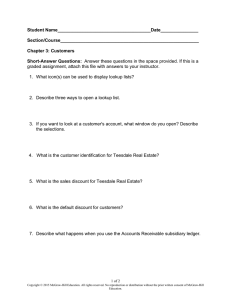

UNIT 5 Home The sales journal is used to record credit sales of merchandise. The cash receipts journal is used to record the cash a business receives. Home Glencoe Accounting Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Identify the special journals and explain how they are used in a merchandising business. Record transactions in sales and cash receipts journals. Post from the sales and cash receipts journals to customer accounts in the accounts receivable subsidiary ledger. Foot, prove, total, and rule the sales and cash receipts journals. Post column totals from the sales and cash receipts journals to general ledger accounts. Prepare a schedule of accounts receivable. Home Glencoe Accounting Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Section 16.1 The Sales Journal Key Terms special journals sales journal footing Home Glencoe Accounting Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Using Special Journals Section 16.1 The Sales Journal Sales Journal Sale of merchandise on account Most Commonly Used Special Journals Cash Receipts Journal Receipt of cash Purchases Journal Purchase of any asset on account Cash Payments Journal Payment of cash, including payment by check special journals Journals that have amount columns for recording debits and credits to specific general ledger accounts. Home Glencoe Accounting Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Sales Journal Section 16.1 The Sales Journal Sales Journal See page 454 sales journal A special journal used to record only the sale of merchandise on account. Home Glencoe Accounting Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Sales Journal Section 16.1 The Sales Journal Recording Sales of Merchandise on Account Business Transaction On December 1 The Starting Line sold merchandise on account to Casey Klein for $200 plus $12 sales tax, Sales Slip 50. Home Glencoe Accounting See page 454 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Sales Journal Section 16.1 The Sales Journal Posting a Sale Journal Entry to the Accounts Receivable Subsidiary Ledger See page 456 Home Glencoe Accounting Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Sales Journal Section 16.1 The Sales Journal The Sales Credit Posted Column Totals for the Sales Journal The Sales Tax Payable Credit The Accounts Receivable Debit Home Glencoe Accounting Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Sales Journal Section 16.1 The Sales Journal Footing, Proving, Totaling, and Ruling the Sales Journal footing A column total written in small pencil figures. See page 457 Home Glencoe Accounting Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Sales Journal Section 16.1 The Sales Journal Posting the Total of the Sales Credit Column Home Glencoe Accounting See page 458 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Sales Journal Section 16.1 The Sales Journal Posting the Total of the Sales Tax Payable Credit Column Home Glencoe Accounting See page 458 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Sales Journal Section 16.1 The Sales Journal Posting the Total of the Accounts Receivable Debit Column Home Glencoe Accounting See page 459 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Sales Journal Section 16.1 The Sales Journal Proving the Sales Journal at the End of a Page Sometimes the transactions will not fit on a single page. When this occurs, the journal page must be totaled and ruled before a new page is started. Home Glencoe Accounting See page 460 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Section 16.2 The Cash Receipts Journal Key Terms cash receipts journal schedule of accounts receivable Home Glencoe Accounting Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Cash Receipts Journal Section 16.2 The Cash Receipts Journal The Cash Receipts Journal Home Glencoe Accounting See page 462 cash receipts journal A special journal used to record all transactions in which cash is received. Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Cash Receipts Journal Section 16.2 The Cash Receipts Journal Recording Cash from Charge Customers Business Transaction On December 5 The Starting Line received $212 from Casey Klein to apply on account, Receipt 301. Home Glencoe Accounting See page 463 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Cash Receipts Journal Section 16.2 The Cash Receipts Journal Recording Cash Received on Account, Less a Cash Discount Business Transaction On December 12 The Starting Line received $1,470 from South Branch High School Athletics in payment of Sales Slip 51 for $1,500 less the discount of $30, Receipt 302. Home Glencoe Accounting See page 464 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Cash Receipts Journal Section 16.2 The Cash Receipts Journal Recording Cash Sales Business Transaction On December 15 The Starting Line records the cash sales for the first two weeks of December, $3,000, and $180 in related sales taxes, Tape 55. Home Glencoe Accounting See page 464 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Cash Receipts Journal Section 16.2 The Cash Receipts Journal Recording Bankcard Sales Business Transaction On December 15 The Starting Line recorded bankcard sales of $700 for the first two weeks of December and related sales taxes of $42, Tape 55. Home Glencoe Accounting See page 465 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Cash Receipts Journal Section 16.2 The Cash Receipts Journal Recording Other Cash Receipts Business Transaction On December 16 The Starting Line received $30 from Mandy Harris, an office employee. She purchased a calculator that the business was no longer using, Receipt 303. Home Glencoe Accounting See page 466 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Cash Receipts Journal Section 16.2 The Cash Receipts Journal Posting to the Accounts Receivable Subsidiary Ledger Home Glencoe Accounting See page 466 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Cash Receipts Journal Section 16.2 The Cash Receipts Journal Posting to the General Credit Column Home Glencoe Accounting See page 467 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Journalizing and Posting to the Cash Receipts Journal Section 16.2 The Cash Receipts Journal Posting Column Totals to the General Ledger See page 469 Home Glencoe Accounting Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Using the Schedule of Accounts Receivable Section 16.2 The Cash Receipts Journal To prove the accounts receivable subsidiary ledger, accountants prepare a schedule of accounts receivable. schedule of accounts receivable A list of each charge customer, the balance in the customer’s account, and the total amount due from all customers. Home Glencoe Accounting Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Using the Schedule of Accounts Receivable Section 16.2 The Cash Receipts Journal Possible Errors in the Subsidiary Ledger Failing to Post a Transaction Miscalculating an Account Balance Proving the accounts receivable subsidiary ledger does not ensure that transactions were posted to the correct customer account. Home Glencoe Accounting Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Internet Sales Section 16.2 The Cash Receipts Journal Use an Internet merchant account for credit and debit card payments or an online payment service. Internet Sales Steps must be taken to make sure online sales transactions are secure. Home Glencoe Accounting Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Question 1 Use (T) to indicate whether you would post only the column total, (E) to post each individual transaction, or (B) to post each to the subsidiary ledger and the column total to the controlling account in the general ledger. General Credit Sales Credit Sales Tax Payable Credit Accounts Receivable Credit Sales Discounts Debit Cash in Bank Debit E __________ T __________ T __________ B __________ T __________ T __________ Home Glencoe Accounting Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Question 2 A company has the following journals and ledgers: sales, cash receipts, purchases, cash payments, general, and an accounts receivable subsidiary ledger. For each of the following transactions, indicate (a) the correct journal and (b) whether the subsidiary ledger is used. • • • • • • • • sale for cash (a) cash receipts sale on credit (a) sales (b) A/R subsidiary ledger payment of accounts payable (a) cash payments purchase of equipment on credit (a) purchases cash receipt on account from customer (a) cash receipts (b) A/R subsidiary ledger sales for customers using bankcards (a) cash receipts cash received for sale of unneeded equipment (a) cash receipts cash discount taken on account by customer (a) cash receipts (b) A/R subsidiary ledger Home Glencoe Accounting Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. Question 3 In the cash receipts journal, why must you post every payment on account to the customer’s subsidiary account immediately? Most of the information in the cash receipts journal can be posted when you total the journal. However, the subsidiary ledger must be kept current and show the accurate amount owed by each customer in the event a customer inquires about his or her account status or that the current total is needed for some other reason. This also means that until the column total is posted to the controlling account, the total of the subsidiary ledger accounts and the controlling account in the general ledger will not agree. Home Glencoe Accounting Copyright © by The McGraw-Hill Companies, Inc. All rights reserved. End of Home