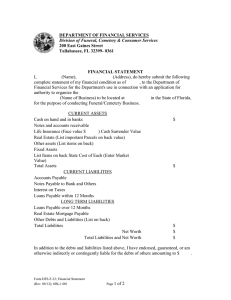

CHAPTER 4: PREPARING THE FINANCIAL STATEMENTS Financial statements – structured representation of the financial position and financial performance of an entity Accounting policies – the specific principles, bases, conventions, rules and practices applied by an entity in preparing financial statements STATEMENT OF FINANCIAL POSITION - the financial position of an enterprise as of a given date economic resources that an enterprise controls, its financial structure, its liquidity and solvency and its capacity to adapt to changes in the environment in which it operates (financial flexibility) Assets = Liabilities + Equity o Equity includes the cumulative (ending) balance of OCI Current and noncurrent classification o Unless presentation based on liquidity provides information that is more relevant to the users o Ability of the enterprise to meet its current obligations o Net assets – working capital and long-term operations o Expected dates of realization of assets and settlement of liabilities Current Assets: 1. 2. 3. 4. Cash and Cash Equivalents Expected to be realized/collected within the normal operating cycle a. Trade receivables b. Prepaid expenses c. Normal operating cycle – the time between the acquisition of assets for processing and their realization in cash and cash equivalents Expected to be realized/collected within 12 months after the reporting period a. Current portion of long-term receivables or noncurrent financial assets Held for trading a. Inventories b. Financial assets at fair value through profit or loss c. NCAHS Noncurrent Assets: 1. 2. 3. 4. Property, plant and equipment Intangible assets Investment property Financial assets that are not expected to be realized in cash in the entity’s normal operating cycle or within 12 months after the reporting period Current Liabilities: 1. 2. 3. 4. Held for trading a. Bonds payable at fair value through profit or loss Expected to be settled within the normal operating cycle a. Trade/ Accounts payable b. Accrued expense c. Income tax payable Expected to be settled within 12 months after the reporting period a. Dividends payable The entity does not have an unconditional right to defer the settlement of obligation for at least 12 months after the reporting period PFRS 5: NON-CURRENT ASSETS HELD FOR SALE (NCAHS) Non-current Asset – an asset that does not meet the definition of a current asset Disposal group – a group of assets to be disposed of, by sale or otherwise, together as a group in a single transaction, and liabilities directly associated with those assets that will be transferred in the transaction Conditions: 1. 2. 3. Realized through sale The management is committed to a plan to sell the asset a. Actively looking for a buyer b. Activities to locate a buyer c. Reasonable quotation price The sale is highly probable a. Expected to occur within one year from the change of use Measurement: 1. 2. 3. At the lower of carrying amount or fair value less cost of disposal (cost to sell) a. Impairment loss is recognized if fair value less cost to sell < current (carrying) value Not subjected to depreciation and amortization Gain not recognized at initial recognition a. If fair value less cost to sell > carrying amount, the difference is not recognized b. Subsequent to initial recognition (recognized) – maximum amount of recovery = cumulative impairment loss Presentation: 1. 2. 3. Noncurrent assets will not be reclassified as current assets until they meet the criteria to be classified as held for sale Held for sale = current assets If the noncurrent asset is a disposal group – assets and liabilities shall be presented separately (cannot be offset) DISCONTINUED OPERATION Retroactive classification – prohibited as a discontinued operation when the criteria are met after the end of the reporting period Profit or loss 1. NCAHS – impairment loss 2. Disposal of geographical area/ location, major line segment, cash generating unit, or part of operation 3. Purchase of subsidiary with a view of resale Components: 1. 2. Actual disposal of the operation Operation that met the criteria to be classified as held for sale Presentation: Income statement - single amount a. Total of post-tax profit or loss of the discontinued operation and the post-tax gain or loss recognized on the measurement to fair value less cost to sell or on the disposal of the assets or disposal group constituting the discontinued operation PAS 10: EVENTS AFTER THE REPORTING PERIOD Events after the reporting period (subsequent events) – events, whether favorable or unfavorable, that occur between the end of reporting period and the date on which the financial statements are authorized for issue 1. 2. Type I (Adjusting events) Provide evidence of conditions that exist at the end of the reporting period Adjusted and disclosed Type II (non-adjusting events) Indicative of conditions that arise after the end of reporting period Disclosed PAS 33: EARNINGS PER SHARE Earnings per share – the amount attributable to every ordinary shares outstanding during the period Ordinary share – an equity instrument that is subordinate to all other classes of equity instruments Presentation: Required for public entities Face of the income statement (continuing operations) Basic Earnings per Share: Earnings Value per Share = (Net Income) Profit attributable to Ordinary Shares Weighted Average Number of Outstanding Ordinary Shares Net Profit xxx Less: Dividends on preference shares (Total par value of preference shares * dividend rate) xxx Profit attributable to Ordinary Shares xxx Cumulative preference share – current year dividend is deducted, whether declared or not Noncumulative preference share – current year dividend is deducted, only if there is a declaration PAS 7: STATEMENT OF CASH FLOWS Statement of Cash Flows – a component of financial statements summarizing the operating, investing and financing activities of an entity Purpose: to provide relevant information about cash receipts and cash payments of an entity during a period a. Inflows (receipts) b. Outflows (distributions; payments) Except for Cash Equivalent transactions (purchases) Operating Activities – cash flows derived primarily from the principal revenue producing activities of the entity a. Working capital (current assets – current liabilities) Normal operations of the business Profit or loss Collections from customers 1. Cash sales 2. Collection of accounts receivable 3. Recovery of accounts receivable b. c. d. e. Payment to suppliers 1. Inventories 2. Accounts payable Payment to employees for wages and salaries Payment to government for taxes Payment to lenders for interest NOTE: Current assets – Operating Non-current assets – Investing Current liabilities – Operating Non-current liabilities – Financing Equity – Financing Methods: a. Direct method – enumerates the major classes of gross operating cash receipts and payments - Based on income statement accounts and changes in account balances in the statement of financial position - Sales revenue (on account, if silent) b. Indirect method – reconciliation of profit or loss before income tax to operating cash flows - Non-cash operating income and expenses Net Income before Tax P xx Non-cash expenses: Depreciation expenses (PPE) xx Amortization expenses (Intangible assets) xx Bad Debts expense xx *AR gross @ working capital Amortization on Discount on Bonds/ Notes payable xx Amortization on Premium on Bonds/ Notes payable (xx) Non-cash income: Gain on sale of equipment (xx) Unrealized gain – Profit or loss (xx) Increase in AR (gross) (xx) Decrease in Interest receivable xx Decrease in AP (xx) Increase in Salaries Payable xx Net Cash Provided (Used) in Operating Activities P xx - Current assets – inverse - Current liabilities – direct Investing Activities – cash flows derived from the acquisition and disposal of long-term assets and other investments not included in cash equivalent Proceeds from Sale of equipment Purchase of Patent Purchase of FVTOCI Sale of FVTOCI Purchase of Investment in Associate Net Cash Provided (Used) in Investing Activities P xx (xx) (xx) Xx (xx) P xx Financing Activities – cash flows derived from the equity capital and borrowings of the entity Proceeds from issuance of bonds/ long term notes/ mortgage payable Proceeds from issuance of shares Proceeds from sale of treasury shares Purchase of treasury shares Retirement of bonds Payment of bank loans Net Cash Provided (Used) in Financing Activities P xx xx xx (xx) (xx) (xx) P xx Net Change in Cash Beginning cash balance Ending cash balance P xx xx P xx