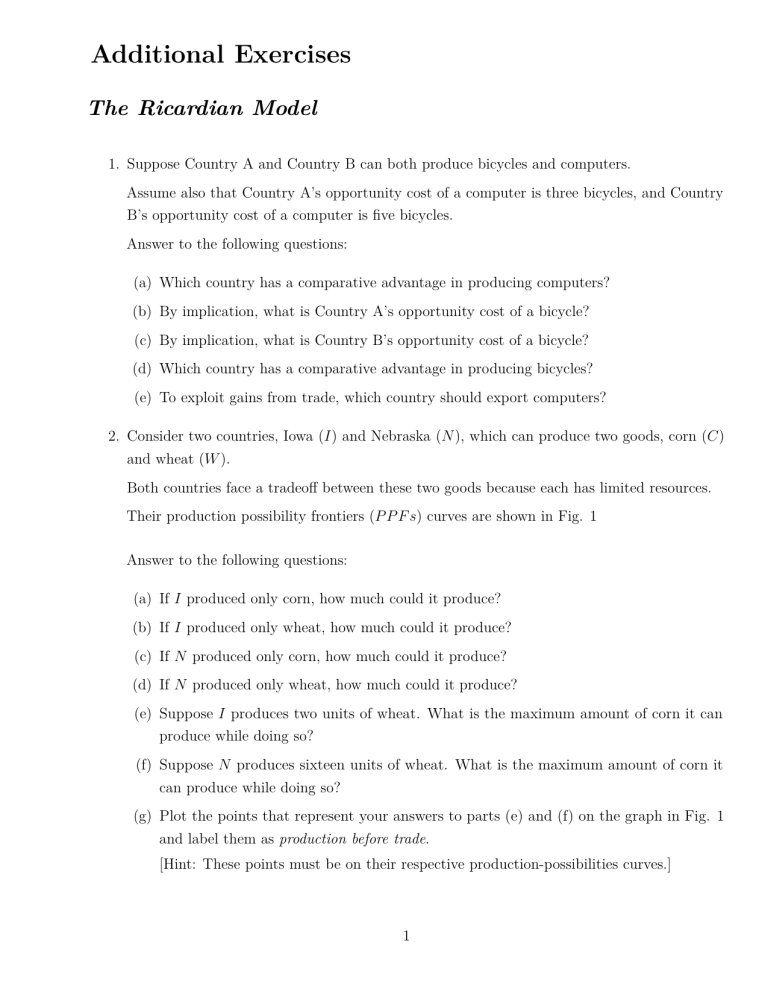

Additional Exercises The Ricardian Model 1. Suppose Country A and Country B can both produce bicycles and computers. Assume also that Country A’s opportunity cost of a computer is three bicycles, and Country B’s opportunity cost of a computer is five bicycles. Answer to the following questions: (a) Which country has a comparative advantage in producing computers? (b) By implication, what is Country A’s opportunity cost of a bicycle? (c) By implication, what is Country B’s opportunity cost of a bicycle? (d) Which country has a comparative advantage in producing bicycles? (e) To exploit gains from trade, which country should export computers? 2. Consider two countries, Iowa (I) and Nebraska (N ), which can produce two goods, corn (C) and wheat (W ). Both countries face a tradeoff between these two goods because each has limited resources. Their production possibility frontiers (P P F s) curves are shown in Fig. 1 Answer to the following questions: (a) If I produced only corn, how much could it produce? (b) If I produced only wheat, how much could it produce? (c) If N produced only corn, how much could it produce? (d) If N produced only wheat, how much could it produce? (e) Suppose I produces two units of wheat. What is the maximum amount of corn it can produce while doing so? (f) Suppose N produces sixteen units of wheat. What is the maximum amount of corn it can produce while doing so? (g) Plot the points that represent your answers to parts (e) and (f) on the graph in Fig. 1 and label them as production before trade. [Hint: These points must be on their respective production-possibilities curves.] 1 QC 6 13 P PP PP 12 A PP PP A A A A I A A A N PP PP P PP P PP P PP P PP PP P A A A A PP P PP P PP P 4 PP 26 - QW Figure 1 (h) What is I’s opportunity cost of a unit of wheat? [That is, if I was already producing somewhere on its PPF and decided to increase production of wheat by one unit, how many units of corn would it have to give up producing?] (i) What is N ’s opportunity cost of a unit of wheat? (j) What is I’s opportunity cost of a unit of corn? [That is, if I was already producing somewhere on its PPF and decided to increase the production of corn by one unit, how many units of wheat would it have to give up producing?] (k) What is the opportunity cost of a unit of corn in N ? (l) Which state has a comparative advantage in producing wheat? (m) Which state has a comparative advantage in producing corn? (n) Given the levels of production you plotted in part (g), is it possible for I and N to trade wheat and corn so that both states can consume combinations of corn and wheat outside their respective PPFs? Motivate your answer and possibly give an example. 2 Multiple Choice Questions 1: Countries trade with each other because they are . . . and because of . . . . a: different, costs b: similar, scale economies c: different, scale economies d: similar, costs e: None of the above. 2: Trade a: b: c: d: e: between two countries can benefit both countries if each country exports that good in which it has a comparative advantage. each country enjoys superior terms of trade. each country has a more elastic demand for the imported goods. each country has a more elastic supply for the supplied goods. Both C and D. 3: The Ricardian theory of comparative advantage states that a country has a comparative advantage in widgets if a: output per worker of widgets is higher in that country. b: that country’s exchange rate is low. c: wage rates in that country are high. d: the output per worker of widgets as compared to the output of some other product is higher in that country. e: Both B and C. 4: In order to know whether a country has a comparative advantage in the production of one particular product we need information on at least . . . unit labor requirements a: one b: two c: three d: four e: five 5: A country engaging in trade according to the principles of comparative advantage gains from trade because it a: is producing exports indirectly more efficiently than it could alternatively. b: is producing imports indirectly more efficiently than it could domestically. c: is producing exports using fewer labor units. d: is producing imports indirectly using fewer labor units. e: None of the above. 3 6: Given the following information (in terms of unit labor requirements): a: b: c: d: e: Country Cloth Widgets Home 10 20 Foreign 60 30 Neither country has a comparative advantage. Home has a comparative advantage in cloth. Foreign has a comparative advantage in cloth. Home has a comparative advantage in widgets. Home has a comparative advantage in both products. 7: If the Home economy suffered a meltdown, and the Unit Labor Requirements in each of the products tripled (that is, go to 30 for cloth and to 60 for widgets) then home should a: export cloth. b: export widgets. c: export both and import nothing. d: export and import nothing. e: All of the above. 8: If wages were to double in Home, then Home should: a: export cloth. b: export widgets c: export both and import nothing. d: export and import nothing. e: All of the above. 9: In a two product two country world, international trade can lead to increases in a: consumer welfare only if output of both products is increased. b: output of both products and consumer welfare in both countries. c: total production of both products but not consumer welfare in both countries d: consumer welfare in both countries but not total production of both products. e: None of the above. 10: A nation engaging in trade according to the Ricardian model will find its consumption bundle a: inside its production possibilities frontier. b: on its production possibilities frontier. c: outside its production possibilities frontier. d: inside its trade-partner’s production possibilities frontier. e: on its trade-partner’s production possibilities frontier. 4 11: If a very small country trades with a very large country according to the Ricardian model, then a: the small country will suffer a decrease in economic welfare. b: the large country will suffer a decrease in economic welfare. c: the small country will enjoy gains from trade. d: the large country will enjoy gains from trade. e: None of the above. 12: If the world terms of trade for a country are somewhere between the domestic cost ratio of H and that of F, then a: country H but not country F will gain from trade. b: country H and country F will both gain from trade. c: neither country H nor F will gain from trade. d: only the country whose government subsidizes its exports will gain. e: None of the above. 13: If the a: b: c: d: e: world terms of trade equal those of country F, then country H but not country F will gain from trade. country H and country F will both gain from trade. neither country H nor F will gain from trade. only the country whose government subsidizes its exports will gain. None of the above. 14: According to Ricardo, a country will have a comparative advantage in the product in which its a: labor productivity is relatively low. b: labor productivity is relatively high. c: labor mobility is relatively low. d: labor mobility is relatively high. e: None of the above. 15: In a two-country, two-product world, the statement "Germany enjoys a comparative advantage over France in autos relative to ships" is equivalent to a: France having a comparative advantage over Germany in ships. b: France having a comparative disadvantage compared to Germany in autos and ships. c: Germany having a comparative advantage over France in autos and ships. d: France having no comparative advantage over Germany. e: None of the above. 5 16: Assume that labor is the only factor of production and that wages in the United States equal $20 per hour while wages in Japan are $10 per hour. Production costs would be lower in the United States as compared to Japan if a: U.S. labor productivity equaled 40 units per hour and Japan’s 15 units per hour. b: U.S. productivity equaled 30 units per hour whereas Japan’s was 20. c: U.S. labor productivity equaled 20 and Japan’s 30. d: U.S. labor productivity equaled 15 and Japan’s 25 units per hour. e: None of the above. 6 The HOS Model Multiple Choice Questions 1: In the 2-factor, 2 good Heckscher-Ohlin model, an influx of workers from across the border would a: move the point of production along the production possibility curve. b: shift the production possibility curve outward, and increase the production of both goods. c: shift the production possibility curve outward and decrease the production of the labor-intensive product. d: shift the production possibility curve outward and decrease the production of the capital-intensive product. e: None of the above. 2: In the a: b: c: d: e: 2-factor, 2 good Heckscher-Ohlin model, the two countries differ in tastes. military capabilities. size. relative availabilities of factors of production. labor productivities. 3: In the 2-factor, 2 good Heckscher- Ohlin model, a change from autarky (no trade) to trade will benefit the owners of a: capital. b: the relatively abundant factor of production. c: the relatively scarce factor of production. d: the relatively inelastic factor of production e: the factor of production with the largest elasticity of substitution. 4: According to the Heckscher-Ohlin model, the source of comparative advantage is a country’s a: technology. b: advertising. c: human capital. d: factor endowments. e: Both A and B 7 5: The Hechscher-Ohlin model states that a country will have a comparative advantage in the good or service whose production is relatively intensive in the . . . with which the country is relatively abundant. a: tastes. b: technology. c: factor of production. d: opportunity cost. e: scale economy. 6: One way in which the Heckscher-Ohlin model differs from the Ricardo model of comparative advantage is by assuming that . . . is (are) identical in all countries. a: factor of production endowments b: scale economies c: factor of production intensities d: technology e: opportunity costs 7: Starting from an autarky (no-trade) situation with Heckscher-Ohlin model, if Country H is relatively labor abundant, then once trade begins a: wages and rents should rise in H b: wages and rents should fall in H c: wages should rise and rents should fall in H. d: wages should fall and rents should rise in H. e: None of the above. 8: Which of the following is false for the HO model? a: If tastes are not identical in both countries, wages may still equalize. b: Differences in technologies could be the source of gains from trade. c: Some groups may gain and some may lose due to trade. d: Gains for the trade-related winners will tend to be larger than losses of losers. e: None of the above. 9: Suppose that there are two factors, capital and land, and that the United States is relatively land endowed while the European Union is relatively capital-endowed. According to the HeckscherOhlin model a: European landowners should support US-European free trade. b: European capitalists should support US-European free trade. c: all capitalists in both countries should support free trade. d: all landowners should support free trade. e: None of the above. 8 10: Assume that only two countries, A and B, exist. Consider the following endowments: LA = 45 KA = 15 LB = 20 KB = 10 and assume that good S is K-intensive. Then, following the HO Theory a: country A will export good S. b: country B will export good S. c: both countries will export good S. d: trade will not occur between these two countries. e: Insufficient information is given. 11: Continuing from the previous question, if you are told that Country B is very much richer than Country A, then the correct answer is: a: country A will export good S. b: country B will export good S. c: both countries will export good S. d: trade will not occur between these two countries. e: insufficient information is given. 12: The following are all assumptions that must be accepted in order to apply the Heckscher-Ohlin Theory, except for one: a: countries differ in their endowments of factors of production. b: countries differ in their technologies. c: there are two factors of production. d: production is subject to constant returns to scale. e: one product always requires more machines per worker in its production than does the other product. 13: In international-trade equilibrium in the Heckscher-Ohlin model a: the capital-rich country will charge less for the capital intensive good than the price paid by the capital-poor country for the capital-intensive good. b: the capital-rich country will charge the same price for the capital intensive good as that paid for it by the capital-poor country. c: the capital-rich country will charge more for the capital intensive good than the price paid by the capital-poor country for the capital-intensive good. d: the workers in the capital-rich country will earn more than those in the poor country. e: the workers in the capital-rich country will earn less than those in the poor country. 9 14: The slope of the PPF of a country reflects a: the opportunity cost of product 1 in terms of product 2. b: the opportunity cost of 2 in terms of money prices. c: the opportunity cost of 1 or 2 in terms of S. d: Both (a) and (b) e: Both (a) and (c) 15: The Heckscher-Ohlin model differs from the Ricardian model of Comparative Advantage in that the former a: has only two countries. b: has only two products. c: has two factors of production. d: has two production possibility frontiers (one for each country). e: None of the above. Essay Questions 1. A good cannot be both land- and labor-intensive. Discuss 2. No country is abundant in everything. Discuss. 10 The Standard Trade Model Multiple Choice Questions 1: The concept terms of trade means a: the amount of exports sold by a country. b: the price conditions bargained for in international markets. c: the price of a country’s exports divided by the price of its imports. d: the quantities of imports received in free trade. e: None of the above. 2: A country cannot produce a mix of products with a higher value than where a: the isovalue line intersects the production possibility frontier. b: the isovalue line is tangent to the production possibility frontier. c: the isovalue line is above the production possibility frontier. d: the isovalue line is below the production possibility frontier. e: the isovalue line is tangent with the indifference curve. 3: Tastes a: b: c: d: e: of individuals are represented by the production possibility frontier. the isovalue line. the indifference curve. the production function. None of the above. 4: If PC /PF (where C denotes cloth and F stands for food) was to increase in the international marketplace, then a: all countries would be better off. b: the terms of trade of cloth exporters improve. c: the terms of trade of food exporters improve. d: the terms of trade of all countries improve. e: None of the above 5: If PC /PF (where C denotes cloth and F stands for food) was to increase, a: the cloth exporter would increase the quantity of cloth exports. b: the cloth exporter would increase the quantity of cloth produced. c: the food exporter would increase the quantity of food exports. d: Both A and B e: None of the above. 11 6: If PC /PF (where C denotes cloth and F stands for food) was to increase a: world relative quantity of cloth supplied and demanded increases. b: world relative quantity of cloth supplied and demanded decreases. c: world relative quantity of cloth supplied increases. d: world relative quantity of cloth demanded decreases. e: None of the above. 7: When the production possibility frontier shifts out relatively more in one direction, we have a: biased growth. b: unbiased growth. c: immiserizing growth. d: balanced growth. e: imbalanced growth. 8: In a world with only two countries, export-biased growth in Country H will a: improve the terms of trade of Country H. b: trigger anti-bias regulations of the WTO. c: worsen the terms of trade of Country F (the trade partner). d: improve the terms of trade of Country F. e: decrease economic welfare in Country H. 9: Immiserizing growth is a: likely to occur if the exporting country is poor. b: likely to occur if the exporting country is rich. c: likely to occur when terms of trade change. d: likely to occur if relative supplies are elastic. e: None of the above. 10: If two a: b: c: d: e: points are both on the production possibility frontier of a country, then consumers are indifferent between the two bundles. producers are indifferent between the two bundles. at any point in time, the country could produce both. Both cost the same. The country could produce either of the two bundles. 12 11: A bundle indicated by a point to the northeast of the production possibility frontier is a: unattainable at a point in time. b: unattainable at a point in time without international trade. c: unattainable at a point in time without domestic trade. d: unattainable as a consumption point. e: None of the above. 12: If, beginning from a free trade equilibrium, the terms of trade improve for a country, then it will a: increase production of its import competing good. b: increase consumption of its export good. c: increase the quantity of its imports. d: experience an export-biased shift in its production possibility frontier. e: None of the above. 13: Immiserizing growth could occur to a: a poor country experiencing export-biased economic growth. b: a poor country experiencing import-biased economic growth. c: a poor country experiencing growth in its non-traded sector. d: a poor country experiencing capital-intensive biased growth. e: None of the above. 14: A large country experiencing import-biased economic growth will tend to experience a: positive terms of trade. b: deteriorating terms of trade. c: improving terms of trade. d: immiserizing terms of trade. e: None of the above. 13 Graphing Problem Consider Fig.2. It represents the situation of a country which originally refuses to engage in international trade for ideological reasons. 1. Which point in the Figure must it choose to produce so as to maximize its economic welfare? Suppose that PA /PB is originally (i.e. in autarky) equal to 1. 2. Given this information, in which good (A or B) does the country enjoy a comparative advantage? Later on, the country is interested in obtaining economic welfare gains from trade. The relevant international relative price is PA /PB = 2. 3. At which point would the country choose to produce (a, b, or c)? 4. Given this additional information, in which good does the country enjoy a comparative advantage? Now, suppose that the relative price of good A is actually not higher than the country’s autarkic level of 1, but the opposite (e.g. PA /PB = 0.5). 5. Would such country still be able to gain from trade? 6. If so, where would its production point be? 7. Given the information in this question, where is the CA of this country? Suppose, as a result of various dynamic factors associated with exposure to international competition, that the economy grew and it is now represented by the rightmost PPF (that is, the P P F2 ) in Figure 2. 8. If the point of production with trade was point c, would you consider this growth to be export - biased or import - biased? 9. What if the point of production with trade was point b? How does your previous answer modify? Why? 14 QA 6 ............................................................. ..................................... ............................. ......................... .................... ................... ........................................... ................. .............................. ................ ........................ ............... .................... .............. .................. .. ............. ................ .. ............. ............... .. ............ ............. .. ........... ............. ........... . ............ . . . . .......... .... ............ .......... ........... .......... ............. .......... .. ......... .. .......... ......... .. ......... ......... .. ......... ........ .. ........ ......... ... ........ ........ ........ ........ ... ....... ........ ... ....... ....... ....... ... ....... ....... ....... . ....... ... ....... ....... ...... ....... ...... .... ...... .. ....... ...... ... ...... ...... .. ...... ........ ...... ......... ...... ....... ...... ..... ...... ....... ...... ....... ...... ......... ...... ......... ..... ....... .... ...... .... ........ .... .............. .... .... ........... .... .... ............. .... . . . .... .............. .. .................... .... ............................................. ...... .... .... .... .... .... .... .... .... .... .... .... .... ... .... ... .... ... ... .... ... .... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... .. ... .. ... .. .. ... .. ... .. .. ... .. ... .. .. ... .. ... .. .. ... .. ... .. .. ... .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... .. .. ub ua uc P P F1 P P F2 - QB Figure 2 15 Economies of Scale, Trade and Imperfect Competition Multiple Choice Questions 1: External economies of scale arise when the cost per unit a: rises as the industry grows larger. b: falls as the industry grows larger rises as the average firm grows larger. c: falls as the average firm grows larger. d: remains constant. e: None of the above. 2: External economies of scale a: may be associated with a perfectly competitive industry. b: cannot be associated with a perfectly competitive industry. c: tends to result in one huge monopoly. d: tends to result in large profits for each firm. e: None of the above. 3: A monopolistic firm a: can sell as much as it wants for any price it determines in the market. b: cannot determine the price, which is determined by consumer demand. c: will never sell a product whose demand is inelastic at the quantity sold. d: cannot sell additional quantity unless it raises the price on each unit. e: None of the above. 4: Monopolistic competition is associated with a: cut-throat price competition. b: product differentiation. c: explicit consideration at firm level of the feedback effects of other firms’ pricing decisions. d: high profit margins. e: None of the above. 5: When by a: b: c: d: e: there are economies of scale, the scale of production possible in a country is constrained the size of the country. the size of the trading partner’s country. the size of the domestic market. the size of the domestic plus the foreign market. None of the above. 16 6: When a: b: c: d: e: there are economies of scale, an increase in the size of the market will increase the number of firms and raise the price per unit. decrease the number of firms and raise the price per unit. increase the number of firms and lower the price per unit. decrease the number of firms and lower the price per unit. None of the above. 7: If output more than doubles when all inputs are doubled, production is said to occur under conditions of a: increasing returns to scale. b: imperfect competition. c: intra-industry trade. d: inter-industry trade. e: None of the above. 8: A monopoly firm engaged in international trade will a: equate average to local costs. b: equate marginal costs with foreign marginal revenues. c: equate marginal costs with the highest price the market will bear. d: equate marginal costs with marginal revenues in both domestic and in foreign markets. e: None of the above. 9: A firm in monopolistic competition a: earns positive monopoly profits because each sells a differentiated product. b: earns positive oligopoly profits because each firm sells a differentiated product. c: earns zero economic profits because it is in perfectly or pure competition. d: earns zero economic profits because of free entry. e: None of the above. 10: The larger the number of firms in a monopolistic competition situation, a: the larger are that country’s exports. b: the higher is the price charged. c: the fewer varieties are sold. d: the lower is the price charged. e: None of the above. 17 11: In industries in which there are scale economies, the variety of goods that a country can produce is constrained by a: the size of the labor force. b: anti-trust legislation c: the size of the market. d: the fixed cost. e: None of the above. 12: An industry is characterized by scale economies and exists in two countries. Should these two countries engage in trade such that the combined market is supplied by one country’s industry, then a: consumers in both countries would suffer higher prices and fewer varieties. b: consumers in the importing country would suffer higher prices and fewer varieties. c: consumers in the exporting country would suffer higher prices and fewer varieties. d: consumers in both countries would enjoy fewer varieties available but lower prices. e: None of the above. 13: An industry is characterized by scale economies and exists in two countries. In order for consumers of its products to enjoy both lower prices and more variety of choice, a: each country’s marginal cost must equal that of the other country. b: the marginal cost of this industry must equal marginal revenue in the other. c: the monopoly must lower prices in order to sell more. d: the two countries must engage in international trade one with the other. e: None of the above. 14: A product is produced in a monopolistically competitive industry with scale economies. If this industry exists in two countries, and these two countries engage in trade one with the other, then we would expect a: the country in which the price of the product is lower will export the product. b: the country with a relative abundance of the factor of production in which production of the product is intensive will export this product. c: each of the countries will export different varieties of the product to the other. d: neither country will export this product since there is no comparative advantage. e: None of the above. 15: The reason why one country may export a product which is produced with positive scale economies is a: its labor productivity will tend to be higher. b: it enjoys a relative abundance of the factor intensely used in the product’s production. c: its demand is biased in favor of the product. d: its demand is biased against the product. e: None of the above. 18 16: Two countries engaged in trade in products with no scale economies, produced under conditions of perfect competition, are likely to be engaged in a: monopolistic competition. b: inter-industry trade. c: intra-industry trade. d: Heckscher-Ohlin trade. e: None of the above. 17: Two countries engaged in trade in products with scale economies, produced under conditions of monopolistic competition, are likely to be engaged in a: price competition. b: inter-industry trade. c: intra-industry trade. d: Heckscher-Ohlinean trade. e: None of the above. Essay Questions 1. Why is it that when an industry is operating under conditions of domestic internal scale economies (i.e. applied to a firm within an industry, in the country) then the resultant equilibrium cannot be consistent with the pure competition model? 2. If positive scale economies characterize an industry, is it possible that the equilibrium may be consistent with purely competitive conditions ? Explain how this could happen. 3. If scale economies are the dominant technological factor defining or establishing comparative advantage, then the underlying facts explaining why a particular country dominates world markets in some product may be pure chance, or historical accident. Explain the statement and compare this answer with the one you would give for the HO model of comparative advantage. 19 Solutions to Additional Exercises The Ricardian Model 1. (a) We know that the OC of a computer is 3 bicycles in A and 5 bicycles in B. Given that the first is lower than the second one, the right answer is country A. (b) If the OC of a computer is 3 bicycles, then it follows that the OC of a bicycle is 1/3. (c) By the same reasoning, the OC of a bicycle in Country B is 1/5 (d) Given that the OC of a bicycle is 1/5 in Country B and 1/3 in Country A, the right answer is Country B ( 1/5 = 0.2 < 1/3 = 0.3̄) (e) According to the Ricardian Model, each country must specialize in the good where it has a CA. In this case, from the first answer we know that Country A has a CA in producing computers, so the right answer is Country A. 2. (a) 12 (b) 4 (c) 13 (d) 26 To answer to the following questions, it is convenient to write down the equations of the two PPFs. Consider the following: aLC QC + aLW QW = L which we can solve by QC : QC = aLW L − QW . aLC aLC (1) From Fig.1 we can infer that the slope (in absolute value) of the PPF for Country N is given by to 13/26 = 1/2. We also know that such slope is equal to aLW /aLC , so for N we obtain: aLW 1 = aLC 2 Once we know this ratio, we need to also determine L. 20 This can be done as follows. For QW = 0, we know that QC = 13. Thus, by plugging these values we know into eq. (1) (recall also that aLC = 2 and QW = 0) we obtain: 13 = L 2 → L = 26 so we can rewrite eq. (1) for N as: QC = 26 1 − QW 2 2 1 QC = 13 − QW 2 → (Country N) (2) An analogous reasoning, mutatis mutandis, allows us to define eq. (1) for I as: QC = 12 − 3QW (Country I) (3) (e) You just need to substitute QW = 2 into eq. (3) so as to obtain QC = 6 (f) In this case you to substitute QW = 16 into eq. (2) so as to obtain QC = 5 (g) (h) You can easily identify the OC of 1 unit of wheat for I by considering eq. (3). Hence, such OC is 3. (i) By considering eq. (2), you can easily notice that the OC of 1 unit of wheat in N is 1/2. To answer to the two following questions, it suffice to consider the reciprocal of the previous ratios. Hence: (j) The OC of a unit of corn in I is equal to 1/3. (k) The OC of a unit of corn in N is equal to 2. (l) By comparing the OCs of the two countries in the previous answers, it is clear that N has a CA in producing wheat. (m) By contrast, I has a CA in producing corn. (n) The answer to the question is clearly yes. From the Ricardian model, we know that both countries will gain from trade if: aLW a∗ < p < LW aLC a∗LC where in this case we know that: aLW 1 = aLC 2 21 and a∗LW =3 a∗LC For the world relative price p the following then must hold: 1/2 < p < 3. Assume that p = 3/5 and both countries initially specialize in the production of the good where they have a CA, so the total production of wheat in N is 26, while that of corn in I is 13. Then, if N trades 10 units of wheat at p = 3/5, it obtains 10 × 53 = 6 units of corn, thus ending with 16 units of wheat and 6 of corn. If you represent this point in Fig. 1, you will immediately notice that it lies above the PPF of N . The same holds for the other country, I: it ends with 10 units of wheat and 6 of corn, which is still above its PPF. [As an additional proof, try to substitute either QC or QW in the equations that define the PPFs of the two countries to obtain the maximum amount of the other good that each country could produce if it was in autarky. You will find that, with trade, both I and N end up with a greater amount of both goods.] Answers to Multiple Choice Questions 1: Countries trade with each other because they are . . . and because of . . . . a: different, costs b: similar, scale economies ** c: different, scale economies ** d: similar, costs e: None of the above. 2: Trade between two countries can benefit both countries if ** a: each country exports that good in which it has a comparative advantage. ** b: each country enjoys superior terms of trade. c: each country has a more elastic demand for the imported goods. d: each country has a more elastic supply for the supplied goods. e: Both C and D. 22 3: The Ricardian theory of comparative advantage states that a country has a comparative advantage in widgets if a: output per worker of widgets is higher in that country. b: that country’s exchange rate is low. c: wage rates in that country are high. ** d: the output per worker of widgets as compared to the output of some other product is higher in that country. ** e: Both B and C. 4: In order to know whether a country has a comparative advantage in the production of one particular product we need information on at least . . . unit labor requirements a: one b: two c: three ** d: four ** e: five 5: A country engaging in trade according to the principles of comparative advantage gains from trade because it a: is producing exports indirectly more efficiently than it could alternatively. ** b: is producing imports indirectly more efficiently than it could domestically. ** c: is producing exports using fewer labor units. d: is producing imports indirectly using fewer labor units. e: None of the above. 6: Given the following information ( in terms of unit labor requirements): a: ** b: c: d: e: Country Cloth Widgets Home 10 20 Foreign 60 30 Neither country has a comparative advantage. Home has a comparative advantage in cloth. Foreign has a comparative advantage in cloth. Home has a comparative advantage in widgets. Home has a comparative advantage in both products. 23 ** 7: If the Home economy suffered a meltdown, and the Unit Labor Requirements in each of the products tripled (that is, go to 30 for cloth and to 60 for widgets) then home should ** a: export cloth. ** b: export widgets. c: export both and import nothing. d: export and import nothing. e: All of the above. 8: If wages were to double in Home, then Home should: ** a: export cloth. ** b: export widgets c: export both and import nothing. d: export and import nothing. e: All of the above. 9: In a two product two country world, international trade can lead to increases in a: consumer welfare only if output of both products is increased. ** b: output of both products and consumer welfare in both countries. ** c: total production of both products but not consumer welfare in both countries d: consumer welfare in both countries but not total production of both products. e: None of the above. 10: A nation engaging in trade according to the Ricardian model will find its consumption bundle a: inside its production possibilities frontier. b: on its production possibilities frontier. ** c: outside its production possibilities frontier. ** d: inside its trade-partner’s production possibilities frontier. e: on its trade-partner’s production possibilities frontier. 11: If a very small country trades with a very large country according to the Ricardian model, then a: the small country will suffer a decrease in economic welfare. b: the large country will suffer a decrease in economic welfare. ** c: the small country will enjoy gains from trade. ** d: the large country will enjoy gains from trade. e: None of the above. 24 12: If the world terms of trade for a country are somewhere between the domestic cost ratio of H and that of F, then a: country H but not country F will gain from trade. ** b: country H and country F will both gain from trade. ** c: neither country H nor F will gain from trade. d: only the country whose government subsidizes its exports will gain. e: None of the above. 13: If the ** a: b: c: d: e: world terms of trade equal those of country F, then country H but not country F will gain from trade. ** country H and country F will both gain from trade. neither country H nor F will gain from trade. only the country whose government subsidizes its exports will gain. None of the above. 14: According to Ricardo, a country will have a comparative advantage in the product in which its a: labor productivity is relatively low. ** b: labor productivity is relatively high. ** c: labor mobility is relatively low. d: labor mobility is relatively high. e: None of the above. 15: In a two-country, two-product world, the statement "Germany enjoys a comparative advantage over France in autos relative to ships" is equivalent to ** a: France having a comparative advantage over Germany in ships. ** b: France having a comparative disadvantage compared to Germany in autos and ships. c: Germany having a comparative advantage over France in autos and ships. d: France having no comparative advantage over Germany. e: None of the above. 16: Assume that labor is the only factor of production and that wages in the United States equal $20 per hour while wages in Japan are $10 per hour. Production costs would be lower in the United States as compared to Japan if ** a: U.S. labor productivity equaled 40 units per hour and Japan’s 15 units per hour. ** b: U.S. productivity equaled 30 units per hour whereas Japan’s was 20. c: U.S. labor productivity equaled 20 and Japan’s 30. d: U.S. labor productivity equaled 15 and Japan’s 25 units per hour. e: None of the above. 25 The HOS Model Answers to Multiple Choice Questions 1: In the 2-factor, 2 good Heckscher-Ohlin model, an influx of workers from across the border would a: move the point of production along the production possibility curve. b: shift the production possibility curve outward, and increase the production of both goods. c: shift the production possibility curve outward and decrease the production of the labor-intensive product. ** d: shift the production possibility curve outward and decrease the production of the capital-intensive product. ** e: None of the above. 2: In the a: b: c: ** d: e: 2-factor, 2 good Heckscher-Ohlin model, the two countries differ in tastes. military capabilities. size. relative availabilities of factors of production. ** labor productivities. 3: In the 2-factor, 2 good Heckscher- Ohlin model, a change from autarky (no trade) to trade will benefit the owners of a: capital. ** b: the relatively abundant factor of production. ** c: the relatively scarce factor of production. d: the relatively inelastic factor of production e: the factor of production with the largest elasticity of substitution. 4: According to the Heckscher-Ohlin model, the source of comparative advantage is a country’s a: technology. b: advertising. c: human capital. ** d: factor endowments. ** e: Both A and B 26 5: The Hechscher-Ohlin model states that a country will have a comparative advantage in the good or service whose production is relatively intensive in the . . . with which the country is relatively abundant. a: tastes. b: technology. ** c: factor of production. ** d: opportunity cost. e: scale economy. 6: One way in which the Heckscher-Ohlin model differs from the Ricardo model of comparative advantage is by assuming that . . . is (are) identical in all countries. a: factor of production endowments b: scale economies c: factor of production intensities ** d: technology ** e: opportunity costs 7: Starting from an autarky (no-trade) situation with Heckscher-Ohlin model, if Country H is relatively labor abundant, then once trade begins a: wages and rents should rise in H b: wages and rents should fall in H ** c: wages should rise and rents should fall in H. ** d: wages should fall and rents should rise in H. e: None of the above. 8: Which of the following is false for the HO model? a: If tastes are not identical in both countries, wages may still equalize. ** b: Differences in technologies could be the source of gains from trade. ** c: Some groups may gain and some may lose due to trade. d: Gains for the trade-related winners will tend to be larger than losses of losers. e: None of the above. 9: Suppose that there are two factors, capital and land, and that the United States is relatively abundant in land endowed while the European Union is relatively abundant in capital. According to the Heckscher-Ohlin model a: European landowners should support US-European free trade. ** b: European capitalists should support US-European free trade. ** c: all capitalists in both countries should support free trade. d: all landowners should support free trade. e: None of the above. 27 10: Assume that only two countries, A and B, exist. Consider the following endowments: LA = 45 KA = 15 LB = 20 KB = 10 and assume that good S is K-intensive. Then, following the HO Theory a: country A will export good S. ** b: country B will export good S. ** c: both countries will export good S. d: trade will not occur between these two countries. e: Insufficient information is given. 11: Continuing from the previous question, if you are told that Country B is very much richer than Country A, then the correct answer is: a: country A will export good S. ** b: country B will export good S. ** c: both countries will export good S. d: trade will not occur between these two countries. e: insufficient information is given. 12: The following are all assumptions that must be accepted in order to apply the Heckscher-Ohlin Theory, except for one: a: countries differ in their endowments of factors of production. ** b: countries differ in their technologies. ** c: there are two factors of production. d: production is subject to constant returns to scale. e: one product always requires more machines per worker in its production than does the other product. 13: In international-trade equilibrium in the Heckscher-Ohlin model a: the capital-rich country will charge less for the capital intensive good than the price paid by the capital-poor country for the capital-intensive good. ** b: the capital-rich country will charge the same price for the capital intensive good as that paid for it by the capital-poor country. ** c: the capital-rich country will charge more for the capital intensive good than the price paid by the capital-poor country for the capital-intensive good. d: the workers in the capital-rich country will earn more than those in the poor country. e: the workers in the capital-rich country will earn less than those in the poor country. 28 14: The slope of the PPF of a country reflects ** a: the opportunity cost of product 1 in terms of product 2. b: the opportunity cost of 2 in terms of money prices. c: the opportunity cost of 1 or 2 in terms of S. d: Both (a) and (b) ** e: Both (a) and (c) 15: The Heckscher-Ohlin model differs from the Ricardian model of Comparative Advantage in that the former a: has only two countries. b: has only two products. ** c: has two factors of production. ** d: has two production possibility frontiers (one for each country). e: None of the above. Essay Questions 1. A good cannot be both land- and labor-intensive. Discuss Answer: In the HO framework, factor intensities are relative intensities. Hence, the relevant statistic that must be considered is either the ratio of Labour (L) over Land (T ), namely L/T, or the opposite, T/L. In order to illustrate the logic of such statement, one can consider the following example. The production of 1 unit of good C requires 4 workers and 1 acre, while the production of 1 unit of good W requires 40 workers and 80 acres. In this case the acres per person required to produce 1 unit of C is one quarter, whereas to produce 1 unit of W requires 2 acres per person. Good W is therefore relatively land intensive, while good C is relatively labor intensive. 2. No country is abundant in everything. Discuss. Answer: the concept of relative factor abundance of a country is, like that of factor intensities in the previous answer, a relative concept. When you identify a country as being capital intensive, it means that it has more capital per worker than the other country (given that in the HO framework only two countries are considered). Hence, if one country has more capital per worker than the other one, it is impossible that it also has more workers per unit of capital. 29 The Standard Trade Model Multiple Choice Questions 1: The concept terms of trade means a: the amount of exports sold by a country. b: the price conditions bargained for in international markets. ** c: the price of a country’s exports divided by the price of its imports. ** d: the quantities of imports received in free trade. e: None of the above. 2: A country cannot produce a mix of products with a higher value than where a: the isovalue line intersects the production possibility frontier. ** b: the isovalue line is tangent to the production possibility frontier. c: the isovalue line is above the production possibility frontier. d: the isovalue line is below the production possibility frontier. e: the isovalue line is tangent with the indifference curve. 3: Tastes a: b: ** c: d: e: ** of individuals are represented by the production possibility frontier. the isovalue line. the indifference curve. ** the production function. None of the above. 4: If PC /PF (where C denotes cloth and F stands for food) was to increase in the international marketplace, then a: all countries would be better off. ** b: the terms of trade of cloth exporters improve. ** c: the terms of trade of food exporters improve. d: the terms of trade of all countries improve. e: None of the above 5: If PC /PF (where C denotes cloth and F stands for food) was to increase, a: the cloth exporter would increase the quantity of cloth exports. ** b: the cloth exporter would increase the quantity of cloth produced. c: the food exporter would increase the quantity of food exports. d: Both A and B e: None of the above. 30 ** 6: If PC /PF (where C denotes cloth and F stands for food) was to increase a: world relative quantity of cloth supplied and demanded increases. b: world relative quantity of cloth supplied and demanded decreases. ** c: world relative quantity of cloth supplied increases. ** d: world relative quantity of cloth demanded decreases. e: None of the above. 7: When the production possibility frontier shifts out relatively more in one direction, we have ** a: biased growth. ** b: unbiased growth. c: immiserizing growth. d: balanced growth. e: imbalanced growth. 8: In a world with only two countries, export-biased growth in Country H will a: improve the terms of trade of Country H. b: trigger anti-bias regulations of the WTO. c: worsen the terms of trade of Country F (the trade partner). ** d: improve the terms of trade of Country F. e: decrease economic welfare in Country H. ** 9: Immiserizing growth is a: likely to occur if the exporting country is poor. b: likely to occur if the exporting country is rich. c: likely to occur when terms of trade change. d: likely to occur if relative supplies are elastic. ** e: None of the above. ** 10: If two a: b: c: d: ** e: points are both on the production possibility frontier of a country, then consumers are indifferent between the two bundles. producers are indifferent between the two bundles. at any point in time, the country could produce both. Both cost the same. The country could produce either of the two bundles. ** 31 11: A bundle indicated by a point to the northeast of the production possibility frontier is a: unattainable at a point in time. ** b: unattainable at a point in time without international trade. ** c: unattainable at a point in time without domestic trade. d: unattainable as a consumption point. e: None of the above. 12: If, beginning from a free trade equilibrium, the terms of trade improve for a country, then it will a: increase production of its import competing good. b: increase consumption of its export good. ** c: increase the quantity of its imports. ** d: experience an export-biased shift in its production possibility frontier. e: None of the above. 13: Immiserizing growth could occur to ** a: a poor country experiencing export-biased economic growth. b: a poor country experiencing import-biased economic growth. c: a poor country experiencing growth in its non-traded sector. d: a poor country experiencing capital-intensive biased growth. e: None of the above. ** 14: A large country experiencing import-biased economic growth will tend to experience a: positive terms of trade. b: deteriorating terms of trade. ** c: improving terms of trade. ** d: immiserizing terms of trade. e: None of the above. 32 Graphing Problem 1. Answer: the country would choose to produce where the PPF (P P F1 ) is tangent to the indifference curve, namely at point a. 2. With no reference to the world terms of trade, it is impossible to establish in which good the country enjoys a CA. 3. See answer (4) 4. Answer: when the country gains knowledge about the fact that the international relative price is PA /PB = 2, it knows that it has a comparative advantage in the production of good A, thus it would make its production at point b. In other words, when PA /PB = 2, the country knows that on the international markets the relative price of A equals twice the price of B, thus it will exploit its CA in good A and exports such good while importing the other one, good B. 5. See answer (7) 6. See answer (7) 7. Answer: yes, the country will still be able to gain from trade because there is still a difference between the world’s terms of trade and those of such country. Given the hypothesis, now the country knows that it has a CA in the production of good B, so its point of production with trade will no longer be point b, but rather point c. 8. Answer: if the production point with trade is originally point c (where the country exports good B and imports good A due to its CA in good B), then from the shape of the new PPF (P P F2 ) as compared to the initial one (P P F1 ) we clearly have an export-biased growth. 9. Answer: obviously, if the production point with trade was point b, then the observed growth would have been an explicit case of import-biased growth, which would have improved the country’s terms of trade. 33 Economies of Scale, Trade and Imperfect Competition Multiple Choice Questions 1: External economies of scale arise when the cost per unit a: rises as the industry grows larger. ** b: falls as the industry grows larger rises as the average firm grows larger. ** c: falls as the average firm grows larger. d: remains constant. e: None of the above. 2: External economies of scale ** a: may be associated with a perfectly competitive industry. b: cannot be associated with a perfectly competitive industry. c: tends to result in one huge monopoly. d: tends to result in large profits for each firm. e: None of the above. ** 3: A monopolistic firm a: can sell as much as it wants for any price it determines in the market. b: cannot determine the price, which is determined by consumer demand. ** c: will never sell a product whose demand is inelastic at the quantity sold. ** d: cannot sell additional quantity unless it raises the price on each unit. e: None of the above. 4: Monopolistic competition is associated with a: cut-throat price competition. ** b: product differentiation. ** c: explicit consideration at firm level of the feedback effects of other firms’ pricing decisions. d: high profit margins. e: None of the above. 34 5: When by a: b: c: ** d: e: there are economies of scale, the scale of production possible in a country is constrained 6: When a: b: ** c: d: e: there are economies of scale, an increase in the size of the market will increase the number of firms and raise the price per unit. decrease the number of firms and raise the price per unit. increase the number of firms and lower the price per unit. decrease the number of firms and lower the price per unit. None of the above. the size of the country. the size of the trading partner’s country. the size of the domestic market. the size of the domestic plus the foreign market. None of the above. ** ** 7: If output more than doubles when all inputs are doubled, production is said to occur under conditions of ** a: increasing returns to scale. ** b: imperfect competition. c: intra-industry trade. d: inter-industry trade. e: None of the above. 8: A monopoly firm engaged in international trade will a: equate average to local costs. b: equate marginal costs with foreign marginal revenues. c: equate marginal costs with the highest price the market will bear. ** d: equate marginal costs with marginal revenues in both domestic and in foreign markets. ** e: None of the above. 9: A firm in monopolistic competition a: earns positive monopoly profits because each sells a differentiated product. b: earns positive oligopoly profits because each firm sells a differentiated product. c: earns zero economic profits because it is in perfectly or pure competition. ** d: earns zero economic profits because of free entry. ** e: None of the above. 35 10: The larger the number of firms in a monopolistic competition situation, a: the larger are that country’s exports. b: the higher is the price charged. c: the fewer varieties are sold. ** d: the lower is the price charged. ** e: None of the above. 11: In industries in which there are scale economies, the variety of goods that a country can produce is constrained by a: the size of the labor force. b: anti-trust legislation ** c: the size of the market. ** d: the fixed cost. e: None of the above. 12: An industry is characterized by scale economies and exists in two countries. Should these two countries engage in trade such that the combined market is supplied by one country’s industry, then a: consumers in both countries would suffer higher prices and fewer varieties. b: consumers in the importing country would suffer higher prices and fewer varieties. c: consumers in the exporting country would suffer higher prices and fewer varieties. d: consumers in both countries would enjoy fewer varieties available but lower prices. ** e: None of the above. ** 13: An industry is characterized by scale economies and exists in two countries. In order for consumers of its products to enjoy both lower prices and more variety of choice, a: each country’s marginal cost must equal that of the other country. b: the marginal cost of this industry must equal marginal revenue in the other. c: the monopoly must lower prices in order to sell more. ** d: the two countries must engage in international trade one with the other. ** e: None of the above. 14: A product is produced in a monopolistically competitive industry with scale economies. If this industry exists in two countries, and these two countries engage in trade one with the other, then we would expect a: the country in which the price of the product is lower will export the product. b: the country with a relative abundance of the factor of production in which production of the product is intensive will export this product. ** c: each of the countries will export different varieties of the product to the other. ** d: neither country will export this product since there is no comparative advantage. e: None of the above. 36 15: The reason why one country may export a product which is produced with positive scale economies is a: its labor productivity will tend to be higher. b: it enjoys a relative abundance of the factor intensely used in the product’s production. c: its demand is biased in favor of the product. d: its demand is biased against the product. ** e: None of the above. ** 16: Two countries engaged in trade in products with no scale economies, produced under conditions of perfect competition, are likely to be engaged in a: monopolistic competition. ** b: inter-industry trade. ** c: intra-industry trade. d: Heckscher-Ohlin trade. e: None of the above. 17: Two countries engaged in trade in products with scale economies, produced under conditions of monopolistic competition, are likely to be engaged in a: price competition. b: inter-industry trade. ** c: intra-industry trade. ** d: Heckscher-Ohlinean trade. e: None of the above. Essay Questions 1. Why is it that when an industry is operating under conditions of domestic internal scale economies (i.e. applied to a firm within an industry, in the country) then the resultant equilibrium cannot be consistent with the pure competition model? Answer (intuition). The equilibrium cannot be consistent with the pure competition model because if one firm becomes bigger than another for some reason (or in the case one firm begins the industry), then there will be no other firm which is able to match its per unit cost and any potential competitor will be driven out of the industry. 37 2. If positive scale economies characterize an industry, is it possible that the equilibrium may be consistent with purely competitive conditions ? Explain how this could happen. Answer (intuition). Yes, the answer is affirmative. In this case it is sufficient to recall the definition of external economies of scale: external economies of scale occur when the cost per unit depends on the size of the industry but not necessarily on the size of one firm. As productivity depends on various external factors and firms can therefore set the price equal to the marginal cost, there is no reason why the firms may not be in perfect competition. 3. If scale economies are the dominant technological factor defining or establishing comparative advantage, then the underlying facts explaining why a particular country dominates world markets in some product may be pure chance, or historical accident. Explain the statement and compare this answer with the one you would give for the HO model of comparative advantage. Answer (intuition). The statement proposed in the question is a true one in the sense that the seller could have reached his monopolist position just as a consequence of the fact that he was the first to start producing a specific product in a given country. To be more precise, this may have no connection neither with supply/demand related factors, nor with any natural or man-made availability of the factors of production. As you may notice, such an explanation is exactly the opposite as the one of the determinants of comparative advantage proposed by the Heckscher-Ohlin model . 38