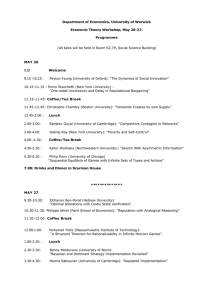

Global Enterprise Experience (GEE) THE EVEROAST COFFEE Team 91 ID 2247s 1989p 1990p 1464s 1120s 2236s 1470p Name Kaleb Anderson Arun Shrestha Guinness Lakhe Brody Skipper Antoneya Graves Jonathan Lemma Marthe Mukangiriye University Country Victoria University of Wellington Kathmandu University School of Management Kathmandu University School of Management University of Otago Alliant International University-Fresno HU University of Applied Sciences Utrecht University of Rwanda New Zealand Nepal Nepal New Zealand United States Netherlands Rwanda May 2020 English as 1st or 2nd language 1st 2nd 2nd 1st 1st 2nd 1st Team 91: GEE The Everoast Coffee, Nepal Table of Contents Executive Summary 1 A. Concept 1 B. Marketing Plan 2 C. Financial Plan 4 D. Implementation Plan 6 Future Outlook 6 References 7 Team 91: GEE The Everoast Coffee, Nepal Executive Summary Despite possessing immense potential in terms of suitable habitat for coffee cultivation, Nepal has yet to realize this opportunity as much as possible. However, coffee farming is slowly starting to become more of a reality for local Nepalese farmers, due to the availability of land resources, and general need for economic growth within Nepal, though this pace of adoption of coffee by local farmers remains sluggish and marred by various challenges even for existing coffee farmers. Although the availability of resources and opportunities of growth provides a business option for farmers, Nepal has concerning issues of economic stagnation throughout various farming districts, where quality and quantity of adequate employment is scarce, as well as these districts having low levels of quality of life. The Everoast Coffee venture, our business proposal, aims to provide an economically beneficial, yet sustainable start-up in the Kavrepalanchowk district, in Bagmati Province of Nepal, that educates local farmers on the cultivation and growth of coffee plants, as well as provide them with the processing and distributing capacities for the coffee bean industry, one that has been established internationally, in which local farmers produce Coffea arabica b eans and distribute the products to their international market through the globally accredited Trade Aid initiative (Trade Aid, 2020), which shall help enhance UN Sustainable Development Goal No. 8: “Decent Work and Economic Growth” by stimulating local communities’ economic growth with well-paying livelihoods for the people in this region. The initial capital investment for the company would be NPR. 1,715,521/-, which would be financed by owners themselves (no debt portion). In the first two years of operation, The Everoast Coffee will incur a net loss of NPR. 270,097/- and NPR. 135,625/-. Nonetheless, after the third year, the company is expected to sell at least 77% of the overall production to the target market. Capital budgeting techniques (PBP: 3.71 years, NPV: NPR. 775,910/-, IRR: 19.60%) are used to appraise the project and have shown that the proposed investment is considerably attractive and shall provide hefty returns to its investors. A. Concept Coffee is an ever-popular beverage, with high international demand for organic coffee with richer taste. The domestic demand itself for the coffee is growing in Nepal, as such the domestic coffee production can barely keep with the international demand. Most of the coffee for domestic consumption has to be imported. However, coffee farming has a tremendously unrealized potential in Nepal. Despite 1,198,535 ha. of land being deemed suitable for coffee cultivation (NTCBD, 2018) in 62 out of 77 districts, in 6 out of 7 provinces of Nepal, currently, only 972.6 ha. of land is being used for farming of coffee in 32 districts of 4 provinces, a mere 0.08% of land being used. A gross under-utilization compared to suitable habitat. The most popular and widely-grown species of coffee known as ‘Arabica’ (Coffea arabica) is best cultivated in high elevations of 1,300 to 2,800 m above sea level but without frosting. It also requires an average temperature between 15 and 24°C. As such, a great portion of the mid-hill regions of Nepal, throughout east to west, qualify these necessary conditions sufficiently as a suitable habitat for production of Arabica coffee. Although there is already a certain level of commercial coffee production being carried out in a select few regions, which is highly fragmented in terms of geographical distribution and is rudimentary in terms of organization. Also, there lie problems of economic stagnation, youth unemployment, lack of decent-paying jobs, and low quality of life in these regions. This can be observed while being on the ground. Furthermore, farmers who are already growing coffee are not being full beneficiaries of their produce as a significant amount of value addition in coffee occurs only after the processing and roasting phase. Due to a lack of processing facilities in local regions, they sell their unprocessed coffee to select few companies, in urban areas, who derive most of the value generated after due processing and export in the international markets under their own brands. Hence, this shows that the full extent of economic benefits that the local communities can derive from coffee farming is still yet to be realized. Page 1 / 6 Team 91: GEE The Everoast Coffee, Nepal Nepali coffee remains in high demand, yet current practices ensure that the efforts of local farmers are stifled, even though Nepal has the climate, topography, and soil type to excel. Lack of adequate support and no development in farming practices are some of the problems plaguing coffee farmers. Identifying and understanding the challenges facing Nepali coffee farmers, and why these challenges need to be resolved for Nepal to become a major exporter of its much sought-after coffee. Problems faced by coffee farmers, such as white and red borer and lack of quality seedlings ensure that there are significant drops in the production of coffee, as farmers must bear losses without any support from the government. As a result, Nepali farmers are withdrawing from coffee farming. On the other hand, farmers need to ensure that they have enough food to sustain themselves, and parts of their lands are used in planting crops like rice, not realizing that seeing the coffee beans can be sustainable. Many farmers turned to coffee farming (as a ‘cash crop’) due to its growing demand in the international market, and this has provided them with an escape from poverty, due to a higher value than traditional crops like maize and millet. Coffee contributes about 10% to annual household income and has shown that it can lift people out of poverty (Acharya & Dhakal, 2014). Unfortunately, many of these farmers lack relevant information, and the employment of archaic practices ensures that Nepal's potentials remain untapped. While coffee farmers can be said to be self-sustaining (as plantations are mostly privately owned) and are surviving without government support/aid for the most part, government aid is essential to ensure that demand is met by improving farmers’ knowledge in technology. Therefore, our idea for a low-cost startup, The Everoast Coffee, is to set up a small-to-medium scale integrated commercial coffee production business in the Kavrepalanchowk district of Nepal. To serve the domestic market in the growing number of urbanizing cities of Nepal. This shall entail all activities from cultivation and harvesting to processing, packaging, marketing and distribution, all the while retaining the value chain in the local level itself. We shall achieve this by allowing the local farmers themselves to have a stake in our startup, so that we are not only producing coffee plants locally but also have a small-scale processing facility locally. In return, our farmers can derive the greatest extent of value that can be generated from their yield. This shall be furthering UN Sustainable Development Goal No. 8: “Decent Work and Economic Growth” by stimulating local communities’ economic growth and by providing good-paying jobs for the people in the region. B. Marketing Plan There are two phases for The Everoast Coffee to generate profit. Firstly, informing and encouraging farmers to participate, buy-in, and invest in our program. Secondly, distributing the roasted coffee beans to consumers. Because of this, there are two market segments, with separate target markets and campaigns. The Farmers Currently in Nepal, agriculture is the largest and broadest sector. Almost 66% of Nepal’s population takes agriculture as the main source of food, income, and employment (Transcend Vision Pvt. Ltd., 2018). The government of Nepal had established a Coffee Research Program in 2013 and according to the study, coffee production in Nepal has extended to 41 districts occupying 2,600 hectares of land, farmed by approximately 32,500 people (Tuladhar, 2020). These farmers face dilemmas whether to farm their land for food to feed themselves (i.e. ‘food crops’) or to farm more profitable crops like Coffea arabica (i.e. ‘cash crops’). Farmers in Nepal have two major barriers to competitive coffee farming: (i) access to education/tools and (ii) processing/distributing. Farmers firstly need quality seeds, currently the supply of planting materials is unmonitored, resulting in non-pure seeds and poor nursery standards. Furthermore, the geographical conditions prove hard work in Nepal. Coffee must be planted with adequate spacing, irrigation and fertilisation. All of which creates efficiency. Secondly, farmers do not have access to high quality machinery to process green coffee beans into a drinkable roasted product, as these machines need to be imported and are quite expensive. Due to this issue, farmers are selling their unprocessed beans at undervalued prices to companies that have processing and distributing capacities. Parallel to this is the lack of distribution channels, especially internationally. Creating a bottleneck for profit maximisation for the farmers and their local communities. Page 2 / 6 Team 91: GEE The Everoast Coffee, Nepal Majority of farmers in Nepal live in rural communities, which is where we will focus our marketing strategy. Through beliefs and values market segmentation, we will inspire farmers to join our program highlighting the potential coffee has, sustainability efforts, return on investment, and their integrated inclusion in the coffee production value chain. It is paramount we meet the needs due to the struggles farmers in Nepal encounter, we shall provide motivation to them while being respectful to the culture. The Consumers Trade Aid is a social enterprise helping talented people around the world improve their lives through fair trade accredited by the World Fair Trade Organisation (Trade Aid, 2020). Trade Aid will be targeted because of their well-known sustainable products, along with the undeniable trust consumers have in the brand. This platform also educates consumers on modern day slavery within supply chains and informational packages are provided on products and organisations that sell through Trade Aid. This will act as a starting point for our brand awareness. Consumers can not only see the process their coffee has taken, but the local farmers who make it possible. We will be targeting these international consumers through psychographic segmentation. Trade Aid consumers are sustainability-minded and enjoy helping workers in unfavourable conditions. According to the University of Chicago, conscious consumers have three common emotions driving behaviour, contempt, concern and celebration. Contempt is the negative feeling they have towards poor ethical movements. Concerns reflect the danger of the workers situations. Celebration occurs when purchasing a Fair Trade product knowing they are supporting a good cause (Gopaldas, 2014). An application will need to be made to Trade Aid to have our product being sold on their platform. The World Fair Trade Organisation will review our business to ensure our practises meet the standard. Communication Farmers in Nepal have limited resources, not all communities have easy online access. To convey our package, traditional marketing channels such as print publications and local community events will be held. Detailed information is easier to express in person, where language barriers can be broken down with expression, tone and translation. The farmers will feel more secure this way. Business with foreign organisations can be daunting, especially with current and previous companies taking advantage of the locals. The communication strategy will be a combination of joint ventures and word-of-mouth. The benefits of this is firstly gaining knowledge from the locals. By having them join with us we can utilise tacit knowledge we could have possibly not researched ourselves. Word-of-mouth will travel fast around farming communities in Nepal. Once one community has experienced a positive interaction with Everoast, it is fair to assume that locals will side with a more ethical and fair focused company. Consumers, i.e. the end users of the product, will have multiple channels to reach Everoast. Majority of this operation will happen online. The first point of contact is the website, followed by the Trade Aid website. Here consumers will be able to learn everything about the company and products offered. Videos will be made for social media distribution. Social media platforms will be constantly updated and reviewed. This allows Everoast to create specific online advertisement campaigns and respond to customers. Multi-channel communication strategies will be developed parallel to chosen channels. A mix of content, social media and word of mouth marketing strategies will be at the main focus. The mix is broad enough to reach many types of customers, as coffee consumers can vary in demographics. Strategies will be developed through specific advertisement campaigns. These will need to be distinct to the different markets as our company expands. Product Mix Width – Physical tools, seeds, fertiliser, irrigation, machinery, distribution, education. Length – ● Physical Tools (husking, rakes, digging, forrest knives, knapsack sprayer, coffee pulpers, fencing) ● Seeds (Quality Coffea arabica seeds) ● Fertiliser (Super-phosphate, m3 growing mixture Rock-phosphate, micronutrients, KCl) Page 3 / 6 Team 91: GEE ● ● ● ● The Everoast Coffee, Nepal Irrigation (Water source, pumping system, filtering system, main network, driplines, sprinklers) Machinery (Wet coffee system, green coffee processing system, drying system, roaster) Distribution (Types of marketing, shipment, Trade Aid, packaging) Education (Video, pamphlets, flyers, brochures, face-to-face, online) Depth – No product has more than one variant. Consistency – The relationship between the products are very closely related in regard to business, they are all needed to grow coffee. Yet the products themselves are quite different in the way they are produced and delivered. C. Financial Plan The Everoast Coffee will require a minimum investment of around NPR 1,715,521/- in its initial phase. This amount would be used primarily for two purposes: (a) to lease 0.1526 hectare (3 ropani) of land in Kavrepalanchok district, and (b) to purchase a low-cost delivery truck; while the remaining capital will be held in cash/bank in order to cover the forthcoming operational expenses. All the funding shall be provided by the owner themselves. Similarly, in 2022, the business will require an additional investment of NPR 463,104/-, which would be used to purchase three machineries, namely: pulper machine, packaging machine, and roasting machine (air roasting). Since it usually takes a minimum of three years after planting of the coffee saplings to produce fruits, the first two years of the business would not generate positive cash flows as there would be no stable sources of income for the company. But the business is expected to rebound after the third year, as coffee plants will start bearing fruit by that time. As we will adopt modern tools and techniques in farming, our production is expected to be slightly higher than normal coffee production per ropani in Nepal, possible via only conventional, rudimentary means. As per our estimate, we can produce up to 1,200 kg of coffee beans in 2022 alone. After undergoing processing (from de-pulping to fermentation & roasting) and then proper packaging, such coffee beans will be put up for sale in the international market at a price not less than NPR 2,000/- (or NZ$ 27.1) per kg of finished product, thereby generating good revenue for the company. However, we expect our sales unit to be less than total production in our early phases, considering the impact of several other externalities such as underselling, distribution of free samples as promotional materials, and/or inventory loss. Similarly, other anticipated income and expenses for our business are shown in the projected income statement shown here. Our initial estimate also indicates that we would pass the break-even point (BEP) if we could sell 257 kg (BEP in sales of NPR 512,904/-) of coffee beans in 2022. However, since our projected sales unit is almost three times as large as the break-even quantity, we can Page 4 / 6 Team 91: GEE The Everoast Coffee, Nepal comfortably make profit during that year. In addition to these, Everoast Coffee also needs to pay more attention (close monitoring) to its major costs such as wages, transportation costs; and try to minimize the extra expenses as much as possible. Similarly, the table below displays some of the financial indicators, such as, the payback period (PBP), Net Present Value (NPV) and Internal Return Rate (IRR) for the company’s operations. As shown in the table, the payback period is 3.71 years, i.e. investment in the company is said to be recovered in 3.71 years. Likewise, the positive NPV of NPR 775,910/- in the first five years of the company shows that it is undoubtedly a good investment idea as present value of cash inflow is higher than that of its outflow. Healthy IRR of 19.60% also adds to the attractiveness of the business proposal (comparing this with average fixed deposit rate in Nepal of 9.75%). Ultimately, our financial projections show that our profitability will gradually start to increase after the first yield and harvest of coffee fruits/’cherry’, from 2022 onwards, for distribution to our markets. The initial investment funding requirement of NPR 1,715,521/-, in conjunction with the education training package offered ensures the local farmers have the appropriate resources and knowledge to carry out the production of coffee beans through all phases of the coffee process. Furthermore, the profitability projections provide an indication of how the local farmers can financially benefit from engaging in the coffee venture. D. Implementation Plan For the location of operations, we have chosen Kavrepalanchowk district in the Bagmati Province, which has the one of the largest proportion of suitable habitat areas for the growth and cultivation of Arabica coffee. Currently, only 104.3 ha of land is being used by 943 farms/farmers in this district (CBS, 2019), however, a total of 47,548 ha of area has been identified as suitable for Arabica coffee by NTCDB (2018), which has been further broken down into 28,544 ha of Moderately Suitable area, 18,206 ha of Suitable area, 799 ha of Highly Suitable area; on the basis of parameters such as elevation, slope, slope-aspect/direction, precipitation, and temperature necessary for coffee. Kavrepalanchowk district is well-connected via the B.P. Highway, which goes on to connect to the East-West Highway and from there, access to Sirisya dry port in the ICP Birgunj, which shall be necessary to international logistics and distribution to Trade Aid. Also, Kavrepalanchowk district is situated only 25 km due east from the capital city of Kathmandu, which has the only international airport of the country for any necessary air-based logistics, and furthermore, alternative access to dry port in the ICP Birgunj can be had via Prithvi Highway and Mugling-Narayangarh road. This makes the access to the market and upstream supplier closer to the locus of our operations. Page 5 / 6 Team 91: GEE The Everoast Coffee, Nepal Necessary land acquisition for cultivation shall be conducted in accordance with the findings of NTCDB (2018), and then bought or leased for long-term for a suitable consideration. Farmers can also work their self-owned lands, with commitment of taking up stake in our startup, and other interested locals can work in the leased areas of lands. As per the published data in NTCDB (2018), Mandandeupur Rural Municipality and Bhumlu Rural Municipality, within Kavrepalanchowk district, specifically show high promise as the most appropriate location for operation of our startup with their 443 ha. and 207 ha. respectively in Highly Suitable Area designation, the highest within this district. Also, Namobuddha Municipality (2,767 ha.), Chaurideurali Rural Municipality (2,528 ha.), and Roshi Rural Municipality (2,454 ha.) have the greatest shares of Suitable Area designation. These short-listed locations will be surveyed for the final selection on the basis of available access via the road network, level of physical infrastructure, ease of land acquisition, and interest shown by local communities towards our business model. As it takes the coffee plant about 3-5 years to start bearing fruits, the farmers, aligning themselves with our business, shall be allowed to receive the learning package from us first with no cost. later on, when the coffee they have planted starts to bear fruit, they can pitch in their investment in the company in proportion to their initial commitment and as per their produced yield. Our startup shall be registered as a body corporate, a private limited (Pvt. Ltd.) to be precise, under the prevailing laws of Nepal (Company Act, 2006), and also obtain all necessary business licences to operate as an agricultural (Small and Cottage Industry licence, tax registration-PAN & VAT) and export-oriented business (EXIM code). The initial setup of overall operations shall be segregated into two phases: (i) first, we shall provide the farmers with necessary knowledge and training package, and also necessary tools, equipment, and chemical supplies for the cultivation, and (ii) second, after the coffee plants start to actually bear fruits and then they are harvested, the integrated value chain, from processing to packaging & branding, shall be retained at the local level itself, so as to make farmers also a distinct beneficiary of the value added in this due process. Also, and then marketing and distributing shall also be carried out through our startup. Due to this distinct timeline of the coffee plant to bear fruit, we can set up the first phase with low initial investment cost and relative ease, as we shall only be dealing with provision for learning packages for the farmers and dealing with upstream suppliers for providing necessary tools, equipment, and supplies. Only in the second phase of our setup, shall we be requiring the substantial portion of investment required for the necessary processing, packaging, and distributing facilities. As we reach the time to kick-off this second phase, coffee plants shall start to bear fruit, thus allowing us access to finance on the basis of reliable collateral, i.e. the yield itself. Regarding the capital need for the startup, national commercial banks (Class ‘A’) and development banks (Class ‘B’) shall be reached out to and approached for necessary loans and this proposal shall also be presented to them. Many banks of both categories have various, special credit packages for agricultural businesses and small and medium enterprises (SMEs). Everoast Coffee shall discuss with a few of these financial institutions and then acquire the loan for necessary capital on the basis of criteria that needs to be fulfilled and interest rate and credit terms offered. Also after the harvest, participating farmers shall be depositing their investments as initially committed and in proportion to their yield, for which our learning package to them in the first phase was instrumental. Future Outlook The projection of coffee bean farming in Nepal is projected to gradually expand over the successive years. The Everoast Coffee production and sales are forecasted to increase, as potential opportunities of obtaining additional farming land by partnering with farmers from neighboring areas within the same Kavrepalanchowk district as well as other districts in the vicinity (Ramechhap, Dhading, Nuwakot) of Nepal become potential business options. The future of distribution looks promising. After gaining brand equity from Trade Aid, our distribution channels have room to expand. The domestic demand for coffee is also on the rise, as more and more individuals as well as businesses (such as restaurants, cafes, hotels) are immersing themselves in the ‘coffee culture’, therefore, providing the option for The Everoast Coffee to venture into the domestic market, especially, in the booming urban centres of Nepal. Everoast will also set goals for business to business transactions. We are aiming to have our roasted beans as the number one choice in cafes around the world. Cafes would order our beans in wholesale weekly installments to sustain the demands of their cafe. Page 6 / 6 Team 91: GEE The Everoast Coffee, Nepal References Acharya, B., & Dhakal, S. (2014). Profitability And Major Problems Of Coffee Production In Palpa District, Nepal. ResearchGate. Retrieved from: https://www.researchgate.net/publication/273191327_Profitability_and_Major_Problems_of_Coffee_Production_in _Palpa_District_Nepal Adhikari, D. (2018, October 7). Nepal -- the latest specialty coffee grower. R etrieved from: https://asia.nikkei.com/Life-Arts/Life/Nepal-the-latest-specialty-coffee-grower Central Bureau of Statistics (CBS), Government of Nepal. (2019). Nepal Commercial Coffee Survey 2019. Retrieved from: https://nada.cbs.gov.np/index.php/catalog/94/download/1128 Dave, & Longest Way Home. (2017, July 22). The Best Coffee Beans & Roasters in Nepal. R etrieved from: https://www.thelongestwayhome.com/blog/nepal/the-best-coffee-beans-roasters-in-nepal Ethirajan, A. (2013, February 27). Nepal farmers brew success with coffee cultivation. Retrieved from: https://www.bbc.com/news/business-21583681 Gopaldas, A. (2014, December). Why Are Consumers Willing to Spend More Money on Ethical Products? Retrieved from University of Chicago Press: https://press.uchicago.edu/pressReleases/2014/September/140923_JCR_ethical_products_consumers_spend_m ore.html Kumar, H. (2019). Coffee sector performing below potential due to archaic ways. Kathmandupost.com. Retrieved from: https://kathmandupost.com/money/2019/12/22/coffee-sector-performing-below-potential-due-to-archaic-ways National Tea and Coffee Development Board, Government of Nepal. (2018). Analysis of Habitat Suitability of Coffee (Coffea arabica) in Nepal. Retrieved from: https://www.teacoffee.gov.np/public/images/pdf-21561443544.pdf National Tea and Coffee Development Board, Government of Nepal. (2014). Coffee Database in Nepal. Retrieved from: https://www.teacoffee.gov.np/public/images/pdf-1576489411.pdf