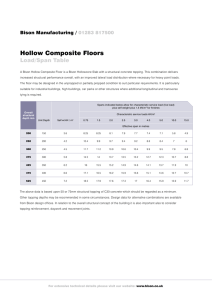

CONSUMER BISON CONSOLIDATED (BISON MK EQUITY, BISO.KL) 22 Dec 2016 Earnings Come Charging In BUY Company report (Maintained) AmInvestment Bank Bhd www.amsecurities.com Rationale for report: Company result 03-2036 2372 Price Fair Value 52-week High/Low RM1.70 RM2.24 RM2.00/RM1.08 Investment Highlights Key Changes Fair value EPS YE to Oct FY16 FY17F FY18F FY19F Revenue (RM mil) Core net profit (RM mil) FD Core EPS (sen) FD Core EPS growth (%) Consensus Net Profit (RM mil) DPS (sen) PE (x) EV/EBITDA (x) Div yield (%) ROE (%) Net Gearing (%) 263.6 18.1 5.8 33.9 1.5 29.1 18.9 0.9 16.4 nm 345.6 21.8 7.0 20.7 24.1 1.7 24.1 14.3 1.0 13.5 nm 373.2 29.4 9.5 34.7 30.8 1.7 17.9 10.7 1.0 15.9 nm 419.3 35.0 11.3 19.1 1.7 15.0 8.7 1.0 16.3 nm Stock and Financial Data Shares Outstanding (million) Market Cap (RMmil) Book Value (RM/share) P/BV (x) ROE (%) Net Gearing (%) 310.1 527.1 0.49 3.5 16.4 - Major Shareholders D&D Consolidated (68.8%) Dang Tai Kien (3.7%) Dang Tai Gean (1.5%) 100.0 0.2 Free Float Avg Daily Value (RMmil) Price performance 3mth 6mth 12mth Absolute (%) Relative (%) (5.6) (3.9) 17.2 17.8 - We maintain our BUY rating on Bison Consolidated (Bison) with a higher fair value of RM2.24/share (vs. 2.13/share previously) as we rollover our valuations to CY17F from FY17F. Our valuations are pegged to an unchanged PE of 27x FY17F earnings which is in line with 7-Eleven Malaysia. Overall, earnings were largely in line with both ours and consensus estimates at 104% and 100% respectively. Bison’s 4QFY16 net profit of RM4.3mil (QoQ: 6.2%) brought cumulative earnings to RM18.1mil (YoY: 34.2%). Meanwhile, 4QFY16 revenue of RM72.4 (QoQ: 11.3%) grew FY16 revenue to RM236.6 (YoY: 21.1%). No dividend was declared. Bison’s QoQ revenue growth of 6.2% was driven by the 9.4% higher store count or the addition 26 new stores against the preceding quarter. It brought the total store count to 303 stores as at end of Oct. It represents a net addition of 74 new stores, slightly ahead of our estimate of 70 stores for the financial year. Gross margins for the year improved to 35.7% from 34.2% on the back of better product mix such as its fresh food gaining greater traction. Notably, Bison’s EBITDA margin for FY16 have improved as well to 10.4% (vs. 9.7% previously in FY15) despite its 32% enlarged store base. We also paid visit to Bison’s newly launched Gourmet To Go store in MidValley yesterday. It is a refurbishment of its existing 1,500 sq ft store. The flagship store highlights its extensive localised fresh food selection. Fresh food SKU is estimated to range between 200 and 300, which has a production split of 70:30 ratio between external sourcing and in-house production. Chilled meals with a shelf life of 1 day were reasonably priced within RM10. Given that earnings were largely within our estimates, we leave our FY17-FY18F earnings unchanged while introducingFY19F projections. Key risks to Bison include:1) delay in food-processing centre setup, which is forecasted to further improve product mix, 2) dilution in its advertising and promotional income per store basis and 3) foreign labour supply. We continue to like Bison for :- 1) full autonomy to its brand name of myNews.com; 2) aggressive store expansion plan and 3) potential margin enhancement underpinned by sales of products from the group’s food processing centre in Rawang and franchising opportunities. Bison Consolidated 22 Dec 2016 EXHIBIT 1: RESULTS REVIEW YE Apr Revenue 16Q3 65.1 16Q4 72.4 Cost of sales -42.8 -46.7 Gross profit 22.3 25.8 Other income 0.9 Admin exp Other exp QoQ (%) 11.3 FY15 217.5 FY16 263.6 -143.1 -169.6 74.4 94.0 1.1 0.5 2.6 -17.0 -19.2 -53.5 -68.1 -1.4 -1.8 -3.9 -5.4 15.6 YoY (%) 21.2 26.3 EBITDA 6.0 7.1 17.4 21.1 27.5 Depreciation -1.2 -1.3 10.9 -3.6 -4.5 24.4 EBIT 4.9 5.8 19.0 17.5 23.0 31.5 Finance costs -0.1 -0.1 -0.6 -0.5 Share of profit of associate 0.3 0.1 PBT 5.0 5.8 Tax expense -1.0 -1.5 PATAMI 4.1 4.3 15.2 6.2 0.7 1.1 17.7 23.6 -4.2 -5.5 13.5 18.1 30.3 33.4 34.3 Core EPS - Diluted (sen) 1.3 -5.1 4.4 0.1 Gross DPS (sen) 0.0 0.0 0.0 0.0 BV / share (RM) 0.5 0.5 0.3 0.5 EBIT margin (%) 9.3 9.8 0.5 8.0 10.4 2.4 Pretax margin (%) 7.7 8.0 0.3 8.1 9.0 0.8 -19.3 -25.6 -6.3 -23.9 -23.2 0.7 Effective tax rate (%) Source: Company, AmInvestment Bank Bhd EXHIBIT 3: BISON’S SELECTION OF CHILLED FOOD EXHIBIT 2: BISON’S 1,500 SQ FT GOURMET TO GO STORE Source: AmInvestment Bank Bhd Source: AmInvestment Bank Bhd AmInvestment Bank Bhd 2 Bison Consolidated 22 Dec 2016 EXHIBIT 4: FINANCIAL DATA Income Statement (RMmil, YE 31 Oct) FY15 FY16 FY17F FY18F FY19F Revenue EBITDA Depreciation/Amortisation Operating income (EBIT) Other income & associates Net interest Exceptional items Pretax profit Taxation Minorities/pref dividends Net profit Core net profit 217.5 20.7 (3.6) 17.1 1.2 (0.6) 17.7 (4.2) 13.5 13.5 263.6 27.5 (4.5) 23.1 3.7 (0.5) 22.5 (5.5) 17.1 18.1 345.6 36.3 (6.3) 30.0 2.6 (0.4) 29.6 (7.7) 21.8 21.8 373.2 47.2 (7.3) 40.0 2.6 (0.4) 39.5 (10.1) 29.4 29.4 419.3 55.5 (8.2) 47.3 2.6 (0.4) 46.9 (11.9) 35.0 35.0 Balance Sheet (RMmil, YE 31 Oct) FY15 FY16 FY17F FY18F FY19F 46.7 1.6 48.3 6.1 21.8 4.2 19.2 51.2 21.4 1.3 10.4 33.1 8.3 2.6 10.9 55.5 0.18 65.3 11.3 76.6 15.7 29.8 7.0 75.4 127.8 26.1 1.3 14.7 42.1 7.0 3.0 9.9 152.4 0.49 83.9 11.3 95.3 17.5 36.9 6.6 75.4 136.5 33.9 1.3 15.1 50.2 7.0 3.0 9.9 171.6 0.55 96.7 11.3 108.0 30.9 38.6 7.2 75.4 152.1 35.4 1.3 15.1 51.8 7.0 3.0 9.9 198.3 0.64 108.5 11.3 119.8 50.1 43.0 8.0 75.4 176.6 39.4 1.3 15.1 55.8 7.0 3.0 9.9 230.7 0.74 Cash Flow (RMmil, YE 31 Oct) FY15 FY16 FY17F FY18F FY19F Pretax profit Depreciation/Amortisation Net change in working capital Others Cash flow from operations Capital expenditure Net investments & sale of fixed assets Others Cash flow from investing Debt raised/(repaid) Equity raised/(repaid) Dividends paid Others Cash flow from financing Net cash flow Net cash/(debt) b/f Net cash/(debt) c/f 17.7 3.6 (2.5) (10.3) 8.5 (7.5) (0.5) (8.1) (0.8) (0.5) (0.8) (2.1) (1.7) 7.8 6.1 22.5 4.5 (2.7) (7.0) 17.3 (23.7) (61.7) (85.4) (1.3) (4.7) 81.5 75.6 7.5 6.4 13.9 29.6 6.3 1.0 (7.7) 29.1 (25.0) (25.0) (5.3) (5.3) (1.1) 16.1 14.9 39.5 7.3 (0.7) (10.1) 36.0 (20.0) (20.0) (5.3) (5.3) 10.8 17.5 28.3 46.9 8.2 (1.2) (11.9) 42.0 (20.0) (20.0) (5.3) (5.3) 16.7 30.9 47.5 Key Ratios (YE 31 Oct) FY15 FY16 FY17F FY18F FY19F Revenue growth (%) EBITDA growth (%) Pretax margin (%) Net profit margin (%) Interest cover (x) Effective tax rate (%) Dividend payout (%) Debtors turnover (days) Stock turnover (days) Creditors turnover (days) 19.3 10.4 8.1 6.2 29.6 23.7 3.7 4 31 30 21.2 33.3 8.6 6.5 45.6 24.3 28.2 8 36 33 31.1 31.8 8.6 6.3 72.5 26.1 24.1 7 35 32 8.0 30.1 10.6 7.9 96.6 25.6 18.0 7 37 34 12.4 17.5 11.2 8.4 114.5 25.3 15.1 7 36 33 Fixed assets Intangible assets Other long-term assets Total non-current assets Cash & equivalent Stock Trade debtors Other current assets Total current assets Trade creditors Short-term borrowings Other current liabilities Total current liabilities Long-term borrowings Other long-term liabilities Total long-term liabilities Shareholders’ funds Minority interests BV/share (RM) Source: Company, AmInvestment Bank Bhd estimates AmInvestment Bank Bhd 3 Bison Consolidated 22 Dec 2016 DISCLOSURE AND DISCLAIMER This report is prepared for information purposes only and it is issued by AmInvestment Bank Berhad (“AmInvestment”) without regard to your individual financial circumstances and objectives. Nothing in this report shall constitute an offer to sell, warranty, representation, recommendation, legal, accounting or tax advice, solicitation or expression of views to influence any one to buy or sell any real estate, securities, stocks, foreign exchange, futures or investment products. AmInvestment recommends that you evaluate a particular investment or strategy based on your individual circumstances and objectives and/or seek financial, legal or other advice on the appropriateness of the particular investment or strategy. The information in this report was obtained or derived from sources that AmInvestment believes are reliable and correct at the time of issue. While all reasonable care has been taken to ensure that the stated facts are accurate and views are fair and reasonable, AmInvestment has not independently verified the information and does not warrant or represent that they are accurate, adequate, complete or up-to-date and they should not be relied upon as such. All information included in this report constituteAmInvestment’s views as of this date and are subject to change without notice. Notwithstanding that, AmInvestment has no obligation to update its opinion or information in this report. Facts and views presented in this report may not reflect the views of or information known to other business units of AmInvestment’s affiliates and/or related corporations (collectively, “AmBank Group”). This report is prepared for the clients of AmBank Group and it cannot be altered, copied, reproduced, distributed or republished for any purpose without AmInvestment’s prior written consent. AmInvestment, AmBank Group and its respective directors, officers, employees and agents (“Relevant Person”) accept no liability whatsoever for any direct, indirect or consequential losses, loss of profits and/or damages arising from the use or reliance of this report and/or further communications given in relation to this report. Any such responsibility is hereby expressly disclaimed. AmInvestment is not acting as your advisor and does not owe you any fiduciary duties in connection with this report. The Relevant Person may provide services to any company and affiliates of such companies in or related to the securities or products and/or may trade or otherwise effect transactions for their own account or the accounts of their customers which may give rise to real or potential conflicts of interest. This report is not directed to or intended for distribution or publication outside Malaysia. If you are outside Malaysia, you should have regard to the laws of the jurisdiction in which you are located. If any provision of this disclosure and disclaimer is held to be invalid in whole or in part, such provision will be deemed not to form part of this disclosure and disclaimer. The validity and enforceability of the remainder of this disclosure and disclaimer will not be affected. AmInvestment Bank Bhd 4