lbs. = $1,610,000 7-15 Static Budget Variance (6) = (1) – (5) 13,000 F $34,000 F 86,900 U $52,900 U Static Budget Variance as % of Static Budget (7) = (6) (5) 2.91% 1.31% 5.55% 5.15% 3. The selling price variance, caused solely by the difference in actual and budgeted selling price, is the flexible-budget variance in revenues = $41,400 U. 4. The flexible-budget variances show that for the actual sales volume of 460,000 pounds, selling prices were lower and costs per pound were higher. The favorable sales volume variance in revenues (because more pounds of ice cream were sold than budgeted) helped offset the unfavorable variable cost variance and shored up the results in June 2017. Geller should be more concerned because the static-budget variance in contribution margin of $52,900 U is actually made up of a favorable sales-volume variance in contribution margin of $29,900, an unfavorable selling-price variance of $41,400 and an unfavorable variable manufacturing costs variance of $41,400. Adler should analyze why each of these variances occurred and the relationships among them. Could the efficiency of variable manufacturing costs be improved? The sales volume appears to have increased due to the lower average selling price per pound. 7-26 Price and efficiency variances. Sunshine Foods manufactures pumpkin scones. For January 2017, it budgeted to purchase and use 14,750 pounds of pumpkin at $0.92 a pound. Actual purchases and usage for January 2017 were 16,000 pounds at $0.85 a pound. Sunshine budgeted for 59,000 pumpkin scones. Actual output was 59,200 pumpkin scones. Required: 1. Compute the flexible-budget variance. 2. Compute the price and efficiency variances. 3. Comment on the results for requirements 1 and 2 and provide a possible explanation for them. SOLUTION (20–30 min.) Price and efficiency variances. 1. The key information items are: Output units (scones) Input units (pounds of pumpkin) Cost per input unit Actual 59,200 16,000 $ 0.85 Budgeted 59,000 14,750 $ 0.92 Sunshine budgets to obtain 3 pumpkin scones from each pound of pumpkin. The flexible-budget variance is $16 F. Pumpkin costs a b Actual Results (1) $13,600a 16,000 × $0.85 = $13,600 59,200 × 0.25 × $0.92 = $13,616 FlexibleBudget Variance (2) = (1) – (3) $16 F Flexible Budget (3) $13,616b Sales-Volume Static Variance Budget (4) = (3) – (5) (5) $46 U $13,570c c 59,000 × 0.25 × $0.92 = $13,570 2. Actual Costs Incurred (Actual Input Qty. × Actual Price) $13,600a Actual Input Qty. × Budgeted Price $14,720b $1,120 F Price variance Flexible Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) $13,616c $1,104 U Efficiency variance $16 F Flexible-budget variance a 16,000 × $0.85 = $13,600 16,000 × $0.92 = $14,720 c 59,200 × 0.25 × $0.92 = $13,616 b 3. The favorable flexible-budget variance of $16 has two offsetting components: (a) favorable price variance of $1,120––reflects the $0.85 actual purchase cost being lower than the $0.92 budgeted purchase cost per pound. (b) unfavorable efficiency variance of $1,104––reflects the actual materials yield of 3.80 scones per pound of pumpkin (59,200 ÷ 16,000 = 3.70) being less than the budgeted yield of 4.00 (59,000 ÷ 14,750 = 4.00). The company used more pumpkins (materials) to make the scones than was budgeted. One explanation may be that Sunshine purchased lower quality pumpkins at a lower cost per pound. 7-27 Materials and manufacturing labor variances. Consider the following data collected for Great Homes, Inc.: Direct Materials Direct Manufacturing Labor Cost incurred: Actual inputs actual prices $200,000 $90,000 Actual inputs standard prices 214,000 86,000 Standard inputs allowed for actual output standard prices 225,000 80,000 Required: Compute the price, efficiency, and flexible-budget variances for direct materials and direct manufacturing labor. SOLUTION (15 min.) Materials and manufacturing labor variances. Direct Materials Actual Costs Incurred (Actual Input Qty. × Actual Price) $200,000 Actual Input Qty. × Budgeted Price $214,000 $14,000 F Price variance Flexible Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) $225,000 $11,000 F Efficiency variance $25,000 F Flexible-budget variance Direct Mfg. Labor $90,000 $86,000 $4,000 U Price variance $80,000 $6,000 U Efficiency variance $10,000 U Flexible-budget variance 7-28 Direct materials and direct manufacturing labor variances. Rugged Life, Inc., designs and manufactures fleece quarter-zip jackets. It sells its jackets to brand-name outdoor outfitters in lots of one dozen. Rugged Life’s May 2017 static budget and actual results for direct inputs are as follows: Static Budget Number of jacket lots (1 lot = 1 dozen) 300 Per Lot of Jackets: Direct materials 18 yards at $4.65 per yard = $83.70 Direct manufacturing labor 2.4 hours at $12.50 per hour = $30.00 Actual Results Number of jacket lots sold 325 Total Direct Inputs: Direct materials 6,500 yards at $4.85 per yard = $31,525 Direct manufacturing labor 715 hours at $12.60 = $9,009 Rugged Life has a policy of analyzing all input variances when they add up to more than 8% of the total cost of materials and labor in the flexible budget, and this is true in May 2017. The production manager discusses the sources of the variances: “A new type of material was purchased in May. This led to faster cutting and sewing, but the workers used more material than usual as they learned to work with it. For now, the standards are fine.” Required: 1. Calculate the direct materials and direct manufacturing labor price and efficiency variances in May 2017. What is the total flexible-budget variance for both inputs (direct materials and direct manufacturing labor) combined? What percentage is this variance of the total cost of direct materials and direct manufacturing labor in the flexible budget? 2. Comment on the May 2017 results. Would you continue the “experiment” of using the new material? SOLUTION (20 min.) Direct materials and direct manufacturing labor variances. 1. May 2017 Lots Direct materials Direct labor Total price variance Total efficiency variance Actual Results (1) 325 $31,525.00 $ 9,009.00 Price Variance (2) = (1)–(3) $1,300.00 U $ 71.50 U $1,371.50 U Actual Quantity Budgeted Price (3) Efficiency Variance (4) = (3) – (5) $30,225.00a $ 8,937.50c $3,022.50 U $812.50 F Flexible Budget (5) 325 $27,202.50b $9,750.00d $2,210.00 U a 6,500 yards × $4.65 per yard = $30,225 325 lots × 18 yards per lot × $4.65 per yard = $27,202.50 c 715 hours × $12.50 per hour = $8,937.50 d 3250 lots × 2.4 hours per lot × $12.50 per hour = $9,750.00 b Total flexible-budget variance for both inputs = $1,371.50 U + $2,210.00 U = $3,581.50 U Total flexible-budget cost of direct materials and direct labor = $27,202.50 + $9,750.00 = $36,952.50 Total flexible-budget variance as % of total flexible-budget costs = $3,581.50 ÷ $36,952.50 = 9.69% 2. It is unclear whether the excess use of materials will continue, or whether it was indeed a result of workers getting accustomed to the new fabric. The time required was indeed lower as predicted, but not nearly enough to overcome the unfavorable direct material efficiency variance. However, direct labor usage will probably decline even further as workers gain experience in working with the new material. The unfavorable direct labor price variance is insignificant and unlikely to be related to the change of material. Rugged Life may wish to continue to use the new material, especially in light of its superior quality and feel, but it may want to keep the following points in mind: • The new material costs substantially more than the old ($4.85 versus $4.65 per yard). Its price is unlikely to come down even more within the coming year. Standard material price should be reexamined and possibly changed. • Rugged Life should continue to work to reduce direct materials and direct manufacturing labor usage. 7-29 Price and efficiency variances, journal entries. The Schuyler Corporation manufactures lamps. It has set up the following standards per finished unit for direct materials and direct manufacturing labor: Direct materials: 10 lb. at $4.50 per lb. $45.00 Direct manufacturing labor: 0.5 hour at $30 per hour 15.00 The number of finished units budgeted for January 2017 was 10,000; 9,850 units were actually produced. Actual results in January 2017 were as follows: Direct materials: 98,055 lb. used Direct manufacturing labor: 4,900 hours $154,350 Assume that there was no beginning inventory of either direct materials or finished units. During the month, materials purchased amounted to 100,000 lb., at a total cost of $465,000. Input price variances are isolated upon purchase. Input-efficiency variances are isolated at the time of usage. Required: 1. Compute the January 2017 price and efficiency variances of direct materials and direct manufacturing labor. 2. Prepare journal entries to record the variances in requirement 1. 3. Comment on the January 2017 price and efficiency variances of Schuyler Corporation. 4. Why might Schuyler calculate direct materials price variances and direct materials efficiency variances with reference to different points in time? SOLUTION (30 min.) Price and efficiency variances, journal entries. 1. Direct materials and direct manufacturing labor are analyzed in turn: Actual Costs Incurred (Actual Input Qty. × Actual Price) Direct Materials (100,000 × $4.65a) $465,000 Actual Input Qty. × Budgeted Price Purchases Usage (100,000 × $4.50) $450,000 (98,055 × $4.50) $441,248 $15,000 U Price variance Direct Manufacturing Labor (4,900 × $31.5b) $154,350 b (9,850 × 10 × $4.50) $443,250 $2,002 F Efficiency variance (4,900 × $30) $147,000 $7,350 U Price variance a Flexible Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) (9,850 × 0.5 × $30) or (4,925 × $30) $147,750 $750 F Efficiency variance $465,000 ÷ 100,000 = $4.65 $154,350 ÷ 4,900 = $31.5 2. Direct Materials Control Direct Materials Price Variance Accounts Payable or Cash Control 450,000 15,000 Work-in-Process Control Direct Materials Control Direct Materials Efficiency Variance 443,250 Work-in-Process Control Direct Manuf. Labor Price Variance Wages Payable Control Direct Manuf. Labor Efficiency Variance 147,750 7,350 465,000 441,248 2,002 154,350 750 3. Some students’ comments will be immersed in conjecture about higher prices for materials, better quality materials, higher grade labor, better efficiency in use of materials, and so forth. A possibility is that approximately the same labor force, paid somewhat more, is taking slightly less time with better materials and causing less waste and spoilage. A key point in this problem is that all of these efficiency variances are likely to be insignificant. They are so small as to be nearly meaningless. Fluctuations about standards are bound to occur in a random fashion. Practically, from a control viewpoint, a standard is a band or range of acceptable performance rather than a single-figure measure. 4. The purchasing point is where responsibility for price variances is found most often. The production point is where responsibility for efficiency variances is found most often. The Schuyler Corporation may calculate variances at different points in time to tie in with these different responsibility areas. 7-30 Materials and manufacturing labor variances, standard costs. Dawson, Inc., is a privately held furniture manufacturer. For August 2017, Dawson had the following standards for one of its products, a wicker chair: Standards per Chair Direct materials 3 square yards of input at $5.50 per square yard Direct manufacturing labor 0.5 hour of input at $10.50 per hour The following data were compiled regarding actual performance: actual output units (chairs) produced, 2,200; square yards of input purchased and used, 6,200; price per square yard, $5.70; direct manufacturing labor costs, $9,844; actual hours of input, 920; labor price per hour, $10.70. 1. Show computations of price and efficiency variances for direct materials and direct manufacturing labor. Give a plausible explanation of why each variance occurred. 2. Suppose 8,700 square yards of materials were purchased (at $5.70 per square yard), even though only 6,200 square yards were used. Suppose further that variances are identified at their most timely control point; accordingly, direct materials price variances are isolated and traced at the time of purchase to the purchasing department rather than to the production department. Compute the price and efficiency variances under this approach. SOLUTION (2030 min.) Materials and manufacturing labor variances, standard costs. 1. Direct Materials Actual Costs Incurred (Actual Input Qty. × Actual Price) Actual Input Qty. × Budgeted Price (6,200 sq. yds. × $5.70) $35,340 (6,200 sq. yds. × $5.50) $34,100 $1,240 U Price variance Flexible Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) (2,200 × 3 × $5.50) (6,600 sq. yds. × $5.50) $36,300 $2,200 F Efficiency variance $960 F Flexible-budget variance The unfavorable materials price variance may be unrelated to the favorable materials efficiency variance. For example, (a) the purchasing officer may be less skillful than assumed in the budget, or (b) there was an unexpected increase in materials price per square yard due to reduced competition. Similarly, the favorable materials efficiency variance may be unrelated to the unfavorable materials price variance. For example, (a) the production manager may have been able to employ higher-skilled workers, or (b) the budgeted materials standards were set too loosely. It is also possible that the two variances are interrelated. The higher materials input price may be due to higher quality materials being purchased. Less material was used than budgeted due to the high quality of the materials. Direct Manufacturing Labor Actual Costs Incurred (Actual Input Qty. × Actual Price) Actual Input Qty. × Budgeted Price (920 hrs. × $10.70) $9,844 (920 hrs. × $10.50) $9,660 $184 U Price variance Flexible Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) (2,200 × 0.5 × $10.50) (1,100 hrs. × $10.50) $11,550 $1,890 F Efficiency variance $1,706 F Flexible-budget variance The unfavorable labor price variance may be due to, say, (a) an increase in labor rates due to a booming economy, or (b) the standard being set without detailed analysis of labor compensation. The favorable labor efficiency variance may be due to, say, (a) more efficient workers being employed, (b) a redesign in the plant enabling labor to be more productive, or (c) the use of higher quality materials. 2. Control Point Purchasing Actual Costs Incurred (Actual Input Qty. × Actual Price) (8,700 sq. yds.× $5.70) $49,590 Actual Input Qty. × Budgeted Price (8,700 sq. yds. × $5.50) $47,850 Flexible Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) $1,740 U Price variance Production (6,200 sq. yds.× $5.50) $34,100 (2,200 × 3 × $5.50) $36,300 $2,200 F Efficiency variance Direct manufacturing labor variances are the same as in requirement 1. 7-31 Journal entries and T-accounts (continuation of 7-30). Prepare journal entries and post them to T-accounts for all transactions in Exercise 7-30, including requirement 2. Summarize how these journal entries differ from the normal-costing entries described in Chapter 4, pages 120–123. SOLUTION (2025 min.) Journal entries and T-accounts (continuation of 7-30). For requirement 1 from Exercise 7-30: a. Direct Materials Control Direct Materials Price Variance Accounts Payable Control To record purchase of direct materials. b. Work-in-Process Control Direct Materials Efficiency Variance Direct Materials Control To record direct materials used. 34,100 1,240 35,340 36,300 c. Work-in-Process Control 11,550 Direct Manufacturing Labor Price Variance 184 Direct Manufacturing Labor Efficiency Variance Wages Payable Control To record liability for and allocation of direct labor costs. 2,200 34,100 1,890 9,844 Direct Materials Control (a) 34,100 (b) 34,100 Work-in-Process Control (b) 36,300 (c) 11,550 Wages Payable Control (c) 9,844 Direct Materials Price Variance (a) 1,240 Direct Materials Efficiency Variance (b) 2,200 Direct Manufacturing Labor Price Variance (a) 184 Direct Manuf. Labor Efficiency Variance (c) 1,890 Accounts Payable Control (a) 35,340 For requirement 2 from Exercise 7-30: The following journal entries pertain to the measurement of price and efficiency variances when 8,700 sq. yds. of direct materials are purchased: a1. Direct Materials Control Direct Materials Price Variance Accounts Payable Control To record direct materials purchased. 47,850 1,740 a2. Work-in-Process Control Direct Materials Control Direct Materials Efficiency Variance To record direct materials used. 36,300 Direct Materials Control (a1) 47,850 (a2) 34,100 Accounts Payable Control (a1) 49,590 49,590 34,100 2,200 Direct Materials Price Variance (a1) 1,740 Work-in-Process Control (a2) 36,300 Direct Materials Efficiency Variance (a2) 2,200 The T-account entries related to direct manufacturing labor are the same as in requirement 1. The difference between standard costing and normal costing for direct cost items is: Direct Costs Standard Costs Standard price(s) × Standard input allowed for actual outputs achieved Normal Costs Actual price(s) × Actual input These journal entries differ from the normal costing entries because Work-in-Process Control is no longer carried at “actual” costs. Furthermore, Direct Materials Control is carried at standard unit prices rather than actual unit prices. Finally, variances appear for direct materials and direct manufacturing labor under standard costing but not under normal costing. 7-32 Price and efficiency variances, benchmarking. Nantucket Enterprises manufactures insulated cold beverage cups printed with college and corporate logos, which it distributes nationally in lots of 12 dozen cups. In June 2017, Nantucket produced 5,000 lots of its most popular line of cups, the 24-ounce lidded tumbler, at each of its two plants, which are located in Providence and Amherst. The production manager, Shannon Bryant, asks her assistant, Joel Hudson, to find out the precise per-unit budgeted variable costs at the two plants and the variable costs of a competitor, Beverage Mate, who offers similar-quality tumblers at cheaper prices. Hudson pulls together the following information for each lot: Per lot Providence Plant Direct materials 74 lbs. @ $3.20 per lb. 76.5 lbs. @ $3.10 per lb. Direct manufacturing labor 2.5 hrs. @ $12.00 per hr. 2.4 hrs. @ $12.20 per hr. 2.4 hrs. @ $10.50 per hr. $20 per lot $22 per lot $20 per lot Variable overhead Amherst Plant Beverage Mate 70 lbs. @ $2.90 per lb. Required: 1. What is the budgeted variable cost per lot at the Providence Plant, the Amherst Plant, and at Beverage Mate? 2. Using the Beverage Mate data as the standard, calculate the direct materials and direct manufacturing labor price and efficiency variances for the Providence and Amherst plants. 3. What advantage does Nantucket get by using Beverage Mate’s benchmark data as standards in calculating its variances? Identify two issues that Bryant should keep in mind in using the Beverage Mate data as the standards. SOLUTION (25 min.) Price and efficiency variances, benchmarking. 1. Providence Plant Prices and quantities Cost per lot Direct materials Direct labor Variable overhead Budgeted variable cost Direct materials Direct labor Variable overhead Budgeted variable cost Direct materials Direct labor Variable overhead Budgeted variable cost 2. 74.0 lbs @ $ 3.20 per lb 2.5 hrs @ $12.00 per hr Amherst Plant Prices and quantities 76.50 lbs @ $ 3.10 per lb 2.4 hrs @ $12.20 per hr Beverage Mate Prices and quantities 70.00 lbs @ $ 2.90 per lb 2.4 hrs @ $10.50 per hr $236.80 30.00 20.00 $286.80 Cost per lot $237.15 29.28 22.00 $288.43 Cost per lot $203.00 25.20 20.00 $248.20 Providence Plant Lots Direct materials Direct labor Actual Results (1) 5,000 $1,184,000 $ 150,000 Price Variance (2) = (1) – (3) $111,000 U $ 18,750 U Actual Quantity Budgeted Price (3) $1,073,000b $ 131,250c Efficiency Variance (4) = (3) – (5) $58,000 U $5,250 U Flexible Budgeta (5) 5,000 $1,015,000 $ 126,000 Using Beverage Mate’s prices and quantities as the standard: Direct materials: (70 lbs./lot 5,000 lots) $2.90/lb. = $1,015,000 Direct labor: (2.4 hrs./lot 5,000 lots) $10.50/hr. = $126,000 b (74.0 lbs./lot 5,000 lots) $2.90 per lb. = $1,073,000 c (2.5 hours/lot 5,000 lots) $10.50/hr. = $131,250 a Amherst Plant Actual Results (1) Lots 5,000 Direct Materials $1,185,750 Direct Labor $ 146,400 a Price Variance (2) = (1) – (3) $76,500 U $20,400 U Using Beverage Mate’s prices and quantities as the standard: Actual Quantity Budgeted Price (3) $1,109,250b $ 126,000c Efficiency Variance (4) = (3) – (5) $8,800 U $ 0F Flexible Budgeta (5) 5,000 $1,015,000 $ 126,000 Direct materials: (70 lbs./lot 5,000 lots) $2.90/lb. = $1,015,000 Direct labor: (2.4 hrs./lot 5,000 lots) $10.50/hr. = $126,000 b (76.5 lbs./lot 5,000 lots) $2.90 per lb. = $1,109,250 c (2.4 hours/lot 5,000 lots) $10.50/hr. = $126,000 3. Using an objective, external benchmark, like that of a competitor, will preempt the possibility of any one plant feeling that the other is being favored. That this competitor, Beverage Mate, is successful will also put positive pressure on the two plants to improve (note that all variances are zero or unfavorable). Issues that Bryant should keep in mind include the following: • Ensure that Beverage Mate is indeed the best and most relevant standard (for example, is there another competitor in the marketplace which should be considered?) • Ensure that the data is reliable • Ensure that Beverage Mate is similar enough to use as a standard (if Beverage Mate has a different business model, for example, it may be following a strategy of lowering costs that Nantucket may not want to emulate because Nantucket is trying to differentiate its products) • The difference in hourly wages is not likely something that Nantucket can easily remedy, as it is associated with the market wage rate for the location of its plants. 7-33 Static and flexible budgets, service sector. Student Finance (StuFi) is a start-up that aims to use the power of social communities to transform the student loan market. It connects participants through a dedicated lending pool, enabling current students to borrow from a school’s alumni community. StuFi’s revenue model is to take an upfront fee of 40 basis points (0.40%) each from the alumni investor and the student borrower for every loan originated on its platform. StuFi hopes to go public in the near future and is keen to ensure that its financial results are in line with that ambition. StuFi’s budgeted and actual results for the third quarter of 2017 are presented below. Required: 1. Prepare StuFi’s static budget of operating income for the third quarter of 2017. 2. Prepare an analysis of variances for the third quarter of 2017 along the lines of Exhibit 7-2; identify the sales volume and flexible budget variances for operating income. 3. Compute the professional labor price and efficiency variances for the third quarter of 2017. 4. What factors would you consider in evaluating the effectiveness of professional labor in the third quarter of 2017? SOLUTION (45 min.) Static and flexible budgets, service sector. 1. Static Budget $9,512,000 Revenue (8,200 × 0.8% × $145,000) Variable costs: Professional labor (8 × $45 × 8,200) Credit verification ($100 × 8,200) Federal documentation fees ($120 × 8,200) Courier services ($50 × 8,200) Total variable costs Contribution margin Fixed administrative costs Fixed technology costs Operating income 2,952,000 820,000 984,000 410,000 5,166,000 4,346,000 800,000 1,300,000 $2,246,000 2. Actual results for third quarter 2017: Revenue (10,250 × 0.8% × $162,000) Variable costs: Professional labor (9.5 × $50 × 10,250) Credit verification ($100 × 10,250) Federal documentation fees ($125 × 10,250) Courier services ($54 × 10,250) Total variable costs Contribution margin Fixed administrative costs Fixed technology costs Operating income $13,284,000 4,868,750 1,025,000 1,281,250 553,500 7,728,500 5,555,500 945,000 _ 1,415,000 $ 3,195,500 31,000 Level 2 Analysis Actual Results (1) Loans Revenue Variable costs: Professional labor Credit verification 10,250 FlexibleBudget Variances (1) – (3) 0 Flexible Budget (3) SalesVolume Variances (3) – (5) Static Budget (5) 10,250 2,050 F 8,200 $13,284,000 $1,394,000 F $11,890,000 $2,378,000 4,868,750 1,178,750 U 1,025,000 0 3,690,000 1,025,000 738,000 U 205,000 U $9,512,000 2,952,000 820,000 Federal doc. Fees Courier services Total variable costs Contribution margin Fixed administrative costs Fixed technology costs Operating income 1,281,250 51,250 U 1,230,000 246,000 U 984,000 553,500 41,000 U 512,500 102,500 U 410,000 7,728,500 1,271,000 U 6,457,500 1,291,500 U 5,166,000 5,555,500 123,000 F 5,432,500 1,086,500 F 4,346,000 945,000 145,000 U 800,000 0 800,000 1,415,000 115,000 U 1,300,000 0 1,300,000 $3,195,500 $ 137,000 U $3,332,500 $1,086,500 F $2,246,000 $137,000 U Total flexiblebudget variance $1,086,500 F Total salesvolume variance $949,500 F Total static-budget variance 3. Actual Costs Incurred (Actual Input Qty. × Actual Price) (1) (10,250 × 9.5 × $50) 97,37 hrs. × $50/hr. $4,868,750 Actual Input Qty. × Budgeted Price (2) (10,250 × 9.5 × $45) 97,375 hrs. × $45/hr. $4,381,875 $486,875 U Price variance Flexible Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) (3) (10,250 × 8.0 × $45) 82,000 hrs. ×$45/hr. $3,690,000 $691,875 U Efficiency variance $1,178,750 U Flexible-budget variance 4. Effectiveness refers to the degree to which a predetermined objective is accomplished. One objective of StuFi professional labor is to maximize loan-based revenue (0.8% of loan amount × number of loans). The professional staff has increased the number of loans from a budgeted 8,200 to 10,250, a significant increase. Additionally, the average loan amount increased from a budgeted $145,000 to $162,000. The result is an increase in revenue from the budgeted $9,512,000 to actual $13,284,000. With both a higher number of loans and a higher average amount per loan, there was an increase in the effectiveness of professional labor in the third quarter of 2017. 7-34 Flexible budget, direct materials, and direct manufacturing labor variances. Emerald Statuary manufactures bust statues of famous historical figures. All statues are the same size. Each unit requires the same amount of resources. The following information is from the static budget for 2017: Expected production and sales 7,000 units Expected selling price per unit $ 680 Total fixed costs $1,400,000 Standard quantities, standard prices, and standard unit costs follow for direct materials and direct manufacturing labor: Direct materials Direct manufacturing labor Standard Quantity Standard Price Standard Unit Cost 10 pounds $ 8 per pound $ 80 $50 per hour $185 3.7 hours During 2017, actual number of units produced and sold was 4,800, at an average selling price of $720. Actual cost of direct materials used was $392,700, based on 66,000 pounds purchased at $5.95 per pound. Direct manufacturing labor-hours actually used were 18,300, at the rate of $48 per hour. As a result, actual direct manufacturing labor costs were $878,400. Actual fixed costs were $1,170,000. There were no beginning or ending inventories. Required: 1. Calculate the sales-volume variance and flexible-budget variance for operating income. 2. Compute price and efficiency variances for direct materials and direct manufacturing labor. SOLUTION (30 min.) Flexible budget, direct materials and direct manufacturing labor variances. 1. Variance Analysis for Emerald Statuary for 2017 Units sold Revenues FlexibleSalesActual Budget Flexible Volume Static Results Variances Budget Variances Budget (1) (2) = (1) – (3) (3) (4) = (3) – (5) (5) 4,800a 0 4,800 2,200 U 7,000a $3,456,000b $192,000 F $3,264,000c $1,496,000 U $4,760,000d Direct materials Direct manufacturing labor Fixed costs Total costs Operating income $ 392,700 $ 8,700 U $ 384,000e $ 176,000 F $ 560,000f a 878,400 9,600 F 888,000g 407,000 F 1,295,000h 1,170,000a 230,000 F 1,400,000a 0 1,400,000a $2,441,100 $230,900 F $2,672,000 $ 583,000 F $3,255,000 $1,014,900 $422,900 F $ 592,000 $ 913,000 U $1,505,000 $422,900 F $913,000 U Flexible-budget variance Sales-volume variance $490,100 U Static-budget variance a Given $720/unit × 4,800 units = $3,456,000 c $680/unit × 4,800 units = $3,264,000 d $680/unit × 7,000 units = $4,760,000 e $80/unit × 4,800 units = $384,000 f $80/unit × 7,000 units = $560,000 g $185/unit × 4,800 units = $888,000 h $185/unit × 7,000 units = $1,295,000 b 2. Direct materials Actual Incurred (Actual Input Qty. × Actual Price) Actual Input Qty. × Budgeted Price Flexible Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) $392,700a $528,000b $384,000c $135,300 F Price variance $144,000 U Efficiency variance $8,700 U Flexible-budget variance Direct manufacturing labor $878,400d $915,000e $36,600 F Price variance $888,000f $27,000 U Efficiency variance $9,600 F Flexible-budget variance a 66,000 pounds × $5.95/pound = $392,700 66,000 pounds × $8/pound = $528,000 c 4,800 statues × 10 pounds/statue × $8/pound = 48,000 pounds × $8/pound = $384,000 d 18,300 hours × $48/hour = $878,400 e 18,300 hours × $50/hour = $915,000 f 4,800 statues × 3.7 hours/statue × $50/hour = 17,760 hours × $50/hour = $888,000 b 7-35 Variance analysis, nonmanufacturing setting. Joyce Brown has run Medical Maids, a specialty cleaning service for medical and dental offices, for the past 10 years. Her static budget and actual results for April 2017 are shown below. Joyce has one employee who has been with her for all 10 years that she has been in business. In addition, at any given time she also employs two other less-experienced workers. It usually takes each employee 2 hours to clean an office, regardless of his or her experience. Brown pays her experienced employee $30 per office and the other two employees $15 per office. There were no wage increases in April. Medical Maids Actual and Budgeted Income Statements For the Month Ended April 30, 2017 Offices cleaned Revenue Budget Actual 140 160 $26,600 $36,000 630 680 3,360 4,200 3,990 4,880 22,610 31,120 4,900 4,900 $17,710 $26,220 Variable costs: Costs of supplies Labor Total variable costs Contribution margin Fixed costs Operating income Required: 1. How many offices, on average, did Brown budget for each employee? How many offices did each employee actually clean? 2. Prepare a flexible budget for April 2017. 3. Compute the sales price variance and the labor efficiency variance for each labor type. 4. What information, in addition to that provided in the income statements, would you want Brown to gather, if you wanted to improve operational efficiency? SOLUTION (30 min.) Variance analysis, nonmanufacturing setting 1. This is a problem of two equations & two unknowns. The two equations relate to the number of offices cleaned and the labor costs (the wages paid to the employees). X = number of offices cleaned by the experienced employee Y = number of offices cleaned by the less experienced employees (combined) Budget: X + Y = 140 $30X + $15Y = $3,360 Actual: X + Y = 160 $30X + $15Y = $4,200 Substitution: 30X + 15(140 – X) = 3,360 15X = 1,260 X= 84 offices Y=140 – 84 = 56 offices Substitution: 30X + 15(160 – X) = 4,200 15X = 1,800 X = 120 offices Y= 160 – 120 = 40 offices Budget: The experienced employee is budgeted to clean 84 offices (and earn $2,520), and the less experienced employees are budgeted to clean 28 offices each and earn $420 apiece. Actual: The experienced employee cleans 120 offices (and grosses $3,600 for the month), and the other two clean 20 offices each and gross $300 apiece. 2. Actual Results (1) Offices cleaned Revenues Variable costs Supplies Labor – Experienced Labor – Less experienced Total variable costs Contribution Margin Fixed costs Operating income a 160 × ($26,600/140) 160 × ($630/140) c 160 × ($2,520/140) d 160 × ($840/140) b FlexibleBudget Variances (2) = (1) – (3) 160 Flexible Budget (3) Sales Volume Variance (4) = (3) – (5) 160 Static Budget (5) 140 $36,000 $ 5,600 F $30,400a $ 3,800 F $ 26,600 680 3,600 600 9,760 31,120 4,900 $26,220 40 F 720 U 360 F 640 U 5,280 F 0 $ 5,200 F 720b 2,880c 960d 4,560 25,840 4,900 $20,940 90 U 360 U 120 U 570 U 3,230 F 0 $ 3,230 F 630 2,520 840 3,990 22,610 4,900 $17,710 3. Actual sales price = $36,000 ÷ 160 = $225 Sales Price Variance = (Actual sales price – Budgeted sales price) × Actual number of offices cleaned: = ($225 – $190) × 160 = $5,600 Favorable Labor efficiency for experienced worker: Standard offices expected to be completed by experienced worker based on actual number of offices cleaned = (84 ÷ 140) × 160 = 96 offices Labor efficiency variance = Budgeted wage rate per office × (Actual offices cleaned – budgeted offices cleaned) = $30 × (120 – 96) = $720 Unfavorable Labor efficiency for less-experienced workers: Standard offices expected to be completed by less-experienced workers based on actual number of offices cleaned = (56 ÷ 140) × 160 = 64 offices Labor efficiency variance = Budgeted wage rate per office × (Actual offices cleaned – budgeted offices cleaned) = $15 × (40 – 64) = $360 Favorable Note that these are the same as the flexible budget variances calculated earlier for labor. Since there were no wage increases, the labor price variances are zero, and so the flexible budget variance and the efficiency variance for labor are the same. 4. In addition to understanding the variances computed above, Brown should attempt to keep track of the number of offices cleaned by each employee, as well as the number of hours actually spent on each office. In addition, Brown should look at the prices charged for cleaning, in relation to the hours spent on each job. It should also be considered whether the experienced worker should be asked to take less time per office, given her prior years at work and the fact that she is paid twice the wage rate of the lessexperienced employees. 7-36 Comprehensive variance analysis review. Ellis Animal Health, Inc., produces a generic medication used to treat cats with feline diabetes. The liquid medication is sold in 100 ml vials. Ellis employs a team of sales representatives who are paid varying amounts of commission. Given the narrow margins in the generic veterinary drugs industry, Ellis relies on tight standards and cost controls to manage its operations. Ellis has the following budgeted standards for the month of April 2017: Average selling price per vial $ 8.30 Total direct materials cost per vial $ 3.60 Direct manufacturing labor cost per hour $ 15.00 Average labor productivity rate (vials per hour) 100 Sales commission cost per vial $ Fixed administrative and manufacturing overhead $990,000 0.72 Ellis budgeted sales of 700,000 vials for April. At the end of the month, the controller revealed that actual results for April had deviated from the budget in several ways: Unit sales and production were 90% of plan. Actual average selling price decreased to $8.20. Productivity dropped to 90 vials per hour. Actual direct manufacturing labor cost was $15.20 per hour. Actual total direct material cost per unit increased to $3.90. Actual sales commissions were $0.70 per vial. Fixed overhead costs were $110,000 above budget. Calculate the following amounts for Ellis for April 2017: Required: 1. Static-budget and actual operating income 2. Static-budget variance for operating income 3. Flexible-budget operating income 4. Flexible-budget variance for operating income 5. Sales-volume variance for operating income 6. Price and efficiency variances for direct manufacturing labor 7. Flexible-budget variance for direct manufacturing labor SOLUTION (60 min.) Comprehensive variance analysis review Actual Results Units sold (90% × 700,000) Selling price per unit Revenues (630,000 × $8.20) Direct materials purchased and used: 630,000 $8.20 $5,166,000 Direct materials per unit Total direct materials cost (630,000 × $3.90) Direct manufacturing labor: Actual manufacturing rate per hour Labor productivity per hour in units Manufacturing labor-hours of input (630,000 ÷ 90) Total direct manufacturing labor costs (7,000 × $15.20) Direct marketing costs: Sales commissions per unit Total direct marketing costs (630,000 × $0.70) Fixed administrative and overhead costs ($990,000 + $110,000) Static Budgeted Amounts Units sold Selling price per unit Revenues (700,000 × $8.30) Direct materials purchased and used: Direct materials per unit Total direct materials costs (700,000 × $3.60) Direct manufacturing labor: Direct manufacturing rate per hour Labor productivity per hour in units Manufacturing labor-hours of input (700,000 ÷ 100) Total direct manufacturing labor cost (7,000 × $15.00) Direct marketing costs: Sales commissions per unit Total direct marketing cost (700,000 × $0.72) Fixed administrative and overhead costs 1. Revenues Variable costs Direct materials Direct manufacturing labor Direct marketing costs Total variable costs Contribution margin Fixed costs Operating income 2. Actual operating income Static-budget operating income Total static-budget variance $3.90 $2,457,000 $15.20 90 7,000 $106,400 $0.70 $441,000 $1,100,000 700,000 $8.30 $5,810,000 $3.60 $2,520,000 $15.00 100 7,000 $105,000 $0.72 $504,000 $990,000 Actual Results $5,166,000 Static-Budget Amounts $5,810,000 2,457,000 106,400 441,000 3,004,400 2,161,600 1,100,000 $1,061,600 2,520,000 105,000 504,000 3,129,000 2,681,000 990,000 $1,691,000 $1,061,600 1,691,000 $ 629,400 U Flexible-budget-based variance analysis for Ellis Animal Health, Inc. for April 2017: Actual Results Units (vials) sold Flexible-Budget Variances 630,000 0 Flexible Budget SalesVolume Variances 630,000 70,000 Static Budget 700,000 Revenues Variable costs Direct materials Direct manuf. labor Direct marketing costs Total variable costs Contribution margin Fixed costs $5,166,000 $ 63,000 U $5,229,000 $ 581,000 U $5,810,000 2,457,000 106,400 441,000 3,004,400 2,161,600 1,100,000 189,000 U 11,900 U 12,600 F 188,300 U 251,300 U 110,000 U 2,268,000 94,500 453,600 2,816,100 2,412,900 990,000 252,000 F 10,500 F 50,400 F 312,900 F 268,100 U 0 2,520,000 105,000 504,000 3,129,000 2,681,000 990,000 Operating income $1,061,600 $361,300 U $1,422,900 $ 268,100 U $1,691,000 $629,400 U Total static-budget variance $361,300 U $268,100 U Total flexible-budget variance Total sales-volume variance 3. Flexible-budget operating income = $1,422,900. 4. Flexible-budget variance for operating income = $361,300 U. 5. Sales-volume variance for operating income = $268,100 U. 6. Analysis of direct mfg. labor flexible-budget variance for Ellis Animal Health, Inc. for April 2017: Direct. Mfg. Labor Actual Costs Incurred (Actual Input Qty. × Actual Price) (7,000 × $15.20) $106,400 Actual Input Qty. × Budgeted Price (7,000 × $15.00) $105,000 $1,400 U Price variance Flexible Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) (*6,300 × $15.00) $94,500 $10,500 U Efficiency variance $11,900 U Flexible-budget variance * 630,000 units ÷ 100 direct manufacturing labor standard productivity rate per hour. DML price variance = $1,400 U; DML efficiency variance = $10,500 U 7. DML flexible-budget variance = $11,900 U 7-37 Possible causes for price and efficiency variances. You have been invited to interview for an internship with an international food manufacturing company. When you arrive for the interview, you are given the following information related to a fictitious Belgian chocolatier for the month of June. The chocolatier manufactures truffles in 12-piece boxes. The production is labor intensive, and the delicate nature of the chocolate requires a high degree of skill. Actual Boxes produced 10,000 Direct materials used in production 2,150,000 g Actual direct material cost 60,200 euro Actual direct manufacturing labor-hours 1,100 Actual direct manufacturing labor cost 12,650 euro Standards Purchase price of direct materials 0.03 euro/g Materials per box 200 g Wage rate 12 euro/hour Boxes per hour 10 Please respond to the following questions as if you were in an interview situation: Required: 1. Calculate the materials efficiency and price variance and the wage and labor efficiency variances for the month of June. 2. Discuss some possible causes of the variances you have calculated. Can you make any possible connection between the material and labor variances? What recommendations do you have for future improvement? SOLUTION (20 min.) Possible causes for price and efficiency variances 1. Actual Costs Incurred (Actual Input Qty. × Actual Price) (1) Direct Materials € 60,200 Actual Input Qty. × Budgeted Price (2) (2,150,000 × € 0.03) € 64,500 € 4,300 F Price variance Direct Manufacturing Labor € 550 F Price variance 2. € 4,500 U Efficiency variance (1,100 × € 12) € 13,200 € 12,650 Flexible Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) (3) (10,000 × 200 × € .03) € 60,000 (10,000 × (1/10) × € 12) € 12,000 € 1,200 U Efficiency variance The favorable materials price variance, paired with the unfavorable materials efficiency variance could be an indication that the company purchased less expensive ingredients, but at the cost of lower quality. Lower quality ingredients may have resulted in a higher than standard number of rejected units. That theory is supported by the unfavorable labor efficiency variance, as rejects cause both an unfavorable materials efficiency and unfavorable labor efficiency variance. The favorable labor price variance suggests that less experienced workers may have worked more hours than more experienced workers. Those workers would have probably worked slower, and their lack of experience may have caused higher than normal rejects or waste. The company should look at the number of rejected units, and if they are indeed abnormal, determine the cause of the rejects. Is it because of faulty materials, underskilled workers, or a combination of both? Perhaps additional training will help. If rejects are not the problem, employees may be wasting both time and materials. 7-38 Material-cost variances, use of variances for performance evaluation. Katharine Johnson is the owner of Best Bikes, a company that produces high-quality cross-country bicycles. Best Bikes participates in a supply chain that consists of suppliers, manufacturers, distributors, and elite bicycle shops. For several years Best Bikes has purchased titanium from suppliers in the supply chain. Best Bikes uses titanium for the bicycle frames because it is stronger and lighter than other metals and therefore increases the quality of the bicycle. Earlier this year, Best Bikes hired Michael Bentfield, a recent graduate from State University, as purchasing manager. Michael believed that he could reduce costs if he purchased titanium from an online marketplace at a lower price. Best Bikes established the following standards based upon the company’s experience with previous suppliers. The standards are as follows: Cost of titanium $18 per pound Titanium used per bicycle 8 lbs. Actual results for the first month using the online supplier of titanium are as follows: Bicycles produced 400 Titanium purchased 5,200 lb. for $88,400 Titanium used in production 4,700 lb. Required: 1. Compute the direct materials price and efficiency variances. 2. What factors can explain the variances identified in requirement 1? Could any other variances be affected? 3. Was switching suppliers a good idea for Best Bikes? Explain why or why not. 4. the production manager’s evaluation be based solely on efficiency variances? Why is it important for Katharine Johnson to understand the causes of a variance before she evaluates performance? 5. Other than performance evaluation, what reasons are there for calculating variances? 6. What future problems could result from Best Bikes’ decision to buy a lower quality of titanium from the online marketplace? SOLUTION (35 min.) Material cost variances, use of variances for performance evaluation 1. Materials Variances Actual Costs Incurred (Actual Input Qty. × Actual Price) Direct Materials (5,200 × $17a) $88,400 Actual Input Qty. × Budgeted Price Purchases Usage (5,200 × $18) (4,700 × $18) $93,600 $84,600 $5,200 F Price variance a $88,400 ÷5,200 = $17 Flexible Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) (400 × 8 × $18) (3,200 × $18) $57,600 $27,000 U Efficiency variance 2. The favorable price variance is due to the $1 difference ($18 - $17) between the standard price based on the previous suppliers and the actual price paid through the on-line marketplace. The unfavorable efficiency variance could be due to several factors including inexperienced workers and machine malfunctions. But the likely cause here is that the lower-priced titanium was lower quality or less refined, which led to more waste. The labor efficiency variance could be affected if the lower quality titanium caused the workers to use more time. 3. Switching suppliers was not a good idea. The $5,200 savings in the cost of titanium was outweighed by the $27,000 extra material usage. In addition, the $27,000 U efficiency variance does not recognize the total impact of the lower quality titanium because, of the 5,200 pounds purchased, only 4,700 pounds were used. If the quantity of materials used in production is relatively the same, Best Bikes could expect the remaining 500 lbs to produce approximately 40 more units. At standard, 40 more units should take 40 × 8 = 320 lbs. There could be an additional unfavorable efficiency variance of (500 $18) $9,000 (40 × 8 × $18) $5,760 $3,240U 4. The purchasing manager’s performance evaluation should not be based solely on the price variance. The short-run reduction in purchase costs was more than offset by higher usage rates. His evaluation should be based on the total costs of the company as a whole. In addition, the production manager’s performance evaluation should not be based solely on the efficiency variances. In this case, the production manager was not responsible for the purchase of the lower-quality titanium, which led to the unfavorable efficiency scores. In general, it is important for Johnson to understand that not all favorable material price variances are “good news,” because of the negative effects that can arise in the production process from the purchase of inferior inputs. They can lead to unfavorable efficiency variances for both materials and labor. Johnson should also that understand efficiency variances may arise for many different reasons and she needs to know these reasons before evaluating performance. 5. Variances should be used to help Best Bikes understand what led to the current set of financial results, as well as how to perform better in the future. They are a way to facilitate the continuous improvement efforts of the company. Rather than focusing solely on the price of titanium, Scott can balance price and quality in future purchase decisions. 6. Future problems can arise in the supply chain. Bentfield may need to go back to the previous suppliers. But Best Bikes’ relationship with them may have been damaged and they may now be selling all their available titanium to other manufacturers. Lower quality bicycles could also affect Best Bikes’ reputation with the distributors, the bike shops and customers, leading to higher warranty claims and customer dissatisfaction, and decreased sales in the future. 7-39 Direct manufacturing labor and direct materials variances, missing data. (CMA, heavily adapted) Oyster Bay Surfboards manufactures fiberglass surfboards. The standard cost of direct materials and direct manufacturing labor is $248 per board. This includes 35 pounds of direct materials, at the budgeted price of $3 per pound, and 11 hours of direct manufacturing labor, at the budgeted rate of $13 per hour. Following are additional data for the month of July: Units completed 5,600 units Direct material purchases 230,000 pounds Cost of direct material purchases $759,000 Actual direct manufacturing labor-hours 43,000 hours Actual direct manufacturing labor cost $623,500 Direct materials efficiency variance $ 1,200 F There were no beginning inventories. Required: 1. Compute direct manufacturing labor variances for July. 2. Compute the actual pounds of direct materials used in production in July. 3. Calculate the actual price per pound of direct materials purchased. 4. Calculate the direct materials price variance. SOLUTION (30 min.) Direct manufacturing labor and direct materials variances, missing data. 1. Direct mfg. labor Actual Costs Incurred (Actual Input Qty.× Actual Price) $623,500a Flexible Budget (Budgeted Input Qty. Allowed for Actual Input Qty. Actual Output × Budgeted Price × Budgeted Price) $559,000b $800,800c $64,500 U Price variance $241,800 F Efficiency variance $177,300 F Flexible-budget variance a Given (or 43,000 hours × $14.50/hour) 43,000 hours × $13/hour = $559,000 c 5,600 units × 11 hours/unit × $13/hour = $800,800 b 2. The favorable direct materials efficiency variance of $241,800 indicates that fewer pounds of direct materials were actually used than the budgeted quantity allowed for actual output. = $1,200 efficiency variance $3 per pound budgeted price = 400 pounds Budgeted pounds allowed for the output achieved = 5,600 x 35 = 196,000 pounds Actual pounds of direct materials used = 196,000 400 = 195,600 pounds 3. Actual price paid per pound = $759,000/230,000 = $3.30 per pound 4. Actual Costs Incurred (Actual Input × Actual Price) $759,000a Actual Input × Budgeted Price $690,000b $69,000 U Price variance a b Given 230,000 pounds × $3/pound = $690,000 7-40 Direct materials efficiency, mix, and yield variances. Sandy’s Snacks produces snack mixes for the gourmet and natural foods market. Its most popular product is Tempting Trail Mix, a mixture of peanuts, dried cranberries, and chocolate pieces. For each batch, the budgeted quantities and budgeted prices are as follows: Quantity per Batch Price per Cup Peanuts 60 cups $1 Dried cranberries 30 cups $2 Chocolate pieces 10 cups $3 Small changes to the standard mix of direct materials reflected in the above quantities do not significantly affect the overall end product. In addition, not all ingredients added to production end up in the finished product, as some are rejected during inspection. In the current period, Sandy’s Snacks made 100 batches of Tempting Trail Mix with the following actual quantity, cost, and mix of inputs: Actual Quantity Actual Cost Actual Mix Peanuts 6,720 cups $ 5,712 64% Dried cranberries 2,625 cups 5,775 25% Chocolate pieces 1,155 cups 3,350 11% Total actual 10,500 cups $14,837 100% Required: 1. What is the budgeted cost of direct materials for the 100 batches? 2. Calculate the total direct materials efficiency variance. 3. Calculate the total direct materials mix and yield variances. 4. How do the variances calculated in requirement 3 relate to those calculated in requirement 2? What do the variances calculated in requirement 3 tell you about the 100 batches produced this period? Are the variances large enough to investigate? SOLUTION (35 min.) Direct materials efficiency, mix, and yield variances 1. Peanuts ($1 × 60 cups) Dried cranberries ($2 × 30 cups) Chocolate pieces ($3 × 10 cups) Budgeted cost per batch Number of batches Budgeted Cost $ 60 60 30 $ 150 × 100 $15,000 2. Solution Exhibit 7-40A presents the total price variance ($598 F), the total efficiency variance ($435 U), and the total flexible-budget variance ($163 F). • SOLUTION EXHIBIT 7-40A Columnar Presentation of Direct Materials Price and Efficiency Variances for Sandy’s Snacks Company. Peanuts Dried Cranberries Chocolate Pieces Actual Costs Incurred (Actual Input Quantity × Actual Price) (1) $ 5,712 5,775 3,350 $14,837 Actual Input Quantity × Budgeted Price (2) 6,720 × $1 = $ 6,720 2,625 × $2 = 5,250 1,155 × $3 = 3,465 $15,435 $598 F Flexible Budget (Budgeted Input Quantity Allowed for Actual Output × Budgeted Price) (3) 6,000 × $1 = $ 6,000 3,000 × $2 = 6,000 1,000 × $3 = 3,000 $15,000 $435 U Total price variance Total efficiency variance $163 F Total flexible-budget variance F = favorable effect on operating income; U = unfavorable effect on operating income 3. Solution Exhibit 7-40B presents the total direct materials yield ($750 U) and mix ($315 F) variances. SOLUTION EXHIBIT 7-40B Columnar Presentation of Direct Materials Yield and Mix Variances for Sandy’s Snacks Company. Actual Total Quantity of All Inputs Used × Actual Input Mix × Budgeted Price (1) Peanuts Dried Cranberries Chocolate Pieces 10,500 × 0.64 × $1 = $ 6,720 10,500 × 0.25 × $2 = 5,250 10,500 × 0.11 × $3 = 3,465 $ 15,435 Actual Total Quantity of All Inputs Used × Budgeted Input Mix × Budgeted Price (2) Flexible Budget: Budgeted Total Quantity of All Inputs Allowed for Actual Output × Budgeted Input Mix × Budgeted Price (3) 10,500 × 0.60 × $1 = $ 6,300 10,500 × 0.30 × $2 = 6,300 10.500 × 0.10 × $3 = 3,150 $ 15,750 10,000 × 0.60 × $1 = $ 6,000 10,000 × 0.30 × $2 = 6,000 10,000 × 0.10 × $3 = 3,000 $15,000 $315 F Total mix variance $750 U Total yield variance $435 U Total efficiency variance F = favorable effect on operating income; U = unfavorable effect on operating income. 4. The total mix variance combines with the total yield variance to equal the total efficiency variance calculated in part 2. The direct materials mix variance of $315 F indicates that the actual product mix uses relatively more of less-expensive ingredients than planned. In this case, the actual mix contains more peanuts while using fewer dried cranberries, and only slightly more chocolate pieces. The direct materials yield variance of $750 U occurs because the amount of total inputs needed (10,500 cups) exceeded the budgeted amount (10,000 cups) expected to produce 100 batches. The direct materials yield variance is significant enough to be investigated. The mix variance may be within expectations but should be monitored since it is favorable largely due to the use of fewer dried cranberries, which is considered an important element of the product’s appeal to customers. 7-41 Direct materials and manufacturing labor variances, solving unknowns. (CPA, adapted) On May 1, 2017, Bovar Company began the manufacture of a new paging machine known as Dandy. The company installed a standard costing system to account for manufacturing costs. The standard costs for a unit of Dandy follow: Direct materials (3 lb. at $4 per lb.) $12.00 Direct manufacturing labor (1/2 hour at $20 per hour) 10.00 Manufacturing overhead (75% of direct manufacturing labor costs) 7.50 $29.50 The following data were obtained from Bovar’s records for the month of May: Debit Revenues Credit $125,000 Accounts payable control (for May’s purchases of direct materials) Direct materials price variance 55,000 $3,500 Direct materials efficiency variance 2,400 Direct manufacturing labor price variance 1,890 Direct manufacturing labor efficiency variance 2,200 Actual production in May was 4,000 units of Dandy, and actual sales in May were 2,500 units. The amount shown for direct materials price variance applies to materials purchased during May. There was no beginning inventory of materials on May 1, 2017. Compute each of the following items for Bovar for the month of May. Show your computations. Required: 1. Standard direct manufacturing labor-hours allowed for actual output produced 2. Actual direct manufacturing labor-hours worked 3. Actual direct manufacturing labor wage rate 4. Standard quantity of direct materials allowed (in pounds) 5. Actual quantity of direct materials used (in pounds) 6. Actual quantity of direct materials purchased (in pounds) 7. Actual direct materials price per pound SOLUTION (20–30 min.) Direct materials and manufacturing labor variances, solving unknowns. All given items are designated by an asterisk. Direct Manufacturing Labor Actual Costs Incurred (Actual Input Qty. × Actual Price) Actual Input Qty. × Budgeted Price Flexible Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) (1,890 × $21) $39,690 (1,890 × $20*) $37,800 (4,000* × 0.5* × $20*) $40,000 $1,890 U* Price variance Direct Materials (12,875 × $4.27) $55,000* Purchases (12,875 × $4*) $51,500 $3,500 U* Price variance $2,200 F* Efficiency variance Usage (12,600 × $4*) $50,400 (4,000* × 3* × $4*) $48,000 $2,400 U* Efficiency variance 1. 4,000 units × 0.5 hours/unit = 2,000 hours 2. Flexible budget – Efficiency variance = $40,000 – $2,200 = $37,800 Actual dir. manuf. labor hours = $37,800 ÷ Budgeted price of $20/hour = 1,890 hours 3. $37,800 + Price variance, $1,890 = $39,690, the actual direct manuf. labor cost Actual rate = Actual cost ÷ Actual hours = $39,690 ÷ 1,890 hours = $21/hour 4. Standard qty. of direct materials = 4,000 units × 3 pounds/unit = 12,000 pounds 5. Flexible budget + Dir. matls. effcy. var. = $48,000 + $2,400 = $50,400 Actual quantity of dir. matls. used = $50,400 ÷ Budgeted price per lb = $50,400 ÷ $4/lb = 12,600 lbs 6. Actual cost of direct materials, $55,000 – Price variance, $3,500 = $51,500 Actual qty. of direct materials purchased = $51,500 ÷ Budgeted price, $4/lb = 12,875 lbs. 7. Actual direct materials price = $51,500 ÷ 12,875 lbs = $4.27 per lb. 7-42 Direct materials and manufacturing labor variances, journal entries. Collegiate Corn Hole is a small business that Zach Morris developed while in college. He began building wooden corn hole game sets for friends, hand painted with college colors and logos. As demand grew, he hired some workers and began to manage the operation. Collegiate Corn Hole maintains two departments: construction and painting. In the construction department, the games require wood and labor. Collegiate Corn Hole has some employees who have been with the company for a very long time and others who are new and inexperienced. Collegiate Corn Hole uses standard costing for the game sets. Zach expects that a typical set should take 4 hours of labor in the construction department, and the standard wage rate is $10.00 per hour. An average set uses 24 square feet of wood, allowing for a certain amount of scrap. Because of the nature of the wood, workers must work around flaws in the materials. Zach shops around for good deals and expects to pay $5.00 per square feet. Zach does not store inventory, and buys the wood as he receives an order. For the month of September, Zach’s workers produced 60 corn hole sets using 250 hours and 1,500 square feet of wood. Zach bought wood for $7,350 (and used the entire quantity) and incurred labor costs of $2,375. Required: 1. For the construction department, calculate the price and efficiency variances for the wood and the price and efficiency variances for direct manufacturing labor. 2. Record the journal entries for the variances incurred. 3. Discuss logical explanations for the combination of variances that the construction department of Collegiate Corn Hole experienced. SOLUTION (20 min.) Direct materials and manufacturing labor variances, journal entries. 1. Direct Materials: Wood Actual Costs Incurred (Actual Input Qty. × Actual Price) (given) $7,350 Actual Input Qty. × Budgeted Price 1,500 $5.00 $7,500 Flexible Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) 60 24 $5.00 $7,200 $150 F $300 U Price variance Efficiency variance $150 U Flexible-budget variance Direct Manufacturing Labor: Actual Costs Incurred (Actual Input Qty. × Actual Price) Actual Input Qty. × Budgeted Price Flexible Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) 250 $10 (given) $2,375 $2,500 $125 F Price variance 60 4 $10 $2,400 $100 U Efficiency variance $25 F Flexible-budget variance 2. Direct Materials Price Variance (time of purchase = time of use) Direct Materials Control 7,500 Direct Materials Price Variance 150 Accounts Payable Control or Cash 7,350 Direct Materials Efficiency Variance Work in Process Control Direct Materials Efficiency Variance Direct Materials Control 7,200 300 7,500 Direct Manufacturing Labor Variances Work in Process Control Direct Mfg. Labor Efficiency Variance Direct Mfg. Labor Price Variance Wages Payable or Cash 2,400 100 125 2,375 3. Plausible explanations for the above variances include: Collegiate Corn Hole paid a little less for the wood, but the wood was lower quality (more flaws in the wood), and workers had to use more of it. Collegiate used less experienced workers in September than usual. This resulted in payment of lower average hourly wages, but the new workers were less efficient and took more hours than normal. However, overall the lower wage rates resulted in Collegiate’s total wage bill being lower than expected. 7-43 Use of materials and manufacturing labor variances for benchmarking. You are a new junior accountant at In Focus Corporation, maker of lenses for eyeglasses. Your company sells generic-quality lenses for a moderate price. Your boss, the controller, has given you the latest month’s report for the lens trade association. This report includes information related to operations for your firm and three of your competitors within the trade association. The report also includes information related to the industry benchmark for each line item in the report. You do not know which firm is which, except that you know you are Firm A. Unit Variable Costs Member Firms for the Month Ended September 30, 2017 Firm A Firm B Firm C Firm D Industry Benchmark Materials input 2.15 2.00 2.20 2.60 2.15 oz. of glass Materials price $ 5.00 $ 5.25 $ 5.10 $ 4.50 $ 5.10 per oz. 0.75 1.00 0.65 0.70 0.70 hours Wage rate $14.50 $14.00 $14.25 $15.25 $12.50 per DLH Variable overhead rate $ 9.25 $14.00 $ 7.75 $11.75 $12.25 per DLH Labor-hours used Required: 1. Calculate the total variable cost per unit for each firm in the trade association. Compute the percent of total for the material, labor, and variable overhead components. 2 Using the trade association’s industry benchmark, calculate direct materials and direct manufacturing labor price and efficiency variances for the four firms. Calculate the percent over standard for each firm and each variance. 3. Write a brief memo to your boss outlining the advantages and disadvantages of belonging to this trade association for benchmarking purposes. Include a few ideas to improve productivity that you want your boss to take to the department heads’ meeting. SOLUTION (30 min.) Use of materials and manufacturing labor variances for benchmarking 1. Unit variable cost (dollars) and component percentages for each firm: Firm A DM DL VOH Total 2. Firm B $10.75 37.6% 10.88 38.1% 6.94 24.3% $28.57 100.0% $10.50 27.3% 14.00 36.3% 14.00 36.4% $38.50 100.0% Firm C Firm D $11.22 44.0% 9.26 36.3% 5.04 19.7% $25.52 100.0% $11.70 38.2% 10.68 34.9% 8.23 26.9% $30.61 100.0% Variances and percentage over/under standard for each firm relative to the Industry Benchmark: Firm A Firm B Firm C Firm D % over % over % over % over Variance standard Variance standard Variance standard Variance standard DM Price Variance DM Efficiency Variance DL Price Variance DL Efficiency Variance $0.22 F -1.96% $0.30 U 2.94% -- -- $1.56 F -11.76% -- -- $0.77 F -6.98% $0.26 U 2.33% $2.30 U 20.93% $1.50 U 16.00% $1.50 U 12.00% $1.14 U 14.00% $1.93 U 22.00% $0.63 U 7.14% $3.75 U 42.86% $0.63 F -7.14% -- -- We illustrate these calculations for Firm A. The DM Price Variance is computed as: = = (Firm A Price – Benchmark Price) × Firm A Usage ($5.00 - $5.10) × 2.15 oz. $0.22 F The DM Efficiency Variance is computed as follows: = = (Firm A Usage – Benchmark Usage) x Benchmark Price (2.15 oz. – 2.15 oz.) x $5.10 $0 The DL Price Variance is computed as: = = (Firm A Rate – Benchmark Rate) x Firm A Hours ($14.50 – $12.50) x 0.75 $1.50 U The DL Efficiency Variance is computed as follows: = = (Firm A Usage – Benchmark Usage) x Benchmark Rate (0.75 hrs. – 0.70 hrs.) x $12.50 $0.63 U The % over standard is the percentage difference in prices relative to the Industry Benchmark. Again using the DM Price Variance calculation for Firm A, the % over standard is given by: (Firm A Price – Benchmark Price)/Benchmark Price = ($5.00 - $5.10)/$5.10 = 1.96% under standard. 3. To: Controller From: Junior Accountant Re: Benchmarking & productivity improvements Date: March 15, 2017 Benchmarking advantages - we can see how productive we are relative to our competition and the industry benchmark - we can see the specific areas in which there may be opportunities for us to reduce costs Benchmarking disadvantages - some of our competitors are targeting the market for high-end and custom-made lenses. I'm not sure that looking at their costs helps with understanding ours better - we may focus too much on cost differentials and not enough on differentiating ourselves, maintaining our competitive advantages, and growing our margins Areas to discuss - we may want to find out whether we can get the same lower price for glass as Firm D - we may want to re-evaluate the training our employees receive given our level of unfavorable labor efficiency variance compared to the benchmark. - can we use Firm B’s materials efficiency and Firm C’s variable overhead consumption levels as our standards for the coming year? - It is unclear why the trade association is still using $12.50 for the labor rate benchmark. Given the difficulty of hiring qualified workers, real wage rates are now substantially higher. We pay our workers $2 more per hour, and at least one of our competitors pays even higher wages than we do! Firm B does pay $0.50 less than we do per hour and that may be worth looking into. 7-44 Direct manufacturing labor variances: price, efficiency, mix, and yield. Elena Martinez employs two workers in her wedding cake bakery. The first worker, Gabrielle, has been making wedding cakes for 20 years and is paid $25 per hour. The second worker, Joseph, is less experienced and is paid $15 per hour. One wedding cake requires, on average, 6 hours of labor. The budgeted direct manufacturing labor quantities for one cake are as follows: Quantity Gabrielle 3 hours Joseph 3 hours Total 6 hours That is, each cake is budgeted to require 6 hours of direct manufacturing labor, composed of 50% of Gabrielle’s labor and 50% of Joseph’s, although sometimes Gabrielle works more hours on a particular cake and Joseph less, or vice versa, with no obvious change in the quality of the cake. During the month of May, the bakery produces 50 cakes. Actual direct manufacturing labor costs are as follows: Gabrielle (140 hours) Joseph (165 hours) Total actual direct labor cost $ 3,500 2,475 $ 5,975 Required: 1. What is the budgeted cost of direct manufacturing labor for 50 cakes? 2. Calculate the total direct manufacturing labor price and efficiency variances. 3. For the 50 cakes, what is the total actual amount of direct manufacturing labor used? What is the actual direct manufacturing labor input mix percentage? What is the budgeted amount of Gabrielle’s and Joseph’s labor that should have been used for the 50 cakes? 4. Calculate the total direct manufacturing labor mix and yield variances. How do these numbers relate to the total direct manufacturing labor efficiency variance? What do these variances tell you? SOLUTION (35 min.) Direct manufacturing labor variances: price, efficiency, mix and yield 1. Gabrielle ($25 × 3 hrs.) Joseph ($15 × 3 hrs.) Cost per cake Number of cakes Total budgeted cost $ $ $ 75 45 120 × 50 units 6,000 2. Solution Exhibit 7-44A presents the total price variance ($0), the total efficiency variance ($25 F), and the total flexible-budget variance ($25 F). Total direct labor price variance can also be computed as: Direct labor price variance for each input = Actual quantity × Budgeted priceActual of input of input price of input Gabrielle = ($25 – $25) × 140 = $0 Joseph = ($15 – $15) × 165 = 0 Total direct labor price variance $0 Total direct labor efficiency variance can also be computed as: • Direct labor efficiency• variance = Actual quantity Budgeted quantity of input × Budgeted price of input of input allowed for actual output for each input Gabrielle = (140 – 150) × $25.00 = $250 F Joseph = (165 – 150) × $15.00 = 225 U Total direct labor efficiency variance $ 25 F • SOLUTION EXHIBIT 7-44A Columnar Presentation of Direct Labor Price and Efficiency Variances for Elena Martinez Wedding Cakes Actual Costs Incurred (Actual Input Quantity × Actual Price) (1) 140 × $25 = $3,500 165 × $15 = 2,475 $5,975 Gabrielle Joseph Actual Input Quantity × Budgeted Price (2) 140 × $25 = $3,500 165 × $15 = 2,475 $5,975 $0 Total price variance Flexible Budget (Budgeted Input Quantity Allowed for Actual Output × Budgeted Price) (3) 150 × $25 = $3,750 150 × $15 = 2,250 $6,000 $25 F Total efficiency variance $25 F Total flexible-budget variance F = favorable effect on operating income; U = unfavorable effect on operating income 3. Actual Quantity of Input 140 hours 165 hours 305 hours Gabrielle Joseph Total Actual Mix 45.9% 54.1% 100.0% Budgeted Quantity of Input for Actual Output 3 hours × 50 units = 150 hours 3 hours × 50 units = 150 hours 300 hours Budgeted Mix 50% 50% 100% 4. Solution Exhibit 7-44B presents the total direct labor yield and mix variances for Elena Martinez Wedding Cakes. The total direct labor yield variance can also be computed as the sum of the direct labor yield variances for each input: Direct labor yield variance for each input = Actual total Budgeted total quantity of quantity of all all direct labor inputs direct labor – allowed for actual output inputs used × Budgeted direct labor input mix percentage × Budgeted price of direct labor inputs Gabrielle = (305 – 300) × 0.50 × $25 = 5 × 0.50 × $25 = $ 62.50 U Joseph = (305 – 300) × 0.50 × $15 = 5 × 0.50 × $15 = 37.50 U Total direct labor yield variance $ 100.00 U The total direct labor mix variance can also be computed as the sum of the direct labor mix variances for each input: Direct labor mix variance for each input = Actual direct labor input mix percentage – Budgeted direct labor input mix percentage × Actual total quantity of all direct labor inputs used × Budgeted price of direct labor inputs Gabrielle = (0.459 – 0.50) × 305 × $25 = – 0.041 × 305 × $25 = $312.63 F Joseph = (0.541 – 0.50) × 305 × $15 = 0.041 × 305 × $15 = 187.58 U Total direct labor mix variance $125.05 F round to $125 F The sum of the direct labor mix variance and the direct labor yield variance equals the direct labor efficiency variance. The favorable mix variance arises from using more of the cheaper labor (and less of the costlier labor) than the budgeted mix. The yield variance indicates that the cakes required more total inputs (305 hours) than expected (300 hours) for the production of 50 guitars. Both variances are relatively small and probably within tolerable limits. It is likely that Joseph, who is less experienced, worked more slowly than Gabrielle, which caused the unfavorable yield variance. Elena Martinez should be careful that using more of the cheaper labor does not reduce the quality of the wedding cake or how customers perceive it. • SOLUTION EXHIBIT 7-44B Columnar Presentation of Direct Labor Yield and Mix Variances for Elena Martinez Wedding Cakes Actual Total Quantity of All Inputs Used × Actual Input Mix × Budgeted Price (1) Gabrielle Joseph 305 × 0.459 × $25 305 × 0.541 × $15 = $3,499.88 = 2,475.08 rounded $5,975.00 Actual Total Quantity of All Inputs Used × Budgeted Input Mix × Budgeted Price (2) Flexible Budget: Budgeted Total Quantity of All Inputs Allowed for Actual Output × Budgeted Input Mix × Budgeted Price (3) 305 × 0.50 × $25 = $3,812.50 305 × 0.50 × $15 = 2,287.50 $6,100.00 300 × 0.50 × $25 = $3,750 300 × 0.50 × $15 = 2,250 $6,000 $125 F $100 U Total mix variance Total yield variance $25 F Total efficiency variance F = favorable effect on operating income; U = unfavorable effect on operating income. 7-45 Direct-cost and selling price variances. MicroDisk is the market leader in the Secure Digital (SD) card industry and sells memory cards for use in portable devices such as mobile phones, tablets, and digital cameras. Its most popular card is the Mini SD, which it sells through outlets such as Target and Walmart for an average selling price of $8. MicroDisk has a standard monthly production level of 420,000 Mini SDs in its Taiwan facility. The standard input quantities and prices for direct-cost inputs are as follows: Phoebe King, the CEO, is disappointed with the results for June 2017, especially in comparison to her expectations based on the standard cost data. King observes that despite the significant increase in the output of Mini SDs in June, the product’s contribution to the company’s profitability has been lower than expected. She gathers the following information to help analyze the situation: Calculate the following variances. Comment on the variances and provide potential reasons why they might have arisen, with particular attention to the variances that may be related to one another: Required: 1 2 3 4 5 Selling-price variance Direct materials price variance, for each category of materials Direct materials efficiency variance, for each category of materials Direct manufacturing labor price variance, for setup and fabrication Direct manufacturing labor efficiency variance, for setup and fabrication SOLUTION (30 min.) Direct-cost and selling price variances. 1. Computing unit selling prices and unit costs of inputs: Actual selling price = $3,626,700 ÷ 462,000 = $7.85 Budgeting selling price = $3,360,000 ÷ 420,000 = $8.00 Selling-price Budgeted Actual Actual = – × selling price selling price units sold variance = ($7.85/unit – $8.00/unit) = $69,300 U × 462,000 units 2., 3., and 4. The actual and budgeted unit costs are: Actual Direct materials Specialty polymer Connector pins Wi-Fi transreceiver Direct manuf. labor Setup Fabrication Budgeted $0.05 ($415,000 ÷ 8,300,000) 0.11 ($550,000 ÷ 5,000,000) 0.50 ($235,000 ÷ 470,000) $0.05 0.10 0.50 24.00 ($182,000 ÷ 455,000 × 60) 31.00 ($446,400 ÷ 864,000 × 60) 24.00 30.00 The actual output achieved is 462,000 Mini SDs. The direct cost price and efficiency variances are: Actual Costs Incurred (Actual Input Qty. × Actual Price) (1) Direct materials Price Variance (2)=(1)–(3) Actual Input Qty. × Budgeted Price (3) Efficiency Variance (4)=(3)–(5) Flex. Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) (5) Specialty polymer $ 415,000 Connector pins 550,000 Wi-Fi transreceiver 235,000 $1,200,000 Direct manuf. labor costs Setup $182,000 Fabrication 446,400 $628,400 a a $ 0 50,000 U 0 $50,000 U $ 415,000 b 500,000 c 235,000 $1,150,000 d $ 0 14,400 U $ 14,400 U $0.05 × 8,300,000 = $415,000 b $0.10 × 5,000,000 = $500,000 c $0.50 × 470,000 = $235,000 d $24.00/hr. × (455,000 min. ÷ 60 min./hr.) = $182,000 e $30.00/hr. × (864,000 min. ÷ 60 min./hr.) = $432,000 $182,000 e 432,000 $614,000 f $22,300 U 38,000 U 4,000 U $64,300 U $ 392,700 g 462,000 h 231,000 $1,085,700 $ 2,800 F 30,000 F $32,800 F $184,800 j 462,000 $646,800 f $0.05 × 17 × 462,000 = $392,700 $0.10 × 10 × 462,000 = $462,000 h $0.50 × 1 × 462,000 = $231,000 i $24.00 × (462,000 60) = $184,800 j $30.00 × (462,000 30) = $462,000 g Comments on the variances include: • Selling price variance. This may arise from a proactive decision to reduce price to expand market share or from a reaction to a price reduction by a competitor. It could also arise from unplanned price discounting by salespeople. • Material price variance. The $0.01 increase in the price per connector pin could arise from uncontrollable market factors or from poor contract negotiations by MicroDisk. • Material efficiency variance. For all three material inputs, usage is greater than budgeted. Possible reasons include lower quality inputs, use of lower quality workers (although this is not reflected in the labor price variances), and the setup and fabrication equipment not being maintained in a fully operational mode. The higher price paid for connector pins (and perhaps higher quality of pins) did not reduce the number of connector pins used to produce actual output. • Labor efficiency variance. There is a small favorable efficiency variance for setup labor and a larger one for fabrication, which could both result from workers eliminating nonvalue-added steps in production. • Labor price variance. There is an unfavorable price variance for fabrication as a result of the $1 higher wage per hour paid for that labor. The higher labor quality could also explain the significant efficiency variance for fabrication labor. i 7-46 Variances in the service sector. Derek Wilson operates Clean Ride Enterprises, an auto detailing company with 20 employees. Jamal Jackson has recently been hired by Wilson as a controller. Clean Ride’s previous accountant had done very little in the area of variance analysis, but Jackson believes that the company could benefit from a greater understanding of his business processes. Because of the labor-intensive nature of the business, he decides to focus on calculating labor variances. Jackson examines past accounting records, and establishes some standards for the price and quantity of labor. While Clean Ride’s employees earn a range of hourly wages, they fall into two general categories: skilled labor, with an average wage of $20 per hour, and unskilled labor, with an average wage of $10 per hour. One standard 5-hour detailing job typically requires a combination of 3 skilled hours and 2 unskilled hours. Actual data from last month, when 600 detailing jobs were completed, are as follows: Skilled (2,006 hours) Unskilled (944 hours) Total actual direct labor cost $ 39,117 9,292 $ 48,409 Looking over last month’s data, Jackson determines that Clean Ride’s labor price variance was $1,151 favorable, but the labor efficiency variance was $1,560 unfavorable. When Jackson presents his findings to Wilson, the latter is furious. “Do you mean to tell me that my employees wasted $1,560 worth of time last month? I’ve had enough. They had better shape up, or else!” Jackson tries to calm him down, saying that in this case the efficiency variance doesn’t necessarily mean that employees were wasting time. Jackson tells him that he is going to perform a more detailed analysis, and will get back to him with more information soon. Required: 1. What is the budgeted cost of direct labor for 600 detailing jobs? 2. How were the $1,151 favorable price variance and the $1,560 unfavorable labor efficiency variance calculated? What was the company’s flexible-budget variance? 3. What do you think Jackson meant when said that “in this case the efficiency variance doesn’t necessarily mean that employees were wasting time”? 4. For the 600 detailing jobs performed last month, what is the actual direct labor input mix percentage? What was the standard mix for labor? 5. Calculate the total direct labor mix and yield variances. 6. How could these variances be interpreted? Did the employees waste time? Upon further investigation, you discover that there were some unfilled vacancies last month in the unskilled labor positions that have recently been filled. How will this new information likely impact the variances going forward? SOLUTION (35 min.) Variances in the service sector 1. Skilled ($20 × 3 hrs.) Unskilled ($10 × 2 hrs.) Cost per job Number of jobs Total budgeted cost $ 60 20 $ 80 × 600 units $ 48,000 2. Solution Exhibit 7-46A presents the total price variance ($318 F), the total efficiency variance ($2,200 U), and the total flexible-budget variance ($1,882 U). • SOLUTION EXHIBIT 7-46A Columnar Presentation of Direct Labor Price and Efficiency Variances for Clean Ride Enterprises Skilled Unskilled Actual Costs Incurred (Actual Input Quantity × Actual Price) (1) $39,117 9,292 $48,409 Flexible Budget (Budgeted Input Quantity Allowed for Actual Output × Budgeted Price) (3) 1,800 × $20 = $36,000 1,200 × $10 = 12,000 $48,000 Actual Input Quantity × Budgeted Price (2) 2,006 × $20 = $40,120 944 × $10 = 9,440 $49,560 $1,151 F Total price variance $1,560 U Total efficiency variance $409 U Total flexible-budget variance F = favorable effect on operating income; U = unfavorable effect on operating income 3. In a company where there is a mixture of workers, some at higher wages and others at lower, all working on the same projects, an unfavorable efficiency variance can be the result of which employees worked on the project, not just how many hours were spent. If higher paid workers worked more than their standard percentage of the time, an unfavorable efficiency variance will result. 4. Skilled: Unskilled: Total Actual Quantity of Input 2,006 hours 944 hours 2,950 hours Actual Mix 68.0% 32.0% 100.0% Budgeted Quantity of Input for Actual Output 3 hours × 600 units = 1,800 hours 2 hours × 600 units = 1,200 hours 3,000 hours Budgeted Mix 60% 40% 100% 5. Solution Exhibit 7-46B presents the total direct labor yield and mix variances for Clean Ride Enterprises. • SOLUTION EXHIBIT 7-46B Columnar Presentation of Direct Labor Yield and Mix Variances for Clean Ride Enterprises Actual Total Quantity of All Inputs Used × Actual Input Mix × Budgeted Price (1) Skilled: 2,950 × 0.68 × $20 = $40,120 Unskilled: 2,950 × 0.32 × $10 = 9,440 $49,560 Actual Total Quantity of All Inputs Used × Budgeted Input Mix × Budgeted Price (2) Flexible Budget: Budgeted Total Quantity of All Inputs Allowed for Actual Output × Budgeted Input Mix × Budgeted Price (3) 2,950 × 0.60 × $20 = $35,400 2,950 × 0.40 × $10 = 11,800 $47,200 3,000 × 0.60 × $20 = $36,000 3,000 × 0.40 × $10 = 12,000 $48,000 $2,360 U $800 F Total mix variance Total yield variance $1,560 U Total efficiency variance F = favorable effect on operating income; U = unfavorable effect on operating income. 6. While the efficiency variance was unfavorable, it was due to the mix of labor, not the total hours used. The unfavorable mix variance is the result of a higher than standard percentage of skilled labor (68% vs. 60%) used. The yield variance, which is a more accurate measure of hours used, is favorable because total hours (2,950) were actually lower than the standard for 600 detail jobs (3,000). The skilled labor workers were probably able to work more quickly than the unskilled. In light of the information regarding the vacancies in the unskilled positions, last month could be treated as an outlier (especially in terms of the mix of labor employed), and more normal variances will likely follow in future months. While it is recommended that variances be calculated monthly, no corrective action with the employees appears necessary. 7-47 Price and efficiency variances, benchmarking and ethics. Sunto Scientific manufactures GPS devices for a chain of retail stores. Its most popular model, the Magellan XS, is assembled in a dedicated facility in Savannah, Georgia. Sunto is keenly aware of the competitive threat from smartphones that use Google Maps and has put in a standard cost system to manage production of the Magellan XS. It has also implemented a just-in-time system so the Savannah facility operates with no inventory of any kind. Producing the Magellan XS involves combining a navigation system (imported from Sunto’s plant in Dresden at a fixed price), an LCD screen made of polarized glass, and a casing developed from specialty plastic. The budgeted and actual amounts for Magellan XS for July 2017 were as follows: Budgeted Amounts Magellan XS units produced Actual Amounts 4,000 4,400 $81,600 $89,000 Navigation systems 4,080 4,450 Polarized glass cost $40,000 $40,300 800 816 $12,000 $12,500 Ounces of specialty plastic used 4,000 4,250 Direct manufacturing labor costs $36,000 $37,200 2,000 2,040 Navigation systems cost Sheets of polarized glass used Plastic casing cost Direct manufacturing labor-hours The controller of the Savannah plant, Jim Williams, is disappointed with the standard costing system in place. The standards were developed on the basis of a study done by an outside consultant at the start of the year. Williams points out that he has rarely seen a significant unfavorable variance under this system. He observes that even at the present level of output, workers seem to have a substantial amount of idle time. Moreover, he is concerned that the production supervisor, John Kelso, is aware of the issue but is unwilling to tighten the standards because the current lenient benchmarks make his performance look good. Required: 1. Compute the price and efficiency variances for the three categories of direct materials and for direct manufacturing labor in July 2017. 2. Describe the types of actions the employees at the Savannah plant may have taken to reduce the accuracy of the standards set by the outside consultant. Why would employees take those actions? Is this behavior ethical? 3. If Williams does nothing about the standard costs, will his behavior violate any of the standards of ethical conduct for practitioners described in the IMA Statement of Ethical Professional Practice (see Exhibit 1-7 on page 17)? 4. What actions should Williams take? 5. Williams can obtain benchmarking information about the estimated costs of Sunto’s competitors such as Garmin and TomTom from the Competitive Intelligence Institute (CII). Discuss the pros and cons of using the CII information to compute the variances in requirement 1. SOLUTION (30 min.) Price and efficiency variances, benchmarking and ethics. 1. Budgeted navigation systems per unit = 4,080 systems ÷ 4,000 units = 1.02 systems Budgeted cost of navigation system = $81,600 ÷ 4,080 units = $20 per system Budgeted sheets of polarized glass per unit = 800 sheets ÷ 4,000 units = 0.20 sheets Budgeted cost of sheet of polarized glass = $40,000 ÷ 800 sheets = $50 per sheet Budgeted ounces of specialty plastic per unit = 4,000 ounces ÷ 4,000 units = 1 ounce per unit Budgeted cost of specialty plastic = $12,000 ÷ 4,000 ounces = $3 per ounce Budgeted direct manufacturing labor cost per hour ($36,000 ÷ 2,000) = $18 per hour Budgeted direct manufacturing labor hours per unit = 2,000 hours ÷ 4,000 units = 0.50 hours per unit Actual output achieved = 4,400 XS units Actual Costs Incurred (Actual Input Qty. × Actual Price) Navigation Systems $89,000 Actual Input Qty. × Budgeted Price (4,450 × $20) $89,000 $0 Price variance Polarized Glass (816 × $50) $40,800 $40,300 $500 F Price variance Plastic Casing (4,250 × $3) $12,750 $12,500 $250 F Price variance Direct Manufacturing Labor (2,040 × $18) $36,720 $37,200 $480 U Price variance Flexible Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) (4,400 × 1.02 × $20) $89,760 $760 F Efficiency variance (4,400 × 0.20 × $50) $44,000 $3,200 F Efficiency variance (4,400 × 1 × $3) $13,200 $450 F Efficiency variance (4,400 × 0.50 × $18) $39,600 $2,880 F Efficiency variance 2. Actions employees may have taken include: (a) Adding steps that are not necessary in working on a GPS unit. (b) Taking more time on each step than is necessary. (c) Creating problem situations so that the budgeted amount of average downtime and rates of spoilage of materials will be overstated. (d) Creating defects in units so that the budgeted amount of average rework will be overstated. Employees may take these actions for several possible reasons. (a) They may be paid on a piece-rate basis with incentives for above-budgeted production. (b) They may want to create a relaxed work atmosphere, and a less demanding standard can reduce stress. (c) They have a “them vs. us” mentality rather than a partnership perspective. (d) They may want to gain all the benefits that ensue from superior performance (job security, wage rate increases) without putting in the extra effort required. This behavior is unethical if it is deliberately designed to undermine the credibility of the standards used at Sunto Scientific. 3. If Williams does nothing about standard costs, his behavior will violate the “Standards of Ethical Conduct for Management Accountants.” In particular, he would be violating the (a) standards of competence, by not performing technical duties in accordance with relevant standards; (b) standards of integrity, by passively subverting the attainment of the organization’s objective to control costs; and (c) standards of credibility, by not communicating information fairly and not disclosing all relevant cost information. 4. Williams should discuss the situation with Kelso and point out that the standards are lax and that this practice is unethical. If Kelso does not agree to change, Williams should escalate the issue up the hierarchy in order to effect change. If organizational change is not forthcoming, Williams should be prepared to resign rather than compromise his professional ethics. 5. are Main pros of using Competitive Intelligence Institute information to compute variances (a) Highlights to Sunto in a direct way how it may or may not be cost-competitive. (b) Provides a “reality check” to many internal positions about efficiency or effectiveness. Main cons are (a) Sunto (and the Savannah plant in particular) may not be comparable to companies in the database. (b) Cost data about other companies may not be reliable. (c) Cost of Competitive Intelligence Institute reports. Try It! 7-1 (a) Static-budget variance for revenues = (28,000 units × $11) − (27,500 units × $12) = $308,000 − $330,000 = $22,000 U (b) Static-budget variance for variable costs = $90,000 − (27,500 units × $3) = $7,500 U (c) Static-budget variance for fixed costs = $55,000 − $58,000 = $3,000 F (d) Static-budget variance for operating income = $26,500 U Units sold Revenues Variable costs Contribution margin Fixed costs Operating income Actual Results 28,000 Static Budget 27,500 Static-Budget Variance $308,000 90,000 $218,000 55,000 $163,000 $330,000 82,500 $247,500 58,000 $189,500 $22,000 7,500 29,500 3,000 $26,500 U U U F U Try It! 7-2 (a) Flexible budget for revenues = Actual units × Budgeted selling price per unit = 28,000 units × $12 = $336,000 (b) Flexible budget for variable costs = Actual units × Budgeted variable cost per unit = 28,000 units × $3 = $84,000 (c) Flexible budget for fixed costs = Static budget = $58,000 (d) Flexible budget for operating income = $336,000 − $84,000 − $58,000 = $194,000 Try It! 7-3 Variance Analysis for Zenefit Corporation Units sold Revenues (a) Variable costs (b) Contribution margin Fixed costs (c) Operating income (d) Actual Results (1) 28,000 $308,000 90,000 218,000 55,000 $ 163,000 Level 2 FlexibleBudget Variances (2) = (1)-(3) $ 28,000 U 6,000 U 34,000 U 3,000 F $31,000 U Flexible Budget (3) 28,000 $336,000 84,000 252,000 58,000 $194,000 $31,000 U Flexible-budget variance Level 1 Sales Volume Variance (4) = (3)-(5) $ 6,000 F 1,500 U 4,500 F 0 $4,500 F a. Direct materials variances: Actual unit cost = $68,600/14,000 square yards = $4.90 per square yard Price variance = 14,000 × ($5.00 - $4.90) = $1,400 F Efficiency variance = $5.00 × [14,000 - (1,500 × 10)] = $5,000 F b. Direct manufacturing labor variances: Actual labor rate = $79,800/7,600 = $10.50 per hour Price variance = 7,600 × ($10.50 - $10.00) = $3,800 U Efficiency variance = $10.00 × (7,600 - 7,500) = $1,000 U $330,000 82,500 247,500 58,000 $189,500 $ 4,500 F Sales-volume variance $26,500 U Static-budget variance Try It! 7-4 Static Budget (5) 27,500